FTSE AIM Index Series Family

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Performance of Demutualized, Cross-Listed and Newly Listed Ipos: Evidences from Alternative Investment Market (AIM)

Performance of Demutualized, Cross-Listed and Newly Listed IPOs: Evidences from Alternative Investment Market (AIM) By Abdul Wahid Reg # S16C06P04001 Faculty of Management Sciences Riphah International University, Islamabad 2019 Performance of Demutualized, Cross-Listed and Newly Listed IPOs: Evidences from Alternative Investment Market (AIM) By Abdul Wahid Reg # S16C06P04001 Supervised By: Dr. Shahzad Ahmad Khan Co-Supervised By: Dr. Muhammad Zubair Mumtaz A thesis submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy In Management Sciences (Finance) at Riphah International University, Islamabad, Pakistan 2019 ii RIPHAH INTERNATIONAL UNIVERSITY, ISLAMABAD APPROVAL SHEET SUBMISSION OF HIGHER RESEARCH DEGREE THESIS The following statement is to be signed by the candidates ‘supervisor (s), Dean/ HOD and must be received by the COE, prior to the dispatch of the thesis to the approved examiners. Candidate’s Name & Reg #: Abdul Wahid & Reg # S16C06P04001 Programme Title: PhD (Finance) Faculty/Department: Management Sciences Thesis Title: Performance of Demutualized, Cross-Listed and Newly Listed IPOs: Evidences from Alternative Investment Market (AIM) I hereby certify that the above candidate’s work, including the thesis, has been completed to my satisfaction and that the thesis is in a format and of an editorial standard recognized by the faculty/department as appropriate for examination. The Thesis has been checked through Turnitin for plagiarism (test report attached). Signature (s): Supervisor: Dr. Shahzad Ahmad Khan Signature:__________________ Date:______________________ Co-supervisor: Dr. Muhammad Zubair Mumtaz Signature __________________ Date: _____________________ The undersigned certify that: 1. The candidate presented at a pre-completion seminar, an overview and synthesis of major findings of the thesis, and that the research is of a standard and extent appropriate for submission as a thesis. -

COMPARISON of the EUROPEAN and the U.S. UNREGULATED STOCK MARKETS DESIGNED for SMES Imanou Akala, Sakarya University

The International Journal of Business and Finance Research Vol. 13, No. 1, 2019, pp. 85-102 ISSN: 1931-0269 (print) www.theIBFR.com ISSN: 2157-0698 (online) COMPARISON OF THE EUROPEAN AND THE U.S. UNREGULATED STOCK MARKETS DESIGNED FOR SMES Imanou Akala, Sakarya University ABSTRACT This paper examines the state of small and medium enterprises (SMEs) in European and U.S. unregulated stock markets. The analysis compares the performance of both markets, using the weekly adjusted closing index prices of Euronext all share index, NYSE AMEX Composite Index, and the OTCM ADR Index for the 2013-2017 period. ADF, EGARCH, and ARCH tests were performed on the collected time series data, to measure and forecast index price volatility, risk and return. The results show a high level of price volatility in some periods; but a permanent effect of shocks was not observed in the long term for all the analyzed indexes. Negative shocks cause more volatility than positive shocks. However, an overall result shows that, the Euronext all share index, despite slight declines, displays an upward trend and relatively higher returns with less risk, than the NYSE AMEX Composite Index, and the OTCM ADR Index. This results reflects the better performance of the European unregulated market, compare to its U.S. counterparts. JEL: M130, G1, C120, C220 KEYWORDS: Small and Medium Enterprises, Stock Markets, Initial Public Offering, Index Prices, Financial Risk and Return INTRODUCTION lthough a significant amount of reports and studies have been conducted regarding SMEs in the American, the Asian, the European unregulated stock markets and elsewhere (Hall, 2007; OICV AIOSCO 2015; Bremus, 2015; Kiškis, Limba and Gulevičiūtė, 2016; Kentaro, 2016 and others); studies comparing SMEs’ unregulated stock markets performance to each other, locally or internationally are scarce. -

Ewelina Sokołowska a Study of the Global Market

Ewelina Sokołowska The Principles of Alternative Investments Management A Study of the Global Market The Principles of Alternative Investments Management ThiS is a FM Blank Page Ewelina Sokołowska The Principles of Alternative Investments Management A Study of the Global Market Ewelina Sokołowska Department of Corporate Finance Faculty of Management University of Gdansk Sopot, Poland ISBN 978-3-319-13214-3 ISBN 978-3-319-13215-0 (eBook) DOI 10.1007/978-3-319-13215-0 Library of Congress Control Number: 2015943397 Springer Cham Heidelberg New York Dordrecht London © Springer International Publishing Switzerland 2016 This work is subject to copyright. All rights are reserved by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use. The publisher, the authors and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. Neither the publisher nor the authors or the editors give a warranty, express or implied, with respect to the material contained herein or for any errors or omissions that may have been made. -

