MPC Annual Report 2012 With

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Perspectives on Climate-Related Scenarios Risks and Opportunities Table of Contents

October 2019 Perspectives on Climate-Related Scenarios Risks and Opportunities Table of Contents 3 Letter from the Chairman and CEO 36 Metrics and Performance Data 4 About MPC 37 Managing Physical Risks to Our Facilities 6 Introduction 41 Conclusions 7 Governance and Risk Management 43 Endnotes 10 Climate Scenario Planning 43 Forward-looking Statements 30 Energy Strategy and Performance GLOSSARY OF TERMS barrel: 42 U.S. gallons — a common volume ERM: Enterprise Risk Management measure for crude oil and petroleum products GHGs: Greenhouse gases, such as carbon dioxide barrel of oil equivalent or boe: is a unit of energy and methane based on the energy released by burning one barrel IEA: International Energy Agency of crude oil or 5.8 million British thermal units. IEA’s CPS: Current Policies Scenario bpcd: barrels per calendar day — the average of how much crude oil or other feedstock a refinery IEA’s NPS: New Policies Scenario processes over a period of time, divided by the IEA’s SDS: Sustainable Development Scenario number of days in that period, typically 365 days (a LNG: Liquefied natural gas common rate measure for petroleum refineries) LPG: Liquefied petroleum gases bpd: barrels per day — a common rate measure for crude oil and petroleum products Tonne or metric ton: 2,205 pounds Carbon dioxide equivalent is a common unit MPC: Marathon Petroleum Corporation CO2e: of measurement converting all greenhouse gases NGL: Natural gas liquid — a light hydrocarbon to carbon dioxide. MPC calculates CO2e emissions liquid often produced with natural gas using the EPA factors identified in Equation A-1 in Scope 1 Emissions: All direct GHG emissions by 40 CFR Part 98. -

Louisiana Crude Oil Refinery Survey Report: Eleventh Edition

LOUISIANA CRUDE OIL REFINERY SURVEY REPORT Eleventh Edition Louisiana Fiscal Year 1999 Survey by Sam Stuckey, P.E. Refining, Alternative Energy & Power Systems Program LOUISIANA DEPARTMENT OF NATURAL RESOURCES Jack C. Caldwell Secretary of Natural Resources Technology Assessment Division T. Michael French, P.E. Director Baton Rouge, Louisiana November 15, 1999 This edition of Louisiana Crude Oil Refinery Survey Report is funded 100% ($320.30) with Petroleum Violation Escrow funds as part of the State Energy Conservation Program as approved by the U.S. Department of Energy and Louisiana Department of Natural Resources. This public document was published at a total cost of $320.30. 300 copies of this public document were published in this first printing at a total cost of $320.30. The total cost of all printings of this document, including reprints, is $320.30. This document was published by the Department of Natural Resources, 625 N. 4th Street, Baton Rouge, LA, to promulgate the State Energy Conservation Plan developed under authority of P.L. 94-163. This material was printed in accordance with the standards for printing by State agencies established pursuant to R.S. 43:31. Printing of this material was purchased in accordance with the provisions of Title 43 of the Louisiana Revised Statutes. -ii- TABLE OF CONTENTS PAGE FOREWORD ......................................................... 1 DISCUSSION ......................................................... 3 DEFINITIONS ......................................................... 33 FIGURES 1 Location Map of Louisiana Refineries ..................................... 2 2 Operating Rates of Louisiana, Texas Gulf Coast, and all U.S. Refineries 1989-1999 .................................................................................. 17 3 Operating Capacity of Louisiana and U.S. Refineries 1947-1999 .................. 21 4 Louisiana Oil Production and Refinery Operating Capacity 1900-1998 ........................................ -

