View Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cultivar and Rootstock Research for the Arizona Citrus Industry

Supporting the University of Arizona Citrus Variety Collection 20171 Glenn C. Wright2 2School of Plant Sciences, University of Arizona, Yuma Agriculture Center, Yuma, AZ Introduction The 8-acre citrus variety collection at the Yuma Agriculture Center is the most comprehensive collection of citrus within Arizona, containing about 110 selections. The collection was propagated in 1993 and is found in Block 17. The collection has value because it serves as a resource for research, teaching and extension. From 1993 until 2008, data was taken from the lemon selections within the collection. We use fruit, leaves and flowers from the collection to teach students of the Citrus and Date palm production course that I teach through UA-Yuma. A part of one laboratory session takes place within the collection. We also use the collection to teach Master Gardeners, and the we lead tours through the collection for Master Gardeners and other interested parties. We use fruit from the collection for displays and tasting for community events. Now, the trees are aging, and we are in the process of re-propagating the collection into a 3-acre parcel in Block 18 at the Center, but the task is not yet finished. Some of those new trees are planted in the new blocks while others are growing in a field nursery and others have yet to be budded. About one acre of the new collection is in the ground. Few of the new trees have fruit. The University has borne the cost of maintaining the collection for the past 23 years, but those costs can no longer be absorbed. -

LIMONEIRA COMPANY (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on August 12, 2011 Registration No. 333-175929 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 AMENDMENT NO. 1 TO FORM S-3 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 LIMONEIRA COMPANY (Exact name of registrant as specified in its charter) Delaware 77-0260692 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 1141 Cummings Road Santa Paula, California 93060 (805) 525-5541 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) Harold S. Edwards President and Chief Executive Officer Limoneira Company 1141 Cummings Road Santa Paula, California 93060 (805) 525-5541 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) with copies to: Stephen C. Mahon, Esq. Squire, Sanders & Dempsey (US) LLP 221 East Fourth Street, Suite 2900 Cincinnati, Ohio 45202 Telephone: (513) 361-1200 Telecopy: (513) 361-1201 Approximate date of commencement of proposed sale to the public : From time to time after this registration statement becomes effective. If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨ If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. -

Specialty Citrus & Crops = $3.5M 8% Of

(1) Cautionary Statement The following information and the statements made during this presentation contain forward-looking statements. These forward-looking statements are based on Management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Forward-looking statements include information concerning our possible or assumed future results of operations, weather-related phenomena, pricing and supply of raw materials, industry environment, business strategies, financing plans for land development activities, the effects of regulation, and labor disruptions. These statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements including those set forth under the heading “Risk Factors” in the Company’s filings with the Securities and Exchange Commission (SEC). All forward-looking statements in this presentation speak only as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements. This document may also contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP financial measures presented in this document see the Appendix to this presentation. 2 Company Overview . We are in three businesses: agribusiness, real estate development, and rental operations FY 2011 Sales by Segment . -

The Limoneira Company

Case Study THE LIMONEIRA COMPANY Case Study by Imani Lee, Inc. The Limoneira Company Limoneira is a publicly traded, global company whose mission is to preserve and promote its tradi- tion, heritage and legacy in agriculture, community development and stewardship to maximize value for its shareholders. Prepare date 03/10/2015 Contact us 11297 Send Luna Llena, Bldg B San Diego, CA 92130 www.imanilee.com 858-523-9733 Imani Lee, Inc. proprietary and confidential information copyright © 2015 || www.imanilee.com | [email protected] | 858-523-9733 Case Study Project Summary: One Campaign, Four Countries n early 2013, Imani Lee Language Services entered Korea, China, Brazil, and more. Director of Marketing into a multi-year agreement with The Limoneira Com- John Chamberlain was responsible for spearheading Ipany (NASDAQ: LMNR), one of the largest agricultural the company’s “Unleash the Power of Lemons” cam- producers of lemons, avocados, and other specialty paign, designed to promote the five major uses for citrus fruits based in Santa Paula, CA. The agreement lemons: cooking, health, lifestyle, beauty, and green included Imani Lee’s full suite of language services in- cleaning. cluding translation, interpretation, social media market- ing, and expansion services and cultural advisement for the company’s launch into multiple foreign coun- tries such as Peru, Australia, the Philippines, Japan, 2 Imani Lee, Inc.| || www.imanilee.com | [email protected] | 858-523-9733 Client situation/objectives The project was primarily concerned with social media, establishing Limoneira’s brand and promoting the Unleash campaign, with an initial focus on Japan, Korea, Peru, and America. Imani Lee was responsible for managing the international campaigns, while a separate marketing team managed the English-only American campaign. -

