Introduction to the Federal Open Market Committee (FOMC) and Monetary Policy June 6, 2013 Rexburg, ID

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EATON 2019 Proxy Statement and Notice of Meeting 9

Proposal 1: Election of Directors —Our Nominees Gregory R. Page Retired Chairman and Chief Executive Officer, Cargill Gregory R. Page is the retired Chairman and Chief Executive Officer of Cargill, an international marketer, processor and distributor of agricultural, food, financial and industrial products and services. He was named Corporate Vice President & Sector President, Financial Markets and Red Meat Group of Cargill in 1998, Corporate Executive Vice President, Financial Markets and Red Meat Group in 1999, and President and Chief Operating Officer in 2000. He became Chairman and Chief Executive Officer in 2007 and was named Executive Chairman in 2013. Mr. Page served as Executive Director from 2015 to 2016, after which he retired from the Cargill Board. Mr. Page is a director of 3M and Deere & Company and is a member of the Advisory Committee of the Agriculture Division of DowDuPont, Corteva. He is past Chairman and current board member of Big Brothers Big Sisters of America. Mr. Page is a former Director since 2003 director of Carlson and the immediate past President and a board member of the Northern Star Council Age 67 of the Boy Scouts of America. He is a member of the board of the American Refugee Committee. Director Qualifications: As the retired Chairman and former Chief Executive Officer of one of the largest global corporations, Mr. Page brings extensive leadership and global business experience, in-depth knowledge of commodity markets, and a thorough familiarity with the key operating processes of a major corporation, including financial systems and processes, global market dynamics and succession management. Mr. -

Harvard Law Today

Ruling out Risk? | Harvard Law Today http://today.law.harvard.edu/feature/ruling-risk/ http://today.harvard.edu In 20 years as a bank regulatory lawyer, Robin Maxwell ’85 has encountered nothing quite as complicated as the Volcker Rule, the 2010 financial overhaul law provision designed to limit risk-taking on Wall Street. So when the five U.S. banking regulators approved the final version last December, Maxwell shut the door of her midtown Manhattan office, did her best to ignore the phone and emails, and started to read. For three days, Maxwell pored over the 71-page rule and nearly 900-page preamble, trying to figure out what was different from an earlier version, which had attracted withering criticism on Wall Street. “This was just a huge new piece of incredibly important regulation essentially coming down at 1 of 7 6/17/2014 3:31 PM Ruling out Risk? | Harvard Law Today http://today.law.harvard.edu/feature/ruling-risk/ once,” says Maxwell, who heads Linklaters’ U.S. financial regulation group. “It’s an interesting and challenging time.” Three and a half years after President Barack Obama ’91 signed the Dodd-Frank Act into law, directing regulators to develop the Volcker Rule, banks finally had the final language detailing how regulators intended to limit banks’ ability to trade on their own money and invest in hedge funds. But the work was just beginning for banking lawyers such as Maxwell, who estimates she has spent 90 percent of her time since December helping client banks figure out what the final rule means and how to comply with it. -

US FEDERAL RESERVE in FOCUS Who Matters in the FOMC?

US FEDERAL RESERVE IN FOCUS Who Matters In The FOMC? Sensing the Fed is finally on the cusp of normalizing pol- throughout the last few years) and the QE program com- icy interest rate, there will be a sharper intensity in mar- ing to an end in the next FOMC meeting on 28-29 Oct 2014, ket’s Fed watching, not just about the FOMC decisions the market is sensing that the Fed is finally on the cusp of and the minutes, and also Fed officials’ commentary. normalizing the FFTR. The market consensus is currently ex- pecting the Fed’s rate-lift off to take place in the summer of A recent St. Louis Fed report highlighted that between 2015 (we are expecting it to be announced in the 16-17 June 2008 and 2014, the Fed Reserve bank presidents ac- 2015 FOMC). Thus, there is increasingly intense interest in Fed counted for all of the dissents since 2008 which is un- watching, both in terms of the FOMC decisions & minutes as usual according to the authors. In prior years, both Fed well as the comments from senior Fed Reserve officials that Presidents and Fed Board Governors dissented. are participants in the FOMC (voters and non-voters). In 2014 FOMC decisions so far, Charles Plosser and Rich- First, it is instructive to have a bit of background to the mon- ard Fishers are the key dissenters. And we believe that etary policy formulation process within the US Federal Re- they may be joined by Loretta Mester in the dissent serve. -