Bakken Production Optimization Program Prospectus

Bakken Production Optimization Program BAKKEN PRODUCTION OPTIMIZATION PROGRAM 2.0 PROSPECTUS PROGRAM INTRODUCTION Led by the Energy & Environmental Research Center (EERC), the highly successful Bakken Production Optimization Program (BPOP), funded by its members and the North Dakota Industrial Commission, is continuing for the time frame of 2017–2020. The goal of this research program, BPOP 2.0, is to improve Bakken system oil recovery and reduce its environmental footprint. The results of the 3-year program will increase well productivity and the economic output of North Dakota’s oil and gas resources, decrease environmental impacts of wellsite operations, and reduce demand for infrastructure construction and maintenance. BPOP 1.0 PARTNERS A premier partnership program was recently completed which has been cited as an exemplary model by others nationwide. It has demonstrated that state lawmakers, state regulators, and industry can work together for positive results for shareholders and taxpayers alike. Phase I partners focused research on industry-driven challenges and opportunities. Continental Resources, Inc. ® Marathon Oil Corporation America’s Oil Champion Whiting Petroleum Corporation North Dakota Oil and Gas Research Program ConocoPhillips Company Nuverra Environmental Solutions Hitachi Hess Corporation Oasis Petroleum, Inc. SM Energy XTO Energy, Inc. BPOP 1.0 ACHIEVEMENTS (2013–2016) Continental’s Hawkinson Project Water Use and Handling Forecast Aimed at significantly increasing total production and A summary of trends in the Bakken, an estimation of production rates from North Dakota oil wells where oil future demand/disposal needs, an overview of treatment reserves of the second and third benches of the Three technologies, recycling/reuse considerations, and a Forks Formation, located just below the Bakken oil summary of implications for BPOP partners were created. -

Marathon Agreement

UNITED STATES OF AMERICA BEFORE THE FEDERAL TRADE COMMISSION __________________________________________ ) In the Matter of ) ) Marathon Petroleum Corporation, ) a corporation, ) ) Express Mart Franchising Corp., ) File. No. 181-0152 a corporation, ) ) Petr-All Petroleum Consulting Corporation, ) a corporation, and ) ) REROB, LLC, ) a limited liability company. ) __________________________________________) AGREEMENT CONTAINING CONSENT ORDERS The Federal Trade Commission (“Commission”) has initiated an investigation of the proposed acquisition by Respondent Marathon Petroleum Corporation, through its wholly owned subsidiary, Speedway LLC (collectively “Marathon”), of retail fuel outlets from Respondents REROB, LLC, Petr-All Petroleum Consulting Corporation, and Express Mart Franchising Corp. (collectively “Proposed Respondents”). The Commission’s Bureau of Competition has prepared a draft administrative complaint (“Draft Complaint”). The Bureau of Competition, Proposed Respondents, and Sunoco LP (“Sunoco”) enter into this Agreement Containing Consent Orders (“Consent Agreement”) to divest certain assets and providing for other relief to resolve the allegations in the Draft Complaint through a proposed Decision and Order and Order to Maintain Assets, all of which are attached, to present to the Commission. IT IS HEREBY AGREED by and between Proposed Respondents and Sunoco, by their duly authorized officers and attorneys, and counsel for the Commission that: 1. Proposed Respondent Marathon Petroleum Corporation is a corporation organized, existing, and doing business under, and by virtue of, the laws of the State of Delaware, with its office and principal place of business located at 539 South Main Street, Findlay, Ohio 45840. 2. Proposed Respondent Express Mart Franchising Corp. is a corporation organized, existing, and doing business under, and by virtue of, the laws of the State of New York, with its office and principal place of business located at 7401 Round Pond Road, Syracuse, New York 13212. -

