Third Quarter 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Clydestone Group Annual Report and Consolidated Financial Statements

CLYDESTONE GROUP ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER, 2016 Clydestone Group Consolidated financial statements for the year ended 31 December, 2016 Page Contents Reference Corporate information - Report of the Directors 2-3 Statement of Directors’ responsibilities 4 Report of the independent auditor 5 – 11 Financial statements: Consolidated statement of profit or loss and other comprehensive income 12 Consolidated statement of financial position 13 Consolidated statement of changes in equity 14 Consolidated statement of cash flow 15 - 16 Notes to the financial statements 17 - 43 Clydestone Group Financial statements for the year ended 31 December, 2016 Corporate information Directors Paul Jacquaye Robert Alloh Edward K.A. Amuh Tinawurah Satuh Company secretary Samuel Adjetey Registered office Adebeto Close North Labone P. O. Box CT 1003 Accra Independent auditor’s UHY Voscon Chartered Accountants No. C806/4, Boundary Road, Tudu, Accra Adjacent to City Paints Supply P. O. Box LA 476 La, Accra. Solicitors Alloh & Partners. P. O. Box NT 478 New Town, Accra Bankers Unibank Ghana Limited Fidelity Bank Limited UBA (Gh) Limited Firstrust Savings & Loans Limited Zenith Bank (Gh) Limited Registrars NTHC Limited Martco House P. O. Box KA 9563 Airport, Accra Ghana Report of the Group Directors to the Members of Clydestone Group The Group Directors have the pleasure in submitting to the shareholders their report together with the audited financial statements of Clydestone Group for the year ended 31 December, 2016. Nature of business The Group is engaged in Information and Communication Technology, specializing in payment systems-comprising Cheque Code Line Truncation, Transaction Processing and Switching Services to banks and independent service organisations system integration and outsourcing. -

Has Gse Played Its Role in the Economic Development of Ghana?

CAPITAL MARKET 23 YEARS AND COUNTING: HAS GSE PLAYED ITS ROLE IN THE ECONOMIC DEVELOPMENT OF GHANA? 1st CAPITAL MARKET CONFERENCE BY EKOW AFEDZIE, DEPUTY MANAGING DIRECTOR MAY 10, 2013 INTRODUCTION Ghana Stock Exchange (GSE) was established with a Vision: -To be a relevant, significant, effective and efficient instrument in mobilizing and allocating long-term capital for Ghana’s economic development and growth. INTRODUCTION OBJECTIVES - To facilitate the Mobilization of long term capital by Corporate Bodies/Business and Government through the issuance of securities (shares, bonds, etc). - To provide a Platform for the trading of issued securities. MEMBERSHIP OF GHANA STOCK EXCHANGE GSE as a public company limited by Guarantee has No OWNERS OR SHAREHOLDERS. GSE has Members who are either corporate or individuals. There are two categories of members:- - Licensed Dealing Members - 20 - Associate Members - 34 HISTORICAL BACKGROUND 1968 - Pearl report by Commonwealth Development Finance Co. Ltd. recommended the establishment of a Stock Exchange in Ghana within two years and suggested ways of achieving it. 1970 – 1989 - Various committees established by different governments to explore ways of bringing into being a Stock Exchange in the country. HISTORICAL BACKGROUND 1971 - The Stock Exchange Act was enacted. - The Accra Stock Exchange Company incorporated but never operated. Feb, 1989 - PNDC government set up a 10-member National Committee on the establishment of Stock Exchange under the chairmanship of Dr. G.K. Agama, the then Governor of the Bank of Ghana. HISTORICAL BACKGROUND July, 1989 - Ghana Stock Exchange was incorporated as a private company limited by guarantee under the Companies Code, 1963. HISTORICAL BACKGROUND Nov. -

