Drones Go to Work the Future Looks Promising the UAS Market Has a Huge Forecasted Growth (2)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quarterly Aviation Report

Quarterly Aviation Report DUTCH SAFETY BOARD page 14 Investigations Within the Aviation sector, the Dutch Safety Board is required by law to investigate occurrences involving aircraft on or above Dutch territory. In addition, the Board has a statutory duty to investigate occurrences involving Dutch aircraft over open sea. Its October - December 2020 investigations are conducted in accordance with the Safety Board Kingdom Act and Regulation (EU) In this quarterly report, the Dutch Safety Board gives a brief review of the no. 996/2010 of the European past year. As a result of the COVID-19 pandemic, the number of commercial Parliament and of the Council of flights in the Netherlands was 52% lower than in 2019. The Dutch Safety 20 October 2010 on the Board therefore received fewer reports. In 2020, 27 investigations were investigation and prevention of started into serious incidents and accidents in the Netherlands. In addition, accidents and incidents in civil the Dutch Safety Board opened an investigation into a serious incident aviation. If a description of the involving a Boeing 747 in Zimbabwe in 2019. The Civil Aviation Authority page 7 events is sufficient to learn of Zimbabwe has delegated the entire conduct of the investigation to the lessons, the Board does not Netherlands, where the aircraft is registered and the airline is located. In the conduct any further investigation. past year, the Dutch Safety Board has offered and/or provided assistance to foreign investigative bodies thirteen times in investigations involving Dutch The Board’s activities are mainly involvement. aimed at preventing occurrences in the future or limiting their In this quarterly report you can read, among other things, about an consequences. -

Introduction This Publication Contains Facts and Figures on Schiphol Group for the Year 2008

Introduction This publication contains Facts and Figures on Schiphol Group for the year 2008. The information has been grouped into three categories: ‘About Schiphol Group’, ‘Amsterdam Airport Schiphol’ and ‘Airport Network’. More information on Schiphol Group can be found on the Internet. Please visit www.schipholgroup.com Information on Amsterdam Airport Schiphol can also be found on the Internet. Please visit www.schiphol.com, or telephone +31 (0)20 - 794 0800. Published by Schiphol Group Corporate Affairs P.O. Box 7501 1118 ZG Schiphol The Netherlands 1 Contents About Schiphol Group Airport Network Financial Results 6 Rotterdam Airport 29 Investments 8 Eindhoven Airport 30 Business Areas 9 Lelystad Airport 30 Aviation Business Area 10 Terminal 4, John F. Kennedy Airport, New York (USA) 31 Consumers Business Area 11 Brisbane Airport, Australia 31 Real Estate Business Area 12 Alliances & Participations business area 13 General Information History 14 Marketing AirportCity Products 33 Did you know…? 34 Amsterdam Airport Schiphol Other Publications 35 Airport Zone 15 Telephone numbers, addresses, websites 35 Capacity 16 Shops and Catering Outlets 16 Ten Major European Airports 17 Traffic and Transport 18 Passengers Profile 24 Employment 25 Miscellaneous 27 Awards 28 2 3 About Schiphol Group Schiphol Group is an airport operator headquartered in the Netherlands. Our aim is to create sustainable value for our stakeholders by developing AirportCities and by positioning Amsterdam Airport Schiphol as most preferred airport in Europe. Our ambition is to rank among the world’s leading airport companies. An AirportCity is not only an efficient, multi- modal hub for air, rail an road transport, it is a dynamic hub integrating people and businesses, logistics and shops, information and entertainment offering its visitors and locally-based international businesses all the services they require on a 24/7 basis. -

