[ENG] Presentation PPI 13.08.2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lions Clubs International Club Membership Register Summary the Clubs and Membership Figures Reflect Changes As of September 2004

LIONS CLUBS INTERNATIONAL CLUB MEMBERSHIP REGISTER SUMMARY THE CLUBS AND MEMBERSHIP FIGURES REFLECT CHANGES AS OF SEPTEMBER 2004 CLUB CLUB LAST MMR FCL YR MEMBERSHI P CHANGES TOTAL DIST IDENT NBR CLUB NAME STATUS RPT DATE OB NEW RENST TRANS DROPS NETCG MEMBERS 3148 016918 BELO HORIZONTE NOVA SUISSA LC 4 4 08-2004 21 0 0 0 0 0 21 3148 016919 BELO HORIZONTE GUTIERREZ LC 4 4 08-2004 30 0 0 0 -1 -1 29 3148 016920 BELO HORIZONTE CENTRO LC 4 4 08-2004 15 1 0 0 -3 -2 13 3148 016921 BELO HORIZONTE CARMO SION LC 4 4 08-2004 23 0 0 0 0 0 23 3148 016922 BELO HORIZONTE ITACOLOMI LC 4 4 08-2004 23 1 0 0 0 1 24 3148 016923 BELO HORIZONTE LIBERDADE LC 4 4 08-2004 27 0 0 0 0 0 27 3148 016924 BELO HORIZONTE PAMPULHA LC 4 4 08-2004 35 0 0 0 -4 -4 31 3148 016925 BELO HORIZONTE INCONFIDENCIA LC 4 4 08-2004 20 0 0 0 0 0 20 3148 016926 BELO HORIZONTE INDEPENDENCIA LC 4 4 08-2004 15 0 0 0 -1 -1 14 3148 016927 BELO HORIZONTE TIRADENTES LC 4 4 08-2004 17 0 0 0 0 0 17 3148 016928 BELO HORIZONTE VILA RICA LC 4 4 06-2004 13 0 0 0 0 0 13 3148 016929 BELO HORIZONTE MARILIA DE DIRC LC 4 4 08-2004 25 0 0 0 0 0 25 3148 016930 BELO HORIZONTE SANTO ANTONIO LC 4 4 08-2004 33 1 0 0 -2 -1 32 3148 016931 BELO HORIZONTE SANTA TEREZA LC 4 4 08-2004 26 0 0 0 0 0 26 3148 016932 BETIM LC 4 4 08-2004 22 0 0 0 -2 -2 20 3148 016934 BELO HORIZONTE JARAGUA LC 4 4 08-2004 22 0 0 0 -3 -3 19 3148 016935 BOM DESPACHO LC 4 4 08-2004 36 3 0 0 0 3 39 3148 016936 CAETE LC 4 4 08-2004 17 0 0 0 0 0 17 3148 016937 CORINTO LC 4 4 08-2004 34 0 0 0 -1 -1 33 3148 016938 CONGONHAS DO CAMPO LC 4 4 08-2004 -

