211633987-V1 IGDL Facility Rulebook V2 8 (Filed 11-25-15) (Nals)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interbank Offered Rates (Ibors) and Alternative Reference Rates (Arrs)

VERSION: 24 SEPTEMBER 2020 Interbank Offered Rates (IBORs) and Alternative Reference Rates (ARRs) The following table has been compiled on the basis of publicly available information. Whilst reasonable care has been taken to ensure that the information in the table is accurate as at the date that the table was last revised, no warranty or representation is given as to the information in the table. The information in the table is a summary, is not exhaustive and is subject to change. Key Multiple-rate approach (IBOR + RFR) Moving to RFR only IBOR only Basis on Development of Expected/ Expected fall which forward-looking likely fall- back rate to IBOR is Expected ARR? back rate to the ARR (if 3 Expected being Date from date by the IBOR2 applicable) discontinu continued which which ation date (if Alternative ARR will replaceme for IBOR applicable Reference be nt of IBOR Currency IBOR (if any) )1 Rate published is needed ARS BAIBAR TBC TBC TBC TBC TBC TBC TBC (Argentina) 1 Information in this column is taken from Financial Stability Board “Reforming major interest rate benchmarks” progress reports and other publicly available English language sources. 2 This column sets out current expectations based on publicly available information but in many cases no formal decisions have been taken or announcements made. This column will be revisited and revised following publication of the ISDA 2020 IBOR Fallbacks Protocol. References in this column to a rate being “Adjusted” are to such rate with adjustments being made (i) to reflect the fact that the applicable ARR may be an overnight rate while the IBOR rate will be a term rate and (ii) to add a spread. -

1- FIRST ABU DHABI BANK PJSC US$15000000000 Euro Medium

SECOND SUPPLEMENT DATED 8 OCTOBER 2019 TO THE BASE PROSPECTUS DATED 16 JULY 2019 FIRST ABU DHABI BANK PJSC (incorporated with limited liability in the Emirate of Abu Dhabi, the United Arab Emirates) U.S.$15,000,000,000 Euro Medium Term Note Programme This base prospectus supplement (the "Supplement") is supplemental to, forms part of and must be read and construed in conjunction with, the base prospectus dated 16 July 2019 as supplemented by the first supplement to the base prospectus dated 19 July 2019 (the "Base Prospectus") prepared by First Abu Dhabi Bank PJSC (the "Issuer", "FAB" or the "Bank") in connection with the Issuer's Euro Medium Term Note Programme (the "Programme") for the issuance of up to U.S.$15,000,000,000 in aggregate nominal amount of notes (the "Notes"). Terms defined in the Base Prospectus shall, unless the context otherwise requires, have the same meaning when used in this Supplement. This Supplement has been approved by the United Kingdom Financial Conduct Authority (the "U.K. Listing Authority") in its capacity as the United Kingdom competent authority for the purposes of Part VI of the Financial Services and Markets Act 2000, as amended (the "FSMA"). This Supplement constitutes a supplementary prospectus for the purposes of Section 87G of the FSMA (as that provision stood immediately prior to 21 July 2019) and, together with the Base Prospectus, comprises a base prospectus for the purposes of Directive 2003/71/EC, as amended (which includes the amendments made by Directive 2010/73/EU and includes any relevant implementing measure in a relevant Member State of the European Economic Area) (when used in this Supplement, the "Prospectus Directive"). -

Notice of Listing of Products by Icap Sef (Us) Llc for Trading by Certification 1

NOTICE OF LISTING OF PRODUCTS BY ICAP SEF (US) LLC FOR TRADING BY CERTIFICATION 1. This submission is made pursuant to CFTC Reg. 40.2 by ICAP SEF (US) LLC (the “SEF”). 2. The products certified by this submission are the following: Fixed for Floating Interest Rate Swaps in CNY (the “Contract”). Renminbi (“RMB”) is the official currency of the Peoples Republic of China (“PRC”) and trades under the currency symbol CNY when traded in the PRC and trades under the currency symbol CNH when traded in off-shore markets. 3. Attached as Attachment A is a copy of the Contract’s rules. The SEF is listing the Contracts by virtue of updating the terms and conditions of the Fixed for Floating Interest Rate Swaps submitted to the Commission for self-certification pursuant to Commission Regulation 40.2 on September 29, 2013. A copy of the Contract’s rules marked to show changes from the version previously submitted is attached as Attachment B. 4. The SEF intends to make this submission of the certification of the Contract effective on the day following submission pursuant to CFTC Reg. 40.2(a)(2). 5. Attached as Attachment C is a certification from the SEF that the Contract complies with the Commodity Exchange Act and CFTC Regulations, and that the SEF has posted a notice of pending product certification and a copy of this submission on its website concurrent with the filing of this submission with the Commission. 6. As required by Commission Regulation 40.2(a), the following concise explanation and analysis demonstrates that the Contract complies with the core principles of the Commodity Exchange Act for swap execution facilities, and in particular Core Principle 3, which provides that a swap execution facility shall permit trading only in swaps that are not readily susceptible to manipulation, in accordance with the applicable guidelines in Appendix B to Part 37 and Appendix C to Part 38 of the Commission’s Regulations for contracts settled by cash settlement and options thereon. -

