TOOLKIT Technology Solutions for Tourism Businesses in a Post-Covid19 Scotland

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Case of Scottish Tourism Marketing

Capturing the essence of a brand from its history: The case of Scottish tourism marketing Received (in revised form): 14th September, 2005 IAN YEOMAN is the Scenario Planner for VisitScotland, the national tourism organisation for Scotland. He has a PhD in Management Science from Napier University, Edinburgh and is the author/editor of nine tourism books. Ian is the Editor of the Journal of Revenue and Pricing Management and has taught on a number of courses. His special interests include the use of modelling techniques to interpret and analyse tourism scenarios and policy. ALASTAIR DURIE was a senior academic at the University of Glasgow, but now teaches at the University of Stirling. He is author of a number of works on the history of tourism in Scotland including Scotland for the Holidays: Tourism in Scotland c.1780–1939, which was published in 2003, and Water is best. Hydropathy and Health Tourism (in press). UNA MCMAHON-BEATTIE is a lecturer, researcher and consultant at the University of Ulster, Northern Ireland. Her research interests lie in the areas of tourism marketing and tourism futures. She has published widely as an author and book editor in the UK and internationally. Una is the Practice Editor of the Journal of Revenue and Pricing Management. ADRIAN PALMER is Professor of Services Marketing at the University of Gloucestershire Business School, Cheltenham, UK. After holding marketing management positions within the travel industry, he joined academia where he has researched buyer-seller relationships within the service sector. Recent research has been published in the European Journal of Marketing, Journal of Marketing Management, Journal of Strategic Marketing and Journal of Services Marketing. -

Supportingmaterial August2013 SCOTTISH FUTURES TRUST SUPPORTING MATERIAL

SupportingMaterial August2013 SCOTTISH FUTURES TRUST SUPPORTING MATERIAL Introduction This supplementary document contains supporting material for each of the individual benefits identified. Each benefit is listed on the following contents page and has a section setting out the nature of the intervention made by SFT that delivered the benefit, and the assumptions and methodologies used in its quantification. This document should be read in conjunction with the associated excel work book (SFT Statement of Benefits 2012-13 - Calculations), a copy of which is available on SFTs website at www.scottishfuturestrust.org.uk/publications/benefits 2 SCOTTISH FUTURES TRUST SUPPORTING MATERIAL £/t Cost per tonne. BREEAM Building Research Establishment Environmental Assessment Model. An environmental assessment method and rating system for buildings, it sets the standard for best practice in sustainable building design, construction and operation and has become one of the most comprehensive and widely recognised measures of a building's environmental performance. Capex Capital (construction) cost CCS Construction Skills Scotland - Sector Skills Council and Industry Training Board for the construction industry, governed by a non-executive Board, who are appointed by the Secretary of State for Business, Innovation and Skills. CEC City of Edinburgh Council CMAL Caledonian Maritime Assets Ltd. – the company, wholly owned by the Scottish Government with the Scottish Ministers sole shareholders, which owns the ferries, ports, harbours, and infrastructure for ferry services serving the West coast of Scotland and the Clyde Estuary. COSLA Convention of Scottish Local Authorities D&B Design and Build – form of infrastructure procurement paid for from capital budgets as the asset is built DBFM Design, Build, Finance and Maintain – form of infrastructure procurement including asset maintenance and financing, with payment over time as the asset is used. -

Ayrshire Growth Deal Leaflet

Suppliers guide to the Ayrshire Growth Deal • 19 projects based around five programmes • A guide for small and medium sized businesses What are Growth Deals? Growth Deals are agreements between the UK Government, the Scottish Government and a local government designed to bring about long-term strategic approaches to improving regional economics. Growth Deals are delivered by regional partnerships between partners. The aim of these collaborations is to drive inclusive economic growth. What is the Ayrshire Growth Deal? It is an agreement between the UK Government, Scottish Government and East, North and South Ayrshire Councils. It is the first non-City Region Deal in Scotland with a financial commitment of £251.5m to be delivered over 10 years. The deal is estimated to create 7,000 new jobs, unlocking an additional £300m from private sectors. The deal is made up of 19 projects, based around five programmes: Aerospace and Space; Energy, Circular Economy, and Environment; Economic Infrastructure; Tourism; and Communities. Projects focus on infrastructure investment designed to act as a catalyst for business growth, and are complemented by a Skills and Inclusion Programme and a Community Wealth Building Programme. What does the Ayrshire Growth Deal mean for my business? • The Deal will position Ayrshire as one of the UK’s leading centres of Aerospace and Space activity. • Improved infrastructure - creating conditions for growth providing jobs, strong regional supply chains and skills development. • The Energy, Circular Economy and Environment programme will support innovation and development in energy products. • The Tourism programme will build on and strengthen existing tourism to make a highly desirable place to visit, live, work and invest in. -

