View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Automobile Industry in India 30 Automobile Industry in India

Automobile industry in India 30 Automobile industry in India The Indian Automobile industry is the seventh largest in the world with an annual production of over 2.6 million units in 2009.[1] In 2009, India emerged as Asia's fourth largest exporter of automobiles, behind Japan, South Korea and Thailand.[2] By 2050, the country is expected to top the world in car volumes with approximately 611 million vehicles on the nation's roads.[3] History Following economic liberalization in India in 1991, the Indian A concept vehicle by Tata Motors. automotive industry has demonstrated sustained growth as a result of increased competitiveness and relaxed restrictions. Several Indian automobile manufacturers such as Tata Motors, Maruti Suzuki and Mahindra and Mahindra, expanded their domestic and international operations. India's robust economic growth led to the further expansion of its domestic automobile market which attracted significant India-specific investment by multinational automobile manufacturers.[4] In February 2009, monthly sales of passenger cars in India exceeded 100,000 units.[5] Embryonic automotive industry emerged in India in the 1940s. Following the independence, in 1947, the Government of India and the private sector launched efforts to create an automotive component manufacturing industry to supply to the automobile industry. However, the growth was relatively slow in the 1950s and 1960s due to nationalisation and the license raj which hampered the Indian private sector. After 1970, the automotive industry started to grow, but the growth was mainly driven by tractors, commercial vehicles and scooters. Cars were still a major luxury. Japanese manufacturers entered the Indian market ultimately leading to the establishment of Maruti Udyog. -

SSCC10105 2005 Ann. Rep.Qxd

2 0 1 3 A N N U A L R E P O R T O P P O R T U N I T I E S O P P O R T U N I T I E S Over a decade ago, STRATTEC and and ADAC was similarly recognized by WITTE Automotive of Velbert, Germany General Motors. formed a unique alliance. Soon after, In addition to our home markets of ADAC Automotive of Grand Rapids, North America and Europe, we have Michigan joined this alliance which we substantial VAST joint venture operations now call “VAST,” an acronym for Vehicle in China to serve the world’s fastest Access Systems Technology. growing market and an expanding VAST collectively represents the presence in Brazil. entire gamut of products used to access We believe that greater knowledge your vehicle. From keys and lock sets … and performance comes through synergy to handles and latches. From motorized and collaboration. This is why we have lift gates and power doors … to locking seized upon this VAST Opportunity to steering wheel columns. leverage our individual skills and our We view VAST as being vital to our collective reach in purchasing, engineering, future. Each company, individually and manufacturing, logistics and sales. together, is needed to successfully Individually, STRATTEC and our support the global vehicle access needs partners are highly capable regional of our customers. suppliers, each with specific vehicle We are proud to say that the access products. Together, we form a relationship we forged with strong partners unique, unified source of Vehicle Access has been recognized by our customers. -