Limoneira's CEO

Lemons from South America will help to "balance" the U.S. market this year after strong winds in coastal regions of California reduced the proportion of fancy grade fruit, according to Limoneira's CEO. Speaking in an earnings call for the first quarter, Harold Edwards said that the winds earlier this year caused the fruit to rub against the thorns on the trees, causing scarring and downgrading the quality of much of the fruit to choice grade. "And so, in District 2, what normally would be forecasted 40% of the total tree crop being harvested at fancy grade for the Limoneira production and that of our affiliated growers, we’re estimating that now closer to 25% fancy grade and then the choice grade upwards of 40% to 45%, where that’s typically a little lower than that," he said. He said this situation could result in an oversupply for the foodservice market, which could be exacerbated if restaurants and bars are slow to reopen, creating negative pricing pressure. In addition, the overall tree crop size is down 20 percent in total as an industry, he said. However, he said there is good news from Chile and Argentina - two of the key Southern Hemisphere lemon suppliers to the U.S. market. In Argentina, Limoneira's production is not in the heavily drought-affected areas, unlike much of the middle part of the country. "We believe, ultimately, that’ll help us because there’ll be a much better balance between the supplies of Argentine fruit and then its ability to find the markets," he said. -

Lemon, Lemon-Type

Holdings of the University of California Citrus Variety Collection Lemon, lemon type Category Other identifiers CRC VI PI numbera Accession name or descriptionb numberc numberd Sourcee Datef Lemon, lemon type 0280 Villafranca lemon 539292 Fawcett’s #128, Florida collection 1914 0390 Villafranca lemon 600625 Grove in Glendora CA 1914 0400 Florida rough lemon (ops) 76 539268 Fawcett’s #175. Seed rec’d from A. Melson, Florida 1914 0565 Genoa lemon (Eureka type) 539313 J.W. Mills, Pomona CA 1914 0569 Millsweet lemon 539281 J.W. Mills, Pomona CA buds from tree 1195 1914 0599 Eureka variegated lemon 539325 Chase lemon grove, Corona CA 1914 0710 Chinese lemon 539211 Riverside Station grounds (see notes below) 1909 1222 Mazoe lemon (ops) 539257 A.C. Turner, Salisbury, Rhodesia 1919 2317 Limon Real 539193 Philippine Islands (via CPB) 1930 2322 India- lemon 539204 CPB 1930 2323 India lemon 539287 CPB 1930 2325 South African rough lemon 539258 South Africa? 2367 Variegated Pink Fleshed Eureka lemon 486 539315 Home garden, D.W. Field, Burbank CA 1931 2429 Amber lemon (Eureka type) 539316 Detweiler grove, Alta Loma CA 1932 2477 Khobs-el-arsa 539288 M.H. Brayard, Marrakech, Morocco 1933 2489 Rhobs-el-arsa (ops) 539289 Rabat, Morocco 1935 2544 Indian rough lemon (ops) 539290 Simla Hills, India (via CPB & Florida) 1932 2557 Gomiri rough lemon (ops) 77 103496 India (via PI, USDA) 1933 2695 Faris sweet lemon 539444 Beverly Hills CA 1938 2703 Cascade Eureka lemon 539317 Cascade Ranch 8-16-1 1939 2881 Bergamot 420 539179 UCLA 1951 2899 Italian pink fleshed lemon 133875 Fd 21, R-47, CRC, Riverside 3001 Seedless Lisbon 492 133731 Lasscock’s Nursery, South Australia 3005 Frost nucellar Eureka lemon 21 539318 2nd budded generation from sdlg of o.l. -