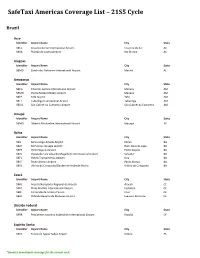

Safetaxi Americas Coverage List – 21S5 Cycle

SafeTaxi Americas Coverage List – 21S5 Cycle Brazil Acre Identifier Airport Name City State SBCZ Cruzeiro do Sul International Airport Cruzeiro do Sul AC SBRB Plácido de Castro Airport Rio Branco AC Alagoas Identifier Airport Name City State SBMO Zumbi dos Palmares International Airport Maceió AL Amazonas Identifier Airport Name City State SBEG Eduardo Gomes International Airport Manaus AM SBMN Ponta Pelada Military Airport Manaus AM SBTF Tefé Airport Tefé AM SBTT Tabatinga International Airport Tabatinga AM SBUA São Gabriel da Cachoeira Airport São Gabriel da Cachoeira AM Amapá Identifier Airport Name City State SBMQ Alberto Alcolumbre International Airport Macapá AP Bahia Identifier Airport Name City State SBIL Bahia-Jorge Amado Airport Ilhéus BA SBLP Bom Jesus da Lapa Airport Bom Jesus da Lapa BA SBPS Porto Seguro Airport Porto Seguro BA SBSV Deputado Luís Eduardo Magalhães International Airport Salvador BA SBTC Hotéis Transamérica Airport Una BA SBUF Paulo Afonso Airport Paulo Afonso BA SBVC Vitória da Conquista/Glauber de Andrade Rocha Vitória da Conquista BA Ceará Identifier Airport Name City State SBAC Aracati/Aeroporto Regional de Aracati Aracati CE SBFZ Pinto Martins International Airport Fortaleza CE SBJE Comandante Ariston Pessoa Cruz CE SBJU Orlando Bezerra de Menezes Airport Juazeiro do Norte CE Distrito Federal Identifier Airport Name City State SBBR Presidente Juscelino Kubitschek International Airport Brasília DF Espírito Santo Identifier Airport Name City State SBVT Eurico de Aguiar Salles Airport Vitória ES *Denotes -

Lista De Classificados Para a Etapa Regional

Lista de Classificados para a Etapa Regional 1 – Classificados para Etapa Regional. Módulo I Basquete Feminino SRE Município Escola Curvelo Curvelo E.E. Major Antônio Salvo Diamantina Alvorada de Minas E.E. José Madureira Horta Montes Claros Montes Claros Centro Educacional Ímpar Pirapora Ponto Chique E.E. Professor Edilson Brandão Januária Varzelândia E.E. Padre José Silveira Centro de Educação e Cultura - Janaúba Janaúba CEC Basquete Masculino SRE Município Escola Instituto Pequeno Príncipe Curvelo Curvelo Expansão Diamantina Alvorada de Minas E.E. José Madureira Horta Montes Claros Montes Claros Centro Educacional Ímpar Colégio Nossa Senhora do Pirapora Pirapora Santíssimo Sacramento Januária Varzelândia E.E. Padre José Silveira Centro de Educação e Cultura - Janaúba Janaúba CEC Futsal Feminino SRE Município Escola E.M. Geralda Márcia Pereira Curvelo Três Marias Gonçalves Diamantina Capelinha E.E. Rosarinha Pimentinha Montes Claros E.E. Doutor Carlos Albuquerque Montes Claros Patis E.E. Francisco Andrade Pirapora Pirapora E.E. Coronel Ramos Januária Icaraí de Minas E.E. Manoel Tibério E.M. Madre Cândida Maria de Janaúba Janaúba Jesus Futsal Masculino SRE Município Escola E.M. Geralda Márcia Pereira Curvelo Três Marias Gonçalves Diamantina Capelinha E.E. Rosarinha Pimentinha Montes Claros Capitão Enéas E.E. José Patrício da Silveira E.E. José Natalino Boaventura Pirapora Pirapora Leite E.M. Carmem Maria Andrade Januária Itacarambi Nogueira E.E. Professor José Américo Janaúba Mato Verde Barbosa Handebol Feminino SRE Município Escola E.M. Geralda Márcia Pereira Curvelo Três Marias Gonçalves Diamantina Minas Novas E.E. Presidente Costa Silva Montes Claros Colégio Sólido Montes Claros Bocaiúva E.E. Professor Gastão Valle Colégio Nossa Senhora do Pirapora Pirapora Santíssimo Sacramento E.M. -

|1129|Itacarambi: Um Município Às Margens Do Rio São Francisco E Na Periferia Do Sistema