Climate Risk Regulatory Developments in the Financial Services Industry (FSI)

February 2021 Creating a climate of change digest: Climate risk regulatory developments in financial services Leading off management of climate risks in financial services, now and in the Until recently, climate risk has received significantly more interest coming decade. We look forward to convening a dialogue with you from United Kingdom (UK) and European Union (EU) financial on these important developments and their broader impact. institutions and regulators than from their United States (US) The current landscape counterparts. Over the past several months, however, there has On pause: The Office of the Comptroller of the Currency’s (OCC) been a steady increase in US regulatory and supervisory activities proposed rule to ensure fair access to the banking system reflects to monitor climate risks and assess their impact on global financial the ongoing discussion over the proper role of incorporating stability, accompanied by growing climate awareness among environmental, social, and governance (ESG) principles in capital leading US financial institutions. In an annual letter to CEOs, allocation and corporate decision-making. BlackRock’s Chairman and CEO Larry Fink urged all companies to assess sustainability risks and disclose a plan for how their To begin this month’s perspective, we are highlighting the rapidly business models will be compatible with a net-zero economy evolving debate and rulemaking process following the OCC’s 1 “rather than waiting for regulators to impose them.” proposed rule to ensure fair access to the banking system, which— in less than two months—went from proposal to comment period The sustainability agenda will likely continue, accelerating change to finalized rule, only to be paused in the Federal Register on for financial services in the US with a new administration, Congress, January 28, 2021.2 and regulatory leadership. -

Maintaining Stability in a Changing Financial System

The Participants TOBIAS ADRIAN JEANNINE AvERSA Senior Economist Economics Writer Federal Reserve Bank of New York Associated Press SHAMSHAD AKHTAR MARTIN H. BARNES Governor Managing Editor, State Bank of Pakistan The Bank Credit Analyst BCA Research LEWIS ALEXANDER Chief Economist CHARLES BEAN Citi Deputy Governor Bank of England HAMAD AL-SAYARI Governor STEVEN BECKNER Saudi Arabian Monetary Agency Senior Correspondent Market News International SINAN ALSHABIBI Governor C. FRED BERGSTEN Central Bank of Iraq Director Peterson Institute for DAVID E. ALTIG International Economics Senior Vice President and Director of Research RICHARD BERNER Federal Reserve Bank of Atlanta Co-Head, Global Economics Morgan Stanley, Inc. SHUHEI AOKI General Manager for the Americas BRIAN BLACKSTONE Bank of Japan Special Writer Dow Jones Newswires 679 08 Book.indb 679 2/13/09 3:59:24 PM 680 The Participants ALAN BOLLARD JOSÉ R. DE GREGORIO Governor Governor Reserve Bank of New Zealand Central Bank of Chile HENDRIK BROUWER SErvAAS DEROOSE Executive Director Director De Nederlandsche Bank European Commission JAMES B. BULLARD WILLIAM C. DUDLEY President and Chief Executive Vice President Executive Officer Federal Reserve Bank of New York Federal Reserve Bank of St. Louis ROBERT H. DUGGER MARIA TEODORA CARDOSO Managing Director Member of the Board of Directors Tudor Investment Corporation Bank of Portugal ELIZABETH A. DUKE MARK CARNEY Governor Governor Board of Governors of the Bank of Canada Federal Reserve System JOHN CASSIDY CHARLES L. EvANS Staff Writer President and Chief The New Yorker Executive Officer Federal Reserve Bank of Chicago LUC COENE Deputy Governor MARK FELSENTHAL National Bank of Belgium Correspondent Reuters LU CÓRDOVA Chief Executive Officer MIGUEL FERNÁNDEZ Corlund Industries OrDÓÑEZ Governor ANDREW CROCKETT Bank of Spain President JPMorgan Chase International CAMDEN R. -

