P02950 Glu Mobile Inc. Combo 2018 V1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Take-Two Interactive Software, Inc. Equity Analyst Report

Merrimack College Merrimack ScholarWorks Honors Senior Capstone Projects Honors Program Spring 2016 Take-Two Interactive Software, Inc. Equity Analyst Report Brian Nelson Goncalves Merrimack College, [email protected] Follow this and additional works at: https://scholarworks.merrimack.edu/honors_capstones Part of the Finance and Financial Management Commons Recommended Citation Goncalves, Brian Nelson, "Take-Two Interactive Software, Inc. Equity Analyst Report" (2016). Honors Senior Capstone Projects. 7. https://scholarworks.merrimack.edu/honors_capstones/7 This Capstone - Open Access is brought to you for free and open access by the Honors Program at Merrimack ScholarWorks. It has been accepted for inclusion in Honors Senior Capstone Projects by an authorized administrator of Merrimack ScholarWorks. For more information, please contact [email protected]. Running Head: TAKE-TWO INTERACTIVE SOFTWARE, INC. EQUITY ANALYST REPORT 1 Take-Two Interactive Software, Inc. Equity Analyst Report Brian Nelson Goncalves Merrimack College Honors Department May 5, 2016 Author Notes Brian Nelson Goncalves, Finance Department and Honors Program, at Merrimack Collegei. Brian Nelson Goncalves is a Senior Honors student at Merrimack College. This report was created with the intent to educate investors while also serving as the students Senior Honors Capstone. Full disclosure, Brian is a long time share holder of Take-Two Interactive Software, Inc. 1 Running Head: TAKE-TWO INTERACTIVE SOFTWARE, INC. EQUITY ANALYST REPORT 2 Table of Contents -

Miniclip Free Games to Download

Miniclip free games to download Downloadable Games. Play 3 Foot Ninja 3 Foot Ninja Download · Play 3FootNinja 2 3FootNinja 2 Download · Play Slacking Slacking Download · Play Alien. Play Free Online Games, fun games, puzzle games, action games, sports you can try the games for free on Miniclip and then download them to your iPhone. 8 Ball Pool - Miniclip, free and safe download. 8 Ball Pool - Miniclip latest version: Free and addictive Multiplayer Pool Game. 8 Ball Pool - Miniclip is one of. Download 8 Ball Pool - Miniclip for Windows now from Softonic: % safe Free pool game with realistic physics A Full Version Sport game for Windows. Top Download Free Games by , Free Online Games, Adventure Games, Shooting Games, Action Games, Arcade Games, Sports Games, Racing. Find Miniclip software downloads at CNET , the most games are extremely popular because they are fun, free, high quality. Miniclip Roll on Miniclip War on Angry Gran Toss Free Run, Free Kick Expert. Free Board, 3G Free Kick, Free Kicker, A Game About Kingdoms CCG. All Games from Miniclip. Games from Miniclip. Sorted by date | Sorted by total downloads | Sorted by last week downloads Miniclip Alien Attack Updated: 07/29/ Miniclip FREE GAMES DOWNLOAD - PC Games Free Download. How to Download Miniclip Games. You can download Miniclip games, free and legitimately. Downloading "Miniclip games" is simple to do on a computer or on. This video is showing how to Download Miniclip Games Link: If you want to use the. Free download. Vote: 1 2 3 4 5 As a single player "practice" game, 8 Ball Pool stands up quite well. -

