Market Roundup

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Urban Geology in Chelsea: a Stroll Around Sloane Square Ruth Siddall

Urban Geology in London No. 33 Urban Geology in Chelsea: A Stroll Around Sloane Square Ruth Siddall Situated in the Royal Borough of Kensington and Chelsea, Sloane Square SW1, and several of the neighbouring streets are named after Sir Hans Sloane (1660-1753) who lived in the area in the mid 18th Century. The area is now owned by the Cadogan Estate Ltd. The Cadogan family inherited this from Sloane via his daughter, Elizabeth and it is still the hands of the 8th Earl Cadogan. The eldest sons of this family inherit the title Viscount Chelsea and this area is one of the top pieces of real estate in the country, earning the family over £5 billion per year. It is correspondingly a pleasant area to stroll around, the home to designer shops, the Saatchi Gallery as well as a theatre and concert venue. Development took place between the mid 19th Century and the present day and displays a range of stones fairly typical of London Building during this period – along with a few surprises. Fountain, Sloane Square, with Peter Jones Department Store behind. This walk starts at Sloane Square Underground Station on Holbein Place, and takes in the Square itself, the southern end of Sloane Street, Duke of York Square and the eastern end of the King’s Road. It is easy to return to Sloane Square station when finished, or you could visit the Saatchi Gallery which displays a collection of contemporary art to suit all tastes (and none). For the buildings described below, architectural information below is derived from Pevsner’s guide to North West London (Cherry & Pevsner, 1991), unless otherwise cited. -

Park Modern Park Modern

PARK M O DERN SEPTEMBER 2019 PREMIERE HEALTHCARE FACILITY PARK MODERN PARK MODERN 2 3 Opportunity Overview - Opportunity to secure up to 18,000 sqft in a new world class building - Prime park facing frontage surrounded by new public realm including a newly built gate into Hyde Park - 4.5 metre ground floor ceiling heights - Valet parking service available, commercial car park attached - Private access through underground car park provides discretion and exclusivity - Excellent public transport links including two tube stations and Paddington within easy walking distance - Frontage onto Bayswater Road with 15 million annual footfall 3 5 Project Overview • New 10 story building designed by PLPArchitects • Commercial opportunities include restaurant, retail and healthcare • Beautiful park side location 4 1.0 Introduction Project Overview / Key Target Timelines 5 PARK MODERN Contents © COPYRIGHT A1 The copyright in this drawing is vested in AXIS and no licence or assignment of any kind has© been, COPYRIGHT or is, granted to any third party whether by provision of copies or originals of the drawings or otherwise unless otherwise agreed in writing. GA PLANS DO NOT SCALE FROM THIS DRAWING The contractor shall check and verify all dimensions on site and report any discrepancies in writing to AXIS before proceeding with work FOR ELECTRONIC DATA ISSUE Electronic data / drawings are issued as "read only" and should not be interrogated for measurement. All dimensions and levels should be read, only from those values stated 1.0 Introduction in text, on the drawing. Project Overview Key 4 Target Timelines 5 6 2.0 Option 1A Ground Level 00 8 Basement Level 01 9 Basement Level 02 10 REV. -

How an International Experience Contributed to My Professional Development

- HOW AN INTERNATIONAL EXPERIENCE CONTRIBUTED TO MY PROFESSIONAL DEVELOPMENT Senior Honors Thesis 499 Elizabeth Anne Schweigert Thesis Advisor Dr. Iris Nierenberg Ball State University - Muncie, Indiana Thesis Completion: May 1996 Expected Graduation: December 1997 How An International Experience Contributed To My Professional Development - - , I~ ( , - Elizabeth Anne Schweigert Senior Honors Thesis How An International Experience Contributed To My Professional Development Table of Contents C:»"t!",iE!,", ...•.............................•••....•....•..........•.•.•..•.•.......••...••..•.•.... 1 Part I: Description and Comparison of Educational Systems in England and America ...................................... 2 Indiana State Curriculum British National Curriculum in England Calendar Length Administrative Structure School Choice Children with Special Needs Parent Involvement Conclusions Part II: Illustrated Journal Interpretation ................................... 20 Journal Entries by Date Part III: Professional Development .......................................... 150 European living in Ormskirk at Edge Hill European Seminar Experiences Theory and Practice Discipline Religion Culture Among Schoolchildren European Teaching Experiences at Rainford Brook Lodge Independent Listening Interviews European Language-Rich Classrooms European Travel Experiences Varied Cultures Geography and Currency History Getting Along with Others Conclusions Reference List ............................................................................ 174 -

