Christchurch City Holdings Limited Fixed Rate Bond Offer Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Christchurch City Holdings Limited (CCHL)

Christchurch City Holdings Limited Fixed Rate Bond Offer Presentation Arranger and Joint Lead Manager Joint Lead Manager Important Notice The offer of Bonds is being made in reliance upon the exclusion in clause 19 of schedule 1 of the Financial Markets Conduct Act 2013 (FMCA). Except for the interest rate and maturity date, the Bonds will have identical rights, privileges, limitations and conditions as CCHL’s $150,000,000 3.40% fixed rate bonds maturing on 6 December 2022 which are quoted on the NZX Debt Market under the ticker code CCH010 (the Quoted Bonds). The Bonds are of the same class as the Quoted Bonds for the purposes of the FMCA and the Financial Markets Conduct Regulations 2014. CCHL is subject to a disclosure obligation that requires it to notify certain material information to NZX Limited (NZX) for the purpose of that information being made available to participants in the market and that information can be found by visiting www.nzx.com/companies/CCH. The Quoted Bonds are the only debt securities of CCHL that are currently quoted and in the same class as the Bonds. Investors should look to the market price of the Quoted Bonds to find out how the market assesses the returns and risk premium for those bonds. 2 Disclaimer The information in this presentation is of a general nature and does not take into account your particular investment objectives, financial situation, tax position or circumstances. It does not constitute legal, financial, tax or investment advice and should not be relied on in connection with any contract or commitment whatsoever. -

Christchurch City Holdings Limited Is a Wholly-Owned Subsidiary of Christchurch City Council

Christchurch City Holdings Limited is a wholly-owned subsidiary of Christchurch City Council cChristchurchc Cityh Holdingsl Investing in the city’s infrastructure The primary purpose of Christchurch City Holdings Ltd (CCHL) is to invest in and promote the establishment of key infrastructure, and this now extends to assisting the Council in the rebuild and redevelopment of Christchurch following the Canterbury earthquakes. CCHL will continue to invest in existing and new infrastructural assets such as the electricity distribution network, the airport, port, transport and high speed broadband. CCHL’s strategic approach is to identify infrastructural needs that are not or cannot be filled by the private sector or existing Council operations, then take a role in helping to meet those needs through joint ventures, public-private partnerships, establishing new entities or simply acting as a catalyst for others. Appropriate investment is encouraged and, if necessary, facilitated by CCHL in its trading companies when significant upgrades are required to existing infrastructural assets – recent examples being the establishment and funding of Enable Services, and the provision of some of the funding requirements for the construction of the new airport terminal. CCHL is supportive of its companies as they deal with post-earthquake repairs and rebuild of assets and markets. 2 About CCHL Christchurch City Holdings Ltd (CCHL) is the commercial and investment arm of Christchurch City Council. The company is responsible for managing the Council’s investment in eight fully or partly-owned Council-controlled trading organisations – Orion New Zealand Ltd, Christchurch International Airport Ltd, Lyttelton Port Company Ltd, Enable Services Ltd, City Care CHRISTCHURCH Ltd, Red Bus Ltd, EcoCentral Ltd and Selwyn CITY HOLDINGS Plantation Board Ltd. -

MBIE NZ Core Cities Research Summary

Research Summary AUCKLAND T AURANGA HAMILTON WELLINGTON CHRISTCHURCH DUNEDIN ISBN 978-0-478-38260-0 NZ Core Cities Research Summary (PDF) 978-0-478-38261-7 NZ Core Cities Research Summary (Print) © Crown Copyright First published: July 2012 Ministry of Business, Innovation and Employment PO Box 1473 Wellington 6011 New Zealand www.mbie.govt.nz Local Government New Zealand PO Box 1214 Wellington 6140 New Zealand www.lgnz.co.nz Permission to reproduce: The copyright owner authorises reproduction of this work, in whole or in part, so long as no charge is made for the supply of copies, and the integrity and attribution of the work as a publication of the Ministry of Business Innovation and Employment New Zealand and Local Government New Zealand is not interfered with in any way. Important notice: The opinions and proposals contained in this document are those of the Ministry of Business, Innovation and Employment and LGNZ and do not reflect government policy. The Ministry and LGNZ do not accept any responsibility or liability whatsoever whether in contract, tort (including negligence), equity or otherwise for any action taken as a result of reading, or reliance placed on the Ministry and LGNZ because of having read, any part, or all, of the information in this report or for any error, inadequacy, deficiency, flaw in or omission from the report. Auckland photography Leon Rose, courtesy of Auckland Tourism, Events and Economic Development Table of contents About this report 4 Purpose 4 The Core Cities Project 4 Principles for working together -

