News Round up 08.08.2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Superb Sri Lanka

SUPERB SRI LANKA Starting From :Rs.:16529 Per Person 5 Days / 4 Nights KANDY | BENTOTA | COLOMBO .......... Package Description SUPERBDay 1: Arrive in ColomboSRI LANKA - Pinnawala - Kandy - city tour Kandy.captivityorphanageWelcome in to isthe Sri an world.Lanka. also breedingArrive Arrive in at paceKandy Colombo for and elephants, airport check andin the at transfer hotel.first elephant Later to Kandy proceed baby via was forPinnawala Kandyborn in city Elephant1984, tour and with Orphanage. it has cultural the greatest show. This 24 Overnight herdacres of large elephants stay elephant in in plantsAfterDay 2: breakfast, andKandy creepers. - Bentota proceed Arrive to Bentota.in Bentota En and route check visit in Royal at hotel. Botanical Overnight Gardens stay -in Peradeniya. Bentota. There are more than 5,000 species of trees, EnjoyDay 3: your Bentota day at beaches of Bentota. Overnight stay in Bentota. ThisDay 4:morning Bentota check - Colombo out from - City hotel Tour & transfer to Colombo. Colombo is the largest city and commercial capital of Sri Lanka. While on your OvernightIslamTradecity tour andCenter in Christianstay Colombo towers, in Colombo. places youOld mayParliament of worship.visit famous Building, For shopping,places Fort including district, you may Independence Galle visit Face Odel, Green, House Hall theat of Independence Viharamahadevi Fashion, Beverly Square, Park, Street, and National Majestic prominent Museum, City, Buddhist, Noritake, Twin World Hindu, etc. AfterDay 5: breakfast Colombo it’s - Departure time to check out. Transfer to the airport for your onward flight or back home. .......... Itinerary Day.1 Day 1: Arrive in Colombo - Pinnawala - Kandy - city tour Welcome to Sri Lanka. Arrive at Colombo airport and transfer to Kandy via Pinnawala Elephant Orphanage. -

Explore Sri Lanka

EXPLORE SRI LANKA CHECK OUT THE UNIQUE OFFERS INSIDE FOR THESE ELIGIBLE BRANDS: RETAIL DINING & RESTAURANTS ODEL Berlin Sky Lounge RECEIVE A ENJOY 10% OFF 10% DISCOUNT YOUR MEAL ON YOUR PURCHASE The Goldblock, 101/11 Hunupitiya Lake Road, Colombo 2 1st, Floor Capital Mall, No 135, Dutugemunu +94 11 4366388 Thalawathugoda Street, Kohuwala +94 113 357900 +94 114 542756 286, Highlevel Road, No 29A, Jayathilake Colombo 6 Mawatha, Panadura IL Cielo +94 114 209139 +94 384 285008 ENJOY 10% OFF 385, Negombo Road, No 322, Koswatte, YOUR MEAL Wattala Battaramulla +94 11 2980171 +94 114 641400 The Goldblock, 101/11 Hunupitiya Lake Road, Colombo 2 G-3, Udeshi City Shopping No 4, Hotel Road, Complex, Makola Road, Mount Lavinia +94 11 4366355 Kiribathgoda +94 114 640490 +94 114 641961 No 5, Alexandra Place, Level 3, Kandy City Centre Colombo 7 Loon Tao 5, Dalada Veediya, Kandy +94 114 625800 ENJOY 10% OFF +94 81 2205382 No. 53, Hospital Road YOUR MEAL K Zone, Ja-Ela, Kalubowila Gampaha +94 113 383833 Race Course, Philip Gunewardena Mawatha, +94 112 071071 Colombo 7 No 89A, New Galle +94 11 2698989 No 1-29, Majestic City, Road, Moratuwa Galle Road, Colombo 4 +94 114 209571 +94 112 595763 Tsing Tao Maximum discount per transaction of LKR 1000. Offer valid 1-December-2016 to 31-May-2017. ENJOY 10% OFF YOUR MEAL 43/12 College Avenue, Mount Lavinia +94 11 2722723 Above offers valid 1-December-2016 to 31-December-2017. RECEIVE A $10 DISCOUNT OFF ANY PURCHASE ABOVE $65 Flemingo Flow- Hilton Colombo Residencies Bandaranaike International Airport, Colombo, Sri Lanka ENJOY 15% OFF YOUR FINAL BILL +94 11 4696969 P.O. -