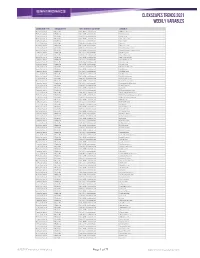

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

EA Unveils Spore Creature Creator... Now in 2-D

EA Unveils Spore Creature Creator... Now in 2-D New FLASH Application Gives Spore Players New Ways to Get Creative EMERYVILLE, Calif., Sep 16, 2009 (BUSINESS WIRE) -- The revolutionary Spore(TM) Creature Creator is going 2-D! Maxis (TM),an Electronic Arts Inc. (NASDAQ:ERTS) studio, today announced Spore(TM) Creature Creator 2-D, a new Flash application where players experience an all new take on the variety and creative fun offered by the original 3-D Spore Creature Creator. Now available for free* at www.spore2d.com, players can create a creature from scratch or import a creature from the Sporepedia(TM), thelibrary of 120+ million pieces of user-generated content in Spore. Five legs or ten, bat wings or horns; there are no limits to what users create. Once players have created their 2-D creature,they can embed it onto their social networking pages, and share it with friends via email. Spore Creature Creator 2-D takes creature-creating to new heights by making it a social, shared experience. "Spore Creature Creator 2-D offers players a brand new way to express their creativity and share their creatures as it can be played by anyone with internet access," stated Caryl Shaw, Sr. Producer of Spore Creature Creator 2-D. "The clean art style and intuitive point-and-drag functionality makes it easy for creators of all ages to get in on the fun. It'll be interesting to see how players use this new creative application." Spore Creature Creator 2-D features the full suite of more than 250 body parts, including limbs, eyes, feet, heads, and fun accessories like antlers and wings. -

Electronic Arts Reports Q4 and FY21 Financial Results

Electronic Arts Reports Q4 and FY21 Financial Results Results Above Expectations, Record Annual Operating Cash Flow Driven by Successful New Games, Live Services Engagement, and Network Growth REDWOOD CITY, CA – May 11, 2021 – Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its fiscal fourth quarter and full year ended March 31, 2021. “Our teams have done incredible work over the last year to deliver amazing experiences during a very challenging time for everyone around the world,” said Andrew Wilson, CEO of Electronic Arts. “With tremendous engagement across our portfolio, we delivered a record year for Electronic Arts. We’re now accelerating in FY22, powered by expansion of our blockbuster franchises to more platforms and geographies, a deep pipeline of new content, and recent acquisitions that will be catalysts for further growth.” “EA delivered a strong quarter, driven by live services and Apex Legends’ extraordinary performance. Apex steadily grew through the last year, driven by the games team and the content they are delivering,” said COO and CFO Blake Jorgensen. “Looking forward, the momentum in our existing live services provides a solid foundation for FY22. Combined with a new Battlefield and our recent acquisitions, we expect net bookings growth in the high teens.” Selected Operating Highlights and Metrics • Net bookings1 for fiscal 2021 was $6.190 billion, up 15% year-over-year, and over $600 million above original expectations. • Delivered 13 new games and had more than 42 million new players join our network during the fiscal year. • FIFA 21, life to date, has more than 25 million console/PC players. -

Second Grade Teacher Reading Academy

Phonics and Spelling Second Grade Teacher Reading Academy These materials are copyrighted © by and are the property of the University of Texas System and the Texas Education Agency. ©2009 2TRA: Phonics and Spelling Handout 1 (1 of 1) Learning to Read and Spell Alphabet Pattern Meaning The alphabetic principl e Knowledge of spelling or Structural units or groups matches letters, singly or syllable patterns and their of letters, such as prefixes, in combinations, to common pronunciations suffixes, and Greek or sounds in a left-to-right can help students read Latin roots or base words sequence to read and spell and spell words. focus on meaning and the words. morphological characteristics that represent consistent spellings and/or pronunciations (words with similar meanings are often spelled the same and/or pronounced the same). Examples: Examples: Examples: blending together the /ade/ in made, fade, define and definition sounds /s/ /a/ /t/ to read shade, trade or write the word, sat Adapted from Bear, D. R., Invernizzi, M., Templeton, S., & Johnston, F. (2000). Words their way: Word study for phonics, vocabulary and spelling instruction. (2nd ed.). Upper Saddle River, NJ: Merrill. ©2009 University of Texas/Texas Education Agency 2TRA: Phonics and Spelling Handout 2 (1 of 1) Reading Processes in Spanish Los Procesos de Lectura en Español The four reading processes can be applied to both English and Spanish. Decoding - Decodificación In Spanish, it is essential for students to be able to segment, delete, and manipulate individual phonemes. Students learn to blend sounds at the phoneme level to read syllables and words. Example: /s/ /o/ /l/ = sol Sight - Reconocimiento automático de palabras Although the Spanish language has a regular phonetic system, there are certain syllables or spelling patterns that have to be learned so they can be recognized and read automatically. -