2015 Annual Report

Securiries and Exchange Commission 2015 ANNUAL REPORT 1 Securiries and Exchange Commission Vision To be an internationally recognized securities market regulator promoting efficient capital market in Ghana and ensuring investor protection. Mission To promote the orderly growth and development of an efficient, fair and transparent securities market in which investors and the integrity of the market are protected through the proactive implementation of the securities laws. This involves ongoing supervision and regulation of the Ghanaian securities market, education of market operators, policy makers as well as investors on their respective rights and obligations. Objectives • Enhancement of capital market infrastructure and strengthening the capacity of market institutions and intermediaries. • Providing the legal and regulatory framework for market and product innovation. • Promotion of public awareness, investor rights and corporate education • Establishment of an overall robust, supportive, legal and regulatory framework that conforms to international best practices 2 Securiries and Exchange Commission Contents Chairman’s Statement 4 Report of The Director-General 8 Corporate Governance Report 14 Profile of Commissioners 18 Operational Review 24 Broker- Dealers & Advisors Department 32 Funds Management Industry 35 Exchanges and Markets Department 37 Issuers Department 39 Policy, Research and Information Technology Department 45 Legal and Enforcement Department 49 Human Resources & Administration Department 51 Economic Review 53 Capital Market Review 59 Industry Analysis 71 Collective Investment Scheme Sector 75 Financial Statements 78 Commissioners’ Responsibility Statement 79 Independent Auditor’s Report 80 Statement of Operations 82 Statement of Financial Position 83 Statement of Cash Flow 84 Notes to the Financial Statements 85 Register of Licensees 2014/2015 96 Useful contacts 134 3 Securiries and Exchange Commission Chairman’s Statement Introduction as the Centre of capital raising and investment in the sub- region of West-Africa. -

Clydestone Group Annual Report

CLYDESTONE GROUP ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER, 2016 Clydestone Group Consolidated financial statements for the year ended 31 December, 2016 Page Contents Reference Corporate information - Report of the Directors 2-3 Statement of Directors’ responsibilities 4 Report of the independent auditor 5 – 11 Financial statements: Consolidated statement of profit or loss and other comprehensive income 12 Consolidated statement of financial position 13 Consolidated statement of changes in equity 14 Consolidated statement of cash flow 15 - 16 Notes to the financial statements 17 - 43 Clydestone Group Financial statements for the year ended 31 December, 2016 Corporate information Directors Paul Jacquaye Robert Alloh Edward K.A. Amuh Tinawurah Satuh Company secretary Samuel Adjetey Registered office Adebeto Close North Labone P. O. Box CT 1003 Accra Independent auditor’s UHY Voscon Chartered Accountants No. C806/4, Boundary Road, Tudu, Accra Adjacent to City Paints Supply P. O. Box LA 476 La, Accra. Solicitors Alloh & Partners. P. O. Box NT 478 New Town, Accra Bankers Unibank Ghana Limited Fidelity Bank Limited UBA (Gh) Limited Firstrust Savings & Loans Limited Zenith Bank (Gh) Limited Registrars NTHC Limited Martco House P. O. Box KA 9563 Airport, Accra Ghana Report of the Group Directors to the Members of Clydestone Group The Group Directors have the pleasure in submitting to the shareholders their report together with the audited financial statements of Clydestone Group for the year ended 31 December, 2016. Nature of business The Group is engaged in Information and Communication Technology, specializing in payment systems-comprising Cheque Code Line Truncation, Transaction Processing and Switching Services to banks and independent service organisations system integration and outsourcing. -