Scotland's Towns

Scotland’s Towns Digital Guidance World Class Scotland 2020 March 2017 1 Contents 1. Introduction 3 2. Executive Summary 4 3. The Context for Scotland’s Towns 4 4. Design – A Best Practice Approach 7 5. Digital Towns Case Studies 8 - 5.1 Perth 8 - 5.2 Clarkston 11 - 5.3 Elgin 13 - 5.4 Auchterarder 15 - 5.5 Milngavie 17 - 5.6 St. Andrews 19 - 5.7 Fort William 21 - 5.8 Paisley 24 - 5.9 Glasgow City Centre 26 6. Digital Providers Case Studies 26 Appendix 1 – The Relevant Technologies 35 Appendix 2 – Digital Audit Process 38 Appendix 3 – Digital Skills Provision 39 Appendix 4 – Digital Providers List 41 Note of Thanks 47 2 1. Introduction The Scottish Government has committed to developing and delivering world class digital infrastructure across Scotland by 2020. Investment totalling over £400 million of public and private sector funding, alongside ongoing commercial programmes will collectively deliver 95% fibre broadband coverage across Scotland by 2018 with a further commitment to deliver 100% superfast broadband access across Scotland by 2021. A combination of technologies will be deployed including fibre optic, copper, ADSL, wi-fi, mobile, satellite and tv white space. Digital connectivity, economy, participation, and public services are all vital to delivering Scotland’s Digital Future. A parallel process, led by Highlands and Islands Enterprise will support and empower remote and rural communities across Scotland to establish community broadband networks, delivering improved connectivity to transform the way communities live, work and learn. In addition to this, investment was made to roll out Public Access Wireless connectivity via the Public Wireless Programme, which aims to help Scottish Public Bodies to dramatically improve their leadership, shared technical understanding, planning, public procurement, market engagement, collaborations and facilitation of digital investment through place-based and nationally themed wireless deployments. -

Moray Hostel in a Different Class

MBE Director of Findhorn Village Centre, Christine Hunt, and VisitScotland Regional Director, Jo Robinson in front of the hostel Jan 11, 2017 14:16 GMT Moray hostel in a different class A volunteer-run hostel,in the heart of the village of Findhorn, has doubled its VisitScotland star rating. Findhorn Village Hostel, which was converted from an old school, has gone from a two-star to a four-star accommodation provider under the national tourism organisation’s Quality Assurance (QA) scheme after making a number of improvements. The QA scheme is a benchmark for quality across the tourism industry and operates across accommodation, visitor attractions and food sectors. The coastal accommodation, which opened in 2000, received a two-star grading in 2014 but has since been committed to development. A massive refurbishment took place in May which included a new kitchen and living room as well as the installation of double glazing. An excellent new website has been created and improvements have also been made to the hostel’s booking process. Along with two members of staff, these changes are largely down to the community spirit of the village, with around 20 locals volunteering their services. All of the hard work has been rewarded with the four-star accreditation. Now open all year round, and with an annexe being opened in January, Findhorn Village Hostel offers excellent accommodation for those exploring the Moray coast. Justina Baltakyte, the hostel’s Marketing Manager, said: “We are extremely pleased to be given this four-star QA award. The team and volunteers have worked very hard so it’s great to receive this recognition and see that our efforts have paid off.” Jo Robinson, Regional Director at VisitScotland, said: “I would like to congratulate everyone at Findhorn Village Hostel on their four- star QA award. -

