Kim Mercado CBRE April 23 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Section Ii Geographical List / Liste Géographique 1

SECTION II GEOGRAPHICAL LIST / LISTE GÉOGRAPHIQUE 1 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 100 MILE HOUSE, BC 000108270 08270-001 BANK OF MONTREAL Cariboo Mall, P.O. Box 10, 100 Mile House, BC V0K 2E0 001000550 00550-010 CANADIAN IMPERIAL BANK OF COMMERCE 100 Mile House Banking Centre, 1-325 Birch Ave, Box 98, 100 Mile House, BC V0K 2E0 000304120 04120-003 ROYAL BANK OF CANADA 100 Mile House Branch, 200 Birch Ave-PO Box 700, 200 Birch Ave, 100 Mile House, BC V0K 2E0 ABBEY, SK 000300118 00778-003 ROYAL BANK OF CANADA Abbey Branch, Wayne & Cathedral, c/o 120 Centre St, Abbey, SK S0N 0A0 (Sub to 00778) ABBOTSFORD, BC 000107090 07090-001 BANK OF MONTREAL Abbotsford Main, 101-32988 South Fraser Way, Abbotsford, BC V2S 2A8 000107490 07490-001 Highstreet Branch, 3122 Mt.Leham Rd, Abbotsford, BC V2T 0C5 000120660 20660-001 Lower Sumas Mountain, 1920 North Parallell Road, Abbotsford, BC V3G 2C6 000200240 00240-002 THE BANK OF NOVA SCOTIA Abbotsford, #100-2777 Gladwin Road, Abbotsford, BC V2T 4V1 (Sub to 11460) 000211460 11460-002 Clearbrook, PO Box 2151, Clearbrook Station, Abbotsford, BC V2T 3X8 000280960 80960-002 Ellwood Centre, #1-31205 Maclure Road, Abbotsford, BC V2T 5E5 (Sub to 11460) 000251680 51680-002 Glenn Mountain Village, Unit 106 2618 McMillan Road, Abbotsford, BC V3G 1C4 001000420 00420-010 CANADIAN IMPERIAL BANK OF COMMERCE Abbotsford, 2420 McCallum Rd, Abbotsford, BC V2S 6R9 (Sub to 08820) 001001720 01720-010 McCallum Centre, Box 188, Abbotsford, -

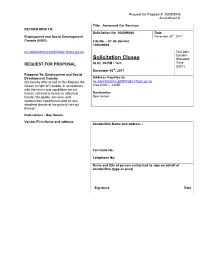

Rfp 100009046.Pdf

Request for Proposal #: 100009046 Amendment #: Title: Armoured Car Services RETURN BIDS TO: Solicitation No. 100009046 Date th Employment and Social Development November 20 , 2017 Canada (ESDC) File No. – N° de dossier 100009046 [email protected] Time Zone Eastern Solicitation Closes Standard Time REQUEST FOR PROPOSAL At 02 :00 PM / 14 h (EST) th December 06 , 2017 Proposal To: Employment and Social Development Canada Address Inquiries to : We hereby offer to sell to Her Majesty the [email protected] Queen in right of Canada, in accordance Size limit – 13MB with the terms and conditions set out herein, referred to herein or attached Destination hereto, the goods, services, and See Herein construction listed herein and on any attached sheets at the price(s) set out thereof. Instructions : See Herein Vendor/Firm Name and address Vendor/firm Name and address : Facsimile No. Telephone No. Name and title of person authorized to sign on behalf of Vendor/firm (type or print) Signature Date Request for Proposal #: 100009046 Amendment #: TABLE OF CONTENTS PART 1 - INFORMATION AND INSTRUCTIONS 1. Security Requirement 2. Statement of Work 3. Standard Instructions, Clauses and Conditions 4. Submission of Bids 5. Mandatory Certifications Precedent to Contract Award 6. Enquiries – Bid Solicitation 7. Evaluation Procedures 8. Applicable Laws 9. Debriefings PART 2 - RESULTING CONTRACT CLAUSES 1. Applicable Laws 2. Priority of Documents 3. Statement of Work 4. Standard Clauses and Conditions 5. Security Requirement 6. Term of Contract 7. Authorities 8. Payment 9. Method of Payment 10. Invoice Submission 11. Foreign Nationals (Canadian Contractor 12. -