Limoneira Company (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED JANUARY 31, 2014 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission File Number: 001-34755 Limoneira Company (Exact name of Registrant as Specified in its Charter) Delaware 77-0260692 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) 1141 Cummings Road, Santa Paula, CA 93060 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (805) 525-5541 Not Applicable (Former name, former address and former fiscal year, if changed since last report) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). -

Proxy Statement, a Proxy Card and Our Annual Report

LIMONEIRA COMPANY Notice of Annual Meeting of Stockholders February 12, 2021 Dear Stockholder: You are cordially invited to attend via webcast the 2021 Annual Meeting of Stockholders of Limoneira Company (“Annual Meeting”). The meeting will be held on Tuesday, March 23, 2021, at 10:00 a.m., Pacific Time. Due to concerns regarding the novel coronavirus (“COVID-19”) pandemic and to protect the safety and well-being of our stockholders, Board of Directors and employees, the Annual Meeting will be a virtual meeting conducted solely online via live webcast communication. This means that you will be able to participate in the Annual Meeting and vote during the Annual Meeting via live webcast by visiting www.meetingcenter.io/271870547, Password LMNR2021. You will not be able to attend the Annual Meeting in person. To participate in the Annual Meeting, registered stockholders will need the control number included on their proxy card and all other stockholders will need to follow the instructions that accompanied their proxy materials. Enclosed please find our proxy statement, a proxy card and our annual report. The proxy statement contains important information about the Annual Meeting, the proposals we will consider and how you can vote your shares. Your vote is very important to us. We encourage you promptly to vote your shares by telephone, Internet or by completing, signing, dating and returning the enclosed proxy card, which contains instructions on how you would like your shares to be voted. Please submit your proxy regardless of whether you will attend the Annual Meeting via webcast. This will help us ensure that your vote is represented at the Annual Meeting. -

Limoneira Company Announces Formation of Limoneira South Africa

April 12, 2016 Limoneira Company Announces Formation of Limoneira South Africa -Additional volume to supply global customer network SANTA PAULA, Calif.--(BUSINESS WIRE)-- Limoneira Company (the "Company" or "Limoneira") (NASDAQ: LMNR) announced today the formation of Limoneira S.A. (Limoneira South Africa) as another component of the company's One World of Citrus® model. Limoneira and South African based Re:inc also announced their partnership called Real Citrus to represent and manage packing and sales opportunities on the continent. Limoneira SA will be based in Paarl, South Africa, and Limoneira's U.S. organization together with Re:inc will manage grower, packing and sales functions. Citrus will be sourced from South African growers and will be packed locally for marketing and global sales. Alex Teague, Limoneira's Chief Operating Officer stated "Africa is one of the largest citrus exporting continents in the world - exports are almost 4 times larger than California's and Arizona's combined. This represents another promising opportunity for supplying our global customers year-round. Limoneira S.A. will also pursue investments in joint venture farming and packing operations in South Africa." Limoneira Senior Director, Agricultural Director Mark Palamountain, echoed these comments and said "We're delighted to partner with Re:inc. They have extensive experience in getting world class fruit to market, and they mirror Limoneira's commitment to sustainability, stewardship and innovation. This continues our mission of perfecting the 52 week citrus supply chain." Riaan van Wyk, Re:inc. CEO, said "working with Limoneira made perfect sense. Their 124 year history of growing high quality citrus for export is admirable as is their responsibility for sustainability. -

