2018 for Personal Use Only Use Personal for CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

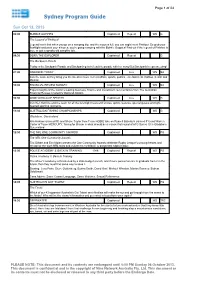

Sydney Program Guide

Page 1 of 21 Sydney Program Guide Sun Apr 5, 2015 06:00 EASTER SUNRISE SERVICE Captioned Live WS G Easter Sunrise Service Join Wesley Mission for this Easter celebration service LIVE from the Sydney Opera House. As the sun rises on Easter Day, Keith Garner leads a live band and speaks with a number of guests who share their faith and the hope of Easter. 07:00 WEEKEND TODAY Captioned Live WS NA Join the Weekend Today team as they bring you the latest in news, current affairs, sports, politics, entertainment, fashion, health and lifestyle. 10:00 THE BOTTOM LINE Captioned Repeat WS PG Fr Chris Riley This week, Founder of Youth Off The Streets, Father Chris Riley sits down with Alex Malley to talk about dedicating his life to helping the homeless youth, the challenges facing the Catholic Church and his views on modern day religion. Cons.Advice: Adult Themes 10:30 WIDE WORLD OF SPORTS Captioned Live WS G Join Ken Sutcliffe and the team for all the overnight news and scores, sports features, special guests and light- hearted sporting moments. 11:30 SUNDAY FOOTY SHOW Captioned Live WS G Breaking NRL news, expert analysis, high profile guests taking you to places and people no ticket can buy – Hosted by Peter Sterling. 13:30 MONKEY TROUBLE 1994 Captioned Repeat WS G Monkey Trouble A young girl's life turns hairy when her new pet monkey turns out to be a trained pickpocket on the run from a scheming gypsy. Starring: Thora Birch, Harvey Keitel 15:30 NINE'S LIVE SUNDAY FOOTBALL Captioned Live WS NA Sydney Roosters v Cronulla Sharks Wide World Of Sports presents Sydney Roosters v Cronulla Sharks live from Allianz Stadium, Sydney. -

Sydney Program Guide

Page 1 of 24 Sydney Program Guide Sun Oct 13, 2013 06:00 BUBBLE GUPPIES Captioned Repeat WS G The Legend of Pinkfoot! Legend has it that when you go on a camping trip, and the moon is full, you just might meet Pinkfoot. So grab your flashlight and pack your s’mores; you’re going camping with the Bubble Guppies! Find out if the legend of Pinkfoot is true, or just a spooky old campfire tale. 06:30 DORA THE EXPLORER Captioned Repeat G The Backpack Parade Today is the Backpack Parade and Backpack gets to lead the parade with her song! But Backpack keeps sneezing! 07:00 WEEKEND TODAY Captioned Live WS NA Join the team as they bring you the latest in news, current affairs, sports, politics, entertainment, fashion, health and lifestyle. 10:00 FINANCIAL REVIEW SUNDAY Captioned Live WS NA Expert insights of the nation’s leading business, finance and investment commentators from The Australian Financial Review, hosted by Deborah Knight. 10:30 WIDE WORLD OF SPORTS Captioned Live WS G Join Ken Sutcliffe and the team for all the overnight news and scores, sports features, special guests and light- hearted sporting moments. 11:30 AUSTRALIAN FISHING CHAMPIONSHIPS Captioned WS G Gladstone, Queensland Kris Hickson (ranked #3) and Shane Taylor from Team HOBIE take on Russell Babekuhl (ranked #1) and Warren Carter of Team MERCURY, fishing for Bream in what should be a classic first round of AFC Series 10 in Gladstone, Queensland 12:00 THE NRL ONE COMMUNITY AWARDS Captioned WS PG The NRL One Community Awards Tim Gilbert and Erin Molan present the One Community Awards celebrate Rugby League’s unsung heroes and recognise the work NRL stars and volunteers contribute to grassroots rugby league. -

