Chairman's Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wealthy Gold Bus

Wealthy Gold Bus Ltd 學之園幼稚園暨雙語幼兒園(君豪校) - 褓姆車收費表 Learning Habitat Kindergarten& Bilingual Nursery (Novum East Campus) Nanny Bus Fee for School Year 2020-2021 編號 地區收費表 雙程(HKD$) 單程(HKD$) Code Districts Bus Fee Round Trip Single Trip 鰂魚涌、太古 Quarry Bay, Taikoo 1 太古城、康怡花園 Taikoo Shing, Kornhill Garden $850 $570 北角、炮台山 North Point, Fortress Hill 2 和富中心、城巿花園 Provident Centre, City Garden $900 $600 3 寶馬山花園、摩天大廈、富澤花園 $950 $640 Pacific Palisades, Skyscraper, Fortress Garden 西灣河、筲箕灣 Sai Wan Ho, Shau Kei Wan 4 鯉景灣、嘉亨灣、東濤苑 $900 $600 Lei King Wan, Grand Promenade, Tung Tao Crt 杏花村、柴灣、小西灣 Heng Fa Chuen, Chai Wan, Siu Sa Wan 5 杏花村、新翠花園、樂軒臺、富怡花園、富欣花園、藍灣半島 $1000 $670 Heng Fa Chuen, New Jade Garden, Lok Hin Terrace, Cheerful Garden, Harmony Garden, Island Resort 大坑 Tai Hang 6 瑞士花園、光明臺 Swiss Tower, Illumination Terrace $1000 $720 跑馬地 Happy Valley 7 藍塘道 Blue Pool Road $1120 $750 中半山干德道 Mid-Level Conduit Road 8 駿豪閣、金碧閣 Valiant Park, Cimbria Court $1380 $920 西營盤、堅尼地城 Sai Ying Pun, Kennedy Town 9 俊庭居、西港城 Imperial Terrace, Western Market $1220 $820 10 西寶城、華明中心、海景大廈 $1240 $830 The Westwood, Wah Ming Ctr, Seaview Mansion 香港仔、鴨脷洲 Aberdeen, Ap Lei Chau 11 深灣軒、海怡半島、香港仔中心 $1200 $800 Sham Wan Towers, South Horizon, Aberdeen Ctr 12 置富花園、碧瑤灣 Chi Fu Fa Yuen, Baguio Villa $1600 $1070 觀塘、藍田、油塘 Kwun Tong, Lam Tin, Yau Tong 13 匯景花園、鯉魚門廣場 Sceneway Garden, Domain $2000 $1340 14 觀塘福塘道 Kwun Tong Fuk Tong Road $2100 $1400 將軍澳 Tseung Kwan O 15 將軍澳皇冠假日酒店、寶林站、維景灣畔 $2280 $1520 TKO Hotel, Po Lam Station,Ocean Shore 16 日出康城 Lohas Park $2380 $1590 備註 Remarks: 1. -

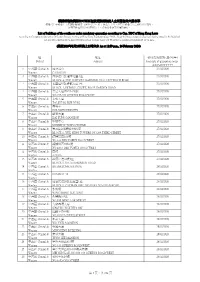

Name of Buildings Awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (As at 8 February 2018)

Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (as at 8 February 2018) Name of Building Type of Building District @Convoy Commercial/Industrial/Public Utilities Eastern 1 & 3 Ede Road Private/HOS Residential Kowloon City 1 Duddell Street Commercial/Industrial/Public Utilities Central & Western 100 QRC Commercial/Industrial/Public Utilities Central & Western 102 Austin Road Commercial/Industrial/Public Utilities Yau Tsim Mong 1063 King's Road Private/HOS Residential Eastern 11 MacDonnell Road Private/HOS Residential Central & Western 111 Lee Nam Road Commercial/Industrial/Public Utilities Southern 12 Shouson Hill Road Private/HOS Residential Central & Western 127 Repulse Bay Road Private/HOS Residential Southern 12W Commercial/Industrial/Public Utilities Tai Po 15 Homantin Hill Private/HOS Residential Yau Tsim Mong 15W Commercial/Industrial/Public Utilities Tai Po 168 Queen's Road Central Commercial/Industrial/Public Utilities Central & Western 16W Commercial/Industrial/Public Utilities Tai Po 17-19 Ashley Road Commercial/Industrial/Public Utilities Yau Tsim Mong 18 Farm Road (Shopping Arcade) Commercial/Industrial/Public Utilities Kowloon City 18 Upper East Private/HOS Residential Eastern 1881 Heritage Commercial/Industrial/Public Utilities Yau Tsim Mong 211 Johnston Road Commercial/Industrial/Public Utilities Wan Chai 225 Nathan Road Commercial/Industrial/Public Utilities Yau Tsim Mong Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) -