|1129|ITACARAMBI: UM MUNICÍPIO ÀS MARGENS DO RIO SÃO FRANCISCO E NA PERIFERIA DO SISTEMA Jeanne Cristina Menezes Crespo Resumo: No ano de 2011, fomos convidados pela Assembleia Legislativa do Estado de Minas Gerais a participar de um levantamento de campo para o Projeto “Cidadania Ribeirinha”, que tem por objetivo a melhoria das condições de vida das populações ribeirinhas que residem no Estado de Minas Gerais, a partir da valorização da identidade sociocultural são-franciscana, por meio de ações e de articulação institucional desenvolvidas nos municípios contemplados pelo projeto. Assim, no período compreendido entre 16 e 23 de agosto de 2011, a equipe visitou os municípios de Manga, Matias Cardoso, Itacarambi e Pedras de Maria da Cruz, todos com sedes municipais banhadas pelo Rio São Francisco e possuidores dos menores Índices de Desenvolvimento Humano do Estado de Minas Gerais. Desta forma, a partir de dados levantados na ocasião, com auxílio de bibliografia especializada no assunto, realizaremos uma breve análise sobre a organização do espaço urbano do Município de Itacarambi, que a nosso ver seria um destaque dentre os municípios antes mencionados, uma vez que verificamos esforços tanto da iniciativa pública municipal, quanto de organizações coletivas - estas últimas fortemente marcadas pelo cooperativismo social, no sentido de melhorar a inserção deste município no espaço econômico regional do Norte de Minas Gerais. Palavras-chave: Itacarambi, política urbana, economia solidária, cooperativismo social. Considerações Iniciais O Município de Itacarambi está localizado na microrregião de Januária, mesorregião do Norte de Minas Gerais, possui 1.225 Km2 de extensão, com população total estimada em 17.720 habitantes. -

Governo Do Estado De Minas Gerais

GOVERNO DO ESTADO DE MINAS GERAIS 1 SECRETARIA DE ESTADO DA SAÚDE Minas: Aqui se constrói um país GOVERNO DO ESTADO DE MINAS GERAIS SECRETARIA DE ESTADO DA SAÚDE CONSELHO ESTADUAL DE SAÚDE COLEGIADO DE SECRETARIOS MUNICIPAIS DE SAÚDE DE MINAS GERAIS – COSEMS-MG PLANO DIRETOR DE REGIONALIZAÇÃO 2001 / 2004 REGIONALIZAÇÃO COM HIERARQUIZAÇÃO MINAS GERAIS – 2002 GOVERNO DO ESTADO DE MINAS GERAIS 2 SECRETARIA DE ESTADO DA SAÚDE Minas: Aqui se constrói um país GAL. CARLOS PATRÍCIO FREITAS PEREIRA SECRETÁRIO DE ESTADO DA SAÚDE DR. LUIS MÁRCIO ARAÚJO RAMOS SECRETÁRIO ADJUNTO DE SAÚDE DR. HÉLIO SALVADOR ARÊAS ASSESSOR TÉCNICO DRA. MARIA AUXILIADORA SALLES GONÇALVES SUPERINTENDENTE DE PLANEJAMENTO E COORDENAÇÃO DR. ADILSON ANTÔNIO DA SILVA STOLET SUPERINTENDENTE OPERACIONAL DE SAÚDE COMISSÃO DE ELABORAÇÃO DO PLANO DIRETOR DE REGIONALIZAÇÃO COORDENAÇÃO CENTRAL IVÊTA MALACHIAS DIRETORA DE PLANEJAMENTO DA SUPERINTENDENCIA DE PLANEJAMENTO E COORDENAÇÃO DRA. MYRIAM ARAÚJO COELHO TIBÚRCIO PRESIDENTE DO COLEGIADO DE SECRETARIOS MUNICIPAIS DE SAÚDE DE MINAS GERAIS PAULO TAVARES ASSESSOR TÉCNICO DA DIRETORIA DE REDES ASSISTENCIAIS DE SAÚDE DA SUPERINTENDENTE OPERACIONAL DE SAÚDE INSTITUIÇÕES PARTICIPANTES CONSELHO ESTADUAL DE SAÚDE REPRESENTAÇÃO DE CONSELHOS MUNICIPAIS DE SAÚDE DIRETORIAS REGIONAIS DE SAÚDE SECRETARIAS MUNICIPAIS DE SAÚDE GOVERNO DO ESTADO DE MINAS GERAIS 3 SECRETARIA DE ESTADO DA SAÚDE Minas: Aqui se constrói um país EQUIPE TÉCNICA RESPONSÁVEL MARIA AUXILIADORA DA SILVA PINTO ANA SIMÔA DE ALMEIDA MARCONI PEREIRA COSTA JOSE JOAQUIM ROCHA VIEIRA MILTON DE SIQUEIRA DRA. CATARINA DEMÉTRIO HELOISA JOSEFINA BUENO OSVALDO K. DE OLIVEIRA SURAIME PIMENTEL HÉLIO HAMILTON GOVERNO DO ESTADO DE MINAS GERAIS 4 SECRETARIA DE ESTADO DA SAÚDE Minas: Aqui se constrói um país SUMÁRIO 1. -

