Form 990 FY 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Encyclopedia of Greater Philadelphia Civic Partnership and Planning Workshop April 16-17, 2009, at the Historical Society of Pennsylvania Summary of Sessions

The Encyclopedia of Greater Philadelphia Civic Partnership and Planning Workshop April 16-17, 2009, at the Historical Society of Pennsylvania Summary of Sessions DAY 1 Morning Panel: Capitalizing on the Region’s Historical Assets The session began with an introduction from Howard Gillette, who spoke about the general goals of the Encyclopedia project and the role of civic investment and engagement within it. He emphasized the importance of collaboration across disciplines and state lines and the Encyclopedia’s potential to build on existing assets while also generating new initiatives and knowledge. Panel chair Steven Conn then introduced the panel and posed the question, “What are we doing here?” In response to his question, Conn spoke of the parallel flourishing of new scholarship on Philadelphia over the past twenty years and a civic and cultural renaissance that this project hopes to connect further. Conn also described the past’s ability to reflect on the present and inform the future and concluded with the hope that the Encyclopedia will be a resource that resonates with people in the present and shapes debates about the future. The first speaker was Michael Coard from the Avenging the Ancestors Coalition, who spoke about the President’s House project. Coard described the uniqueness of the President’s House site and Liberty Bell Center as a space where visitors must cross the “hell of slavery” into the “heaven of liberty” and addressed the importance of recognizing both sides of that story. To this point, Coard identified truth as the prime historical need and spoke of the power of projects in civic engagement and investment like the President’s House to challenge one-sided history and make the experiences of African Americans part of the larger narrative. -

Academy of Music; Academy of Music_____ and Or Common Academy of Music______2

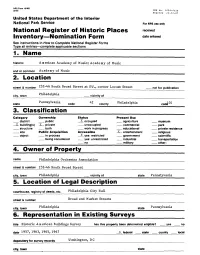

NPS Form 10-900 (3-82) 0MB No. 1024-0018 Expires 10-31-87 United States Department of the Interior National Park Service For NPS use only National Register of Historic Places received Inventory Nomination Form date entered See instructions in How to Complete National Register Forms Type all entries complete applicable sections_________________ 1. Name___________________ historic______American Academy of Music; Academy of Music_____ and or common Academy of Music_______________________ 2. Location_________________ street & number 232-46 South Broad Street at SW., corner Locust Street not for publication Philadelphia city, town vicinity of P ennsylvania 42 county Philadelphia state code CO 3. Classification Category Ownership Status Present Use district public X occupied agriculture museum _ K- building(s) X private unoccupied commercial park structure both work in progress educational private residence site Public Acquisition, Accessible X entertainment religious object in process X yes: restricted government scientific being considered - yes: unrestricted __ industrial transportation .... no military __ other: 4. Owner of Property name Philadelphia Orchestra Association street & number 232-46 South Broad Street city, town Philadelphia vicinity of state Pennslyvania 5. Location of Legal Description courthouse, registry of deeds, etc. Philadelphia City Hall street & number Broad and Market Streets city, town Philadelphia state Pennsylvania 6. Representation in Existing Surveys title Historic American Buildings Survey has this property been determined eligible? yes no date 1957, 1963, 1965, 1967 JL federal state county local depository for survey records W ashing ton, D C city, town state 7. Description Condition Check one Check one excellent deteriorated unaltered ^ original site good ruins X altered moved date fair unexposed Interior Describe the present and original (if known) physical appearance This free standing brick Renaissance Revival Style building exhibits a free use of classical forms. -