Administration of Barack Obama, 2014 Nominations Submitted to The

Administration of Barack Obama, 2014 Nominations Submitted to the Senate November 21, 2014 The following list does not include promotions of members of the Uniformed Services, nominations to the Service Academies, or nominations of Foreign Service Officers. Submitted January 6 Jill A. Pryor, of Georgia, to be U.S. Circuit Judge for the 11th Circuit, vice Stanley F. Birch, Jr., retired. Carolyn B. McHugh, of Utah, to be U.S. Circuit Judge for the 10th Circuit, vice Michael R. Murphy, retired. Michelle T. Friedland, of California, to be U.S. Circuit Judge for the Ninth Circuit, vice Raymond C. Fisher, retired. Nancy L. Moritz, of Kansas, to be U.S. Circuit Judge for the 10th Circuit, vice Deanell Reece Tacha, retired. John B. Owens, of California, to be U.S. Circuit Judge for the Ninth Circuit, vice Stephen S. Trott, retired. David Jeremiah Barron, of Massachusetts, to be U.S. Circuit Judge for the First Circuit, vice Michael Boudin, retired. Robin S. Rosenbaum, of Florida, to be U.S. Circuit Judge for the 11th Circuit, vice Rosemary Barkett, resigned. Julie E. Carnes, of Georgia, to be U.S. Circuit Judge for the 11th Circuit, vice James Larry Edmondson, retired. Gregg Jeffrey Costa, of Texas, to be U.S. Circuit Judge for the Fifth Circuit, vice Fortunato P. Benavides, retired. Rosemary Márquez, of Arizona, to be U.S. District Judge for the District of Arizona, vice Frank R. Zapata, retired. Pamela L. Reeves, of Tennessee, to be U.S. District Judge for the Eastern District of Tennessee, vice Thomas W. Phillips, retiring. -

Congressman Jamie Raskin Maryland’S 8Th Congressional District

Congressman Jamie Raskin Maryland’s 8th Congressional District Congressman Jamie Raskin proudly represents Maryland’s 8th Congressional District in the U.S. House of Representatives. The district includes parts of Montgomery, Carroll, and Frederick Counties. Raskin was sworn in to the 115th Congress on January 3, 2017. Congressman Raskin is the Vice-Ranking Member of the House Judiciary Committee, and serves on two Judiciary subcommittees: the Subcommittee on the Constitution and Civil Justice; and the Subcommittee on Crime, Terrorism, Homeland Security, and Investigation. He also serves on the House Oversight and Government Reform Committee, and the Committee on House Administration. Raskin is the Freshman Representative on the House Democratic Steering and Policy Committee, the Congressional Progressive Caucus Vice Chair and Liaison to New Members, and a Senior Whip for the House Democratic Caucus. For more than 25 years, Congressman Raskin has been a professor of constitutional law at American University’s Washington College of Law. He authored several books, including the Washington Post best-seller Overruling Democracy: The Supreme Court versus the American People and the highly-acclaimed We the Students: Supreme Court Cases For and About America’s Students, which has sold more than 50,000 copies. Prior to his time in Congress, Jamie was a three-term State Senator in Maryland, where he also served as the Senate Majority Whip. He quickly earned a reputation for building coalitions in Annapolis, and delivered a series of landmark legislative accomplishments. Congressman Raskin is a graduate of Harvard University and Harvard Law School. He and his wife, Sarah Bloom Raskin, live in Takoma Park with their dog, Potter. -

Bernanke Visits Biotechnology Site in Oakland Thursday, October 14, 2010 by Erich Schwartzel-Pittsburgh Post Gazette

Bernanke visits biotechnology site in Oakland Thursday, October 14, 2010 By Erich Schwartzel-Pittsburgh Post Gazette Lake Fong/Post-Gazette Federal Reserve chairman Ben Bernanke, right, checks out a snaking robot camera made by Cardiorobotics Inc. that's used in minimally invasive surgical procedures. Looking on in South Oakland are three company executives, from left to right, CEO Samuel Straface, vice president Kevin Gilmartin and director of clinical application Richard Kuenzler Say what you will about the economic crisis, but it’s done amazing things for Ben Bernanke's celebrity. In what other economic environment would hallways fill with paparazzi ready to catch the chairman of the Federal Reserve? When else would national cable stations send two teams of reporters to track a former Princeton professor? Boom mics almost outnumbered Secret Service earpieces when Mr. Bernanke stopped Wednesday for two hours at the Pittsburgh Life Sciences Greenhouse. He's in town for a meeting today between the Federal Reserve Bank of Cleveland and the Fed's Pittsburgh branch, and the listening-tour portion of his trip started at the Greenhouse, a local incubator program for biotechnology companies. But drastic economic measures like stimulus funding and bank bailouts have transformed the Fed chairman from a bureaucratic mainstay into a political operative, equal parts prophet and punching bag. Indeed, if Wednesday's discussion was any proof, Mr. Bernanke now presides over a nation of nervous entrepreneurs ready to question his every decision -- even if he's in the same room. A quiet tour of four Greenhouse-assisted companies was followed by a lively discussion on the problems executives face in a national credit crunch. -

