Responsible Leadership

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AIIM LAW Brochure 2019 A4 Fi

Adani Institute of Infrastructure Management (AIIM) Post-Graduate Diploma in Management (Law) AICTE-approved 2-year Full-time Program 'Legal & regulatory' expertise in infrastructure management Adani Institute of Infrastructure Management (AIIM) Pioneering Institute of Infrastructure in the Country Adani Institute of Infrastructure Management (AIIM) was founded in 2009 by the promoters of the Adani Group with a vision to establish an institution of excellence that provides world- class education and training to young professionals to shoulder managerial responsibilities in the infrastructure sector. AIIM is India's pioneering institute exclusively focused on research, education and training in the field of infrastructure management. It aims to create a pool of nation-builders and future business leaders. AIIM is an institute of excellence offering specially-designed programs with a curriculum aligned to the needs and aspiration of the infrastructure industry. At AIIM, students are groomed into becoming trained professionals who wish to take managerial and leadership positions in the infrastructure sector, with a unique blend of strong conceptual, analytical, and decision-making abilities. The students are provided with a perfect learning environment for intellectual stimulation and professional growth through interactions with highly-acclaimed faculty and distinguished industry captains. AIIM offers 2 flagship programs: • PGDM (Infrastructure Management) • PGDM (Law) A host of customized short-term Management Development Programs (MDPs) and industry- specific Executive Programs in Management are also part of the AIIM offerings. Our Well-wishers “PGDM (Law) by AIIM is a unique initiative to develop infrastructure 'legal and regulatory' practitioners. We will advise, train and mentor the students and be a part of creating an eco-system for infrastructure 'legal and regulatory' education.” Shri Vikram Nankani, Shri Cyril Shroff, Shri Amit Kapur, Sr. -

“Adani Ports and Special Economic Zone Limited FY20 Earnings Conference Call” May 06, 2020

“Adani Ports and Special Economic Zone Limited FY20 Earnings Conference Call” May 06, 2020 MANAGEMENT: MR. ADANI – CHIEF EXECUTIVE OFFICER, ADANI PORTS AND SEZ LIMITED MR. DEEPAK MAHESHWARI – CHIEF FINANCIAL OFFICER AND HEAD OF STRATEGY, ADANI PORTS AND SEZ LIMITED MR. JEET ADANI – VICE PRESIDENT, ADANI GROUP MODERATOR: MR. ADITYA MONGIA – KOTAK SECURITIES LIMITED Page 1 of 25 Adani Ports and Special Economic Zone Limited May 06, 2020 Moderator: Ladies and gentlemen, good day. And welcome to the Adani Ports and SEZ FY20 Earnings Conference Call, hosted by Kotak Securities Limited. As a reminder, all participant lines will be in the listen-only mode. And there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ then ‘0’ on your touchtone phone. I would now like to hand the conference over to Mr. Aditya Mongia from Kotak Securities Limited. Thank you and over to you, sir. Aditya Mongia: Thank you, Lizann. Thank you to everybody here on the call to cover FY20 Adani Ports and SEZ call. From the management side we have Mr. Adani – the CEO; and Mr. Deepak Maheshwari – the CFO and Head of Strategy; Mr. Robbie Singh – Group CFO; and Mr. Jeet Adani – VP, Adani Group, as well as other members of the management team. At the onset, I would want to, first of all, congratulate Adani Ports for a fairly good performance, both in volumes as well as on the balance sheet. And would also want to thank them for the increased amount of disclosures which are now there as part of the presentation. -