Council 11 December 2014

CHRISTCHURCH CITY COUNCIL AGENDA WEDNESDAY 10 DECEMBER 2014 10.30AM AND THURSDAY 11 DECEMBER 2014 9.30AM COUNCIL CHAMBER, CIVIC OFFICES, 53 HEREFORD STREET Watch Council meetings live on the web: http://councillive.ccc.govt.nz/live-stream AGENDA - OPEN CHRISTCHURCH CITY COUNCIL Thursday 11 December 2014 at 9.30am in the Council Chamber, Civic Offices, 53 Hereford Street Council: The Mayor, (Chairperson). Councillors, Vicki Buck, Jimmy Chen, Phil Clearwater, Pauline Cotter, David East, Jamie Gough, Yani Johanson, Ali Jones, Glenn Livingstone, Paul Lonsdale, Raf Manji, Tim Scandrett, Andrew Turner ITEM DESCRIPTION PAGE NO. NO 1. APOLOGIES 1 2. DECLARATION OF INTEREST 1 3. DEPUTATIONS BY APPOINTMENT 1 4. PRESENTATION OF PETITIONS 1 5. CONFIRMATION OF MINUTES - COUNCIL MEETINGS OF 27 NOVEMBER 2014 AND 1 5 DECEMBER 2014 6. REPORT OF THE AKAROA/WAIREWA COMMUNITY BOARD MEETING OF 8 OCTOBER 2014 11 7. REPORT OF THE LYTTELTON/MT HERBERT COMMUNITY BOARD MEETING OF 17 15 OCTOBER 2014 8. CHAIRPERSON’S REPORT OF THE LYTTELTON/MT HERBERT COMMUNITY BOARD 23 MEETING OF 19 NOVEMBER 2014 9. REPORT OF THE HAGLEY/FERRYMEAD COMMUNITY BOARD MEETING OF 29 5 NOVEMBER 2014 10. REPORT OF THE HAGLEY/FERRYMEAD COMMUNITY BOARD MEETING OF 35 19 NOVEMBER 2014 11. REPORT OF THE RICCARTON/WIGRAM COMMUNITY BOARD MEETING OF 53 4 NOVEMBER 2014 12. REPORT OF THE RICCARTON/WIGRAM COMMUNITY BOARD MEETING OF 57 18 NOVEMBER 2014 13. REPORT OF THE RICCARTON/WIGRAM COMMUNITY BOARD EXTRAORDINARY MEETING 73 OF 25 NOVEMBER 2014 14. REPORT OF THE SHIRLEY/PAPANUI COMMUNITY BOARD MEETING OF 5 NOVEMBER 2014 75 15. -

Enable Services Limited 2018 Annual Report

CONNECTING OUR COMMUNITY CONTENTS Stories from our community ..........................................04 Operational excellence as an infrastructure provider ......16 WITH UNLIMITED Job Done – network build completed .........................06 Financial performance ...................................................18 Our people believe in our business .............................08 Engaging with industry and Government ...................20 2018 – Our Annual Review .............................................10 OPPORTUNITY 2019 – The year ahead ...................................................22 Chair and CEO introduction ..........................................10 2019 – Another year of ambitious growth for Enable ......24 Every local family, business, school, healthcare provider and Record demand for fibre broadband ...........................11 community service provider that embraces fibre broadband is Board of Directors ..........................................................26 bringing us a step closer to realising our purpose. A customer centric business ..........................................12 Governance .....................................................................28 Health, Safety and Wellness - part of our DNA ...........13 Our people – realising our purpose .............................14 Financial statements .......................................................30 Supporting our community ...........................................15 Independent auditor’s report ........................................69 -

