Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Certified Facilities (Cooking)

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

Tallest Buildings Constructed in 1970-1980

This PDF was downloaded from The Skyscraper Center on 2018/01/11 UTC For the most up to date version, please visit http://skyscrapercenter.com Building List All Regions, All Companies, 200m+, 1970-1980 Completed Architecturally Topped Structurally Topped Under On Never Proposed Vision Demolished Out Out Construction Hold Completed # Building Name City Height (m) Height (ft) Floors Completed Material Use 1 Willis Tower Chicago 442.1 1,451 108 1974 steel office 2 Aon Center Chicago 346.3 1,136 83 1973 steel office 3 First Canadian Place Toronto 298.1 978 72 1975 steel office 4 601 Lexington New York City 278.9 915 63 1977 steel office 5 Water Tower Place Chicago 261.9 859 74 1976 concrete residential / hotel / retail 6 Aon Center Los Angeles 261.5 858 62 1974 steel office 7 Transamerica Pyramid Center San Francisco 260 853 48 1972 composite office 8 U.S. Steel Tower Pittsburgh 256.3 841 64 1970 steel office 9 IDS Center Minneapolis 241.4 792 55 1973 composite office 10 200 Clarendon Boston 240.8 790 62 1976 steel office 11 Sunshine 60 Tower Tokyo 240 787 60 1978 composite office 12 Commerce Court West Toronto 239 784 57 1973 composite office 13 Enterprise Plaza Houston 230.4 756 55 1980 composite office 14 One Penn Plaza New York City 228.6 750 57 1972 steel office 15 1251 Avenue of the Americas New York City 228.6 750 54 1972 steel office 16 MLC Centre Sydney 228 748 60 1977 concrete office 17 One Astor Plaza New York City 227.1 745 54 1972 composite office 18 One Liberty Plaza New York City 226.5 743 54 1972 steel office 19 Parque Central -

Semi-Annual Report

Tenth Fiscal Period Semi-Annual Report May 1, 2008 October 31, 2008 Profile Nomura Real Estate Office Fund, Inc. (referred to as “Nomura Office Fund” or the “Company” hereafter) was listed on the Tokyo Stock Exchange on December 4, 2003 as a real estate investment corporation formed to own and invest in office properties, subject to the Law Concerning Investment Trusts and Investment Corporations of Japan. The Company’s basic investment policy is to assure stable rent revenues and steady portfolio growth over the medium- to long-term. Nomura Real Estate Asset Management Co., Ltd. (referred to as “NREAM” hereafter), a wholly owned subsidiary of Nomura Real Estate Holdings, Inc. is in charge of asset management on behalf of Nomura Office Fund in accordance with the basic investment policy as described above. Through coordination with Nomura Real Estate Holdings, Inc. and other group companies, NREAM aims to achieve these goals and more. Strength of Nomura Office Fund J-REIT with a large-capitalization specialized in office buildings ■ Portfolio of 46 properties at a total acquisition price of ¥362.2 billion (as of October 31, 2008) ■ Market capitalization of ¥168.1 billion (as of October 31, 2008) ■ Constituent of MSCI Standard Index Track records of stable managements ■ Ten consecutive fiscal periods of growth in operating revenues and net income ■ Steady growth in DPU Collaboration with Nomura Real Estate Group ■ NREAM, in charge of the Company’s asset management, belongs to Nomura Real Estate Group ■ Supported by the group companies through provision of sales information and management expertise Rated A or more by three domestic and foreign rating agencies Rating and Investment Information, Inc. -