Icap Sef (Us) Llc

ICAP SEF (US) LLC Swap Execution Facility Rulebook Version: 3.2 Revised July 2016 © Copyright ICAP SEF (US) LLC 2016 All Rights Reserved. SEF Rulebook TABLE OF CONTENTS Page DEFINITIONS ................................................................................................................................................ i CHAPTER 1 MARKET GOVERNANCE ....................................................................................................... 1 Rule 101. Board of Directors and Officers ...................................................................................... 1 Rule 102. Limitation of Liability ....................................................................................................... 1 Rule 103. Confidentiality ................................................................................................................. 2 Rule 104. Emergency Action .......................................................................................................... 3 Rule 105. Suspension of Trading .................................................................................................... 5 Rule 106. Risk Controls for Trading ................................................................................................ 6 Rule 107. Market Data .................................................................................................................... 6 Rule 108. Intellectual Property ....................................................................................................... -

Product Disclosure Statement

Product Disclosure Statement United States & Canada (January 2014) Global Payment and Risk Management Solutions Product Disclosure Statement - United States & Canada January 2014 Contents Introduction . 3 Products . 3 Trade Confirmations . 8 Telephone Recordings . 8 Complaints . 8 Privacy Statement . 14 Fraud Protection . 15 Compliance . 16 Taxation . 17 Contact Us . 18 Glossary . 19 Page 2 of 20 Product Disclosure Statement - United States & Canada January 2014 Introduction This Product Disclosure Statement (PDS) contains About AFEX information about the Global Payment and Risk Associated Foreign Exchange, Inc . (AFEX), a California Management Solutions provided to you by AFEX . Corporation located at Warner Center, 21045 Califa Street, Woodland Hills, California 91367 United States, is The information set out in this PDS is general in nature licensed and regulated as a Money Transmitter by several and has been prepared without taking into account your State Regulatory Agencies, and it is registered as a Money objectives, financial situation or needs . Before dealing Services Business (MSB) with the Financial Crimes in foreign exchange transactions you should consider Enforcement Network (FinCEN), a bureau of the United whether it is appropriate, having regard to your own States Department of the Treasury Financial . In addition, objectives, financial situation and needs . This PDS does AFEX is also registered with the Financial Transactions and not constitute financial or legal advice, including financial Reports Analysis Centre of Canada (FINTRAC) . recommendations . If you need legal advice, please seek the services of an Established in 1979, AFEX effectively pioneered the attorney . business of personalized foreign exchange services, tailored to small and mid-size business clients . AFEX is If you have any questions or need more information, please wholly owned by Associated Foreign Exchange Holdings, contact your AFEX Account Executive or visit our website at Inc . -

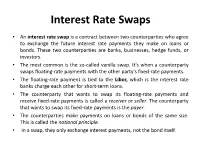

Interest Rate Swaps

Interest Rate Swaps • An interest rate swap is a contract between two counterparties who agree to exchange the future interest rate payments they make on loans or bonds. These two counterparties are banks, businesses, hedge funds, or investors. • The most common is the so-called vanilla swap. It's when a counterparty swaps floating-rate payments with the other party's fixed-rate payments. • The floating-rate payment is tied to the Libor, which is the interest rate banks charge each other for short-term loans. • The counterparty that wants to swap its floating-rate payments and receive fixed-rate payments is called a receiver or seller. The counterparty that wants to swap its fixed-rate payments is the payer. • The counterparties make payments on loans or bonds of the same size. This is called the notional principle. • In a swap, they only exchange interest payments, not the bond itself. • A smaller number of swaps are between two counter parties with floating- rate payments. • Also, the present value of the two payment streams must also be the same. That means that over the length of the bond, each counterparty will pay the same amount. It’s easy to calculate the NPV for the fixed-rate bond because the payment is always the same. It's more difficult to predict with the floating rate bond. The payment stream is based on Libor, which can change. Based on what they know today, both parties have to agree then on what they think will probably happen with interest rates. • A typical swap contract lasts for one to 15 years. -