Environment and Conservation Fund. Trustee Report 2011-2012. For

Environment and Conservation Fund Environment and Conservation Fund Trustee Report 2011-2012 For Presentation to the Legislative Council on 31 October 2012 Environment and Conservation Fund CONTENTS Report by the Trustee Covering the Period 1 April 2011 to 31 March 2012 ........…......... 2 -6 Membership List of the Environment and Conservation Fund Committee ..................…. 7 Membership List of the Energy Conservation Projects Vetting Subcommittee …………. 8 Membership List of the Research Projects Vetting Subcommittee………………………. 9 Membership List of the Waste Recovery Projects Vetting Subcommittee ..................….. 10 Membership List of the Environmental Campaign Committee....................…………….. 11 Membership List of the Investment Committee....................……………......................... 12 List of Approved Projects………………………………………………………………… 13-49 Report of the Director of Audit……………………........................................………....... 50-51 Balance Sheet .........................................................................................................…........ 52 Income and Expenditure Account ...........................................................................……... 53 Statement of Changes in Equity ............................................................................……… 54 Statement of Cash Flows…………………………………………………………………. 55 Notes to the Financial Statements.....................……............................................……….. 56-60 1 Environment and Conservation Fund Report by the Trustee on the -

Building List 20200301.Xlsx

根據香港法例第599C章正在接受強制檢疫人士所居住的大廈名單 根據《若干到港人士強制檢疫規例》(第599C章),除了豁免人士外,所有在到港當日之前的14日期間, 曾在內地逗留任何時間的人士,必須接受14天的強制檢疫。 List of buildings of the confinees under mandatory quarantine according to Cap. 599C of Hong Kong Laws According to Compulsory Quarantine of Certain Persons Arriving at Hong Kong Regulation (Cap. 599C), except for those exempted, all persons having stayed in the Mainland for any period during the 14 days preceding arrival in Hong Kong will be subject to compulsory quarantine for 14 days. (截至2020年2月26日晚上11時59分 As at 11:59 p.m., 26 February 2020) 區 地址 檢疫最後日期 (日/月/年) District Address End date of quarantine order (DD/MM/YYYY) 1 中西區 Central & 加多近山 27/02/2020 Western CADOGAN 2 中西區 Central & 西摩道11號福澤花園A座 27/02/2020 Western BLOCK A, THE FORTUNE GARDENS, NO.11 SEYMOUR ROAD 3 中西區 Central & 花園道55號愛都大廈3座 27/02/2020 Western BLOCK 3, ESTORIL COURT, NO.55 GARDEN ROAD 4 中西區 Central & 皇后大道西355-359號 27/02/2020 Western NO.355-359 QUEEN'S ROAD WEST 5 中西區 Central & 泰成大廈 27/02/2020 Western TAI SHING BUILDING 6 中西區 Central & 高雲臺 27/02/2020 Western GOLDWIN HEIGHTS 7 中西區 Central & 啟豐大廈 27/02/2020 Western KAI FUNG MANSION 8 中西區 Central & 堅城中心 27/02/2020 Western KENNEDY TOWN CENTRE 9 中西區 Central & 第三街208號毓明閣1座 27/02/2020 Western BLOCK 1, YUK MING TOWERS, NO.208 THIRD STREET 10 中西區 Central & 德輔道西333號 27/02/2020 Western NO.333 DES VOEUX ROAD WEST 11 中西區 Central & 德輔道西408A號 27/02/2020 Western NO.408A DES VOEUX ROAD WEST 12 中西區 Central & 蔚然 27/02/2020 Western AZURA 13 中西區 Central & 羅便臣道74號1座 27/02/2020 Western BLOCK 1, NO.74 ROBINSON ROAD 14 中西區 Central & BRANKSOME -

