Union Calendar No. 477 ACTIVITIES

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Women in the United States Congress: 1917-2012

Women in the United States Congress: 1917-2012 Jennifer E. Manning Information Research Specialist Colleen J. Shogan Deputy Director and Senior Specialist November 26, 2012 Congressional Research Service 7-5700 www.crs.gov RL30261 CRS Report for Congress Prepared for Members and Committees of Congress Women in the United States Congress: 1917-2012 Summary Ninety-four women currently serve in the 112th Congress: 77 in the House (53 Democrats and 24 Republicans) and 17 in the Senate (12 Democrats and 5 Republicans). Ninety-two women were initially sworn in to the 112th Congress, two women Democratic House Members have since resigned, and four others have been elected. This number (94) is lower than the record number of 95 women who were initially elected to the 111th Congress. The first woman elected to Congress was Representative Jeannette Rankin (R-MT, 1917-1919, 1941-1943). The first woman to serve in the Senate was Rebecca Latimer Felton (D-GA). She was appointed in 1922 and served for only one day. A total of 278 women have served in Congress, 178 Democrats and 100 Republicans. Of these women, 239 (153 Democrats, 86 Republicans) have served only in the House of Representatives; 31 (19 Democrats, 12 Republicans) have served only in the Senate; and 8 (6 Democrats, 2 Republicans) have served in both houses. These figures include one non-voting Delegate each from Guam, Hawaii, the District of Columbia, and the U.S. Virgin Islands. Currently serving Senator Barbara Mikulski (D-MD) holds the record for length of service by a woman in Congress with 35 years (10 of which were spent in the House). -

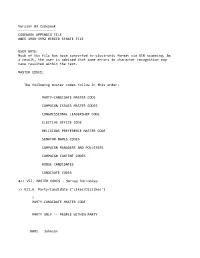

Appendix File Anes 1988‐1992 Merged Senate File

Version 03 Codebook ‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐ CODEBOOK APPENDIX FILE ANES 1988‐1992 MERGED SENATE FILE USER NOTE: Much of his file has been converted to electronic format via OCR scanning. As a result, the user is advised that some errors in character recognition may have resulted within the text. MASTER CODES: The following master codes follow in this order: PARTY‐CANDIDATE MASTER CODE CAMPAIGN ISSUES MASTER CODES CONGRESSIONAL LEADERSHIP CODE ELECTIVE OFFICE CODE RELIGIOUS PREFERENCE MASTER CODE SENATOR NAMES CODES CAMPAIGN MANAGERS AND POLLSTERS CAMPAIGN CONTENT CODES HOUSE CANDIDATES CANDIDATE CODES >> VII. MASTER CODES ‐ Survey Variables >> VII.A. Party/Candidate ('Likes/Dislikes') ? PARTY‐CANDIDATE MASTER CODE PARTY ONLY ‐‐ PEOPLE WITHIN PARTY 0001 Johnson 0002 Kennedy, John; JFK 0003 Kennedy, Robert; RFK 0004 Kennedy, Edward; "Ted" 0005 Kennedy, NA which 0006 Truman 0007 Roosevelt; "FDR" 0008 McGovern 0009 Carter 0010 Mondale 0011 McCarthy, Eugene 0012 Humphrey 0013 Muskie 0014 Dukakis, Michael 0015 Wallace 0016 Jackson, Jesse 0017 Clinton, Bill 0031 Eisenhower; Ike 0032 Nixon 0034 Rockefeller 0035 Reagan 0036 Ford 0037 Bush 0038 Connally 0039 Kissinger 0040 McCarthy, Joseph 0041 Buchanan, Pat 0051 Other national party figures (Senators, Congressman, etc.) 0052 Local party figures (city, state, etc.) 0053 Good/Young/Experienced leaders; like whole ticket 0054 Bad/Old/Inexperienced leaders; dislike whole ticket 0055 Reference to vice‐presidential candidate ? Make 0097 Other people within party reasons Card PARTY ONLY ‐‐ PARTY CHARACTERISTICS 0101 Traditional Democratic voter: always been a Democrat; just a Democrat; never been a Republican; just couldn't vote Republican 0102 Traditional Republican voter: always been a Republican; just a Republican; never been a Democrat; just couldn't vote Democratic 0111 Positive, personal, affective terms applied to party‐‐good/nice people; patriotic; etc. -

