Estate Analyst®

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ELAMANTE 2009 + La Sorpresa: Lluvia De Hamburguesas

CINE N02l0 NOVIEMBRE ELAMANTE 2009 + La sorpresa: Lluvia de hamburguesas co (Y) '"o 00'"~~ OZ 'z (/) «'!:! o 0= - ..,""'"= 0N== o - Estetica, Spa d Salón »Hidromasaje -Sauna -Ducha escocesa »Baño de vapor «Sala de relax «Dtas de spa -Masaje descontracturante -Masaje con piedras calientes -Masaje ayurvédico »Tratamientos corporales «Termoestimuíación «Ierapio subdérmica no inuasiva «Contractor- Electroestimulación- Ondas Rusas «Drenaje linfático manual »Tratamiento para estrías -Máscaras faciales «Iratamientos a/ltiage -Microdermoabrasión con puntas de diamante e Rad iojrecuencia «Mesotempío-Mesotijting-Peeling - Estudio Pilates e Yoga -Peluquería El Centro de Estética L'essentielle da la bienvenida a DEL SUR Medicina Estética a cargo del Dr. Daniel Félix para ocuparse de la parte médica de su establecimiento. De esta forma, L'essentiel podrá ofrecer a sus clientas la posibilidad de realizarse botox, implantes, hilos iensores, jlebologia estética, depilación definitiva y consultas sobre cirugfas estéticas con el Dr. Félix y su equipo. Hortiguera 423 Capital Federal- 4433 6122/4432 6487 - www.lessentiel.com.ar-info@/essentie/.com.ar ELAM NOVIEMBRE 2009 l Amante es una revista de entusiasmos, una revista de cine que podrá ser cualquier cosa menos el resultado burocrático de un trabajo buro- E crático. En El Amante se termina de armar el sumario muy cerca del cierre (idemasiado cerca!, gritan la diseñadora y las correctoras) para poder disponer de esos entusiasmos con la mayor justicia posible. En este sentido, Bastardos sin gloria de Tarantino sigue dando que hablar (ya van tres números seguidos), y publicamos otras dos notas sobre la película. Otro entusiasmo es, obviamente, el de nuestra película de tapa: Los amantes, de James Gray. -

First Grade Alphabet, Punctuation and Sounds Sample Lesson Plan Tie-In

Sample Lesson Plan Tie-In First Grade Alphabet, Punctuation and Sounds TEACHING SCHOOL KIDS FUN, CREATIVE MOVES FOR BETTER HEALTH! Let’s Move Kids to Health | A PROGRAM OF THE | www.recessrocks.com | 860-852-0830 Recess Rocks Review of Alphabet, Punctuation and Sounds GRADE: 1 COURSE: Language Arts LESSON SUBJECT: Alphabet, Punctuation and Sounds TIME: 30 minutes STANDARD(S): Phonological Awareness 1.3.3, 1.3.4; Phonics 1.3.5; Fluency 1.3.1; Listening 4.1.4; Speaking 4.2.2, 4.2.8 (This sample tie-in meets Connecticut standards.) Overview Drive home important facts and concepts with Recess Rocks™ lesson plan tie-ins! Students love to learn with fun, heart-healthy movement and music, and with Recess Rocks™, they embrace their lessons, boost their fitness and open their minds to your teaching objectives. In this class, students use their body to sequence events; recognize syllables; review vowels; distinguish between singular and plural words; rhyme words; and differentiate between words and nonsense words. Fully customizable to meet your needs, this lesson plan tie-in class reviews and reinforces ongoing studies while meeting state standards for phonological awareness, phonics, fluency, listening and speaking. We’ve provided you with a bounty of information for one comprehensive class, but feel free to select just one or two goals outlined below for an in-depth exploration of the underlying concepts and complimentary activities. Information presented here also assumes a teacher brings in a professional movement instructor to lead the Recess Rocks™ lesson plan tie-in class. But, teachers and movement instructors, please read everything so you know what to expect! Note that the format of this class follows the “Conducting the Class” guideline presented on pages 21–22 of the Recess Rocks™ Implementation Guide. -

