RICR Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

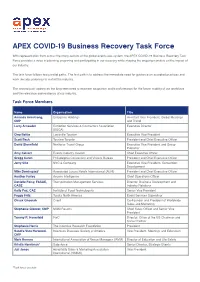

APEX COVID-19 Business Recovery Task Force

APEX COVID-19 Business Recovery Task Force With representation from across the many sectors of the global events eco-system, the APEX COVID-19 Business Recovery Task Force provides a voice in planning, preparing and participating in our recovery while shaping the ongoing narrative on the impact of our industry. The task force follows two parallel paths. The first path is to address the immediate need for guidance on accepted practices and work already underway to restart the industry. The second path addresses the long-term need to examine adaptation and transformation for the future stability of our workforce and the relevance and resiliency of our industry. Task Force Members Name Organisation Title Amanda Armstrong, Enterprise Holdings Assistant Vice President, Global Meetings CMP and Travel Larry Arnaudet Exhibition Services & Contractors Association Executive Director (ESCA) Cleo Battle Louisville Tourism Executive Vice President Scott Beck Tourism Toronto President and Chief Executive Officer David Blansfield Northstar Travel Group Executive Vice President and Group Publisher Amy Calvert Events Industry Council Chief Executive Officer Gregg Caren Philadelphia Convention and Visitors Bureau President and Chief Executive Officer Jerry Cito NYC & Company Executive Vice President, Convention Development Mike Dominguez* Associated Luxury Hotels International (ALHI) President and Chief Executive Officer Heather Farley Access Intelligence Chief Operations Officer Danielle Foisy, FASAE, Transportation Management Services Director, Business Development and CASE Industry Relations Kelly Fox, CAE Institute of Food Technologists Senior Vice President Peggy Fritz Toyota North America Event Services Supervisor Chuck Ghoorah Cvent Co-Founder and President of Worldwide Sales and Marketing Stephanie Glanzer, CMP MGM Resorts Chief Sales Officer and Senior Vice President Tammy R. -

General Assembly of North Carolina Session 2019 House Bill 219 Ratified Bill an Act to Revise Various Insurance Laws in Order To

GENERAL ASSEMBLY OF NORTH CAROLINA SESSION 2019 HOUSE BILL 219 RATIFIED BILL AN ACT TO REVISE VARIOUS INSURANCE LAWS IN ORDER TO MAINTAIN NAIC ACCREDITATION, AS RECOMMENDED BY THE DEPARTMENT OF INSURANCE. The General Assembly of North Carolina enacts: PART I. SUPERVISION OF INTERNATIONALLY ACTIVE INSURANCE GROUPS SECTION 1.(a) G.S. 58-19-5 is amended by adding a new subdivision to read: "(10a) Group-wide supervisor. – The regulatory official authorized to engage in conducting and coordinating group-wide supervision activities who is determined or acknowledged by the Commissioner under G.S. 58-19-38 to have sufficient significant contacts with the internationally active insurance group." SECTION 1.(b) G.S. 58-19-5 is amended by adding a new subdivision to read: "(12a) Internationally active insurance group. – An insurance holding company system that includes an insurer registered under G.S. 58-19-25 and that meets all of the following criteria: a. The insurance holding company system writes premiums in at least three countries. b. The percentage of gross premiums of the insurance holding company system written outside the United States is at least ten percent (10%) of the insurance holding company system's total gross written premiums. c. Based on a three-year rolling average, the total assets of the insurance holding company system are at least fifty billion dollars ($50,000,000,000) or the total gross written premiums of the insurance holding company system are at least ten billion dollars ($10,000,000,000)." SECTION 1.(c) Article 19 of Chapter 58 of the General Statutes is amended by adding a new section to read as follows: "§ 58-19-38. -

Goldmine Confirmation Letter Template

POSITION DESCRIPTION October 2018 Dr. Susan Love Research Foundation Chief Executive Officer The Board of Directors seeks an experienced executive to: double contributed revenue, expand the organization’s public profile as a leader in breast cancer prevention and research and collaborate with the organization’s Founder, Board and staff to drive innovative programs and new initiatives. Dr. Susan Love Research Foundation challenges us all to invest in achieving a future without breast cancer. The Foundation pursues this goal through: science that traces the sources and causes of breast cancer; research on ways to eliminate breast cancer, particularly before the disease takes hold; education programs about breast cancer, breast cancer treatment and collateral damage of treatment; advocacy for metastatic breast cancer patients to advance treatment options and improve lives. By mobilizing the public, encouraging risk-taking and innovation and promoting cross- disciplinary collaborations among scientists and medical professionals the Foundation pursues the goal of eradicating breast cancer in our lifetime. BACKGROUND: The Foundation was established in 1983 as The Santa Barbara Breast Cancer Institute by famed breast cancer researcher Otto Satorius. Dr. Susan Love joined as the Foundation’s medical director in 1995. The Institute’s name was changed to The Susan Love MD Breast Cancer Research Foundation in 2000 to honor Dr. Love and her visionary work as an author, teacher, surgeon, entrepreneur, researcher and activist. Since then, Dr. Love has expanded the Foundation nationally and increased its funding base. In 2004 the Foundation was renamed Dr. Susan Love Research Foundation and relocated to the Los Angeles area where it continues to make its home. -