December 1934) James Francis Cooke

Gardner-Webb University Digital Commons @ Gardner-Webb University The tudeE Magazine: 1883-1957 John R. Dover Memorial Library 12-1-1934 Volume 52, Number 12 (December 1934) James Francis Cooke Follow this and additional works at: https://digitalcommons.gardner-webb.edu/etude Part of the Composition Commons, Ethnomusicology Commons, Music Education Commons, Musicology Commons, Music Pedagogy Commons, Music Performance Commons, Music Practice Commons, and the Music Theory Commons Recommended Citation Cooke, James Francis. "Volume 52, Number 12 (December 1934)." , (1934). https://digitalcommons.gardner-webb.edu/etude/53 This Book is brought to you for free and open access by the John R. Dover Memorial Library at Digital Commons @ Gardner-Webb University. It has been accepted for inclusion in The tudeE Magazine: 1883-1957 by an authorized administrator of Digital Commons @ Gardner-Webb University. For more information, please contact [email protected]. THE ETUDE s CMCusic S&gmim December 1934 Price 25 Cents <Cy/ i/<)/maJ ($v-e vnM, DECEMBER 19,% Page 695 THE ETUDE THE HARCOURT, BRACE MUSIC DEPARTMENT Albert E. Wier, Editor £Magnifying Christmas PRESENTS FOUR NEW AND DISTINCTIVE MUSIC COLLECTIONS PIECES FOR TWO PIANOS—Four Hands THE DAYS OF THE HARPSICHORD If you do any two-piano playing, this collection of This is the first volume of a series to be known as 48 classic, romantic and modem compositions is in¬ “The Pianist’s Music Shelf.” It contains 80 dispensable for recital, study or recreation. There melodic compositions by more than fifty famous Eng¬ is a 200-word note of general musical interest pre¬ lish, French, German and Italian harpsichord com¬ £Musical Joy ceding each composition, also a page of twelve recital posers in the period from 1500 to 1750. -

February 1934) James Francis Cooke

Gardner-Webb University Digital Commons @ Gardner-Webb University The tudeE Magazine: 1883-1957 John R. Dover Memorial Library 2-1-1934 Volume 52, Number 02 (February 1934) James Francis Cooke Follow this and additional works at: https://digitalcommons.gardner-webb.edu/etude Part of the Composition Commons, Ethnomusicology Commons, Fine Arts Commons, History Commons, Liturgy and Worship Commons, Music Education Commons, Musicology Commons, Music Pedagogy Commons, Music Performance Commons, Music Practice Commons, and the Music Theory Commons Recommended Citation Cooke, James Francis. "Volume 52, Number 02 (February 1934)." , (1934). https://digitalcommons.gardner-webb.edu/etude/819 This Book is brought to you for free and open access by the John R. Dover Memorial Library at Digital Commons @ Gardner-Webb University. It has been accepted for inclusion in The tudeE Magazine: 1883-1957 by an authorized administrator of Digital Commons @ Gardner-Webb University. For more information, please contact [email protected]. THE ETUDE <'Music <3XCavazine February 1934 ^ Price 25 Cents THE ETUDE FEBRUARY 1934. Page 67 Choose Your Own Books Many Successful Piano Teachers of To-day Regularly Use These Works JctA^eUpto^O^S BUY AS FEW AS ALBUMS OF PIANO PIECES Works with attractive qualities that keep P^° ‘^/^cher to achieve results. First and Second FOUR A YEAR these works for examination. Grade Pieces for Boys Price, 75<! eavorfd PRESENT-DAY “dolly” pieces. ^selectuon or easy piano solos of the t est of the “real boy” beginner. Priscilla’s Week ilsIiiSsss-Hiii Boy’s Own Book of Piano Pieces A reliable and complete book service. As a plete and reliable guide to all of the impor¬ tant new books published each month the Editorial Board reviews in WINGS about twenty books which, in their opinion, are the out¬ Girl’s Own Book of Piano Pieces standing books to be published by the leading publishing houses. -

Spring 2007 a Letter from the President

College of Musical Arts Bowling Green State University Bowling Green, Ohio 43403-0290 Promoting Musical Excellence Pro Musica supports the College of Musical Arts by inviting the participation of alumni, friends, parents and the Bowling Green community in a wide variety of musical events and by providing financial support for projects that are often beyond the reach of state funding. A letter from the President Pro Musica: Promoting Musical Excellence This has been an extraordinary year for Pro Musica. As you can see from their essays, students greatly appreciate the 51 travel grants we’ve been able to A special year of award thanks to new and renewed memberships. We are making a substantial difference in the Bowling Green State University’s College of Musical Arts. promoting excellence! Student memberships alone increased by 254 percent! Two students, Jami Lynn Haswell and Michael Hsin-en Liu, were elected by their peers to serve on the Pro Musica Board. We are proud to have them with us and look forward to Pro Musica funded serving with them. Pro Musica also sponsors and provides musical events in our community. 98 individual student For example, a fantastic piano concert was given at the Wood County District grants, awarding nearly Public Library on a cold winter’s Sunday afternoon. It was well attended and greatly appreciated by all. The Bowling Green Kiwanis Club was treated by $39,000 for 2006-07! our student, Jami Lynn Haswell, with her memories and pictures of her musical experiences in Pitten, Austria. We hope to expand providing musical events to our community. -