Explore Our 160 Premium Locations Around the World

120. Explore our 160 premium locations around the world. We have selected the finest locations around the globe to help the growth of your business and to ensure an impressive experience for your clients. Australia Bahrain France Adelaide Manama Paris Westpac House Bahrain Financial Harbour Haussmann - Opéra Brisbane Diplomatic Commercial Tower Eagle Street Germany Santos Place Belgium Berlin Canberra Brussels Potsdamer Platz Nishi Building Bastion Tower The Realm Schuman India Hobart Mumbai Reserve Bank Building China Vibgyor Towers Melbourne Beijing Hyderbad 101 Collins Street China Central Place Mindspace Complex 140 William Street Fortune Financial Center Southbank Riverside Quay Oriental Plaza Indonesia Perth Chengdu Jakarta Brookfield Place Shangri-La Office Tower International Financial Centre AMP Tower Guangzhou Sydney International Finance Center Japan Avaya House Hangzhou Barangaroo Tower One Fukuoka JIAHUA International Business Fukuoka Tenjin Fukoku Seimei Chifley Tower Center Deloitte Building Building Shanghai NMF Hakata Ekimae Building Gateway Citigroup Tower 44 Market Street Osaka Jing An Kerry Center Edobori Center Building 101 Miller Street Hong Kong MLC Centre Hilton Plaza West Tower One Peking Road Shinsaibashi Plaza Building Nexus Norwest The Hong Kong Club Building Octagon Building Two International Finance Centre Westfield Tower Japan (continued) Qatar United Kingdom Nagoya Doha London Honmachi Minami Garden City Commercial Bank Plaza Canary Wharf Nagoya Lucent Tower Doha Tower Dashwood House Nagoya Nikko Shoken -

Consolidated Financial Results for the Nine Months from April 1 to December 31, 2014 & Business Overview

(First section of TSE: 3231) Consolidated Financial Results for the Nine Months from April 1 to December 31, 2014 & Business Overview Copyright (c) 2015 Nomura Real Estate Holdings, Inc. All rights reserved. Index 02 Highlights of 3Q Financial Results 08 Progress of Mid- to Long-term Business Plan 12 Operating Results by Segment Copyright (c) 2015 Nomura Real Estate Holdings, Inc. All rights reserved. 1 Highlights of 3Q Financial Results Copyright (c) 2015 Nomura Real Estate Holdings, Inc. All rights reserved. 2 Outline of Consolidated Financial Results for 3Q of FY ending March 31, 2015 FY14/3 3Q FY15/3 3Q (Billions of yen) Actual Actual Changes Key Factors *Figures rounded down to the nearest 100 million yen ① ② ②-① Operating revenue 391.0 352.5 −38.4 <Operating revenue & Operating income> Operating gross profit 119.8 103.6 −16.2 ・Decrease in the number of housing units sold (Recording of sales is Selling, general and administrative expenses 61.3 63.2 +1.9 concentrated in 4Q compared with FY14/3) Operating income 58.5 40.4 −18.1 ・Partial moving-out of Toshiba Corporation from Hamamatsucho Building Non-operating income 1.0 0.6 −0.3 ・Rebound from the recording of asset acquisition fee related to IPO of Non-operating expenses 9.3 7.5 −1.7 Nomura Real Estate Master Fund in FY14/3 Ordinary income 50.3 33.5 −16.7 Extraordinary income 0.8 2.5 +1.7 <Extraordinary income & losses> Extraordinary losses 7.3 6.0 −1.2 ・Impairment loss associated with write-down of fixed assets Income taxes 17.6 11.6 −5.9 Minority interests in income 1.0 1.6 +0.6 -

For Translation Purposes Only June 25, 2004 for Immediate Release

For Translation Purposes Only June 25, 2004 For Immediate Release Nomura Real Estate Office Fund, Inc. 8-5-1 Nishi Shinjuku, Shinjuku-ku, Tokyo Yasutoshi Akiyama Representative and Executive Director (Securities Code: 8959) Inquiries: Nomura Real Estate Asset Management Co., Ltd. Atsushi Ogata Fund Management Group TEL: +81-3-3365-0507 Notice Concerning Property Acquisition Nomura Real Estate Office Fund, Inc. (“Nomura Office Fund” or the “Fund”) today announced that it has determined and agreed with the seller on, the acquisition of real estate, as briefly explained below. 1. Summary (1) Type of asset: Trust beneficial interest (2) Property name: Seiwa Shinjuku Building (3) Acquisition price: ¥2,280 million (4) Date of acquisition: June 25, 2004 (date of delivery of the trust beneficial interest) (5) Seller: CREO Kobe Private Company (please refer to 4. “Seller Profile”, below) (6) Financing: Private fund The asset outlined above shall be hereinafter referred to as the “Property.” 2. Grounds Nomura Office Fund will acquire the Property in accordance with the Fund’s policies as stipulated in its Articles of Incorporation. Especially, the Fund appreciates the following factors. (1) Location The Property is located in south of Shinjuku St. area where there have been numbers of major multi-complex developments, Takashimaya Times Square, Odakyu Southern Tower and also major office developments, JR East Head Office, NTT Docomo Yoyogi Building. The Property is located on Meiji-Dori and 4 minutes from Shinjuku Station which is one of the largest terminal stations in Japan. The area is expected to be more convenient when new subway station starts operation in 2007 (Tokyo Metro Line No.13). -

