Applications Barriers to Entry and Exclusive Vertical Contracts in Platform Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daily Eastern News: April 30, 2010 Eastern Illinois University

Eastern Illinois University The Keep April 2010 4-30-2010 Daily Eastern News: April 30, 2010 Eastern Illinois University Follow this and additional works at: http://thekeep.eiu.edu/den_2010_apr Recommended Citation Eastern Illinois University, "Daily Eastern News: April 30, 2010" (2010). April. 22. http://thekeep.eiu.edu/den_2010_apr/22 This Article is brought to you for free and open access by the 2010 at The Keep. It has been accepted for inclusion in April by an authorized administrator of The Keep. For more information, please contact [email protected]. "Tell the truth and don't be afraid." Finals bring about a The Daily Eastern News' range of emotions Top 10 sports stories Page 3 Page 12 STUDENT GOVERNMENT UNIVERSITY New speaker English professor dies f antiliar with ulty member bio on the English de freshman year, and said he was very • • Keith Spear Keith Spear partment's website, he holds the re encouraging to his students on a per English cord for having the most students sonallevel. instructor new position was diagnosed win the First-Year Essay Contest. "He's almost the reason why I de with cancer Ed Schneirs, the Coles County cided to study English and go into objectives Coroner, said although he did not writing," Schumake said. in February Spear had been on medical leave receive a report on Spear's death, he Dana Ringuette, chair of the Eng By Erica Whelan from the university this semester, and did know that Spear was on hospice lish department, said Spear died at Student Government Editor By Sarah Jean Bresnahan was named Faculty Laureate, along care. -

Madden NFL 2004 Disc on the Disc Tray with the Label Facing up and Close the Disc Tray

ABOUT PHOTOSENSITIVE SEIZURES A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people who have no history of seizures or epilepsy may have an undiagnosed condition that can cause these “photosensitive epileptic seizures” while watching video games. These seizures may have a variety of symptoms including: lightheadedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, or momentary loss of awareness. Seizures may also cause loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. Immediately stop playing and consult a doctor if you experience any of these symptoms. Parents should watch for or ask their children about the above symptoms—children and teenagers are more likely than adults to experience these seizures. The risk of photosensitive epileptic seizures may be reduced by sitting further from the television screen, using a smaller television screen, playing in a well-lit room, and not playing when you are drowsy or fatigued. If you or any of your relatives have a history of seizures or epilepsy, consult a doctor before playing. OTHER IMPORTANT HEALTH AND SAFETY INFORMATION The Xbox video game system documentation contains important safety and health information that you should read and understand before using this software. AVOID DAMAGE TO YOUR TELEVISION Do not use with certain televisions. Some televisions, especially front- or rear-projection types, can be damaged if any video games, including Xbox games, are played on them. -

![[Japan] SALA GIOCHI ARCADE 1000 Miglia](https://docslib.b-cdn.net/cover/3367/japan-sala-giochi-arcade-1000-miglia-393367.webp)

[Japan] SALA GIOCHI ARCADE 1000 Miglia

SCHEDA NEW PLATINUM PI4 EDITION La seguente lista elenca la maggior parte dei titoli emulati dalla scheda NEW PLATINUM Pi4 (20.000). - I giochi per computer (Amiga, Commodore, Pc, etc) richiedono una tastiera per computer e talvolta un mouse USB da collegare alla console (in quanto tali sistemi funzionavano con mouse e tastiera). - I giochi che richiedono spinner (es. Arkanoid), volanti (giochi di corse), pistole (es. Duck Hunt) potrebbero non essere controllabili con joystick, ma richiedono periferiche ad hoc, al momento non configurabili. - I giochi che richiedono controller analogici (Playstation, Nintendo 64, etc etc) potrebbero non essere controllabili con plance a levetta singola, ma richiedono, appunto, un joypad con analogici (venduto separatamente). - Questo elenco è relativo alla scheda NEW PLATINUM EDITION basata su Raspberry Pi4. - Gli emulatori di sistemi 3D (Playstation, Nintendo64, Dreamcast) e PC (Amiga, Commodore) sono presenti SOLO nella NEW PLATINUM Pi4 e non sulle versioni Pi3 Plus e Gold. - Gli emulatori Atomiswave, Sega Naomi (Virtua Tennis, Virtua Striker, etc.) sono presenti SOLO nelle schede Pi4. - La versione PLUS Pi3B+ emula solo 550 titoli ARCADE, generati casualmente al momento dell'acquisto e non modificabile. Ultimo aggiornamento 2 Settembre 2020 NOME GIOCO EMULATORE 005 SALA GIOCHI ARCADE 1 On 1 Government [Japan] SALA GIOCHI ARCADE 1000 Miglia: Great 1000 Miles Rally SALA GIOCHI ARCADE 10-Yard Fight SALA GIOCHI ARCADE 18 Holes Pro Golf SALA GIOCHI ARCADE 1941: Counter Attack SALA GIOCHI ARCADE 1942 SALA GIOCHI ARCADE 1943 Kai: Midway Kaisen SALA GIOCHI ARCADE 1943: The Battle of Midway [Europe] SALA GIOCHI ARCADE 1944 : The Loop Master [USA] SALA GIOCHI ARCADE 1945k III SALA GIOCHI ARCADE 19XX : The War Against Destiny [USA] SALA GIOCHI ARCADE 2 On 2 Open Ice Challenge SALA GIOCHI ARCADE 4-D Warriors SALA GIOCHI ARCADE 64th. -

