1 Punjab National Bank REQUEST for PROPOSAL (RFP)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 4, 2021 EDs in Public Sector Banks: Banks Board Bureau recommends 10 candidates in 2021-22: The Banks Board Bureau (BBB) has recommended ten candidates to the panel that will be used for filling vacancies of Executive Directors in various Public Sector Banks (PSBs) in the year 2021-22. These names have been shortlisted after the BBB, which is the head hunter for the government for filling top level posts in PSBs, insurance companies and other financial institutions, interfaced with 40 candidates (chief general managers and general managers) from various PSBs on July 2 and 3 for the position of Executive Directors, sources close to the development said. The ten names that have been recommended (in the order of merit) for the Panel are Rajneesh Karnatak; Joydeep Dutta Roy; Nidhu Saxena, Kalyan Kumar; Ashwani Kumar; Ramjass Yadav, Asheesh Pandey, Ashok Chandra; A V Rama Rao and Shiv Bajrang Singh. This panel will be operated in the financial year 2021–22, subject to availability of vacancies in the panel year 2021–22, sources said. https://www.thehindubusinessline.com/money-and-banking/eds-in-public-sector-banks-banks-board- bureau-recommends-10-candidates-in-2021-22/article35125016.ece Supreme Court seeks response of Centre, RBI on plea of PNB against disclosure of info under RTI: The Supreme Court has refused to grant interim stay on the RBI’s notice asking Punjab National Bank to disclose information such as defaulters list and its inspection reports under the RTI Act, and sought responses from the Centre, federal bank and its central public information officer. -

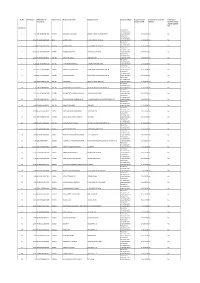

Statement of Unpaid and Unclaimed Dividend Amount for FY 2018-19

SR. No. Due Amount DPID-Client ID- Instrument No Name of the Payee Registered Bank Investment Type Propose date of Is the Investment under Is the shares Account No transfer to IEPF litigation transferred from unpaid suspense A/c FY 2018-19 Amount for unclaimed and 1 0.12 1203320005311836 103833 MANMOHAN KUMAR ORIENTAL BANK OF COMMERCE unpaid dividend 27-10-2026 No No Amount for unclaimed and 2 12.00 IN30236510307646 103777 GURMIT RAM STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 3 0.60 IN30114310890533 103834 KARAN SINGLA STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 4 60.00 1201320000425029 103779 PURNIMA MISHRA . STATE BANK OF INDIA unpaid dividend 27-10-2026 No No Amount for unclaimed and 5 12.00 IN30011810990050 103780 RICHH PAL SINGH IDBI BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 6 1.20 1202420000605238 103781 VIJAY MOHAN PAINULI PUNJAB NATIONAL BANK unpaid dividend 27-10-2026 No No Amount for unclaimed and 7 18.00 1202420000168896 103782 TARSEM LAL MAHAJAN STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 8 6.00 1201210100496051 103784 VIKAS MAHARISHI STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 9 3.60 1301760000657165 103785 REENA JAIN BANK OF RAJASTHAN LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 10 1.20 1203320000858515 103786 MAHAVEER CHAND CHHAJED BALOTRA URBAN CO OP BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 11 -