Pdfroster of Attendees

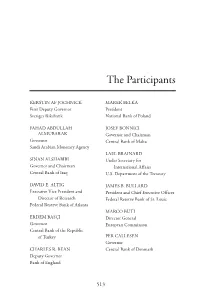

The Participants KERSTIN AF JOCHNICK MAREK BELKA First Deputy Governor President Sveriges Riksbank National Bank of Poland FAHAD ABDULLAH JOSEF BONNICI ALMUBARAK Governor and Chairman Governor Central Bank of Malta Saudi Arabian Monetary Agency LAEL BRAINARD SINAN ALSHABIBI Under Secretary for Governor and Chairman International Affairs Central Bank of Iraq U.S. Department of the Treasury DAVID E. ALTIG JAMES B. BULLARD Executive Vice President and President and Chief Executive Officer Director of Research Federal Reserve Bank of St. Louis Federal Reserve Bank of Atlanta MARCO BUTI ERDEM BASÇI Director General Governor European Commission Central Bank of the Republic of Turkey PER CALLESEN Governor CHARLES R. BEAN Central Bank of Denmark Deputy Governor Bank of England 513 514 The Participants AGUSTÍN CARSTENS DOUGLAS W. ELMENDORF Governor Director Bank of Mexico Congressional Budget Office NORMAN CHAN WILLIAM B. ENGLISH Chief Executive Director of Monetary Affairs Hong Kong Monetary Authority Board of Governors of the Federal Reserve System LUC COENE Governor CHARLES L. EVANS National Bank of Belgium President and Chief Executive Officer Federal Reserve Bank of Chicago JULIA LYNN CORONADO Chief Economist for North America MARTIN FELDSTEIN BNP Paribas President Emeritus, National Bureau of Economic Research CARLOS DA SILVA COSTA Professor, Harvard University Governor Bank of Portugal JACOB A. FRENKEL Chairman CHARLES H. DALLARA JP Morgan Chase International Managing Director Institute of International Finance ARDIAN FULLANI Governor TROY DAVIG Bank of Albania Senior Vice President and Director of Research JOHN GEANAKOPLOS Federal Reserve Bank of Kansas City Professor Yale University PAUL DEBRUCE CEO and Founder, ESTHER L. GEORGE DeBruce Grain Inc. -

Sarah Bloom Raskin Is Deputy Secretary of the U.S

Sarah Bloom Raskin is Deputy Secretary of the U.S. Department of the Treasury, a position for which she was confirmed by the United States Senate on March 12, 2014. In addition to the broad range of substantive and organizational issues she oversees and directs at the Treasury Department, Ms. Raskin focuses on the macroeconomic impact of student loan borrowing, and cyber security, as well as drivers that bolster and sustain U.S. and global economic growth and recovery. Prior to her confirmation as Deputy Secretary, Ms. Raskin served as a Governor of the Federal Reserve Board where she conducted the nation’s monetary policy as a member of the Federal Open Markets Committee, regulated banking institutions, monitored threats to financial stability, oversaw compliance and community development, and engaged in oversight of the nation’s payment systems. In addition, she chaired the Board’s Committee on Board Affairs as the Board’s Administrative Governor. She was confirmed to the Federal Reserve by the United States Senate on September 30, 2010. Before joining the Federal Reserve Board, Ms. Raskin served as the Commissioner of Financial Regulation for the State of Maryland from 2007 to 2010. As Commissioner, during and after the financial crisis, she and her agency were responsible for regulating Maryland’s financial institutions, including all state-chartered depository institutions, banks, credit unions, mortgage lenders, mortgage servicers, and trust companies, among others. Throughout her career, Ms. Raskin has worked across the public and private sectors in both legal and regulatory capacities. Her work has centered on the landscape for financial services, regional and community banks, financial market utilities, consumer protection issues, economic growth and income inequality, and Dodd-Frank implementation, including the Volcker Rule, enhanced prudential standards, and resolution planning. -