Colombo Seven Colombo

COLOMBO SEVEN COLOMBO JETWING COLOMBO SEVEN 57, Ward Place, Colombo, Sri Lanka Reservations: +94 11 4709400 Hotel: +94 11 2550200 Fax: + 94 11 2345729 E-mail: [email protected] Web site: www.jetwinghotels.com General Manager: Ms. Rookamanie Fernando 01. INTRODUCTION Colombo, the commercial capital of Sri Lanka, is a bustling city with a long history as a port on ancient east-west trade routes, ruled successively by the Portuguese, Dutch and British. Jetwing Colombo Seven, an urban resort situated in the heart of Colombo, offers the discerning traveller modern, contemporary accommodation surrounded by Colombo city life, and reflections of the times of colonial powers and foreign trade. Rising over the city landscape, the property boasts stunning views while being in close proximity to all the city attrac- tions. 02. LOCATION It is 33 km (approx. 60 minutes drive) from the Bandaranaike International Airport, while all main Colombo attractions are nearby. 03. ROOMS The hotel offers spacious rooms defined by a mod- ern ambience, with amenities set in minimalist con- tours of elegance and efficiency. 03.01 Total Number of Rooms Rooms Number Area Room area - 131.6 sqm Serviced Bathroom - 3.4 sqm 02 Apartments Living area - 53 sqm - 3 rooms Total area -188 sqm Serviced Room area - 74.3 sqm Bathroom - 3.4 sqm Apartments 05 Living area - 20 sqm - 2 rooms Total area -97.7 sqm Studio Room area - 30 sqm Apartments 21 Bathroom - 8 sqm -1room Kitchenette - 4 sqm Total area -42 sqm Room area - 27.4 sqm Super Deluxe 16 Bathroom - 8.1 -

Download Brochure

Page 1 THE JEWEL OF SOUTH ASIA INTRODUCING COLOMBO’S PREMIER LUXURY LIFESTYLE DESTINATION Page 2 Page 3 City Core The Residences THE PRIDE OF SRI LANKA Office Beira Lake Renowned as the Pearl of the Indian Ocean, the tropical island nation of Sri Lanka has long captured the hearts of many with its rich cultural heritage, pristine beaches, lush nature, warm people, and now, a fast rising economy. ITC With the country’s growing eminence, Shangri-La, Asia Pacific’s leading luxury hotel, resort and residential group, has chosen to unveil its very first mixed development project — One Galle Face — in the heart of Colombo City. A fully integrated lifestyle destination for different communities, this iconic oceanfront development is an intimately woven tapestry of the best international and local brands. Epitomising the city’s vibrant energy, aspirations Galle and achievements, One Galle Face will become Face the pride of the city. Roof-top Garden THE MALL AT ONE GALLE FACE Hotel Ocean View 2 3 Page 4 Page 5 21.2 MILLION POPULATION IN 2016 CAPITAL SD SRI JAYAWARDENAPURA SD KOTTE 3.52 ILLION 3,759 IN REVENUE FROM TARGETED PER BUSINESS AND TOURIST ARRIVALS CAPITA INCOME IN 2016 IN 2016 FINANCIAL CAPITAL Source: Sri Lanka Tourism Source: Development Authority Trading COLOMBO Statistical Report Economics 2016 AREA SRI LANKA 65,610 SQ KM CLIMATE 14% FULFILLING TROPICAL 6.4% ROT AVERAGE GDP IN TORIST BETWEEN 2010 ARRIAL POTENTIAL MAJOR INDUSTRY TO 2016 TEXTILE, TOURISM, TEA Source: Source: Sri Lanka Tourism KEI Development Authority & MANUFACTURING Statistical Report 2016 A strategic trading hub since ancient times, Sri Lanka has emerged as one of the fastest growing economies in the world. -