Quarterly Financial Markets Report

Quarterly Financial Markets Report Second Quarter 2016 Global Economic Highlights Highlighted by UK’s vote to leave the EU, weak demand, high unemployment levels, financial frailties and geopolitical risks, the global economic environment continued to be plagued by weakened growth prospects in the last three months. The late June U.K. referendum to leave the European Union sent shock waves across the globe, leaving global financial markets in turmoil. The equity markets fell sharply and the British Pound plunged 8.4% and 12.5% against the U.S. Dollar and Japanese Yen, respectively. The value of the British Pound against the US Dollar was at its lowest in the past 31 years. Reassurance on support from the central bank saw the economy enjoying some reprieve as the financial markets rebounded partially in fragments. With manufacturing growth stalling over the past year and construction figures weakening markedly in June, U.K. growth continued to be driven primarily by the services sector. The rate of Consumer Price Inflation (CPI) remained low at around 0.3% partly due to relatively subdued global demand growth. Both Standard & Poor’s, and Fitch on the back of the foregoing downgraded U.K’s credit ratings. With a lift from the European Central Bank’s stimulus cut, low energy prices and a rebound in consumer spending, figures from the 19-nation bloc were impressive before the Brexit, with GDP rising by 0.6% in Q1 2016 despite a backdrop of the global market turmoil at the start of the year. However, questions about the EU’s stability and the potential for an economic downturn after Britain’s surprise exit from the EU dominated the centre stage in the Eurozone at the end of the second quarter. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 8th January, 2015 STOCK MARKET ACCRA BOURSE MAKES PROMISING START INDICATORS WEEK OPEN WEEK END CHANGE The year 2014 has begun living up to expectations as bullish runs in equities from the petroleum, finance and consumer Market Capitalization (GH¢ goods sectors saw the annual returns of the broader market 'million) 64,352.42 64,229.12 -0.19% Market Capitalization (US$' inch up to 0.42% last Thursday. Though, most equities gave million) 20,109.50 20,014.06 -0.47% up their opening prices, rise in the market value of Ghana Oil Petroleum Company Limited (GOIL), Societe Generale Ghana Volume traded (shares) 783,118.00 573,274.00 -26.80% Table 1: Market Summary Limited (GOIL) and Fan Milk Limited (FML) were enough to close the week’s activities on a positive note. Key benchmark indices closed the week better despite slight volatilities during inter-day trading. The GSE Composite INDEX ANALYSIS index closed at a year-to-date return of 0.42% whiles the GSE Financial Stocks Index settled at 0.67% returns. INDICATORS Closing Week YTD Level Change CHANGE Total market capitalization of the Ghana Stock Exchange was GH¢64.23 billion, an equivalent to USD20.00 billion. GSE Composite Index 2,270.57 0.42% 0.42% GSE Financial Stocks Index 2,258.77 0.67% 0.67% Table 2: Key Stock Market Indices LIQUIDITY The absence of block trades over the period saw liquidity comparatively down last week. All in all, an approximate figure of 573,274 shares exchanged hands within the first trading week of the year, and was also valued about GH¢2.48 million. -

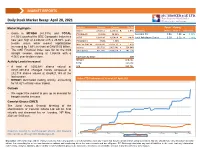

Daily Market Recap

MARKET REPORTS Daily Stock Market Recap: April 28, 2021 Market Highlights Indicator Previous Current Chg (%) Open Closing GSE-CI 2,342.14 2,436.62 4.03% Company Price ¢ Price ¢ Gain/Loss • Gains in MTNGH (+8.33%) and TOTAL YTD (GSE-CI) 20.63% 25.50% Scancom PLC 0.96 1.04 8.33% (+1.56%) pushed the GSE Composite Index to a GSE-FI 1,864.04 1,864.04 0.00% Total Petroleum Ghana 3.20 3.25 1.56% new year high of 2,436.62 with a 25.50% year- YTD (GSE-FI) 4.56% 4.56% to-date return while market capitalization Mkt Cap (GH¢ M) 58,506.48 59,495.31 1.69% increased by 1.69% to close at GH¢59.50 billion. Volume 282,718 1,002,641 254.64% • The GSE Financial Index was flat for the third Value (GH¢) 421,149 1,438,514 241.57% straight session, closing at 1,864.04 with a 4.56% year-to-date return. Top Trades by Value GH¢ MTNGH 840,421 Activity Levels Increased TOTAL 282,019 • A total of 1,002,641 shares valued at GCB 222,741 GH¢1,438,514 changed hands compared to 282,718 shares valued at GH¢421,149 at the last session. Index YTD Performance (%) as at 28th April 2021 • MTNGH dominated trading activity, accounting for 58.42% of total value traded. 30 Outlook 25 • We expect the market to pick up as demand for bargain stocks increase. 20 Camelot Ghana (CMLT) The 22nd Annual General Meeting of the 15 shareholders of Camelot Ghana Ltd will be held virtually and streamed live on Tuesday, 25th May, 2021 at 10:00 a.m. -