Full Year Statutory Accounts

Appendix 4E (Rule 4.3A) For the year ended 30 June 2021 Results for Announcement to the Market 2020 2021 Restated Key Financial Information $’000 $’000 Continuing operations Revenue from ordinary activities Up by 8% 2,342,178 2,172,060 Revenue from ordinary activities, excluding specific items Up by 8% 2,332,984 2,156,785 Net profit/(loss) from ordinary activities after tax n/m 183,961 (507,751) Net profit after tax, excluding specific items Up by 76% 277,530 157,694 Discontinued operations Profit/(loss) from ordinary activities after tax — (66,189) Total income attributable to: Net profit/(loss) from ordinary activities after tax — owners of the parent n/m 169,364 (589,198) Net profit from ordinary activities after tax — non-controlling interest Down by 4% 14,597 15,258 n/m = not meaningful Refer to the attached Financial Report, Results Announcement and Investor Presentation for management commentary on the results. Dividends A fully franked dividend of 5.5 cents per share has been announced payable on 20th October 2021. Amount per Franked amount share per share Dividends cents cents Dividend per share (paid 20th October 2020) 2.0 2.0 Interim 2021 dividend per share (paid 20th April 2021) 5.0 5.0 A fully franked dividend amounting to $34,107,865 of 2.0 cents per share was paid on 20 October 2020. An interim fully franked dividend amounting to $85,269,663 of 5.0 cents per share was paid on 20 April 2021. Dividend and AGM Dates Ex-dividend date: 9 September 2021 Record date: 10 September 2021 Payment date: 20 October 2021 Annual General Meeting date: 11 November 2021 Net Tangible Assets per Share 2020 2021 Restated Reported cents cents Net tangible asset (deficit)/backing per ordinary share 1 (38.3) (40.9) Net asset backing per ordinary share 114.9 108.4 1. -

Your Prime Time Tv Guide ABC (Ch2) SEVEN (Ch6) NINE (Ch5) WIN (Ch8) SBS (Ch3) 6Pm the Drum

tv guide PAGE 2 FOR DIGITAL CHOICE> your prime time tv guide ABC (CH2) SEVEN (CH6) NINE (CH5) WIN (CH8) SBS (CH3) 6pm The Drum. 6pm Seven Local News. 6pm Nine News. 6pm News. 6pm Mastermind Australia. 7.00 ABC News. 6.30 Seven News. 7.00 A Current Affair. 6.30 The Project. 6.30 SBS World News. Y 7.30 Inside Dame 7.00 Better Homes And Gardens. 7.30 Rugby League. NRL. Round 13. 7.30 The Living Room. (PG) 7.30 Belsen: The Untold Story. A Elisabeth’s Garden. 8.30 MOVIE Raising Helen. South Sydney Rabbitohs v 8.30 Have You Been Paying (M) The story of Bergen-Belsen D I 8.30 MotherFatherSon. (MA15+) (2004) (PG) Kate Hudson, Abigail Brisbane Broncos. Attention? (M) concentration camp. Kathryn dedicates herself to her Breslin. A woman cares for her late 9.45 Friday Night Knock Off. 9.30 To Be Advised. 8.30 Walt Disney. (PG) Part 2 of 2. FR son’s recovery. sister’s children. 10.35 MOVIE Homefront. (2013) 10.00 Celebrity Continues to explore the life and 9.30 Marcella. (M) 10.50 To Be Advised. (MA15+) Jason Statham. A former Gogglebox USA. (M) legacy of Walt Disney. 10.20 ABC Late News. DEA agent battles a drug lord. 11.00 WIN News. 10.35 SBS World News Late. 7pm ABC News. 6pm Seven News. 6pm Nine News Saturday. 6pm Bondi Rescue. (PG) 6.30pm SBS World News. Y 7.30 Father Brown. (PG) A choir 7.00 AFL Pre-Game Show. Pre-game 7.00 A Current Affair. -