CONGRESSIONAL RECORD—HOUSE March 29, 2001

March 29, 2001 CONGRESSIONAL RECORD—HOUSE 4995 Hoeffel, Peter Hoekstra, Tim Holden, Rush Thomas G. Tancredo, John S. Tanner, Ellen transmitting a copy of the annual report in D. Holt, Michael M. Honda, Darlene Hooley, O. Tauscher, W. J. (Billy) Tauzin, Charles H. compliance with the Government in the Sun- Stephen Horn, John N. Hostettler, Amo Taylor, Gene Taylor, Lee Terry, William M. shine Act during the calendar year 2000, pur- Houghton, Steny H. Hoyer, Kenny C. Thomas, Bennie G. Thompson, Mike Thomp- suant to 5 U.S.C. 552b(j); to the Committee Hulshof, Duncan Hunter, Asa Hutchinson, son, Mac Thornberry, John R. Thune, Karen on Government Reform. Henry J. Hyde, Jay Inslee, Johnny Isakson, L. Thurman, Todd Tiahrt, Patrick J. Tiberi, f Steve Israel, Darrell E. Issa, Ernest J. John F. Tierney, Patrick J. Toomey, James Istook, Jr., Jesse L. Jackson, Jr., Sheila A. Traficant, Jr., Jim Turner, Mark Udall, PUBLIC BILLS AND RESOLUTIONS Jackson-Lee, William J. Jefferson, William Robert A. Underwood, Fred Upton, Nydia M. Under clause 2 of rule XII, public ´ L. Jenkins, Christopher John, Eddie Bernice Velazquez, Peter J. Visclosky, David Vitter, bills and resolutions of the following Johnson, Nancy L. Johnson, Sam Johnson, Greg Walden, James T. Walsh, Zach Wamp, Timothy V. Johnson, Stephanie Tubbs Maxine Waters, Wes Watkins, Melvin L. titles were introduced and severally re- Jones, Walter B. Jones, Paul E. Kanjorski, Watt, J.C. Watts, Jr., Henry A. Waxman, An- ferred, as follows: Marcy Kaptur, Ric Keller, Sue W. Kelly, thony D. Weiner, Curt Weldon, Dave Weldon, By Mr. WATTS of Oklahoma (for him- Mark R. -

FBI Academy Training Facility A&E Study………………………………

Table of Contents Page No. I. Overview ………………………………………………………………….............. 1-1 II. Summary of Program Changes…………………………………………….. 2-1 III. Appropriations Language and Analysis of Appropriations Language….......... 3-1 IV. Decision Unit Justification…………………………………………………... 4-1 A. Intelligence………………………………………………………………… . 4-1 1. Program Description 2. Performance Tables 3. Performance, Resources, and Strategies a. Performance Plan and Report for Outcomes b. Strategies to Accomplish Outcomes B. Counterterrorism/Counterintelligence ……………………………………… 4-14 1. Program Description 2. Performance Tables 3. Performance, Resources, and Strategies a. Performance Plan and Report for Outcomes b. Strategies to Accomplish Outcomes C. Criminal Enterprises and Federal Crimes…………………………………… 4-36 1. Program Description 2. Performance Tables 3. Performance, Resources, and Strategies a. Performance Plan and Report for Outcomes b. Strategies to Accomplish Outcomes D. Criminal Justice Services…………………………………………………….. 4-59 1. Program Description 2. Performance Tables 3. Performance, Resources, and Strategies a. Performance Plan and Report for Outcomes b. Strategies to Accomplish Outcomes V. Program Increases by Item………………………………………………… 5-1 Domain and Operations Increases Comprehensive National Cybersecurity Initiative………………………... 5-1 Intelligence Program………………………………………………….…... 5-6 National Security Field Investigations……….………………………….... 5-13 Mortgage Fraud and White Collar Crime………………………………… 5-15 WMD Response………………………………………………………..…. 5-19 Infrastructure Increases -