Temple University Snyder Report 2015-2016 Part A

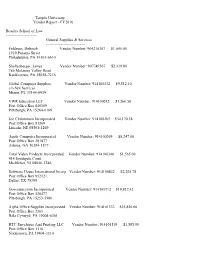

Temple University Vendor Report - FY2016 Beasley School of Law --------------------- General Supplies & Services -------------------------- Feldman, Deborah Vendor Number: 904210387 $1,045.00 1910 Panama Street Philadelphia, PA 19103-6610 Shellenberger, James Vendor Number: 907749507 $2,319.80 786 Molasses Valley Road Kunkletown, PA 18058-7216 Global Computer Supplies Vendor Number: 914100132 $9,512.10 c/o Syx Services Miami, FL 33144-0939 VWR Education LLC Vendor Number: 914100242 $1,266.50 Post Office Box 640169 Pittsburgh, PA 15264-0169 Joe Christensen Incorporated Vendor Number: 914100265 $34,170.38 Post Office Box 81269 Lincoln, NE 68501-1269 Apple Computer Incorporated Vendor Number: 914100269 $8,247.00 Post Office Box 281877 Atlanta, GA 30384-1877 Total Video Products Incorporated Vendor Number: 914100340 $1,565.00 414 Southgate Court Mickleton, NJ 08056-1246 Software House International Incorp Vendor Number: 914100842 $2,205.78 Post Office Box 952121 Dallas, TX 75395 Govconnection Incorporated Vendor Number: 914101112 $19,812.42 Post Office Box 536477 Pittsburgh, PA 15253-5906 Alpha Office Supplies Incorporated Vendor Number: 914101333 $35,826.60 Post Office Box 2361 Bala Cynwyd, PA 19004-6361 BTC Envelopes And Printing LLC Vendor Number: 914101519 $1,585.00 Post Office Box 1110 Norristown, PA 19404-1110 Temple University Vendor Report - FY2016 Beasley School of Law --------------------- General Supplies & Services -------------------------- Terra Dotta LLC Vendor Number: 914102165 $10,100.00 501 West Franklin Street Chapel -

Form 990 2015

46 9 Return of Organization Exempt From Income Tax OMB No 1545-0047 Form 990 Under section 501(c), 527, or 4947( a)(1) of the Internal Revenue Code ( except private foundations) 2015 Do not enter social security numbers on this form as it may be made public. nepa_'tr"e"t of the T,eaS u- ► Open to PPublic Intern a l Revenue Service . ► Information about Form 990 and its instructions is at www irs.gov/form990. A For the 2015 calendar year, or tax year beginning and ending -B-cnedFn- C-Name of organization D Employer identification number applicable THE US CHARITABLE GIFT TRUST C/O Ocha^ WILMINGTON TRUST , NATIONAL ASSOCIATION x-lcnange Doing business as 31-1663020 Initial Number and street (or P.O. box if mail is not delivered to street address) Room/s uite E Telephone number nal E::IFreturn/ 1100 NORTH MARKET STREET, 2ND FLOOR 800-664-6901 termin- ated City or town , state or province , country, and ZIP or foreign postal code G Gross receipts $ 244 678,524. aanended return WILMINGTON , DE 19890 H(a) Is this a group return tonAPPI"a F Name and address of principal officer JEFFREY P. BEALE for subordinates? D Yes L1 No pending 2 INTERNATIONAL PLACE , BOSTON , MA 02110 H(b) Are all subordinates included = Yes =No I Tax-exempt status x 501(c)(3) 501(c) ( ) 4 (insert no.) L_J 4947(a 1) or 527 If "No," attach a list (see instructions) WWW.USCHARITABLEGIFTTRUST.ORG J Website : ► K Form of organization : L_J Corporation Lx Trust Association L_J Other " Year of formation: 1999 I M State of legal domicile: DE 1 Briefly describe the organization 's mission or most significant activities : PROVIDE GIFTS TO VARIOUS PUBLIC CHARITIES FOR ITS STATED EXEMPT PURPOSE. -