Economic Mission to the Republic of Indonesia 9 March - 13 March 2020 3 Index

Economic mission to the Republic of Indonesia 9 March - 13 March 2020 3 Index The Netherlands Foreword by Sigrid Kaag 7 HYDRODIESEL 89 FMO 125 Foreword by Hans de Boer 9 IDN Liveable Cities 90 Geesinknorba 126 Map of the Netherlands 13 Innovam 91 Holland Circular Hotspot 127 Introducing the Netherlands 14 LV Shipping & Transport 92 HyET Solar 128 Indonesia - the Netherlands 2020 16 MARIN | Maritime Research Hyva 129 Institute Netherlands 93 IHE Delft Institute for Water Ministry of Finance 94 Education 130 Naturalis Biodiversity Center 95 LeapFrog Waste Management 131 Company profiles Netherlands Maritime Technology 96 Machinefabriek Boessenkool 132 Agri & Food 21 Enraf-Nonius 54 Netherlands Water Partnership 97 MetaSus 133 Aeres Training Centre International 22 Erasmus MC, University Medical Port of Rotterdam 98 MVO Nederland 134 Agricultural Laboratory North- Center 55 Rabobank 99 Natural Resources & Technologies 135 Netherlands (ALNN) 23 Frans Seda Foundation 56 Rohill Engineering 100 Nazava Water Filters 136 Agriprom 24 HealthInc - Empowering Royal HaskoningDHV 101 Netherlands Water Partnership 137 Agriterra 25 entrepreneurs in Health 57 Royal IHC 102 Paqell 138 AsiAspire 26 Hospitainer 58 STC International 103 ROM 139 Capital 4 Development Partners 27 IDBH Senso 59 STC-NESTRA 104 Royal HaskoningDHV 140 Coolfinity 28 Incision Group 60 Sweco 105 The Great Bubble Barrier 141 CTC Group 29 Leiden University Medical Center 61 Teqplay 106 The Ocean Cleanup 142 East-West Seed 30 LifeSense Group 62 TOS | People & Ship Delivery 107 TNO 143 -

Ontwerp Luchthavenbesluit Luchthaven Twente

Ontwerp luchthavenbesluit luchthaven Twente 1. Luchthavenbesluit: artikelteksten 2. Bijlagen bij luchthavenbesluit 3. Nota van toelichting 4. Artikelsgewijze toelichting 5. Lijst van gebruikte afkortingen Ontwerp luchthavenbesluit luchthaven Twente Luchthavenbesluit Besluit van de Staatssecretaris van Infrastructuur en Milieu, van ......., nr. IENM/BSK-2014/…, tot vaststelling van een luchthavenbesluit voor de luchthaven Twente (Luchthavenbesluit luchthaven Twente) De Staatssecretaris van Infrastructuur en Milieu, Gelet op artikel 8.70, zesde lid, van de Wet luchtvaart; Gezien de brieven van 29 november 2013 en 4 februari 2014 van Area Development Twente mede namens de Exploitatiemaatschappij Vliegveld Twente B.V.; BESLUIT: Hoofdstuk 1 ALGEMENE BEPALINGEN Artikel 1 (Begripsbepalingen) In dit besluit wordt verstaan onder: ATC-slot (Air traffic control-slot): een door de luchtverkeersleiding opgegeven aankomst- of vertrektijd; bedrijfswoning: woning in of bij een gebouw of op of bij een terrein, slechts bestemd voor het huishouden van een persoon wiens huisvesting daar, gelet op de bestemming van het gebouw of terrein, noodzakelijk is; extramurale opslag, overslag of verwerking: opslag, overslag of verwerking anders dan in een volledig afgesloten gebouw; gebouw: gebouw als bedoeld in artikel 1 van de Woningwet; geluidsgevoelig gebouw: gebouw met een onderwijs- of gezondheidszorgfunctie als bedoeld in artikel 1.1 van het Bouwbesluit 2012; kwetsbaar gebouw: gebouw met een onderwijs- of gezondheidszorgfunctie als bedoeld in artikel 1.1 van het Bouwbesluit 2012; obstakel: object dat zich boven het maaiveld bevindt en zich niet voortbeweegt; verkeersvlucht: een vlucht van een luchtvaartmaatschappij die vervoer van passagiers of vracht ten doel heeft; woning: gebouw dat geheel of gedeeltelijk voor bewoning is bestemd. Artikel 2 (Reikwijdte) Dit besluit heeft betrekking op de luchthaven Twente. -

Serving the Northern Netherlands Groningen Airport Eelde the Northern Netherlands: Groningen, Drenthe, Friesland

Serving the Northern Netherlands Groningen Airport Eelde The Northern Netherlands: Groningen, Drenthe, Friesland 10% of Dutch population The Guardian: Groningen happiest city of Europe From Cow to Google Groningen Airport Eelde (GRQ) is the only airport in the densely- populated Benelux/ Northwest Germany region that does not overlap catchment areas with other airports. GRQ is not slot-constrained and has capacity for growth. Copenhagen 2019 2014 London Best in class in Diary; Milk reservoir of Europe Worldclass Research Institutes; Agribusiness Van Hall Larenstein and University of Groningen International trade Nobel prize winning research (nanotech) Life Science, Modern and innovative business cluster Health & Medical Largest University Hospital in the Netherlands (12,141 employees) Organ Transplantation Hotspot Technology Abundance of feedstock Large scale green energy Energy Transition development Power to gas (Hydrogen) and Biobased Green dataport Eemshaven (data center development) Chemicals Green energy supply; 600 MW Gemini Wind International fiber connections Home to the smartest production facilities in the world World class materials research (Zernike Institute) High tech industry Big data Fleet management & Crewing Maritime sector Specialty ship building Tourism Culture Sports Within 30 minutes – 575,000 inhabitants Within 45 minutes – 1,279,000 inhabitants Within 60 minutes – 2,079,000 inhabitants Major leakage effect Minor leakage effect Route potential from GRQ Leakage analysis results Currently Destination Name Upper range -