CONGRESSIONAL RECORD— Extensions of Remarks E89 HON

February 8, 2000 CONGRESSIONAL RECORD Ð Extensions of Remarks E89 granting such contracts. The second adminis- vember 8, 1999 by voice vote and currently In the movie ``Life is Beautiful'' the child sur- trative vendor contract will be negotiated in awaits action in the U.S. Senate. vives the concentration camp because his fa- California later this year. Without Congres- You may remember that Mr. Ileto, a resident ther is clever enough to hide him each day. sional action on this issue, it is likely that there of Chino Hills, was the postal employee who The child is led to believe that he is playing a will once again be competition among partici- was murdered on August 10, 1999 by Buford game with the SS soldiers. Harold Gordon and pating health plans to obtain the vendor con- Furrow, the gunman who shot and wounded his father survived the concentration camp tract. five children and employees at the North Val- through no special gimmicks. There was no To further describe the seriousness of this ley Jewish Community Center (in suburban fantasy and no games. This was life-and- conflict of interest, under California's program Los Angeles). death reality at its worst. the administrative vendor performs a wide va- At the time of H.R. 3189's passage, I was And yet, Harold Gordon has written of his riety of functions including: providing trained listed as the only sponsor of the bill. The Post- experience during that awful time a book that staff on the program's toll free telephone lines, al Subcommittee of the House Government is an inspiration to us all. -

Local Lodges 27 and 83 Hold Regional Tripartite Meeting

Vol. 40 No. 2 the Boilermaker Mar • Apr 2001 The Official Publication of the International Brotherhood of Boilermakers, Iron Ship Builders, Blacksmiths, Forgers, and Helpers, AFL-CIO Charles W. Jones, Editor-in-Chief http://www.IBB.workingfamilies.com Reporter http://www.boilermakers.org IN THESE PAGES Local Lodges 27 and 83 hold NACBE Safety Award goes to Local 132 . .4 regional tripartite meeting Union, owner, employers LEAP conference discuss common issues stresses bipartisanship . 5-12 REPRESENTATIVES OF 27 employ- ers and owners met in Kansas City, Mo., on January 20, 2001, for the first regional tripartite conference spon- sored by Lodge 83, Kansas City; Lodge 27, St. Louis; the Kansas City Power & Light Co. (KCPL); and Enerfab. Representatives of the Greater Kansas City Building Trades also attended. Delegates attend the first Missouri regional These locals are carrying the tri- tripartite conference, January 20, 2001. partite concept to the local and regional level, ensuring that lines of Boilermakers helped screening, pulmonary function and industry and to seek solutions togeth- communication remain open respirator fit testing, safety prescrip- er, it is encouraging.” build the Panama Canal . between Boilermakers, owners, and 13 tion glasses, and helping to meet man- Contractor and owner representa- contractors. power needs. tives also addressed the meeting, dis- Presentations made at the confer- Roger Erickson, bus. mgr. Local 83, cussing several areas of concern, includ- Will the Bush tax cut ence explained the Boilermaker presided over the meeting. He offered ing manning upcoming work. Demand apprenticeship program and the many benefit your family? . 14 these remarks: “Anytime owners, for Boilermakers is expected to be much cost-saving services provided by contractors, and labor come together heavier this year than usual. -

NEW MEMBERS of the SENATE 1968-Present (By District, with Prior Service: *House, **Senate)

