Gores Holdings III, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PENDING PETITION MEMO Date: 711212007

PENDING PETITION MEMO Date: 711212007 TO : Office of Accounting and Finance Office of General Counsel Office of Telecommunications FROM : CENTRAL OPERATIONS UTILITY: FIRST COMMUNICATIONS, LLC SUBJECT: 07-C-0824 Joint Petition of First Communications, LLC, Xtension Services. Inc. and Gores FC Holdings, LLC for Approval for Transfer of Control. BINGHAM :I z _ I +- : Jean L. Kiddoo ~. Danielle Burt -".Ln ' Phone: 202.373.6000 -7 Fax: 202.373.6001 Ym, , [email protected] [email protected] -r; zj". fi July 1 1,2007 A 1 Via FedEx 1 Jaclyn A. Brilling, Secretary New York Public Service Commission Agency Building 3 Three Empire State Plaza Albany, N.Y. 12223-1350 ! Re: Joint Petition of First Communications, LLC, Xtension Services, Inc., and Gores FC Holdings, LLC for Approval for Transfer of Control Dear Ms. Brilling: / Please tind enclosed for filing with the Commission an original and nine (9) copies of the ' above-referenced Joint Petition. In addition, First Communications, LLC, Xtension Services, Inc. and First Communications, Inc. hereby notify the Commission that on July 2, 2007, they consummated the transfers of control described in the Petition approved in Docket No. 06-C-1440. Please date-stamp the enclosed extra copy of this filing and return it in the self-addressed, stamped envelope provided. Should you have any questions, please do not hesitate to Boston contact the undersigned. Hartfold HOng Kong Respectfully submitted, London 10s An~eles New Yark Orange County Jean L. Kiddoo San Francisco Danielle Burt Santa Monica Silicon Valley Tokyo Enclosure Walnut Creek Wnshlrlpton Bingham McCutchen LLP 1010 K Strecl NW Washlngten, DC 10006~1806 BEFORE THE NEW YORK PUBLIC SERVICE COMMISSION Joint Petition of ) ) First Communications, LLC, ) Xtension Services, Inc., ) and ) Gores FC Holdings, LLC ) ) For Approval of Transfer of Control ) JOINT PETITION First Communications, LLC ("FCL"), Xtension Services, Inc. -

John Laco Partner

John Laco Partner Los Angeles D: +1-213-430-6544 [email protected] John Laco is a seasoned corporate lawyer with 30 years of Admissions experience advising public and private companies and financial investors. Bar Admissions California He works with some of the best-known Southern California companies global private equity and institutional investors along the full investment cycle, from negotiating initial investments and Education acquisitions to subsequent tack-on acquisitions, financings, and Loyola Marymount University, J.D., portfolio company growth counseling. 1992: Loyola Law Review, Editor and John is also a boardroom level counselor who provides C-level Staff Member; Order of the Coif; American Jurisprudence Award, executives, in-house counsel, and boards of directors with Torts/Legal Writing experienced corporate advice on fiduciary duties, corporate University of Notre Dame, B.S.E.E., structuring, stockholder agreements, complex commercial 1987 arrangements and transformative strategic undertakings. Lead Engineer/Manager, Northrop, He offers deep knowledge of business and legal issues in the Reliability Engineering Group, 1987- manufacturing, retail, infrastructure, agriculture, aerospace, and 1989 technology sectors, and is a founding member of O’Melveny’s Water Industry Practice. John leads O’Melveny’s Equity Investment Committee, an internal group managing the investment of more than US$180 million of the firm’s retirement funds. He is the Chair of the O’Melveny Scholarship Program, which provides college scholarships and mentors to fifth graders at LAUSD’s O’Melveny Elementary School, with the goal of encouraging each “O’Melveny Scholar” to succeed academically and pursue a college education. O’Melveny & Myers LLP 1 Experience • Representing Guess?, Inc. -