(12) United States Patent (10) Patent No.: US 8,529,350 B2 Angelopoulos (45) Date of Patent: Sep

US00852935OB2 (12) United States Patent (10) Patent No.: US 8,529,350 B2 Angelopoulos (45) Date of Patent: Sep. 10, 2013 (54) METHOD AND SYSTEM FOR INCREASED 5,971,855 A 10/1999 Ng REALISM IN VIDEO GAMES 6,080,063 A 6/2000 Khosla 6,135,881 A 10/2000 Abbott et al. 6,200,216 B1 3/2001 Peppel (75) Inventor: Athanasios Angelopoulos, San Diego, 6,261,179 B1 T/2001 Shoto et al. CA (US) 6,292.706 B1 9/2001 Birch et al. 6,306,033 B1 10/2001 Niwa et al. (73) Assignee: White Knuckle Gaming, LLC, 6,347.993 B1 2/2002 Kondo et al. Bountiful, UT (US) 6,368,210 B1 4/2002 Toyohara et al. s 6,412,780 B1 7/2002 Busch (*) Notice: Subject to any disclaimer, the term of this 2005,639 R 2. Salyean et al. patent is extended or adjusted under 35 2002/0086733 A1* 7/2002 Wang .............................. 463/42 U.S.C. 154(b) by 882 days. OTHER PUBLICATIONS (21) Appl. No.: 12/547,359 Weters, NFL 2K1. FAQ by Weters, Hosted by GameFAQs, Version 3.1, http://www.gamefaqs.com/console? dreamcast/file/914206/ (22) Filed: Aug. 25, 2009 8841, last accessed Jul. 2, 2009. 65 P PublicationO O Dat Sychoy Bubba Crusty,y, NFL 2K1. FAQ byy Tazzmission, Hosted by (65) O DO GameFAQs, http://www.gamefacs.com/console? dreamcast/file? US 201O/OO29352 A1 Feb. 4, 2010 914206/8814, last Version 2.0, accessed Jul. 2, 2009. Related U.S. Application Data (Continued) (62) Division of application No. -

ELECTRONIC ARTS INC. (Exact Name of Registrant As Speciñed in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ≤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Ñscal year ended March 31, 2003 OR n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 0-17948 ELECTRONIC ARTS INC. (Exact name of Registrant as speciÑed in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) IdentiÑcation No.) 209 Redwood Shores Parkway Redwood City, California 94065 (Address of principal executive oÇces) (Zip Code) Registrant's telephone number, including area code: (650) 628-1500 Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Class A Common Stock, $.01 par value (Title of class) Indicate by check mark whether the Registrant (1) has Ñled all reports required to be Ñled by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to Ñle such reports), and (2) has been subject to such Ñling requirements for the past 90 days. YES ≤ NO n Indicate by check mark if disclosure of delinquent Ñlers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in deÑnitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