Foreign Exchange Training Manual

CONFIDENTIAL TREATMENT REQUESTED BY BARCLAYS SOURCE: LEHMAN LIVE LEHMAN BROTHERS FOREIGN EXCHANGE TRAINING MANUAL Confidential Treatment Requested By Lehman Brothers Holdings, Inc. LBEX-LL 3356480 CONFIDENTIAL TREATMENT REQUESTED BY BARCLAYS SOURCE: LEHMAN LIVE TABLE OF CONTENTS CONTENTS ....................................................................................................................................... PAGE FOREIGN EXCHANGE SPOT: INTRODUCTION ...................................................................... 1 FXSPOT: AN INTRODUCTION TO FOREIGN EXCHANGE SPOT TRANSACTIONS ........... 2 INTRODUCTION ...................................................................................................................... 2 WJ-IAT IS AN OUTRIGHT? ..................................................................................................... 3 VALUE DATES ........................................................................................................................... 4 CREDIT AND SETTLEMENT RISKS .................................................................................. 6 EXCHANGE RATE QUOTATION TERMS ...................................................................... 7 RECIPROCAL QUOTATION TERMS (RATES) ............................................................. 10 EXCHANGE RATE MOVEMENTS ................................................................................... 11 SHORTCUT ............................................................................................................................... -

Derivatives User Guide Oracle Banking Treasury Management

Derivatives User Guide Oracle Banking Treasury Management Release 14.5.0.0.0 Part No. F43223-01 May 2021 Copyright Copyright: 2007, 2021 Copyright Holder: Oracle Product Name: Oracle Financial Software Services, Oracle park, off western express highway, Goregaun (east) mumbai, Maharashtra 400 063, India, Phone Number - 91-22 6718 3000, 91-22 6718 3001. www.oracle.com/finan- cial services Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners. U.S. GOVERNMENT END USERS: Oracle programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, delivered to U.S. Government end users are “commer- cial computer software” pursuant to the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, use, duplication, disclosure, modification, and adaptation of the programs, including any oper- ating system, integrated software, any programs installed on the hardware, and/or documentation, shall be subject to license terms and license restrictions applicable to the programs. No other rights are granted to the U.S. Govern- ment. This software or hardware is developed for general use in a variety of information management applications. It is not developed or intended for use in any inherently dangerous applications, including applications that may create a risk of personal injury. If you use this software or hardware in dangerous applications, then you shall be respon- sible to take all appropriate failsafe, backup, redundancy, and other measures to ensure its safe use. Oracle Corpo- ration and its affiliates disclaim any liability for any damages caused by use of this software or hardware in dangerous applications. -

FX Option Tutorial | Finpricing

Currency Option or FX Option Introduction and Pricing Guide FinPricing Currency Option A currency option or FX option is a contract that gives the buyer the right, but not the obligation, to buy or sell a certain currency at a specified exchange rate on or before a specified date. Currency options are one of the most common ways for corporations, individuals or financial institutions to hedge against adverse movements in exchange rates. Currency options are one of the most common ways for corporations, individuals or financial institutions to hedge against adverse movements in exchange rates. Corporations primarily use FX options to hedge uncertain future cash flows in a foreign currency. The general rule is to hedge certain foreign currency cash flows with forwards, and uncertain foreign cash flows with options. Currency Option Summary ▪ Currency Option or FX Option Introduction ▪ The Use of Currency Option ▪ Forex Market Convention ▪ Currency Option Payoffs ▪ Valuation ▪ Practical Guide ▪ A Real World Example Currency Option Currency Option or FX Option Introduction • A currency option is a derivative contract that grants the buyer the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified future date. • The FX options market is the deepest, largest and most liquid market for options of any kind. • Most trading is over the counter (OTC) and is lightly regulated. • There are call options and put options. Also a currency option could be European style or American style. • Call options provide the holder the right but not the obligation to purchase an underlying currency at a specified FX rate on a future date. -

