Alcon-20-F-2020.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Snippet Roundup: CETP Kaput and Biogen Buys Into Amyloid

October 27, 2017 Snippet roundup: CETP kaput and Biogen buys into amyloid Edwin Elmhirst Welcome to your weekly roundup of EP Vantage’s snippets – short takes on smaller news items. This week, October 23 to 27, 2017, we had thoughts on the following: Amgen puts another CETP out of its misery; Stryker buys Vexim without waiting for US approval; How much is aducanumab worth? At least $8bn, Biogen reckons; Alcon delay puts dampener on Novartis; Soliris sitting pretty with complementary new indication; Smith & Nephew acquires, but divestments could follow; Global Blood drops IPF programme. These snippets were previously published daily via twitter. Amgen puts another CETP out of its misery October 26, 2017 If the once-promising CETP drug class lives on, it might only be in a rather restricted group of heart disease patients with a very specific mutation. Amgen became the last big biopharma group to cancel work on a drug in the HDL-raising class when it announced plans to seek a partner for AMG 899, following the lead of Merck & Co, which recently terminated its work with anacetrapib after disappointing results in the Reveal trial. Although big pharma groups obviously believe that it is unlikely for a CETP inhibitor to succeed commercially, it is not out of the realm of possibility that a partner could emerge for AMG 899 – Roche licensed its project, dalcetrapib, to the Canadian group Dalcor Pharmaceuticals, which has been researching its use in a genetic subtype, patients with an AA polymorphism at the rs1967309 location in the ADCY9 gene. Amgen will write off the $300m it paid for AMG 899’s originator, Dezima Pharma, in 2015, which at the time was seen as a cheap bet on the CETP sector. -

Abbvie Allergan Acquisition

Creating a New Diversified Biopharmaceutical Company The Combination of AbbVie and Allergan Investor Presentation June 25, 2019 NO OFFER OR SOLICITATION This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the acquisition or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In particular, this presentation is not an offer of securities for sale into the United States. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Any securities issued in the acquisition are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act of 1933, as amended. The acquisition will be made solely by means of the Scheme Document (or, if applicable, the Takeover Offer document), which will contain the full terms and conditions of the acquisition, including details with respect to the AbbVie shareholder vote in respect of the acquisition. Any decision in respect of, or other response to, the acquisition, should be made only on the basis of the information contained in the Scheme Document. IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC In connection with the proposed Acquisition, Allergan will file with the Securities Exchange Commission (the “SEC”) a Proxy Statement, which will include the Scheme Document. -

![[Docket No. FDA-2017-N-3203] Wyeth Pharmaceutical](https://docslib.b-cdn.net/cover/0756/docket-no-fda-2017-n-3203-wyeth-pharmaceutical-90756.webp)

[Docket No. FDA-2017-N-3203] Wyeth Pharmaceutical

This document is scheduled to be published in the Federal Register on 06/21/2017 and available online at https://federalregister.gov/d/2017-12908, and on FDsys.gov 4164-01-P DEPARTMENT OF HEALTH AND HUMAN SERVICES Food and Drug Administration [Docket No. FDA-2017-N-3203] Wyeth Pharmaceuticals Inc. et al.; Withdrawal of Approval of 121 New Drug Applications and 161 Abbreviated New Drug Applications AGENCY: Food and Drug Administration, HHS. ACTION: Notice. SUMMARY: The Food and Drug Administration (FDA) is withdrawing approval of 121 new drug applications (NDAs) and 161 abbreviated new drug applications (ANDAs) from multiple applicants. The holders of the applications notified the Agency in writing that the drug products were no longer marketed and requested that the approval of the applications be withdrawn. DATES: The withdrawal is effective on [INSERT DATE 30 DAYS AFTER DATE OF PUBLICATION IN THE FEDERAL REGISTER]. FOR FURTHER INFORMATION CONTACT: Florine P. Purdie, Center for Drug Evaluation and Research, Food and Drug Administration, 10903 New Hampshire Ave., Bldg. 51, rm. 6248, Silver Spring, MD 20993-0002, 301-796-3601. SUPPLEMENTARY INFORMATION: The holders of the applications listed in table 1 in this document have informed FDA that these drug products are no longer marketed and have requested that FDA withdraw approval of the applications under the process in § 314.150(c) (21 CFR 314.150(c)). The applicants have also, by their requests, waived their opportunity for a hearing. Withdrawal of approval of an application or abbreviated application under § 314.150(c) is without prejudice to refiling. 2 Table 1 Application No. -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

