Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Clydestone Group Annual Report and Consolidated Financial Statements

CLYDESTONE GROUP ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER, 2016 Clydestone Group Consolidated financial statements for the year ended 31 December, 2016 Page Contents Reference Corporate information - Report of the Directors 2-3 Statement of Directors’ responsibilities 4 Report of the independent auditor 5 – 11 Financial statements: Consolidated statement of profit or loss and other comprehensive income 12 Consolidated statement of financial position 13 Consolidated statement of changes in equity 14 Consolidated statement of cash flow 15 - 16 Notes to the financial statements 17 - 43 Clydestone Group Financial statements for the year ended 31 December, 2016 Corporate information Directors Paul Jacquaye Robert Alloh Edward K.A. Amuh Tinawurah Satuh Company secretary Samuel Adjetey Registered office Adebeto Close North Labone P. O. Box CT 1003 Accra Independent auditor’s UHY Voscon Chartered Accountants No. C806/4, Boundary Road, Tudu, Accra Adjacent to City Paints Supply P. O. Box LA 476 La, Accra. Solicitors Alloh & Partners. P. O. Box NT 478 New Town, Accra Bankers Unibank Ghana Limited Fidelity Bank Limited UBA (Gh) Limited Firstrust Savings & Loans Limited Zenith Bank (Gh) Limited Registrars NTHC Limited Martco House P. O. Box KA 9563 Airport, Accra Ghana Report of the Group Directors to the Members of Clydestone Group The Group Directors have the pleasure in submitting to the shareholders their report together with the audited financial statements of Clydestone Group for the year ended 31 December, 2016. Nature of business The Group is engaged in Information and Communication Technology, specializing in payment systems-comprising Cheque Code Line Truncation, Transaction Processing and Switching Services to banks and independent service organisations system integration and outsourcing. -

16 Annual Report

47th Annual Report and Financial Statements 30 SEPTEMBER 2016 2 - 47th annual report & financial statement AUDITORS AND REGISTERED OFFICE Auditors KPMG (ICAG/F/2014/038) Chartered Accountants 13 Yiyiwa Drive, Abelenkpe Post Office Box 242 Accra. Registered Office Cocoa House 41 Kwame Nkrumah Avenue Post Office Box GP 933 Accra Tel. 233 -302 – 661752/678972/661782/683300 Fax: 233 -302- 667104/665076 E-mail: [email protected] Website: www.cocobod.gh 2 - 47th annual report & financial statement I - 47th annual report & financial statement TABLE OF CONTENTS Auditors i Registered Office i Table of Contents ii Highlights iii Board of Directors 2015/16 iv Heads of Subsidiaries and Divisions 2015/16 iv Chairman’s Statement v Review of Business Operations 1 1. Producer Price 1 2. Cocoa Purchases Performance and Licensed Buying Companies 1 3. Coffee and Sheanut Purchases/Exports 2 4. Performance of Divisions and Subsidiaries 4 A. Quality Control Company 4 a. Selective Grading of cocoa 4 b. Grading and Sealing 5 i. Cocoa 5 ii. Composition of Bean-size Categories 5 iii. Other Produce Inspected 5 c. Check Sampling 5 d. Disinfestation Activities 5 1. Insect Control Operations 5 2. Shipment Inspection and Treatment 5 B. Cocoa Marketing Company (Gh.) Ltd. 6 a. Shipments and Processing 6 i. Cocoa Beans 6 ii. Cocoa Products 6 C. Seed Production Division 6 a. Hybrid Seed Pods 7 b. Cocoa Seedlings 7 47th annual report & financial statement - II Table of contents cont. D. Cocoa Health & Extension Division 7 a. Field Operations 7 b. CODAPEC & Hi-Tech 8 E Cocoa Research Institute of Ghana 9 TABLE OF a. -