Évaluation Des Retombées Issues D'un Éventuel Développement Urbain

Transport collectif Axe A-10/Montréal Évaluation des retombées issues d'un éventuel développement urbain Agence métropolitaine de transport (AMT) Bureau de projet Transport collectif Axe A-10/Montréal 210-1001-15-10-00A (R00) Rapport Final 2015-06-08 Transport collectif Axe A-10 I Montréal Évaluation des retombées issues d'un éventuel développement urbain Transport collectif Axe A-10/Montréal Évaluation des retombées issues d'un éventuel développement ÉQUIPE DE RÉALISATION urbain Noms Titre Firme Marc Perreault Urbaniste Lemay+ DAA Marie-Claude Aubin Urbaniste Lemay+ DAA David Poiré Urbaniste Lemay+ DAA Jean-François Morneau Urbaniste Lemay+ DAA Jimmy Bouchard Géographe Lemay+ DAA Préparé par : Philippe Dubé Urbaniste AMT Marie-Claude Aubin, urb. David Poiré, urb. Responsable de lot TABLEAU DES RÉVISIONS Vérifié par : Philippe Dubé, urb (O.U.Q 1347) Émission Date Description Chargé des études en urbanisme ROA 2015-03-04 Préliminaire ROB 2015-05-08 Préliminaire ROO 2015-06-08 Finale Validé par : André Thibeault, urb., M.lng. (n° O.U.Q 901) Directeur des études Approbation administrative : Jean-Marc Deschamps Directeur technique, Transport collectif Ax A-10/Montréal Approbation administrative : Christian Corriveau, ing. (n° 010 45166) Directeur de projet, Transport collectif Axe A-10/Montréal Rapport 210-1001-15-10-00A 2015-06-08 Transport collectif Axe A-10 / Montréal Évaluation des retombées issues d'un éventuel développement urbain Table des matières 3.3.3 Description du site ............................................................................................................................................. -

