Nordea Group Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

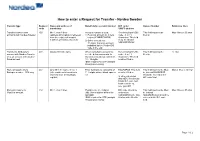

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

Focused Financial Report 2013 of HSH Nordbank AG Strong for Entrepreneurs 2 HSH NORDBANK AG Lagebericht

FOCuseD FinANCIAL RePORT 2013 OF HSH NORDBANK AG STROng FOR enTREPReneuRS 2 HSH NORDBANK AG Lagebericht CONTENT MANAGEMENT REPORT OF HSH NORDBANK AG 03 Basis 03 Business model 03 Objectives and strategy 04 Management system 05 Remuneration system 06 Economic report 07 Underlying economic and industry conditions 07 Business developments 10 Earnings, net assets and financial position 14 Report on events after the reporting period 23 Forecast, opportunities and risks report 23 Forecast report including opportunities and risks 23 Risk report 30 Risks within HSH Nordbank Group 30 Risk management system 30 Default risk 38 Market risk 47 Liquidity risk 50 Operational risk 57 Other material risks 59 Summary and outlook 60 FINAL DECLARATION TO THE DEPENDENT COMPANY REPORT 62 ANNUAL ACCOUNTS OF HSH NORDBANK AG 63 Balance sheet 63 Income statement 67 Notes 69 AUDITOR’S REPORT 126 RESPONSIBILITY STATEMENT BY THE MANAGEMENT BOARD 127 3 HSH NORDBANK AG Management Report MANAGEMENT REPORT of HSH NORDBANK AG BASIS of the newly formed Savings Banks & Institutional Clients division, which is also part of the Corporates & BUSINESS MODEL Markets segment. Furthermore, the Capital Markets and Products divisions remain assigned to this segment. HSH Nordbank AG was created in June 2003 by the merger of Hamburgische Landesbank – Girozentrale – The administrative and service divisions as well as Over- with Landesbank Schleswig-Holstein Girozentrale (LB all Bank positions and equity holdings not assigned to Kiel) and is managed in the form of a German public segments are included in the Corporate Center segment. limited company (Aktiengesellschaft – AG). The head- quarters of the Bank are located in Hamburg and Kiel. -

Changes in the Arctic: Background and Issues for Congress

Changes in the Arctic: Background and Issues for Congress Updated May 22, 2020 Congressional Research Service https://crsreports.congress.gov R41153 Changes in the Arctic: Background and Issues for Congress Summary The diminishment of Arctic sea ice has led to increased human activities in the Arctic, and has heightened interest in, and concerns about, the region’s future. The United States, by virtue of Alaska, is an Arctic country and has substantial interests in the region. The seven other Arctic states are Canada, Iceland, Norway, Sweden, Finland, Denmark (by virtue of Greenland), and Russia. The Arctic Research and Policy Act (ARPA) of 1984 (Title I of P.L. 98-373 of July 31, 1984) “provide[s] for a comprehensive national policy dealing with national research needs and objectives in the Arctic.” The National Science Foundation (NSF) is the lead federal agency for implementing Arctic research policy. Key U.S. policy documents relating to the Arctic include National Security Presidential Directive 66/Homeland Security Presidential Directive 25 (NSPD 66/HSPD 25) of January 9, 2009; the National Strategy for the Arctic Region of May 10, 2013; the January 30, 2014, implementation plan for the 2013 national strategy; and Executive Order 13689 of January 21, 2015, on enhancing coordination of national efforts in the Arctic. The office of the U.S. Special Representative for the Arctic has been vacant since January 20, 2017. The Arctic Council, created in 1996, is the leading international forum for addressing issues relating to the Arctic. The United Nations Convention on the Law of the Sea (UNCLOS) sets forth a comprehensive regime of law and order in the world’s oceans, including the Arctic Ocean. -