Health Care Spending and Investment Opportunities on the Rise

HEALTH CARE SPENDING AND INVESTMENT OPPORTUNITIES ON THE RISE WEISERMAZARS THOUGHT LEADERSHIP U.S. HEALTH CARE SYSTEM ON THE CUSP OF CHANGE AS A RESULT OF NEW TECHNOLOGIES COMING INTO THE MARKET. With so many challenges ahead, investors have ample opportunity to make investments in the sector. WeiserMazars LLP is an independent member firm of Mazars Group. HEALTH CARE PROVIDERS NEED TO FIGURE OUT HOW TO OPTIMALLY LEVERAGE TECHNOLOGY. If there’s a T.V. Junkie in your home, you’re familiar with House, the television medical drama that followed Dr. Gregory House as he led a team of top diagnosticians to miraculously solve the most difficult medical cases. Dr. House saved each of his patients’ lives in under 45 minutes—an awesome feat. Of course this show is fiction, but new technologies are indeed making it easier for real life physicians to develop correct diagnoses—maybe not in 45 minutes—but more quickly than was previously possible. For example, new sensor technology enables a physician to remotely receive real-time information about the heartbeat and blood levels of a patient in a distant location. “We still have a long way to go, but the U.S. health care system is on the cusp of change as a result of new technologies coming government initiatives and the aging population at a reasonable into the market. Adoption will take some time, but it is a step in cost. Predictive models were non-existent 20 years ago, but the right direction,” says Steven Kops, a Partner in the Financial today they enable physicians to rapidly zero in on a correct Advisory Services Group at WeiserMazars. -

Financial Sponsors Go on a SPAC Attack

Financial sponsors go on a SPAC attack Once a shaky alternative to conventional IPOs, these special-purpose acquisition companies are being used by private equity firms to buy and exit portfolio holdings. By Bill Meagher Updated on August 12, 2016, 11:31 AM ET Over the last year, more than half of the initial public offerings and registrations tied to special -purpose acquisition plays have been led by private equity players. And while PE investors have always had a connection to this quirky corner of Wall Street, the bond has never been this pronounced. According to PrivateRaise, a service of The Deal LLC, nine SPACs since August 2015 have raised almost $3.8 billion in IPOs led by PE-related entities. That total includes a $510 million private-equity-in-public-equity, or PIPE, transaction prior to the$690 million May 2016 IPO of CF Corp. (CFCO), a blank check company led by former Blackstone Group LP dealmaker Chinh Chu and Fidelity National Financial Inc. Chairman William Foley. The CF deal was the largest transaction in the past year, but it certainly wasn't the only transaction that included marquee private equity investors. July, for example, saw Conyers Park Acquisition Corp. (CPAAU) sponsor Centerview Capital Holdings debut its $402.5 million IPO, and TPG Capital LP is behind the $450 million IPO of Pace Holdings Corp. (PACE). Riverstone Holdings LLC, a PE firm focused on the energy sector, priced its $500 million Silver Run Acquisition Corp. (SRAQ) SPAC in February. Fellow energy player KLR Holdings raised $85 million with its KLR Acquisition Corp. -

The Software Industry Financial Report

The Software Industry Financial Report 2015 Annual 2015 Software Equity Group, L.L.C. 12220 El Camino Real Suite 320 San Diego, CA 92130 [email protected] (858) 509-2800 SOFTWARE INDUSTRY FINANCIAL REPORT CONTENTS About Software Equity Group Leaders in Software M&A 5 Extensive Global Reach 6 About Software Equity Group 7 Software Industry Macroeconomics U.S and Global GDP 9 U.S. GDP and Unemployment 10 Global IT Spending 11 E-Commerce and Digital Advertising Spend 12 Stock Market Performance 13 Public Software Financial and Valuation Performance The SEG Software Index 15 The SEG Software Index: Financial Performance 16-20 The SEG Software Index: Public Market Multiples 21-23 The SEG Software Index by Product Category 24 The SEG Software Index by Product Category: Financial Performance 25 The SEG Software Index by Product Category: Public Market Multiples 26 Public SaaS Company Financial and Valuation Performance The SEG SaaS Index 28 The SEG SaaS Index: Financial Performance 29-33 The SEG SaaS Index: Public Market Multiples 34-37 The SEG SaaS Index by Product Category: Financial Performance 38 The SEG SaaS Index by Product Category: Public Market Multiples 39 Public Internet Company Financial and Valuation Performance The SEG Internet Index 41 The SEG Internet Index: Financial Performance 42-46 The SEG Internet Index: Public Market Multiples 47-49 The SEG Internet Index by Product Category 50 The SEG Internet Index by Product Category: Financial Performance 51 The SEG Internet Index by Product Category: Public Market Multiples 52 -