440 René-Lévesque West, Montreal, Quebec Prime Retail Spaces for Lease/ Espaces Commerciaux Exceptionnels À Louer

440 RENÉ-LÉVESQUE WEST, MONTREAL, QUEBEC PRIME RETAIL SPACES FOR LEASE/ ESPACES COMMERCIAUX EXCEPTIONNELS À LOUER COREY BESSNER MATTHEW KRANTZBERG REAL ESTATE BROKER | COMMERCIAL REAL ESTATE BROKER | COURTIER IMMOBILIER COURTIER IMMOBILIER COMMERCIAL T 514.819.8847 X 101 T 514.819.8847 X 103 E [email protected] E [email protected] PROPERTY HIGHLIGHTS/ DETAILS DE LA PROPRIÉTÉ: ASKING GROSS RENT/ $60.00 PER SQ. FT. WITH ESCALATIONS FOLLOWING THE BASE YEAR LOYER BRUT DEMANDÉ: (2018)/ 60.00 $ PAR PIED CARRÉ AVEC INDEXATION SUIVANT L’ANNÉE TOTAL AREA/ SUPERFICIE: APPROXIMATELY 3,825 SQ. FT./ ENVIRON 3,825 PIEDS CARRÉS 16 STOREY OFFICE TOWER/ 16 ÉTAGES 70 FEET OF FAÇADE FRONTING THE HEAVILY TRAFFICKED RENÉ L’ÉVESQUE WEST BOULEVARD/ 70 PIEDS DE FAÇADE ORIENTÉ VERS LA CIRCULATION DENSE DE BOULEVARD RENÉ-L’EVESQUE QUEST GROSS LEASABLE AREA/ SUPERFICIE LOCATIVE BRUTE 128,000 SQ. FT. OF OFFICE / 128,000 PIEDS CARRÉS DE BUREAUX +/- 1,200 PEOPLE WITHIN THE PROPERTY / +/- 1,200 PERSONNES DANS LA CAPACITY/ CAPACITÉ: PROPRIÉTÉ OCCUPANCY/ OCCUPATION: IMMEDIATE/ IMMÉDIATEMENT RESTAURANT, FINANCIAL INSTITUTION/ INSTITUTION FINANCIÈRE, SUGGESTED USES/ MEDICAL CLINIC/ CLINIQUE MÉDICALE, RETAIL SHOWROOM/ SALLE UTILISATIONS SUGGÉRÉES: D’EXPOSITION, OTHER GENERAL RETAIL USES/ AUTRES UTILISATIONS GÉNÉRALES 440 RENÉ-LÉVESQUE WEST MONTREAL, QUEBEC RETAIL SPACE FOR LEASE | ESPACE COMMERCIAUX EXCEPTIONNELS À LOUER STEPS AWAY FROM MANY OF MONTREAL’S LARGEST OFFICE BUILDINGS (TELUS TOWER, PLACE VILLE MARIE, 800 RENÉ-L ‘ÉVESQUE, SNC LAVALIN BUILDING, SUN LIFE BUILDING, PALAIS DES CONGRÈS AND MANY OTHERS). THE ENVIRONMENT: UNRIVALLED LOCATION IN THE HEART OF MONTREAL’S QUARTIER DES SPECTACLES/ JAZZ FESTIVAL NEIGHBORHOOD WHICH WELCOMES AN ASTONISHING 2 MILLION VISITORS TO THE CITY EACH YEAR. -

1170 PLACE DU FRÈRE-ANDRÉ Between Réné-Lévesque West & Sainte-Catherine Street

1170 PLACE DU FRÈRE-ANDRÉ Between Réné-Lévesque West & Sainte-Catherine Street PRIME RETAIL SPACE ON THE HARD CORNER OF PLACE FRÈRE-ANDRÉ & RÉNÉ-LÉVESQUE SUGGESTED USES: International Retailer, High End Boutique, Financial Institution, Jew- elry Store, Currency Exchange, Medical Clinic, Unique Retail Store, Retail Showroom, and other general retail uses Corey Bessner Matthew Krantzberg Real Estate Broker Commercial Real Estate Broker T: 514.819.8847 x101 T: 514.819.8847 x103 [email protected] [email protected] 1170 PLACE DU FRÈRE-ANDRÉ Between Réné-Lévesque West & Sainte-Catherine Street Property Details: • Approximately 1,970 square feet on the ground floor and 2,600 square feet adjoining lower level usable retail space • Rent: Ground floor: $50 net per square foot Basement: $20 gross per square foot • Additionals: $7.50 per square foot for the ground floor • Occupancy: June 1, 2018 • Magnificent hard corner retail space in the heart of Downtown Montreal • Many high profile branded retailers and bou- tiques in the immediate area. • Steps away from many of Montreal’s largest of- fice buildings (Telus Tower, Place Ville Marie, 800 Réné-Lévesque, Sun Life building, and many oth- ers) • Bus Lines servicing the immediate vicinity: 150, 350, 355, 358, 364, 410, 427, 430, 435, 747 • Metro’s servicing the immediate vicinity: McGill, Square-Victoria, Bonaventure Highly visible with maximum signage opportunity DEMOGRAPHIC 1 KM RADIUS 1.5 KM RADIUS Total Population 24,229 61,270 Daytime Population 250,941 347,189 Average Household Income $66,393 $70,501 The information contained herein has been obtained through sources deemed reliable but can not be guaranteed 1170 PLACE DU FRÈRE-ANDRÉ Between Réné-Lévesque West & Sainte-Catherine Street GROUND FLOOR PLANS 1170 PLACE DU FRÈRE-ANDRÉ Between Réné-Lévesque West & Sainte-Catherine Street LOWER LEVEL PLANS 1170 PLACE DU FRÈRE-ANDRÉ Between Réné-Lévesque West & Sainte-Catherine Street SURROUNDING MARKET SITE . -