Nordea Group Annual Report 2018

Annual Report 2018 CEO Letter Casper von Koskull, President and Group CEO, and Torsten Hagen Jrgensen, Group COO and Deputy CEO. Page 4 4 Best and most accessible advisory, with an 21 easy daily banking experience, delivered at scale. Page 13 Wholesale Banking No.1 relationship Asset & Wealth bank in the Nordics Management with operational Personal Banking 13 excellence. Page 21 Commercial & Business Banking Our vision is to become the lead- ing Asset & Wealth Manager in the 25 Nordic market by 2020. Page 25 Best-in-class advisory and digital experience, 17 ef ciency and scale with future capabilities in a disruptive market. Page 17 Annual Report 2018 Contents 4 CEO letter 6 Leading platform 10 Nordea investment case – strategic priorities 12 Business Areas 35 Our people Board of Directors’ report 37 The Nordea share and ratings 40 Financial Review 2018 46 Business area results 49 Risk, liquidity and capital management 67 Corporate Governance Statement 2018 76 Non-Financial Statement 78 Conflict of interest policy 79 Remuneration 83 Proposed distribution of earnings Financial statements 84 Financial Statements, Nordea Group 96 Notes to Group fi nancial statements 184 Financial statements Parent company 193 Notes to Parent company fi nancial statements 255 Signing of the Annual Report 256 Auditor’s report Capital adequacy 262 Capital adequacy for the Nordea Group 274 Capital adequacy for the Nordea Parent company Organisation 286 Board of Directors 288 Group Executive Management 290 Main legal structure & Group organisation 292 Annual General Meeting & Financial calendar This Annual Report contains forward-looking statements macro economic development, (ii) change in the competitive that reflect management’s current views with respect to climate, (iii) change in the regulatory environment and other certain future events and potential fi nancial performance. -

Nordic Broadband City Index 2012

Nordic Broadband City Index How cities facilitate a digital future June 2012 - Nexia DA - Nordic Broadband City Index Document history Title Nordic Broadband City Index Date and version June 2012 – Version 1.0 About this report The Nordic Broadband City Index has been prepared by Marit Wetterhus and Harald Wium Lie at Nexia DA on behalf of Telenor ASA and IKT-Norge in the period from January to May 2012. Special thanks to We would not have been able to obtain information on the Swedish market if it was not for Anna- Carin Mattson, Tommy Y. Andersson and Per Gundersen at Skanova, Stefan Albertsson at Eltel Networks, Mats Gustavson and Lars-Eric Gustavsson at TeliaSonera and several other people at Eltel Networks, TeliaSonera and Skanova. In Denmark Peder Hansen at Telcon was of invaluable importance, and we would also like to thank Anders Poulsen at Global Connect. In Norway we would like to thank Svein Nassvik, Herleik Johansen, Sverre Lysnes, Morten Skjelbred, at Sønnico, Roar Salen, in Eltel Networks and Tom Bakke Pedersen, Øystein Knudsen, Knut Beving and Erik Sikkeland in Relacom provided us with valuable information we needed in order to develop the index, and we are very grateful that they all took time out of their busy schedule to talk to us. We would also like to thank all the municipalities for their time and efforts, Liv Freihow at IKT-Norge and last, but not least the people in Telenor Denmark, Telenor Norway and Telenor Sweden and Erlend Bjørtvedt in Telenor Group for their support and expert knowledge. -

Fitch Ratings ING Groep N.V. Ratings Report 2020-10-15

Banks Universal Commercial Banks Netherlands ING Groep N.V. Ratings Foreign Currency Long-Term IDR A+ Short-Term IDR F1 Derivative Counterparty Rating A+(dcr) Viability Rating a+ Key Rating Drivers Support Rating 5 Support Rating Floor NF Robust Company Profile, Solid Capitalisation: ING Groep N.V.’s ratings are supported by its leading franchise in retail and commercial banking in the Benelux region and adequate Sovereign Risk diversification in selected countries. The bank's resilient and diversified business model Long-Term Local- and Foreign- AAA emphasises lending operations with moderate exposure to volatile businesses, and it has a Currency IDRs sound record of earnings generation. The ratings also reflect the group's sound capital ratios Country Ceiling AAA and balanced funding profile. Outlooks Pandemic Stress: ING has enough rating headroom to absorb the deterioration in financial Long-Term Foreign-Currency Negative performance due to the economic fallout from the coronavirus crisis. The Negative Outlook IDR reflects the downside risks to Fitch’s baseline scenario, as pressure on the ratings would Sovereign Long-Term Local- and Negative increase substantially if the downturn is deeper or more prolonged than we currently expect. Foreign-Currency IDRs Asset Quality: The Stage 3 loan ratio remained sound at 2% at end-June 2020 despite the economic disruption generated by the lockdowns in the countries where ING operates. Fitch Applicable Criteria expects higher inflows of impaired loans from 4Q20 as the various support measures mature, driven by SMEs and mid-corporate borrowers and more vulnerable sectors such as oil and gas, Bank Rating Criteria (February 2020) shipping and transportation. -