The Miami Symphony Orchestra's

The Miami Symphony Orchestra’s “MIAMI ROCKS” presenting artists are available for interviews On Sunday, March 20th 2016, Maestro Eduardo Marturet alongside Stage Director Richard Jay-Alexander and Classical-Crossover Director Rudy Perez will welcome an interesting list of performers including Tiempo Libre, virtuoso pianist-composer Lola Astanova, electric guitarist Brev Sullivan, vocalists Louis Amanti, Haven Star, EnVee, Victor Valdez, King David and R&B legend Sam Moore, who will be honored at the concert. MAESTRO EDUARDO MARTURET RUDY PEREZ is a Cuban-born American musician, songwriter, composer, producer, arranger, sound engineer, musical director and singer, so well as entertainment entrepreneur and philanthropist, whose area of specialty is ballads. RICHARD JAY ALEXANDER celebrates a 40 year career, as both a Director and a Producer, which has taken him all over the world and into every type of theatre, concert hall and nightclub across the globe, with a spectacular roster of artists. Although his pedigree is Broadway and he began his career as a performer, he is associated with some of the biggest hits in history, including titles such as LES MISERABLES, THE PHANTOM OF THE OPERA and MISS SAIGON among them. TIEMPO LIBRE is known for its powerful live performances and for harmonizing contemporary sonorities and symphonic sounds with seductive Caribbean beats. SAM MOORE is an American Southern soul and R&B singer, musician, and songwriter, who was the tenor vocalist for the soul vocal duo Sam & Dave, the most successful and critically acclaimed duo in soul music history. Named one of the 100 greatest singers of the rock era by Rolling Stone, Moore is a member of the Rock & Roll Hall of Fame, the GRAMMY Hall of Fame, the Vocal Group Hall of Fame, and a GRAMMY Award and a multi-Gold Record award-winning recording artist. -

Wwaaagggooonnn Wwhhheeeeeell

WWAAGGOONN WWHHEEEELL RREECCOORRDDSS Music for Education & Recreation Rhythms • Folk • Movement YYoouurr CChhiillddrreenn’’ss aanndd TTeeaacchheerr’’ss SSppeecciiaalliisstt ffoorr MusicMusic andand DanceDance VS 067 Brenda Colgate WWAAGGOONN WWHHEEEELL RREECCOORRDDSS 16812 Pembrook Lane • Huntington Beach, CA 92649 Phone or Fax: 714-846-8169 • www.wagonwheelrecords.net TTaabbllee ooff CCoonntteennttss Music for Little People . .3 Holiday Music . .20 Quiet Time . .3 Kid’s Fun Music . .21-22 Expression . .3 Kid’s Dance/Party Music . .23 Fun For Little People . .4-5 Dance/Party Music . .24-26 Manipulatives & Games . .6-8 Sports . .26 Jump-Rope Skills . .6 Island Music . .26 Streamers/Scarves/Balls . .6 Dance Videos & Music - Christy Lane . .27-29 Games & Skills . .7 Country Dancing Bean Bag . .7 . .30 Parachute Activities . .8 Square Dancing . .31-33 Seated Exercises . .8 Christy Lane’s . .31 Aerobic/Fitness/Movement . .9 Everyone’s Square Dances . .32 Square Dancing for All Ages . .32 Fitness/Movement Activities . .10-11 Fundamentals of Square Dancing Instructional Series . .33 Lee Campbell-Towell . .10 Square Dance Party For The New Dancer Series . .33 Physical Education . .12-13 Folk Dancing . .34-37 Dynamic Program . .12 Rhythmically Moving Series . .34 Spark Program . .13 Beginning Folk Dances . .35 Music & Movement . .14-15 We Dance Series . .35 Rhythm & Movement . .16-18 Young People’s Folk Dances . .36 Rhythm Sticks . .16 Christy Lane . .37 Tinikling . .16 Multicultural Songs & Greg and Steve . .18 Dances . .38-39 Rhythm, Movement -

SEE the SOUND Once Aurora Who Let the Dogs out a Girl’S Band Henryk Górecki: Symphony No