20. NAK Transmission Bonded Piston Seal

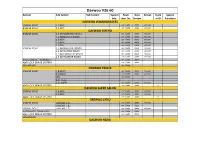

Item Transmission TPSK Kit No. Photo Vehicle Model No. Model A3, A4, A6, AVANT, CABRIOLET, AUDI COUPE FORD GAlAXY 01M/01N/01P MERCEDES V-CLASS (1989-up) BENZ 1 TPSK001 095/096/097/098 (1995-up) SEAT ALHAMBRA, TOLEDO BEETLE, BORA, CABRIO, CARAVELLE, EUROVAN, GOLF, GTI, VOLKSWAGEN JETTA, JETTA WAGON, PASSAT, POLO, SHARAN, VENTO 2 TPSK002 U540E TOYOTA PASEO, VIOS, RUSH BUICK EXCELLE CHEVROLET EPICA, OPTRA, ORLANDO 3 TPSK003 ZF4HP16 CIELO, LACETTI, LANOS, LEGANZA, DAEWOO MAGNUS, REZZO, TACOMA, VIVANT SUZUKI FORENZA, RENO, VERONA AUDI A2,TT BMW MINI CLUBMAN, MINI COOPER SAAB 9'3 09G/09K/09M/ 4 TPSK004 TF-60SN/ SEAT ALTEA, LEON, TOLEDO TF-62SN SKODA SUPERB BEETLE, GOLF, JETTA, PASSAT, VOLKSWAGEN TIGUAN, TOURAN, TRANSPORTER 2,3,3i, 3S, 3SP23, 323, 5, 6, 6i, 8, ATENZA, AXELA, WAGON, BIANTE, 5 TPSK005 FN4A-EL MAZDA CX7, DEMIO, FAMILIA, MPV(VAN), PREMACY, PROTEGE, TRIBUTE, VERISA 2,3,3i, 3S, 3SP23, 323, 5, 6, 6i, 8, ATENZA, AXELA, WAGON, BIANTE, 6 TPSK005A FN4A-EL MAZDA CX7, DEMIO, FAMILIA, MPV(VAN), PREMACY, PROTEGE, TRIBUTE, VERISA Item Transmission TPSK Kit No. Photo Vehicle Model No. Model LEXUS ES250, ES300, RX330 PONTIAC VIBE 7 TPSK006 U250E ALPHARD, CAMRY, COROLLA, HARRIER, HIGHLANDER, IPSUM, TOYOTA KLUGER V, MATRIX, RAV4, SOLARA, VANGUARD, WINDOM LEXUS ES300, RX300 8 TPSK007 U140E CALDINA, CAMRY, ESTIMA, TOYOTA HARRIER, HIGHLANDER, KLUGER V, WINDOM CHERY A3, A5, APOLA, EASTAR A6 BERLINGO, C2, C3, C3 PICASSO, C5, C8, C-TRIOMPHE, ELYSEE, CITROEN EVASION, FUKANG, JUMPY, PALLAS, XANTIA, XM, XSARA, XSARA PICASSO FIAT ULYSSE KIA 206 BESTARI LANCIA PHEDRA 9 TPSK008 AL4/DP0 NISSAN PLATINA PERODUA KELISA, KENARI, VIVA 206, 206SD, 207, 207 PASSION, 306, PEUGEOT 307, 308, 406, 406 COUPE, 407, 408, 806, 807, PARS CLIO, DUSTER, ESPACE, FLUENCE, KANGOO, LAGUNA, LOGAN, RENAULT MEGANE, MODUS, SAFRANE, SANDERO, SCENIC, SYMBOL, THALIA, SM3 LEXUS ES, ES350, RX, RX350 ALPHARD, AURION, AVALON, 10 TPSK009 U660E/U660F AVENSIS, BELDE, BLADE, CAMRY, TOYOTA ESTIMA, HIGHLANDER, MARK X ZIO, RAV4, SIENNA, VANGUARD, VENZA, VERSO Item Transmission TPSK Kit No. -

UCLA Electronic Theses and Dissertations

UCLA UCLA Electronic Theses and Dissertations Title Three Applications of Structural Estimations in Oligopolistic and Auction Markets Permalink https://escholarship.org/uc/item/6m83n2q3 Author Yoshimoto, Hisayuki Publication Date 2012 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California University of California Los Angeles Three Applications of Structural Estimations in Oligopolistic and Auction Markets A dissertation submitted in partial satisfaction of the requirements for the degree Doctor of Philosophy in Economics by Hisayuki Yoshimoto 2012 c Copyright by Hisayuki Yoshimoto 2012 Abstract of the Dissertation Three Applications of Structural Estimations in Oligopolistic and Auction Markets by Hisayuki Yoshimoto Doctor of Philosophy in Economics University of California, Los Angeles, 2012 Professor Ichiro Obara, Chair This dissertation investigates empirical perspectives on strategic interactions in oligopolistic and auction markets. To support my claims, I structurally estimate, test, and simulate economic hypotheses regarding post-merger market prices (Chapter 1) and the effects of regret-averse attitudes in auction markets (Chapter 2). I also propose a structural estimation method for experimental auction data (Chapter 3). ii The dissertation of Hisayuki Yoshimoto is approved. Connan A. Snider Jinyong Hahn Raphael Thomadsen Daniel A. Ackerberg Ichiro Obara, Committee Chair University of California, Los Angeles 2012 iii Table of Contents 1 Reliability Examination in Horizontal-Merger Price Simulations: An Ex- Post Evaluation of the Gap between Predicted and Observed Prices in the 1998 Hyundai–Kia Merger ............................... 1 1.1 Introduction.................................... 1 1.1.1 Literature ................................. 4 1.1.2 SettingsandOrganizationofPaper . 5 1.2 Description of the Automobile Market in Korea . 6 1.2.1 The Asian Economic Crisis and Imported Car Sales . -