Whiting Petroleum Corporation and Our Ability to Grow MMBOE: One Million BOE

Whiting Petroleum Corporation ANNUAL REPORT 8 0 0 2 NATU RAL HUM+AN Resources ABOUT THE COVER Having assembled a solid foundation of quality assets through acquisition, we are now more focused on organic drilling activity and on the development of previously acquired properties. We believe that our experienced team of management, engineering and geoscience professionals is generating superior results as evidenced by our reserves and production growth in the Bakken formation in North CONTENTS Dakota and our two CO 2 enhanced oil recovery projects. Corporate Profile 1 From our Bakken play in North Dakota, our average net daily production jumped 516% to 14,165 BOE in December 2008 Financial and Operations Summary 2 from 2,300 BOE in December 2007. We also completed Letter to the Shareholders 4 our first two infill wells in the Sanish field, which we believe Drilling and Operations Overview 7 adds a total of 78 potential infill well locations. Also of note was our first Three Forks horizontal well completion in the Northern Rockies 8 Sanish field. Production and pressure data from this well are Central Rockies 10 being analyzed to determine the viability of developing the Three Forks in the Sanish field. EOR Projects 12 Board of Directors 14 At our two EOR projects, our average net daily production Annual Report on Form 10-K 15 from the Postle and North Ward Estes fields increased 26% to 13,700 BOE in December 2008 from 10,900 BOE in Corporate Investor Information Inside back cover December 2007. We expect production from both EOR projects to continue to increase as 2009 progresses. -

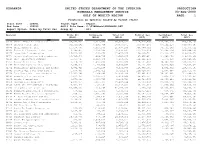

Ranking Operator by Gas 1999

PDRANKOP UNITED STATES DEPARTMENT OF THE INTERIOR PRODUCTION MINERALS MANAGEMENT SERVICE 03-AUG-2000 GULF OF MEXICO REGION PAGE: 1 Production by Operator Ranked by Volume (4120) Start Date : 199901 Report Type : Report End Date : 199912 ASCII File Name: C:\TIMSWork\PDRANKOP.DAT Report Option: Order by Total Gas Group By : All Operator Crude Oil Condensate Total Oil Natural Gas Casinghead Total Gas (BBLS) (BBLS) (BBLS) (MCF) (MCF) (MCF) 02140 Shell Deepwater Production Inc. 85,672,533 9,411,739 95,084,272 245,810,790 213,353,317 459,164,107 00078 Chevron U.S.A. Inc. 50,545,262 6,292,709 56,837,971 353,305,284 87,102,210 440,407,494 00689 Shell Offshore Inc. 15,438,780 6,417,500 21,856,280 300,789,310 30,544,202 331,333,512 00003 Union Oil Company of California 6,344,477 2,334,388 8,678,865 253,150,024 15,694,524 268,844,548 00276 Exxon Mobil Corporation 16,626,406 1,243,669 17,870,075 168,330,701 51,313,377 219,644,078 00771 Texaco Exploration and Production Inc 10,785,640 1,908,736 12,694,376 187,865,901 31,396,468 219,262,369 00114 Amoco Production Company 1,853,723 2,410,438 4,264,161 182,121,250 1,573,019 183,694,269 01855 Vastar Resources, Inc. 7,750,730 1,435,200 9,185,930 114,537,982 34,747,390 149,285,372 01364 Newfield Exploration Company 4,368,048 2,162,039 6,530,087 132,431,383 10,633,590 143,064,973 02332 PennzEnergy Exploration and Production 5,772,629 3,160,145 8,932,774 118,870,351 9,572,802 128,443,153 00491 Coastal Oil & Gas Corporation 1,038,860 1,682,412 2,721,272 119,028,667 2,687,097 121,715,764 02219 Kerr-McGee Oil & Gas Corporation 13,307,198 1,569,590 14,876,788 102,681,653 14,762,861 117,444,514 00185 Samedan Oil Corporation 2,673,355 2,285,513 4,958,868 104,938,141 7,424,318 112,362,459 00105 Apache Corporation 6,574,028 1,660,755 8,234,783 92,723,545 12,356,983 105,080,528 00059 Amerada Hess Corporation 9,001,254 7,825,335 16,826,589 76,749,036 23,640,310 100,389,346 00540 MOBIL OIL EXPLORATION & PRODUCING SOUT 8,967,820 1,142,597 10,110,417 88,168,916 11,699,694 99,868,610 01680 BP Exploration & Oil Inc. -