The Republic of Ghana the Africa Country Series

2016 The Africa Country Series The Republic Of Ghana The Africa Country Series The Republic Of Ghana May 2016 Acknowledgements Team Leader: Samir S. Amir Lead Researcher: Falak Hadi Disclaimer The findings, interpretations and conclusions expressed herein do not necessarily reflect the views of the Board of Directors and Members of the Pakistan Business Council or the companies they represent. Any conclusions of analysis based on ITC, IDB, CTS, UNCTSD and WTO data are the responsibility of the author(s) and do not necessarily reflect the opinion of the WTO, IMF or UN. Although every effort has been made to cross-check and verify the authenticity of the data, the Pakistan Business Council, or the author(s) do not guarantee the data included in this work. All data and statistics used are correct as of 28th February 2016, and may be subject to change. Unless otherwise stated, all monetary amounts are given in USD (millions). For any queries or feedback regarding this report, please contact [email protected] or falak@ pbc.org.pk ii The Republic of Ghana The Pakistan Business Council: An Overview The Pakistan Business Council (PBC) is a business policy advocacy forum, representing private- sector businesses that have substantial investments in Pakistan’s economy. It was formed in 2005 by 14 (now 52) of Pakistan’s largest enterprises, including multinationals, to allow businesses to meaningfully interact with government and other stakeholders. The Pakistan Business Council is a pan-industry advocacy group. It is not a trade body nor does it advocate for any specific business sector. -

Daily Market Recap

MARKET REPORTS Daily Stock Market Recap: June 01, 2021 Market Highlights Indicator Previous Current Chg (%) Open Closing GSE-CI 2,421.11 2,421.43 0.01% Company Price ¢ Price ¢ Gain/Loss • TOTAL advanced by 0.92%, pushing the YTD (GSE-CI) 24.70% 24.71% Total Petroleum Ghana 3.27 3.30 0.92% benchmark index up by 0.01% to close at GSE-FI 1,902.90 1,902.90 0.00% 2,421.43 with a 24.71% year-to-date return. YTD (GSE-FI) 6.74% 6.74% Market capitalization increased by 0.01% to Mkt Cap (GH¢ M) 59,333.16 59,336.51 0.01% settle at GH¢59.34 billion. Volume 52,731 62,129 17.82% • There were no gainers or losers in the financial Value (GH¢) 136,452 71,604 -47.52% sector. The GSE-FI closed at 1,902.90 with a 6.74% year-to-date return. Top Trades by Value GH¢ SOGEGH 45,414 Activity Levels Declined TOTAL 21,450 • A total of 62,129 shares valued at GH¢71,604 EGH 3,696 changed hands compared to 52,731 shares valued at GH¢136,452 at the last session. • SOGEGH dominated trading activity, accounting Index YTD Performance (%) as at 1st June 2021 for 63.42% of total value traded. 45 Outlook 40 • We expect the market to pick up as demand for bargain stocks increase. 35 Ecobank Ghana (EGH) 30 The Annual General Meeting of Ecobank Ghana will 25 be held virtually and streamed live on www.ecobankghAGM.com from the Head Office of 20 Ecobank Ghana on Friday, 4th June, 2021 at 10:30 am. -

Members' Profile

MEMBERS’ PROFILE The Leading Voice of the private sector MEMBERS’ PROFILE The Leading Voice of the private sector Members’ Profile | 3 1 DANPONG HEALTHCARE LTD 67 Nungua Link, Spintex Road, Baatsona, Accra-Ghana COMPANY PROFILE What has grown to become the Danpong Group of Companies started as Danpong Pharmacy (GH) Ltd in September 1989, when Dr. Yaw Adu Gyamfi (Dr. Danpong) formed his initial pharmacy supply company. He launched his first pharmacy shop at Nungua in 1991 with only eight workers, toiling from 7am to 11pm – and often after hours – to build a community pharmacy that was loved by the people of Nungua. In October 1999, Dr Gyamfi expanded his business and set up a bigger pharmacy, a 15-bed clinic, and a modern medical lab at Baatsona, on Spintex Dr. Yaw Adu Gyamfi Road. CEO Through hard work, the sale of quality drugs and high health standards, the Danpong Group became widely known, with loyal customers coming from the nearby community and even further afield, with many referrals from various clinics and hospitals in Ghana. In 2005, Dr Gyamfi also started Danadams Pharmaceuticals Ltd, which focused on manufacturing and selling antiretroviral agents for HIV treatment, and anti-malarial medications. 4 | Members’ Profile Throughout its existence, the Danpong Group has As a company, we are committed to a vision of been committed to promoting good health. In the raising the standard of healthcare in Ghana, where past few years, the company has organized various our services are motivated by quality, affordability, health campaigns and medical screenings for the accessibility, and excellence in all we do. -