Ports and Logistics

Serial Number: Name of Investor: adani Ports and Logistics Adani Ports and Special Economic Zone Limited Public limited company incorporated under the Companies Act, 1956 with Corporate Identification Number L63090GJ1998PLC034182 Date of Incorporation: 26th May, 1998 Registered Office: Adani House, Mithakhali Six Roads, Navrangpura, Ahmedabad 380 009 Contact person: Mr. Kamlesh Bhagia Email: [email protected] Tel: +91-79-2555 5555; Fax: +91-79-2555 5500; Website: www.adaniports.com INFORMATION MEMORANDUM FOR THE ISSUE OF DEBENTURES ON A PRIVATE PLACEMENT BASIS ISSUE OF 15000 RATED, LISTED, SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES OF FACE VALUE OF RS. 10,00,000/- EACH, AGGREGATING RS. 1500 CRORES ON A PRIVATE PLACEMENT BASIS (THE “ISSUE”) BY ADANI PORTS AND SPECIAL ECONOMIC ZONE LIMITED (THE “ISSUER” OR THE “COMPANY”). This Private Placement Offer Letter (hereinafter referred to as the “Information Memorandum”) is prepared in conformity with Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued vide Circular No. LAD-NRO/GN/2008/13/127878 dated June 06, 2008, as amended by the Securities and Exchange Board of India (Issue and Listing of Debt Securities (Amendment) Regulations, 2012 issued vide Circular No. LAD-NRO/GN/2012-13/19/5392 dated October 12, 2012 and CIR/IMD/DF/18/2013 dated October 29, 2013), Securities and Exchange Board of India Issue and Listing of Debt Securities (Amendment) Regulations, 2014 issued vide Circular No. LAD-NRO/GN/2013-14/43/207 dated January 31, 2014 and Securities and Exchange Board of India Issue and Listing of Debt Securities (Amendment) Regulations, 2014 issued vide Circular No. -

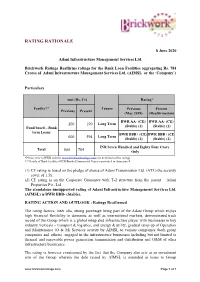

Rating Rationale

RATING RATIONALE 8 June 2020 Adani Infrastructure Management Services Ltd. Brickwork Ratings Reaffirms ratings for the Bank Loan Facilities aggregating Rs. 784 Crores of Adani Infrastructure Management Services Ltd. (AIMSL or the ‘Company’) Particulars Amt (Rs. Cr) Rating* Facility** Tenure Previous Present Previous Present (May 2019) (Reaffirmation) BWR AA- (CE) BWR AA- (CE) 200 190 Long Term Fund based – Bank (Stable) (1) (Stable) (1) term Loans BWR BBB+ (CE) BWR BBB+ (CE 600 594 Long Term (Stable) (2) (Stable) (2) INR Seven Hundred and Eighty Four Crore Total 800 784 Only *Please refer to BWR website www.brickworkratings.com/ for definition of the ratings ** Details of Bank facilities/NCD/Bonds/Commercial Paper is provided in Annexure-I (1) CE rating is based on the pledge of shares of Adani Transmission Ltd. (ATL) the security cover of 1.5x. (2) CE rating is on the Corporate Guarantee with T-2 structure from the parent – Adani Properties Pvt. Ltd. The standalone unsupported rating of Adani Infrastructure Management Services Ltd. (AIMSL) is BWR BBB- (Stable). RATING ACTION AND OUTLOOK : Ratings Reaffirmed The rating factors, inter alia, strong parentage being part of the Adani Group which enjoys high financial flexibility in domestic as well as international markets, demonstrated track record of the Group which is a global integrated infrastructure player with businesses in key industry verticals – transport & logistics, and energy & utility, gradual ramp-up of Operation and Maintenance (O & M) Services activity by AIMSL to various companies (both group companies and others) engaged in the infrastructure businesses including but not limited to thermal and renewable power generation, transmission and distribution and O&M of other infrastructure businesses. -

“Adani Ports & SEZ Limited Earnings Call Hosted by Kotak Securities

“Adani Ports & SEZ Limited Earnings Call hosted by Kotak Securities Limited” May 4, 2021 MANAGEMENT: MR. KARAN ADANI, CEO AND WHOLE-TIME DIRECTOR, ADANI PORTS & SEZ LIMITED MODERATOR: MS. TEENA VIRMANI, KOTAK SECURITIES LIMITED Page 1 of 21 Adani Ports & SEZ Limited May 4, 2021 Moderator: Ladies and Gentlemen, Good Day and Welcome to the Adani Ports & SEZ Earnings Call hosted by Kotak Securities Limited. As a reminder, all participants’ lines will be in the listen-only mode, and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ and then ‘0’ on your touchtone phone. Please note that this conference is being recorded. I now hand the conference over to Ms. Teena Virmani from Kotak Securities Limited. Thank you and over to you, Madam. Teena Virmani: Good Evening everybody, this is Teena from Kotak Securities. We Welcome here today the Management of APSEZ for a call on full year results. We have with us Mr. Karan Adani, CEO and Whole-Time Director. Without much delay, I will hand over the floor to Mr. Karan. Over to you Mr. Karan now for the call. Karan Adani: Good Evening Ladies and Gentlemen, Welcome to the conference call to discuss Quarter-4 and FY ’21 operational and financial performance of Adani Ports and SEZ Limited. Let me start by giving you an overview. FY ’21 was a year of transformation and consolidation for APSEZ. We have demonstrated our strength once again with the capability to withstand COVID-like disruption. -