Sydney Program Guide

Page 1 of 19 Sydney Program Guide Sun Jun 26, 2016 06:00 PAW PATROL Captioned Repeat HD WS G A pack of six heroic puppies and a tech-savvy 10-year-old boy work together using a unique blend of problem- solving skills, cool vehicles and lots of cute doggy humour on high-stakes rescue missions to protect the Adventure Bay community. 06:30 DORA THE EXPLORER Captioned Repeat WS G Vamos A Pintar Dora and Boots are painting pictures in Dora's yard when suddenly, they hear crying. In the nearby forest, they discover Pincel, a paintbrush who's crying multi-colored tears. He needs their help getting back to the Art Studio! 07:00 WEEKEND TODAY Captioned Live HD WS NA Join the Weekend Today team as they bring you the latest in news, current affairs, sports, politics, entertainment, fashion, health and lifestyle. 10:00 WIDE WORLD OF SPORTS Captioned Live HD WS PG Join Ken Sutcliffe, Emma Freedman and the team for all the overnight news and scores, sports features, special guests and light-hearted sporting moments. 11:00 SUNDAY FOOTY SHOW Captioned Live HD WS PG Breaking NRL news, expert analysis, high profile guests taking you to places and people no ticket can buy. Hosted by Yvonne Sampson. 13:00 SUBARU FULL CYCLE Captioned HD WS NA Hosted by two of Australia’s most coveted former cyclists Scott McGrory and Bradley McGee who will keep fans up to date with all the news & action on the road and behind the scenes at the Subaru National Road Series. -

The Official Journal of the NSW SES Volunteers Association the Issue 50 | December 2019 Volunteerissn 1445-3886 | PP 100018972

The official journal of the NSW SES Volunteers Association the Issue 50 | December 2019 VolunteerISSN 1445-3886 | PP 100018972 PROUDLY SUPPORTED BY Volunteer 17,000 EMPLOYEES MAINTENANCE CONTRACTS COVERING MORE THAN ACTIVE IN ALMOST 740,000 EQUIPMENT OF DIFFERENT 50 COUNTRIES MAKES Our vision is that we know in real time how millions of lifting Konecranes is a global industry-lead- ing group of lifting businesses. Every- devices perform. We use thing we do is targeted at one goal: improving the safety and productivity this knowlege around of our customers’ operations. When you choose Konecranes, you acquire the clock to make our a trusted source of global experience and knowlege combined with local customers’ operations know-how to empower your material handling. For over 80 years, we have safer and more been dedicated to improving efficiency and performance of businesses in all productive types of industries. And we have done this by continuously providing lifting equipment and services people can trust. www.konecranes.com.au the Volunteer NSW SES VOLUNTEERS ASSOCIATION BOARD OF DIRECTORS President of the Board of Directors Vice President Managing Director Kim Davis ESM (Captains Flat) Shannon Crofton ESM CF (Metro Zone) Erin Pogmore (Metro Zone) [email protected] [email protected] [email protected] Secretary Director Kim Edwards (Waverley/Woolhara) Megan Hamblin (Wellington) [email protected] [email protected] NSW SES VOLUNTEERS ASSOCIATION COORDINATORS & AMBASSADORS Patricia Johnson Cheryl Goodchild Teddy Haryjanto Flower Coordinator Membership Coordinator Mental Health Coordinator Adam Jones Selina Thomas Mark Elm Member Benefits Coordinator Mental Health Coordinator VA Rep NSW SES Awards Committee Anthorr Nomchong Cory McMillan Member Recognition Coordinator Mental Health Coordinator CRITICAL INCIDENT SUPPORT PROGRAM 1800 626 800 CONTRIBUTIONS Content for The Volunteer Photography should only be supplied digitally, please avoid scanning of any type. -

Express Vpn for Windows 10 Download How to Get an Expressvpn Free Trial Account – 2021 Hack

express vpn for windows 10 download How to Get an ExpressVPN Free Trial Account – 2021 Hack. The best way to make sure ExpressVPN is the right VPN for you is to take it for a test drive before you commit and make sure its features fit your needs. Unlike some other VPNs, ExpressVPN doesn’t have a standard free trial. But it does have a no-questions-asked, 30-day money-back guarantee. So you can test out the VPN with no limitations, risk-free. If at any point during those 30 days, you decide that ExpressVPN isn’t right for you, you can just request a refund. This is super simple: I’ve tested it using several accounts, and got my money back every time. ExpressVPN Free Trial : Quick Setup Guide. It’s easy to set up ExpressVPN and get your 30 days risk-free. Here’s a step-by-step walkthrough that will have you ready in minutes. Head over to the ExpressVPN free trial page, and select, “Start Your Trial Today” to go right to their pricing list. Choose your subscription plan length, and then enter your email address and payment details. Note that longer plans are much cheaper. ExpressVPN’s long-term plans are the most affordable. It’s easy to download the app to your device. The set up for the ExpressVPN app is simple, and fast. Request a refund via live chat. Try ExpressVPN risk-free for 30-days. Free Trial Vs. Money-Back Guarantee. The trial period for ExpressVPN is really a 30-day money-back guarantee, but this is better than a free trial. -