Eltel 210226 Company Report

ELTEL Construction & Engineering/Sweden, February 26, 2021 Company report Initiating coverage with BUY Rating BUY We initiate coverage of Eltel with BUY rating and a TP of SEK 30. 70 We see that Eltel has the potential to succeed in its turnaround and, as such, we expect Eltel’s profitability to improve in the 60 coming years and net sales to turn to growth in H2/2021. In our 50 view, the margin improvement potential is not fully reflected in 40 the current share price. 30 Eltel is in the midst of its turnaround journey Price/SEK Eltel is the leading Nordic field service provider for critical power and 20 communication networks. Eltel’s development since the IPO in 2015 did 10 not meet expectations, and following a strategic review in 2017, Eltel 0 has focused on its core businesses, Power and Communication in the 02/16 02/17 02/18 02/19 02/20 02/21 Nordics, and the company is currently in the midst of a turnaround journey. The focus is on improving profitability, restructuring non- Eltel DJ STOXX 600 performing businesses, and strengthening its financial position, with first signs of operational improvement already visible. Share price, SEK (Last trading day’s 27.05 closing price) We expect the recovery in margins to continue Target price, SEK 30.0 In 2021E, we expect that net sales will decrease by 2.3% to EUR 916.8 million due to the focus on improving profitability and restructuring Latest change in recommendation 26-Feb-21 non-performing businesses. We expect net sales to turn to growth in Latest report on company 26-Feb-21 H2/2021 and we see the targeted growth rate of 2-4% in the Nordics Research paid by issuer: YES achievable from 2022 onwards. -

PRESS RELEASE Public Joint Stock Company «Mining and Metallurgical Company «NORILSK NICKEL» (PJSC “MMC “Norilsk Nickel”, “Nornickel” Or the “Company”)

PRESS RELEASE Public Joint Stock Company «Mining and Metallurgical Company «NORILSK NICKEL» (PJSC “MMC “Norilsk Nickel”, “Nornickel” or the “Company”) NORNICKEL AWARDS MAJOR CONTRACT FOR PROCESSING EQUIPMENT SUPPLY TO METSO OUTOTEC Moscow, August 10, 2021 - Nornickel, the world’s largest producer of palladium and high- grade nickel and a major producer of platinum and copper, has awarded a major contract for the supply of some of the key industry-leading equipment used in mining operations to Metso Outotec, further extending the partnership with Finland’s technology solutions provider. Nornickel and Metso Outotec have signed an agreement to deliver industry-leading dewatering, flotation and automation equipment for Nornickel’s Talnakh concentrator expansion project in Russia’s Arctic city of Norilsk. The contract value is a commercially sensitive matter and therefore may not be disclosed publicly. Metso Outotec’s delivery scope consists of modernization of three existing thickeners and delivery of over 100 TankCell® flotation machines and an automation system for the new Talnakh concentrator Line 3 flotation area. In addition, the contract covers the supply of spare parts and consumables. Metso Outotec will also provide a metallurgical performance guarantee as well as advisory services for the installation and commissioning of the equipment. The delivery is scheduled for 2022-23. Sergey Dubovitsky, Nornickel Senior Vice President Strategy, Strategic Projects, Logistics & Procurement, commented: “The new contract further develops the collaboration with our longstanding partner Metso Outotec, which has supplied technology to us for many years. We have an excellent track record of using the Metso Outotec machinery across the entire geography of our operations. -

Nordea Fund of Funds, SICAV Société D’Investissement À Capital Variable R.C.S

Nordea Fund of Funds, SICAV Société d’Investissement à Capital Variable R.C.S. Luxembourg B 66 248 562, rue de Neudorf, L-2220 Luxembourg NOTICE TO SHAREHOLDERS On 25th January 2018 NORDEA and UBS announced an agreement on the acquisition of part of Nordea’s Luxembourg-based private banking business by UBS (hereinafter the “Transaction”). The Transaction foresees the acquisition of part of Nordea Bank S.A.’s business and its integration onto UBS’s advisory platform. Subject to the completion of the Transaction, the shareholders (the “Shareholders“) of Nordea Fund of Funds (the “Company”) are hereby informed of the following changes: 1. Change of the Investment Managers and appointment of an Investment Sub Manager: 1.1. Nordea Investment Management AB : New Investment Manager : Current Investment Manager Investment Manager with effect as of the 15th of October 2018 Nordea Bank S.A. Nordea Investment Management AB, including 562, rue de Neudorf its branches L-2220 Luxembourg Mäster Samuelsgatan 21 Stockholm, M540 10571 Sweden 1.2. UBS Europe SE, Luxembourg Branch : Investment Sub Manager : Nordea Investment Management AB has further appointed UBS Europe SE, Luxembourg Branch, 33 A Avenue J.F. Kennedy L-1855 Luxembourg as investment sub-manager with effect as of the 15th of October 2018. 2. Redemption of shares free of charges Shareholders who do not agree to the changes as described above may redeem their Shares free of any charges, with the exception of any local transaction fees that might be charged by local intermediaries on their own behalf and which are independent from the Company and the Management Company. -