Third Quarter 2019

MARKET OUTLOOK Q3 2019 MARKET REVIEW AND Q4 2019 OUTLOOK MARKET REPORTS Q3 2019 Macro Recap Economic Activity Marginally Lower GDP Year-on-Year Change (%) Global economic growth remained largely subdued due to trade tensions, 9.0 8.5 8.4 brexit and geopolitical issues. These led to a growing appetite in fixed 8.0 7.4 income securities, pushing debt to negative yields. According to the IMF, 6.8 6.7 global growth is forecast at 3% in 2019, picking up to 3.4% in 2020. 7.0 6 5.4 5.7 Domestically, growth has remained positive. Ghana’s provisional Real Gross 6.0 5 Domestic Product (GDP) in volume terms was estimated to have increased 5.0 4.3 to 5.7% in Q2 2019. When seasonally adjusted, Real GDP was 1.4% in Q2 4.0 2019; down from 1.6% in Q1 2019. The main sub-sectors driving growth in 3.0 the April to June 2019 GDP were Information & Communication, Mining & 2.0 Quarrying, Health & Social Work and Real Estate. 1.0 There was a weakness in economic activity in July 2019. The Composite of 0.0 Economic Activity recorded an annual real decline from 4.3% in July 2018 to 2018_Q2* 2018_Q3* 2018_Q4* 2019_Q1* 2019_Q2* 2.1% in July 2019. The key drivers of economic activity during the period were private sector credit expansion, contributions to SSNIT by the private *Provisional Oil GDP Non-Oil GDP sector, port activity, exports, and domestic VAT. Confidence surveys by the BoG show that on a y-o-y basis, business and 2 consumer confidence declined in Aug-19. -

Has Gse Played Its Role in the Economic Development of Ghana?

CAPITAL MARKET 23 YEARS AND COUNTING: HAS GSE PLAYED ITS ROLE IN THE ECONOMIC DEVELOPMENT OF GHANA? 1st CAPITAL MARKET CONFERENCE BY EKOW AFEDZIE, DEPUTY MANAGING DIRECTOR MAY 10, 2013 INTRODUCTION Ghana Stock Exchange (GSE) was established with a Vision: -To be a relevant, significant, effective and efficient instrument in mobilizing and allocating long-term capital for Ghana’s economic development and growth. INTRODUCTION OBJECTIVES - To facilitate the Mobilization of long term capital by Corporate Bodies/Business and Government through the issuance of securities (shares, bonds, etc). - To provide a Platform for the trading of issued securities. MEMBERSHIP OF GHANA STOCK EXCHANGE GSE as a public company limited by Guarantee has No OWNERS OR SHAREHOLDERS. GSE has Members who are either corporate or individuals. There are two categories of members:- - Licensed Dealing Members - 20 - Associate Members - 34 HISTORICAL BACKGROUND 1968 - Pearl report by Commonwealth Development Finance Co. Ltd. recommended the establishment of a Stock Exchange in Ghana within two years and suggested ways of achieving it. 1970 – 1989 - Various committees established by different governments to explore ways of bringing into being a Stock Exchange in the country. HISTORICAL BACKGROUND 1971 - The Stock Exchange Act was enacted. - The Accra Stock Exchange Company incorporated but never operated. Feb, 1989 - PNDC government set up a 10-member National Committee on the establishment of Stock Exchange under the chairmanship of Dr. G.K. Agama, the then Governor of the Bank of Ghana. HISTORICAL BACKGROUND July, 1989 - Ghana Stock Exchange was incorporated as a private company limited by guarantee under the Companies Code, 1963. HISTORICAL BACKGROUND Nov. -