Buses from Battersea Park

Buses from Battersea Park 452 Kensal Rise Ladbroke Grove Ladbroke Grove Notting Hill Gate High Street Kensington St Charles Square 344 Kensington Gore Marble Arch CITY OF Liverpool Street LADBROKE Royal Albert Hall 137 GROVE N137 LONDON Hyde Park Corner Aldwych Monument Knightsbridge for Covent Garden N44 Whitehall Victoria Street Horse Guards Parade Westminster City Hall Trafalgar Square Route fi nder Sloane Street Pont Street for Charing Cross Southwark Bridge Road Southwark Street 44 Victoria Street Day buses including 24-hour services Westminster Cathedral Sloane Square Victoria Elephant & Castle Bus route Towards Bus stops Lower Sloane Street Buckingham Palace Road Sloane Square Eccleston Bridge Tooting Lambeth Road 44 Victoria Coach Station CHELSEA Imperial War Museum Victoria Lower Sloane Street Royal Hospital Road Ebury Bridge Road Albert Embankment Lambeth Bridge 137 Marble Arch Albert Embankment Chelsea Bridge Road Prince Consort House Lister Hospital Streatham Hill 156 Albert Embankment Vauxhall Cross Vauxhall River Thames 156 Vauxhall Wimbledon Queenstown Road Nine Elms Lane VAUXHALL 24 hour Chelsea Bridge Wandsworth Road 344 service Clapham Junction Nine Elms Lane Liverpool Street CA Q Battersea Power Elm Quay Court R UE R Station (Disused) IA G EN Battersea Park Road E Kensal Rise D ST Cringle Street 452 R I OWN V E Battersea Park Road Wandsworth Road E A Sleaford Street XXX ROAD S T Battersea Gas Works Dogs and Cats Home D A Night buses O H F R T PRINCE O U DRIVE H O WALES A S K V Bus route Towards Bus stops E R E IV A L R Battersea P O D C E E A K G Park T A RIV QUEENST E E I D S R RR S R The yellow tinted area includes every Aldwych A E N44 C T TLOCKI bus stop up to about one-and-a-half F WALE BA miles from Battersea Park. -

EVALUATING YOUR EPROOF If You Wish to Make Changes to Your Title Metadata, Click on the See More Details Link in the Title Approval Page

EVALUATING YOUR EPROOF If you wish to make changes to your title metadata, click on the See More Details link in the Title Approval page. You’ll then be able to edit and save changes to each section of metadata as needed. Your eproof file contains the following: • Evaluating your eProof information page • eProof hairlines information page • Full dustjacket image (if applicable) • Full cover image • Cropped front cover image (this does not appear in the printed book) • Interior content (multiple pages, in reader order), first page to be on the right-hand side (or left-hand for RTL books*) • Cropped back cover image (this does not appear in the printed book) Recommended items to consider while evaluating your eProof: • Have your latest changes been incorporated? • Is the pagination correct? • Odd numbered pages on the right/recto and even numbers on the left/verso? • RTL books*: odd numbered pages on the left/verso and even number on the right/recto? • Are the pages in the desired reading order? • Are the page items and text positioned correctly on the page? • Does your proof contain any spelling or grammatical errors or typos that need to be corrected? • Is the ISBN correct and identical on the cover as well as the copyright page? • Does the price on the cover match the price in the title metadata? Other considerations: • eProofs should not be used to evaluate color or print quality. A physical copy should be reviewed to evaluate this. • The cropping of both cover and interior is approximate and does not account for the manufacturing variance of 1/16” (2mm) • eProof file sizes are limited. -