Daily Market Recap

MARKET REPORTS Daily Stock Market Recap: November 11, 2020 Market Highlights Indicator Previous Current Chg (%) Open Closing GSE-CI 1,813.46 1,813.27 -0.01% Company Price ¢ Price ¢ Gain/Loss • The benchmark index closed marginally lower due to YTD (GSE-CI) -19.66% -19.67% SIC Insurance Company Ltd. 0.10 0.09 -10.00% a loss in SIC Insurance (-10.00%), declining to GSE-FI 1,608.59 1,608.25 -0.02% 1,813.27 with a -19.67% year-to-date return while YTD (GSE-FI) -20.35% -20.37% market capitalization settled at GH¢52.86 billion. Mkt Cap (GH¢ M) 52,866.13 52,864.17 0.00% • The GSE Financial Index shed 0.34 points to close at Volume 15,044,522 1,014,394 -93.26% 1,608.25 with a -20.37% year-to-date return. Value (GH¢) 9,192,469 98,509 -98.93% Trading Activity Declined Top Trades by Value GH¢ • A total of 1,014,394 shares valued at GH¢98,509 SIC 90,140 changed hands compared to 15,044,522 shares MTNGH 6,943 valued at GH¢9,192,469 at the last session. CAL 910 • SIC Insurance dominated trading activity, accounting for 91.50% of total value traded. Outlook Index YTD Performance (%) as at 11th November 2020 • We expect a slowdown in the market’s performance 5.00 as the coronavirus threat lingers. - Standard Chartered Bank Ghana Limited (SCB) 02-Jan-20 02-Feb-20 02-Mar-20 02-Apr-20 02-May-20 02-Jun-20 02-Jul-20 02-Aug-20 02-Sep-20 02-Oct-20 02-Nov-20 SCB has announced the appointment of Mr. -

WEEKLY MARKET REVIEW 25 June 2018

DATABANK RESEARCH WEEKLY MARKET REVIEW 25 June 2018 ANALYST CERTIFICATE & REQUIRED DISCLOSURE BEGINS ON PAGE 4 GSE MARKET STATISTICS SUMMARY Current Previous % Change Weekly Market Update Databank Stock Index 36,989.82 37,829.75 -2.22% The equities market ended the week with reducing year to date GSE-CI Level 2,918.27 2,989.68 -2.39% returns of 13.12% for the GSE’s Composite Index and 12.49% for Market Cap (GH¢ m) 58,718.96 62,501.44 -6.05% the Databank Stock Index. YTD Return DSI 12.49% 15.04% YTD Return GSE-CI 13.12% 15.89% The gainers this week were ACCESS (+17.65% GH¢4.00), ETI Weekly Volume Traded (Shares) 7,111,051 3,728,037 90.75% (+5.00%, 21Gp) and GOIL (+1.27% GH¢4.00). Weekly Turnover (GH¢) 10,906,829 1,946,907 460.21% The laggards were CAL (-2.40% GH¢1.22), EGH (-11.76% Avg. Daily Volume Traded 878,468 854,409 2.82% (Shares) GH¢9.00), GCB (-0.39% GH¢5.15), SCB (-0.66% GH¢27.15), TLW Avg. Daily Value Traded (GH¢) 3,788,144 3,859,240 -1.84% (-15.00% GH¢14.56), SOGEGH (-17.58%, GH¢1.36) and Total (- No. of Counters Traded 20 20 1.23%, GH¢4.00). No. of Gainers 3 5 A total of ~7.11 million shares valued at ~GH¢10.9 million were No. of Laggards 7 11 traded on the Ghana Stock Exchange this week. Outlook KEY ECONOMIC INDICATORS Fixed Income Market Current Previous Change We anticipate lackluster activity on the Ghana Stock Exchange 91-Day Treasury Bill 13.34% 13.30% +4bps next week with a price gain in Unilever Ghana.