Dáil Éireann

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dáil Éireann

DÁIL ÉIREANN Dé Máirt, 11 Nollaig, 2007 Tuesday, 11th December, 2007 RIAR NA hOIBRE ORDER PAPER 72 DÁIL ÉIREANN 947 Dé Máirt, 11 Nollaig, 2007 Tuesday, 11th December, 2007 2.30 p.m. ORD GNÓ ORDER OF BUSINESS 6. Tairiscint maidir le Comhaltaí a cheapadh ar Choiste. Motion re Appointment of Members to Committee. 2. An Bille Leasa Shóisialaigh 2007 — Ordú don Dara Céim. Social Welfare Bill 2007 — Order for Second Stage. 9. Tairiscintí Airgeadais ón Aire Airgeadais [2007] (Tairiscint 5, atógáil). Financial Motions by the Minister for Finance [2007] (Motion 5, resumed). GNÓ COMHALTAÍ PRÍOBHÁIDEACHA PRIVATE MEMBERS' BUSINESS 19. Tairiscint maidir le Sábháilteacht ar Bhóithre; An córas pointí pionóis a athchóiriú. Motion re Road Safety; Reform of penalty points system. P.T.O. 948 I dTOSACH GNÓ PHOIBLÍ AT THE COMMENCEMENT OF PUBLIC BUSINESS Billí ón Seanad : Bills from the Seanad 1. An Bille um Eitic in Oifigí Poiblí (Leasú) 2007 [Seanad] — An Dara Céim. Ethics in Public Office (Amendment) Bill 2007 [Seanad] — Second Stage. Billí a thionscnamh : Initiation of Bills Tíolactha: Presented: 2. An Bille Leasa Shóisialaigh 2007 — Ordú don Dara Céim. Social Welfare Bill 2007 — Order for Second Stage. Bille dá ngairtear Acht do leasú agus do Bill entitled an Act to amend and extend leathnú na nAchtanna Leasa Shóisialaigh the Social Welfare Acts and to amend the agus do leasú an Achta um Ranníocaí Sláinte Health Contributions Act 1979. 1979. —An tAire Gnóthaí Sóisialacha agus Teaghlaigh. 3. Bille na nDlí-Chleachtóirí (An Ghaeilge) 2007 — Ordú don Dara Céim. Legal Practitioners (Irish Language) Bill 2007 — Order for Second Stage. -

An Exploration of Parliamentary Speeches in the Irish Parliament Using Topic Modeling

Technological University Dublin ARROW@TU Dublin Dissertations School of Computer Sciences 2018 An Exploration of Parliamentary Speeches in the Irish Parliament Using Topic Modeling Fiona Leheny Technological University Dublin Follow this and additional works at: https://arrow.tudublin.ie/scschcomdis Part of the Computer Sciences Commons Recommended Citation Leheny, Fiona (2018). An exploration of parliamentary speeches in the Irish parliament using topic modeling. Masters dissertation, DIT, 2018. This Dissertation is brought to you for free and open access by the School of Computer Sciences at ARROW@TU Dublin. It has been accepted for inclusion in Dissertations by an authorized administrator of ARROW@TU Dublin. For more information, please contact [email protected], [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-Share Alike 4.0 License An Exploration of Parliamentary Speeches in the Irish Parliament using Topic Modeling Fiona Leheny A dissertation submitted in partial fulfilment of the requirements of Dublin Institute of Technology for the degree of M.Sc. in Computing (Data Analytics) September 2017 Declaration I certify that this dissertation which I now submit for examination for the award of MSc in Computing (Data Analytics), is entirely my own work and has not been taken from the work of others save and to the extent that such work has been cited and acknowledged within the text of my work. This dissertation was prepared according to the regulations for postgraduate study of the Dublin Institute of Technology and has not been submitted in whole or part for an award in any other Institute or University. -