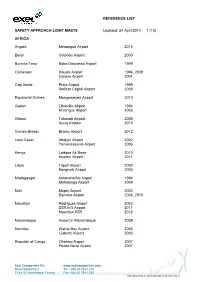

Reference List Safety Approach Light Masts

REFERENCE LIST SAFETY APPROACH LIGHT MASTS Updated: 24 April 2014 1 (10) AFRICA Angola Menongue Airport 2013 Benin Cotonou Airport 2000 Burkina Faso Bobo Diaulasso Airport 1999 Cameroon Douala Airport 1994, 2009 Garoua Airport 2001 Cap Verde Praia Airport 1999 Amilcar Capral Airport 2008 Equatorial Guinea Mongomeyen Airport 2010 Gabon Libreville Airport 1994 M’vengue Airport 2003 Ghana Takoradi Airport 2008 Accra Kotoka 2013 Guinea-Bissau Bissau Airport 2012 Ivory Coast Abidjan Airport 2002 Yamoussoukro Airport 2006 Kenya Laikipia Air Base 2010 Kisumu Airport 2011 Libya Tripoli Airport 2002 Benghazi Airport 2005 Madagasgar Antananarivo Airport 1994 Mahajanga Airport 2009 Mali Moptu Airport 2002 Bamako Airport 2004, 2010 Mauritius Rodrigues Airport 2002 SSR Int’l Airport 2011 Mauritius SSR 2012 Mozambique Airport in Mozambique 2008 Namibia Walvis Bay Airport 2005 Lüderitz Airport 2005 Republic of Congo Ollombo Airport 2007 Pointe Noire Airport 2007 Exel Composites Plc www.exelcomposites.com Muovilaaksontie 2 Tel. +358 20 754 1200 FI-82110 Heinävaara, Finland Fax +358 20 754 1330 This information is confidential unless otherwise stated REFERENCE LIST SAFETY APPROACH LIGHT MASTS Updated: 24 April 2014 2 (10) Brazzaville Airport 2008, 2010, 2013 Rwanda Kigali-Kamombe International Airport 2004 South Africa Kruger Mpumalanga Airport 2002 King Shaka Airport, Durban 2009 Lanseria Int’l Airport 2013 St. Helena Airport 2013 Sudan Merowe Airport 2007 Tansania Dar Es Salaam Airport 2009 Tunisia Tunis–Carthage International Airport 2011 ASIA China -

Luchtvaart, Derde Kwartaal 2019 02

Kwartaalmonitor Luchtvaart 01 3e kwartaal 2019 Het aantal aangekomen en vertrokken passagiers op de vijf nationale luchthavens lag in het derde kwartaal van 2019 1,3 procent hoger dan een jaar eerder. Het totale gewicht van vervoerde goederen daalde met 10,3 procent. De dienstverlenende bedrijven binnen de luchtvaart zetten dit kwartaal ruim 6 procent meer om. Dit meldt het CBS op basis van nieuwe kwartaalcijfers. INHOUD Aantal aangekomen en vertrokken passagiers op Schiphol is stabiel 2 Meer dan 2 miljoen vervoerde passagiers op luchthaven Eindhoven 3 Luchthaven Eindhoven populaire bestemmingen 4 Vervoerde luchtvracht in Amsterdam en Maastricht blijft afnemen 5 Totale hoeveelheid vervoerde luchtvracht gedaald 6 Omzet luchtvaartmaatschappijen en dienstverlenende bedrijven voor de luchtvaart blijft groeien 7 Afname aantal vliegbewegingen op kleine luchthavens 8 Vliegveld Oostwold grootste groei van de kleine luchthavens 9 Stijging aantal vliegbewegingen van en naar Caribisch Nederland 10 Stijging aantal passagiers op alle eilanden behorend tot Caribisch Nederland 11 Bronnen 11 Contact [email protected] Datum 19-12-2019 www.cbs.nl | Volg ons op Twitter, Facebook en Instagram @statistiekcbs Kwartaalmonitor Luchtvaart, derde kwartaal 2019 02 Geringe groei passagiers op nationale luchthavens In het derde kwartaal van 2019 vlogen 23 miljoen passagiers van en naar Nederland. Dat is ruim 1 procent meer vergeleken met het derde kwartaal in 2018. Dit is de laagste stijging sinds het tweede kwartaal van 2010. De ontwikkeling van het aantal vervoerde passagiers op de vijf nationale luchthavens laat al drie kwartalen hetzelfde beeld zien. Op Groningen Airport Eelde werden in het derde kwartaal van 2019 bijna 21 procent minder reizigers vervoerd dan een jaar eerder, terwijl de overige vier vliegvelden licht of sterk groeiden. -

