Annual Report December 31, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Natixis Loomis Sayles Short Duration Income ETF Semi-Annual Financial Report

Semiannual Report June 30, 2021 Natixis Loomis Sayles Short Duration Income ETF Table of Contents Natixis U.S. Equity Opportunities ETF Portfolio Review 1 Portfolio of Investments 12 Natixis Vaughan Nelson Mid Cap ETF Financial Statements 23 Natixis Vaughan Nelson Select ETF Notes to Financial Statements 31 NATIXIS LOOMIS SAYLES SHORT DURATION INCOME ETF Managers NYSE Arca: LSST Daniel Conklin, CFA® Christopher T. Harms Clifton V. Rowe, CFA® Loomis, Sayles & Company, L.P. Investment Goal The Fund’s investment objective is current income consistent with preservation of capital. Average Annual Total Returns — June 30, 20213 Life of Fund Expense Ratios4 (Inception 6 Months 1 Year12/28/17) Gross Net NAV1 0.36% 2.21% 3.45% 1.05% 0.38% Market1 0.28 2.20 3.49 Comparative Performance Bloomberg Barclays U.S. Government/Credit 1-3 Year Bond Index2 0.00 0.44 2.55 Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem or sell their shares. 1 The NAV return is based on the NAV of the Fund, and the market return is based on the market price per share of the Fund, which is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. -

S P O T L I G H T Pa R T I C I Pa N

SPOTLIGHT PARTICIPANTS 12 Copyright © 2019 Mercer (US) Inc. All rights reserved. ORGANIZATION LISTING 3M (Minnesota Mining & Manufacturing) Atlas Energy Group LLC City of Overland Park, KS Cleveland Indians Baseball Co. A&E Television Networks Auburn University City of Winston-Salem, NC CliftonLarsonAllen, LLP A.O. Smith Corporation Automatic Data Processing California Health Care Foundation CMA CGM (America) LLC American Automobile Association, Inc., The Automobile Club of Southern California Cabot Oil & Gas Corporation CNH Industrial America LLC Accenture LLP AXA XL Cactus Feeders, Inc. CNO Financial Group Accudyne Industries, LLC Badger Meter, Inc. Cadmus Holding Company CNOOC Petroleum U.S.A. Inc. Advance Auto Parts Baltimore Orioles California Endowment, The CNX Resources ADVICS North America, Inc. Bank of the Ozarks, Inc. California ISO Colorado Rockies Baseball Club AECOM Building & Construction Bank of New York Mellon California Wellness Foundation Cobb Electric Membership Corporation AECOM Enterprise Baptist Health - FL Cambia Health Solutions (Regence Group) Coca-Cola Company, Inc., The AECOM Management Services Crestline Hotels & Resorts, LLC Canadian Imperial Bank of Commerce COG Operating, LLC Aera Energy Services Company Barnes & Noble, Inc. Canadian National Cognizant Technology Solutions Corporation Affinity Federal Credit Union BASF Corporation Canadian Pacific Railway CohnReznick LLP AgReserves Inc. Basin Electric Power Co-op Canadian Solar, Inc. Colby College Agri Beef Company Bates College Capital Group Companies, Inc., The Colonial Group, Inc. American International Group, Inc. (AIG) Battelle Memorial Institute Capital One Financial Corporation Columbia Sportswear Company Aimbridge Hospitality Baylor College of Medicine CarMax Auto Superstores, Inc. Columbia University American Institutes for Research BB&T Corporation Carilion Clinic Columbus McKinnon Corporation Air Liquide USA Blue Cross Blue Shield of Kansas Carrix, Inc. -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

Fund Holdings March 31, 2021

Fund Holdings March 31, 2021 Our Funds Daily Income Fund (HDIXX) Short-Term Government Securities Fund (HOSGX) Short-Term Bond Fund (HOSBX) Intermediate Bond Fund (HOIBX) Stock Index Fund (HSTIX) Value Fund (HOVLX) Growth Fund (HNASX) International Equity Fund (HISIX) Small-Company Stock Fund (HSCSX) Table of Contents Daily Income Fund......................................................... 1 Short-Term Government Securities Fund .................... 3 Short-Term Bond Fund.................................................. 7 Intermediate Bond Fund ...............................................15 Stock Index Fund............................................................25 S&P 500 Index Master Portfolio.....................................26 Value Fund ......................................................................35 Growth Fund...................................................................37 International Equity Fund .............................................39 Small-Company Stock Fund..........................................42 Portfolio of Investments Daily Income Fund | March 31, 2021 | (Unaudited) U.S. Government & Agency Obligations | 74.0% of portfolio Interest Rate / Yield Maturity Date Face Amount Value Federal Farm Credit Bank .% // $ ,, $ ,, Federal Farm Credit Bank .(a) // ,, ,, Federal Home Loan Bank . // ,, ,, Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal National Mortgage Assoc. // ,, ,, Tunisia Government AID Bonds . -