Terça-Feira, 23 De Fevereiro De 2021

8 – terça-feira, 23 de fevereiro de 2021 diário do exeCutivo Minas Gerais - Caderno 1 Paulo Aparecido Ferreira - 894960 Varginha Daniel Lima Fernandes - 683890 Bocaiúva Darlan Rodrigues Do Nascimento - 647131 Bom Despacho Do Presídio de Dores do Indaiá I para o Presídio de Divinópolis I: Paulo De Souza Neto - 920658 Varginha Dhonatha Maia Ribeiro - 562929 Bocaiúva Fabiano Alexandre De Souza - 930107 Bom Despacho Rudiery Celestino Gabriel - 917284 Varginha Diego Henrique Ferreira Da Silva - 631781 Bocaiúva Gabriel Rodrigues De Oliveira - 639006 Bom Despacho Aline De Sousa Barbosa - 930746 Dores Do Indaiá Tiago Geraldo Braga - 919916 Varginha Gilmar Alves Pereira - 220730 Bocaiúva Grampier De Moura -379984 Bom Despacho Raneza Kethene Campos - 128460 Dores Do Indaiá Wellington Abreu Ribeiro - 911448 Varginha Leonardo Estavao Dos Reis - 928731 Bocaiúva Helio Pinheiro De Paula - 929671 Bom Despacho Yago Lucas Flauzino Batista - 912094 Varginha Maycon Pereira Dos Santos - 928727 Bocaiúva Jeferson Gomes Ferreira - 929605 Bom Despacho Do Presídio de Dores do Indaiá I para o Presídio de Pompéu I: Piter Farley Santos Pereira- 138329 Bocaiúva Jhonatan Junio Santos - 853145 Bom Despacho Retificar a autorização de transferência publicada no IOF de Rian Souza De Jesus - 736058 Bocaiúva Leonardo Fonseca Braga - 411938 Bom Despacho Itatiana Almeida De Souza - 568289 Dores Do Indaiá 05/01/2021: Onde se lê: “Do Centro de Remanejamento Provisório de Valden Dos Santos Caldeira - 137633 Bocaiúva Magnum Dyonata Roberto - 270343 Bom Despacho Itabira I para -