Your Guide to Living & Working in Sri Lanka

INTERNATIONAL WATER MANAGEMENT INSTITUTE Your Guide to living & working in Sri Lanka January 2012 Your Guide to Living & Working in Sri Lanka Your Guide to Living & Working in Sri Lanka .......................................................................................... 2 Housing ................................................................................................................................................... 2 Security ................................................................................................................................................... 2 Schooling & Child‐care ............................................................................................................................ 3 Schools ................................................................................................................................................ 3 Shopping ................................................................................................................................................. 4 Domestic staff ......................................................................................................................................... 5 Embassies / Foreign Mission ................................................................................................................... 5 German ............................................................................................................................................... 5 Australian ........................................................................................................................................... -

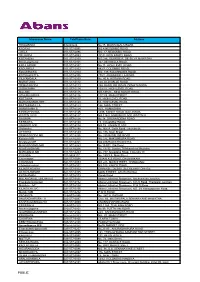

PUBLIC Dehiattakandiya M/B 027-577-6253 NO

Showroom Name TelePhone Num Address HINGURANA 632240228 No.15, MUWANGALA ROAD. KADANA 011-577-6095 NO.4 NEGOMBO ROAD JAELA 011-577-6096 NO. 17, NEGOMBO ROAD DELGODA 011-577-6099 351/F, NEW KANDY ROAD KOTAHENA 011-577-6100 NO:286, GEORGE R. DE SILVA MAWATHA Boralesgamuwa 011-577-6101 227, DEHIWALA ROAD, KIRULAPONE 011-577-6102 No 11, HIGH LEVEL ROAD, KADUWELA 011-577-6103 482/7, COLOMBO ROAD, KOLONNAWA 011-577-6104 NO. 139, KOLONNAWA ROAD, KOTIKAWATTA 011-577-6105 275/2, AVISSAWELLA ROAD, PILIYANDALA 011-577-6109 No. 40 A, HORANA ROAD , MORATUWA 011-577-6112 120, OLD GALLE ROAD, DEMATAGODA 011-577-6113 394, BASELINE ROAD, DEMATAGODA, GODAGAMA 011-577-6114 159/2/1, HIGH LEVEL ROAD. MALABE 011-577-6115 NO.837/2C , NEW KANDY ROAD, ATHURUGIRIYA 011-577-6116 117/1/5, MAIN STREET, KOTTAWA 011-577-6117 91, HIGH LEVEL ROAD, MAHARAGAMA RET 011-577-6120 63, HIGH LEVEL ROAD, BATTARAMULLA 011-577-6123 146, MAIN STREET, HOMAGAMA B 011-577-6124 42/1, HOMAGAMA KIRIBATHGODA 011-577-6125 140B, KANDY ROAD, DALUGAMA, WATTALAJVC 011-577-6127 NO.114/A,GAMUNU PLACE,WATTALA RAGAMA 011-577-6128 No.18, SIRIWARDENA ROAD KESBAWA 011-577-6130 19, COLOMBO ROAD, UNION PLACE 011-577-6134 NO 19 , UNION PLACE Wellwatha 011-577-6148 No. 506 A, Galle Road, colombo 06 ATTIDIYA 011-577-6149 No. 186, Main Street, DEMATAGODA MB 011-577-6255 No. 255 BASELINE ROAD Kottawa M/B 011-577-6260 NO.375, MAKUMBURA ROAD, Moratuwa M/B 011-577-6261 NO.486,RAWATHAWATTA MAHARAGAMA M/B 011-577-6263 No:153/01, Old Road, NUGEGODA MB 011-577-6266 No. -