2012-Edition-GC100-Directory.Pdf

2012 2012 DIRECTORY DIRECTORY NAME OF COMPANY BUSINESS CATEGORY LOCATION ADDRESS TELEPHONE FAX/E-MAIL/WEBSITE CONTACT PERSON TITLE 7 Dr. Amilcar Cabral Road, Accra (233-302) 770189/90/91 “(233-302) 770187 1 Abosso GoldFields Limited Mining Institution Airport Residential Area P. O. Box KA 30742 www.goldfields.co.za” Alfred Baku Managing Director Accra Banking Services [email protected] Head, Corporate 2 Acces Bank (Ghana) (Commercial & Merchant) “Starlets ‘91 Road “P. O. Box GP 353 Osu- Accra” (233-302) 684860 / 742699 www.accessbankplc.com/gh Matilda Asante-Aseidu Communications (233-302) 2688960 3 Accra Brewery Manufacturing - Beverages Opp. Ohene Djan Staduim” P. O. Box GP351 (233-302) 688851-6 [email protected] Gregory Metcalf Managing Director www.sabmiller.com (233-302) 685176 4 Activa International Insurance Company Non-Banking-Insurance Graphic Road, Adabraka PMB KA 85 (233-32) 686352 / 672145 [email protected] Limited www.group-activa.com “P. O. Box 35 Banking Service-Rural & 3rd Floor Heritage Tower, 6th Ave. West (233-322) 420926 / 90099 Lucy Opoku-Arthur Ag General Manager 5 Adansi Rural Bank Limited Community Banking Ridge, Accra Fomena-Adansi” Banking Services-Rural & 6 Adonten Community Bank Limited Community Banking Head Office: Fomena - Adansi P.O.Box 140 3420-24109/027-895636/027-7609343 3420-26780 [email protected] Mr.Francis Mensah Senior Manager Banking Services-Rural & 7 Ahantaman Rural Bank Limited Community Banking New Tafo, Akyem, Eastern Region P. O. Box 41, Ahanta (233-312) 23431 / 21016 (233-312)29116 David Bampoe General Manager Banking Services-Rural & 8 Amanano Rural Bank Limited Community Banking Agona Ahanta,Western Region P. -

Produce Buying Company Limited

PRODUCE BUYING COMPANY LIMITED FINANCIAL STATEMENTS 30 SEPTEMBER 2010 PRODUCE BUYING COMPANY LIMITED FINANCIAL STATEMENTS CONTENTS PAGE COMPANY INFORMATION 1 CHAIRMAN'S STATEMENT 2-4 MANAGING DIRECTOR'S REVIEW 5-8 REPORT OF THE DIRECTOR'S 9-11 REPORT OF THE AUDITOR'S 12-13 STATEMENT OF COMPREHENSIVE INCOME 14 STATEMENT OF FINANCIAL POSITION 15 STATEMENT OF CHANGES IN EQUITY 16 STATEMENT OF CASH FLOW 17 NOTES TO THE FINANCIAL STATEMENTS 18-47 SCHEDULE TO THE STATEMENT OF COMPREHENSIVE INCOME 48-50 PRODUCE BUYING COMPANY LIMITED CORPORATE INFORMATION FOR THE YEAR ENDED 30 SEPTEMBER 2010 BOARD OF DIRECTORS Dr. John Frank Abu - Chairman Kojo Atta-Krah - Managing Director Hon. Ernest Kofi Yakah (MP) - Director Mabel Oseiwa Quakyi (Mrs.) - Director Ebenezer Tei Quartey - Director James M. K. Ampiaw - Director Kofi Graham - Director Cecilia Nyann (Mrs.) - Director Nana Kwame Nkrumah I - Director Alhaji Yakubu Ziblim - Director Yaw Sarpong - Director SECRETARY Godfrey Osei Aggrey TOP MANAGEMENT Kojo Atta-Krah - Managing Director George Kwadwo Boateng - DMD-Operations Joseph Osei Manu - DMD-Finance and Administration AUDITORS Pannell Kerr Forster Chartered Accountants Farrar Avenue P. O. Box 1219 Accra SOLICITOR Godfrey Osei Aggrey Olusegun Obasanjo Road Dzorwulu Junction Accra REGISTERED OFFICE Olusegun Obasanjo Road Dzorwulu Junction Accra BANKERS Barclays Bank of Ghana Limited Ecobank Ghana Limited Ghana Commercial Bank Limited SG-SSB Bank Limited Standard Chartered Bank Ghana Limited Merchant Bank 1 CHAIRMAN’S STATEMENT Distinguished Shareholders, I am very pleased to welcome you once again to the 10th Annual General Meeting of the Produce Buying Company Limited and have the pleasure to present to you the Annual Report and Statement of Accounts of your company for the Financial Year ended September 30, 2010. -