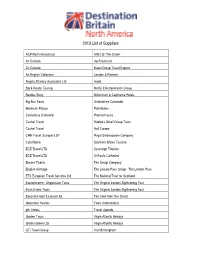

2013 List of Suppliers

2013 List of Suppliers ACP Rail International IHM Ltd "The Circle" Air Canada JacTravel Ltd Air Canada Kuoni Group Travel Experts An English Collection London & Partners Angela Shanley Associates Ltd made Back-Roads Touring Merlin Entertainments Group Beatles Story Millennium & Copthorne Hotels Big Bus Tours Oxfordshire Cotswolds Blenheim Palace Pathfinders Canterbury Cathedral Premium tours Cashel Travel Rabbie's Small Group Tours Cashel Travel Rail Europe CHR Travel (Europe) LLP Royal Shakespeare Company Cola Hotels Southern Wales Tourism ECE Travel LTD Sovereign Tourism ECE Travel LTD St Paul's Cathedral Encore Tickets The Group Company English Heritage The Leisure Pass Group - The London Pass ETS European Travel Services Ltd The National Trust for Scotland Eurowelcome / Anglovision Tours The Original London Sightseeing Tour Evan Evans Tours The Original London Sightseeing Tour Executive Golf & Leisure ltd. The View from The Shard Generator Hostels Tours International glh. Hotels Travel Agenda Golden Tours Virgin Atlantic Airways Gretna Green Ltd Virgin Atlantic Airways GTi Travel Group Visit Birmingham 2013 List of Suppliers Hard Days Night Hotel Liverpool Ltd Visit Kent Hertz UK Ltd Visit Manchester HF Holidays Ltd Visit Wales HF Holidays Ltd Visit Wales Highland Experience Tours VisitEngland Historic Royal Palaces VisitLiverpool Historic Scotland VisitScotland Hotels and More Ltd. Warner Bros. Studio Tour London Hyatt Regency London - The Churchill Welsh Rarebits Wimbledon Lawn Tennis Museum & Tour . -

The GB Day Visitor Statistics 2015

The GB Day Visitor Statistics 2015 GB Day Visits 2015 Contents This report presents the main Section 1: Introduction findings of the 2015 Great Britain Survey methods 4 Day Visits Survey (GBDVS 2015). Definitions 7 Scope of this report 9 The survey measures participation in Tourism Day Visits taken to Section 2: Tourism Day Visits destinations in the UK (including Volume and value of visits 11 Northern Ireland) by the residents Activities undertaken 14 of England, Scotland and Wales. Accessibility 23 Ethnicity 27 GBDVS 2015 is jointly sponsored by the Visit duration 29 statutory tourist boards of England and Visit destination 33 Scotland and Visit Wales (the Tourism Claimed distance travelled 41 Department of the Welsh Government). Mode of transport 48 Visit expenditure 52 No part of this publication may be reproduced Visitor profile 60 for commercial purposes without the written permission of the sponsors. Extracts may be Section 3: Summary of changes over time quoted if the source is acknowledged. Volume and value of visits 65 Activities undertaken 69 Published and copyright of the sponsors: Visit duration 71 VisitEngland Type of place visited 72 VisitScotland Claimed distance travelled 74 Visit Wales Mode of transport 76 © April 2015 Visit expenditure 77 Section 4: The wider context Leisure Day Visits 80 Section 5: Summary data tables Tourism Day Visits 83 3 hour+ Leisure Day Visits 99 All Leisure Day Visits 116 Appendices 117 Further information 123 The GB Day Visitor Page 2 Introduction 1 Section 1: Introduction The Great Britain Day Visit Survey (GBDVS) was commissioned jointly by VisitEngland, VisitScotland and Visit Wales (the Tourism Department of the Welsh Government). -