Names of Candidates Elected

DÁIL ÉIREANN 30ú DÁIL OLLTOGHCHÁN Bealtaine, 2007 Torthaí Toghcháin agus Aistriúna Vótaí 30th DÁIL GENERAL ELECTION May, 2007 Election Results and Transfer of Votes 1 © Government of Ireland 2007 2 CLÁR CONTENTS Page EXPLANATORY NOTES ............................................................................................... 5 GENERAL ELECTION: Constituencies - Carlow-Kilkenny ....................................................................................................... 9 Cavan-Monaghan .................................................................................................... 10 Clare ........................................................................................................................ 11 Cork East ................................................................................................................. 12 Cork North-Central .................................................................................................. 13 Cork North-West ...................................................................................................... 14 Cork South-Central .................................................................................................. 15 Cork South-West ..................................................................................................... 16 Donegal North-East ................................................................................................. 17 Donegal South-West .............................................................................................. -

NWCI E-News September 2007

National Women’s Council of Ireland E-newsletter Comhairle Naisiunta na mBan in Eirinn Nuachtlitir Leichtreonach September 2007 MIGRANT WOMEN IN IRELAND: ACTION FOR INTEGRATION 3 REPORT OF NWCI MEMBERS MEETING SEPTEMBER 15TH 2007 3 The Domestic Workers Support Group Migrant Rights Centre Ireland........................................... 3 The Work of Longford Women’s Link................................................................................................... 3 The Immigrant Council of Ireland: Their work on behalf of Migrant Women................................. 3 Action for Integration a view from Cairde............................................................................................ 3 Introducing the New Communities Partnership................................................................................... 3 Addressing the challenges faced by migrant and minority women in the EU.................................... 3 NWCI POLICY NEWS 3 NWCI Pre-Budget Submission (Social Welfare proposals)................................................................. 3 Date for your Diary Launch.................................................................................................................... 3 NWCI Pre-Budget Submission 2008...................................................................................................... 3 Social Welfare Reform Campaign 2007................................................................................................. 3 Skillnets supporting marginalised workers.......................................................................................... -

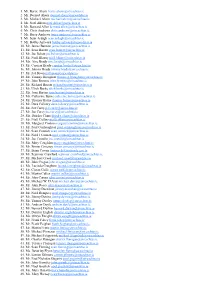

1. Mr. Bertie Ahern [email protected] 2. Mr. Dermot Ahern [email protected] 3. Mr. Michael Ahern [email protected] 4

1. Mr. Bertie Ahern [email protected] 2. Mr. Dermot Ahern [email protected] 3. Mr. Michael Ahern [email protected] 4. Mr. Noel Ahern [email protected] 5. Mr. Bernard Allen [email protected] 6. Mr. Chris Andrews [email protected] 7. Mr. Barry Andrews [email protected] 8. Mr. Seán Ardagh [email protected] 9. Mr. Bobby Aylward [email protected] 10. Mr. James Bannon [email protected] 11. Mr. Sean Barrett [email protected] 12. Mr. Joe Behan [email protected] 13. Mr. Niall Blaney [email protected] 14. Ms. Aíne Brady [email protected] 15. Mr. Cyprian Brady [email protected] 16. Mr. Johnny Brady [email protected] 17. Mr. Pat Breen [email protected] 18. Mr. Tommy Broughan [email protected] 19. Mr. John Browne [email protected] 20. Mr. Richard Bruton [email protected] 21. Mr. Ulick Burke [email protected] 22. Ms. Joan Burton [email protected] 23. Ms. Catherine Byrne [email protected] 24. Mr. Thomas Byrne [email protected] 25. Mr. Dara Calleary [email protected] 26. Mr. Pat Carey [email protected] 27. Mr. Joe Carey [email protected] 28. Ms. Deirdre Clune [email protected] 29. Mr. Niall Collins [email protected] 30. Ms. Margaret Conlon [email protected] 31. Mr. Paul Connaughton [email protected] 32. Mr. Sean Connick [email protected] 33. Mr. Noel J Coonan [email protected] 34. -