Section Ii Geographical List / Liste Géographique 1

SECTION II GEOGRAPHICAL LIST / LISTE GÉOGRAPHIQUE 1 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 100 MILE HOUSE, BC 000108270 08270-001 BANK OF MONTREAL Cariboo Mall, P.O. Box 10, 100 Mile House, BC V0K 2E0 001000550 00550-010 CANADIAN IMPERIAL BANK OF COMMERCE 100 Mile House Banking Centre, 1-325 Birch Ave, Box 98, 100 Mile House, BC V0K 2E0 000304120 04120-003 ROYAL BANK OF CANADA 100 Mile House Branch, 200 Birch Ave-PO Box 700, 200 Birch Ave, 100 Mile House, BC V0K 2E0 ABBEY, SK 000300118 00778-003 ROYAL BANK OF CANADA Abbey Branch, Wayne & Cathedral, c/o 120 Centre St, Abbey, SK S0N 0A0 (Sub to 00778) ABBOTSFORD, BC 000107090 07090-001 BANK OF MONTREAL Abbotsford Main, 101-32988 South Fraser Way, Abbotsford, BC V2S 2A8 000107490 07490-001 Highstreet Branch, 3122 Mt.Leham Rd, Abbotsford, BC V2T 0C5 000120660 20660-001 Lower Sumas Mountain, 1920 North Parallell Road, Abbotsford, BC V3G 2C6 000200240 00240-002 THE BANK OF NOVA SCOTIA Abbotsford, #100-2777 Gladwin Road, Abbotsford, BC V2T 4V1 (Sub to 11460) 000211460 11460-002 Clearbrook, PO Box 2151, Clearbrook Station, Abbotsford, BC V2T 3X8 000280960 80960-002 Ellwood Centre, #1-31205 Maclure Road, Abbotsford, BC V2T 5E5 (Sub to 11460) 000251680 51680-002 Glenn Mountain Village, Unit 106 2618 McMillan Road, Abbotsford, BC V3G 1C4 001000420 00420-010 CANADIAN IMPERIAL BANK OF COMMERCE Abbotsford, 2420 McCallum Rd, Abbotsford, BC V2S 6R9 (Sub to 08820) 001001720 01720-010 McCallum Centre, Box 188, Abbotsford, -

308 Burnaby Branch, 115-4603 Kingsway, Burnaby, BC V5H 4M4 030800121 00121-308 MONTREAL BRANCH, 1000 Sherbrooke St W-Suite 920, Montreal, QC H3A 0A6

SECTION I NUMERIC LIST / LISTE NUMÉRIQUE 1 AMEX BANK OF CANADA 303 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030300012 00012-303 101 McNabb Street, Markham, ON L3R 4H8 030300022 00022-303 101 McNabb Street, Markham, ON L3R 4H8 030300032 00032-303 101 McNabb Street, 101 McNabb Street, Markham, ON L3R 4H8 BANK OF AMERICA NATIONAL ASSOCIATION 241 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 024101312 01312-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 024156792 56792-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 BANK OF CANADA 177 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 017700000 00000-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 017700006 00006-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 BANK OF CHINA (CANADA) 308 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030800012 00012-308 3265 Highway 7 East - Unit3, Markham, ON L3R 3P9 030800022 00022-308 Toronto Downtown Branch, 396 Dundas Street West, Toronto, ON M5T 1G7 030800030 00030-308 Vancovuer Branch, 1025 Dunsmuir Street, 1025 Dunsmuir Street PO Box 49277, Vancouver, BC V7X 1L3 030800050 00050-308 Richmond Branch, 8060 Westminster Highway, Richmond, BC V6X 1A6 030800062 00062-308 GTA Main Branch, -