City Recital Hall Limited

ANNUAL REPORT 2018-19 CITY RECITAL HALL LIMITED 1 CONTENTS 3 STRATEGIC FRAMEWORK Concert: Man of Constant Sorrow: A tribute to the music 4 ACTIVITY HIGHLIGHTS of ‘O Brother Where art Thou?’ Photo: Tim da-RIn 5 CHAIR’S MESSAGE 6 CEO’S MESSAGE 7 PRESENTING PARTNERS AND HIRERS 8 APPEARING ON OUR STAGE 10 VISITOR EXPERIENCE 11 SUPPORT FOR THE SECTOR 12 COMMUNITY ENGAGEMENT 14 CITY RECITAL HALL PRESENTS 17 KEY PRESENTERS 18 VENUE HIRERS 19 PARTNERS AND SUPPORTERS 20 GIVING 21 MEMBERSHIP 22 CORPORATE GOVERNANCE 23 BOARD 26 STAFF 2 STRATEGIC FRAMEWORK Concert: Man of Constant Sorrow: A tribute to the music of ‘O Brother Where art Thou?’ Photo: Tim da-RIn VISION OUR GUIDING PRINCIPLES STRATEGIC GOALS To be one of the ‘must visit’ cultural AND VALUES BRAND destinations in Australia. • Progressive thinking and creative City Recital Hall is a place that offers excellence underpin everything we do. “music and more” to a wide audience MISSION We think outside the square to deliver unique and creative experiences for PLACE To unlock the cultural, social and our artists, partners and audiences. The beating cultural heart of the economic value of City Recital Hall. Sydney CBD • Democratic and diverse - Everyone We will do this by: plays an important part, every voice is QUALITY heard, everyone is respected. If it’s on at City Recital Hall, it must be • producing, promoting, presenting, We champion diversity by engaging good encouraging and facilitating excellent with all genres, all peoples, all ideas. cultural events; We are proud to be open, transparent SERVICE and inclusive. -

MEDIA RELEASE 8 May 2019 PERTH NINJA WARRIOR PREPARING TO

MEDIA RELEASE 8 May 2019 PERTH NINJA WARRIOR PREPARING TO STEP UP FOR MSWA Ninja Warrior and local firefighter Alex Matthews is preparing to put his special skills to the test when he takes part in the Shadforth Financial Group Step Up for MSWA, racing to the top of Central Park in the Perth CBD on Sunday, 30 June. 2019 marks the 12th annual Step Up for MSWA. The event sees a broad range of participants – from professional athletes and protective services personnel, to office workers and families – who make the climb up Central Park’s 1,103 stairs (53 flights) to raise funds for people living with MS and all neurological conditions in WA. In preparation for Step Up for MSWA, Alex and other registered participants will take part in an exciting training session at Perth’s own Ninja Academy, in Osborne Park – home to Australia’s most extensive Ninja Warrior-style obstacle course. Alex, a qualified aviation firefighter based at Perth Airport, is competing in the Extreme Firefighter Challenge category of the event and said he would be taking full advantage of the Ninja Academy training session. In the first series of Channel Nine’s Australian Ninja Warrior Alex smashed the gruelling course in six minutes and six seconds. He said that in 2019, he planned to work just as hard when tackling Step Up for MSWA in aid of a very worthy cause. “The reward and exhilaration of climbing 1,103 steps to the top of Central Park, whilst knowing you have helped make a difference to thousands of Western Australians living with MS and all neurological conditions, is incredible,” Alex said. -

Submission to the Inquiry Into Broadcasting, Online Content and Live Production to Rural and Regional Australia