Hyde Park, London

Hyde Park, London Hyde Park is one of the largest parks in London, and one I permitted limited access to gentlefolk,[6] appointing a of the Royal Parks of London, famous for its Speakers’ ranger to take charge. Charles I created the Ring (north Corner. of the present Serpentine boathouses), and in 1637 he [7] The park was the site of the Great Exhibition of 1851, opened the park to the general public. for which the Crystal Palace was designed by Joseph Pax- ton. The park has become a traditional location for mass demonstrations. The Chartists, the Reform League, the Suffragettes, and the Stop the War Coalition have all held protests in the park. Many protesters on the Liberty and Livelihood March in 2002 started their march from Hyde Park. On 20 July 1982 in the Hyde Park and Regents Park bombings, two bombs linked to the Provisional Irish Republican Army caused the death of eight members of the Household Cavalry and the Royal Green Jackets and seven horses. The park is divided in two by the Serpentine and the Long Water. The park is contiguous with Kensington Gardens; although often still assumed to be part of Hyde Park, Hyde Park c. 1833: Rotten Row is “The King’s Private Road” Kensington Gardens has been technically separate since 1728, when Queen Caroline made a division between the two. Hyde Park covers 142 hectares (350 acres)[2] and Kensington Gardens covers 111 hectares (275 acres),[3] giving an overall area of 253 hectares (625 acres), making the combined area larger than the Principality of Monaco (196 hectares or 480 acres), though smaller than the Bois de Boulogne in Paris (845 hectares, or 2090 acres), New York City's Central Park (341 hectares or 840 acres), and Dublin’s Phoenix Park (707 hectares, or 1,750 acres). -

INVESTOR PACK INTERIM RESULTS for the 6 MONTHS ENDING 30TH JUNE 2018 INVESTOR PACK Introduction to Your Presenters

INVESTOR PACK INTERIM RESULTS FOR THE 6 MONTHS ENDING 30TH JUNE 2018 INVESTOR PACK Introduction to your presenters Mark Lawrence Group Chief Executive Officer Appointed to Board, 2nd May 2003 | Age 50 Mark has had 31 years with the company and started his career here by completing an electrical apprenticeship in 1987. He progressed through the company, becoming Technical Director in 1997, Executive Director in 2003 and Managing Director, London Operations in 2007. As Group Chief Executive Officer since January 2010, Mark has led strategic changes across the group and remains a hands-on leader, taking personal accountability and pride in Clarke's performance and, ultimately our shareholders’ and clients’ satisfaction. He regularly walks project sites and gets involved personally with many of our clients, contractors and our supply chain. Trevor Mitchell Group Finance Director Appointed to the Board on 1st February 2018 | Age 58 Trevor is a Chartered Accountant and accomplished finance professional with extensive experience across many sectors, including financial services, construction and maintenance, education and retail, working with organisations such as Balfour Beatty plc, Kier Group plc, Rok plc, Clerical Medical Group and Halifax plc. Prior to his appointment, Trevor had been working with TClarke since October 2016, assisting with simplifying the structure and improving the Group’s financial controls and procedures. 2 INVESTOR PACK M&E Contracting Every Picture tells a TClarke Story Secured Battersea Power Station Phase 2 Electrical -