Retail User Guide

Retail User Guide User Guide for Retail Internet Banking Users Punjab National Bank introduces the upgraded version of Internet Banking for its esteemed Retail Customers. Experience a convenient, simple and secure way of banking & e-commerce at your comfort with PNB Internet Banking Services. Start using now!!! Page 1 CONTENTS Topic Page 1. How to get user ID/Password 3 2. How to use internet banking 3 3. My Accounts 4 4. Transactions 5 5. Value Added Services 6 6. Personal Settings 7 7. Other Services 8 8. Mail and Messages 9 9. Security Features 9 10. Safeguard 10 11. Contact Us 10 Page 2 1. How to get User ID/Password 1.1 On-line Registration for Internet Banking facility: Customers can avail Retail Internet Banking facility by getting themselves registered online using debit card credentials. Follow the steps as under: Visit http://www.netpnb.com On Home Page, Click on the link –> Register Here Enter Account Number & Select Registration Type. Select Type of facility View Only or View & Transaction Both Click on “Verify” Enter OTP received on Registered Mobile Number in “One Time Password” field. After verification of OTP, enter account details/ ATM credentials. On successful validation of entered details, you can set the passwords. Once these processes are successfully completed, you will be shown success message with regard to your registration process. After completing this process, user will be enabled immediately. 1.2 Registration through PNB ATMs: Customers can submit request for Internet Banking registration through PNB ATMs: 1.3 Submitting request on Form no. PNB-1063 in branch: Customers may download the IBS Registration form from the link DownloadFormsPNB 1063 and submit the same to any PNB branch after entering required details. -

Sustainability and Ethical Banking: a Case Study of Punjab National Bank

Volume 4 Issue 1 2019 AJCG Amity Journal of Corporate Governance 4 (1), (15-27) ©2019 ADMAA Sustainability and Ethical Banking: A Case Study of Punjab National Bank Amrish Dogra & Manu Dogra Guru Nanak Dev University, Amritsar, Punjab, India Abstract In the field of banking and finance, Ethical banking is a business model that responds to emerging approaches to sustainable economy based on the principles of corporate social responsibility. Ethical banking is also known as ‘sustainable banking’ or ‘civic banking’ or ‘clean banking’. ‘Transparency in reporting’ is a major value integrated in the fundamentals of ethical banking (Barcelona, 2012). The recent disclosure of mega scam in Punjab National Bank has violated this fundamental norm of ethical banking. Besides, the surmounting non- performing assets in banks pose a threat to the sustainability of these banks. The present study focusses upon these two areas of CSR by forecasting NPAs of PNB in 2025 and by highlighting the present case of mega scam in the bank. The study has forecasted the non-performing assets of PNB on the basis of quarterly data from 2010 to 2017. Basel II guidelines regarding better supervisory review, market discipline via certain disclosure requirements and minimum regulatory capital were introduced in an advanced manner in India in 2010. Hence, quarterly data relating to repo rate, gross domestic product, inflation rate and loans and advances from 2010 to 2017 has been considered. The second major objective of the study aims at highlighting the recently revealed scam relating to Punjab National Bank. Coincidentally, the PNB scam also lasted seven years from 2010 to 2017. -

Corporate Overview Transact with Ease: Solutions That Work for Everyone, Everywhere

Corporate Overview Transact with ease: Solutions that work for everyone, everywhere... Leading Payments Platform Provider One of India’s leading end-to-end banking and payments solution providers: Pan-India § 20 years proven track record presence in 27 States § 600+ banks are provided switching and & 3 UTs payment services § 15 million debit cards issued § 10 million transactions per day § 2500 ATMs, 5000 Micro ATMs deployed © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 2 Top NPCI Partner & ASP § First ASP certified by NPCI and a pioneer in 54% market share developing payment solutions on various in RuPay NFS sub- NPCI platforms membership § Leading end-to-end solution provider offering RuPay Debit cards, ATM, POS, ECOM, Micro ATM, IMPS, AEPS, UPI, BBPS Sarvatra Others © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 3 Leading in Co-operative Banking Sector India’s top provider of debit card platform, switching & payment services to co-op. banking sector. CO-OPERATIVE BANK TYPE SARVATRA CLIENTS Urban Cooperative Banks (UCBs) 395 State Cooperative Banks (SCBs) 14 District Central Cooperative Banks (DCCBs) 129 © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 4 One of India’s largest Debit Card Issuing platforms (hosted) © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 5 Top Private & Public Sector Banks as Customers § Our key enterprise customers in Private Sector Banks include ICICI Bank, Punjab National Bank, The Nainital Bank, Oriental Bank of Commerce, IDBI Bank, Bank of Maharashtra, NSDL Payments Bank. § Our Sponsor Banks (Partners for NPCI’s Sub-membership Model) include HDFC Bank, ICICI Bank, YES Bank, Axis Bank, IndusInd Bank, IDBI Bank, State Bank of India, Kotak Mahindra Bank. -