The Role of a Chief Executive Officer

The Role of a Chief Executive Officer An extended look into the role & responsibilities of a CRO Provided by: Contents 1 Chief Revenue Officer Role within the Corporate Hierarchy 1 1.1 Chief revenue officer ......................................... 1 1.1.1 Roles and functions ...................................... 1 1.1.2 The CRO profile ....................................... 1 1.1.3 References .......................................... 2 1.2 Corporate title ............................................. 2 1.2.1 Variations ........................................... 2 1.2.2 Corporate titles ........................................ 4 1.2.3 See also ............................................ 8 1.2.4 References .......................................... 9 1.2.5 External links ......................................... 9 1.3 Senior management .......................................... 9 1.3.1 Positions ........................................... 10 1.3.2 See also ............................................ 11 1.3.3 References .......................................... 11 2 Areas of Responsibility 12 2.1 Revenue ................................................ 12 2.1.1 Business revenue ....................................... 12 2.1.2 Government revenue ..................................... 13 2.1.3 Association non-dues revenue ................................. 13 2.1.4 See also ............................................ 13 2.1.5 References .......................................... 13 2.2 Revenue management ........................................ -

2020 Press Kit Our Mission: to End Breast Cancer

2020 PRESS KIT OUR MISSION: TO END BREAST CANCER. Dr. Susan Love Foundation for Breast Cancer Research challenges the status quo to end breast cancer and improve the lives of people impacted by it now through education and advocacy. The Foundation drives collaborative, cutting-edge research with nontraditional partners, brings to light the collateral damage of treatment and seeks ways to diminish it, and interprets science to empower patients. Fast, flexible, and project-based, the Foundation actively engages the public in scientific research to ensure that it produces accurate and meaningful results. Dr. Susan Love Foundation for Breast Cancer Research Dr. Susan Love Foundation 16133 Ventura Boulevard drsusanlovefoundation Suite 1000 Encino, California 91436 drloveresearch Dr. Susan Love Foundation 310.828.0060 [email protected] www.drsusanloveresearch.org DR. SUSAN LOVE Founder & Chief Visionary Officer Recognized for her fierce intellect, unrelenting tenacity, and laser-like focus, Dr. Susan Love is our quintessential Chief Visionary Officer. For the past 20 years, she has dedicated her career to the eradication of breast cancer and pioneered some of the world’s more innovative research. From spearheading a partnership with NASA’s Jet Propulsion Laboratory to map the breast ductal system, to harnessing the power of artificial intelligence in the preliminary development stages of a handheld, self-reading ultrasound for breast cancer screening in underserved populations, Dr. Love’s goal remains simple and clear: to end breast cancer. Dr. Susan Love is known as one of the “founding mothers” of breast cancer advocacy and research. Her book, Dr. Susan Love’s Breast Book, in it's 6th edition, is termed “the bible for people with breast cancer” by The New York Times. -

2017 Summit Brochure

2017 Global Summit of Women Beyond Womenomics: Accelerating Access Summit Features Pre-Summit Roundtable for Women Government Ministers on best practices in public/private sector partnerships for advancing women’s economic opportunities; Plenary sessions which cover You are invited to join women leaders from every corner of the world in Regional and Global Megatrends Tokyo, Japan at the 2017 Global Summit of Women — the premier that impact economies around the international forum to accelerate women’s economic progress world; worldwide. The 2017 Summit will salute women’s achievements while continuing to explore practical strategies and best practices in Women CEO Forum on Accelerating improving women’s economic status, whether they are corporate Women’s Corporate Leadership; initiatives, public policies or NGO programs. The Summit’s unique engagement of the three critical ‘legs’ of change – government, Practical strategies for business business and civil society – is reflected in its participants, presenters growth – personal and and partners. Over 60 International organizations representing women entrepreneurial – developed in from five continents are planning to be part of the 2017 Summit in different parts of the world; Japan, along with women government Ministers and multilateral agency executives. Skills-building sessions in three tracks: Leadership Development, Entrepreneurial, and Issues; and The theme of the 2017 Summit — “Beyond Womenomics: Accelerating Access” — showcases various initiatives developed in different parts of Creative tips from women the world to speed up both women’s access to corporate leadership entrepreneurs succeeding in the roles as well as strategies for growing women-owned enterprises global economy. worldwide. In addition, the 2017 Summit will inform delegates on how to access the Japanese and Asia-Pacific market, showcase women business and government leaders from the region, and provide skills- building sessions, as well as establish networks among such leaders. -