Monatsemta-Gzamkvlevi.Pdf

მონაცემთა გზამკვლევი გლობალური განვითარების რაკურსში სტატისტიკა ინდექსები რეიტინგები თბილისი 2020 წელი შ ი ნ ა ა რ ს ი ს ტ ა ტ ი ს ტ ი კ ა ..............................................................................................................................................................................11 გაეროს სტატისტიკა / UNITED NATIONS STATISTICS ................................................................................................................11 მსოფლიო ბანკის მონაცემები/ THE WORLD BANK DATA .......................................................................................................11 საერთაშორისო სავალუტო ფონდის სტატისტიკა / IMF - INTERNATIONAL MONETARY FUND STATISTICS .............................11 შრომის საერთაშორისო ორგანიზაციის სტატისტიკა და მონაცემთა ბაზები / ILO - INTERNATIONAL LABOUR ORGANIZATION STATISTICS AND DATABASES ....................................................................................................................................11 მსოფლიო სავაჭრო ორგანიზაციის სტატისტიკა / WTO - WORLD TRADE ORGANIZATION STATISTICS ...................................11 გაეროს ვაჭრობისა და განვითარების კონფერენციის სტატისტიკა / UNCTAD STAT - UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT STATISTICS .................................................................................................................12 გაეროს სამრეწველო განვითარების ორგანიზაციის სტატისტიკა / UNIDO - UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION STATISTICS .......................................................................................................................................12 -

Corporate Communications SBC Warburg Schweiz

Portfolio Certificates Linked to the Leading Global Trends Portfolio Issued by UBS AG, Zurich Cash settled SVSP Product Type: Tracker Certificates (1300, Callable) ISIN: CH0410019324 / WKN: UBS1HM / Valor: 41001932 Public Offer Final Termsheet This Product does not represent a participation in any of the collective investment schemes pursuant to Art. 7 ff of the Swiss Federal Act on Collective Investment Schemes (CISA) and thus does not require an authorisation of the Swiss Financial Market Supervisory Authority (FINMA). Therefore, investors in this Product are not eligible for the specific investor protection under the CISA. Moreover, Investors in this Product bear the issuer risk. This is a structured product. Prospective purchasers of this Product should ensure that they understand the nature of the Product and the extent of their exposure to risks and that they consider the suitability of the Product as an investment in the light of their own circumstances and financial condition. This Product involves a high degree of risk, including the risk of it expiring worthless. Potential investors should be prepared to sustain a total loss of the purchase price of their investment. This Product is linked to a notional dynamic portfolio, which is actively advised on in the sole discretion of the Reference Portfolio Advisor pursuant to the Reference Portfolio Description Document (Annex 1). This document (Indicative Terms) constitutes the non-binding Indicative Simplified Prospectus for the Product described herein. It does not constitute a binding offer, contains indicative terms and conditions subject to change and can be obtained free of charge from UBS AG, P.O. Box, CH-8098 Zurich (Switzerland), via telephone (+41-(0)44-239 47 03), fax (+41-(0)44-239 69 14) or via e-mail (swiss- [email protected]). -

FTSE AIM Index Series Rules

Ground Rules FTSE AIM Index Series v3.8 ftserussell.com An LSEG Business August 2021 Contents 1.0 Introduction .................................................................... 3 2.0 Management Responsibilities ....................................... 4 3.0 FTSE Russell Index Policies ......................................... 6 4.0 Eligible Securities .......................................................... 8 5.0 Index Qualification Criteria ......................................... 11 6.0 Periodic Review of Constituent Companies .............. 12 7.0 Additions Outside of a Review ................................... 14 8.0 Corporate Actions and Events .................................... 15 9.0 Industry Classification Benchmark (ICB)................... 17 10.0 Algorithm and Calculation Method ............................. 18 Appendix A: Index Opening and Closing Hours ................. 19 Appendix B: Status of Indices .............................................. 20 Appendix C: Further Information ......................................... 21 FTSE Russell An LSEG Business | FTSE AIM Index Series, v3.8, August 2021 2 of 21 Section 1 Introduction 1.0 Introduction 1.1 This document sets out the Ground Rules for the construction and management of the FTSE AIM Index Series. Copies of these Ground Rules are available from FTSE International Limited (FTSE). 1.2 The FTSE AIM Index Series is designed to represent the performance of companies quoted on the AIM Market (AIM) of the London Stock Exchange. The Index Series includes the following Indices: FTSE AIM 100 Index (Real Time Index) FTSE AIM UK 50 Index (Real Time Index) FTSE AIM All-Share Index (Real Time Index) FTSE AIM All-Share Supersector Indices (End of Day Indices) 1.3 The FTSE AIM Index Series does not take account of ESG factors in its index design. 1.4 FTSE Russell FTSE Russell is a trading name of FTSE International Limited, Frank Russell Company, FTSE Global Debt Capital Markets Limited (and its subsidiaries FTSE Global Debt Capital Markets Inc. -