ILPA Private Equity Principles Endorsements (Updated: April, 2017)

ILPA Private Equity Principles Endorsements (Updated: April, 2017) Historically, the private equity partnership structure has been effective in aligning the interests of investors (the “limited partners”) with those individuals managing the money (the “general partner”). By sharing a substantial portion of profits with the general partner and requiring the general partner to have a meaningful equity interest in their own funds, a business culture was created where most private equity firms were able to maintain a single-minded determination to maximize returns on the underlying investments. The principles contained herein are a means to restore and strengthen the basic “alignment of interests” value proposition in private equity. Certain terms and conditions that have gradually evolved should receive renewed attention in private equity partnership agreements entered into prospectively in order to (i) correctly align interests between general partners and limited partners, (ii) enhance fund governance and (iii) provide greater transparency to investors. A summary of private equity principles is provided below. Appendix A contains details on preferred private equity terms, and Appendix B contains best practices for Limited Partner Advisory Committees (“LPAC”). The concepts contained in these documents reflect suggested best practices and are intended to serve as a basis for continued discussion among and between the general partner and limited partner communities with the goal of improving the private equity industry for the long-term benefit of all its participants. These documents were developed through the efforts, contributions and collaboration of many institutional private equity investors and their senior investment officers, the Institutional Limited Partners Association (“ILPA”) and the Private Equity Principles and Best Practices Committee of the ILPA Board of Directors. -

The Rise of Spacs: Private Equity’S New Frontier

BLOG The rise of SPACs: Private Equity’s new frontier Ambarish Srivastava Although special-purpose acquisition companies (SPACs) have been around for three decades, they suddenly reported USD83bn in investments in 2020. We also noticed increased participation in SPACs by private equity (PE) firms. In the current scenario, investors are likely wondering what benefits PE firms and investors can expect from SPACs, and whether the current frenzy is sustainable or just a passing fad. Three decades of SPACs in nutshell SPACs first appeared in the late 1980s1. The 1990s were a dull phase as SPACs failed to benefit investors. They regained popularity in the early 2000s only to become dormant after 2007 due to the credit crunch2. The recent spike started in 2019 with Virgin Galactic’s USD674m SPAC deal that went public at a significant valuation of USD2.2bn3. Since then, SPAC deals have skyrocketed. The Economist estimates that about 250 SPACs raised close to USD83bn in 2020. They started 2021 with a strong footing – in January 2021, on average, five SPACs were created daily, achieving USD26bn in capital. The amounts raised in 2019 were surpassed in January 2021 alone4. CNBC estimates that USD38bn was achieved in early 20215 , but, of course, we are still counting. What is driving the current frenzy? Besides the stated reduction in the time and documentation involved, SPACs are often used in times of stress and volatility, as they help investors avoid the “typical time, risks and uncertainty6 associated with typical IPOs”, we believe the current uncertainty due to the pandemic and US election provided the tailwind. -