Clydestone Group Annual Report

CLYDESTONE GROUP ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER, 2016 Clydestone Group Consolidated financial statements for the year ended 31 December, 2016 Page Contents Reference Corporate information - Report of the Directors 2-3 Statement of Directors’ responsibilities 4 Report of the independent auditor 5 – 11 Financial statements: Consolidated statement of profit or loss and other comprehensive income 12 Consolidated statement of financial position 13 Consolidated statement of changes in equity 14 Consolidated statement of cash flow 15 - 16 Notes to the financial statements 17 - 43 Clydestone Group Financial statements for the year ended 31 December, 2016 Corporate information Directors Paul Jacquaye Robert Alloh Edward K.A. Amuh Tinawurah Satuh Company secretary Samuel Adjetey Registered office Adebeto Close North Labone P. O. Box CT 1003 Accra Independent auditor’s UHY Voscon Chartered Accountants No. C806/4, Boundary Road, Tudu, Accra Adjacent to City Paints Supply P. O. Box LA 476 La, Accra. Solicitors Alloh & Partners. P. O. Box NT 478 New Town, Accra Bankers Unibank Ghana Limited Fidelity Bank Limited UBA (Gh) Limited Firstrust Savings & Loans Limited Zenith Bank (Gh) Limited Registrars NTHC Limited Martco House P. O. Box KA 9563 Airport, Accra Ghana Report of the Group Directors to the Members of Clydestone Group The Group Directors have the pleasure in submitting to the shareholders their report together with the audited financial statements of Clydestone Group for the year ended 31 December, 2016. Nature of business The Group is engaged in Information and Communication Technology, specializing in payment systems-comprising Cheque Code Line Truncation, Transaction Processing and Switching Services to banks and independent service organisations system integration and outsourcing. -

Quarterly Financial Markets Report

Quarterly Financial Markets Report Second Quarter 2016 Global Economic Highlights Highlighted by UK’s vote to leave the EU, weak demand, high unemployment levels, financial frailties and geopolitical risks, the global economic environment continued to be plagued by weakened growth prospects in the last three months. The late June U.K. referendum to leave the European Union sent shock waves across the globe, leaving global financial markets in turmoil. The equity markets fell sharply and the British Pound plunged 8.4% and 12.5% against the U.S. Dollar and Japanese Yen, respectively. The value of the British Pound against the US Dollar was at its lowest in the past 31 years. Reassurance on support from the central bank saw the economy enjoying some reprieve as the financial markets rebounded partially in fragments. With manufacturing growth stalling over the past year and construction figures weakening markedly in June, U.K. growth continued to be driven primarily by the services sector. The rate of Consumer Price Inflation (CPI) remained low at around 0.3% partly due to relatively subdued global demand growth. Both Standard & Poor’s, and Fitch on the back of the foregoing downgraded U.K’s credit ratings. With a lift from the European Central Bank’s stimulus cut, low energy prices and a rebound in consumer spending, figures from the 19-nation bloc were impressive before the Brexit, with GDP rising by 0.6% in Q1 2016 despite a backdrop of the global market turmoil at the start of the year. However, questions about the EU’s stability and the potential for an economic downturn after Britain’s surprise exit from the EU dominated the centre stage in the Eurozone at the end of the second quarter. -