Abbott Abbvie ACE Pharmaceuticals Alcon Alfasigma ALK Abello

Abbott Eisai MSD Animal Health Abbvie Elanco Mundipharma Pharmaceuticals ACE Pharmaceuticals Eli Lilly Mylan Alcon Essity Mylan Healthcare Alfasigma Eurocept Nevro Medical ALK Abello Eurocept Pharmaceuticals Nobel Biocare Allergan EUSA Pharma Nordic Pharma AllweCare Medical Ferring Norgine Pharma Almirall Flen Health Novartis Pharma Amgen FMH Medical Novo Nordisk Amomed Pharma Focus Care Pharmaceuticals Olympus Amryt Pharmaceuticals Fresenius Kabi Otsuka Pharmaceuticals Amryt Research Fresenius Medical Care Paion Apceth Galapagos Biopharma Pentax Arega Medical Galderma Pfizer Arthrex GDM Philips Electronics Astellas Pharma GE Healthcare PIERRE FABRE AstraZeneca Gedeon Richter PIERRE FABRE SANTE AtriCure Genzyme Pro Care AveXis Getinge Recordati B.Braun Medical Gilead Sciences ResMed Bausch&Lomb OPS GlaxoSmithKline Roche Diabetes Care Baxter Goodlife Pharma Roche Diagnostics Bayer Grünenthal Roche Pharma Bayer Animal Health Guerbet Sandoz Becton Dickinson GW Pharma Sanofi Beldico Horus Pharma Sanquin Plasma Products Benu Direct HRA Pharma Santen Biogen IDB Holland Santhera Bio-Rad Laboratories Incyte Biosciences Sarepta Biotronik InSpine Seagen Bioventus Intercept Pharma Seqirus Bluebird Bio Ipsen Farmaceutica Servier Boehringer Ingelheim Janssen -Cilag Shire Boehringer Ingelheim Animal Health Janssen-Cilag (Actelion) Siemens Healthineers Boston Scientific Jazz Pharmaceuticals SkylineDX Bracco Imaging Johnson & Johnson Medical Smith & Nephew Bristol-Myers Squibb Khondrion SoBi (Swedish Orphan Biovitrum) Cablon Medical Kyowa Kirin Pharma -

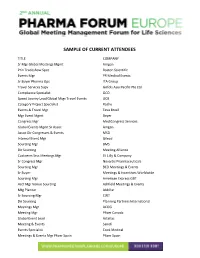

Sample of Current Attendees

SAMPLE OF CURRENT ATTENDEES TITLE COMPANY Sr Mgr Global Meetings Mgmt Amgen Prin Tradeshow Spec Boston Scientific Events Mgr PR Medical Events Sr Buyer Pharma Ops ITA Group Travel Services Supv Grifols Asia Pacific Pte Ltd Compliance Specialist GCO Spend Jouney Lead Global Mtgs Travel Events UCB Category Project Specialist Roche Events & Travel Mgr Teva Brasil Mgr Event Mgmt Bayer Congress Mgr MediCongress Services Global Events Mgmt Sr Assoc Amgen Assoc Dir Congresses & Events MSD Internal Event Mgr Gilead Sourcing Mgr BMS Dir Sourcing Meeting Alliance Custoerm Srvs Meetings Mgr Eli Lilly & Company Sr Congress Mgr Novartis Pharmaceuticals Sourcing Mgr BCD Meetings & Events Sr Buyer Meetings & Incentives Worldwide Sourcing Mgr American Express GBT Acct Mgr Venue Sourcing Ashfield Meetings & Events Mtg Planner AbbVie Sr Sourcing Mgr CWT Dir Sourcing Planning Partners International Meetings Mgr ACOG Meeting Mgr Pfizer Canada Global Event Lead Astellas Meeting & Events Sanofi Events Specialist Cook Medical Meetings & Events Mgr Pfizer Spain Pfizer Spain Sr Mgr Hotel Procurement Meetings & Incentives WorldWide Inc Event Planner SFU BCcampus Mgr Global Strategic Mtg Mgmt Teva Pharmaceuticals Global Mtgs & Events Virtual Mtgs Specialist AstraZeneca Global Congress Strategy Lead MSD Assoc Dir Congresses & Events Alnylam Pharmaceuticals Event Planner AbbVie Institutional & Scientific Events Coordr Almirall Congress Mgr AO Spine Sr Meeting Planner Medtronic Mgr Global Mtgs Mgmt Alnylam Pharmaceuticals Meeting Planner AbbVie Global Audit Meetings -