£438M £890 Apr-Jun Highlands & Islands Source: IPS 2018 Jul-Sept 35% 42% Flights

Market profile Origin of visitors UNITED STATES (Top 5) In 2018, the USA was Scotland's largest international visitor market new york by number of visits, number of nights and by visitor spend. illinois california florida visits in 2018 Seasonality of trip TExas Source: VisitScotland research 2018 Oct-Dec Jan-Mar 492,000 7% 16% top visited VALUE Average spend per visit regions £438m £890 Apr-Jun Highlands & Islands Source: IPS 2018 Jul-Sept 35% 42% Flights JFK Duration of stay Boston Newark 7% 1-3 nights Edinburgh Edinburgh & The Lothians Chicago 30% 4-7 nights 49% 8-14 nights Washington D.C 15% 15+ nights Greater Glasgow Philadelphia & Clyde Valley Source: IPS 2018 Top drivers or JFK Purpose of travel motivators Other History & Culture Planning & booking timeline priority Newark Glasgow 3% Visiting friends and relatives Scenery & Landscapes segments Planning lead time Orlando 22% My Scottish Ancestry “Always wanted to visit” 10 Sightseers Business Booking lead time Explorers Airline 9% Top activities Scotland Visitor Scotland Visitor Delta United American Virgin Holiday based on Charts Visiting cathedrals and churches, 5 Buzzseekers castles/historic houses, sightseeing, cities Source: 2015/16 Survey 67% Source: 3 year average IPS 2016-18 Source: Scotland Visitor Survey 2015/16 Months 2 4 6 8 10 As per VisitBritain research CUSTOMER JOURNEY Everyone has a bank of holiday hopes and ideas in their If the idea doesn't suit, it goes back into the soup and heads that bubble away, constantly being added to over they try another. Within this process, four main time. It's almost like a holiday soup. -

Giving Agents the Edge TB 2510 2019 Cover Wrap Layout 1 22/10/2019 17:40 Page 2 TB 2510 2019 Cover Layout 1 22/10/2019 14:56 Page 1

TB 2510 2019 Cover Wrap_Layout 1 22/10/2019 17:40 Page 1 October 25 2019 | ISSUE NO 2,128 | travelbulletin.co.uk Giving agents the edge TB 2510 2019 Cover Wrap_Layout 1 22/10/2019 17:40 Page 2 TB 2510 2019 Cover_Layout 1 22/10/2019 14:56 Page 1 October 25 2019 | ISSUE NO 2,128 | travelbulletin.co.uk Giving agents the edge WORLD TRAVEL MARKET Special Preview Edition Cover pic : london.wtm.com S01 TB 2510 2019 Start_Layout 1 23/10/2019 10:33 Page 2 S01 TB 2510 2019 Start_Layout 1 22/10/2019 16:55 Page 3 OCTOBER 25 2019 | travelbulletin.co.uk NEWS BULLETIN 3 THIS WEEK UNINSURED ABROAD 70% of Brits are not sure whether their travel insurance covers them if Brexit happens, according to research by Holiday Extras. 04 NEWS News from the industry to help agents book more great holidays 08 AGENT INSIGHT Sandy Murray writes about luggage challenges 12 EVENT BULLETIN Brits should ensure that their travel insurance is up to date post-Brexit, to avoid disasters while abroad. All the action from our latest Airline Showcase in pictures A NATIONWIDE study The nation is becoming discovered in September conducted by Holiday Extras increasingly concerned that that almost three quarters of found that cancellation of the usually swift process Brits are unsure if their travel flights, ferries and trains to from a UK airport to a insurance covers them for the continent is a real holiday destination in Europe Brexit disruptions, and that concern for travellers ahead might be a thing of the past, the percentage of travellers 15 of Britain’s proposed exit with 29% of Brits fearing postponing or cancelling from the European Union, hectic passport queues. -