NEW MEMBERS OF THE SENATE 1968-Present (By District, With Prior Service: *House, **Senate) According to Article III, Section 15(a) of the Constitution of the State of Florida, Senators shall be elected for terms of 4 years. This followed the 1968 Special Session held for the revision of the Constitution. Organization Session, 1968 Total Membership=48, New Members=11 6th * W. E. Bishop (D) 15th * C. Welborn Daniel (D) 7th Bob Saunders (D) 17th * John L. Ducker (R) 10th * Dan Scarborough (D) 27th Alan Trask (D) 11th C. W. “Bill” Beaufort (D) 45th * Kenneth M. Myers (D) 13th J. H. Williams (D) 14th * Frederick B. Karl (D) Regular Session, 1969 Total Membership=48, New Members=0 Regular Session, 1970 Total Membership=48, New Members=1 24th David H. McClain (R) Organization Session, 1970 Total Membership=48, New Members=9 2nd W. D. Childers (D) 33rd Philip D. “Phil” Lewis (D) 8th * Lew Brantley (D) 34th Tom Johnson (R) 9th * Lynwood Arnold (D) 43rd * Gerald A. Lewis (D) 19th * John T. Ware (R) 48th * Robert Graham (D) 28th * Bob Brannen (D) Regular Session, 1972 Total Membership=48, New Members=1 28th Curtis Peterson (D) The 1972 election followed legislative reapportionment, where the membership changed from 48 members to 40 members; even numbered districts elected to 2-year terms, odd-numbered districts elected to 4-year terms. Organization Session, 1972 Redistricting Total Membership=40, New Members=16 2nd James A. Johnston (D) 26th * Russell E. Sykes (R) 9th Bruce A. Smathers (D) 32nd * William G. Zinkil, Sr., (D) 10th * William M. -

Campaign Committee Transfers to the Democratic Congressional Campaign Committee JOHN KERRY for PRESIDENT, INC. $3,000,000 GORE 2

Campaign Committee Transfers to the Democratic Congressional Campaign Committee JOHN KERRY FOR PRESIDENT, INC. $3,000,000 GORE 2000 INC.GELAC $1,000,000 AL FRIENDS OF BUD CRAMER $125,000 AL COMMITTEE TO ELECT ARTUR DAVIS TO CONGRESS $10,000 AR MARION BERRY FOR CONGRESS $135,000 AR SNYDER FOR CONGRESS CAMPAIGN COMMITTEE $25,500 AR MIKE ROSS FOR CONGRESS COMMITTEE $200,000 AS FALEOMAVAEGA FOR CONGRESS COMMITTEE $5,000 AZ PASTOR FOR ARIZONA $100,000 AZ A WHOLE LOT OF PEOPLE FOR GRIJALVA CONGRESSNL CMTE $15,000 CA WOOLSEY FOR CONGRESS $70,000 CA MIKE THOMPSON FOR CONGRESS $221,000 CA BOB MATSUI FOR CONGRESS COMMITTEE $470,000 CA NANCY PELOSI FOR CONGRESS $570,000 CA FRIENDS OF CONGRESSMAN GEORGE MILLER $310,000 CA PETE STARK RE-ELECTION COMMITTEE $100,000 CA BARBARA LEE FOR CONGRESS $40,387 CA ELLEN TAUSCHER FOR CONGRESS $72,000 CA TOM LANTOS FOR CONGRESS COMMITTEE $125,000 CA ANNA ESHOO FOR CONGRESS $210,000 CA MIKE HONDA FOR CONGRESS $116,000 CA LOFGREN FOR CONGRESS $145,000 CA FRIENDS OF FARR $80,000 CA DOOLEY FOR THE VALLEY $40,000 CA FRIENDS OF DENNIS CARDOZA $85,000 CA FRIENDS OF LOIS CAPPS $100,000 CA CITIZENS FOR WATERS $35,000 CA CONGRESSMAN WAXMAN CAMPAIGN COMMITTEE $200,000 CA SHERMAN FOR CONGRESS $115,000 CA BERMAN FOR CONGRESS $215,000 CA ADAM SCHIFF FOR CONGRESS $90,000 CA SCHIFF FOR CONGRESS $50,000 CA FRIENDS OF JANE HARMAN $150,000 CA BECERRA FOR CONGRESS $125,000 CA SOLIS FOR CONGRESS $110,000 CA DIANE E WATSON FOR CONGRESS $40,500 CA LUCILLE ROYBAL-ALLARD FOR CONGRESS $225,000 CA NAPOLITANO FOR CONGRESS $70,000 CA PEOPLE FOR JUANITA MCDONALD FOR CONGRESS, THE $62,000 CA COMMITTEE TO RE-ELECT LINDA SANCHEZ $10,000 CA FRIENDS OF JOE BACA $62,000 CA COMMITTEE TO RE-ELECT LORETTA SANCHEZ $150,000 CA SUSAN DAVIS FOR CONGRESS $100,000 CO SCHROEDER FOR CONGRESS COMMITTEE, INC $1,000 CO DIANA DEGETTE FOR CONGRESS $125,000 CO MARK UDALL FOR CONGRESS INC. -