Financial Inclusion-Account Opening Form

FINANCIAL INCLUSION-ACCOUNT OPENING FORM Reference No.______________Date: ____________ Account No. Name of the Branch____________________ D No_________________ Customer ID No. Sub District/Block Name SSA Code/Ward No. Village Code/Town Code Name of Village/Town [as per census 2011] [as per census 2011] Applicant Details: Full Name Mr./Mrs./Ms. (In Capital Letters) First Middle Last Name Marital StatusMarried/Single Gender Male/Female Name of Spouse No. of Dependents: Name of Father Address City State Pin Code Nationality : Religion: Hindu/Muslim/Sikh/Christian/others Location Rural/ Semi-urban/Urban/Metro Category: General/OBC/SC/ST/Minority Type of Account Individual/Joint/ Sr Citizen Mode of Operation: Self/ Guardian/ Telephone & Mobile No. Date of Birth dd mm yyyy Aadhaar/ EID No. PAN /GIR No. Voter ID No; If available MNREGA JOB CARD NO: Occupation/Profession Agriculture/Service/Housewife/Business/Salaried/Retired/Student/Others Annual Income (ü ) Up to Rs.60000/- 60001/- to 1.5 lakh 1.5 lakh to 5.00 lakh > 5 lakhs Detail of Assets Owning House : Y/N No. of Animals : Owning Farm : Y/N Any other : Existing Bank A/c of family Y/N If yes Bank A/c No. members/household Kisan Credit Card Whether Eligible Y/N If already Issued ; Y/N I request you to issue me a Rupay Debit Card. I authorize UIDAI to share my e-KYC data with Punjab National Bank. I request you to sanction me an overdraft facility with the Limit of Rs. 5000/-(Rupees Five Thousand only) in the above account to meet my emergency/family needs. -

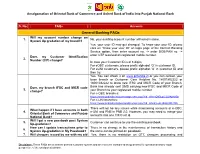

Faqs Answers

Amalgamation of Oriental Bank of Commerce and United Bank of India into Punjab National Bank S. No. FAQs Answers General Banking FAQs Will my account number change on 1. No, your existing account number will remain same. System Up gradation of my branch? Yes, your user ID may get changed. To know your user ID, please click on “Know your user ID” on login page of the Internet Banking Service option, then enter account no. -> enter DOB/PAN no. -> enter OTP received on registered mobile number. Does my Customer Identification 2. Number (CIF) change? In case your Customer ID is of 8 digits, For eOBC customers, please prefix alphabet „O‟ in customer ID. For eUNI customers, please prefix alphabet „U‟ in customer ID and then try. Yes. You can check it on www.pnbindia.in or you can contact your base branch or Customer Care Helpline No. 18001802222 or 18001032222 to know new IFSC and MICR Code of your Branch. Does my branch IFSC and MICR code Bank has already sent SMS carrying new IFSC and MICR Code of 3. change? your Branch to your registered mobile number. For e-OBC branches: https://www.pnbindia.in/downloadprocess.aspx?fid=dYhntQN3LqL12L04pr6fGg== For e-UNI branches: https://www.pnbindia.in/downloadprocess.aspx?fid=8dvm/Lo2L15cQp3DtJJIlA== There will not be any issues while maintaining accounts of e-OBC, What happen if I have accounts in both 4. e-UNI and PNB in PNB 2.0. However, you may need to merge your Oriental Bank of Commerce and Punjab accounts into one CIF/Cust Id. -