Hong Kong Property Review 2016

2 01 6 香港物業報告 Hong Kong Property Review 2016 本報告回顧 2015 年香港物業市場的活動, 並預測 2016 及 2017 年的樓宇落成量。 A review of the Hong Kong property market for the year 2015 with forecast of completionsp for 2016 and 2017 差餉物業估價署署長 鄧炳光太平紳士 2016年4月 PK TANG, JP Commissioner 差餉物業估價署 Rating and Valuation Department Rating and Valuation Department April 2016 目錄 Contents 序言 Foreword 03 綜觀 Overview 08 評論 - 私人樓宇 Commentary on Private Developments 住宅 Domestic 16 整體 Overall 中 / 小型單位 Small / Medium Units 大型單位 Large Units 寫字樓 Off ice 30 整體 Overall 甲級 Grade A 乙級 Grade B 丙級 Grade C 商業樓宇 Commercial 48 工業樓宇 Industrial 54 分層工廠大廈 Flatted Factories 工貿大廈 Industrial / Off ice 特殊廠房 Specialised Factories 貨倉 Storage 技術附註 Technical Notes 64 圖表 Tables 78 附錄 Appendix 各區域及地區 Areas and Districts 分區圖 Plans 寫字樓分區圖 Off ice Sub-districts Plan 序言 Foreword 私人住宅 Private Domestic 私人寫字樓 Private Off ice 私人商業樓宇 Private Commercial 私人工業樓宇 Private Industrial 《香港物業報告》載錄差餉物業估價署 The Hong Kong Property Review presents property 在每年年底所編製的物業數據與資料。 data compiled by Rating and Valuation Department 有關落成量、使用量∕入住量、空置 at the end of each year. Information on completions, 量、售價和租金的資料,除詳載於正文 take-up, vacancy, prices and rents is reported in text 外,並會另表列明。報告所預測的落成 and tables. The Review also shows forecast completion 量是根據發展商與建築師所提供的資料 figures based on information obtained from developers and 推算。本署並藉著視察及在預測期初所 project architects, supported by development progress 進行的調查,瞭解發展進度和蒐集有關 inspections and enquiries at the beginning of the forecast 資料,以求得出更可靠的預測數字。報 period. These forecast figures are on a calendar year 告內所載的預測數字均以曆年計算,因 basis and may be different from those compiled on a 而或會與載於其他政府刊物並以財政年 financial year basis in other Government publications. -

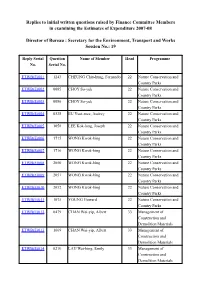

Replies to Initial Written Questions Raised by Finance Committee Members in Examining the Estimates of Expenditure 2007-08 Direc

Replies to initial written questions raised by Finance Committee Members in examining the Estimates of Expenditure 2007-08 Director of Bureau : Secretary for the Environment, Transport and Works Session No.: 19 Reply Serial Question Name of Member Head Programme No. Serial No. ETWB(E)001 1243 CHEUNG Chiu-hung, Fernando 22 Nature Conservation and Country Parks ETWB(E)002 0085 CHOY So-yuk 22 Nature Conservation and Country Parks ETWB(E)003 0086 CHOY So-yuk 22 Nature Conservation and Country Parks ETWB(E)004 0328 EU Yuet-mee, Audrey 22 Nature Conservation and Country Parks ETWB(E)005 1058 LEE Kok-long, Joseph 22 Nature Conservation and Country Parks ETWB(E)006 1715 WONG Kwok-hing 22 Nature Conservation and Country Parks ETWB(E)007 1716 WONG Kwok-hing 22 Nature Conservation and Country Parks ETWB(E)008 2050 WONG Kwok-hing 22 Nature Conservation and Country Parks ETWB(E)009 2051 WONG Kwok-hing 22 Nature Conservation and Country Parks ETWB(E)010 2052 WONG Kwok-hing 22 Nature Conservation and Country Parks ETWB(E)011 1075 YOUNG Howard 22 Nature Conservation and Country Parks ETWB(E)012 0479 CHAN Wai-yip, Albert 33 Management of Construction and Demolition Materials ETWB(E)013 1669 CHAN Wai-yip, Albert 33 Management of Construction and Demolition Materials ETWB(E)014 0210 LAU Wai-hing, Emily 33 Management of Construction and Demolition Materials ETWB(E)015 0211 LAU Wai-hing, Emily 33 Management of Construction and Demolition Materials ETWB(E)016 2455 LEONG Kah-kit, Alan 33 Management of Construction and Demolition Materials ETWB(E)017 0144 TAM -