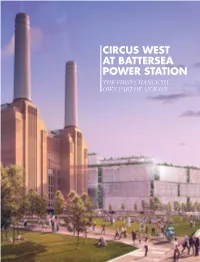

Circus West at Battersea Power Station the First Chance to Own Part of an Icon

CIRCUS WEST AT BATTERSEA POWER STATION THE FIRST CHANCE TO OWN PART OF AN ICON PHASE 1 APARTMENTS 01 02 CIRCUS WEST AT BATTERSEA POWER STATION 03 A GLOBAL ICON 04 AN IDEAL LOCATION 06 A PERFECT POSITION 12 A VISIONARY PLACE 14 SPACES IN WHICH PEOPLE WILL FLOURISH 16 AN EXCITING RANGE OF AMENITIES AND ACTIVITIES 18 CIRCUS WEST AT BATTERSEA POWER STATION 20 RIVER, PARK OR ICON WHAT’S YOUR VIEW? 22 CIRCUS WEST TYPICAL APARTMENT PLANS AND SPECIFICATION 54 THE PLACEMAKERS PHASE 1 APARTMENTS 1 2 CIRCUS WEST AT BATTERSEA POWER STATION A GLOBAL ICON IN CENTRAL LONDON Battersea Power Station is one of the landmarks. Shortly after its completion world’s most famous buildings and is and commissioning it was described by at the heart of Central London’s most the Observer newspaper as ‘One of the visionary and eagerly anticipated fi nest sights in London’. new development. The development that is now underway Built in the 1930s, and designed by one at Battersea Power Station will transform of Britain’s best 20th century architects, this great industrial monument into Battersea Power Station is one of the centrepiece of London’s greatest London’s most loved and recognisable destination development. PHASE 1 APARTMENTS 3 An ideal LOCATION LONDON The Power Station was sited very carefully a ten minute walk. Battersea Park and when it was built. It was needed close to Battersea Station are next door, providing the centre, but had to be right on the river. frequent rail access to Victoria Station. It was to be very accessible, but not part of London’s congestion. -

LONDON Cushman & Wakefield Global Cities Retail Guide

LONDON Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | London | 2019 0 For decades London has led the way in terms of innovation, fashion and retail trends. It is the focal location for new retailers seeking representation in the United Kingdom. London plays a key role on the regional, national and international stage. It is a top target destination for international retailers, and has attracted a greater number of international brands than any other city globally. Demand among international retailers remains strong with high profile deals by the likes of Microsoft, Samsung, Peloton, Gentle Monster and Free People. For those adopting a flagship store only strategy, London gives access to the UK market and is also seen as the springboard for store expansion to the rest of Europe. One of the trends to have emerged is the number of retailers upsizing flagship stores in London; these have included Adidas, Asics, Alexander McQueen, Hermès and Next. Another developing trend is the growing number of food markets. Openings planned include Eataly in City of London, Kerb in Seven Dials and Market Halls on Oxford Street. London is the home to 8.85 million people and hosting over 26 million visitors annually, contributing more than £11.2 billion to the local economy. In central London there is limited retail supply LONDON and retailers are showing strong trading performances. OVERVIEW Cushman & Wakefield | London | 2019 1 LONDON KEY RETAIL STREETS & AREAS CENTRAL LONDON MAYFAIR Central London is undoubtedly one of the forefront Mount Street is located in Mayfair about a ten minute walk destinations for international brands, particularly those from Bond Street, and has become a luxury destination for with larger format store requirements. -

CIRCUS WEST VILLAGE – Designed by Drmm and Simpsonhaugh and Partners – BPSDC Office Headquarters – 865 New Homes – 23 Cafés, Restaurants and Shops

LIVE DON’T DO ORDINARY CGI of Battersea Power Station looking towards Battersea Park Battersea Power Station is a global icon, in one BATTERSEA POWER STATION of the world’s greatest cities. The Power Station’s incredible rebirth will see it transformed into one of the most exciting and innovative new neighbourhoods in the world, comprising unique homes designed YOUR HOME IN A by internationally renowned architects, set amidst the best shops, restaurants, offices, green space, GLOBAL ICON and spaces for the arts. 2 3 Battersea Power Station’s place in history is assured. From its very beginning, the building’s titanic form and scale THE ICON have captured the world’s imagination. Two design icons, one designer. The world-renowned London telephone box was one of architect Sir Giles Gilbert Scott’s most memorable creations, the other was Battersea Power Station. Red buses, A BRITISH ICON Beefeaters, Buckingham Palace, Big Ben and Battersea Power Station – this icon takes its place as part of the world’s visual language for London. 4 5 BATTERSEA POWER STATION THE ICON A DESIGN ICON This was no ordinary Power Station, no ordinary design. Entering through bronze doors sculpted with personifications of power and energy, ascending via elaborate wrought iron staircases and arriving at the celebrated art deco control room with walls lined with Italian marble, polished parquet flooring and intricate glazed ceilings, looking out across the heart of the Power Station, its turbine hall, its giant walls of polished terracotta, it’s no wonder it was christened the ‘Temple of Modern Power’. Sir Giles Gilbert Scott’s design of Battersea Power Station turned this immense structure into a thing of beauty, which stood as London’s tallest building for 30 years and remains one of the largest brick buildings in the world. -