Effect of the Traffic Distribution Rule on the Nature of Traffic Development at Lelystad Airport

EFFECT OF THE TRAFFIC DISTRIBUTION RULE ON THE NATURE OF TRAFFIC DEVELOPMENT AT LELYSTAD AIRPORT A study into market demand and dynamics following the opening of Lelystad Airport with a Traffic Distribution Rule (TDR) in place. CONTENTS EXECUTIVE SUMMARY 3 INTRODUCTION 7 2.1 Context 7 2.2 Objective of this study 7 2.3 Scope and limitations 8 APPROACH TO ESTIMATING TRAFFIC DEVELOPMENT 10 3.1 Logic used to determine traffic development 10 3.2 Methodology for determining traffic development at Lelystad Airport 11 3.3 Definition of autonomous versus non-autonomous traffic 11 FACTORS DRIVING TRAFFIC DEVELOPMENT 14 4.1 Demand outlook 14 4.2 Supply outlook 19 4.3 Airline market dynamics 26 TRAFFIC DEVELOPMENT SCENARIOS FOR LELYSTAD AIRPORT 38 5.1 Demand and supply balance in the Netherlands 38 5.2 Potential demand for slots at Lelystad Airport 39 5.3 Scenarios for slot allocation 41 OTHER FACTORS THAT COULD INFLUENCE TRAFFIC DEVELOPMENT 48 CONCLUSIONS 50 REFERENCES 52 1 EXECUTIVE SUMMARY 2 EXECUTIVE SUMMARY In this study, we have addressed the following question: “Can Lelystad Airport fulfil its targeted role of an overflow airport to Amsterdam Airport Schiphol (Schiphol) when the Traffic Distribution Rule (TDR) – supplemented by supportive measures if needed – is applied?” We conclude that Lelystad Airport will largely fulfil the role of an overflow airport, with an expected 10- 20% share of autonomous traffic in 2023 (at 10 thousand movements). This conclusion is based on the following two premises: 1. The share of autonomous traffic depends on how the EU Slot Regulation is specifically applied. -

2002 Statistical Annual Review (6.1 MB .Pdf)

Statistical Annual Review 2002 2002 Statistical Annual Review 2002 Preface April, 2003 In the case of the 2002 Annual Statistical Review, we felt that we had to respond to changes in the way that information can be presented. Whereas in the past this review largely consisted of tables supplemented with brief analyses, now the analyses have been greatly expanded and the number of tables have been kept to a minimum. Furthermore, we have now opted for a clear classification of the topics. The tables that are no longer included in the report are available on our website www.schiphol.nl. If you require any further information, please feel free to contact the department mentioned below. Data from this publication may be published as long as the source is quoted. Published by Amsterdam Airport Schiphol P.O. Box 7501 1118 ZG Schiphol Amsterdam Airport Schiphol Airlines Marketing & Account Management Statistics & Forecasts Phone : 31 (20) 601 2664 Fax : 31 (20) 601 4195 E-mail : [email protected] 3 Contents 1 Summary of developments 2002 5 Table: Traffic and transport summary 9 2 Aircraft movements 11 Table: Air transport movements, monthly totals 2002 17 Table: Air transport movements, annual totals 1993 - 2002 17 Map: Origins and destinations Europe 18 Map: Origins and destinations intercontinental 19 3 Passenger transport 21 Table: Passenger transport, monthly totals 2002 25 Table: Passenger transport, annual totals 1993 - 2002 25 4 Cargo transport 27 Table: Cargo transport, monthly totals 2002 32 Table: Cargo transport, annual totals 1993 - 2002 32 Table: Mail transport, annual totals 1993 - 2002 33 5 Other Airports 35 Table: Air transport movements 41 Table: Passenger transport (transit-direct counted once) 41 Table: Cargo transport 42 Table: Dutch airports 43 6 Infrastructure 45 4 Statistical Annual Review 2002 1. -

