Caravan Background Paper

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kilgetty/Begelly Community Council - Kilgetty Ward Cyngor Cymuned Cilgeti/Begeli - Ward Cilgeti

ELECTION OF COMMUNITY COUNCILLORS ETHOLIAD CYNGHORWYR CYMUNED 4 MAY 2017 / 4 MAI 2017 The following is a statement as to the persons nominated for election for the Mae’r canlynol yn ddatganiad am y personau a enwebwyd cael ei/eu (h)ethol ar gyfer KILGETTY/BEGELLY COMMUNITY COUNCIL - KILGETTY WARD CYNGOR CYMUNED CILGETI/BEGELI - WARD CILGETI STATEMENT OF PERSONS NOMINATED DATGANIAD AM Y PERSONAU A ENWEBWYD 1. 2. 3. 4. 5. 6. Surname / Other Home Address Description Names of Proposer Decision of Returning Officer that Cyfenw Names / (in full) (if any) and Seconder Nomination Paper is invalid or other reason why a person Enwau Cyfeiriad Cartref Disgrifiad Enwau y Bobl a nominated no longer stands Eraill (yn llawn) (os oes un) Lofnododd y Papur nominated Penderfyniad y Swyddog Enwebu Canlyniadau fod y papur yn ddirym neu reswm arall paham na chaiff person a enwebwyd barhau i fod felly Renate D Boone ANDREWS Trevor 2 Heritage Gardens Arthur Kilgetty Janet D Ward Pembrokeshire SA68 0TW Independent Janet D Ward LOCKLEY Diane Churchlands Farm Christine Reynalton Trevor A Andrews Kilgetty Pembrokeshire SA68 0PE David J Pugh SMITH Sandra Mary Cozy Nook 27 Oakfield Drive Susan Rees Kilgetty Pembrokeshire SA68 0UD Trevor A Andrews WARD Janet Diane Little Oaks Ryelands Way Jeanette E Andrews Kilgetty Pembrokeshire SA68 0US Sandra M Smith WOODGATE Josephine 15 Park Avenue Mary Kilgetty Peter G Gilder Pembrokeshire SA68 0UB The persons opposite whose names no entry is made in column 6, have been and stand validly nominated. Y mae’r personau nad oes cofnod gyferbyn a’u henwau yng ngholofn 6, wedi’u henwebu’n gyfreithlon, ac yn parhau i fod felly. -

Cottages Guest Comments

Guest comments Bosherston Lily Ponds Sycamore Cottage Bosherston Kind comments from happy guests. Lily ponds wonderful. Beaches superb. Dogs shattered. Another relaxing week in Bosherston. Cottage great. Already booked for next year. Back again for a second visit. Still in awe of the location and such a lovely cottage. Hours of beautiful morning walks which cover woodland, cliff top, lily ponds, sandy beaches and all straight out of the front door. The cottage is like home from home – fabulous. Fantastic walks to Barafundle, Stackpole. Top tips - kayaking with The Prince’s Trust at Pembrokeshire Activity Centre – brilliant morning – they also do canoeing and coasteering for all ages and abilities. Carew Castle also a great place to play hide and seek! Wood burner a great bonus on cold nights. Great holiday, fabulous cottage with plenty of equipment. Well worth visiting Barafundle, St Govan’s Chapel and Pembroke Castle. Thanks for a great holiday! We are going to miss our daily stroll around the lily ponds in search of otters. We’ve had the most relaxing and enjoyable week in your beautiful cottage. The location is Book now! Contact Steve or Suzanne on: excellent and we have made the most of it. We have walked miles. We’ll be back for certain. Tel: 029 2061 4064 or 07768 416591 Email: [email protected] Web: cottages.capellcreative.co.uk Twitter: WestWalesFun Discounts for late and group bookings! Conditions apply. Contact us for more information. Sycamore Cottage Bosherston Kind comments from happy guests. This cottage is wonderfully presented and ideally situated. A thoroughly enjoyable week. -