Ads Canadian Bank 343 Amex Bank of Canada 303 Bank Of

SECTION I NUMERIC LIST / LISTE NUMÉRIQUE 1 ADS CANADIAN BANK 343 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 034300012 00012-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 034300092 00092-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 AMEX BANK OF CANADA 303 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030300012 00012-303 101 McNabb Street, Markham, ON L3R 4H8 030300022 00022-303 101 McNabb Street, Markham, ON L3R 4H8 030300032 00032-303 101 McNabb Street, 101 McNabb Street, Markham, ON L3R 4H8 BANK OF AMERICA NATIONAL ASSOCIATION 241 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 024101312 01312-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 024156792 56792-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 BANK OF CANADA 177 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 017700000 00000-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 017700006 00006-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 BANK OF CHINA (CANADA) 308 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030800012 00012-308 50 Minthorn BLVD-Suite 600, Markham, ON L3T 7X8 030800022 00022-308 Toronto Downtown -

Section Ii Geographical List / Liste Géographique 1

SECTION II GEOGRAPHICAL LIST / LISTE GÉOGRAPHIQUE 1 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 100 MILE HOUSE, BC 000108270 08270-001 BANK OF MONTREAL Cariboo Mall, P.O. Box 10, 100 Mile House, BC V0K 2E0 001000550 00550-010 CANADIAN IMPERIAL BANK OF COMMERCE 100 Mile House Banking Centre, 1-325 Birch Ave, Box 98, 100 Mile House, BC V0K 2E0 000304120 04120-003 ROYAL BANK OF CANADA 100 Mile House Branch, 200 Birch Ave-PO Box 700, 200 Birch Ave, 100 Mile House, BC V0K 2E0 ABBEY, SK 000300118 00778-003 ROYAL BANK OF CANADA Abbey Branch, Wayne & Cathedral, c/o 120 Centre St, Abbey, SK S0N 0A0 (Sub to 00778) ABBOTSFORD, BC 000107090 07090-001 BANK OF MONTREAL Abbotsford Main, 101-32988 South Fraser Way, Abbotsford, BC V2S 2A8 000107490 07490-001 Highstreet Branch, 3122 Mt.Leham Rd, Abbotsford, BC V2T 0C5 000120660 20660-001 Lower Sumas Mountain, 1920 North Parallell Road, Abbotsford, BC V3G 2C6 000200240 00240-002 THE BANK OF NOVA SCOTIA Abbotsford, #100-2777 Gladwin Road, Abbotsford, BC V2T 4V1 (Sub to 11460) 000211460 11460-002 Clearbrook, PO Box 2151, Clearbrook Station, Abbotsford, BC V2T 3X8 000280960 80960-002 Ellwood Centre, #1-31205 Maclure Road, Abbotsford, BC V2T 5E5 (Sub to 11460) 000251680 51680-002 Glenn Mountain Village, Unit 106 2618 McMillan Road, Abbotsford, BC V3G 1C4 001000420 00420-010 CANADIAN IMPERIAL BANK OF COMMERCE Abbotsford, 2420 McCallum Rd, Abbotsford, BC V2S 6R9 (Sub to 08820) 001001720 01720-010 McCallum Centre, Box 188, Abbotsford, -