Colombo City Tour Click Here to More Details

John Keells Group - Confidential About Us Fulfilling travel dreams since 1969, we are not just another Destination Management Company. Believing in making dreams come true we move beyond our means to make travel dreams happen. With 49 years of experience in the FIT, GIT and MICE segments we have set the bar to the highest level of quality. Our holiday experts are driven to excel in serving our clients; with their passion for travel and leisure coupled with our extensive learning and development initiatives, they always deliver the most creative and imaginatively designed tours. In addition to offering more than just main stream tourism, we offer tailor- made tours as well as excursions that cater to various levels of interest. The specialized brand of Walkers Tours, “Nature Odyssey” focusses on designing and operating nature, wildlife and adventure relates travel. It offers a range of authentic experiences which will allow travelers to truly discover the intricacies of the destination. Come on board to explore the untapped beauty of our Island paradise. With no compromise made to quality of service standards, let us assure you the comfort of knowing that your clients are in secure hands of our experts. Whilst we respect every other DMC trying to elevate the positioning of Sri Lanka as a tourist destination across the globe, here are few elements which we believe sets us apart from the rest: John Keells Group - Confidential Walkers Tours is powered by an internal talent pool of close to 200 employees with over 100 of them being holiday experts. This pool entails a mix of cultures from China, Russia, Indian etc. -

Near Your Stay

NEAR YOUR STAY Renuka City Hotel 328 Galle Road Colombo 3 Sri Lanka +94-112573598/602 [email protected] Index Page no Useful Addresses 1 Hospitals 2 Tourist Attraction in Colombo 3 Other Tourist Attraction in Colombo 4 The Casinos 5 Nightclubs 6 Foreign Missions 7 International Banks 8 Shopping 9 Religious Places 10 1 Useful Addresses Sri Lanka Tourism Development Authority No. 80, Galle Road, Colombo 03, Sri Lanka. +94 112426800 / +94 112426900 (Distance from the hotel - 1.1 km) Colombo Central Bus Stand Olcott Mawatha, Pettah, Colombo 01, Sri Lanka. +94 112329606 (Distance from the hotel - 5.1 km) Sri Lanka Railways - Fort railway station Fort railway station, Sri Lanka. +94 112432908 / +94 112434215 (Distance from the hotel - 4.4 km) 2 Hospitals National Hospital of Sri Lanka Durdans Hospital Colombo 10. No. 03 Alfred Place Sri Lanka. Colombo 03 +9411-2691111 / +9411-2693510 Sri Lanka. (Distance - 2.8 km) +9411-2140000 1344 (Short code) (Distance - 1.3 km) Nawaloka Hospital Asiri Central Hospital No. 23, No. 14 Deshamanya H. K Dharmadasa, Norris Canal Rd, Mawatha, Colombo 10 , Colombo 2, Sri Lanka. Sri Lanka. +9411-4665500 +9411-5577111 / +9411-5777777 (Distance - 2.7 km) (Distance - 2.0 km) Lanka Hospitals Oasis Hospital No. 578 No:18/A, Elvitigala Mawatha, Muhandiram E.D. Colombo 5, Dabare Mawatha Sri Lanka. Colombo 5, +9411-5430000 Sri Lanka. (Distance - 5.1 km) +9411-5506000 (Distance - 5.7 km) 3 Tourist Attractions in Colombo Independence Memorial Hall Arcade Independence Square Colombo 7. Colombo 7. Sri Lanka. Sri Lanka. +9411-28789961 +9471-3456789 (Distance - 3.0 km) (Distance - 3.1 km) Laksala Handicraft Emporium Gangaramaya Temple No. -