Sun Hung Kai Properties Limited

Sun Hung Kai Properties has been building ‘Homes with Heart’ for over three decades. The Group has already built dream homes for hundreds of thousands of Hong Kong people, and it is dedicated to creating the finest residences for the next generation of homebuyers. Cover Photos: 1 Two IFC, Central 2 YOHO Town, Yuen Long 1234 3 Kelletteria, The Peak 4 Airport Railway Kowloon Station Package 3 Development SUN HUNG KAI PROPERTIES LIMITED Annual Report 2002/03 2 SUN HUNG KAI PROPERTIES LIMITED ANNUAL REPORT 2002/03 Contents 3 Financial Highlights 4 Corporate and Shareholders’ Information 5 Corporate Structure 6 Chairman’s Statement 18 Review of Operations 72 Financial Review 76 Group Financial Summary 77 Directors’ Report 93 Directors and Organization 104 Financial Contents SUN HUNG KAI PROPERTIES LIMITED ANNUAL REPORT 2002/03 3 FINANCIAL HIGHLIGHTS For the year ended 30th June 2003 2002 Change (%) Turnover (HK$ million) 22,945 25,373 -9.6 Profit attributable to shareholders (HK$ million) 6,584 8,519 -22.7 Earnings per share (HK$) 2.74 3.55 -22.8 Dividends per share (HK$) 1.60 1.55 +3.2 Special cash dividends per share (HK$) – 0.60 – Shareholders’ funds per share (HK$) 50.70 53.56 -5.3 Gross rental income 1 (HK$ million) 5,628 5,844 -3.7 Net rental income 1 (HK$ million) 4,100 4,432 -7.5 Net debt to shareholders’ funds ratio (%) 10.9 15.6 -4.7 2 Land bank (million square feet) 45.3 50.4 -10.1 Turnover Earnings and Dividends Net Asset Value per Share per Share* HK$ million HK$ HK$ 30,000 5 60 4.51 25,826 53.48 53.56 25,373 51.56 50.70 25,000 -

Food Wise Hong Kong Campaign 惜食香港運動

Food Wise Hong Kong Campaign 惜食香港運動 Signees of the Food Wise Charter (1056 signees (as at 15 September 2021)) 已簽惜食約章機構及企業 (1056 簽署者 (截至2021年9月15日)) Business Sectors 工商界 Business and Professional Associations 商企及專業協會 Hong Kong Association of Property Management Companies 香港物業管理公司協會 Hong Kong Federation of Restaurants and Related Trades 香港餐飲聯業協會 Hong Kong Food Council 香港食品委員會 Hong Kong Green Building Council Limited 香港綠色建築議會有限公司 Hong Kong Hotels Association 香港酒店業協會 Hong Kong Institute of Qualified Environmental Professionals Limited 香港合資格環保專業人員學會有限公司 Hong Kong Waste Disposal Industry Association 香港廢物處理業協會 Hong Kong WEEE Recycling Association 香港電器及電子設備回收協會 Institution of Dining Art 稻苗學會 The Hong Kong Institution of Engineers 香港工程師學會 The Hong Kong Institute of Housing 香港房屋經理學會 Food and Beverage Sector (incl. also food markets and supermarkets, etc.) 飲食業界 (亦包括食物市場和超級市場等) Aeon Stores (Hong Kong) Company Limited 永旺(香港)百貨有限公司 Alize Noire de Nova Limited Asia Pacific Catering Corporation Limited 泛亞飲食有限公司 Asia Pacific Catering Corporation Limited - Luncheon Star 泛亞飲食有限公司 - 活力午餐 Bijas Company Limited Catering Services Contractor 膳食承辦商 Cathay Pacific Catering Services (H.K.) Limited 國泰航空飲食服務(香港)有限公司 Compass Group Hong Kong Limited 金巴斯集團香港有限公司 Crystal Jade La Mian Xiao Long Bao(TM) Limited 翡翠拉麵小籠包(屯門)有限公司 Cuisine Continental (HK) Limited - Alfafa Cuisine Continental (HK) Limited - Chatterbox Daikiya Catering Group 大喜屋飲食集團 Daliang Vegetarian Kitchen 滋味齋素食餐廳 Delicious Chef King Catering Limited 美味王餐飲管理有限公司 Delifrance (HK) Limited Dutch Kitchen Limited -