Pobl Dewi March 2014.Indd

www.stdavidsdiocese.org.uk www.facebook.com/pobl.dewi http://twitter.com/PoblDewi Mawrth/March 2014 Women bishops: “Nothing must be lost” Meetings across the diocese have sent a clear message to the bishops as they draw up a Code of Practice to cater for those who, in conscience, cannot accept the principle of female headship HE Governing Body voted in September to allow the believed calling – “a gift from ordination of women as bishops one year on. And the God” – was more important and present Bench was required to bring forward “without feared creating a Church within T a Church. “We are a family,” she delay” a Code of Practice which would govern how opponents of said. “We have to live together or the measure could be accommodated. we will die together.” The Vicar of Tregaron, Canon as the one appointed in 1996 when Rhoda Healey said that if Philip Wyn Davies, set out his stall women were first ordained into the priests were there to represent at the opening meeting in Aber- priesthood. the Bishop at the Eucharist, there aeron: “It must be acceptable to Elizabeth Arnold-Davies, a was no logical sense to oppos- have reservations about women’s Reader in the United Parish of ing women bishops, when women sacramental ministry, at least until Lampeter, pointed to the Provin- already administered sacraments, the Anglican Communion as a cial Episcopal Visitor scheme in as priests. whole has taken a position,” he England, which seemed to work But Revd Stephen Edwards said. “There is no evidence that well. -

Angle Peninsular School Hundleton

AnglePeninsularSchool Hundleton DesignandAccessStatement RevisionP00 July2016 AnglePeninsularSchool– DesignandAccessStatement– July2016 Contents: Page: Introduction and proposal 1 Policy Context and PreRapplication Advice 2 Proposed Site 3 Site Analysis 4 Constraints and Opportunities 5 Sustainability and Massing and Appearance 6 Landscape Proposals 7 Local Precedents 8 Proposed Materials and Palletes 9– 14 The proposals 15– 18 List of Appendices Appendix A R Review of Education Provision on the Angle Peninsular. 19 Consultation Document September 2015 AnglePeninsularSchool– DesignandAccessStatement– July2016 Introduction This design statement has been prepared in accordance with advice given in Technical Advice Note (Wales) 12: Design (Welsh Assembly Government, 2014) and is submitted in support of the planning application for the new school to be known as Angle Peninsular School, on the site adjacent to Orielton Community Primary School, Pembrokeshire. The application is for full planning permission, reference is made to additional supporting documentation where appropriate. In April 2016, Pembrokeshire County Council invited Contractors off the South West Wales Regional Contractors Framework to submit design and tender proposals for the creation of the new school in line with a set of employers requirements and survey information. In June 2016, WRW Construction along with the design team members were selected as the preferred contractor to take the scheme forward and submit a planning application on behalf of Pembrokeshire County Council by the end of July 2016. The proposal The proposed development is in response to a review of Education Provision on the Angle Peninsular. In September 2015, a Consultation Document was prepared by Pembrokeshire County Council that sets out the case for change to the primary education provision on the Angle Peninsular and the councils preferred option to locate a new school in Hundleton. -

The Skyrmes of Pembrokeshire (1) Manorbier and Penally

The Skyrmes of Pembrokeshire (1) Manorbier and Penally David J Skyrme The Skyrmes of Manorbier and Penally Contents Do You Know Your Skyrmes? ............................................................................................... 3 10 Interesting Facts .............................................................................................................. 3 Preface .................................................................................................................................. 4 Introduction .......................................................................................................................... 5 Skyrmes of Manorbier .......................................................................................................... 5 George Skyrme (1819 – 1876) & Eliza .................................................................................. 6 Charles Skyrme (1840 – 1908) .......................................................................................... 8 David Skyrme (1844-1901) ............................................................................................... 9 George Thomas Skyrme (1846 – 1929) .......................................................................... 11 James Thomas Skyrme (1849 – 1905) ............................................................................ 12 John Thomas Skyrme (1854 – 1903) .............................................................................. 12 Thomas Skyrme (1857 – 1932) and Ellen (1854 – 1922) ................................................... -