Financial Markets and International Stock Exchanges Mercados

Financial Markets and International Stock Exchanges Mercados Financieros y Bolsas de Acciones Internacionales AUTORES: Cabrera Duran, Rafael David Rodríguez Guillermo, Adrián Grado de Contabilidad y Finanzas Curso 2019/2020 Convocatoria: junio de 2020 Fecha de presentación: 12/06/2020 Tutor: Javier Giner Rubio ÍNDICE DE CONTENIDO RESUMEN ..................................................................................................................................... 4 INTRODUCCIÓN ........................................................................................................................... 5 1. RANKING MUNDIAL POR CAPITALIZACIÓN BURSÁTIL ...................................................... 6 1.1. TOP 10 GLOBAL. .............................................................................................................. 6 1.2. TOP 3 POR CONTINENTES. ............................................................................................. 7 1.2.1. Continente europeo ................................................................................................... 7 1.2.1.1. Euronext .............................................................................................................. 7 1.2.1.2. La Bolsa de Londres ........................................................................................... 8 1.2.1.3. La Bolsa de Frankfurt ....................................................................................... 10 1.2.1.4. La Bolsa de Valores de Madrid ....................................................................... -

Executing a Successful Listing London

www.pwc.com/ipocentre Executing a successful listing London An IPO Centre publication November 2012 About this brochure This brochure summarises the different London markets, the listing standards for each market, the process and the timeline for going public in London and an overview of the wider regulatory environment. Content London – an overview 2 London Stock Exchange markets 5 Listing requirements and ongoing obligations 6 Corporate governance 8 Market indices 9 Indicative IPO timeline and process 10 How PwC can help you 11 London; an overview... London remains one of the most influential global financial centres. It owes much of its continuing appeal to its cosmopolitan status, the liquidity of the financial markets and the regulatory, business and political framework that supports those markets. • The London Stock Exchange is one of the world's oldest exchanges and offers a wide choice of routes to market, for UK and international companies. The markets that companies can list on are shown in the table below. Which market a company should consider will depend upon different criteria including the: – stage of the company’s development; – size of the company; – complexity of the offer and securities issued; – overall strategy and objectives; and – investors who are being targeted; – eligibility. Securities admitted to ocial list Securities not admitted to ocial list (maintained by UKLA) Main Market Specialist Fund Market EU Regulated Markets Professional AIM Exchange Securities Market Regulated Markets • NYSE Euronext recently opened its London platform, complementing their other European platforms in Paris, Amsterdam, Brussels. Eurotunnel SA was the first company to complete a listing on the London platform in June 2012. -

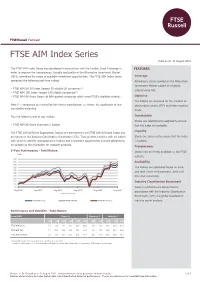

FTSE AIM Index Series

FTSE Russell Factsheet FTSE AIM Index Series Data as at: 31 August 2021 bmkTitle1 The FTSE AIM Index Series was developed in conjunction with the London Stock Exchange in FEATURES order to improve the transparency, liquidity and profile of the Alternative Investment Market (AIM), extending the range of available investment opportunities. The FTSE AIM Index Series Coverage comprises the following real-time indices: All ordinary shares quoted on the Alternative Investment Market subject to eligibility – FTSE AIM UK 50 Index (largest 50 eligible UK companies*) criteria being met. – FTSE AIM 100 Index (largest 100 eligible companies*) – FTSE AIM All-Share Index (all AIM quoted companies which meet FTSE's eligibility criteria) Objective The indices are designed for the creation of Note (*): companies are ranked by full market capitalisation i.e. before the application of any structured products, ETFs and index tracking investibility weighting. funds. Plus the following end-of-day indices: Investability Stocks are selected and weighted to ensure – FTSE AIM All-Share Supersector Indices that the index is investable. Liquidity The FTSE AIM All-Share Supersector Indices are derived from the FTSE AIM All-Share Index and are based on the Industry Classification Benchmark (ICB). They provide investors with 19 indices Stocks are screened to ensure that the index with which to identify macroeconomic trading and investment opportunities and are designed to is tradable. be suitable as the foundation for tradable products. Transparency 5-Year Performance - Total Return Index rules are freely available on the FTSE (GBP) website. 190 180 Availability 170 160 The indices are calculated based on price 150 and total return methodologies, both real 140 130 time and end-of-day. -