Município SRE ABADIA DOS DOURADOS SRE MONTE

LISTA DOS MUNICÍPIO DE MINAS GERAIS POR SUPERINTENDÊNCIA REGIONAL DE ENSINO (SER) Município SRE ABADIA DOS DOURADOS SRE MONTE CARMELO ABAETÉ SRE PARÁ DE MINAS ABRE CAMPO SRE PONTE NOVA ACAIACA SRE OURO PRETO AÇUCENA SRE GOVERNADOR VALADARES ÁGUA BOA SRE GUANHÃES ÁGUA COMPRIDA SRE UBERABA AGUANIL SRE CAMPO BELO ÁGUAS FORMOSAS SRE TEÓFILO OTONI ÁGUAS VERMELHAS SRE ALMENARA AIMORÉS SRE GOVERNADOR VALADARES AIURUOCA SRE CAXAMBU ALAGOA SRE CAXAMBU ALBERTINA SRE POUSO ALEGRE ALÉM PARAÍBA SRE LEOPOLDINA ALFENAS SRE VARGINHA ALFREDO VASCONCELOS SRE BARBACENA ALMENARA SRE ALMENARA ALPERCATA SRE GOVERNADOR VALADARES ALPINÓPOLIS SRE PASSOS ALTEROSA SRE POÇOS DE CALDAS ALTO CAPARAÓ SRE CARANGOLA ALTO JEQUITIBÁ SRE MANHUAÇU ALTO RIO DOCE SRE BARBACENA ALVARENGA SRE CARATINGA ALVINÓPOLIS SRE PONTE NOVA ALVORADA DE MINAS SRE DIAMANTINA AMPARO DO SERRA SRE PONTE NOVA ANDRADAS SRE POÇOS DE CALDAS ANDRELÂNDIA SRE BARBACENA ANGELÂNDIA SRE DIAMANTINA ANTÔNIO CARLOS SRE BARBACENA ANTÔNIO DIAS SRE CORONEL FABRICIANO ANTÔNIO PRADO DE MINAS SRE MURIAÉ ARAÇAÍ SRE SETE LAGOAS ARACITABA SRE BARBACENA ARAÇUAÍ SRE ARAÇUAÍ ARAGUARI SRE UBERLÂNDIA ARANTINA SRE JUIZ DE FORA ARAPONGA SRE PONTE NOVA ARAPORÃ SRE UBERLÂNDIA ARAPUÁ SRE PATOS DE MINAS ARAÚJOS SRE DIVINÓPOLIS ARAXÁ SRE UBERABA ARCEBURGO SRE SÃO SEBASTIÃO DO PARAÍSO ARCOS SRE DIVINÓPOLIS AREADO SRE POÇOS DE CALDAS ARGIRITA SRE LEOPOLDINA ARICANDUVA SRE DIAMANTINA ARINOS SRE UNAÍ ASTOLFO DUTRA SRE UBÁ ATALÉIA SRE TEÓFILO OTONI AUGUSTO DE LIMA SRE CURVELO BAEPENDI SRE CAXAMBU BALDIM SRE SETE LAGOAS BAMBUÍ SRE -

Minas Gerais

MINAS GERAIS - UNIDADES INSS - CARTÓRIOS NOME UNIDADE UF MUNICÍPIO ENDEREÇO BAIRRO AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - BARREIRO MG BELO HORIZONTE AVENIDA TITO FULGÊNCIO, 104 - BARREIRO AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - FLORESTA MG BELO HORIZONTE R PITANGUI, 2052 SAGRADA FAMILIA AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - OESTE MG BELO HORIZONTE RUA ESPIRITO SANTO , 54 CENTRO AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - PADRE EUSTÁQUIO MG BELO HORIZONTE RUA PADRE EUSTAQUIO, 1831 PADRE EUSTAQUIO AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - SANTA EFIGÊNIA MG BELO HORIZONTE RUA DOS TUPINAMBÁS, 351 CENTRO AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - SUL MG BELO HORIZONTE RUA DOS GUAICURUS, 312 CENTRO AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - VENDA NOVA MG BELO HORIZONTE RUA PADRE EUSTÁQUIO, 1831 PADRE EUSTAQUIO AGÊNCIA DA PREVIDÊNCIA SOCIAL ATENDIMENTO DEMANDAS JUDICIAIS MG BELO HORIZONTE AVENIDA AMAZONAS, 266 CENTRO BELO HORIZONTE AGÊNCIA DA PREVIDÊNCIA SOCIAL BELO HORIZONTE - CALAFATE MG BELO HORIZONTE RUA PADRE EUSTAQUIO, 1831 PADRE EUSTAQUIO AGÊNCIA DA PREVIDÊNCIA SOCIAL TELEATENDIMENTO BELO HORIZONTE MG BELO HORIZONTE R ESPIRITO SANTO 871 CENTRO AGÊNCIA DA PREVIDÊNCIA SOCIAL ATENDIMENTO ACORDOS MG BELO HORIZONTE AVENIDA AMAZONAS, 266 CENTRO INTERNACIONAIS BELO HORIZONTE AGÊNCIA DA PREVIDÊNCIA SOCIAL CEAB RECONHECIMENTO DE DIREITO MG BELO HORIZONTE AV AMAZONAS 266 CENTRO SRII AGÊNCIA DA PREVIDÊNCIA SOCIAL CEAB MANUTENÇÃO DA SR-II MG BELO HORIZONTE AV AMAZONAS CENTRO AGÊNCIA DA PREVIDÊNCIA SOCIAL BARBACENA -