Dyfed Final Recommendations News Release

NEWS RELEASE Issued by the Telephone 02920 395031 Boundary Commission for Wales Caradog House Fax 02920 395250 1-6 St Andrews Place Cardiff CF10 3BE Date 25 August 2004 FINAL RECOMMENDATIONS FOR THE PARLIAMENTARY CONSTITUENCIES IN THE PRESERVED COUNTY OF DYFED The Commission propose to make no change to their provisional recommendations for five constituencies in the preserved county of Dyfed. 1. Provisional recommendations in respect of Dyfed were published on 5 January 2004. The Commission received eleven representations, five of which were in support of their provisional recommendations. Three of the representations objected to the inclusion of the whole of the Cynwyl Elfed electoral division within the Carmarthen West and South Pembrokeshire constituency, one objected to the name of the Carmarthen West and South Pembrokeshire constituency and one suggested the existing arrangements for the area be retained. 2. The Commission noted that, having received no representation of the kind mentioned in section 6 (2) of the Parliamentary Constituencies Act 1986, there was no statutory requirement to hold a local inquiry. The Commission further decided that in all the circumstances they would not exercise their discretion under section 6 (1) to hold an inquiry. Final recommendations 3. The main objection to the provisional recommendations was in respect of the inclusion of the Cynwyl Elfed electoral division in the Carmarthen West and South Pembrokeshire constituency. It was argued that the division should be included in Carmarthen East and Dinefwr on the grounds that the majority of the electorate in the division fell within that constituency and that inclusion in Carmarthen East and Dinefwr rather than Carmarthen West and South Pembrokeshire would reduce the disparity between the electorates of the two constituencies and would bring them closer to the electoral quota. -

Women in the Rural Society of South-West Wales, C.1780-1870

_________________________________________________________________________Swansea University E-Theses Women in the rural society of south-west Wales, c.1780-1870. Thomas, Wilma R How to cite: _________________________________________________________________________ Thomas, Wilma R (2003) Women in the rural society of south-west Wales, c.1780-1870.. thesis, Swansea University. http://cronfa.swan.ac.uk/Record/cronfa42585 Use policy: _________________________________________________________________________ This item is brought to you by Swansea University. Any person downloading material is agreeing to abide by the terms of the repository licence: copies of full text items may be used or reproduced in any format or medium, without prior permission for personal research or study, educational or non-commercial purposes only. The copyright for any work remains with the original author unless otherwise specified. The full-text must not be sold in any format or medium without the formal permission of the copyright holder. Permission for multiple reproductions should be obtained from the original author. Authors are personally responsible for adhering to copyright and publisher restrictions when uploading content to the repository. Please link to the metadata record in the Swansea University repository, Cronfa (link given in the citation reference above.) http://www.swansea.ac.uk/library/researchsupport/ris-support/ Women in the Rural Society of south-west Wales, c.1780-1870 Wilma R. Thomas Submitted to the University of Wales in fulfillment of the requirements for the Degree of Doctor of Philosophy of History University of Wales Swansea 2003 ProQuest Number: 10805343 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. -