FI IIR 2021 Part4 IPPU

FINLAND’s INFORMATIVE INVENTORY REPORT 2021 Air Pollutant Emissions 1980-2019 under the UNECE CLRTAP and the EU NECD Part 4 – IPPU March 2021 FINNISH ENVIRONMENT INSTITUTE Centre for Sustainable Consumption and Production Environmental Management in Industry – Air Emissions Team 1 Photo on the cover page: Ari Andersin (2008), Valkeakoski, ympäristöhallinnon kuvapankki 2 PART 4 IPPU 4 INDUSTRIAL PROCESSES and PRODUCT USE (NFR 2) 4.1 Overview of the sector 4.2 Mineral Products (NFR 2.A) Overview of the NFR category Cement production Lime production Glass production . Quarrying and mining of minerals other than coal Construction and demolition Storage, handling and transport of mineral products Other Mineral products 4.3 Chemical Industry (NFR 2.B) Overview of the NFR category Ammonia production Nitric acid production Adipic acid production Carbide production Titanium dioxide production Soda ash production and use Other chemical industry Storage, handling and transport of chemical products 4.4 Metal Industry (NFR 2C) Overview of the NFR category Iron and steel production Ferroalloys production Aluminium production Lead production Zinc production Copper production Nickel production Other metal production Storage, handling and transport of metal products Domestic solvent use including fungicides Road paving with asphalt Asphalt roofing 4.5 Solvent and Other Product Use (NFR 2D) Coating applications Degreasing Dry cleaning Chemical products Printing Other solvent (2D3i) and product (2G) use 4.6 Other industry (NFR 2H) Pulp and paper Food and -

Nordea Annual Report 2016

Annual Report 2016 Report Annual Annual Report 2016 Casper von Koskull, President and CEO Letter Group CEO, and Torsten Hagen Jørgensen, Group COO and Deputy CEO. Page 6 Strengthened customer relationships built on 6 core capabilities and a winning culture. Page 19 Long-term Personal Banking ambition to be Wholesale Banking No. 1 in profitability, customer and employee satisfaction. Page 11 19 Wealth Management 11 Commercial & Business Banking Largest private bank, asset manager and 23 life and pensions provider. Page 23 Leading position in corporate banking in 15 the Nordics with best in class advisory and digital experience. Page 15 Annual Report 2016 Contents 4 Leading platform 6 CEO letter 8 Nordea Investment Case – Strategic Priorities 01 Business Areas 72 Group Corporate Centre 92 The Nordea share and ratings 23 Financial targets 33 Our people shape the future 34 Sustainability Board of Directors’ report 36 Financial Review 2016 40 Business area results 43 Risk, Liquidity and Capital management 59 Corporate Governance Report 66 Remuneration 69 Proposed distribution of earnings Financial statements 71 Financial statements Nordea Group 84 Notes to Group financial statements 175 Financial statements Parent company 186 Notes to Parent company financial statements 227 Signing of the Annual Report 228 Auditor’s report Organisation 232 Board of Directors 234 Group Executive Management 235 Legal structure 235 Group Organisation 236 Annual General Meeting 236 Financial calendar This Annual Report contains forward-looking statements macro economic development, (ii) change in the competitive that reflect management’s current views with respect to climate, (iii) change in the regulatory environment and other certain future events and potential financial performance. -

Financial Statements Review 2019

2019 Financial Statements Review Metso’s Financial Statements Review January 1 – December 31, 2019 Metso has classified its Minerals segment as discontinued operations from October 29, 2019, in accordance with IFRS. This was based on the decision taken by Metso’s Extraordinary General Meeting on October 29, 2019, to approve the partial demerger of the company. As a result, the depreciation and amortization of the Minerals segment is calculated only for the period of January-October 2019 according to IFRS. Metso has also prepared consolidated financial information, where the depreciation and amortization of Minerals is calculated for the full- year 2019, and these figures are comparable to the year 2018. Analysis of the fourth-quarter 2019 and January-December 2019 in this Financial Statements Review is based on the comparable figures unless otherwise noted. Figures in brackets refer to the corresponding period in 2018, unless otherwise stated. Fourth-quarter 2019 in brief • Market activity continued to be good • Orders received increased 1% to EUR 914 million (902 million) • Sales grew 7%, totaling EUR 963 million (897 million) • Adjusted EBITA improved to EUR 117 million, or 12.2% of sales (98 million, or 10.9%) • Operating profit improved to EUR 96 million, or 10.0% of sales (93 million, or 10.4%) • Earnings per share were EUR 0.41 (0.42) • Free cash flow was EUR 18 million (57 million) • Acquisition of the Canadian mobile aggregates equipment supplier McCloskey was completed • Shareholders approved Metso’s partial demerger to create