Hybrid Distribution Trucks: Costs and Benefits 6

Technical Report Documentation Page 1. Report No. 2. Government Accession No. 3. Recipient's Catalog No. SWUTC/11/476660-00080-1 4. Title and Subtitle 5. Report Date June 2011 Hybrid Distribution Trucks: Costs and Benefits 6. Performing Organization Code 7. Author(s) 8. Performing Organization Report No. Garrett Anderson and Rob Harrison Report 476660-00080-1 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) Center for Transportation Research University of Texas at Austin 11. Contract or Grant No. 1616 Guadalupe Street DTRS99-G-0006 Austin, TX 78701 12. Sponsoring Agency Name and Address 13. Type of Report and Period Covered Southwest Region University Transportation Center September 2010-June 2011 Texas Transportation Institute Texas A&M University System 14. Sponsoring Agency Code College Station, Texas 77843-3135 15. Supplementary Notes Supported by a grant from the U.S. Department of Transportation, University Transportation Centers Program. 16. Abstract The respective populations of the United States and Texas are expected to significantly increase over to the next several decades, primarily in urban and metropolitan areas. Economists have also predicted that oil prices will rise in real terms during the same period. Air quality is getting worse in a number of metropolitan areas, triggering non-attainment penalties and spurring an interest in cleaner transportation. Incentives and new policies must be adopted to increase the efficiency of the transportation system and thus move freight with a reduced impact on society and the environment. Hybrids can potentially help solve this issue through their increased fuel economy and reduced emissions. This project evaluated a package delivery truck, beverage delivery truck, and a refuse truck. -

Airline Split Operadons

Airline Split Opera-ons Dra final report October 16th, 2017 Confiden'al; for internal use only Execuve summary Key conclusions airline split operaons research Dra1 § The opening of Lelystad Airport may result in airlines operang from/to both Schiphol and Lelystad, serving the same catchment area, in a split operaon set up. This research describes what kind of airline split opera-on models exist and under which condions such operaon may or may not be sustainable. The basis for this research is an extensive analysis of flight schedules complemented with market developments. Client envisions a Traffic Distribu'on Rule (VVR) and requested to imply its implicaons. § The term ‘airline split operaons’ refers to network configuraons where an airline operates from its home base to mul'ple des'naons in the same catchment area or where an airline operates from another airport than its original home base in the same catchment area. The main types of split operaons are: ‘mul-airport’, ‘outside base’, ‘addional base’, and ‘second home base’. For the Dutch situaon the ‘second home base’ type is not relevant § All three relevant types of split opera-ons are being operated by airlines in the Dutch market for a long -me. From all regional airports in the Netherlands ‘outside base’ operaons are executed, while airlines have established ‘addional bases’ at Eindhoven and RoYerdam (partly due to the lack of development poten'al at Schiphol). Foreign airlines, mainly network carriers, but also low cost airlines, operate flights from their foreign home base to a second airport in the Netherlands next to Schiphol (‘mul+-airport’) or have done so in the past § The ‘Addi)onal base’ -type is well-suited for Lelystad from a market demand perspec've. -

Aer Rodrom Me Meteo S Orologi Study Gr Ical Obs

AMOFSG/9-IP/8 20/9/11 AERODROME METEOROLOGICAL OBSERVATION AND FORECAST STUDY GROUP (AMOFSG) NINTH MEETING Montréal, 26 to 30 September 2011 Agenda Item 5: Observing and forecasting at the aerodrome and in the terminal area 5.1: Observations AUTO METAR SYSTEM AT CIVIL AIRPORTS IN THE NETHERLANDS: DESCRIPTION AND EXPERIENCES (Presented by Jan Sondij) SUMMARY This paper provides an overview of the AUTO METAR system used in the Netherlands. The system includes the entire technical infrastructure used for the automated generation of all meteorological aeronautical observation reports including baack-up systems and procedures. It also includes the supervision of all issued reports by a remote meteorologist who can provide additional information to ATC. Experiences of the performance and acceptance by ATC of the AUTO METAR system are reported. The process of how this was achieved is presented as well as lessons learned. 1. INTRODUCTION 1.1 The eighth meeting of the Aerodrome Meteorological Observation and Forecast Study Group (AMOFSG/8) led to the formation of an ad-hoc group tasked with reviewing the options for the future reporting of present weather in fully automated weather reports. More background on automated weather observations is provided in this information paper. 1.2 This information paper describes the so-called AUTO METAR system at civil airports in the Netherlands. The process of introduction and approval as well as experiences are presented. Some highlights are reported below. Details are given in the appended document entitled AUTO METAR System at Civil Airports in the Netherlands: Description and Experiences by Wauben and Sondij. (49 pages) AMOFSG.9.IP.008.5.en.docx AMOFSG/9-IP/8 - 2 - 1.3 Since 15 March 2011, the AUTO METAR system has been operational 24/7 at Rotterdam-The Hague Airport (EHRD).