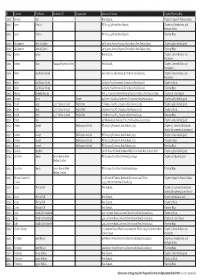

STAGE TWO Submissions List(9Nov)

# Surname First Name On Behalf Of Organisation Address for Service Chapter/Planning Map 2000 Bennett Earl New Zealand, Chapter 21 Specifi c Purpose Zones 2001 Lyons Patricia PO Box 33,Lyttelton,New Zealand, Chapter 10 Designations and Heritage Orders 2001 Lyons Patricia PO Box 33,Lyttelton,New Zealand, Planning Maps 2002 McGammon John & Colleen 49 St James Avenue,Papanui,Christchurch,New Zealand,8053 Chapter 14 Residential (part) 2002 McGammon John & Colleen 49 St James Avenue,Papanui,Christchurch,New Zealand,8053 Planning Maps 2004 Burton James New Zealand, Chapter 6 General Rules and Procedures 2005 Arneric Erion Raropua Property Limited New Zealand, Chapter 6 General Rules and Procedures 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Chapter 6 General Rules and Procedures 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Chapter 17 Rural 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Planning Maps 2007 Mundy Reginald George Unit 4, 6 Lonsdale Street,New Brighton,Christchurch,New Zealand,8083 Chapter 18 - Open Space 2008 George Brent Private 64A Dyers Pass Road,Cashmere,Christchurch,New Zealand,8022 Chapter 14 Residential (part) 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New Zealand,2585 Chapter 14 Residential (part) 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New Zealand,2585 Chapter 17 Rural 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New -

1 June 2017 Leah Scales Chief Financial Officer Christchurch City

1 June 2017 Leah Scales Chief Financial Officer Christchurch City Holdings Limited PO Box 73016 CHRISTCHURCH By email Dear Leah STATEMENT OF INTENT – 30 JUNE 2018 Please find attached a copy of Enable Services Limited’s Statement of Intent for the year ending 30 June 2018, approved by the Board on 23 May 2017. Yours sincerely Steve Fuller Chief Executive Enable Services Limited Copy to: Mark Bowman Amanda Strong Les Montgomery PO Box 9228 Tower Junction, Christchurch 8149 / Phone 03 363 2965 / Fax 03 363 2961 / www.enable.net.nz STATEMENT OF INTENT FOR YEAR ENDING 30 JUNE 2018 DIRECTORY Address PO Box 9228, Christchurch Registered office Enable House, 2nd Floor, 106 Wrights Road, Addington, Christchurch Board Mark Bowman (Chair) Timothy Lusk Brett Gamble William Luff Owen Scott Charlotte Walshe Chief Executive Steve Fuller Telephone 03 335 1765 Web enable.net.nz Email [email protected] INTRODUCTION This 2018 Statement of Intent (SoI) is submitted by the Board of Directors of Enable Services Limited (ESL) and is prepared in accordance with Section 64(1) of the Local Government Act 2002. ESL, which also owns 100% of Enable Networks Limited (ENL), together the Enable Group (Enable), are both council-controlled trading organisations (CCTO) for the purposes of the Local Government Act 2002 and this SoI covers the activities of Enable. The SoI specifies the objectives, the nature and scope of the activities to be undertaken, and the performance targets and other measures by which the performance of Enable may be judged in relation to its objectives, amongst other requirements. -