Annex (Page 1 of 17) Public Transport Fare Concession Scheme for The

Annex (Page 1 of 17) Public Transport Fare Concession Scheme for the Elderly and Eligible Persons with Disabilities Extension to Green Minibus Services 407 Route Details of the 127 Operators A. Hong Kong Island Route Origin - Destination The Peak (Public Transport Terminus) - Central (Hong Kong 1 1 Station Public Transport Interchange) Central (Hong Kong Station Public Transport Interchange) - 2 1A Macdonnell Road (Circular) Central (Hong Kong Station Public Transport Interchange) - 3 2 Old Peak Road (Circular) Central (Hong Kong Station Public Transport Interchange) - 4 3 Po Shan Road Central (Hong Kong Station Public Transport Interchange) - 5 3A Conduit Road 6 4A Aberdeen (Shek Pai Wan) - Causeway Bay (Cannon Street) 7 4B Aberdeen (Shek Pai Wan) - Wan Chai (Circular) 8 4C Aberdeen (Shek Pai Wan) - Causeway Bay (Cannon Street) 9 4S Shek Pai Wan - Aberdeen (Circular) 10 5 Aberdeen (Nam Ning Street) - Causeway Bay (Lockhart Road) 11 8 Baguio Villas (Lower) - Central (Exchange Square) 12 8X Baguio Villas (Lower) - Central (Exchange Square) 13 9 Central (Exchange Square) - Bowen Road (Circular) Causeway Bay (Jaffe Road) - Cyberport Public Transport 14 10 Interchange Causeway Bay (Jaffe Road) - Cyberport Public Transport 15 10P Interchange 16 12 Kwun Lung Lau - Sai Ying Pun (Circular) 17 13 Sai Wan Estate - Sai Ying Pun (Circular) 18 14M Causeway Bay (Lan Fong Road) - Moorsom Road (Circular) 19 16A Chai Wan Station - Chung Hom Kok (Cheshire Home) 20 16M Chai Wan Station - Ma Hang / Chung Hom Kok 21 16X Chai Wan Station - Stanley Beach Road 22 18M Chai Wan Station - Cape Collinson (Correctional Institution) Chai Wan Industrial City - Sai Wan Ho (Grand Promenade) 23 20 Public Transport Terminus 24 20M Hing Man Estate - Chai Wan Industrial City 25 21A Causeway Bay (Lan Fong Road) - Lai Tak Tsuen (Circular) Remark: Routes on the list include all their overnight services, short-working services, special services and supplementary services. -

3. Noise Impact

Consultancy Agreement No. NEX/2301 South Island Line (East) Environmental Impact Assessment 3. Noise Impact 3.1 Introduction This section has evaluated and assessed the potential noise impact likely to arise from the proposed Project during both the construction and operation phases. The noise impact from the proposed Project can be divided into airborne and ground-borne during the construction and operation phases. The assessment has been based on the criteria and guidelines for evaluation and assessing noise impact as stated in Annexes 5 and 13 of the EIAO-TM and NCO and covered the scope outlined in Clause 3.4.1 of the EIA Study Brief. 3.2 Environmental Legislation, Standards and Guidelines 3.2.1 Construction Phase 3.2.1.1 General Construction Activities during Non-Restricted Hours Noise impacts arising from general construction activities other than percussive piling during the daytime period (07:00-19:00 hours of any day not being a Sunday or general holiday) shall be assessed against the noise standards tabulated in Table 3.1 below. Table 3.1: Noise Standards for Daytime Construction Activities 0700 to 1900 hours on any day not being a Sunday or general Noise Sensitive Uses holiday, Leq (30 min), dB(A) All domestic premises including temporary housing accommodation 75 Hotels and hostel Educational institutions including kindergarten, 70 nurseries and all others where unaided voice communication is required 65 during examination Source: EIAO-TM, Annex 5, Table 1B - Noise Standards for Daytime construction Activities Note: The above noise standards apply to uses, which rely on opened windows for ventilation. -