Marathon Petroleum's Galveston Bay Division

Case Study Marathon Petroleum’s Galveston Bay Division Embarks on Multi-Year Upgrade Path “Our first challenge is to create a new infrastructure that we can build on for Levels 1, 2 and 3. Because Honeywell has extended the life of certain products, we can migrate portions of our old antiquated systems slowly, giving us time to migrate such things as HPMs.” - Marcos Espinosa, Marathon Petroleum Corp., Galveston Bay Refinery Background The Galveston Bay Refinery began operation in 1934 as a Pan Headquartered in Findlay, Ohio, Marathon Petroleum Corpora- American Oil refinery and was later purchased by Amoco. In tion (MPC), together with its subsidiaries, including Marathon 1998, refinery ownership changed as Amoco Oil merged with BP. Petroleum Company LP, Speedway LLC and MPLX LP, is one of Since 2005, the refinery has undergone significant renovation the largest petroleum product refiners, marketers and transpor- and upgrades to units and site infrastructure. MPC purchased the ters in the United States. refinery from BP on February 1, 2013. MPC is the nation’s fourth-largest refiner and the largest refiner in Operations include crude distillation, hydrocracking, catalytic the Midwest. Its refining, marketing and transportation operations cracking, hydrotreating, reforming, alkylation, aromatics extrac- are concentrated primarily in the Midwest, Gulf Coast and South- tion, sulfur recovery and coking east regions of the U.S. Benefits MPC operations are strategically located to serve major markets. Since this upgrade effort is in progress, over a significant time- They include a seven-plant refining network, a comprehensive frame, benefits can be stated in terms of expectations. The instal- terminal and transportation system, and extensive wholesale and lation and implementation will provide the foundation for several retail marketing operations. -

Marathon Oil Corporation Creates Value by Responsibly Producing Oil and Natural Gas Vital to Meeting Growing Global Energy Needs

Create, Grow, Sustain: BUSINESS ROUNDTABLE Celebrating Success 2014 SUSTAINABILITY REPORT Marathon Oil Corporation creates value by responsibly producing oil and natural gas vital to meeting growing global energy needs. In doing so, we act responsibly toward our shareholders and business partners, support those who work for us, and strive to improve the communities where we operate. www.marathonoil.com/lov2012/index.shtml Our goal is to be recognized as the premier independent exploration and production company, and to accomplish this, we must successfully execute the strategic imperatives that guide our efforts. These imperatives begin with an uncompromising focus on our long-standing core values of health and safety, environmental stewardship, honesty and integrity, corporate citizenship, and a high-performance team culture. Our values help us protect our license to operate and drive business performance. We believe that developing oil To achieve sustainable and profitable growth, Marathon Oil is accelerating activity in our U.S. and gas resources in a safe, unconventional resource assets — the South Texas Eagle Ford Shale, North Dakota Bakken Shale and Oklahoma resource basins. These resource plays are at the forefront of the technology-driven environmentally sound and renaissance in the American oil and gas industry, which is making vast hydrocarbon resources available for the economic growth and energy security of our nation. responsible way is not only We recognize that the same spirit of technological discovery and innovation that is driving the possible, but also vital to the renaissance in the oil and gas industry can and will drive our ability to develop these important energy resources with less impact on the environment. -