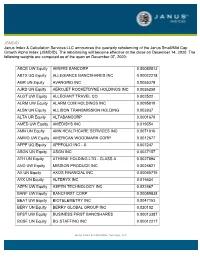

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

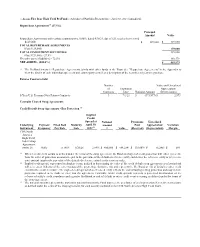

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

Page 1 of 375 6/16/2021 File:///C:/Users/Rtroche

Page 1 of 375 :: Access Flex Bear High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited) Repurchase Agreements(a) (27.5%) Principal Amount Value Repurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received $129,000. $ 129,000 $ 129,000 TOTAL REPURCHASE AGREEMENTS (Cost $129,000) 129,000 TOTAL INVESTMENT SECURITIES 129,000 (Cost $129,000) - 27.5% Net other assets (liabilities) - 72.5% 340,579 NET ASSETS - (100.0%) $ 469,579 (a) The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to view the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase. Futures Contracts Sold Number Value and Unrealized of Expiration Appreciation/ Contracts Date Notional Amount (Depreciation) 5-Year U.S. Treasury Note Futures Contracts 3 7/1/21 $ (371,977) $ 2,973 Centrally Cleared Swap Agreements Credit Default Swap Agreements - Buy Protection (1) Implied Credit Spread at Notional Premiums Unrealized Underlying Payment Fixed Deal Maturity April 30, Amount Paid Appreciation/ Variation Instrument Frequency Pay Rate Date 2021(2) (3) Value (Received) (Depreciation) Margin CDX North America High Yield Index Swap Agreement; Series 36 Daily 5 .00% 6/20/26 2.89% $ 450,000 $ (44,254) $ (38,009) $ (6,245) $ 689 (1) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receive from the seller of protection an amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receive a net amount equal to the par value of the defaulted reference entity less its recovery value. -

Jacob A. Kling.Pdf

Jacob A. Kling Partner, Corporate P: 212.403.1003 F: 212.403.2003 [email protected] Jake Kling is a partner in Wachtell Lipton’s Corporate Department. Jake’s practice primarily focuses on mergers, acquisitions and dispositions, securities law matters, and advising companies and boards of directors on takeover defense, shareholder activism and general corporate governance matters. He has advised a broad range of public and private clients across multiple industries, including banking, financial services, healthcare and pharmaceutical, life sciences, technology, media and telecom, industrial, retail, private equity and real estate. In 2021, Jake was one of five lawyers recognized by Law360 as a “Rising Star” in M&A. He was also named a “Rising Star” by The Deal, which recognized him as one of the 21 most promising new M&A partners. Selected healthcare and pharmaceutical, life sciences, financial services, technology and media, industrial, retail, engineering and real estate representations include: Adobe in its $1.275 billion acquisition of frame.io L Brands’ independent directors in its spin-off of Victoria’s Secret, $1.5 billion secondary offering and $730 million repurchase of common stock TD Ameritrade’s Strategic Development Committee in its $26 billion merger with Schwab AECOM in its $2.4 billion carve-out sale of its Management Services business to American Securities and Lindsay Goldberg, its carve-out sale of its Power construction business to affiliates of CriticalPoint Capital, its carve-out sale of its Civil construction business -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Stephens Bank Research Team