T S C A J J M M Foto: Felix Kuballa · Gesicht: Marie Blum L 2 M C J C D U U 8 A A E . D U A A O O A S M L L U D A R I . T L L E N S A 2 C L Y C M H I W C Y U O T E E S U I E S D I H T F H K X H N T L R E L L : T D E E H A A A M U O T L R A W S T I I W U O L 8 M T I G E Z O A D M E E Y C U R R W Y : A I E N A … U H B , L O N I W V I M W F L , S T L R L S E A R U I . M . U , E M C N T M A M A L P V N K H P ’ E O S S E . N U C A R O T - L A F H A H L F S P E U L I D A I C L S I N R N S N T T Y L T I E A I S A A A O O I L - E I M 3 N N I S F I G D N I R I I G , V U W N E N F R E N N I O E C 1 N ö N D R Y S 1 I N S D T S . -

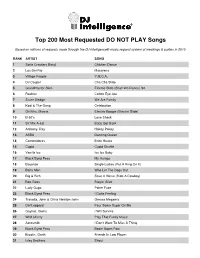

DJ Intelligence Most Requested Songs of 2010

Top 200 Most Requested DO NOT PLAY Songs Based on millions of requests made through the DJ Intelligence® music request system at weddings & parties in 2010 RANK ARTIST SONG 1 Sorta Crackers Band Chicken Dance 2 Los Del Rio Macarena 3 Village People Y.M.C.A. 4 DJ Casper Cha Cha Slide 5 Grandmaster Slice Electric Slide (Shall We Dance) '92 6 Rednex Cotton Eye Joe 7 Sister Sledge We Are Family 8 Kool & The Gang Celebration 9 Griffiths, Marcia Electric Boogie (Electric Slide) 10 B-52's Love Shack 11 Sir Mix-A-Lot Baby Got Back 12 Anthony, Ray Hokey Pokey 13 ABBA Dancing Queen 14 Commodores Brick House 15 Cupid Cupid Shuffle 16 Vanilla Ice Ice Ice Baby 17 Black Eyed Peas My Humps 18 Beyonce Single Ladies (Put A Ring On It) 19 Baha Men Who Let The Dogs Out 20 Big & Rich Save A Horse (Ride A Cowboy) 21 Bee Gees Stayin' Alive 22 Lady Gaga Poker Face 23 Black Eyed Peas I Gotta Feeling 24 Travolta, John & Olivia Newton-John Grease Megamix 25 Def Leppard Pour Some Sugar On Me 26 Gaynor, Gloria I Will Survive 27 Wild Cherry Play That Funky Music 28 Aerosmith I Don't Want To Miss A Thing 29 Black Eyed Peas Boom Boom Pow 30 Brooks, Garth Friends In Low Places 31 Isley Brothers Shout 32 Idol, Billy Mony Mony 33 AC/DC You Shook Me All Night Long 34 Bega, Lou Mambo No. 5 (A Little Bit Of...) 35 Lynyrd Skynyrd Sweet Home Alabama 36 Brooks & Dunn Boot Scootin' Boogie 37 Right Said Fred I'm Too Sexy 38 Village People Macho Man 39 Diamond, Neil Sweet Caroline (Good Times Never Seemed So Good) 40 Cyrus, Miley Party In The U.S.A. -

2000S POP HITS QUIZ

2000s POP HITS QUIZ ( www.TriviaChamp.com ) 1> What pop icon covered Don McLean's classic song American Pie for the soundtrack to her film The Next Best Thing? a. Christina Aguilera b. Madonna c. Pink d. LeAnn Rimes 2> In 2000, the band Filter wanted us to "Take a ??????"? a. Picture b. Toke c. Break d. Nap 3> Which of the following songs was a hit for Sheryl Crow in 2002? a. Soak Up the Sun b. Hands Clean c. Rainy Dayz d. We Are All Made of Stars 4> What Rapper and rocker released the hit song "Only God Knows Why"? a. Kid Rock b. Carl Thomas c. R. Kelly d. Nelly 5> Lost due to a plane crash at the age of 22, Aaliyah had a number one Billboard hit with what song? a. Bye Bye Bye b. Beautiful Day c. Try Again d. You Sang to Me 6> Finish the song title to this number one hit for Christina Aguilera, What a Girl ??????. a. Wants b. Loves c. Needs d. Feels 7> Listed by Rolling Stone magazine as one of the most annoying songs of all time, who released "Who Let the Dogs Out?" as a single in 2000? a. Linkin Park b. Blink 182 c. Baha Men d. The Wallflowers 8> Whom did Mandy Moore want to be with in 2000? a. You b. Jake c. Me d. Everyone 9> Jay-Z teamed up with what soul singer to record the song "Empire State of Mind" in 2009? a. Taylor Swift b. Alicia Keys c. -