2018 Annual Report

CALIFORNIA RESOURCES CORPORATION 2018 ANNUAL REPORT FINANCIAL AND OPERATIONAL HIGHLIGHTS Amounts in millions, except per-share amounts as of and for the years ended December 31, Financial Highlights 2018 2017 2016 Total Revenue $ 3,064 $ 2,006 $ 1,547 Income (Loss) Before Income Taxes $ 429 $ (262) $ 201 Net Income Attributable to Noncontrolling Interests $ 101 $ (4) $ - Net Income (Loss) Attributable to Common Stock $ 328 $ (266) $ 279 Adjusted Net Income (Loss)(a) $ 61 $ (187) $ (317) Net Income (Loss) Attributable to Common Stock per Share – Basic and Diluted(b) $ 6.77 $ (6.26) $ 6.76 Adjusted Net Income (Loss) per Share – Basic and Diluted(b) $ 1.27 $ (4.40) $ (7.85) Net Cash Provided by Operating Activities $ 461 $ 248 $ 130 Capital Investments $ 690 $ 371 $ 75 Net Payments on Debt $ 26 $ 18 $ 73 Net Cash Provided (Used) by Financing Activities $ 692 $ 73 $ (69) Total Assets $ 7,158 $ 6,207 $ 6,354 Long-Term Debt $ 5,251 $ 5,306 $ 5,168 Deferred Gain and Issuance Costs, Net $ 216 $ 287 $ 397 Equity $ (247) $ (720) $ (557) Weighted-Average Shares Outstanding(b) 47.4 42.5 40.4 Year-End Shares 48.7 42.9 42.5 Operational Highlights 2018 2017 2016 Production: Oil (MBbl/d) 82 83 91 NGLs (MBbl/d) 16 16 16 Natural Gas (MMcf/d) 202 182 197 Total (MBoe/d)(c) 132 129 140 Average Realized Prices: Oil with hedge ($/Bbl) $ 62.60 $ 51.24 $ 42.01 Oil without hedge ($/Bbl) $ 70.11 $ 51.47 $ 39.72 NGLs ($/Bbl) $ 43.67 $ 35.76 $ 22.39 Natural Gas ($/Mcf) $ 3.00 $ 2.67 $ 2.28 Reserves: Oil (MMBbl) 530 442 409 NGLs (MMBbl) 60 58 55 Natural Gas (Bcf) 734 706 626 Total (MMBoe)(c) 712 618 568 Organic Reserve Replacement Ratio(a) 127% 119% 71% PV-10 of Proved Reserves(a) (in billions) $ 9.4 $ 4.5 $ 2.8 Net Mineral Acreage (in thousands): Developed 701 703 717 Undeveloped 1,539 1,550 1,614 Total 2,240 2,253 2,331 Closing Share Price $ 17.04 $ 19.44 $ 21.29 (a) See www.crc.com, Investor Relations for a discussion of these non-GAAP measures, including a reconciliation to the most closely related GAAP measure or information on the related calculations. -

Marathon Petroleum Corporation [email protected]

February 6, 2017 Molly R. Benson Marathon Petroleum Corporation [email protected] Re: Marathon Petroleum Corporation Incoming letter dated December 23, 2016 Dear Ms. Benson: This is in response to your letter dated December 23, 2016 concerning the shareholder proposal submitted to MPC by the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union. We also received a letter from the proponent on January 18, 2017. Copies of all of the correspondence on which this response is based will be made available on our website at http://www.sec.gov/divisions/corpfin/cf-noaction/14a-8.shtml. For your reference, a brief discussion of the Division’s informal procedures regarding shareholder proposals is also available at the same website address. Sincerely, Matt S. McNair Senior Special Counsel Enclosure cc: Shawn Gilchrist USW [email protected] February 6, 2017 Response of the Office of Chief Counsel Division of Corporation Finance Re: Marathon Petroleum Corporation Incoming letter dated December 23, 2016 The proposal urges the board to report on the steps the company has taken to reduce the risk of accidents. The proposal further specifies that the report should describe the board’s oversight of process safety management, staffing levels, inspection and maintenance of facilities and other equipment. We are unable to concur in your view that MPC may exclude the proposal under rule 14a-8(i)(10). Based on the information you have presented, it does not appear that MPC’s public disclosures compare favorably with the guidelines of the proposal. Accordingly, we do not believe that MPC may omit the proposal from its proxy materials in reliance on rule 14a-8(i)(10). -