The Chief Management Officer of the Department of Defense: an Assessment

DEFENSE BUSINESS BOARD Submitted to the Secretary of Defense The Chief Management Officer of the Department of Defense: An Assessment DBB FY 20-01 An assessment of the effectiveness, responsibilities, and authorities of the Chief Management Officer of the Department of Defense as required by §904 of the FY20 NDAA June 1, 2020 DBB FY20-01 CMO Assessment 1 Executive Summary Tasking and Task Force: The Fiscal Year (FY) 2020 National Defense Authorization Act (NDAA) (Public Law (Pub. L. 116-92) required the Secretary of Defense (SD) to conduct an independent assessment of the Chief Management Officer (CMO) with six specific areas to be evaluated. The Defense Business Board (DBB) was selected on February 3, 2020 to conduct the independent assessment, with Arnold Punaro and Atul Vashistha assigned to co-chair the effort. Two additional DBB board members comprised the task force: David Walker and David Van Slyke. These individuals more than meet the independence and competencies required by the NDAA. Approach: The DBB task force focused on the CMO office and the Department of Defense (DoD) business transformation activities since 2008 when the office was first established by the Congress as the Deputy Chief Management Officer (DCMO), and in 2018 when the Congress increased its statutory authority and elevated it to Executive Level (EX) II and the third ranking official in DoD. The taskforce reviewed all previous studies of DoD management and organizations going back twenty years and completed over ninety interviews, including current and former DoD, public and private sector leaders. The assessments of CMO effectiveness since 2008 are focused on the performance of the CMO as an organizational entity, and is not an appraisal of any administration or appointee. -

Treading the Thin Blue Line: Military Special-Operations Trained Police SWAT Teams and the Constitution

William & Mary Bill of Rights Journal Volume 9 (2000-2001) Issue 3 Article 7 April 2001 Treading the Thin Blue Line: Military Special-Operations Trained Police SWAT Teams and the Constitution Karan R. Singh Follow this and additional works at: https://scholarship.law.wm.edu/wmborj Part of the Law Enforcement and Corrections Commons Repository Citation Karan R. Singh, Treading the Thin Blue Line: Military Special-Operations Trained Police SWAT Teams and the Constitution, 9 Wm. & Mary Bill Rts. J. 673 (2001), https://scholarship.law.wm.edu/wmborj/vol9/iss3/7 Copyright c 2001 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/wmborj TREADING THE THIN BLUE LINE: MILITARY SPECIAL-OPERATIONS TRAINED POLICE SWAT TEAMS AND THE CONSTITUTION The increasing use of SWAT teams and paramilitaryforce by local law enforcement has been thefocus of a growingconcern regardingthe heavy-handed exercise of police power. Critics question the constitutionality ofjoint-training between the military and civilian police, as well as the Fourth Amendment considerationsraised by SWAT tactics. This Note examines the history, mission, and continuing needfor police SWAT teams, addressingthe constitutionalissues raisedconcerning training and tactics. It explains how SWATjoint-training with the military is authorized by federal law and concludes that SWAT tactics are constitutionallyacceptable in a majority of situations. Though these tactics are legal andconstitutionally authorized, this Note acknowledges the validfearscritics have regarding the abuse of such police authority, and the limitations of constitutionaltort jurisprudence in adequately redressingresulting injuries. INTRODUCTION Americans awoke on the morning of April 23,2000 to news images seemingly taken from popular counterterrorist adventure movies. -