World Bank Document

Public Disclosure Authorized ® ® Public Disclosure Authorized ® Public Disclosure Authorized "i'Р ¹ ®' I Public Disclosure Authorized A Worid Bank Glossary Glossaire de la Banque mondiale Glosario del Banco Mundial Glossary of Finance and Debt Glossaire des finances et de la dette Glosario de finanzas y de deuda English-French-Spanish Français-anglais-espagnol Espafiol-4nglés--francés The World Bank Washington, D.C., U.S.A. Copyright @ 1991 International Bank for Reconstruction and Development / The World Bank Banque internationale pour la reconstruction et le d6velopperpent / Banque mondiale Banco Intemacional de Reconstrucci6n y Fomento / Banco Mundial 1818 H Street, N.W. Washington, D.C. 20433, U.S.A. All rights reserved Tons droits r6serv6s Reservados todos los derechos First printing: March 1991 Premibre 6dition : mars 1991 Primera impresi6n: marzo de 1991 Manufactured in the United States of America Publi6 aux Etats-Unis d'Amdrique Hecho en los Estados Unidos de Amdrica Library of Congress Cataloging in Publication Data Glossary of finance and debt : English-French-Spanish = Glossaire des finances et de la dette : frangais-anglais-espagnol = Glosario de finanzas y de deuda : espaffol-ingl6s-franc6s. p. cm. - (A World Bank Glossary = Glossaire de la Banque mondiale) ISBN 0-8213-1644-3 1. International finance-Dictionaries 2. Debts, External- -Dictionaries. 3. English language--Dictionaries-Spanish. 4. English language-Dictionaries-French. I. Title: Glossaire des finances et de la dette. II. Title: Glosario de finanzas y de deuda. III. Series: World Bank glossary. HG151.G629 1990 332'.042'03-dc20 90-44772 CIP iii Contents-Table des matieres-Indice Foreword v Avant-propos vi Prefacio vii Terminology of Finance and Debt 1 English-French-Spanish Abbreviations (English) 111 Sigles (frangais) 119 Siglas (Espailol) 125 Terminologie des finances et de la dette Frangais-anglais 129 Terminologiadefinanzas y de deuda Espaiol-Ingls 181 V Foreword This glossary supersedes Borrowing and Lending Terminology, which appeared in 1984. -

SAIBOR Alternative Working Group

€STR Forward Looking Term Structure Presentation to the Working Group on Euro Risk-Free Rates Stephan Flagel 16 October 2019 The Financial and Risk business of Thomson Reuters is now Refinitiv. Introduction to Refinitiv • Refinitiv is the former Financial and Risk business of Thomson Reuters o Formed on 1st October 2018, 55% owned by a Blackstone led consortium and 45% owned by Thomson Reuters o Refinitiv is one of the world’s largest providers of financial markets data and infrastructure, serving over 40,000 institutions in over 190 countries o Refinitiv provides leading data and insights, trading platforms, and open data and technology platforms that connect a thriving global financial markets community - driving performance in trading, investment, wealth management, regulatory compliance, market data management, enterprise risk and fighting financial crime • Refinitiv is organised into five divisions o Trading o Investing and Advisory o Risk o Wealth 2 Refinitiv benchmark administration Refinitiv is the administrator for 34 benchmarks and the calculation agent for a further 67 benchmarks All Refinitiv benchmarks are in alignment with IOSCO principles (https://www.refinitiv.com/en/financial-data/financial-benchmarks/benchmark-regulation) Refinitiv Benchmark Services (UK) Limited (“RBSL”), a wholly owned subsidiary of Refinitiv, is an authorized benchmark administrator and has been regulated in the UK by the Financial Conduct Authority since 2014 Benchmarks administered by RBSL under Benchmarks and indices administered under Calculation -

First Abu Dhabi Bank PJSC

23 June 2020 CNY 1,400,000,000 3.500 per cent. Fixed Rate Notes due 2025 (the "Notes") issued under the First Abu Dhabi Bank PJSC U.S.$15,000,000,000 Euro Medium Term Note Programme Issue Price: 100 per cent. Issue Date: 2 July 2020 This information package includes (i) the Base Prospectus dated 16 July 2019 and the supplemental Base Prospectuses dated 19 July 2019, 8 October 2019, 25 October 2019, 28 January 2020 and 20 May 2020, respectively, (including the documents incorporated into the Base Prospectus by reference) (together, the "Base Prospectus") and (ii) the Final Terms for the Notes dated 23 June 2020 (the "Final Terms", together with the Base Prospectus and the other information set out herein, the "Information Package") pertaining to the U.S.$15,000,000,000 Euro Medium Term Note Programme of First Abu Dhabi Bank PJSC (the "Issuer"). The Notes will be issued by the Issuer. Application will be made by the Issuer for the Notes to be (i) listed on the Taipei Exchange (the "TPEx") in the Republic of China (the "ROC") and (ii) listed on the Official List of the Financial Conduct Authority and admitted to trading on the regulated market of the London Stock Exchange plc (the "LSE"). The Notes will be traded on the TPEx pursuant to the applicable rules of the TPEx and will be admitted to trading on the regulated market of the LSE. Effective date of (i) listing and trading of the Notes on the TPEx and (ii) listing of the Notes on the Official List of the Financial Conduct Authority and admission to trading on the regulated market of the LSE is on or about 2 July 2020.