Sri Lankan Serenity Date: 21St – 27Th January 2017 Duration- 6N / 7D

Sri Lankan Serenity Date: 21st – 27th January 2017 Duration- 6N / 7D Tour Highlights Destinations PinnawalaèDambullaèKandyèNuwara EliyaèBentotaè Colombo Accommodations: • Dambulla – Fresco Water Villa/Thilanka or similar • Kandy – Thilanka/ Tree of Life or similar • Nuwara Eliya – Horton Towers • Bentota – Earls Reef/Temple tree or similar • Colombo – Pearl Grand / Ramada or similar Activities: • Pinnawala Elephant Orphanage, Dambulla Cave Temples, the Sigiriya Rock Fortress, Gem Museum, Temple of Tooth Relic , Peradeniya Botanical Gardens • Visit Golf course, trout streams, Victoria Park, and boating or fishing on Lake Gregory. • Tea Factory • Seetha Eliya and Haggala Gardens • Boat safari in Madu River • Galle Face Green, the Viharamahadevi Park, National Museum, Twin World Trade Center towers, Old Parliament Building, Fort district, Independence Hall • Odel, House of Fashion, Beverly Street, Majestic City, Noritake • A grand lunch in five star hotels Meals: 6 Breakfast, 6 Dinner Travel: Visa,Travel Insurance upto 60yrs, transportations in AC vehicle Services: English speaking guide, PnF buddy Sri Lanka What makes you choose Sri Lanka as your ‘ME’ time destination Sri Lanka is one of the Asian hotspot that attracts thousands of tourists from far off places. The country has many qualities and has various UNESCO preserved sites which are packed in such small area and form a part of various Sri Lanka vacations. Sri Lanka packs an extraordinary variety of places to visit within its modest physical dimensions, and few islands of comparable size can boast a natural environment of such beauty and diversity. Lapped by the Indian Ocean, the coast is fringed with idyllic – and often refreshingly undeveloped – beaches, while the interior boasts a compelling variety of landscapes ranging from wildlife-rich lowland jungles, home to extensive populations of elephants, leopards and rare endemic bird species, to the misty heights of the hill country, swathed in immaculately manicured tea plantations. -

Research Intelligence Unit RESEARCH INTELLIGENCE UNIT

Research Intelligence Unit RESEARCH INTELLIGENCE UNIT Sri Lanka Real Estate Market Report 2021 Real Estate Market Update KeyPrepared Highlights for RIL Properties ByJuly Research 2020 Intelligence Unit (RIU) Research Intelligence Unit RESEARCH INTELLIGENCE UNIT Economic Performance Economic Indicators Research Intelligence Unit 10.0% RESEARCH INTELLIGENCE UNIT 5.2% GDP Growth Rate 2020 Following the negative economic impact from 5.0% • 2.4% 2.3% the April 2019 Easter attacks, Sri Lanka 0.0% progressed towards a gradual recovery in early -0.4% Bangladesh Bhutan Nepal Pakistan Afghanistan Sri Lanka South Asia India Maldives 2020. -5.0% -5.0% -5.5% -6.8% • However, occurrence of the COVID-19 pandemic -10.0% -9.0% halted the progress, with the economy -15.0% experienced downward pressure, as the global economy, as well as the outrys main export -20.0% markets. -20.5% -25.0% • According to ADB, Sri Lakas GDP contracted by 5.5 percent in 2020 and expect to grow by 4.1 GDP Growth Rate 2021 Forecast percent in 2021 12.00% 10.50% • The forecast for the following year seems to be 10.00% a lot more optimistic as industries bounce back 8.00% 8.00% 7.10% 6.80% 6.00% 4.10% 4.00% 2.00% 1.70% 2.00% 1.50% 1.50% 0.00% Maldives India South Asia Bangladesh Sri Lanka Pakistan Bhutan Afghanistan Nepal Source: ADB, RIU Economic Indicators Research Intelligence Unit 4.3% RESEARCH INTELLIGENCEInflation UNIT 4.2% 4.2% 4.2% 4.2% 4.1% 4.1% 4.1% 4.1% 4.0% 4.0% 4.0% 4.0% 3.9% Jul Aug Sep Oct Nov Dec CCPI (Y-o-Y) • Sri Lakas 12-month consumer inflation edged up to 4.2 percent at the end of the year. -