Various Investment Firms

20160229-NEWS--0001-NAT-CCI-CD_-- 2/26/2016 5:48 PM Page 1 After a winding road to development, work expected to start on new downtown building, PAGE 3 FEBRUARY 29-MARCH 6, 2016 Were pension fund Who gave what? Crain’s searched federal records to find out who some of the state’s business and government leaders have warnings missed? backed for president. The results reflect a sampling of $2,700 individual contributions. More donors on Page 25. Michigan donors gave more than $5 million to candidates By Robert Snell signs of revitalization in Detroit. A through January, months before the March 8 primary. [email protected] recession or poor market perform- All Candidates $5,411,523 Paul (R)* $198,289 Mayor Mike Duggan’s revelation ance by the city’s two pension funds Republicans $3,689,330 Fiorina (R)* $101,639 that the city faces a $491 million could even mean Detroit would be pension fund shortfall shocked forced to pay more than $491 mil- Democrats $1,718,804 O’Malley (D)* $31,131 legal experts and city officials who lion starting in 2024. Clinton (D) $1,174,906 Trump (R) $27,067 thought Detroit had left budget- “If there is a change in the market Dan Gilbert Richard DeVos Sr. Bush (R)* $998,093 Christie (R)* $24,075 busting problems behind in bank- ... going forward, it could have an Carson (R) $862,147 Graham (R)* $21,635 $500,000 + $750,000 $250,000 ruptcy court. impact on how large the deficit is in Rubio (R) $618,459 Jindal (R)* $11,300 Interviews and court records, 2024,” Detroit’s CFO John Hill said. -

CPT Employers: 2013-2018

CPT Employers: 2013-2018 Table of Contents Background ______________________________________________________________________________ 2 Arts & Humanities ________________________________________________________________________ 2 Engineering ______________________________________________________________________________ 4 Professional programs _____________________________________________________________________ 8 Social Sciences __________________________________________________________________________ 16 Sciences ________________________________________________________________________________ 21 1 of 27 BACKGROUND International student leaders came to the Dashew Center for International Students & Scholars and the Career Center with concerns about possible discrimination in the job market affecting them as they seek career development opportunities through two forms of work authorization: Curricular Practical Training (CPT) and Optional Practical Training (OPT). While the Dashew Center does not have direct information about discrimination in the job market, the center periodically publishes lists of employers known to hire international students, sometimes in collaboration with the Career Center, as resources allow. The purpose of these lists is to 1) support the job-seeking process for international students by providing lists of employers who have demonstrated their willingness to employ international students, and 2) recognize employers who have hired international students. The following list is organized by field of study (e.g. the -

Gores Holdings, Inc. Completes Acquisition of Hostess Brands, Llc, Maker of Twinkies®

GORES HOLDINGS, INC. COMPLETES ACQUISITION OF HOSTESS BRANDS, LLC, MAKER OF TWINKIES® Combined company renamed Hostess Brands, Inc. and will trade on NASDAQ under TWNK and TWNKW FOR IMMEDIATE RELEASE LOS ANGELES, CA, November 4, 2016 – Gores Holdings, Inc. (“Gores Holdings”) (NASDAQ CM: GRSHU, GRSH, GRSHW), a special purpose acquisition company sponsored by an affiliate of The Gores Group, LLC (“The Gores Group” or “Gores”), today announced that it completed the acquisition of Hostess Brands, LLC (“Hostess Brands”), the maker of Hostess® Twinkies®, Ding Dongs® and CupCakes. The transaction has been unanimously approved by the Boards of Directors of both Gores Holdings and the indirect parent of Hostess Brands, and was approved at a special meeting of Gores Holdings’ shareholders on November 3, 2016. In connection with the transaction, Gores Holdings has been renamed Hostess Brands, Inc. (“Hostess” or “the Company”), and its common stock and warrants will trade on NASDAQ under the symbols “TWNK” and “TWNKW”, respectively. As previously announced, along with the $375 million of Gores Holdings’ shareholder equity, additional investors comprising large institutional investors, C. Dean Metropoulos (through $50 million of additional rollover contribution) and Gores affiliates participated in a $350 million private placement, led by Alec Gores, Chairman and CEO of The Gores Group. Additionally, funds managed by affiliates of Apollo Global Management, LLC (together with its consolidated subsidiaries, “Apollo”) (NYSE: APO) and C. Dean Metropoulos and family, the prior majority owners of Hostess, will continue to hold an approximately 42% combined stake in the Company. Dean Metropoulos and William Toler continue to lead Hostess as Executive Chairman and Chief Executive Officer, respectively. -