Health Care Industrial Welcome

ONSITE PROGRAM Loews Don CeSar Hotel, St. Pete Beach, Fla. • October 8–9, 2015 Health Care Industrial Welcome On behalf of the Associated Builders and Contractors (ABC) Users Summit Steering Committee, welcome to the 3rd Users Summit! After two years of holding successful Summits focused on improving project planning and delivery in the industrial market, this year we expanded to include our counterparts in the health care. While my industrial friends may find it odd to share a venue with the health care group, the reality is that all construction users and contractors benefit from conversations about how to deliver quality projects on time and on budget, regardless of where they fit in the market. As we continue to grow the program, our hope is to one day have a Users Summit where construction owners from every segment gather with ABC contractors to focus on quality and process improvements. Over the next two days, you will take part in general sessions as well as health care and industrial breakouts, and I encourage you to take the networking as serious at the education. Use this opportunity to network with one another—user to contractor, user to user, contractor to contractor—and to develop your professional network and share ideas and best practices with those you meet here at the Summit. We feel confident that our program will provide you and your business - regardless of whether you are a user or a contractor - a better understanding of the opportunities and challenges in the ever-changing and growing health care and industrial markets. -

Dr. Susan Love Research Foundation

POSITION DESCRIPTION October 2018 Dr. Susan Love Research Foundation Chief Executive Officer The Board of Directors seeks an experienced executive to: double contributed revenue, expand the organization’s public profile as a leader in breast cancer prevention and research and collaborate with the organization’s Founder, Board and staff to drive innovative programs and new initiatives. Dr. Susan Love Research Foundation challenges us all to invest in achieving a future without breast cancer. The Foundation pursues this goal through: science that traces the sources and causes of breast cancer; research on ways to eliminate breast cancer, particularly before the disease takes hold; education programs about breast cancer, breast cancer treatment and collateral damage of treatment; advocacy for metastatic breast cancer patients to advance treatment options and improve lives. By mobilizing the public, encouraging risk-taking and innovation and promoting cross- disciplinary collaborations among scientists and medical professionals the Foundation pursues the goal of eradicating breast cancer in our lifetime. BACKGROUND: The Foundation was established in 1983 as The Santa Barbara Breast Cancer Institute by famed breast cancer researcher Otto Satorius. Dr. Susan Love joined as the Foundation’s medical director in 1995. The Institute’s name was changed to The Susan Love MD Breast Cancer Research Foundation in 2000 to honor Dr. Love and her visionary work as an author, teacher, surgeon, entrepreneur, researcher and activist. Since then, Dr. Love has expanded the Foundation nationally and increased its funding base. In 2004 the Foundation was renamed Dr. Susan Love Research Foundation and relocated to the Los Angeles area where it continues to make its home. -

Dec-2020-SCAC-Presentation.Pdf

THE PARENT COMPANY INVESTOR PRESENTATION DECEMBER 14 2020 DISCLOSURES Disclaimer Forward-Looking Statements This document is for information purposes only and should not be considered a Certain information in this presentation may constitute "forward-looking information" Although management of Subversive, the Sponsor and their respective affiliates have recommendation to purchase, sell or hold a security. This presentation has been within the meaning of applicable securities legislation. Forward-looking information may attempted to identify important factors that could cause actual results to differ prepared in connection with the proposed qualifying transaction pursuant to which, relate to Subversive, Subversive Capital Sponsor LLC (the "Sponsor"), the resulting issuer materially from those contained in forward- looking statements, there may be other among other things, Subversive Capital Acquisition Corp. (“Subversive” or “we”) is following closing of the qualifying transaction (the “resulting issuer”), the target factors that cause results not to be as anticipated, estimated or intended. There can be expected to acquire CMG Partners Inc. (“Caliva”) and Left Coast Ventures Inc. (the businesses or their respective affiliates' future outlook and anticipated events or results no assurance that such statements will prove to be accurate, as actual results and “qualifying transaction” or the “Transaction”). This presentation and any supplements and may include statements regarding the financial position, business strategy, growth future events could differ materially from those anticipated in such statements. and amendments regarding a possible qualifying transaction by Subversive, constitutes strategy, budgets, operations, financial results, taxes, dividends, plans and objectives of the Accordingly, readers should not place undue reliance on forward-looking statements. an offering of securities only in those jurisdictions and to those persons where and to resulting issuer and the target businesses, as the case may be. -