Annual Report 2014 Dream Office REIT 2014 ANNUAL REPORT

DREAM OFFICE REIT OFFICE DREAM Annual Report 2014 Dream Office REIT 2014 ANNUAL REPORT ANNUAL 2014 Letter to Unitholders In 2014, we remained focused on executing our strategy of improving the quality of our assets, building strong relationships with our tenants, and continually improving the service we provide. Dream Office REIT finished 2014 strong market. We will use the proceeds of the cross-border tenants expanding due to and we are off to a solid start for 2015. dispositions to repurchase units under a lower Canadian dollar. Excellent tenant retention and new our normal course issuer bid or to invest We presently estimate our in-place leasing momentum in the latter part in higher quality properties. rents to be approximately 8% below of 2014 have resulted in fourth quarter In the latter part of 2014, oil prices, the market rents. Our two largest markets, results that are reflective of the appeal Canadian dollar and interest rates have downtown Toronto and downtown of the Trust’s portfolio. Tenant retention declined and provinces are rewriting Calgary, presently have in-place rents of was high at 64% and new leasing their outlook for growth. Across the 10% and 15% below market, respectively, activity remained strong, resulting in country, we feel the impact of these providing both the opportunity for quarter-over-quarter positive absorption macro-events to varying degrees. The growth or a significant buffer, should we and in-place occupancy increasing by pace of activity in the office sector in see some softening of rental rates. 30 basis points in Q4 2014. -

440 Réné-Lévesque West Between St-Alexande and Bleury

440 RÉNÉ-LÉVESQUE WEST BETWEEN ST-ALEXANDE AND BLEURY PRIME RETAIL SPACE WITH 70 FEET OF FAÇADE FRONTING THE HEAVILY TRAFFICKED RÉNÉ- LÉVESQUE WEST BOULEVARD SUGGESTED USES: Restauration, International Retailer, High End Boutique, Financial Institution, Medical Clinic, Unique Retail Store, Retail Showroom, and other general re- tail uses Corey Bessner Matthew Krantzberg Real Estate Broker Commercial Real Estate Broker T: 514.819.8847 x 101 T: 514.819.8847 x 103 [email protected] [email protected] 440440 RÉNÉRÉNÉ--LÉVESQUELÉVESQUE WESTWEST BETWEENBETWEEN STST--ALEXANDEALEXANDE ANDAND BLEURYBLEURY Property Details: • Approximately 3,825 square feet • Gross Rent: $60 per square foot with escalations following base year (2017) • Occupancy: Immediately • Many new residential projects currently under construction in the area and thousands of units within proximity • On the ground floor of a building housing approximately 130,000 square feet of office space • Magnificent hard corner retail space with 70 feet of façade in the heart of Downtown Montreal • Steps away from many of Montreal’s largest office buildings (Telus Tower, Place Ville Marie, 800 Réné-Lévesque, SNC Lavalin building, Sun Life building, Palais des Congrès and many oth- ers) • Hotels in the vicinity include Courtyard Marriot (Corperate Stays), AC Hotels Marriott, Le Square Phillips Hotel & Suites, Hotel Monville, Embassy Suites by Hilton, Hotel Le St-James, Le Westin, and many other high end hotels. • Bus Lines servicing the immediate vicinity: 150, -

Ads Canadian Bank 343 Amex Bank of Canada 303

SECTION I NUMERIC LIST / LISTE NUMÉRIQUE 1 ADS CANADIAN BANK 343 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 034300012 00012-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 034300092 00092-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 AMEX BANK OF CANADA 303 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030300012 00012-303 101 McNabb Street, Markham, ON L3R 4H8 030300022 00022-303 101 McNabb Street, Markham, ON L3R 4H8 030300032 00032-303 101 McNabb Street, 101 McNabb Street, Markham, ON L3R 4H8 BANK OF AMERICA NATIONAL ASSOCIATION 241 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 024101312 01312-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 024156792 56792-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 BANK OF CANADA 177 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 017700000 00000-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 017700006 00006-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 BANK OF CHINA (CANADA) 308 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030800012 00012-308 50 Minthorn BLVD-Suite 600, Markham, ON L3T 7X8 030800022 00022-308 Toronto Downtown