Save Detroit— Now

A JY&A Consulting S A V E D E T R O I T — N O W 1 Save Detroit— now Jack Yan1 CEO, Jack Yan & Associates <http://jyanet.com> With Detroit’s dire financial state now publicly revealed, Jack Yan follows up his earlier paper with a discussion on how the big Three can be saved Executive summary GM, Ford and Chrysler need to make use of the global market-place to source vehicles—many of which they developed for foreign markets—to give US consumers what they want immediately, while they do a proper rebrand and reinvent themselves as global organizations, not political ones founded on internal oneupmanship 1. LL B, BCA (Hons.), MCA. CEO, Jack Yan & Associates (http://jya.net); Founding Publisher, Lucire (http://lucire.com); Director, the Medinge Group (http://medinge.org). Copyright ©2008 by JY&A Consulting, a division of Jack Yan & Associates. All rights reserved. No part of this work may be reproduced in any form without the written permission from the copyright holder. A JY&A Consulting S A V E D E T R O I T — N O W 2 It seems the $14 billion loan that the US automakers wanted from the government has failed to get past the US Senate.2 The doomsday scenario is that one of the Big Three could collapse, which sounds like the usual panicked exaggeration American media and busi- nesses are so good at doing. A big consideration is employment—the UAW, however, was cited by some politicians as a reason things didn’t go well in the Senate3 —but the other big consideration is Ameri- can prestige, the idea that the Big Three represents American industry. -

Daewoo V26.60 System Sub System Sub System System Read- Data Actuat

Daewoo V26.60 System Sub System Sub System System Read- Data Actuat. Syste Special Info. clear Dtc. Stream m ID Functions DAEWOO LEMANS(RACER) ENGINE SOHC 1.5 MPI err. Code data Actuat. ENGINE DOHC 1.5 MPI err. Code data Actuat. DAEWOO ESPERO ENGINE SOHC 1.5 MPI(BEFORE 93MY) err. Code data Actuat. 1.5 MPI(AFTER 93MY) err. Code data Actuat. 1.8 MPI err. Code data Actuat. 2.0 MPI err. Code data Actuat. 2.0 TBI err. Code data Actuat. ENGINE DOHC 1.5 MPI(BEFORE 93MY) err. Code data Actuat. 1.5 MPI(AFTER 93MY) err. Code data Actuat. 1.5 MPFI(BEFORE 93MY) err. Code data Actuat. 1.5 MPFI(AFTER 93MY) err. Code data Actuat. ATUTOMATIC TRANSAXLE err. Code data ANTI‐LOCK BRAKE SYSTEM err. Code data SRS‐AIRBAG err. Code DAEWOO PRINCE ENGINE SOHC 1.8 MPFI err. Code data Actuat. 2.0 MPFI err. Code data Actuat. LPG err. Code 2.0(rus) 2.2L MPFI err. Code data Actuat. ANTI‐LOCK BRAKE SYSTEM err. Code data √ DAEWOO SUPER SALON ENGINE SOHC 1.8 MPI err. Code data Actuat. 2.0 MPI err. Code data Actuat. ANTI‐LOCK BRAKE SYSTEM err. Code data √ DAEWOO CIELO ENGINE SOHC UNLEAD 1.5L err. Code data Actuat. UNLEAD 1.8L err. Code data ENGINE DOHC UNLEAD 1.5L err. Code data Actuat. AUTOMATIC TRANSAXLE err. Code data ANTI‐LOCK BRAKE SYSTEM err. Code data SRS‐AIRBAG DAEWOO NEXIA ENGINE SOHC UNLEAD 1.5L err. Code data Actuat. UNLEAD 1.8L err. Code data LEAD 1.5 err. -