162B SLOANE STREET LONDON

LUXURYLUXURY A1 A1 CAFÉ CAFÉ OPPORTUNITY LONDON SW1 -– 162B162b SLOANESLOANE STREETSTREET Location Lease The unit is located on the south A new effectively full repairing end of Sloane Street, a short and insuring lease for a term distance from Sloane Square by arrangement, subject to and the Kings Road. The upward only annual rent surrounding area is renowned increases linked to the Retail for its boutique hotels, Property Index. The lease will restaurants and luxury retail. be contracted outside of the security of tenure of the Accommodation Landlord and Tenant Act 1954. The premises comprise Rates payable the following approximate net internal floor areas:- Rateablevalue (2010) £250,000 Net Frontage 14.1 ft 4.29 m Rate payable (2016/17) £129,250 Return Frontage Subject to confirmation. 29.7 ft 9.07 m Further details are available from www.voa.gov.uk Ground Floor 1,431 ft2 132 m2 Rent £95,000 per annum or 15% of Basement 2 2 gross annual turnover, 1,458 ft 135 m whichever is the higher, exclusive of rates, service Legal costs charge and VAT. Nearby retailers Each party to bear its own EPC costs. Available u p on request. CADOGAN GATE W E i cks mi l t i e a TO KNIGHTSBRIDGE a d e m r aw ves R Y elo D Zarzycka Basia Sole Shoes French Davictor ELLIS STREET RDENS CADOGAN GA Paule Ka Contact Browns Brunello Cameron Scott Cucinelli [email protected] Anya Hindmarch +44 (0)207 290 4562 Restaurant WILBRAHAM PLACE Boutique 1 [email protected] Dalgleish Vacant Chloé KX Cadogan Hall Gym +44 (0)207 290 4565 PA Mont Blanc VI Red -

Shop to Let LONDON, SW1 – 93 LOWER SLOANE STREET

Shop to Let LONDON, SW1 – 93 LOWER SLOANE STREET Location Lease The property is located on the east This unit is offered by way of a new side of Lower Sloane Street, close to 10 year full repairing and insuring the junction with Pimlico Road and lease on standard Royal Hospital Road. Cadogan terms subject to upward annual rent increases linked to the Nearby is the 12.8 acre site of the Retail Price Index. former Chelsea Barracks which will provide 448 residential units. The The lease will be contracted outside area is also home to the world- of the security of tenure and renowned RHS Chelsea Flower Show compensation provisions held in May. of the Landlord and Tenant Sloane Square underground station is Act 1954 within a few minutes’ walk (Circle & District Lines) Rates Payable Accommodation Rateable value £41,500 The premises comprise the following approximate net internal floor areas:- Rate payable (2019/2020) £20,377 per annum Ground Floor 2 2 346 ft 32.14 m Further details are available from www.voa.gov.uk Basement Nearby Retailers 73 ft2 6.78 m2 EPC Available upon request. Rent Upon application. Legal Costs Each party to bear its own costs. ABOUT CADOGAN Cadogan takes pride in the vibrant history and heritage of Chelsea that makes this area unique – and is committed to its long term success. Duke of York Square (formerly a Ministry of Defence Base) was developed by Cadogan into a thriving location for shopping and dining, and proactive management of Sloane Street, Sloane Square and King’s Road ensures that Chelsea remains one of the world’s most inspiring destinations to live, shop and work.