11/09/2016 Provider Subsystem Healthcare and Family Services Run Time: 20:25:21 Report Id 2794D051 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 11/09/2016 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 20:25:21 REPORT ID 2794D051 PAGE: 01 NUMERIC COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 01/01/2017 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 00002 ELI LILLY AND COMPANY 00145 STIEFEL LABORATORIES, INC, 00003 E.R. SQUIBB & SONS, LLC. 00149 WARNER CHILCOTT PHARMACEUTICALS INC. 00004 HOFFMANN-LA ROCHE 00168 E FOUGERA AND CO. 00006 MERCK & CO., INC. 00169 NOVO NORDISK, INC. 00007 GLAXOSMITHKLINE 00172 IVAX PHARMACEUTICALS, INC. 00008 WYETH LABORATORIES 00173 GLAXOSMITHKLINE 00009 PFIZER, INC 00178 MISSION PHARMACAL COMPANY 00013 PFIZER, INC. 00182 GOLDLINE LABORATORIES, INC. 00015 MEAD JOHNSON AND COMPANY 00185 EON LABS, INC. 00023 ALLERGAN INC 00186 ASTRAZENECA LP 00024 SANOFI-AVENTIS, US LLC 00187 VALEANT PHARMACEUTICALS NORTH AMERICA 00025 PFIZER, INC. 00206 LEDERLE PIPERACILLIN 00026 BAYER HEALTHCARE LLC 00224 KONSYL PHARMACEUTICALS, INC. 00029 GLAXOSMITHKLINE 00225 B. F. ASCHER AND COMPANY, INC. 00032 SOLVAY PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 00037 MEDA PHARMACEUTICALS, INC. 00245 UPSHER-SMITH LABORATORIES, INC. 00039 SANOFI-AVENTIS, US LLC 00258 FOREST LABORATORIES INC 00046 AYERST LABORATORIES 00259 MERZ PHARMACEUTICALS 00049 PFIZER, INC 00264 B. BRAUN MEDICAL INC. 00051 UNIMED PHARMACEUTICALS, INC 00281 SAVAGE LABORATORIES 00052 ORGANON USA INC. 00299 GALDERMA LABORATORIES, L.P. 00053 CSL BEHRING 00300 TAP PHARMACEUTICALS INC 00054 ROXANE LABORATORIES, INC. 00310 ASTRAZENECA LP 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00327 GUARDIAN LABS DIV UNITED-GUARDIAN INC 00062 ORTHO MCNEIL PHARMACEUTICALS 00338 BAXTER HEALTHCARE CORPORATION 00064 HEALTHPOINT, LTD. 00378 MYLAN PHARMACEUTICALS, INC. -