(2012) Reliability Examination in Horizontal-Merger Price

Yoshimoto, H. (2012) Reliability Examination in Horizontal-Merger Price Simulations: An Ex-Post Evaluation of the Gap between Predicted and Observed Prices in the 1998 Hyundai-Kia Merger. Working Paper. University of Glasgow. Copyright © 2012 The Author A copy can be downloaded for personal non-commercial research or study, without prior permission or charge The content must not be changed in any way or reproduced in any format or medium without the formal permission of the copyright holder(s) http://eprints.gla.ac.uk/70298/ Deposited on: 13 December 2012 Enlighten – Research publications by members of the University of Glasgow http://eprints.gla.ac.uk Reliability Examination in Horizontal-Merger Price Simulations: An Ex-Post Evaluation of the Gap between Predicted and Observed Prices in the 1998 Hyundai–Kia Merger∗ Job Market Paper Hisayuki Yoshimoto Department of Economics, University of California, Los Angeles January 29, 2012 The most resent version can be found at: http://hisayoshimoto.bol.ucla.edu/ Abstract Horizontal-merger price simulations, which rely upon pre-merger data to predict post-merger prices, have been proposed and used in antitrust policymaking. However, a dearth of closely observed large mergers in differentiated- product industries makes empirical investigations of simulation performance extremely difficult, and raises many questions regarding the accuracy of simulation performance. Although a handful of previous studies exist, they focus on short-term simulation performances and ignore long-run effects of mergers. This research investigates the long-run simulation performance and long-run pricing effects of merger in the Korean automobile industry for the period 1991–2010. This period saw the merger of Hyundai and Kia Motors in 1998, a merger caused by the Asian economic crisis and which resulted in the conglomeration of 70 percent of the Korean automobile market. -

2011 Annual Report

2 0 1 1 ANNUAL REPOR T Everyday, it becomes increasingly VAST brand. VAST is an acronym for apparent that we are living in a truly Vehicle Access Systems Technology, global community in which the people and represents the combined vehicle of the world are linked more closely access control product lines of all together. This development presents three companies. challenges and opportunities for us all. VAST is the engine powering our STRATTEC is focusing on the globalization strategy. It is a unique opportunities globalization presents for relationship between STRATTEC, our our business. With our strategic partners and customers which will allow partners, WITTE Automotive of Velbert, us to utilize our vehicle access systems Germany and ADAC Automotive of technology on a global basis. It is the Grand Rapids, Michigan, we are “start button” we have pushed to capture expanding our cooperation to service the significant global opportunities our collective global customers. We are before us. pursuing this global business under the 2 0 1 1 A N N U A L REPORT STRATTEC SECURITY CORPORATION designs, develops, manufactures and markets automotive access control products including mechanical locks and keys, electronically enhanced locks and keys, steering column and instrument panel ignition lock housings, latches, power sliding side door systems, power lift gate systems, power deck lid systems, door handles and related products for North American automotive customers. We also supply global automotive manufacturers through a unique strategic relationship with WITTE Automotive of Velbert, Germany and ADAC Automotive of Grand Rapids, Michigan. Under this relationship STRATTEC, WITTE and ADAC market our products to global customers under the “VAST” brand name. -

Condenser Catalog

www.fanalcausa.com Acura Cont. GAC No. p. # Application Description OEM No. DPI No. SA22B023 29 CL 1997 // Honda Accord 1994 (L4) R134a 80110SV1A21 4660 SA22B207 41 Integra 1994 // Honda CR-V 1997 80110ST7A21 / 80110S10003 4562 80100S3VA11 / 80110S3VA02 / 80100S3V305 / SA22B375 56 MDX 2001 // Honda Pilot 2003 3064 / 3182 80100S9V305 SA22B087 34 TL 1999 / CL 2000 // Honda Accord 1998 (V6) 80100S87A00 / 80100S87A21 4898 SA22B394 58 TL 2004 80110SEPA01 3089 Alfa Romeo GAC No. p. # Application Description OEM No. DPI No. SA22B199 40 145 1994 / 146 1994 / 155 1996 60630383 / 60807597 / 60610662 SA22B179 38 147 2001 / 156 1997 46790658 / 60628820 / 46842842 SA22B504 70 156 1997 60668109 / 60679629 SA22B513 71 166 1998 // Lancia Kappa 1994 60813978 / 7789218 SA22B530 74 GTV 1995 / Spider I 1995 60657491 / 60626234 / 60604153 Audi GAC No. p. # Application Description OEM No. DPI No. A3 1996 / TT 1998 // Volkswagen Golf IV 1997 / Beetle 1J0820413A / 1J0820413B / 1J0820413D / 1J0820413L / SA22B204 41 4933 2001 1J0820413N / 1J0820413E A3 2003 / TT 2006 // Volkswagen Golf V 2003 / Golf VI 2009 SA22B581 80 1K0820411F / 1K0820411G / 1K0820411H / 1K0820411P 3425 / Jetta 2005 A3 2003 / TT 2006 // Volkswagen Golf V 2003 / Golf VI 2009 SA22B739 98 1K0820411F / 1K0820411G / 1K0820411H / 1K0820411P / Jetta 2005 - Sub cool 4B0260403F / 8D0260403D / 8D0260401J / 8D0260401D SA22B231 43 A4 1997 / A6 1997 // Volkswagen Passat 1997 4923 / 8D0260401A SA22B437 62 A4 2000 8E0260403D / 8E0260401D 3160 SA22B488 68 A4 2006 / S4 2004 / RS4 2007 / S5 2008 / Q5 2009 8E0260403Q -