Trends in Tokyo's Office Market

Trends in Tokyo’s Office Market — Tokyo’s Dominance Grows Amid Concern of a Market Downturn By Toshihiko Yamakata Social Development Research Group Introduction Tokyo’s office market enjoyed steady growth last year as strong demand from foreign financial institu- tions and IT companies brought the vacancy rate down to 3.6% in the first quarter of 2001. In particu- lar, new large office buildings were in short supply, becoming almost fully occupied by the time con- struction was completed. However, the effects of the ailing U.S. economy and IT downturn from the second half of 2000 have been cropping up in the market data from the second quarter of 2001. Moreover, with the terrorist attacks in the U.S. and war in Afghanistan creating uncertainty in the global economy, many compa- nies including foreign financial institutions and hi-tech companies are postponing office relocations and implementing further cost cuts. Considering these market conditions and the large supply of large office buildings slated to come on line in 2003 in central Tokyo, there is growing concern that the mar- ket will deteriorate further. However, compared to Osaka and Nagoya, Tokyo’s office market, being at the center of Japan’s econo- my, has strong potential. Demand for advanced and diverse office space is concentrated in Tokyo, giv- ing depth to the market. This, along with the renewed population concentration in Tokyo, are enhanc- ing Tokyo’s preeminent position. 1. Tokyo’s Clear Dominance (1) Vacancy Rate Trend After dropping to 3.6% in March 2001, the vacancy rate in Tokyo’s 23 wards (Tokyo 23) rose for two consecutive quarters. -

NOMURA REAL ESTATE OFFICE FUND, INC. Eighth Fiscal Period Semi-Annual Report Profile

NOMURA REAL ESTATE OFFICE FUND, INC. Eighth Fiscal Period Se mi-Annual Report Eighth Fiscal Period Semi-Annual Report May 1, 2007 October 31, 2007 http://www.nre-of.co.jp/english/ Profile Nomura Real Estate Office Fund, Inc. (referred to as “Nomura Office Fund” or the “Company” hereafter) was listed on the Tokyo Stock Exchange on December 4, 2003 as a real estate investment corporation formed to own and invest in office properties, subject to the Law Concerning Investment Trusts and Investment Corporations of Japan. The Company’s basic investment policy is to assure stable rent revenues and steady portfolio growth over the medium- to long-term. Nomura Real Estate Asset Management Co., Ltd. (referred to as “NREAM” hereafter), a wholly owned subsidiary of Nomura Real Estate Holdings, Inc. is in charge of asset management on behalf of Nomura Office Fund in accordance with the basic investment policy as described above. Through coordination with Nomura Real Estate Holdings, Inc. and other group companies, NREAM aims to achieve these goals and more. Strength of Nomura Office Fund J-REIT with a large-capitalization specialized in office buildings Portfolio of 34 properties at a total acquisition price of ¥292.4 billion (as of October 31, 2007) Market capitalization of ¥308.4 billion (as of October 31, 2007) Constituent of MSCI Standard Index Track records of stable managements Eight consecutive fiscal periods of growth in operating revenues and net income Steady growth in DPU Collaboration with Nomura Real Estate Group NREAM, in charge of the Company’s asset management, belongs to Nomura Real Estate Group Supported by the group companies through provision of sales information and management expertise Rated A or more by domestic and foreign rating agencies Long-term rating: A Standard & Poor’s Ratings Services Short-term rating: A-1 Moody’s Investors Service, Inc. -