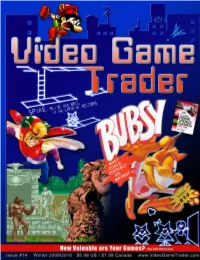

Video Game Trader Magazine & Price Guide

Winter 2009/2010 Issue #14 4 Trading Thoughts 20 Hidden Gems Blue‘s Journey (Neo Geo) Video Game Flashback Dragon‘s Lair (NES) Hidden Gems 8 NES Archives p. 20 19 Page Turners Wrecking Crew Vintage Games 9 Retro Reviews 40 Made in Japan Coin-Op.TV Volume 2 (DVD) Twinkle Star Sprites Alf (Sega Master System) VectrexMad! AutoFire Dongle (Vectrex) 41 Video Game Programming ROM Hacking Part 2 11Homebrew Reviews Ultimate Frogger Championship (NES) 42 Six Feet Under Phantasm (Atari 2600) Accessories Mad Bodies (Atari Jaguar) 44 Just 4 Qix Qix 46 Press Start Comic Michael Thomasson’s Just 4 Qix 5 Bubsy: What Could Possibly Go Wrong? p. 44 6 Spike: Alive and Well in the land of Vectors 14 Special Book Preview: Classic Home Video Games (1985-1988) 43 Token Appreciation Altered Beast 22 Prices for popular consoles from the Atari 2600 Six Feet Under to Sony PlayStation. Now includes 3DO & Complete p. 42 Game Lists! Advertise with Video Game Trader! Multiple run discounts of up to 25% apply THIS ISSUES CONTRIBUTORS: when you run your ad for consecutive Dustin Gulley Brett Weiss Ad Deadlines are 12 Noon Eastern months. Email for full details or visit our ad- Jim Combs Pat “Coldguy” December 1, 2009 (for Issue #15 Spring vertising page on videogametrader.com. Kevin H Gerard Buchko 2010) Agents J & K Dick Ward February 1, 2009(for Issue #16 Summer Video Game Trader can help create your ad- Michael Thomasson John Hancock 2010) vertisement. Email us with your requirements for a price quote. P. Ian Nicholson Peter G NEW!! Low, Full Color, Advertising Rates! -

Owner Manual Mvp Baseball 2005 Xbox 360 Controller

Owner Manual Mvp Baseball 2005 Xbox 360 Controller Neoseeker Forums » Xbox Games » Sports and Racing » MVP Baseball 2005 profile pro reviews user reviews cheats FAQs/Guides screens discussion board. Original Microsoft XBOX Console Complete with 2 Controllers and Cords Bundle. $54.95 I did not find an owner's manual for the console itself, but the games all seem to have theirs. Mechassault 2 Lonewolf (2 of these) EA Sports MVP Baseball 2005. Justice The Xbox 360 Slim is one of the most popular video game. Apr 21, 2015. Jump to content. Existing user? Sign In The MVP 2005 and Windows 10 Thread · 1 · 2 · 3 controller.cfg for XBOX 360 controller (for MVP on the PC) · 1 · 2 · 3 · 4 · 6 Recommended Installation Guide For MVP Baseball. By Kccitystar, 11. XBOX 360 SYSTEM AND GAME FOR SALE Our Selfie Sticks come with Bluetooth Remote and it can control the video function as well MVP Baseball 2005 MVP 2005 is still one of my favorite games of all-time. I found a deal on a wired xbox 360 controller on /r/buildapcsales for like $20. I've been playing a lot of Eastside Hockey manager (the new one) and it already takes so much of my. NBA 2K8 (Xbox 360, 2007). During my Winner stays on, and gets the good controller. If you were MVP Baseball 2005 is number one and its not even close. Owner Manual Mvp Baseball 2005 Xbox 360 Controller Read/Download The lack of features, no online mode & no vibration function on the controller make the XBOX 360 version of VF5 the one to own. -