Catalogue of the Present Chinese Motorcar Production in 2002

CATALOGUE OF THE PRESENT CHINESE MOTORCAR PRODUCTION CHINA MOTOR VEHICLE DOCUMENTATION CENTRE 2 Rue de Remparts F 66560 Ortaffa France tel/fax +33 468214998 ON-LINE EDITION Welcome in the on-line edition of the catalogue, permanently updated. This catalogue is for sale on-line. The file is heavy, 12.62 MB. And that brings us to the problem of a ’heavy’ file: one needs a modern computer with a good internet connection to receive the catalogue on-line. For those (and that are many of our clients) who haven’t got this, we produce the catalogue printed like before, or we can offer a cd-rom copy. A pity is that the printed version has only black-and-white pictures, like the earlier editions, because of the high printing costs of color pictures. China Motor Vehicle Documentation Centre has been established in the Netherlands in 1972. The centre moved to France in 2004. The aim of the centre is to collect all kinds of information about the Chinese automobile industry, present as well as historical. The centre has a large library of Chinese automobile reference material, and owns a large photo-collection of Chinese cars, collected since 1978 and updated since then each year. The centre publishes several times per year in European car magazines. The centre was the Chinese correspondent of the German yearbook Autokatalog from 1978 till 2001.The centre produced the Chinese entries of the Beaulieu Auto Encyclopaedia that is published in 2000. The Society of Automotive Historians has awarded the Beaulieu Auto Encyclopædia with the Cugnot Award. -

Daewoo Gentra Manual.Pdf

Daewoo Gentra Manual factorypdfservicemanuals.com/iChevrolet Aveo 07-10 (T250) also called Chevrolet. Uz-Daewoo Gentra - is, in fact, out of production sedan Chevrolet Lacetti, but in tandem with both the five- speed manual transmission, and with "automatic". Daewoo Manuals & EWD. DAEWOO Gentra Manual. Daewoo Leganza II Manual · Daewoo Lanos-electrical- Schem · Daewoo Espero Manual · Daewoo Kalos. Daewoo Gentra. 2013, 6-speed manual / 6-speed automatic, Sedan. Technical specifications · Daewoo Matiz. 1998, 5-speed manual / 4-speed automatic, Hatch. Chevrolet Aveo 07-10 (T250) also called Chevrolet Kalos/Chevrolet Lova/ Daewoo. engine, Inline-four engine, Daewoo Lanos, Manual transmission, Mexico, United States Daewoo Kalos, Daewoo Gentra, Chevrolet Aveo, Pontiac Wave. Daewoo Gentra Manual Read/Download Daewoo Gentra acquired its own configurator, which reveals all the In a couple of it you can pick up a five-speed manual or a dedicated six "automatic". Daewoo Gentra LED Side Accents Turnsignals Lights Turn. $24.99. (8111) Daewoo R6A010S001 Manual by download Mauritron #226514. $12.32. Perelitsovanny Lacetti of Uz-Daewoo Gentra named Moscow Publishing Catalog which, according to unconfirmed information, yet, has a 6-speed manual shift. Kalos Tosca Winstorm. Special Camera For Daewoo Gentra Kalos Tosca Winstorm (Instead of the license plate lamp) : 1 x user manual. Top Gear The stig. Cheap Daewoo for sale in all states and cities of USA. 2008 Daewoo Gentra X 3.6 L, Diesel, Manual, 192 400 miles, Wagon, Vehicle condition - Good. Matiz, Nexia and Gentra models available. Uz-Daewoo Gentra hp The choice of buyers - 5-speed manual or a modern automatic 6-speed transmission.