2019 Corporate Responsibility Report

2019 Corporate Responsibility Report See Brilliantly Our Story About This Report Benefiting Customers Caring for Our Winning in the Working With Integrity ESG Content Indices 2 & Patients Environment Workplace Performance Data Contents A Message From Our CEO 3 Winning in the Workplace 26 Talent Attraction & Retention 27 Our Story 4 Diversity & Inclusion (D&I) 29 Company Overview 5 Health & Safety 31 About This Report 8 Working With Integrity 34 Business Ethics 35 Benefiting Customers Responsible Procurement & 9 37 & Patients Supply Chain Cybersecurity & Data Privacy 39 Medical Innovation 10 Product Quality & Patient Safety 13 ESG Performance Data 41 Access, Affordability & Pricing 15 Philanthropy 17 Content Indices 46 Caring for Our SASB Index 47 20 Environment GRI Index 49 Environmental Sustainability 21 Company Topic-Specific 52 Disclosures Sustainable Products & Services 22 Glossary 53 Reducing Our Environmental 24 Footprint Legal Disclaimers 54 Our Story About This Report Benefiting Customers Caring for Our Winning in the Working With Integrity ESG Content Indices 3 & Patients Environment Workplace Performance Data A Message From Our CEO It is my pleasure to present our first Corporate Responsibility Environment; Winning in the Workplace; and Working with Report as a new public company. We’ve been actively Integrity. We recognize that the road to corporate citizenship engaged in environmental, social, and governance initiatives requires significant reflection and organizational alignment, (ESG) over our 70+ years in ophthalmology and optometry, and it is a journey, not a point in time. While some of our ESG and we are pleased to share with you our perspective on initiatives are more developed, others are still in the early corporate citizenship in this inaugural report. -

Mckesson Corporation

Annual Report Fiscal Year Ended March 31, 2010 “In fi scal 2010, McKesson continued its track record of delivering outstanding stockholder returns.” John H. Hammergren Chairman, President and Chief Executive Offi cer McKesson Corporation Financial Results *Diluted earnings per share (“EPS”) excludes adjustments for litigation charges (credits), net. For supplemental fi nancial data and corresponding reconciliation to U.S. generally accepted accounting principles (“GAAP”), see Appendix A to this 2010 Annual Report. Non-GAAP measures should be viewed in addition to, and not as an alternative for, fi nancial results prepared in accordance with GAAP. **Assumes $100 invested in McKesson’s common stock and in each index on March 31, 2005, and reinvestment of all dividends. Dear Fellow Stockholders: I am pleased to report that McKesson delivered strong results in fiscal 2010, an achievement made all the more remarkable by the challenging economic environment we faced coming into the year. Rarely in our 177-year history has the Company insurance reimbursement methods. We believe that experienced an era like the present — one that offers our unmatched HIT solution portfolio positions us so many opportunities for success and growth in extremely well to meet these demands. the healthcare industry, while presenting so many questions about the path forward. 3. Deep Customer Relationships An important lesson to be learned from our long With so much change occurring in healthcare, and successful history is that change presents customers are looking for strategic partners who can opportunities, and I can say with confidence that we help them improve their financial, operational, and are well positioned to thrive in the years ahead. -

Annual Report 2019 See Brilliantly See Brilliantly Alcon Is the Global Leader in Eye Care, Dedicated to Helping People See Brilliantly

Official Sponsor of 20/20 See Brilliantly Annual Report 2019 See Brilliantly See Brilliantly Alcon is the global leader in eye care, dedicated to helping people see brilliantly. With our 70+ year heritage, we are the largest eye care company in the world – with complementary businesses in Surgical and Vision Care. See Brilliantly Being a truly global company, we serve patients in more than 140 countries. We have a long history of industry firsts, and each year we commit a substantial amount in research and development to meet customer needs and patient demands. Table of Contents ii Message from the Board Chair iv Message from the CEO vi Business Summary ix Innovation Milestones x Financial Highlights xiv Alcon’s Strategy xv Corporate Responsibility Message from the Board Chair I am proud of what our team has accomplished following spin-off, Dear Shareholder, Dear Shareholder, particularly in the areas of standing up the new company, accelerating In 1945, two pharmacists in Fort Worth, Texas, Robert our innovation pipeline to grow revenue, and developing the culture to In 1945, two pharmacists in Fort Worth, Texas, Robert Alexander become an agile market leader. Our independence has created Alexander and William Conner, started a company that and William Conner, started a company that would focus tremendous energy among our associates, who can now directly would focus on manufacturing and selling products in a on manufacturing and selling products in a relatively new and participate in our success. In addition, we delivered solid results in relatively new and underserved market at the time: eye care. -