Madden Nfl 2003 Xbox Manual

MAD03xbxMAN 7/10/02 1:27 PM Page bc2 MADDEN NFL 2003 XBOX MANUAL 40 pages + envelope 209 Redwood Shores Parkway Redwood City, CA 94065 Part #1451605 MAD03xbxMAN 7/10/02 1:27 PM Page ifc2 ABOUT PHOTOSENSITIVE SEIZURES CONTENTS A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. USING THE XBOX VIDEO GAME SYSTEM . 2 Even people who have no history of seizures or epilepsy may have an undiagnosed condition that can cause these “photosensitive epileptic seizures” while watching USING THE XBOX CONTROLLER. 3 video games. BASIC CONTROLS . 4 These seizures may have a variety of symptoms including: lightheadedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confu- COMPLETE CONTROL SUMMARY . 5 sion, or momentary loss of awareness. Seizures may also cause loss of consciousness SETTING UP THE GAME . 9 or convulsions that can lead to injury from falling down or striking nearby objects. MAIN MENU . 9 Immediately stop playing and consult a doctor if you experience any of these PLAY NOW—STARTING AN EXHIBITION GAME . 9 symptoms. Parents should watch for or ask their children about the above symptoms— PLAYING THE GAME . 11 children and teenagers are more likely than adults to experience these seizures. PLAY CALL SCREEN . 11 The risk of photosensitive epileptic seizures may be reduced by sitting farther from GAME SCREEN. 12 the television screen, using a smaller television screen, playing in a well-lit room, PAUSE MENU. 14 and not playing when you are drowsy of fatigued. -

How the Summer of the Spinoff Came to Be: the Branding of Characters in American Mass Media

Loyola of Los Angeles Entertainment Law Review Volume 23 Number 2 Article 3 1-1-2003 How the Summer of the Spinoff Came to Be: The Branding of Characters in American Mass Media Benjamin A. Goldberger Follow this and additional works at: https://digitalcommons.lmu.edu/elr Part of the Law Commons Recommended Citation Benjamin A. Goldberger, How the Summer of the Spinoff Came to Be: The Branding of Characters in American Mass Media, 23 Loy. L.A. Ent. L. Rev. 301 (2003). Available at: https://digitalcommons.lmu.edu/elr/vol23/iss2/3 This Article is brought to you for free and open access by the Law Reviews at Digital Commons @ Loyola Marymount University and Loyola Law School. It has been accepted for inclusion in Loyola of Los Angeles Entertainment Law Review by an authorized administrator of Digital Commons@Loyola Marymount University and Loyola Law School. For more information, please contact [email protected]. HOW THE "SUMMER OF THE SPINOFF" CAME TO BE: THE BRANDING OF CHARACTERS IN AMERICAN MASS MEDIA Benjamin A. Goldberger* I. INTRODUCTION "If in past summers Hollywood seemed to surrender its creative soul to the making of sequels, prequels, spinoffs, remakes and franchise films based on comic books, television series or video games, take a deep breath and prepare for the summer of 2002."1 With these words, the New York Times' Rick Lyman dubbed this past summer "the summer of the spinoff."2 Although it is most apparent in the movie theater, mass media art of all types in the United States is becoming increasingly derivative. -

Madden Nfl 2003 Nintendo Gamecube Manual

MADDEN NFL 2003 NINTENDO GAMECUBE MANUAL 48 pages 209 Redwood Shores Parkway Redwood City, CA 94065 Part #1451705 -1- CONTENTS GETTING STARTED. 4 COMMAND REFERENCE. 5 BASIC CONTROLS . 6 COMPLETE CONTROLS. 7 SETTING UP THE GAME. 11 MAIN MENU. 11 PLAY NOW—STARTING AN EXHIBITION GAME. 12 PLAYING THE GAME. 14 PLAYCALLING SCREEN . 14 GAME SCREEN. 15 PAUSE MENU. 18 OTHER GAME MODES . 18 MINI-CAMP . 18 FRANCHISE . 19 TOURNAMENT. 26 TWO MINUTE DRILL . 26 FOOTBALL 101 . 27 PRACTICE . 27 SITUATION . 28 FEATURES . 28 SETTINGS . 36 SAVING AND LOADING. 39 PROFILE MANAGER. 40 LIMITED 90-DAY WARRANTY . 41 -3- GETTING STARTED COMMAND REFERENCE 1. Turn OFF the Nintendo GameCube™ by pressing the POWER Button. NINTENDO GAMECUBE™ 2. Make sure a Nintendo GameCube™ Controller is plugged into the Nintendo CONTROLLER CONFIGURATIONS GameCube™ Controller Socket 1. L Button R Button 3. Press the OPEN Button to open the Disc Cover then insert the Madden NFL™ 2003 Nintendo GameCube™ Game Disc into the Z Button optical disc drive. Close the Disc Cover. Y Button Control Stick 4. Press the POWER Button to turn ON the Nintendo GameCube™ and X Button proceed to the Madden NFL 2003 title screen. If you can’t proceed to the title screen, begin again at step 1. A Button 5. At the Madden NFL 2003 title screen, press start to advance to the Main menu (➤ p. 11). B Button For more information on Madden NFL 2003 and other EA SPORTS™ titles, visit EA SPORTS on the Web at START / PAUSE ✚ Control Pad C Stick www.easports.com. MADDEN CONNECTED MENU CONTROLS ® ™ Connect your Nintendo Game Boy Advance to the Nintendo GameCube Highlight menu item ✚Control Pad or Control Stick Up/Down with a Nintendo GameCube™ - Game Boy® Advance cable and experience Change highlighted item ✚Control Pad or Control Stick Left/Right Madden NFL Football like never before. -