CCHL Annual Report 2017

July 2016—June 2017 A WHOLLY OWNED SUBSIDIARY of CHRISTCHURCH CITY COUNCIL Annual Report 2017 Christchurch City Holdings Limited Lyttleton Port Company Ltd Cover Photo Christchurch at Dawn by Richard Simmonds 2 Annual Report 17 Christchurch City Holdings Limited Contents Group Structure 06 About CCHL 07 Chair/CEO Report 10 Financial Overview 12 Corporate Governance Statement 16 CCHL Board Of Directors 18 Subsidiary And Associated Companies: Orion New Zealand Ltd 20 Christchurch International Airport Ltd 22 Lyttelton Port Company Ltd 24 Enable Services Ltd 26 City Care Ltd 28 Red Bus Ltd 30 Ecocentral Ltd 32 Development Christchurch Ltd 34 Directors' Responsibility Statement 36 Financial Statements 38 Statutory Information 83 Independent Auditor's Report 87 Ten Year Summary 90 Directory 91 Annual Report 17 3 Christchurch City Holdings Limited Control tower lit up orange for World Vision 4 Annual Report 17 Christchurch City Holdings Limited Annual Report 17 5 Christchurch City Holdings Limited Group Structure 89.3% 100% 100% Orion New Zealand Ltd Enable Lyttelton Port Services Ltd Company Ltd 100% 75% Christchurch City Holdings Limited is the commercial and investment arm of Christchurch Red Bus Ltd International Airport Ltd 100% 100% 100% Development EcoCentral Ltd Christchurch Ltd City Care Ltd Christchurch City Holdings Ltd (CCHL) is the commercial and investment arm of Christchurch City Council (the Council). The company is responsible for managing the Council’s investment in eight fully or partly-owned trading companies – Orion New Zealand Ltd, Christchurch International Airport Ltd, Lyttelton Port Company Ltd, Enable Services Ltd, City Care Ltd, Red Bus Ltd, EcoCentral Ltd and Development Christchurch Ltd. -

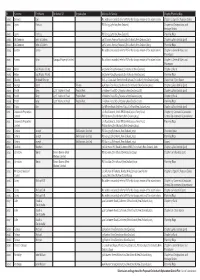

Submissions List(16July)

# Surname First Name On Behalf Of Organisation Address for Service Chapter/Planning Map 2000 Bennett Earl No address recorded, refer to PDF or hard copy version of the submissions Chapter 21 Specifi c Purpose Zones 2001 Lyons Patricia PO Box 33,Lyttelton,New Zealand, Chapter 10 Designations and Heritage Orders 2001 Lyons Patricia PO Box 33,Lyttelton,New Zealand, Planning Maps 2002 McGammon John & Colleen 49 St James Avenue,Papanui,Christchurch,New Zealand,8053 Chapter 14 Residential (part) 2002 McGammon John & Colleen 49 St James Avenue,Papanui,Christchurch,New Zealand,8053 Planning Maps 2004 Burton James No address recorded, refer to PDF or hard copy version of the submissions Chapter 6 General Rules and Procedures 2005 Arneric Erion Raropua Property Limited No address recorded, refer to PDF or hard copy version of the submissions Chapter 6 General Rules and Procedures 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Chapter 17 Rural 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Planning Maps 2007 Mundy Reginald George Unit 4, 6 Lonsdale Street,New Brighton,Christchurch,New Zealand,8083 Chapter 18 - Open Space 2008 George Brent Private 64A Dyers Pass Road,Cashmere,Christchurch,New Zealand,8022 Chapter 14 Residential (part) 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New Zealand,2585 Chapter 14 Residential (part) 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New Zealand,2585 Chapter 17 Rural 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New Zealand,2585 Planning Maps 2010 Sitarz Ken 65 Hillview Road,Birdlings Flat,Little River,New Zealand,7591 Chapter 14 Residential (part) 2011 Oakwoods Properties . -

Enable Services Limited 2016 Annual Report Contents

Enable Services Limited 2016 Annual Report Enable Services Limited 2016 Annual Report Contents Bringing Directory Celebrating 50 percent 4 uptake in Rolleston Shareholder Christchurch City Holdings Limited Christchurch families fi b r e 5 and businesses connect Registered offi ce Enable House 2nd Floor 106 Wrights Road The Enable Group Christchurch 8149 and UFB in greater New Zealand 6 Christchurch broadband Contact address PO Box 9228 Chairman and Tower Junction CEO report Christchurch 8149 8 New Zealand Web: www.enable.net.nz to greater Email: [email protected] Board of Directors Phone: 0800 434 273 26 Auditor The Auditor-General is the auditor pursuant to section 14 of the Public Audit Act 2001. Christchurch Julian Tan of Audit New Zealand was appointed to perform the audit on behalf of theGovernance Auditor-General. Solicitor 28 Simpson Grierson This vision is being realised access customers with today,Banker with more and more fibre connectivity. Financial statements families,BNZ businesses, schools Families throughout greater 30 “ and community organisations Christchurch are moving embracing fibre broadband to online entertainment Enable’s fi bre network is an essential to transform how we live options in enormous Independent our lives. Auditor’s report enabler of an economically and socially numbers and discovering 75 Children across our new ways to connect with community are taking friends and family. vibrant, innovative, connected and advantage of exciting new The potential value of online learning opportunities Enable’s fibre broadband is globally competitive Christchurch. in school and beyond. no longer a promise to be Enable CEO, Steve Fuller. The business community – realised tomorrow – it is here from Rangiora to Rolleston, now bringing benefits and and throughout the city – opening new possibilities for are discovering new ways everyone in our community. -