Venues Are Finally Receiving Funds, but Crew Members Are Still Struggling

Bulletin YOUR DAILY ENTERTAINMENT NEWS UPDATE JUNE 2, 2021 Page 1 of 27 INSIDE Venues Are Finally • Venues Are Receiving Funds, But Crew Members Receiving Government Grant Are Still Struggling Approvals... Slowly BY TAYLOR MIMS • The German Music Industry Is Tackling Piracy Through Self- Last week, the Small Business Administration fi- additional $600 or $300 a month on top of unemploy- Regulation nally began awarding grants to independent venues, ment. promoters and talent agencies as part of the $16.25 When the second stimulus package on Dec. 27, • Assessing the billion Shuttered Venue Operators Grant. The grant mixed earners who received at least $5,000 in self- Music Industry’s Progress 1 Year After can award up to $10 million per venue and is much- employment income in 2019 are eligible for a $100 Blackout Tuesday: needed support for entities that have been closed for weekly benefit on top of the $300 federal pandemic ‘We Need to Build a 14 months since the pandemic halted mass gatherings. unemployment supplement provided under the new Bigger Table’ The grants will help venues pay back-rent and help legislation. States were also allowed to opt out of the • S-Curve Records them on their way to welcoming fans back as concerts additional benefit. Inks Worldwide Pact reopen around the country. As the industry braces “There really aren’t any government programs for With Disney Music for a return to live this summer, many live music people like me,” says guitar technician Tom We- Group crew members are still struggling after a brutal year ber who has worked for Billy Corgan, Matchbox 20, • Tammy Hurt without work. -

Mbmbam 394: Face 2 Face: I Fritos Hard Published on February 19, 2018 Listen Here on Themcelroy.Family

MBMBaM 394: Face 2 Face: I Fritos Hard Published on February 19, 2018 Listen here on TheMcElroy.family Intro (Bob Ball): The McElroy brothers are not experts, and their advice should never be followed. Travis insists he’s a sexpert, but if there’s a degree on his wall, I haven’t seen it. Also, this show isn’t for kids, which I mention only so the babies out there will know how cool they are for listening. What’s up, you cool baby? [theme music, “(It’s a) Departure” by The Long Winters, plays] Justin: Uh, hello, and welcome to My Brother, My Brother and Me, an advice show for the modern era. I’m your oldest brother, Justin McElroy. [audience cheers] Travis: I’m your middlest brother, Travis McElroy! [audience cheers] Griffin: And I’m your sweet baby brother and 30 Under 30 media luminary, Griffin McElroy. [audience cheers] Travis: You know, folks... here we are. It’s the end of a tour. Griffin: The end of our four—it’s been four days. Travis: The end of our four-day tour. [audience laughs] Travis: And we are not as young as we once were. [audience laughs] Griffin: That’s how time works. Travis: This—yeah! And this tour has been plagued with completely unavoidable injuries. Griffin: Was anybody at the Minneapolis show last night? [scattered cheers] Griffin: Alright. Don’t tell what happened, but... [audience laughs] Griffin: I suffered a very brave injury. [audience laughs] Travis: On top Griffin’s unavoidable injury... Griffin: Brave, heroic... Travis: Brave. -

Custom Program Style Guide

Custom Program Style Guide Version 3 Table of Contents LINE ART CHARACTERS 1. lntroduction - Important Start-up Information Raggs .......................................................... 42-43 Toni Steedman, Creator of Raggs ........................... 4 Trilby ................................................................ 44 Brand Overview ................................................... 5 Pido.................................................................. 45 About the TV Series .............................................. 5 B. Max ............................................................. 46 1. Play at Palladium with Raggs Razzles ............................................................. 47 Scenes .............................................................. 48 Program Logos .................................................. 6-7 Groups ............................................................. 49 Lobby Signage ..................................................... 8 Misc. ................................................................ 50 Resort Signage ............................................... 9-10 Instruments & Animals. ........................................ 51 Guest Room ....................................................... 11 Mini and Baby Club Art ................................. 12-13 ...................................................... 52 Restaurant & Buffet ............................................. 14 3. Website Retail / Logo Shop ............................................ 15 ...................................................... -