ILPA Private Equity Principles Endorsements (Updated: March 2018)

ILPA Private Equity Principles Endorsements (Updated: March 2018) The ILPA has authored the ILPA Private Equity Principles, a document that contains best practice concepts and that speaks to issues relating to the alignment of interest between general partners and limited partners, fund governance and transparency and reporting. It is intended to serve as a common framework for continued discussion among and between the general partner and limited partner communities with the goal of improving the private equity industry for the long-term benefit of all its participants. Endorsement of these Principles is an indication of general support for the efforts of the ILPA and industry supporters to contribute to an effort to strengthen the basic “alignment of interests” value proposition in private equity. The authors, sponsors and the groups below that have provided an endorsement of these Principles are not specifically committing to (nor seeking the commitment) of any private equity investor to each and every outlined term. Complete list of organizations that have endorsed the ILPA Private Equity Principles: ABB Merchant Banking Brookfield Asset Management Aberdeen Asset Management BT Pension Scheme Management Limited Abu Dhabi Investment Authority The California Public Employees' Retirement System Access Capital Partners (CalPERS) Achmea Investment Management B.V. California State Teachers' Retirement System Acorn Growth Companies Camden Living Advanced Capital Canada Pension Plan Investment Board General Partner* Canada Post Pension Plan Adveq Management AG Canadian Medical Protective Association AEW Capital Management Canyon Capital Realty Advisors Alberta Teachers’ Retirement Fund Capital Analytics Al Masah Capital Limited Capital Dynamics Allianz Capital Partners GmbH Capri Capital Partners, LLC Insurance Company* CapRidge Partners, LLC Almanac Realty Investors, LLC The Carlyle Group AlpInvest Partners Inc. -

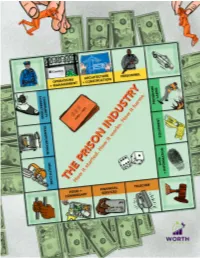

The Prison Industry and Ending the Exploitation of Those It Touches

Worth Rises Worth Rises is a non-profit advocacy organization dedicated to dismantling the prison industry and ending the exploitation of those it touches. Partnering deliberately with directly impacted people, we work to expose the commercialization of the legal system and advocate and organize to protect and return the economic value extracted from affected communities. We envision a society in which no entity or individual relies on human caging or control for their wealth, operation, or livelihood. Through our work, we strive to help pave the road toward a world without police and prisons. As part of our public education strategy, we conduct research, collect data, and perform innovative analyses aimed at unmasking the harms caused by the prison industry. Understanding the mobilizing power of knowledge, we transform our analyses into accessible and compelling content designed to increase awareness and shift discourse around the commercialization of the criminal legal system. Acknowledgements Worth Rises graciously acknowledges everyone whose time, energy, and passion went into the development of this report. Of course, we thank our staff members who worked tirelessly to get this report across the finish line Bianca Tylek, Jan Combopiano, Taylor Campbell, Luke Noel, and Martin Garcia. We thank David Etheridge-Bartow for his design and mensen for her illustrations. We also extend our thanks to Connor McCleskey, Tolu Lawal, Dana Rasso, and Megan French-Marcelin for their writing contributions, and Tamar Davis, Ekemini Ekpo, Hannah Ambinder, Benjamin Finegan, the Harvard Prison Legal Assistance Project, and the Yale Undergraduate Prison Project for their research support and editing assistance. Finally, we thank Adobe, and more specifically Jon Rogers, Jen Alleman, Mark Apker, Julie Carvalho, Josh Felt, Michael Fielding, Prashant S G, Benjamin Hillyard, Charlie Hunt, Nathan Metcalf, Mike Niedert, Nate Priday, Jamie Robinson, Aaron Sadock, and Tyson Young, for citation assistance.