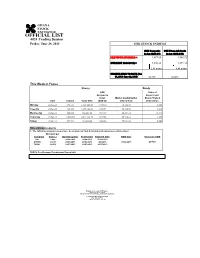

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES GSE Composite GSE Financial Stocks Index (GSE-CI) Index (GSE-FSI) PREVIOUS 27/06/2013) = 1,877.65 1,585.72 CURRENT 28/06/2013) = 1,880.26 1,591.18 2.61 points 5.46 points CHANGE-YEAR TO DATE (Jan 01, 2013- June 28, 2013) 56.72% 53.02% This Week in Focus Shares Bonds GSE Value of Composite Government Index Market Capitalization Bonds Traded Date Volume Value GH¢ (GSE-CI) GH¢ million GH¢ million Monday 24-Jun-13 493,511 1,581,041.68 1,900.10 56,154.80 0.000 Tuesday 25-Jun-13 426,550 1,196,438.69 1,891.94 56,110.32 1.240 Wednesday 26-Jun-13 880,088 966,256.30 1,874.67 55,894.32 15.743 Thursday 27-Jun-13 1,553,869 2,844,118.70 1,877.65 55,910.61 4.295 Friday 28-Jun-13 251,546 482,820.80 1,880.26 55,924.82 0.000 Notes/Announcements 1. The following announcements have been made on final dividends and annual general meetings: Dividend per Company Share ¢ Qualifying Date Ex-Div Date Payment Date AGM Date Venue for AGM CAL 0.006 26/06/2013 24/06/2013 30/08/2013 AYRTN 0.0013 25/06/2013 21/06/2013 8/8/2013 27/06/2013 OEPCH TOTAL 0.6900 18/07/2013 16/07/2013 26/07/2013 GCPS:GhanaAICC: Accra International College of Physicians Conference and Centre Surgeons OEPCH:Osu Ebenezer Presbyterian Church HalL Enquiries to: General Manager Ghana Stock Exchange 5th & 6th Floors Cedi House, Liberia Road, Accra Tel: 021 669908, 669914, 669935 Fax: 021 669913 e-mail: [email protected] OFFICIAL LIST 4024 Trading Session ODD LOT Friday, June 28, 2013 ISIN Share Code Total Shares No. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 8th January, 2015 STOCK MARKET ACCRA BOURSE MAKES PROMISING START INDICATORS WEEK OPEN WEEK END CHANGE The year 2014 has begun living up to expectations as bullish runs in equities from the petroleum, finance and consumer Market Capitalization (GH¢ goods sectors saw the annual returns of the broader market 'million) 64,352.42 64,229.12 -0.19% Market Capitalization (US$' inch up to 0.42% last Thursday. Though, most equities gave million) 20,109.50 20,014.06 -0.47% up their opening prices, rise in the market value of Ghana Oil Petroleum Company Limited (GOIL), Societe Generale Ghana Volume traded (shares) 783,118.00 573,274.00 -26.80% Table 1: Market Summary Limited (GOIL) and Fan Milk Limited (FML) were enough to close the week’s activities on a positive note. Key benchmark indices closed the week better despite slight volatilities during inter-day trading. The GSE Composite INDEX ANALYSIS index closed at a year-to-date return of 0.42% whiles the GSE Financial Stocks Index settled at 0.67% returns. INDICATORS Closing Week YTD Level Change CHANGE Total market capitalization of the Ghana Stock Exchange was GH¢64.23 billion, an equivalent to USD20.00 billion. GSE Composite Index 2,270.57 0.42% 0.42% GSE Financial Stocks Index 2,258.77 0.67% 0.67% Table 2: Key Stock Market Indices LIQUIDITY The absence of block trades over the period saw liquidity comparatively down last week. All in all, an approximate figure of 573,274 shares exchanged hands within the first trading week of the year, and was also valued about GH¢2.48 million. -

PBC As the Most Attractive Dealer in Cocoa, Sheanut and Any Other Cash Crop in the West African Sub-Region