Masculinities, Sports and Popular Music

Popular Music and Society ISSN: 0300-7766 (Print) 1740-1712 (Online) Journal homepage: http://www.tandfonline.com/loi/rpms20 “We are the Champions”: Masculinities, Sports and Popular Music Ken McLeod To cite this article: Ken McLeod (2006) “We are the Champions”: Masculinities, Sports and Popular Music, Popular Music and Society, 29:5, 531-547, DOI: 10.1080/03007760500238551 To link to this article: https://doi.org/10.1080/03007760500238551 Published online: 12 Dec 2006. Submit your article to this journal Article views: 776 View related articles Citing articles: 12 View citing articles Full Terms & Conditions of access and use can be found at http://www.tandfonline.com/action/journalInformation?journalCode=rpms20 Popular Music and Society Vol. 29, No. 5, December 2006, pp. 531–547 ‘‘We are the Champions’’: Masculinities, Sports and Popular Music Ken McLeod This paper explores the increasing confluence between music and sport, two previously largely distinct realms of cultural production. Focusing on the popularity and marketing of sports rock and hypermasculinized sports anthems by gay icons Queen, the Village People and Pet Shop Boys, this article theorizes the often paradoxical social and sexual codes engendered by the relationship of sports and popular music. The relationship between sports and popular music forms an important, although little understood nexus of cultural production. The popular reception of British invasion bands and their effeminized hair styles and attention to fashion challenged notions of physical integrity on the basis on gender that had previously underpinned both sports and music. The intersection of these two cultural spheres has often been regarded as dichotomous and tense. -

Most Requested Songs of 2012

Top 200 Most Requested DO NOT PLAY Songs Based on millions of requests made through the DJ Intelligence® music request system at weddings & parties in 2012 RANK ARTIST SONG 1 Sorta Crackers Band Chicken Dance 2 Los Del Rio Macarena 3 Village People Y.M.C.A. 4 DJ Casper Cha Cha Slide 5 Griffiths, Marcia Electric Boogie (Electric Slide) 6 Sister Sledge We Are Family 7 Kool & The Gang Celebration 8 Rednex Cotton Eye Joe 9 B-52's Love Shack 10 Grandmaster Slice Electric Slide (Shall We Dance) '92 11 Sir Mix-A-Lot Baby Got Back 12 Cupid Cupid Shuffle 13 Black Eyed Peas I Gotta Feeling 14 Anthony, Ray Hokey Pokey 15 ABBA Dancing Queen 16 Beyonce Single Ladies (Put A Ring On It) 17 Commodores Brick House 18 Vanilla Ice Ice Ice Baby 19 Big & Rich Save A Horse (Ride A Cowboy) 20 Diamond, Neil Sweet Caroline (Good Times Never Seemed So Good) 21 Journey Don't Stop Believin' 22 Bee Gees Stayin' Alive 23 Baha Men Who Let The Dogs Out 24 Lmfao Sexy And I Know It 25 Def Leppard Pour Some Sugar On Me 26 Black Eyed Peas My Humps 27 Maroon 5 Feat. Christina Aguilera Moves Like Jagger 28 Lynyrd Skynyrd Sweet Home Alabama 29 Jepsen, Carly Rae Call Me Maybe 30 Keith, Toby Red Solo Cup 31 Nelly Hot In Herre 32 Bega, Lou Mambo No. 5 (A Little Bit Of...) 33 Bayou City Beats Cotton Eyed Joe 34 Black Eyed Peas Boom Boom Pow 35 Lmfao Feat. Lauren Bennett And Goon Rock Party Rock Anthem 36 Aerosmith I Don't Want To Miss A Thing 37 Brooks, Garth Friends In Low Places 38 Wild Cherry Play That Funky Music 39 Travolta, John & Olivia Newton-John Grease Megamix 40 Isley Brothers Shout 41 Lady Gaga Poker Face 42 Bon Jovi Livin' On A Prayer 43 Pink Raise Your Glass 44 AC/DC You Shook Me All Night Long 45 Cyrus, Miley Party In The U.S.A.