FEDERAL RESERVE SYSTEM Board of Governors of the Federal Reserve System Twentieth Street and Constitution Avenue NW., Washington, DC 20551 Phone, 202–452–3000

404 U.S. GOVERNMENT MANUAL Activities Superintendent of Documents, U.S. Cases brought before the Commission Government Printing Office, are assigned to the Office of Washington, DC 20402. The Administrative Law Judges, and hearings Commission’s Web site includes recent are conducted pursuant to the decisions, a searchable database of requirements of the Administrative previous decisions, procedural rules, Procedure Act (5 U.S.C. 554, 556) and audio recordings of recent public the Commission’s procedural rules (29 meetings, and other pertinent CFR 2700). information. A judge’s decision becomes a final but nonprecedential order of the Requests for Commission records should Commission 40 days after issuance be submitted in accordance with the unless the Commission has directed the Commission’s Freedom of Information case for review in response to a petition Act regulations. Other information, or on its own motion. If a review is including Commission rules of procedure conducted, a decision of the and brochures explaining the Commission becomes final 30 days after Commission’s functions, is available issuance unless a party adversely from the Executive Director, Federal affected seeks review in the U.S. Circuit Court of Appeals for the District of Mine Safety and Health Review Columbia or the Circuit within which Commission, 601 New Jersey Avenue the mine subject to the litigation is NW., Suite 9500, Washington, DC located. 20001–2021. Internet, www.fmshrc.gov. As far as practicable, hearings are held Email, [email protected]. at locations convenient to the affected For information on filing requirements, mines. In addition to its Washington, the status of cases before the DC, offices, the Office of Administrative Law Judges maintains an office in the Commission, or docket information, Colonnade Center, Room 280, 1244 contact the Office of General Counsel or Speer Boulevard, Denver, CO 80204. -

1 in the United States District Court For

IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION LEON STAMBLER, § § Plaintiff, § § v. § § FEDERAL RESERVE BANK OF ATLANTA, § FEDERAL RESERVE BANK OF BOSTON, § FEDERAL RESERVE BANK OF CHICAGO, § FEDERAL RESERVE BANK OF § Civil Action No. 2:12-cv-611 CLEVELAND, FEDERAL RESERVE BANK § OF DALLAS, FEDERAL RESERVE BANK § OF KANSAS CITY, FEDERAL RESERVE § JURY TRIAL DEMANDED BANK OF MINNEAPOLIS, FEDERAL § RESERVE BANK OF NEW YORK, § FEDERAL RESERVE BANK OF § PHILADELPHIA, FEDERAL RESERVE § BANK OF RICHMOND, FEDERAL § RESERVE BANK OF SAN FRANCISCO, and § FEDERAL RESERVE BANK OF ST. LOUIS, § § Defendants. § PLAINTIFF’S ORIGINAL COMPLAINT FOR PATENT INFRINGEMENT Plaintiff LEON STAMBLER files this Original Complaint against the above-named Defendants, alleging as follows: I. THE PARTIES 1. Plaintiff LEON STAMBLER (“Stambler”) is an individual residing in Parkland, Florida. 2. On information and belief, Defendant FEDERAL RESERVE BANK OF ATLANTA is a corporation organized and existing under the laws of the United States of America, with its principal place of business in Atlanta, Georgia. This Defendant may be served 1 with process by and through its President and CEO at Federal Reserve Bank of Atlanta, c/o Dennis P. Lockhart, 1000 Peachtree Street, N.E., Atlanta, Georgia 30309. 3. On information and belief, Defendant FEDERAL RESERVE BANK OF BOSTON is a corporation organized and existing under the laws of the United States of America, with its principal place of business in Boston, Massachusetts. This Defendant may be served with process by and through its President and CEO at Federal Reserve Bank of Boston, c/o Eric S. Rosengren, 600 Atlantic Avenue, Boston, Massachusetts 02210-2204.