The Mobile Games Landscape in 2015 | Newzoo

© 2015 Newzoo NEWZOO TREND REPORT The Mobile Gaming Landscape 2015 And the power users who shaped it INCLUDES CONTRIBUTIONS FROM What I believe we’ve seen in mobile gaming in 2015 is the beginning of a broader trend toward convergence. As shown by the success of FOREWORD Bethesda’s Fallout Shelter on mobile in June 2015 and Fallout 4 on PC, PS4 and Xbox One, game companies are beginning to realize that consumers desire gaming content to fit the various contexts that form It has been another big year for mobile gaming. In fact, it has been the their lives. biggest year in the history of the industry so far. With the sector generating revenues of over $30 billion and King, arguably the biggest As a result, we’ll be seeing in 2016 onward a move player in the market, valued at $6 billion, it’s fair to say that mobile gaming has reached heights in 2015 that few of us would have expected away from defining games by their platform toward a decade ago. Unfortunately, what this means for the industry now and models that allow game content to be played and, in the future has been clouded by antagonistic models of thinking. Whether deliberately or otherwise, mobile gaming’s success has tended equally important, viewed everywhere. to be framed as a battle with console or PC. Sony’s announcement that PS4 Remote Play, which allows console When I unpacked the data from this report, a different picture emerged. owners to play content without carrying the product around, comes hot In contrast to the usual narratives about mobile versus console or PC on the tail of Microsoft allowing Xbox One titles to run on Windows. -

EA Supercharges Its Partner Program with New Titles from Independent Mobile and Social Game Developers

EA Supercharges Its Partner Program with New Titles from Independent Mobile and Social Game Developers EA Partners Expands to Chillingo and Playfish to Help Independent Developers Publish on Fast-Growing Digital Platforms REDWOOD SHORES, Calif.--(BUSINESS WIRE)-- Electronic Arts Inc. (NASDAQ:ERTS) today announced that Chillingo and Playfish™ will offer publishing services to the fast-growing mobile and social gaming platforms to the independent development community. Following the successful and award-winning EA Partners program, EA will be expanding its partnership programs for Chillingo and Playfish furthering the delivery of fresh content to platforms such as the Apple App StoreSM, Google Android™ and Facebook®. Since its establishment in 2003, EA Partners has built a reputation for working with top-notch independent game developers, promoting both creativity and innovation amongst its global partners. Current partner titles include Epic Games and People Can Fly (Bulletstorm™), Crytek (Crysis®2), Valve (Portal 2), 38 Studios (Kingdoms of Amalur: Reckoning), Spicy Horse (Alice: Madness Returns™), Grasshopper Manufacture (Shadows of the Damned™), Paramount Digital Entertainment (Rango The Video Game), Trap Door (Warp), Funcom (Secret World) and Vanguard Games (Gatling Gears). EA partner studios also include Insomniac Games, Starbreeze Studios and Respawn Entertainment with forthcoming titles. "The EA Partners program has proven to be a phenomenally successful model. It is an all around win-win situation. The program allows EA to partner with some of the world's best console, PC and digital developers while providing those independent developers with a global distribution/publishing partner," said Bryan Neider, EA Games Label COO and General Manager of EA Partners. -

Electronic Arts Inc

ELECTRONIC ARTS INC FORM 10-K (Annual Report) Filed 5/30/2007 For Period Ending 3/31/2007 Address 209 REDWOOD SHORES PARKWAY REDWOOD CITY, California 94065 Telephone 650-628-1500 CIK 0000712515 Industry Software & Programming Sector Technology Fiscal Year 03/31 Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2007 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 0-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway 94065 Redwood City, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (650) 628-1500 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.01 par value The NASDAQ Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