The Pembrokeshire (Communities) Order 2011

Status: This is the original version (as it was originally made). This item of legislation is currently only available in its original format. WELSH STATUTORY INSTRUMENTS 2011 No. 683 (W.101) LOCAL GOVERNMENT, WALES The Pembrokeshire (Communities) Order 2011 Made - - - - 7 March 2011 Coming into force in accordance with article 1(2) and (3) The Local Government Boundary Commission for Wales has, in accordance with sections 54(1) and 58(1) of the Local GovernmentAct 1972(1), submitted to the Welsh Ministers a report dated April 2010 on its review of, and proposals for, communities within the County of Pembrokeshire. The Welsh Ministers have decided to give effect to those proposals with modifications. More than six weeks have elapsed since those proposals were submitted to the Welsh Ministers. The Welsh Ministers make the following Order in exercise of the powers conferred on the Secretary of State by sections 58(2) and 67(5) of the Local Government Act 1972 and now vested in them(2). Title and commencement 1.—(1) The title of this Order is The Pembrokeshire (Communities) Order 2011. (2) Articles 4, 5 and 6 of this Order come into force— (a) for the purpose of proceedings preliminary or relating to the election of councillors, on 15 October 2011; (b) for all other purposes, on the ordinary day of election of councillors in 2012. (3) For all other purposes, this Order comes into force on 1 April 2011, which is the appointed day for the purposes of the Regulations. Interpretation 2. In this Order— “existing” (“presennol”), in relation to a local government or electoral area, means that area as it exists immediately before the appointed day; “Map A” (“Map A”), “Map B” (“Map B”), “Map C” (“Map C”), “Map D” (“Map D”), “Map E” (“Map E”), “Map F” (“Map F”), “Map G” (“Map G”), “Map H” (“Map H”), “Map I” (“Map (1) 1972 c. -

Local Development Plan Draft Review (LDP2: 2017 – 2033) Strategic Housing Options Supplementary Paper Defining Settlement Clusters

Local Development Plan Draft Review (LDP2: 2017 – 2033) Strategic Housing Options Supplementary Paper Defining Settlement Clusters 1. Introduction This paper has been prepared to assist the review of the Local Development Plan and specifically relates to the potential approach to Settlement Clusters discussed within the ‘Strategic Housing Options Paper’. That paper will assist in identifying alternative options for future housing development within urban and rural areas of the County outside of the National Park. The Authority is currently working towards establishing a Preferred Strategy and is preparing a draft vision and objectives for the Plan. These will be available for public consultation Summer 2018. A range of information has been gathered about services available at individual settlements, which is set out in the Rural Facilities Paper 2017. The information gathered allows us to understand the role and function currently performed by settlements and is used to inform the settlement hierarchy for the LDP review. The purpose of this supplementary paper is to set out an approach to settlement clusters at the lower end of the settlement hierarchy. Settlements at the lower end of the settlement hierarchy are called Large Local Villages and Small Local Villages within the Local Development Plan hierarchy. (They are proposed as ‘Local Villages’ within the Rural Facilities Paper). This paper is not intended to set out locations where development can take place, but to identify a clear methodology for clusters of settlements, and taking account of the settlement hierarchy established as part of the LDP2 Review and published within the Rural Facilities Background Paper 2017. It is supplementary to the Strategic Housing Options Paper where the rural housing option of Clusters is considered along with other options for housing at Local Villages. -

Rail Station Usage in Wales, 2018-19

Rail station usage in Wales, 2018-19 19 February 2020 SB 5/2020 About this bulletin Summary This bulletin reports on There was a 9.4 per cent increase in the number of station entries and exits the usage of rail stations in Wales in 2018-19 compared with the previous year, the largest year on in Wales. Information year percentage increase since 2007-08. (Table 1). covers stations in Wales from 2004-05 to 2018-19 A number of factors are likely to have contributed to this increase. During this and the UK for 2018-19. period the Wales and Borders rail franchise changed from Arriva Trains The bulletin is based on Wales to Transport for Wales (TfW), although TfW did not make any the annual station usage significant timetable changes until after 2018-19. report published by the Most of the largest increases in 2018-19 occurred in South East Wales, Office of Rail and Road especially on the City Line in Cardiff, and at stations on the Valleys Line close (ORR). This report to or in Cardiff. Between the year ending March 2018 and March 2019, the includes a spreadsheet level of employment in Cardiff increased by over 13,000 people. which gives estimated The number of station entries and exits in Wales has risen every year since station entries and station 2004-05, and by 75 per cent over that period. exits based on ticket sales for each station on Cardiff Central remains the busiest station in Wales with 25 per cent of all the UK rail network. -