Bus Routes and Costs

Aug 2015 Bus Routes and Costs Pick-up Drop-off Areas Bus Route Time Stop No. Bus Stops (Pick-up) Time Stop No. Bus Stops (Drop-off) Costs 1 Marinella (Junction at Welfare Rd/ Nam Long Shan Road) 1 Marinella (Junction at Welfare Rd/ Nam Long Shan Road) 2 Bel-Air Phase 3 (Fountain) 2 Bel-Air Phase 3 (Fountain) Hong Kong Island Bel-Air Phase 2 (bus stop opposite to Glass Door at Cyberport 3 Bel-Air Phase 2 (Glass Door at Cyberport Road) 3 Road) $2,600 4 Victoria Garden (Bus Stop at Victoria Rd towards Central) 4 Victoria Garden (Main Entrance) Aberdeen / A 06:45-07:15 15:25-16:05 Pokfulam / Central / 5 86 Victoria Road (Carpark entrance) 5 86 Victoria Road (Bus Stop opposite to building) Wan Chai Kennedy Town Swimming Pool (Bus Stop at Kennedy Town Kennedy Town Swimming Pool (Bus Stop at Kennedy Town 6 6 Praya towards Central) Praya towards Central) 7 Central Ferry Pier No. 3 (Bus Stop) 7 Central Ferry Pier No.3 (Bus Stop) $1,900 Harbour Road (Road entrance at Convention Plaza 8 8 Harbour Road (Shui On Centre) Apartments) Pick-up Drop-off Areas Bus Route Time Stop No. Bus Stops (Pick-up) Time Stop No. Bus Stops (Drop-off) Costs Roundabout at Ap Lei Chau Drive/ Ap Lei Chau Praya Road Roundabout at Ap Lei Chau Drive/ Ap Lei Chau Praya Road 1 1 Hong Kong Island (opposite to Sham Wan Towers) (opposite to Sham Wan Towers) 145 Pokfulam Road (Bus stop outside Chinese Cuisine 2 2 Pokfulam Road (Bus Stop outside Pokfulam Village) Training Institue HK) Pokfulam Road /Smithfield Road (Bus Stop next to pedestrian Pokfulam Road /Smithfield Road (Bus -

BILCO JOB REFERENCE in HONG KONG/CHINA 1. Andrew Telecom, Suzhou, PRC 2. ASD School Improvement Ph.3- Package1group1 3. Bluff He

BILCO JOB REFERENCE IN HONG KONG/CHINA 1. Andrew Telecom, Suzhou, PRC 2. ASD School Improvement Ph.3- Package1Group1 3. Bluff Head, Stanley 4. The British Council 5. Club Lusitano at 16 Ice House Street, Central 6. Cityplaza Phase 3 & 4, Tai Koo Shing 7. Cityplaza South Renovation 8. Chater Road No. 11, Central 9. Castle Peak Hospital Redevelopment Phase ill, Stage I 10. Castle Peak Hospital Phase 2, Stage 2 11. Castle Peak Hospital Phase 1 Block A 12. Chinese Cuisine Training Institute Phase I 13. Child Assessment Centre and Skill Centre 14. Caritas Medical at Sham Shui Po 15. Fanling Health Care Centre 16. Fanling Magistracy Building 17. Harbour at Pier Road in Sheung Wan 18. Ho Man Tin South Phase I 19. Hong Kong Disneyland - Main Street 20. HongKong Disneyland- Fantasyland 21. HongKong Disneyland- River Boat Landing 22. HongKong Disneyland- Adventure land 23. International School of Beijing -Shunyi, PRC 24. KCRC CC203 Tin Shui Wai Station 25. KCRC CC300 Tsuen Wan Station 26. KCRC CC402 Nam Cheong Station 27. KCRC C403 Mei Foo Yen Chow Station 28. KCRC CC404 Mei Foo Station 29. KCRC CC602 Kam Sheung Road 30. KCRC HCC300 Tsim Sha Tsui Station 31. King's Road No 1063 32. King's Road No. 494 33. Kent Road No. 19 34. Lai King Hospital 35. MTRC Tender No. R1160-90 36. MTRC 506A Mei Foo Station Interchange 37. MTRC Mong kok Station 38. MTRC Causeway Bay Station 39. MTRC Kwun Tong Station Refurbishment 40. MTRC C4420 Tsim Sha Tsui Station 41. New Operating Theatre QEH 42.