Alô, Minas!” Após a Análise Dos Recursos

GOVERNO DO ESTADO DE MINAS GERAIS Resultado final dos distritos e localidades selecionados para participarem do Programa “Alô, Minas!” após a análise dos recursos A Comissão Coordenadora do Edital de Chamamento Público Nº 01/2020 , no uso das atribuições que lhe foram conferidas pela Resolução SEPLAG Nº 108, de 26 de Dezembro de 2019, torna público o resultado final do Programa Alô, Minas: Resultado Final Edital de Chamamento Público SEPLAG Nº 01/2020 - Programa Alô, Minas! Município Localidade / Distrito Nome Abre Campo Localidade Povoado Aparecida Acaiaca Localidade Povoado de Palmeiras de Fora Açucena Localidade Pompéu Água Boa Localidade Povoado de Bonfim Água Boa Localidade Povoado de Ribeirão dos Pêgos Aguanil Localidade Boticão Aimorés Distrito São José do Limoeiro Alfredo Vasconcelos Distrito Potreiro Angelândia Localidade Santo Antônio dos Moreiras Antônio Dias Localidade Porteira Grande Araçuaí Localidade Povoado Baixa Quente Araçuaí Localidade Povoado Alfredo Graça Araçuaí Localidade Povoado de Neves Araponga Localidade Estouros Araponga Localidade São Domingos Arcos Localidade Ilha Aricanduva Localidade Comunidade Carneiros Ataléia Distrito Tipiti Ataléia Distrito São Miguel de Ataléia Baependi Localidade Bairro Piracicaba Baependi Localidade Bairro São Pedro Baldim Distrito São Vicente Belo Oriente Localidade Povoado Boa Esperança Belo Vale Distrito Roças Novas dos Bandeirantes Belo Vale Distrito São Sebastião das Lajes Belo Vale Distrito Chacará dos Cordeiros Belo Vale Distrito Boa Morte Berilo Localidade Vila Santa Isodoro Berizal Localidade Povoado de Barreiros Bocaina de Minas Distrito Santo Antonio do Alto Rio Grande Bocaiúva Distrito Engenheiro Dolabela Bocaiúva Distrito Sentinela Bocaiúva Distrito Machados Serrano Bocaiúva Distrito Camilo Prates Bocaiúva Distrito Pedregulho do Vale Ato 270 (14443334) SEI 1500.01.0039228/2019-39 / pg. -