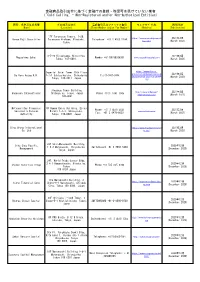

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) 17F Toranomon Towers, 1-28, https://www.gunmafujisecurit 2021年3月 Gunma Fuji Securities Toranomon 4-chome, Minatoku, Telephone: +81 3 4565 5204 ies.com/ (March 2021) Tokyo 3-5-20 Kitaaoyama, Minato-ku, 2021年3月 Nagashima Sakai Number +81(50)58936981 www.nagashimasakai.com Tokyo, 107-0061. (March 2021) Imperial Hotel Tower 15th Floor https://www.devere- group.com/globalpresence/gl 2021年3月 De Vere Acuma K.K. 1-1-1 Uchisaiwaicho, Chiyoda-ku Tel: 03-3507-5684 obalpresence.aspx?officePK= (March 2021) Tokyo, 100-0011 Japan 118 Jingumae Tower Building http://www.andersen- 2021年3月 Andersen International Shibuya-ku, Tokyo, Japan Phone (813) 6741 7585 international.com/ (March 2021) 105-0001 Metropolitan Financial 8F Humax Ebisu Building, Ebisu Phone: +81 3 4579-5647 2021年3月 Services & Futures Minami 1-1-1, Shibuya-ku, www.mfinsfa.com Fax: +81 3 6478-8029 (March 2021) Authority Tokyo, 150-0022 Japan Ding Sheng International https://www.heydayint.com/z 2021年3月 Co. Ltd h-cn/ (March 2021) 23F Shin-Marunouchi Building, Oita Chuo Pacific 2020年12月 1-6-2 Marunouchi, Chiyoda-ku, Switchboard +81 3 6863 5404 Management (December 2020) Tokyo, Japan 24F, World Trade Center Bldg. 2-4-1 Hamamatsucho, Minato-ku, 2020年12月 Chinen Securties Group Phone +81 505 865 9240 Tokyo (December 2020) 105-6124 Japan The Marunouchi Building, 2 https://www.stonefinancialco 2020年12月 Stone Financial Corp Chome-4-1 Marunouchi, Chiyoda rp.com (December 2020) City, Tokyo 100-6390, Japan 38F Shinjuku i-Land Tower, 6 2020年12月 Okuras Global Capital Chome-5-1 Nishishinjuku, Tokyo, SWITCHBOARD +81-3-4590-0730 (December 2020) Japan 8F PMO Ginza, 8-12-8 Ginza, http://www.hshmanagement.c 2020年12月 Hokkaido Security Holdings Switchboard +81 3 4578 1355 Chuo-ku, Tokyo, Japan om (December 2020) 5th Fl. -

NOMURA REAL ESTATE OFFICE FUND, INC. Sixth Fiscal Period Semi-Annual Report Profile Corporate Data

NOMURA REAL ESTATE OFFICE FUND, INC. Sixth Fiscal Period Sem i-Annual Report Sixth Fiscal Period Semi-Annual Report May 1, 2006 October 31, 2006 http://www.nre-of.co.jp/english/ Profile Corporate Data Nomura Real Estate Office Fund, Inc. (referred to as “Nomura Office Fund” or the “Company” hereafter) was listed on the Tokyo Stock Exchange on December 4, 2003 as a real estate investment corporation formed to own and invest in office Corporate Name Transfer Agent properties, subject to the Law Concerning Investment Trusts and Investment Corporations of Japan. The Company’s basic Nomura Real Estate Office Fund, Inc. Mitsubishi UFJ Trust and Banking Corporation investment policy is to assure stable rent revenues and steady portfolio growth over the medium- to long-term. 1-4-5 Marunouchi Chiyoda-ku, Tokyo 100-8212, Japan Nomura Real Estate Asset Management Co., Ltd. (referred to as “NREAM” hereafter), a wholly owned subsidiary of Corporate Office Nomura Real Estate Holdings, Inc. is in charge of asset management on behalf of Nomura Office Fund in accordance with 8-5-1 Nishi Shinjuku Shinjuku-ku, Tokyo Business Office of the Transfer Agent the basic investment policy as described above. Through coordination with Nomura Real Estate Holdings, Inc. and other 160-0023, Japan Corporate Agency Department group companies, NREAM aims to achieve these goals and more. http://www.nre-of.co.jp/english/ Mitsubishi UFJ Trust and Banking Corporation 7-10-11 Higashisuna Koto-ku, Tokyo 137-8081, Japan Date of Incorporation Tel: +81-3-5683-5111 August 7, 2003 Independent Auditors Strength of Nomura Office Fund Stock Listing Ernst & Young ShinNihon Tokyo Stock Exchange (Securities Code: 8959) Hibiya Kokusai Bldg.