22Nd Annual General Meeting July 12, 2021 10:00 A.M. to 11:05 A.M

22nd Annual General Meeting July 12, 2021 10:00 a.m. to 11:05 a.m. CORPORATE PARTICIPANTS: Mr. Gautam S. Adani Chairman & Managing Director Mr. Rajesh S. Adani Non-Executive Director Mr. Karan Adani CEO and Whole Time Director Mr. G.K. Pillai Independent Director Prof. G. Raghuram Independent Director Mr. Bharat Sheth Independent Director Mr. P. S. Jayakumar Independent Director Ms. Nirupama Rao Independent Director Mr. Kamlesh Bhagia Company Secretary Other key executives, Statutory Auditor, Secretarial Auditor, Scrutinizer and Shareholders . Welcome Speech by Mr. Kamlesh Bhagia, Company Secretary Dear Shareholders, Good Morning! I, Kamlesh Bhagia, Company Secretary of the Company welcome all the members to the Annual General Meeting of the Company which is being held through video conferencing. I hope all of you are safe and in good health and stay that way. This meeting is being held through video conferencing because of ongoing pandemic situation. This is in compliance with circulars issued by Ministry of Corporate Affairs and the Securities & Exchange Board of India. Apart from Chairman Sir and CEO present on the dias, other Board members have joined through Video Conference. Our Statutory Auditors, Internal Auditor, Secretarial Auditor and Scrutinizer have also joined from their respective locations. I will take you through certain points regarding the participation and voting at this meeting. - All the members who have joined this meeting are by default placed on mute, to avoid any disturbance from background noise and ensure smooth and seamless conduct of the meeting. - Members who have not voted through remote e-voting can cast their votes through e-voting facility during the AGM. -

Adani-Properties-25Mar2021

RATING RATIONALE 25 March 2021 Adani Properties Pvt. Ltd. Brickwork Ratings withdraws the rating the of the NCD issues aggregating Rs.2840 Cr on redemption, withdraws the Provisional Rating for the NCDs issues aggregating Rs.1160 Cr and reaffirms the existing ratings of the NCD issues and bank loans of Adani Properties Pvt. Ltd. (APPL or the “Company”) Particulars Amt Rated (Rs in Facility Rating History with BWR Crores) Tenor Present Rating Previous Present 13- November - 2020 NCD* 2840 - Long Term BWR AA- (CE) (Stable) Withdrawn on Rédemption Provisional BWR AA- (CE) Withdrawn as the Company is NCD 1160 - Long Term (Stable) not planning to raise the same BWR AA- (CE)(Stable) NCD (1) 1500 1500 Long Term BWR AA- (CE) (Stable) (Reaffirmation) BWR AA- (CE) (Stable) NCD (2) 450 450 Long Term BWR AA- (CE) (Stable) (Reaffirmation) BWR AA- (CE) (Stable) BLR (3) 783 670.50 Long Term BWR AA- (CE) (Stable) (Reaffirmation) BWR AA- (CE) (Stable) NCD (4) 250 250 Long term BWR AA- (CE) (Stable) (Reaffirmation) Unsupported BWR A (Stable) / A1 - - Long Term BWR A (Stable) / A1 Rating (Reaffirmation) (Rupees Two Thousand Eight Hundred Seventy Crore and Fifty Lakhs 6983 2870.50 Only) *Please refer to BWR website www.brickworkratings.com/ for definition of the ratings ** Details of Bank facilities/NCD/Bonds/Commercial Paper is provided in Annexure-I and Annexure-II (1) CE rating is based on the pledge of shares of Adani Ports and Special Economic Zone Ltd. (APSEZ), Adani Transmission Ltd. (ATL) and Adani Green Energy Ltd. (AGEL) with the security cover of 2.23x. -