Projeto Sete Lagoas - Abaeté Estado De Minas Gerais

MINISTÉRIO DE MINAS E ENERGIA SECRETARIA DE GEOLOGIA, MINERAÇÃO E TRANSFORMAÇÃO MINERAL SERVIÇO GEOLÓGICO DO BRASIL – CPRM Diretoria de Geologia e Recursos Minerais Departamento de Geologia Superintendência Regional de Belo Horizonte Programa Geologia do Brasil PROJETO SETE LAGOAS - ABAETÉ ESTADO DE MINAS GERAIS Belo Horizonte 2010 CPRM - SuPeRintenDênCia ReGional De Belo HoRizonte av. BRaSil 1731 – BaiRRo FunCionáRioS Belo HoRizonte – MG- 30.140-002 Fax: (31) 3878 -0383 tel: (31) 3878-0307 HttP://www.CPRM.Gov.BR [email protected] Companhia de Pesquisa de Recursos Mineral-CPRM Projeto Sete Lagoas-Abaeté, Estado de Minas Gerais: texto explicativo./Manoel Pedro Tuller,José Heleno Ribeiro,Nicola Signorelli,Wilson Luis Féboli,Júlio Murilo Martino Pinho, Orgs.- Belo Horizonte: CPRM-BH, 2009. 160p.,06 mapas geológicos, escala 1:100.000 (Série Programa Geologia do Brasil) versão impressa em papel e em meio digital, textos e mapas. Conteúdo: Inclui as folhas geológicas de : Sete Lagoas, Baldim[parcial], Abaeté, Pompéu, , Bom Despacho[parcial], escala 1:100.000, Belo Horizonte [parcial]. Projeto Desenvolvido em SIG-Sistema de Informações Geográficas utilizando o GEOBANK-Bancos de Dados Geoespacial da CPRM. 1.Geologia de Minas Gerais. 2.Recursos Minerais- I – Título. II Tuller,Manoel Pedro. III- Ribeiro,José Heleno. IV –Signorelli,Nicola. V- Féboli,Wilson Luis. VI- Pinho, Julio Murilo Martino.VII.Série. CDU 551 (815.1A/Z) Ficha catalográfica elaborada na CPRM-BH por Bibl. M. Madalena Costa Ferreira – CRB-MG1393 Direitos desta edição: -

Ord. Masp Nome Unidade / Município 1 1107143/8 Efigenia Pereira De Abreu Leao Penitenciaria De Francisco Sa 2 1183620/2 Eurides

GOVERNO DO ESTADO DE MINAS GERAIS SECRETARIA DE ESTADO DE DEFESA SOCIAL SUPERINTENDÊNCIA DE RECURSOS HUMANOS DIRETORIA DE RECRUTAMENTO E SELEÇÃO ATO DE CONVOCAÇÃO CURSO DE REQUALIFICAÇÃO PARA CONTRATADOS DA SEDS – 11ª RISP – MONTES CLAROS A SUPERINTENDENTE DE RECURSOS HUMANOS DA SEDS, NO USO DE SUAS ATRIBUIÇÕES, TORNA PÚBLICA A LISTA DE CONTRATADOS CONVOCADOS PARA O CURSO DE REQUALIFICAÇÃO, NOS TERMOS DO EDITAL EFAP/SEDS Nº 004/2009 DE 29 DE SETEMBRO DE 2009 – PROCESSO DE REQUALIFICAÇÃO PARA O QUADRO DE PESSOAL DA SEDS – 11ª RISP – MONTES CLAROS – MUNICÍPIOS DE MUNICÍPIOS DE MONTES CLAROS, BOCAIUVA, BRASÍLIA DE MINAS, CORAÇÃO DE JESUS, ESPINOSA, GRÃO MOGOL, ITACARAMBI, MANGA, MONTALVÂNIA, MONTE AZUL, PORTEIRINHA, RIO PARDO DE MINAS, SALINAS, SÃO JOÃO DA PONTE, TAIOBEIRAS, FRANCISCO SÁ, JANAUBA, JANUÁRIA, SÃO FRANCISCO. ORIENTAÇÕES: I – O CURSO SERÁ REALIZADO NA RUA URUGUAI, 505, BAIRRO, DOUTOR JOÃO ALVES, MONTES CLAROS– MG. (IGREJA COMUNIDADE CRISTÃ PENTECOSTAL) II – OS CONTRATADOS DEVERÃO COMPARECER AO LOCAL DESIGNADO PARA O CURSO NOS DIAS ESTABELECIDOS PARA CADA GRUPAMENTO, ÀS 07:30H, COM VESTIMENTAS ADEQUADAS AO AMBIENTE ESCOLAR E PORTANDO DOCUMENTO DE IDENTIDADE ORIGINAL COM FOTO. 1º GRUPAMENTO – 28 DE MAIO DE 2012 TÉCNICOS DE NÍVEL MÉDIO E SUPERIOR ORD. MASP NOME UNIDADE / MUNICÍPIO 1 1107143/8 EFIGENIA PEREIRA DE ABREU LEAO PENITENCIARIA DE FRANCISCO SA 2 1183620/2 EURIDES DE FÁTIMA ANTUNE MOTA PRESÍDIO REGIONAL DE MONTES CLAROS 3 1144290/2 IDA SILVIA LEAO RODRIGUES ARAUJO PENITENCIARIA DE FRANCISCO SA 4 0847154/2 IMACULADA RODRIGUES DE AGUILAR PENITENCIARIA DE FRANCISCO SA 5 1183318/3 JANAINE MENDES PIMENTEL PRESÍDIO REGIONAL DE MONTES CLAROS 6 1183595/6 LUCILANDIA MARIA SANTOS PRESÍDIO REGIONAL DE MONTES CLAROS 7 0936381/3 MARIA ANGELA DRUMOND DE ANDRADE PRESÍDIO REGIONAL DE MONTES CLAROS 8 1183638/4 MARIA CLAUDIA ALVES FIGUEIREDO PRESÍDIO ALVORADA 9 0982960/7 TATIANE AMELIA FERREIRA PRESÍDIO ALVORADA AUXILIAR ADMINISTRATIVO ORD. -