Stephens Bank Research Team – Upcoming Investor Events August 22, 2018 Non-Deal Roadshow 2018 Stephens Bank CEO Forum August, 2018 Company Name (Ticker) Company Name (Ticker) Company Name Day Location Allegiance Bancshares, Inc. (ABTX) LegacyTexas Financial Group (LTXB) BancorpSouth Bank (BXS) 22 Boston Ameris Bancorp (ABCB) Merchants Bancorp (MBIN) Banner Corp. (BANR) 28-29 New York, Boston Bank OZK, Inc. (OZK) Midland States Bancorp, Inc. (MSBI) September, 2018 BofI Holding, Inc. (BOFI) National Bank Holdings (NBHC) Company Name Day Location BOK Financial Corporation (BOKF) National Commerce Corp. (NCOM) F.N.B. Corporation (FNB) 11-12 Dallas, Houston Business First Bancshares (BFST) Old Line Bancshares (OLBK) Sterling Bancorp (STL) 19 Boston Byline Bancorp (BY) Old National Bancorp (ONB) November, 2018 Cadence Bancorporation (CADE) Origin Bancorp, Inc. (OBNK) Company Name Day Location CBTX, Inc. (CBTX) Pacific Premier Bancorp, Inc. (PPBI) Carolina Financial Corp. (CARO) 1-2 Kansas City, St. Louis, Dallas CenterState Banks (CSFL) PacWest Bancorp (PACW) Analyst Marketing Chemical Financial (CHFC) Pinnacle Financial (PNFP) August, 2018 City Holding Co (CHCO) Preferred Bank (PFBC) Analyst(s) Day Location County Bancorp (ICBK) Prosperity Bancshares (PB) Terry McEvoy / Austin Nicholas 22-24 New York Stephens 8th Annual Bank Eagle Bancorp (EGBN) RBB Bancorp, Inc. (RBB) Tyler Stafford, CFA 27 New York CEO Forum will take Equity Bancshares (EQBK) Renasant Corp (RNST) th Matt Olney, CFA / Austin Nicholas 28 San Francisco place September 24 – FB Financial Corporation (FBK) Simmons First National Corp (SFNC) 26th in Little Rock – See September, 2018 here for further details. Fidelity Southern Corporation (LION) SmartFinancial (SMBK) Analyst(s) Day Location First Bancshares (FBMS) South State Corporation (SSB) Tyler Stafford, CFA / Matt Olney, CFA 4-5 Kansas City, St. -

Financial Services Fund

SCHEDULE OF INVESTMENTS (Unaudited) June 30, 2020 FINANCIAL SERVICES FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 99.9% Taubman Centers, Inc. 450 $ 16,992 Park Hotels & Resorts, Inc. 1,650 16,318 REITs - 30.1% Macerich Co.1 1,374 12,325 American Tower Corp. — Class A 474 $ 122,548 Crown Castle International Corp. 566 94,720 Total REITs 2,230,982 Prologis, Inc. 998 93,143 BANKS - 25.4% Equinix, Inc. 126 88,490 JPMorgan Chase & Co. 1,968 185,110 Digital Realty Trust, Inc. 496 70,487 Bank of America Corp. 6,585 156,394 SBA Communications Corp. 225 67,032 Citigroup, Inc. 2,218 113,340 Public Storage 339 65,051 Wells Fargo & Co. 4,313 110,413 AvalonBay Communities, Inc. 334 51,650 Morgan Stanley 2,038 98,435 Equity Residential 875 51,468 Goldman Sachs Group, Inc. 477 94,265 Simon Property Group, Inc. 743 50,806 U.S. Bancorp 2,210 81,372 Welltower, Inc. 975 50,456 Truist Financial Corp. 2,040 76,602 Alexandria Real Estate Equities, Inc. 307 49,811 PNC Financial Services Group, Inc. 695 73,121 Realty Income Corp. 823 48,968 Bank of New York Mellon Corp. 1,695 65,512 Weyerhaeuser Co. 2,045 45,931 State Street Corp. 833 52,937 Invitation Homes, Inc. 1,574 43,332 First Republic Bank 440 46,636 Essex Property Trust, Inc. 187 42,855 Northern Trust Corp. 564 44,748 Healthpeak Properties, Inc. 1,547 42,635 HDFC Bank Ltd. ADR 931 42,323 Boston Properties, Inc. 464 41,936 M&T Bank Corp. -

2020 Third Quarter Results

2020 Third Quarter Results Earnings Release Presentation October 14, 2020 Forward-Looking Statements This communication contains certain forward-looking information about PacWest Bancorp that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Statements that are not historical or current facts, including statements about future financial and operational results, expectations, or intentions are forward- looking statements. Such statements are based on information available at the time of the communication and are based on current beliefs and expectations of the Company’s management and are subject to significant risks, uncertainties and contingencies, many of which are beyond our control. The COVID-19 pandemic is adversely affecting PacWest Bancorp, its employees, customers and third-party service providers, and the ultimate extent of the impacts on its business, financial position, results of operations, liquidity and prospects is uncertain. The length of the COVID-19 pandemic and the severity of its impact on key macro-economic indicators such as unemployment and GDP may have a material impact on our allowance for credit losses and related provision for credit losses. Continued deterioration in general business and economic conditions could adversely affect PacWest Bancorp’s revenues and the values of its assets and liabilities, including goodwill, lead to a tightening of credit and increase stock price volatility. In addition, PacWest Bancorp’s results could be adversely affected by changes in interest rates, sustained high unemployment rates, deterioration in the credit quality of its loan portfolio or in the value of the collateral securing those loans, deterioration in the value of its investment securities and legal and regulatory developments.