Public Acts of Contrition As Apologies in the British and French Press: Focus on Evaluation and Ideology

Public acts of contrition as apologies in the British and French press: Focus on evaluation and ideology Clyde Ancarno Thesis submitted in part fulfilment of the degree of Doctor of Philosophy Centre for Language and Communication Research Cardiff University December 2010 UMI Number: U584521 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U584521 Published by ProQuest LLC 2013. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 Ca r d if f DECLARATION UNIVERSITY PRI FYSGOL C a eRDY[§> This work has not previously been accepted in substance for any degree and is not concurrently submitted!!* candidature for any degree. Sighed TTT. (candidate) Date ...l2.*.0.S ..*.2«!j. STATEMENT 1 This thesis is being submitted in partial fulfilment of the requirements for the degree of PhD. Signed — (candidate) Date ....l2^.:.P.S»..*.ZoU.... STATEMENT 2 This thesis is the result of my own independent work/investigation, except where otherwise stated. OtHer'sources are acknowledged by explicit references. Signed ................(candidate) Date ...V2i.-..Q.S..:2<o.U.... STATEMENT 3 I hereby give consent for my thesis, if accepted, to be available for photocopying and for inter-library loan, and for the title and summary to be made available to outside organisations. -

Women and Politics in Ireland: the Road to Sex Quotas

Irish Political Studies ISSN: 0790-7184 (Print) 1743-9078 (Online) Journal homepage: http://www.tandfonline.com/loi/fips20 Women and Politics in Ireland: The Road to Sex Quotas Fiona Buckley To cite this article: Fiona Buckley (2013) Women and Politics in Ireland: The Road to Sex Quotas, Irish Political Studies, 28:3, 341-359, DOI: 10.1080/07907184.2013.818537 To link to this article: http://dx.doi.org/10.1080/07907184.2013.818537 Published online: 10 Sep 2013. Submit your article to this journal Article views: 403 View related articles Citing articles: 5 View citing articles Full Terms & Conditions of access and use can be found at http://www.tandfonline.com/action/journalInformation?journalCode=fips20 Download by: [Leabharlann Choláiste na Tríonóide/Trinity College Library & IReL] Date: 12 October 2015, At: 07:24 Irish Political Studies, 2013 Vol. 28, No. 3, 341–359, http://dx.doi.org/10.1080/07907184.2013.818537 Women and Politics in Ireland: The Road to Sex Quotas FIONA BUCKLEY Department of Government, University College Cork, Ireland ABSTRACT This article tells the story of how and why legislative candidate sex quotas, more commonly known as gender quotas, were adopted by the Irish Parliament in July 2012. In so doing, it reviews both internal party equality strategies and external party influences. Tracing party data over a two-decade period, the article shows that parties have adopted a range of strategies, in line with their ideological orientation, to address women’s political under-rep- resentation. For the most part, however, these strategies have been rhetorical and promotional in nature, and have not resulted in significant gains for women in electoral politics. -

Da´Il E´Ireann

Vol. 678 Wednesday, No. 3 25 March 2009 DI´OSPO´ IREACHTAI´ PARLAIMINTE PARLIAMENTARY DEBATES DA´ IL E´ IREANN TUAIRISC OIFIGIU´ IL—Neamhcheartaithe (OFFICIAL REPORT—Unrevised) Wednesday, 25 March 2009. Leaders’ Questions ……………………………… 651 Ceisteanna—Questions Taoiseach ………………………………… 659 Requests to move Adjournment of Da´il under Standing Order 32 ……………… 668 Order of Business ……………………………… 668 Pre-Budget Statements (resumed) ………………………… 674 Message from Seanad E´ ireann ………………………… 690 Message from Select Committee ………………………… 691 Ceisteanna—Questions (resumed) Minister for Education and Science Priority Questions …………………………… 691 Other Questions …………………………… 701 Adjournment Debate Matters …………………………… 711 Pre-Budget Statements (resumed) ………………………… 712 Private Members’ Business Oireachtas Reform: Motion (resumed) ……………………… 757 Adjournment Debate Tax Code ………………………………… 783 Company Closure ……………………………… 785 RAPID Programmes …………………………… 789 REPS Payments ……………………………… 791 Questions: Written Answers …………………………… 795 DA´ IL E´ IREANN ———— De´ Ce´adaoin, 25 Ma´rta 2009. Wednesday, 25 March 2009. ———— Chuaigh an Ceann Comhairle i gceannas ar 10.30 a.m ———— Paidir. Prayer. ———— Leaders’ Questions. Deputy Enda Kenny: I welcome the fact that the Government has invited the ICTU to talks. I hope this invitation will be accepted and I hope the talks will result in the calling off of next week’s day of action. It is critical at this time in our nation’s development that public services be enabled to continue and that the reputation of our country be kept at a -