BOLETIM EPIDEMIOLÓGICO COVID-19: Doença Causada Pelo Coronavírus – 19

BOLETIM EPIDEMIOLÓGICO COVID-19: Doença causada pelo coronavírus – 19 segunda-feira, 3 de maio de 2021 CENÁRIO EM MINAS GERAIS - COVID-19 CORONAVÍRUS Total de Casos Confirmados Casos em Acompanhamento Casos Recuperados Óbitos Confirmados 1.371.818 75.955 1.261.550 34.313 Fonte: Painel COVID-19 MG/Sala de Situação/SubVS/SES/MG. Dados parciais, sujeitos a alterações. TOTAL DE CASOS CONFIRMADOS: soma dos casos confirmados que não evoluíram para óbito e dos óbitos confirmados por COVID-19. CASOS RECUPERADOS: casos confirmados de COVID-19 que receberam alta hospitalar e/ou cumpriram isolamento domiciliar de 10 dias E estão há 72h assintomáticos (sem a utilização de medicamentos sintomáticos) E sem intercorrências. CASOS EM ACOMPANHAMENTO: casos confirmados de COVID-19 que não evoluíram para óbito, cuja condição clínica permanece sendo acompanhada ou aguarda atualização pelos municípios. ÓBITOS CONFIRMADOS: óbitos confirmados para COVID-19. Nº de Casos Confirmados nas Últimas 24h Nº de Óbitos Confirmados nas Últimas 24h 1.616 24 Observação: o “número de casos e óbitos confirmados nas últimas 24h” pode não retratar a ocorrência de novos casos no período, mas o total de casos notificados à SES/MG nas últimas 24h. / PERFIL EPIDEMIOLÓGICO DOS CASOS CONFIRMADOS DE COVID-19 QUE NÃO EVOLUÍRAM PARA ÓBITO, MG, 2020 Quantidade de Casos por Sexo Apresenta Fator de Risco (Comorbidade*) Quantidade de casos por Faixa Etária SIM 7% NÃO 7% <1ANO 0,7% Média de Idade dos Casos MASCULINO Confirmados: 42 anos 48% 1 A 9 ANOS 2,4% 10 A 19 ANOS 5,5% 20 A 29 ANOS 17,9% 30 A 39 ANOS 22,5% 40 A 49 ANOS 18,9% FEMININO 50 A 59 ANOS 14,7% 52% NÃO INFORMADO 86% 60 ANOS OU MAIS 17,3% *Dados parciais, aguardando atualização dos municípios.