Initial Call for Evidence Submissions

Initial Call for Evidence Submissions 2 / Infrastructure Commission for Scotland / Initial Call for Evidence Submissions Appendix D Initial Call for Evidence Submissions ICE001 Scottish Borders Council https://infrastructurecommission.scot/storage/41/ICE001.0-Scottish-Borders-Council-Response.pdf ICE002 Levenmouth Rail Campaign https://infrastructurecommission.scot/storage/42/ICE002.0-Levenmouth-Rail-Campaign-Response.pdf ICE003 NO SUBMISSION ICE004 Royal Scottish National Opera (RSNO) https://infrastructurecommission.scot/storage/44/ICE004-Royal-Scottish-National-Orchestra-Response.pdf ICE005 ZetTrans and Shetland Islands Council https://infrastructurecommission.scot/storage/45/ICE005-ZetTrans--Shetland-Islands-Council-Response.pdf ICE006 West HUB Scotland Ltd https://infrastructurecommission.scot/storage/46/ICE006-West-HUB-Scotland-Ltd%2C-Response.pdf ICE007 Arancha Arnal Response https://infrastructurecommission.scot/storage/47/ICE007-Arancha-Arnal-Response.pdf ICE008 Colin Jack https://infrastructurecommission.scot/storage/48/ICE008-Colin-Jack%2C-Response.pdf ICE009 Aileen Grant https://infrastructurecommission.scot/storage/49/ICE009-Aileen-Grant%2C-Response.pdf ICE010 Falkirk Council https://infrastructurecommission.scot/storage/50/ICE010-Falkirk-Council%2C-Response.pdf ICE011 Scottish Carbon Capture https://infrastructurecommission.scot/storage/51/ICE011-Scottish-Carbon-Capture.pdf ICE012 Network Rail https://infrastructurecommission.scot/storage/52/ICE012-Network-Rail.pdf ICE013 Scottish Futures Trust https://infrastructurecommission.scot/storage/53/ICE013-SFT.pdf -

Place-Based Working in Scotland Six Month Summary Report

Place-based working in Scotland Six Month Summary Report Convened by – Corra Foundation Sponsored by – Scottish Government Specific research provided by – Collaborate and EKOS Consulting 1 Contents Sections Page Place-Based Working in Scotland – Introduction and purpose 3 What Makes Place-based Working Effective? 5 Case studies – a summary 8 Quantitative Research – a summary 12 27th March Event – a summary and next steps 14 What did we do (in more detail)? 15 What worked well and what could be improved? 19 Annex 1 – List of individuals in the cross-sector group 20 Annex 2 – 13th December pre-reading agenda paper 21 Annex 3 – 13th December output: Landscape, Regime and Niche 24 Annex 4 – 16th January pre-read paper: Measurement 29 Annex 5 – 16th January output: arguments and counter arguments 31 Annex 6 – 25th January pre-read paper: Place Principles 34 Annex 7 – 15th February pre-read paper: planning for the 27 March 36 Annex 8 – Emerging Themes and Tables from Event Report 27 March 37 2 Place-Based Working in Scotland – introduction and purpose Place-based work (PBW) has been undertaken in Scotland over decades, there have been surges of activity in the past, particularly around urban regeneration, and on-going work undertaken by individual communities, notably in the Highlands and Islands. That work continues, and in recent times has been given new impetus because of economic challenges for government and recognition, crystallised by the Christie Commission, of the need for preventative approaches to long-term, deep-seated issues. The question posed for this project’s work is: can place-based working in Scotland be made more effective? This required assessment of what place-based working currently is in Scotland, whether there could be improvements made, and what those might be. -

United Kingdom

298 United Kingdom Tourism in the economy Tourism is a major part of the United Kingdom economy. In 2017, the Tourism Satellite Account estimated a direct contribution of GBP 59.7 billion in GVA, 3.2% of total GVA. Tourism is growing at a faster rate than the overall UK economy and an additional 9 million visitors are forecast by 2025. In 2015, 1.6 million jobs were directly attributable to tourism. When considering jobs in tourism-related industries, this figure rises to approximately 3 million, or one in ten of all jobs. Travel exports represented 12.2% of total service exports in 2018. In 2018, there were 37.9 million visits to the UK, a slight decrease on the record set in 2017, with related spending of GBP 22.9 billion. The top ten markets accounted for 63% of visits and 51% of spending. The top five markets by visitor volume were the United States, France, Germany, Ireland, and Spain. London receives half of all inbound visits to the United Kingdom, 19.1 million visits in 2018, with 18.8 million overnight stays outside of London. Scotland welcomed 3.5 million and Wales 941 000 visits. Northern Ireland received 2.8 million overnight trips from external visitors, including those from elsewhere in the United Kingdom. The overall volume of overnight domestic trips taken in Great Britain in 2018 decreased by 1.7% to 118.6 million, but related expenditure rose marginally by 1.1% to GBP 23.9 billion. Tourism governance and funding The Department for Digital, Culture, Media and Sport (DCMS) is the sponsoring body for tourism in the United Kingdom.