SUBMISSION TO THE INQUIRY INTO BROADCASTING, ONLINE CONTENT AND LIVE PRODUCTION TO RURAL AND REGIONAL AUSTRALIA The Hon Bronwyn Bishop MP Chair Standing Committee on Communications and the Arts PO Box 6021 Parliament House CANBERRA ACT 2600 By email: [email protected] Introduction Thank you for the opportunity to make a submission to the House of Representatives Standing Committee on Communications and the Arts inquiry into broadcasting, online content and live production to rural and regional Australia. This letter is on behalf of the three major regional television providers, Prime Media Group (Prime Media), the WIN Network (WIN) and Southern Cross Austereo (SCA). Prime Media and SCA are members of Free TV Australia, the television peak body which has also made a submission to this inquiry on behalf of the industry. Prime Media broadcasts in northern New South Wales, southern New South Wales, the Australian Capital Territory, regional Victoria, Mildura, the Gold Coast area of south eastern Queensland and all of regional Western Australia. WIN broadcasts in southern New South Wales, the Australian Capital Territory, regional Queensland, regional Victoria, Tasmania, Griffith, regional WA, Mildura, Riverland and Mt Gambier in South Australia. SCA broadcasts in northern New South Wales, southern New South Wales, Queensland, the Australian Capital Territory, Griffith, regional Victoria, Tasmania, the Northern Territory and the Spencer Gulf region of South Australia. Through affiliation agreements, Prime Media, WIN and SCA purchase almost all of their programming from metropolitan networks1 and using more than 500 transmission towers located across the country, retransmit that programming into regional television licence areas. -

1 Transcript of 2019 Nine Entertainment AGM Sydney

1 Transcript of 2019 Nine Entertainment AGM Sydney, November 12, 2019 Chairman Peter Costello Good morning ladies and gentleman. As your Chairman, it's my pleasure to welcome you to the 2019 AGM of Nine Entertainment Company. My name is Peter Costello. Before opening the meeting, I refer you to the disclaimer here on the screen behind me and available through our ASX lodgement. It is now shortly after 10am and I am advised that this is a properly constituted meeting. There's a quorum of at least two shareholders present so I declare the 2019 Annual General Meeting open. Unless there are any objections, I propose to take the Notice of Meeting as read. Copies of the Notice of Meeting are available from the registration desk outside should you require them. Let me now introduce the people who are with us this morning. To my immediate left is Rachel Launders, our General Counsel and Company Secretary. Then Hugh Marks, our Chief Executive Officer, who will address the meeting a little later. Next to Hugh is Nick Falloon, the Independent, Non-Executive Director and Deputy Chair and Member of the People and Remuneration Committee. Then we have Patrick Alloway, Independent, Non-Executive Director and a member of the Audit and Risk Management Committee. Next to Patrick is Sam Lewis, Independent, Non-Executive Director, Chair of the Audit and Risk Committee and a Member of the People and Remuneration Committee. Then we have Mickie Rosen, Independent, Non-Executive Director. At the far end, we have Catherine West, Independent, Non-Executive Director, the Chair of the People and Remuneration Committee and a member of the Audit and Risk Committee. -

Fhu-Fhu1 (800) 348-3481

2009-10 Undergraduate Catalog of Freed-Hardeman University Learning, Achieving, Serving “Teaching How to Live and How to Make a Living” Freed-Hardeman University 158 East Main Street Henderson, Tennessee 38340-2399 (731) 989-6000 (800) FHU-FHU1 (800) 348-3481 NON-DISCRIMINATORY POLICY AS TO STUDENTS Freed-Hardeman University admits qualified students of any race, color, national or ethnic origin to all the rights, privileges, programs, and activities generally accorded or made available to students at the school. Freed-Hardeman does not discriminate on the basis of age, handicap, race, color, national or ethnic origin in administration of its educational policies, admissions policies, scholarship and loan programs, and athletic and other school-administered programs. Except for certain exemptions and limitations provided for by law, the university, in compliance with Title IX of the Education Amendments of 1972, does not discriminate on the basis of sex in admissions, in employment, or in the educational programs and activities which it operates with federal aid. Inquiries concerning the application of Title IX may be referred to Dr. Samuel T. Jones, Freed-Hardeman University, or to the Director of the Office for Civil Rights of the Department of Education, Washington, DC 20202. TABLE OF CONTENTS GENERAL INFORMATION Message from President Joe A. Wiley .................................................................................... 5 Purpose Statement ...........................................................................................................