India Fintech Sector a Guide to the Galaxy

India FinTech Sector A Guide to the Galaxy G77 Asia Pacific/India, Equity Research, 22 February 2021 Research Analysts Ashish Gupta 91 22 6777 3895 [email protected] Viral Shah 91 22 6777 3827 [email protected] DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Contents Payments leading FinTech scale-up in India .................................. 8 8 FinTechs: No longer just payments ..............................................14 Account Aggregator to accelerate growth of digital lending ...............................................................................22 Digital platforms and partnerships driving 50-75%of bank business ...28 Company section ..........................................................................32 PayTM (US$16 bn) ......................................................................33 14 Google Pay ..................................................................................35 PhonePe (US$5.5 bn) ..................................................................37 WhatsApp Pay .............................................................................39 -

PUNJAB NATIONAL BANK RESOURCE MOBALISATION DIVISION HO: NEW DELHI FAQ's NRO Deposit Scheme 1. What Is NRO A/C?

PUNJAB NATIONAL BANK RESOURCE MOBALISATION DIVISION HO: NEW DELHI F.A.Q.’s N.R.O. Deposit Scheme 1. What is NRO A/c? Non-Resident Ordinary Rupee Account (NRO Account) 2. Who can open NRO a/cs? Any person resident outside India may open NRO account with any branch for the purpose of putting through bona fide transaction in rupees. Opening of accounts by individual/ entities of Pakistan and entities of Bangladesh require prior approval of Reserve Bank of India. NRO (current/savings) account can also be opened by a foreign national of non-Indian origin visiting India/ foreign national students. - Foreign Nationals on Non-Indian origin (for period not exceeding 6 Months). 3. Who is Non-resident Indian / Persons of Indian origin? - Those Indian residents, who are in employment, studying and staying permanently abroad and foreign nationals (except of Pakistan and Bangladesh), with their origin in India. -Students proceeding abroad for higher studies are treated as Non-residents. 4. Which type of accounts can be opened under NRO? - NRO accounts may be opened / maintained in the form of current, savings, recurring or fixed deposit accounts. 5. In which currency these a/cs are maintained in the Banks? Account should be denominated in Indian Rupees. 6. These accounts can be opened with which funds? - The accounts can also be opened with / out of the funds received as foreign inward remittances in convertible currency through normal banking channel. The Foreign Currency Travellers Cheques / Notes may be accepted during temporary visits of the NRI, for credit to account. - The accounts can also be opened with the Legitimate local dues denominated in Indian Rupees viz. -

THE RISE of ELECTRONIC PAYMENT SYSTEMS Praboju Shirisha* *MBA, M.A English, TS&AP- SET, Academic Consultant & HOD, Dept

ISSN: 2277-9655 [Shirisha * et al., 6(12): December, 2017] Impact Factor: 4.116 IC™ Value: 3.00 CODEN: IJESS7 IJESRT INTERNATIONAL JOURNAL OF ENGINEERING SCIENCES & RESEARCH TECHNOLOGY 8TH NOVEMBER 2016 DEMONETIZATION - THE RISE OF ELECTRONIC PAYMENT SYSTEMS Praboju Shirisha* *MBA, M.A English, TS&AP- SET, Academic Consultant & HOD, Dept. of Business Management, Palamuru University PG Centre, Kollapur, Nagarkurnool Dist. DOI: 10.5281/zenodo.1130911 ABSTRACT On 8 November 2016, the total world came to know that the Prime Minister Mr. Narendra Modi announced the demonetization in an unscheduled live televised address at 20:00 (IST) on 8 November the demonetization of Rs.500 and Rs.1000 banknotes would be invalid, and announced the issuance of new Rs.500 and Rs.2000 banknotes of New Series in exchange for the old banknotes with a deadline for exchange and the problem evolved for physical cash availability that became an issue and its impact is felt by every Indian citizen. As majority i.e. 78% of consumer payments in India are made in cash and most of the currencies used were Rs.500 and Rs.1000 for transactions, and to overcome this problem Government of India found out various regulatory and infrastructural reforms to create a favorable atmosphere for electronic payment systems. This paper focuses on the study of providing a comprehensive overview of overall development of Electronic payment systems impact, challenges and outcomes. KEYWORDS: Demonetization, cashless payment, mobile banking, e-payments, Digitalization. I. INTRODUCTION Indian economy until Demonetization was maximum dependant on cash. The currency notes are prevailing in the Indian economies which were used to spend and save money. -