Pembrokeshire

1 Town Tree Cover in Pembrokeshire Understanding canopy cover to better plan and manage our urban trees 2 Foreword Introducing a world-first for Wales is a great pleasure, particularly as it relates to greater knowledge about the hugely valuable woodland and tree resource in our towns and cities. We are the first country in the world to have undertaken a country-wide urban canopy cover survey. The resulting evidence base set out in this supplementary county specific study for Pembrokeshire will help all of us - from community tree interest groups to urban planners and decision-makers in local authorities Emyr Roberts Diane McCrea and our national government - to understand what we need to do to safeguard this powerful and versatile natural asset. Trees are an essential component of our urban ecosystems, delivering a range of services to help sustain life, promote well-being, and support economic benefits. They make our towns and cities more attractive to live in - encouraging inward investment, improving the energy efficiency of buildings – as well as removing air borne pollutants and connecting people with nature. They can also mitigate the extremes of climate change, helping to reduce storm water run-off and the urban heat island. Natural Resources Wales is committed to working with colleagues in the Welsh Government and in public, third and private sector organisations throughout Wales, to build on this work and promote a strategic approach to managing our existing urban trees, and to planting more where they will deliver the greatest -

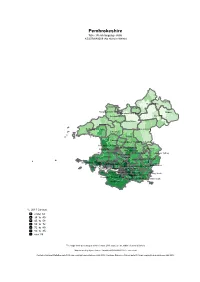

Pembrokeshire Table: Welsh Language Skills KS207WA0009 (No Skills in Welsh)

Pembrokeshire Table: Welsh language skills KS207WA0009 (No skills in Welsh) Cilgerran St. Dogmaels Goodwick Newport Fishguard North West Fishguard North East Clydau Scleddau Crymych Dinas Cross Llanrhian St. David's Solva Maenclochog Letterston Wiston Camrose Haverfordwest: Prendergast,Rudbaxton Haverfordwest: Garth Haverfordwest: Portfield Haverfordwest: Castle Narberth Martletwy Haverfordwest: Priory Narberth Rural Lampeter Velfrey Merlin's Bridge Johnston The Havens Llangwm Kilgetty/Begelly Amroth Milford: North Burton St. Ishmael's Neyland: West Milford: WestMilford: East Milford: Hakin Milford: Central Saundersfoot Milford: Hubberston Neyland: East East Williamston Pembroke Dock:Pembroke Market Dock: Central Carew Pembroke Dock: Pennar Penally Pembroke Dock: LlanionPembroke: Monkton Tenby: North Pembroke: St. MaryLamphey North Manorbier Pembroke: St. Mary South Pembroke: St. Michael Tenby: South Hundleton %, 2011 Census under 34 34 to 45 45 to 58 58 to 72 72 to 80 80 to 85 over 85 The maps show percentages within Census 2011 output areas, within electoral divisions Map created by Hywel Jones. Variables KS208WA0022−27 corrected Contains National Statistics data © Crown copyright and database right 2013; Contains Ordnance Survey data © Crown copyright and database right 2013 Pembrokeshire Table: Welsh language skills KS207WA0010 (Can understand spoken Welsh only) St. Dogmaels Cilgerran Goodwick Newport Fishguard North East Fishguard North West Crymych Clydau Scleddau Dinas Cross Llanrhian St. David's Letterston Solva Maenclochog Haverfordwest: Prendergast,Rudbaxton Wiston Camrose Haverfordwest: Garth Haverfordwest: Castle Haverfordwest: Priory Narberth Haverfordwest: Portfield The Havens Lampeter Velfrey Merlin's Bridge Martletwy Narberth Rural Llangwm Johnston Kilgetty/Begelly St. Ishmael's Milford: North Burton Neyland: West East Williamston Amroth Milford: HubberstonMilford: HakinMilford: Neyland:East East Milford: West Saundersfoot Milford: CentralPembroke Dock:Pembroke Central Dock: Llanion Pembroke Dock: Market Penally LampheyPembroke:Carew St.