Hare Coursing and Fox Hunting, You Are in the Majority of the Electorate

Dear Voter, Thank you for taking the time to read our "Irish Politicians and Animal Issues" booklet. If you care about animals and are opposed to the cruelty of activities such as hare coursing and fox hunting, you are in the majority of the electorate. Despite most Irish people wanting cruelty ended, some politicians ignore this and shamelessly work to defend those involved in terrorising, injuring and killing wildlife. In the following pages, you will see where politicians stand. If TDs in your constituency have spoken in favour of cruelty in the past, please contact them now. Encourage them to respect the wishes of the majority and reconsider their stance. How you and your family vote in the next election will help determine if Ireland's next government is one which chooses to protect animals or protect animal abusers. Before you cast your vote, consider the views of each of the candidates. If particular candidates are not included in this booklet, question them directly. We also recommend watching our "Politicians" playlist at www.youtube.com/icabs We believe that Ireland will only ever achieve true greatness, when foxhunting, hare coursing and all forms of cruelty are permanently abolished here. On election day, please choose compassion over cruelty. Thank you. Irish Council Against Blood Sports www.banbloodsports.com The greatness of a nation and its moral progress can be judged by the way its animals are treated ~ Gandhi TDs listed alphabetically Bannon, James . .09 Cowen, Barry . .36 Flanagan, Terence . .64 Barrett, Seán . .10 Creed, Michael . .37 Fleming, Sean . .65 Barry, Tom . -

Dáil Éireann

Vol. 700 Wednesday, No. 2 27 January 2010 DÍOSPÓIREACHTAÍ PARLAIMINTE PARLIAMENTARY DEBATES DÁIL ÉIREANN TUAIRISC OIFIGIÚIL—Neamhcheartaithe (OFFICIAL REPORT—Unrevised) Wednesday, 27 January 2010. Leaders’ Questions ……………………………… 343 Business of Dáil: Motion …………………………… 348 Order of Business ……………………………… 348 Death of Former Member: Expressions of Sympathy ………………… 358 Civil Partnership Bill 2009: Second Stage (resumed) …………………… 362 Ceisteanna—Questions Minister for Agriculture, Fisheries and Food Priority Questions …………………………… 380 Other Questions …………………………… 392 Adjournment Debate Matters …………………………… 401 Civil Partnership Bill 2009: Second Stage (resumed) …………………………… 402 Referral to Select Committee ………………………… 428 Industrial Relations (Amendment) Bill 2009 [Seanad]: Second Stage (resumed) ………… 428 Private Members’ Business Severe Weather Emergencies: Motion (resumed) ………………… 435 Adjournment Debate Hospital Services ……………………………… 459 Accident and Emergency Services ……………………… 461 Hospital Visiting Regulations ………………………… 463 Schools Building Projects …………………………… 464 Questions: Written Answers …………………………… 467 DÁIL ÉIREANN ———— Dé Céadaoin, 27 Eanáir 2010. Wednesday, 27 January 2010. ———— Chuaigh an Ceann Comhairle i gceannas ar 10.30 a.m. ———— Paidir. Prayer. ———— Leaders’ Questions. Deputy Enda Kenny: The House should note the passing of Mr. Pádraig MacKernan, an outstanding public official who served his country well in the Department of Foreign Affairs. In the diplomatic service he dealt with issues that are very relevant to the discussions that are going on today. The House should note his contribution to Irish life and public service. The Taoiseach is currently engaged in critical discussions with the British Prime Minister and parties in Northern Ireland in respect of the issues that are outstanding. In many ways these issues go back to the conclusion of the talks at St. Andrews more than three years ago, which were concluded between both governments. -