Orion Christchurch Airport Lyttelton Port Company

Christchurch City Holdings Limited Christchurch City Holdings is a wholly-owned subsidiary of cchl Christchurch City Council. annual report2015 . ORION CHRISTCHURCH AIRPORT LYTTELTON PORT COMPANY ENABLE SERVICES CITY CARE RED BUS ECOCENTRAL C H R I S T C H U R C H C I T Y H O L D I N G S L I M I T E D I 2 0 1 5 A N N U A L R E P O R T 2015 snapshot $1.1 $46.0 6,000 work on the billion million Christchurch airport the capital and the dividend campus dividend payments CCHL paid to The largest employment site CCHL has made Christchurch City in the South Island. to the Council Council since 1995 for the 2015 year. Allowing major investments in community assets, while reducing the impact on rates. 10 times 3.8 increase in container million 2 million numbers through New Zealanders Lyttelton Port Red Bus trips serviced by City Care over the past 30 years. during the year and beyond 2The CCHL0 group 1has grown5 significantly in value over the years, and the Council is in the position of owning a valuable portfolio of trading assets. We will work proactively with the Council in implementing its capital release programme over the next few years. seven the number of subsidiary 191,000 companies that the number of make up CCHL Orion, Christchurch Airport, homes & businesses Lyttelton Port Company, to which Orion Enable Services, City Care, Red Bus and EcoCentral. distributes power 86,500 the number of homes, businesses, 97,620 schools & healthcare tonnes of material facilities that can diverted from now access fibre landfill by EcoCentral broadband services the rebuild The CCHL group continues to play a vital role in the rebuild of Christchurch and Canterbury following the series of earthquakes that struck the region in 2010 and 2011. -

ENABLE SERVICES LIMITED 2015 ANNUAL REPORT 2 / Enable Services Limited CONTENTS

ENABLE SERVICES LIMITED 2015 ANNUAL REPORT 2 / Enable Services Limited CONTENTS About Enable Services Limited Page 4 Chairman and CEO Report Page 6 Board of Directors Page 14 Financial Statements Page 16 Independent Auditor’s Report Page 59 Statutory Information Page 61 Enable Services Limited / 3 ABOUT ENABLE SERVICES LIMITED Enable Services Limited (ESL) is a major investor in a fibre broadband network that will transform how people use technology in their businesses and homes, and will provide tremendous value to our community as an enabler of future innovation and economic growth. ESL is a fully owned subsidiary of Christchurch City Holdings Limited (CCHL), the investment arm of the Christchurch City Council (the Christchurch Christchurch City Council). It was launched in 2007 Crown City Council to build a commercial fibre network Holdings aimed at providing better quality Ltd telecommunications services to businesses and schools in Christchurch. In May 2011, ESL entered into a partnership with the Government to provide fibre broadband services to 180,000 homes, businesses, Crown Fibre Enable schools and healthcare facilities Holdings Ltd Services Ltd across Christchurch and parts of the Waimakariri and Selwyn districts – as part of the national ultra-fast broadband (UFB) initiative. Winning the UFB contract resulted in the creation of a new joint venture, local fibre company, Enable Networks Limited (ENL). ENL is jointly Shareholder Shareholder & owned by ESL and the Government & Funder Funder agency Crown Fibre Holdings Limited (CFH). In recent years, ESL has transformed from a small fibre provider into both a large local infrastructure investment business and a leading infrastructure services company.