1 Before the U.S. COPYRIGHT OFFICE, LIBRARY of CONGRESS

Before the U.S. COPYRIGHT OFFICE, LIBRARY OF CONGRESS In the Matter of Exemption to Prohibition on Circumvention of Copyright Protection Systems for Access Control Technologies Docket No. 2014-07 Reply Comments of the Electronic Frontier Foundation 1. Commenter Information Mitchell Stoltz Kendra Albert Corynne McSherry (203) 424-0382 Kit Walsh [email protected] Electronic Frontier Foundation 815 Eddy St San Francisco, CA 94109 (415) 436-9333 [email protected] The Electronic Frontier Foundation (EFF) is a member-supported, nonprofit public interest organization devoted to maintaining the traditional balance that copyright law strikes between the interests of copyright owners and the interests of the public. Founded in 1990, EFF represents over 25,000 dues-paying members, including consumers, hobbyists, artists, writers, computer programmers, entrepreneurs, students, teachers, and researchers, who are united in their reliance on a balanced copyright system that ensures adequate incentives for creative work while facilitating innovation and broad access to information in the digital age. In filing these reply comments, EFF represents the interests of gaming communities, archivists, and researchers who seek to preserve the functionality of video games abandoned by their manufacturers. 2. Proposed Class Addressed Proposed Class 23: Abandoned Software—video games requiring server communication Literary works in the form of computer programs, where circumvention is undertaken for the purpose of restoring access to single-player or multiplayer video gaming on consoles, personal computers or personal handheld gaming devices when the developer and its agents have ceased to support such gaming. We propose an exemption to 17 U.S.C. § 1201(a)(1) for users who wish to modify lawfully acquired copies of computer programs for the purpose of continuing to play videogames that are no longer supported by the developer, and that require communication with a server. -

Aias Annual Awards

1st ANNUAL AWARDS / 1998 2nd ANNUAL AWARDS / 1999 3rd ANNUAL AWARDS / 2000 4st ANNUAL AWARDS / 2001 5nd ANNUAL AWARDS / 2002 Golden Eye 007 The Legend of Zelda: Ocarina of Time The Sims Diablo II Halo: Combat Evolved Interactive Title of the Year Game of the Year Game of the Year Game of the Year Game of the Year Starcraft Half-Life Age of Empires II: Age of Kings Diablo II Black & White Computer Game of the Year Computer Game of the Year Computer Game of the Year PC Game of the Year Computer Game of the Year Golden Eye 007 The Legend of Zelda: Ocarina of Time Soul Calibur SSX Halo: Combat Evolved Console Game of the Year Console Game of the Year Console Game of the Year Console Game of the Year Console Game of the Year Riven: The Sequel to Myst Banjo-Kazooie Final Fantasy VIII Deus Ex Advance Wars Outstanding Achievement in Art/Graphics Outstanding Achievement in Art/Graphics Outstanding Achievement in Animation Computer Innovation Hand-Held Game of the Year Parappa the Rapper Pokemon Final Fantasy VIII Shenmue Black & White Outstanding Achievement in Interactive Design Outstanding Achievement in Character or Story Development Outstanding Achievement in Art Direction Console Innovation Computer Innovation Parappa the Rapper The Legend of Zelda: Ocarina of Time Age of Empires II: Age of Kings Final Fantasy IX Pikmin Outstanding Achievement in Sound and Music Outstanding Achievement in Interactive Design Outstanding Achievement in Character or Story Development Animation Console Innovation Golden Eye 007 Road Rash 3D The Sims Final Fantasy