America's Political System Is Broken

We can fix this. © 2015 Lynford Morton America’s political system is broken. Money has too much power in politics. Our nation faces We are the ReFormers Caucus: A bipartisan group of a governing crisis, and polls confirm an overwhelming former members of Congress and governors dedicated to majority of Americans know it. We deserve solutions now. building a better democracy – one where Americans from The 2016 election must be the last of its kind. all walks of life are represented and are empowered to tackle our nation’s most pressing challenges. That’s why we are coming together – Republicans and Democrats – to renew the promise of self-governance. We have the solutions. Let’s get to work. The ReFormers Caucus We are more than 100 strong and growing. Join us. Rep. Les Aucoin (D-OR) Rep. Tom Downey (D-NY) Rep. Barbara Kennelly (D-CT) Rep. John Edward Porter (R-IL) Sec. Bruce Babbitt (D-AZ) Rep. Karan English (D-AZ) Sen. Bob Kerrey (D-NE) Sen. Larry Pressler (R-SD) Sen. Nancy Kassebaum Baker (R-KS) Rep. Victor Fazio (D-CA) Rep. Ron Klein (D-FL) Sen. Mark Pryor (D-AR) Rep. Michael Barnes (D-MD) Rep. Harold Ford, Jr. (D-TN) Rep. Mike Kopetski (D-OR) Gov. Bill Ritter (D-CO) Rep. Charles Bass (R-NH) Amb. Wyche Fowler (D-GA) Rep. Peter Kostmayer (D-PA) Amb. Tim Roemer (D-IN) Rep. Berkley Bedell (D-IA) Rep. Martin Frost (D-TX) Amb. Madeleine Kunin (D-VT) Rep. Bill Sarpalius (D-TX) Rep. Tony Beilenson (D-CA) Rep. -

MICROCOMP Output File

FINAL EDITION OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SIXTH CONGRESS . JANUARY 4, 2001 Compiled by JEFF TRANDAHL, Clerk of the House of Representatives http://clerk.house.gov Republicans in roman (222); Democrats in italic (208); Independents in SMALL CAPS (2); vacancies (3) 1st VA, 4th MN, 32d CA; total 435. The number preceding the name is the Member’s district. ALABAMA 1 Sonny Callahan ........................................... Mobile 2 Terry Everett ............................................... Enterprise 3 Bob Riley ..................................................... Ashland 4 Robert B. Aderholt ...................................... Haleyville 5 Robert E. (Bud) Cramer, Jr. ........................ Huntsville 6 Spencer Bachus ........................................... Vestavia Hills 7 Earl F. Hilliard ........................................... Birmingham ALASKA AT LARGE Don Young ................................................... Fort Yukon ARIZONA 1 Matt Salmon ................................................ Mesa 2 Ed Pastor ..................................................... Phoenix 3 Bob Stump ................................................... Tolleson 4 John B. Shadegg .......................................... Phoenix 5 Jim Kolbe ..................................................... Tucson 6 J. D. Hayworth ............................................ Scottsdale ARKANSAS 1 Marion Berry ............................................... Gillett