Media Release Adani Ports Commissions Tuna Tekra Bulk

Media Release Adani Ports commissions Tuna Tekra bulk terminal at Kandla in a record time of 24 months Tuna Tekra terminal has a capacity of 20 million tonnes/year Editor’s Synopsis Adani Ports commissions dry bulk terminal at Tuna Tekra, Kandla Port Adani Ports’ Tuna Tekra dry bulk terminal has 20 mmtpa capacity Adani Ports now operates in four locations in Gujarat Adani Ports now operates seven port facilities across India Adani Ports is India’s largest private sector port infrastructure operator Ahmedabad, February 09, 2015: Adani Ports & Special Economic Zone Ltd (APSEZ), India’s largest port developer and part of Adani Group, a global integrated player, today said it had commissioned a bulk terminal at Tuna Tekra, Kandla Port, with an annual handling capacity of over 20 million tonnes, further consolidating its leadership one position on the west coast of India. Mr Nitin Gadkari, the Honourable Minister for Shipping, Road Transport and Highways inaugurated the terminal after the berthing of the project’s first vessel MV Sheng Ming earlier in the day. “The Tuna Tekra terminal is yet another feather in the Adani cap. We expect the terminal to be a game-changer for Export Import trade of the Northwest hinterland of India, thanks to its strategic location. Add to it Adani Group’s infrastructural prowess, speed of execution and operational efficiencies,” said Mr Karan Adani, Executive Director, APSEZ. “It is a proud moment for us at Adani as we commission the Tuna Tekra dry bulk terminal. The port facility is our fourth in Gujarat and fifth on the entire western coast. -

Worldreginfo

WorldReginfo - e59827aa-5172-4508-ad76-1d788ac9f55a Index Corporate Overview 02 About Adani Ports 04 Business Overview 06 Our Reach 08 Key Highlights of FY18 10 Our Sustainability Initiatives 12 Chairman’s Message 14 CEO’s Message 16 Megatrends 18 Our Strategic Priorities 20 Growing with Prudence 22 Growing with Optimism 24 Growing with Efficiency 26 Growing with Financial Acumen 28 Board of Directors Key Highlights of FY18 30 Our Risk Mitigation Strategy Volumes handled PBT 32 People Practices (MMT) (E in crore) 34 APSEZ Sustainability Framework 36 Our Focus on Inclusive Growth 180 5,234 42 Awards and Accolades 7% 25% 44 Corporate Information Rise in container Return on capital Statutory Reports volumes (%) employed (%) 46 Directors’ Report 71 Management Discussion and Analysis 20 14.4 75 Corporate Governance Report Vessels handled Net DEBT/EBITDA 92 Business Responsibility Report Financial Statements 5,410 2.54x 103 Standalone Operating revenue EBITDA 177 Consolidated (E in crore) (E in crore) 267 Notice 11,323 7,062 34% 24% Dividend Policy modified. From FY 19, targetting to pay upto 15% of PAT For further information, log on to www.adaniports.com Compared to FY17 WorldReginfo - e59827aa-5172-4508-ad76-1d788ac9f55a Growth with Goodness. Scale, to us, is not about the size of our operations We have consciously the businesses we are in. in multiple nation-critical extended our scale beyond Scale is about the real sectors, we have been our businesses, to help influence and change we fortunate enough to reach the country overcome can spur. out more and spread this economic challenges; goodness, regardless of to ensure people live It’s about the lives we can the geography. -

Adani Ports Profit Grows by 31 % in Q1 FY17

Media Release Adani Ports Profit grows by 31 % in Q1 FY17 ----------------------------------------------------------------------------------------------------------------------- Consolidated Total Income (including other income) on Year on Year (Y o Y) basis for Q1FY17 up by 11 % at Rs.2084 cr. Consolidated PAT on Year on Year basis for Q1FY17 increased by 31% from Rs.639 cr to Rs.836 cr. EPS for Q1 FY17 at Rs.4.04 per share grew by 31 % Consolidated cargo volumes on Year on Year basis increased by 7 % from 39.61 MMT in Q1 FY 16 to 42.33 MMT in Q1 FY 17. Container volumes increased by 27 % on Y o Y basis. -------------------------------------------------------------------------------------------------------------------- Ahmedabad, 9thAug,2016: Adani Ports and Special Economic Zone Limited (“APSEZ”), India’s largest port developer and the logistics arm of Adani Group, today announced another stellar operational and financial performance for the first quarter ended June 30, 2016. Consolidated total income (including other income) on a Y o Y basis increased by 11 % to Rs. 2084 cr. Our consolidated EBITDA margin is 64% and Ports EBITDA margin is 71%,both continue to be the best in the industry. Consolidated Profit after Tax on a Y o Y basis increased by 31 % to Rs.836 cr in Q1 FY17 on the back of good all round performance. Cargo volume handled on a consolidated basis was 42.33 MMT in Q1 FY17, an increase of 7 % Year on Year (Y o Y) . We have once again outperformed all India port growth, while Indian cargo growth was 4 %, Adani Ports grew at 7 %. Adani Ports and Special Economic Zone Ltd. -