Manufacturers/Wholesalers Street City ST Zip 454 Life Sciences Branford CT A.L.I Holdings, LLC A.L.I

Manufacturers/Wholesalers Street City ST Zip 454 Life Sciences Branford CT A.L.I Holdings, LLC A.L.I. Imaging Systems Corp A.L.I. Technologies (International) LLC Abbott Diabetes Care Division Abbott Diagnostic Division Abbott Laboratories 100 Abbott Park Rd. Bldg. AP6D-1 Abbott Park IL 60064 Abbott Molecular Division Abbott Nutrition Products Division Abbott Pharmaceutical Products Group Abbott Point of Care Division Abbott Vascular Division Abraxis Bioscience, LLC. 11755 Wilshire Blvd., Suite 2000 Los Angeles CA 90025 Access Diabetic Supply, LLC Acclarent, Inc. 1525-B O'Brien Dr. Menlo Park CA 94025 Acorda Therapeutics, Inc. 15 Skyline Drive Hawthorne NY 10532 Advanced Neuromodulation Systems, Inc. Advanced Respiratory, Inc. Advanced Sterilization Products 33 Technology Drive Irvine CA 92618 Aesculap Implant Systems, Inc. 3773 Corporate Parkway Center Valley PA 18034 Aesculap, Inc. 3773 Corporate Parkway Center Valley PA 18034 Alaven Pharmaceuticals, LLC 2260 Northwest parkway Suite A Marietta GA 30067 Alcon Laboratories, Inc. 6201 South Freeway Fort Worth TX 76134 Alexion Pharmaceuticals, Inc. 352 Knotter Drive Cheshire CT 06410 Alkermes, Inc. 88 Sidney Street Cambridge MA 02139 Allen Medical Systems, Inc. Allergan Sales, LLC Allergan USA, Inc. Allergan, Inc. 2525 Dupont Drive Irvine CA 92612 Alpharma Pharmaceuticals, Inc. Alpharma Pharmaceuticals, LLC AMAG Pharmaceuticals, Inc. 100 Hayden Avenue Lexington MA 02421 AMATECH Corporation American Medical Distributors, Inc. 100 New Highway N Amityville NY 11701 American Medical System, -

Corporate Governance Report

Corporate Governance Report 30 June 2009 Board of Directors Executive Board Contents Preliminary remarks 3 1. Board of Directors 4 1.1 Members of the Board of Directors 4 1.2 Professional background and other activities and functions 4 1.3 Cross-involvement 7 1.4 Internal organisational structure 8 2. Executive Board 10 2.1 Members of the Executive Board 10 2.2 Professional background and other activities and functions 11 General Organisation of Nestlé S.A. 15 Situation at 30 June 2009 © 2009, Nestlé S.A., Cham and Vevey (Switzerland) Concept Nestlé S.A., Group Governance Design Nestec Ltd., SGDU, Corporate Identity & Design 2 Nestlé Corporate Governance Report June 2009 Preliminary remarks Nestlé S.A. publishes a full Corporate Governance Report, Contact for Media: including a separate Compensation Report, which Nestlé S.A. forms an integral part of the annual Management Report. Corporate Media Relations We therewith comply with the requirements of the Avenue Nestlé 55 SIX Swiss Exchange (SIX) and its Corporate Governance CH - 1800 Vevey (Switzerland) Directive. tel. +41 (0)21 924 22 00 The present document is a partial update of the fax +41 (0)21 922 63 34 Nestlé Corporate Governance Report 2008, indicating e-mail: [email protected] changes occurred on the Board of Directors and the Executive Board up to 30 June 2009. Contact for Investors: The annual Management Report is available Nestlé S.A. on-line as a PDF file at http://www.nestle.com in English, Investor Relations French and German. Copies can be ordered at: Avenue Nestlé 55 http://www.nestle.com/Media_Center/Order.