Poetry Through Music

2016/17 Season: WordMusic II Poetry Through Music 32nd SEASON 26 February 2017 Settlement Music School Mary Louise Curtis Branch Philadelphia, PA Poetry Through Music – Program Six chamber works composed in response to poetry by Susan Stewart A Sudden Waking (2017)*+ Andrew Rudin Kimberly Reighley – Flutes, Marc Rovetti – Violin, Zachary Mowitz – Cello, Susan Nowicki – Piano Figure to Ground (2017)*+ Eliza Brown String Trio Julia Li – Violin, Meng Wang – Viola, Zachary Mowitz – Cello The Looming Sky (2017)*+ Ke-Chia Chen For Piano Quartet I. Freely II. Rapid Julia Li – Violin, Marvin Moon – Viola, John Koen – Cello, Susan Nowicki – Piano -Intermission- …because it is winter everywhere… (2016)*+ Gerald Levinson For Alto Flute, Viola, Violincello, and Contrabass Kimberly Reighley – Flute, Meng Wang – Viola, John Koen – Cello, Mary Javian – Bass Too light, too light, like a sudden waking... (2016)* Robert Capanna For String Trio Hirono Oka – Violin, Burchard Tang – Viola, John Koen – Cello from quiet scripts (2017)*+ Benjamin Krause For Violin, Viola, Cello, and Piano Marc Rovetti – Violin, Marvin Moon – Viola, Zachary Mowitz – Cello, Susan Nowicki – Piano *NNM Commission +World Premiere A discussion with Susan Stewart, Linda Reichert and the composers will follow the concert. Network for New Music Ensemble Flute Meng Wang Kimberly Reighley Cello Violin John Koen Hirono Oka Zachary Mowitz Marc Rovetti Julia Li Bass Mary Javian Viola Burchard Tang Piano Marvin Moon Susan Nowicki About the Ensemble With its adventurous and innovative programming and virtuoso performances, Network for New Music, under the leadership of Artistic Director Linda Reichert, is committed to breaking new ground in the field of contemporary classical music and building support for new music by engaging in artistic and institutional collaborations and educational activities. -

Philadelphia Orchestra Audited Financials FY 2019

Consolidated Financial Statements and Report of Independent Certified Public Accountants The Philadelphia Orchestra Association August 31, 2019 and 2018 Contents Page Report of Independent Certified Public Accountants 3 Consolidated financial statements Consolidated statements of financial position 5 Consolidated statements of activities 6 Consolidated statements of cash flows 8 Notes to the consolidated financial statements 9 Supplementary information Schedules of changes in net assets without donor restrictions from operating activities 36 The Academy of Music Philadelphia, Inc. statements of financial position 37 The Academy of Music, Inc. statements of activities 38 GRANT THORNTON LLP REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS Two Commerce Square 2001 Market St., Suite 700 Philadelphia, PA 19103 T 215.561.4200 F 215.561.1066 GrantThornton.com Board of Directors linked.in/GrantThorntonUS The Philadelphia Orchestra Association twitter.com/GrantThorntonUS We have audited the accompanying consolidated financial statements of The Philadelphia Orchestra Association and its wholly-owned subsidiary (collectively, the “Association”), which comprise the consolidated statements of financial position as of August 31, 2019 and 2018, and the related consolidated statements of activities and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s responsibility for the financial statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. -