240 Corporate Governance Annual Disclosure

806 KAR 3:240. Corporate governance annual disclosure. RELATES TO: KRS 304.3-235 STATUTORY AUTHORITY: KRS 304.2-110 NECESSITY, FUNCTION, AND CONFORMITY: KRS 304.2-110 authorizes the commissioner of the Department of Insurance to make reasonable rules and administrative regulations necessary for or as an aid to the effectuation of any provision of the Kentucky Insurance Code, as defined in KRS 304.1-010. KRS 304.3-235 requires insurers and insurance groups to file a corporate governance annual disclosure form. This administrative regulation provides specific details on the contents of the required disclosure and incorporates a form to be utilized by reporting entities to permit efficiency in the review and submission. Section 1. Definitions. (1) "Corporate Governance Annual Disclosure" or "CGAD" is defined by KRS 304.3-235(1)(c). (2) "Insurance group" is defined by KRS 301.3-235(1)(a). (3) "Insurer" is defined by KRS 304.37-010(7). (4) "Senior Management" means any corporate officer responsible for reporting information to the board of directors at regular intervals or providing this information to shareholders or regulators, such as the Chief Executive Officer ("CEO"), Chief Financial Officer ("CFO"), Chief Operations Officer ("COO"), Chief Procurement Officer ("CPO"), Chief Legal Officer ("CLO"), Chief Information Officer ("CIO"), Chief Technology Officer ("CTO"), Chief Revenue Officer ("CRO"), Chief Visionary Officer ("CVO"), or any other "C" level executive. Section 2. Filing Procedures. (1) The Corporate Governance Annual Disclosure form or CGAD form shall be filed by June 1 of each calendar year in accordance with the provisions of KRS 304.3-235(3) through (6). -

United States Securities and Exchange Commission Washington, D.C.20549 Form 8-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C.20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): September 11, 2015 Balance Labs, Inc. (Exact name of registrant as specified in its charter) Delaware 333-202959 47-1146785 (State of other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) 1111 Lincoln Road, 4th Floor Miami Beach, FL 33139 (Address of principal executive office) (305) 907-7600 (Registrant's telephone number, including area code) (not applicable) (Former name, former address and former fiscal year, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers. Resignation of Raphael Perez On September 11, 2015, Raphael Perez tendered his resignation as the President, Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and Director of the Company, by providing a notice to the Board of Directors (the “Board”) of Balance Labs, Inc. -

Corporate Titles

CORPORATE TITLES EXECUTIVE OR NON-EXECUTIVE CHAIRPERSON, CHAIRMAN OR CHAIRMAN OF THE BOARD – presiding officer of the corporate BOARD OF DIRECTORS. The Chairman influences the board of directors, which in turn elects and removes the officers of a corporation and oversees the human, financial, environmental and technical operations of a corporation. The CEO also takes on the role of Executive Chairman. Recently, though, many companies have separated the roles of Chairman and CEO, resulting in a non- executive chairman, in order to improve corporate governance. CHIEF ACCOUNTING OFFICER CHIEF ADMINISTRATIVE OFFICER CHIEF ANALYTICS OFFICER OR CAO – high level corporate manager with overall responsibility for the analysis and interpretation of data relevant to a company's activities; generally reports to the CEO, or COO. CHIEF BUSINESS OFFICER CHIEF BUSINESS DEVELOPMENT OFFICER or CBDO. CHIEF BRAND OFFICER or CBO – a relatively new executive level position at a corporation, company, organization, or agency, typically reporting directly to the CEO or Board Of Directors. The CBO is responsible for a BRAND's image, experience, and promise, and propagating it throughout all aspects of the company. The brand officer oversees MARKETING, ADVERTISING, DESIGN, PUBLIC RELATIONS and CUSTOMER SERVICE departments. The BRAND EQUITY of a company is seen as becoming increasingly dependent on the role of a CBO. CHIEF COMMUNICATIONS OFFICER or CCO. CHIEF COMPLIANCE OFFICER - in charge of regulatory compliance, especially SARBANES-OXLEY. CHIEF CREATIVE OFFICER CHIEF CREDIT OFFICER or CCO. CHIEF DATA OFFICER or CDO CHIEF EXECUTIVE OFFICER or CEO (UNITED STATES), Chief Executive or MANAGING DIRECTOR (UNITED KINGDOM, COMMONWEALTH and some other English speaking countries) – The CEO of a corporation is the highest ranking management officer of a corporation and has final decisions over human, financial, environmental, technical operations of the corporation.