NIBC First Round Case NIBC Ele Ctro N Ic Arts Contents

NIBC First Round Case NIBC Ele ctro n ic Arts Contents 1. The Scenario 2. Background Information 3. Tasks & Deliverables A. Discounted Cash Flow Analysis B. Trading Comparables Analysis C. Precedent Transactions Analysis D. LBO Analysis E. Presentation 4. Valuation & Technical Guidance A. Discounted Cash Flow Analysis B. Trading Comparables Analysis C. Precedent Transactions Analysis D. LBO Analysis 5. Rules & Regulations 6. Appendix A: Industry Overview 7. Appendix B: Precedent Transactions Legal Disclaimer: The Case and all relevant materials such as spreadsheets and presentations are a copyright of the members of the NIBC Case Committee of the National Investment Banking Competition & Conference (NIBC), and intended only to be used by competitors or signed up members of the NIBC Competitor Portal. No one may copy, republish, reproduce or redistribute in any form, including electronic reproduction by “uploading” or “downloading”, without the prior written consent of the NIBC Case Committee. Any such use or violation of copyright will be prosecuted to the full extent of the law. Need for Speed Madden NFL Electronic Arts Electronic Arts Welcome Letter Dear Competitors, Thank you for choosing to compete in the National Investment Banking Competition. This year NIBC has continued to expand globally, attracting top talent from 100 leading universities across North America, Asia, and Europe. The scale of the Competition creates a unique opportunity for students to receive recognition and measure their skills against peers on an international level. To offer a realistic investment banking experience, NIBC has gained support from a growing number of former organizing team members now on the NIBC Board, who have pursued investment banking careers in New York, Hong Kong, Toronto, and Vancouver. -

Delaney Opposes Name Change Polk Gets Aid to Buffer AP Range

C M Y K LIVING B12 www.newssun.com NEWS-SUN New year, new you? Highlands County’s Hometown Newspaper Since 1927 Sticking to your New Yearʼs Sunday, January 26, 2014 Volume 95/Number 12 | 75 cents resolutions Dragons done DeLaney opposes name change Boys and girls stopped in By PHIL ATTINGER who served as president of the Monday at 123 E. Pine St. run for titles [email protected] Avon Park City Council for two Kris DeLaney, the former AVON PARK — South Delaney terms and as mayor for 28 years. mayor’s grandson, said it’s fine if SPORTS, B1 Avenue bears the name of a man Current council members are the city wants to name a street for who helped bring Walker scheduled to hear community King, but it shouldn’t be the Memorial Hospital, South Florida input on changing the street name street the city named for his Junior College and federal hous- to Dr. Martin Luther King Jr. grandfather. Polk gets ing projects to Avon Park. Boulevard or if there are other In a letter sent to the city coun- Delaney Heights still bears the suitable streets to name for King. See BATTLE, A6 E.A. DeLANEY Sr. aid to name of Edgar A. DeLaney Sr., The meeting is set for 6 p.m. buffer AP A little Range more than By TOM PALMER Halifax Media Group frost on the BARTOW – Polk County has received $200,000 to aid in ongoing work to buffer Avon Park Air Force windows Range from encroachment by sur- rounding development, Gov. -

A Walk Through MGM National Harbor

A Walk Through MGM National Harbor Timeless design, impeccable service and spectacular amenities combine to create a new generation of resort experiences: MGM National Harbor, the first luxury gaming destination in the Capital Region. Guests will be drawn into the bold, forward-looking design and breathtaking spaces as they discover excitement at every turn: restaurants by some of the region’s most celebrated chefs, an intimate theater showcasing the hottest acts in entertainment, an immersive spa escape, luxurious rooms and suites and much more. MGM National Harbor will be the ultimate destination, whether for an evening of entertainment or an indulgent weekend getaway. Architecture Situated on a hill overlooking the Potomac River, MGM National Harbor serves as a landmark to the community and gateway into Maryland. The overarching vision of the resort draws inspiration from Washington D.C.’s monumental architecture while also incorporating the natural beauty of the surrounding area, including vistas of the Potomac River and annual cherry tree bloom. While respecting the District’s historic sense of place highlighted by classical structures, MGM National Harbor embodies a modern and bold design that complements the sense of timelessness created by the Nation’s Capital buildings. Designed by architecture visionaries HKS Hospitality Group, MGM National Harbor’s architectural unfolds as guests explore the space, from the series of grand steps leading up to the lobby to its glistening knife-like tower rising vertically toward the sky. In designing the resort, it was important to not only pay homage to surrounding architectural marvels, but also to include MGM Resort’s legacy by incorporating trademark elements from Las Vegas resorts such as Bellagio, ARIA and MGM Grand.