Sme Financing Through Capital Markets

SME FINANCING THROUGH CAPITAL MARKETS Final Report The Growth and Emerging Markets Committee of the International Organization of Securities Commissions FR11/2015 JULY 2015 TABLE OF CONTENTS Chapter page number 1 Executive Summary 1 2 Introduction and Background 2 2.1 Why SMEs matter 2 2.2 Objectives of the report 2 3 Overview of the SME Market 4 3.1 Definition of SME 4 3.2 SME Market Structure 5 4 Access to Funding for SMEs 12 4.1 Principal sources of SME financing in relation to SME 12 financing life cycle 4.2 Types of financing used by the surveyed jurisdictions 15 4.3 Cost of capital – Traditional and non-traditional source 17 4.4 IPO Cost 18 4.5 Participation of institutional investors in SME financing 20 4.6 SME Financing through capital markets 22 4.7 Equity Capital Markets 23 4.8 Debt Capital Markets 25 4.9 Pooling investments 29 4.10 Crowd Funding 31 4.11 Sukuk funds 33 4.12 Securitisation 36 4.13 Other Supporting Measures 37 5 Impediments / Challenges 38 5.1 Delisting of SME securities 39 5.2 Financial reporting 41 6 Regulatory Framework for SMEs 42 6.1 Role of legislation 45 6.2 Proportional regulation 45 6.3 Disclosure after Listing 48 6.4 Difficulties in Implementation of Proportional Regulation 51 6.5 Supervision and Monitoring 52 6.6 Market Abuse 53 6.7 Accounting standards 54 7 Incentives / Interventions for SME Financing 56 7.1 Tax incentives 56 7.2 Government guarantees 60 7.3 Other support initiatives 62 7.4 Market Making 66 ii 7.5 Risk Disclaimer for Investors 67 7.6 Outreach initiatives for SMEs 68 8 Conclusion / Recommendations 71 8.1 Key takeaways 71 8.2 Recommendations 74 Appendices Initial Survey Questionnaire Appendix 1 Follow-up Mini Survey Questionnaire Appendix 2 SME Definition Appendix 3 Listing Requirements for SMEs Appendix 4 Best Practices Appendix 5 iii 1. -

Listing in London a Guide to Premium and Standard Listings of Equity and Flotation on AIM

www.pwc.com/mn/capital-markets Listing in London A guide to premium and standard listings of equity and flotation on AIM Capital Markets About this brochure This brochure summarises the different London markets, the listing standards for each market for going public in London and an overview of the wider regulatory environment. 2 Executing a successful listing - London PwC Content London – an overview 2 London Stock Exchange markets 5 Overview of key regulatory requirements 6 Corporate governance 8 Market indices 9 London – an overview... London remains one of the most influential global financial centres. It owes much of its continuing appeal to its cosmopolitan status, the liquidity of the financial markets and the regulatory, business and political framework that supports those markets. • The London Stock Exchange is one of the world's oldest exchanges and offers a wide choice of routes to market, for UK and international companies. The markets that companies can list on are shown in the table below. Which market a company should consider will depend upon different criteria including the: – stage of the company’s development; – size of the company; – complexity of the offer and securities issued; – overall strategy and objectives; and – investors who are being targeted; – eligibility. Securities admitted to official list Securities not admitted (maintained by UKLA) to official list Main Market Specialist Fund Market EU Regulated Markets Professional Alternative Investment Market (AIM) Exchange Securities Market Regulated Markets • NYSE Euronext recently opened its London platform, complementing their other European platforms in Paris, Amsterdam, Brussels. Eurotunnel SA was the first company to complete a listing on the London platform in June 2012. -

London Stock Exchange Group Group Ticker Plant

LONDON STOCK EXCHANGE GROUP GROUP TICKER PLANT GTP 006 - EXTERNAL SOURCES GUIDE ISSUE 7.7 10 OCTOBER 2020 Powered by MillenniumIT Contents Guide Disclaimer ............................................................................................................... 3 1. Documentation ............................................................................................................ 4 1.1 This Guide ........................................................................................................................ 4 1.3 Document Series .............................................................................................................. 4 1.4 Document History ............................................................................................................. 5 1.5 Enquiries ........................................................................................................................... 5 2. FTSE Russell Indices .................................................................................................. 6 2.1 FTSE Russell Indices Redistributed .................................................................................. 6 2.1.1 GTP London FTSE Russell products ................................................................................ 6 2.1.2 GTP Milan FTSE Russell products .................................................................................. 11 Guide Disclaimer The content of this publication is not offered as advice on any particular matter and must not be treated