Detailed Agenda

! DETAILED!AGENDA! ! ! WWW.CITIESALIVE.ORG! ! Host:!!!!! Co"hosts:! !!! !!! ! Introduction! ! Green!Roofs!for!Healthy!Cities!is!very!pleased!to!present!you!with!the!program!for!CitiesAlive!9th!Annual!Green!Roof!and!Wall!Conference!with!our!co"hosts,!the!City!of! Philadelphia!and!the!Pennsylvania!Horticultural!Society!(PHS).!!!These!organizations!have!been!North!American!and!World!leaders!in!moving!toward!the!widespread! use!of!living!green!infrastructure!to!help!address!water!challenges!and!to!build!a!more!sustainable!community.!!The!City!is!planning!to!invest!more!than!$2!billion! dollars!over!the!next!twenty!five!years!to!create!more!than!9,000!Green!Acres!to!manage!storm!water,!which!will!include!technologies!such!as!green!roofs,!green! walls,!urban!forests!and!other!forms!of!green!infrastructure.!!! ! Join!us!in!Philadelphia,!the!City!of!Brotherly!Love,!as!we!celebrate!and!support!their!progress!towards!restoring!urban!waters.!! ! For!more!information!and!to!register!please!go!to:!www.citiesalive.org! ! Conference!Hotel! ! Come!join!us!at!the!beautiful!Sheraton!City!Center!Hotel!located!in!downtown!Philadelphia!–!the!official!hotel!and!venue!for!CitiesAlive2011!!Book!by!Tuesday,! November!15,!2011!to!take!advantage!of!the!discounted!conference!room!rates:!$159!(single!and!double),!$199!(triple),!and!$219!(quad)!per!night.!!! Sheraton!Philadelphia!City!Center!(Downtown)!Hotel,!201!North!17th!Street!Philadelphia,!PA!19103!USA.!!To!make!your!registration!and!take!advantage!of!the! $159.00!rate,!call!1"800"325"3535.! ! Full!Delegate!Passes! -

2017 Grant Listing.Pdf

2017 Grant Recipients Exelon Corporation Exelon’s vision of providing superior value for our customers, employees and investors extends to the communities that we serve. In 2017, the Exelon family of companies provided over $44.9 million to non-profit organizations in the cities, towns and neighborhoods where our employees and customers live and work. In addition, the Exelon Foundation contributed over $7.1 million to communities Exelon serves. Exelon’s philanthropic efforts are focused on math and science education, environment, culture and arts and neighborhood development. Our employees’ efforts complement corporate contributions through volunteering and service on non-profit boards. Our employees volunteered 210,195 hours of community service in 2017. In addition, employees contributed a total of $11.84 million to the charity of their choice through the Exelon Foundation Matching Gifts Program and the Exelon Employee Giving Campaign. Exelon Corporation (NYSE: EXC) is a Fortune 100 energy company with the largest number of utility customers in the U.S. Exelon does business in 48 states, the District of Columbia and Canada and had 2017 revenue of $33.5 billion. Exelon’s six utilities deliver electricity and natural gas to approximately 10 million customers in Delaware, the District of Columbia, Illinois, Maryland, New Jersey and Pennsylvania through its Atlantic City Electric, BGE, ComEd, Delmarva Power, PECO and Pepco subsidiaries. Exelon is one of the largest competitive U.S. power generators, with more than 32,700 megawatts of nuclear, gas, wind, solar and hydroelectric generating capacity comprising one of the nation’s cleanest and lowest-cost power generation fleets. -

Commercial Banking Services

CITY OF PHILADELPHIA Annual Request for Information Calendar Year 2016 Response Provided By: All data contained in PNC’s response to the City of Philadelphia’s Request for Information is proprietary and confidential. Data from this report should not be shared with any third parties without the consent of PNC. 2 City of Philadelphia Office of the City Treasurer Authorized Depository Compliance Reporting: Philadelphia City Code Chapter 19-200 City Funds--Deposits, Investments, & Disbursements Annual Request for Information Questionnaire Calendar Year 2016 3 PNC Bank does not offer loan products that can be described as predatory or high cost. PNC Bank certifies that it provides applicants with information necessary for applicants to protect themselves against predatory lending practices, including all legally-required loan disclosures. PNC Bank also makes available a wide variety of financial education and related tools for consumers to better understand their options when it comes to financial products. An important component of PNC Bank’s commitment to consumers is financial education. PNC Bank understands the extreme importance of providing people the knowledge and skills necessary to take control of their finances, and in turn, improve their quality of life and future stability. PNC Bank offers these useful, dependable and unbiased financial education programs to those who oftentimes need it most. For example: - Financial Education Courses: PNC Bank offers classes to consumers, small businesses and nonprofit organizations through our community outreach and branch educational activities. PNC partners with FDIC and has an agreement to co-brand and deliver its Money Smart financial literacy series on a variety of topics for adult and youth education, taught by bank employees and many also available in Spanish.