2011 FINANCIAL STATEMENTS CONTENTS PAGE CORPORATE VISION NOTICE OF ANNUAL GENERAL MEETING CURRENT COMPANY REGULATIONS OF P.B.C. CORPORATE INFORMATION CHAIRMAN’S STATEMENT REPORT OF DIRECTORS CORPORATE GOVERNANCE DIRECTORS’ PROFILE STATEMENT OF DIRECTORS AUDITOR’S REPORT STATEMENT OF COMPREHENSIVE INCOME BALANCE SHEET CHANGES IN EQUITY STATEMENT OF CASH FLOW NOTES TO THE FINANCIAL STATEMENTS ii 2011 FINANCIAL STATEMENTS PRODUCE BUYING COMPANY LIMITED CORPORATE VISION FOR THE YEAR ENDED 30TH SEPTEMBER 2011 Develop and maintain PBC as the most attractive dealer in cocoa, sheanut and any other cash crop in the West African sub-region MISSION Purchase high quality produce, store and deliver same to designated Take Over Centres internally and the export market in the most efficient and profitable manner. COMMITMENT Produce Buying Company’s traditional commitment to its stakeholders remains the same, that is to ensure: Farmer satisfaction Good return on shareholders’ investment Recruitment and retainment of a well-motivated workforce Support of projects and activities to benefit farming communities. CORE VALUES Integrity Reliability Confidentiality Discipline Team work Customer Satisfaction 1 2011 FINANCIAL STATEMENTS NOTICE OF ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN THAT the 11th Annual General Meeting of Produce Buying Company Limited will be held at the OSU EBENEZER PRESBYTERIAN CHURCH HALL, OSU, ACCRA on WEDNESDAY, 28TH MARCH, 2012 at 10:00 a.m. to transact the following business:- AGENDA 1. To receive and adopt the Report of the Directors, Auditors and the Financial Statements for the year ended 30th September, 2011 2. To declare Dividends for the year ended 30th September, 2011 3. To approve changes in Directorship · Mr. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 10th March, 2016 FINANCIAL STOCKS DRAG PERFORMANCE STOCK MARKET FURTHER DOWN INDICATORS WEEK OPEN WEEK END CHANGE The Ghana Stock Exchange (GSE) declined for the fourth consecutive time last week, following increased uncertainty in Market Capitalization market dealings. Losses in the shares of Ecobank Ghana Limited (GH¢'million) 56,312.92 56,078.75 -0.42% (EBG), Trust Bank (Gambia) Limited (TBL), Ecobank Transnational Market Capitalization (US$'million) 14,559.04 14,562.88 0.03% Incorporated (ETI) and SIC Insurance Company Limited (SIC) dragged the broader market further down by 0.31%. Volume traded (shares) 1,561,353.00 309,918.00 -80.15% In the end, key benchmark indices like the GSE Composite Index Value Traded (GH¢) 1,836,433.71 441,146.43 -75.98% (GSE-CI), the GSE Financial Stocks Index (GSE-FSI) and the SIC- Value Traded (US$) 474,788.31 114,559.68 -75.87% FSL Top 15 Liquid Index (SIC-FSL T-15) closed the week at Table 1: Market Summary annual losses of 1.56%, 1.71% and 6.24% respectively, from a year-to-date losses of 1.25%, 1.23% and 4.75% accordingly. INDEX ANALYSIS The value of listed companies dropped to GH¢56.08 billion INDICATORS Closing Week YTD Level Change CHANGE from GH¢56.31 billion last Thursday. However, an equivalent dollar value remained fairly stable at USD 14.56 billion. GSE Composite Index 1,963.72 -0.31% -1.56% SIC-FSL Top 15 Index 3,478.70 -1.57% -6.24% GSE Financial Stocks Index 1,897.09 -0.48% -1.71% Table 2: Key Stock Market Indices LIQUIDITY Aggregate volume and value of traded shares dropped last week, following the exchange of 309,918 shares which was valued at GH¢441,146.43.