Retail Network All Island

RETAIL NETWORK ALL ISLAND 1 DSI 7.5% off on total bill Islandwide 10% off on Singer Sewing Machines / Singer Branded 2 Singer other products 7.5% / All non Singer Brands 5% from retail Islandwide price special package (Free outgoing within the group / 1000 3 Mobitel Post Paid Contact Darshana 0715342646 mints to Mobitel/SLT) 4 No Limit 8% Islandwide Wellawatte, Kandy, Majestic City, Negombo, Nugegoda, Rajagiriya, Ratnapura, Wattala, One Galle Face, Kiribathgoda, 5 Hameedia 7.5% off on total bill Kurunegala, Kandy City Center, Ja-Ela, Crescat Boulevard , Pelawatte, Pettah Majestic City, Bambalapitiya, Anuradhapura, Ja-Ela, Jaffna, 6 Signature 7.5% off on total bill Kalmunei, Liberty Plaza, Matara 7 Glitz 8% off on total bill Kandy / Negombo / Colombo 02 / Nugegoda / Mt. Lavinia 8 CIB 5% on total bill Islandwide 9 Wijaya Saree Mandiraya 10% on total bill Maharagama / Nugegoda 10 CIB Curtain Center 10% on total bill Maharagama 11 Harcourts Pharmacy 5% on medicine / 10% on cosmetics Islandwide (from all 35 Pharmacies) 12 Softlogic Up to 5% off Tyronne - 0772642901 - Pelawatte Branch Innovax washing Machines 15% / TV 25% / Music Items 13 Seetha Holdings 6%/ Furniture and other elctrcial Items 5% / Exercise Islandwide (Call Tharanga 0777861896) machines 10% ONLINE DEALS 14 MyDeal.lk Additional 5% + Promo Offer Online 15 Babies.lk 15% Off On total bill Except Fomula Milk Powder Online (Colombo Free Delivery) 16 mirraw.com 10% additional off on the total bill online ( islandwide delivery) 17 All Deals Up to 15% off on the tota bill Online HOTELS -

View Merchants

Name Merchant Type Merchant Category City Athula Learners Over the Counter Automobile Dehiwala Purnima Tyre Center Over the Counter Automobile Nugegoda Petco Lanka Car Audio Over the Counter Automobile Kirulapana Crown Tyres Over the Counter Automobile Colombo Olympic Tyre House Over the Counter Automobile Colombo Auto Drome Over the Counter Automobile Colombo 02 Tyre Max Over the Counter Automobile Colombo Jayamaga Learners Over the Counter Automobile Dehiwala Petcom Car Audio Over the Counter Automobile Nugegoda Dishan Motors Over the Counter Automobile Matara Auto Touch Cleaning Center Over the Counter Automobile Mt Lavinia Taiyo Enterprise Pvt Ltd Over the Counter Automobile Mount Lavinia Rahul Motors Over the Counter Automobile Matara Minipura Auto Vision Over the Counter Automobile Ratnapura Senoto Motors Over the Counter Automobile Panadura General Auto Trading Over the Counter Automobile Ratnapura Pasindu Auto Parts Over the Counter Automobile Avissawella Liberty Motors Over the Counter Automobile Ratnapura Baskin Robins Over the Counter Bakers Colombo 02 Baskin Robins Over the Counter Bakers Colombo 04 Baskin Robins Over the Counter Bakers Colombo 03 Divine Foods Over the Counter Bakers Colombo 03 Divine Foods Over the Counter Bakers Wattala Divine Foods Over the Counter Bakers Colombo 08 Divine Foods Over the Counter Bakers Negambo a & m Cupcakes Over the Counter Bakers Colombo English Cake Company Over the Counter Bakers Colombo Secure Salon Over the Counter Beauty Care Welisara Salon Jeewa Over the Counter Beauty Care Mahabage