The Evolving Role of a National Parliament in European Affairs

THE OIREACHTAS AND THE EUROPEAN UNION: the Evolving Role of a National Parliament in European Affairs House of the Oireachtas new.indd 1 06/03/2013 11:49:12 3 House of the Oireachtas new.indd 2 06/03/2013 11:49:12 Acknowledgments What follows constitutes the fruit of the author’s work carried out under the Oireachtas Parliamentary Fellowship in the year 2010-2011. I am thankful to the Oireachtas for having created the Fellowship – a valuable and all-too-rare acknowledgment of the value of, and need for, increased research and understanding concerning the institutions which govern this state. I am thankful, most especially, to Dr. Maurice Manning, Professor John Horgan and Maria Fitzsimons, who made up the panel which decided to award me the Fellowship. I am grateful too for the support in this regard of Professor Brigid Laffan and Brendan Halligan, Chairman of the Institute for International and European Affairs. Professor Laffan, who has written extensively on the topic of this study herself (and indeed is cited in the pages that follow), rendered me the immense service of uncomplainingly reviewing the work for quality control purposes during the period of the Fellowship, at a time when she was extremely busy and indeed, latterly, was engaged in a research sabbatical. Members and former members of the Oireachtas and of the Oireachtas staff were kind enough to grant me many interviews during the course of the year, which gave me a far more accurate feeling for the research work I was doing. The requirements of confidentiality preclude me from naming them individually here, but I hope that all concerned will accept this acknowledgment as an expression of my sincere gratitude. -

CONNECTIONS Alumni Magazine Going Global

UCD2009-2010 CONNECTIONS alumni magazine Going Global ... with CHARISMA, INFLUENCE and a DEGREE from UCD ALUMNI ACHIEVERS in 2009 ______ Brian O’Driscoll George Lee Ryan Tubridy Niall Breslin Joan Burton Rob Kearney Neil Jordan Derval O’Rourke Brendan Gleeson Cracking the Code women in science GOthe L&H AHEAD debate AND ARGUE 5 49 | CONTENTS | 21 GOING GLOBAL UNIVERSITY PEOPLE 6 Charisma, influence A Year in the and a degree from Spotlight … ALUMNI UCD: all you need to ACHIEVERS in conquer the world. All 2009 (page 50). over the globe, UCD Why not alumni are making THE DNA OF UCD GO AHEAD their mark. Meet the BIG IDEAS are AND ARGUE ALUMNI SERVING hatched on campus (page 54) IRELAND ABROAD (page 22). – is the L&H (page 6). Check out UCD professors a breeding ground for three SCIENTISTS ask who’s SHAPING argumentative types? Is PUBLIC THINKING? who have cut a swathe in 5 politics bred in the bone at global scientific research (page 26). Still in touch – the Belfield? HALF THE DÁIL (page 10). Read missives alumni who CALL ARE UCD ALUMNI (page 58). from medics who left ON THEIR UCD The bust means boom … when UCD to PRACTISE CONTEMPORARIES it means GETTING BACK MEDICINE IN (page 30) and TO EDUCATION (page 64). NORTH AMERICA the FAMOUS FICTIONAL FINDER AND (page 14). See how ALUMNI created by Joyce, KEEPER The the CLASS OF 1994 Flann O’ Brien, Maeve Binchy riches of the has fared: 15 years out and more (page 32). Colour university of university they have on Campus … EVERY archives settled all over the PICTURE TELLS A STORY uncovered world (page 16).