India Digital Financial Inclusion | Journey Map Report | Mstar Project

This document was written under the Mobile Solutions Technical Assistance and Research (mSTAR) project, United States Agency for International Development Cooperative Agreement No. AID-OAA-A-12-0073. The content and views expressed in this publication do not necessarily reflect the views of United States Agency for International Development or the United States Government. ii India Digital Financial Inclusion | Journey Map Report | mSTAR Project Table of Contents Acronyms v Executive summary 1 India’s digital financial inclusion journey 1 The role of digital payments in expanding financial inclusion 2 Recommendations 3 Introduction 4 SECTION 1: India’s Digital Financial Services Journey 6 1.1 Growth in Digital Financial Services (DFS) Since 2014 6 1.2 Government Initiatives Since 2014 7 1.2.1 Jan Dhan Yojana 7 1.2.2 Direct Benefit Transfers (DBT) and Government-to-Person (G2P) payments 8 1.2.3 RuPay 9 1.2.4 Account Dormancy 9 1.2.5 Aadhaar and the India Stack 10 1.2.6 Unified Payments Interface (UPI) 11 1.2.7 Demonetization and GST 13 1.2.8 Developments in the Policy and Regulatory Framework 15 1.2.9 Licensing of New Tiers of Banking Institutions 16 1.3 Industry Initiatives 17 1.3.1 Payments Banks 17 1.3.2 Microfinance and Small Finance Banks 18 1.3.3 Fintech 19 1.3.4 Expansion of Smartphones and Internet 20 1.3.5 International Technology Companies 21 1.4 Development Sector Initiatives 21 1.4.1 Supporting Innovation 21 1.4.2 Supporting Infrastructure for the Last Mile 22 1.4.3 Making DFS More Inclusive 22 SECTION 2: Understanding Digital -

Sr.No . Ward Name Father/Husband Adhar Bank Name Accountno

Sr.No Ward Name Father/Husband Adhar Bank name Accountno. present address . Mobile 1 1 rinku devi dablu sonkar Available union bank Available chillupar barhalganj Available 2 1 baby devi jaswant sonkar Available union bank Available chillupar barhalganj Available 3 1 surenddra sonkar ramdas Available oriental bank Available chillupar barhalganj Available 4 1 mannu devi nebulal sonkar Available oriental bank Available chillupar barhalganj Available 5 1 chinta devi rajesh sonkar Available purvanchal bank Available chillupar barhalganj Available 6 1 laliya gulab sonkar Available union bank Available chillupar barhalganj Available 7 1 viraju babulal Available union bank Available chillupar barhalganj Available 8 1 dileep kumar somkar babulal sonkar Available union bank Available chillupar barhalganj Available 9 1 patiya sonkar munib sonkar Available union bank Available chillupar barhalganj Available 10 1 radha devi amarnath Available indian overseas bank Available chillupar barhalganj Available 11 1 Anil Sonkar shiv prakash Sonkar Available punjab national bank Available tahsil chauraha Available 12 1 arun kumar maddhesia anmol prasad Available bank of baroda Available mahadeva muhalla Available 13 1 shakeel ahmad vakil ahmad ansari Available purvanchal bank Available kasab tola barhalganj Available 14 1 suresh chand varma ramashankar Available punjab national bank Available kasab tola barhalganj Available 15 1 geeta devi nandlal verma Available purvanchal bank Available purana gola muhalla Available 16 1 Leelawati Devi Sonkar Phoolchand