Adani Ports & SEZ Limited

Adani Ports & SEZ Limited Adani Ports and Special Economic Zone Limited (APSEZ) is India’s largest private multi-port Adani Ports & Special operator. It is a part of the Adani Group, an integrated infrastructure corporation.[2] The company Economic Zone Limited (earlier known as Mundra Port & Special Economic Zone Ltd.) changed its name to Adani Ports and Special Economic Zone Limited on January 6, 2012.[3] The company commenced operations at Mundra Port and currently operates 10[4] ports in India comprising 45 berths and 14 terminals across 6 states[5] at below locations: Type Public Mundra, Gujarat BSE: 532921 (https:// Hazira, Gujarat Traded as www.bseindia.com/sto Dahej, Gujarat ck-share-price/x/y/532 Tuna, Gujarat (Terminal) 921/) Mormugao, Goa (Terminal) Vizag, Andhra Pradesh (Terminal) Industry Port & Shipping [4] Kattupalli, Tamil Nadu Founded 1998 Ennore, Tamil Nadu (Terminal) Founder Gautam Adani Dhamra, Odisha Vizhinjam, Kerala Headquarters Adani House, Near Mithakhali Circle, Through its subsidiary company Adani Logistics Ltd., APSEZ operates 3 Inland Container Depots, a Navarangpura, storehouse of goods before they are custom cleared at ports.[6] It is located in Kishangarh, Rajasthan; Ahmedabad, Gujarat, [7] Patli, Harayana and Kila Raipur, Punjab. It holds Category 1 License for Indian Railways that helps in India pan-India cargo movement. Key people Gautam Adani Adani Ports and Special Economic Zone Ltd. (APSEZ) provides Dredging and Reclamation solutions, (Chairman & MD) primarily for port and harbor construction.[8] The Adani Group started investing in developing a dredging fleet in 2005. At present, APSEZ operates a fleet of 19 dredgers which is the largest[9] capital Karan Adani (CEO & dredging capacity in India. -

Ports and Logistics

Serial Number: Name of Investor: I Ports and Logistics Adani Ports and Special Economic Zone Limited Public limited company incorporated under the Companies Act. 1956 with Corporate Identification Number L63090GJ1998PLC034182 Date of Incorporation: 26th May, 1998 Registered Office: Adani House, Mithakhali Six Roads. Navrangpura. Ahmedabad 380 009 Contact person: Mr. Kamlesh Bhagia Email: [email protected] Tel: +91-79-2555 5555; Fax: +91-79-2555 5500: Website: www.adaniports.com INFORMATION MEMORANDUM FOR THE ISSUE OF DEBENTURES ON A PRIVATE PLACEMENT BASIS ISSUE OF 1,550 RATED, LISTED, SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES OF FACE VALUE OF RS. 10,00,000/- EACH, AGGREGATING RS. 155 CRORES ON A PRIVATE PLACEMENT BASIS (THE "ISSUE") BY ADANI PORTS AND SPECIAL ECONOMIC ZONE LIMITED (THE "ISSUER"). This Private Placement Offer Letter cum application letter (hereinafter referred to as the "Information Memorandum") is prepared in conformity with Securities and Exchange Board of India (Issue and listing of Debt Securities) Regulations, 2008 issued vide Circular No. LAD-NRO/GN/2008/13/127878 dated June 06, 2008, as amended by the Securities and Exchange Board of India (Issue and listing of Debt Securities (Amendment) Regulations, 2012 issued vide Circular No. LAD-NRO/GN/2012-13/19/5392 dated October 12, 2012 and CIR/IMD/DF/18/2013 dated October 29, 2013), Securities and Exchange Board of India Issue and listing of Debt Securities (Amendment) Regulations, 2014 issued vide Circular No. LAD-NRO/GN/2013-14/43/207 dated January 31, 2014 and Securities and Exchange Board of India Issue and listing of Debt Securities (Amendment) Regulations, 2014 issued vide Circular No.