Marathon Analysis

ANALYSIS OF AGREEMENT CONTAINING CONSENT ORDERS TO AID PUBLIC COMMENT In the Matter of Marathon Petroleum Corporation, Express Mart Franchising Corp., Petr-All Petroleum Consulting Corporation, and REROB, LLC, File No. 181-0152, Docket No. C-4661 I. Introduction The Federal Trade Commission (“Commission”) has accepted for public comment, subject to final approval, an Agreement Containing Consent Orders (“Consent Agreement”) from Marathon Petroleum Corporation (“Marathon”) and Express Mart Franchising Corp., Petr-All Petroleum Consulting Corporation, and REROB, LLC (“Express Mart” and collectively, the “Respondents”). The Consent Agreement is designed to remedy the anticompetitive effects that likely would result from Marathon’s proposed acquisition of retail fuel outlets and other interests from Express Mart. Under the terms of the proposed Consent Agreement, Marathon must divest to the upfront buyer Sunoco LP (“Sunoco”) retail fuel outlets and related assets in five local markets in New York. Marathon must complete the divestiture within 90 days after the closing of Marathon’s acquisition of Express Mart. The Commission and Respondents have agreed to an Order to Maintain Assets that requires Respondents to operate and maintain each divestiture outlet in the normal course of business through the date Sunoco acquires the outlet. The Commission has placed the proposed Consent Agreement on the public record for 30 days to solicit comments from interested persons. Comments received during this period will become part of the public record. After 30 days, the Commission will again review the proposed Consent Agreement and the comments received, and will decide whether it should withdraw from the Consent Agreement, modify it, or make it final. -

Boyd County Industrial Reports for Kentucky Counties

Western Kentucky University TopSCHOLAR® Boyd County Industrial Reports for Kentucky Counties 1974 Industrial Resources: Boyd County - Ashland Kentucky Library Research Collections Western Kentucky University, [email protected] Follow this and additional works at: https://digitalcommons.wku.edu/boyd_cty Part of the Business Administration, Management, and Operations Commons, Growth and Development Commons, and the Infrastructure Commons Recommended Citation Kentucky Library Research Collections, "Industrial Resources: Boyd County - Ashland" (1974). Boyd County. Paper 1. https://digitalcommons.wku.edu/boyd_cty/1 This Report is brought to you for free and open access by TopSCHOLAR®. It has been accepted for inclusion in Boyd County by an authorized administrator of TopSCHOLAR®. For more information, please contact [email protected]. ASHLAND AREA ASHL ^Sq miie^ 500 miles 5 .-."mCvj j -HVH' • ^^^iljlll BOYD COUNTY, KENTUCKY INDUSTRIAL RESOURCES ASHLAND AREA, KENTUCKY Prepared by The Kentucky Department of Commerce in cooperation with The Ashland Area Chamber of Commerce and The City of Catlettsburg 1974 TABLE OF CONTENTS Chapter Page INDUSTRIAL SITES i ASHLAND AREA, KENTUCKY - A RESOURCE PROFILE . 1 THE LABOR MARKET 5 Population Trends 5 General Employment Characteristics 5 Manufacturing Employment Trends by Industry 6 Major Ashland Area Manufacturing Firms, Their Products and Employment . 6 Wages 9 Labor Organizations 10 Estimated Male Labor Supply 10 Estimated Female Labor Supply 11 Per Capita Personal Income 11 TRANSPORTATION 15 Rail 15 Truck Service 15 Air 16 Water 16 Bus . 17 Taxi 17 Rental Services 17 POWER AND FUEL 19 Electricity 19 Natural Gas 19 Other Fuels . 19 WATER AND SEWERAGE 20 Water 20 Sewerage 21 LOCAL GOVERNMENT 23 City 23 County 23 iv Chapter Page Assessed Value of Property, 1973 .