Expansion of Lemon Packing Facilities

Cautionary Statement The following information and the statements made during this presentation contain forward-looking statements. These forward-looking statements are based on Management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Forward-looking statements include information concerning our possible or assumed future results of operations, weather-related phenomena, pricing and supply of raw materials, industry environment, business strategies, financing plans for land development activities, the effects of regulation, and labor disruptions. These statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements including those set forth under the heading “Risk Factors” in the Company’s filings with the Securities and Exchange Commission (SEC). All forward-looking statements in this presentation speak only as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements. This document may also contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. -

China Protocol

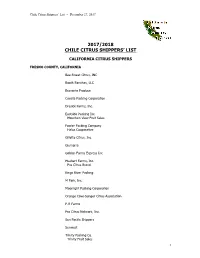

Chile Citrus Shippers’ List – December 27, 2017 2017/2018 CHILE CITRUS SHIPPERS’ LIST CALIFORNIA CITRUS SHIPPERS FRESNO COUNTY, CALIFORNIA Bee Sweet Citrus, INC Booth Ranches, LLC Bravante Produce Cecelia Packing Corporation Dresick Farms, Inc. Eastside Packing Inc Mountain View Fruit Sales Fowler Packing Company Halos Cooperative Gillette Citrus, Inc. Giumarra Golden Farms Express Inc Huebert Farms, Inc. Pro Citrus Brand Kings River Packing M Park, Inc. Moonlight Packing Corporation Orange Cove-Sanger Citrus Association P-R Farms Pro Citrus Network, Inc. Sun Pacific Shippers Sunwest Trinity Packing Co. Trinity Fruit Sales 1 Chile Citrus Shippers’ List – December 27, 2017 IMPERIAL COUNTY, CALIFORNIA Crown Citrus Company KERN COUNTY, CALIFORNIA California Fruit Depot Halos Cooperative Hronis, Inc. Johnston Farms Kern Ridge Kern Ridge Growers, LLC Sun Pacific Shippers Wonderful Citrus MADERA COUNTY, CALIFORNIA Sun Pacific Shippers RIVERSIDE COUNTY, CALIFORNIA Corona-College Heights Orange & Lemon Association Corona Coastal Growers DiMare Co. RBI Packing LLC Richard Bagdasarian, Inc. Sea View Packing PCN (Pro Citrus Network) Seven Seas SAN BERNARDINO COUNTY, CALIFORNIA Redlands Foothill Groves SAN DIEGO COUNTY, CALIFORNIA Sunrise Farms Inc. TULARE COUNTY, CALIFORNIA 2 Chile Citrus Shippers’ List – December 27, 2017 Badger Packing LLC Booth Ranches, LLC Brandt Farms, Inc. California Fresh Citrus Company Cal Valley Citrus, Inc. Corona-College Heights Orange & Lemon Association Corona Coastal Growers Double D Sales Company, Inc. Exeter-Ivanhoe Citrus Association Fancher Creek Packing Fresh Select LLC Dayka & Hackett Seven Seas Grow Pure Citrus LLC Growers Citrus Packing LLC. Hronis, Inc. Jody Fresh Cooling Company Double D Sales Company, Inc. Kaweah Citrus Packing Inc. Kern Ridge Kern Ridge Growers, LLC King Fresh Produce LLC Kings River Packing Klink Citrus Association Legacy Packing & Cold Storage M & G Packing, Inc. -

GLOBAL CITRUS SCAN (40) John Edmonds (13 November 2015) Citrus Growers Association (CGA)

GLOBAL CITRUS SCAN (40) John Edmonds (13 November 2015) Citrus Growers Association (CGA) U.S.: Limoneira closes in on new Chilean acquisitions U.S.-headquartered citrus group Limoneira Company (NASDAQ: LMNR) is looking to expand its operations in Chile, buying in where some agricultural investors are looking for to exit. In August last year the company made its first investment in foreign operations after buying a stake in a northern Chilean citrus packhouse. Limoneira spent US$1.75 million on a 35% stake in La Serena-based packer Rosales, which sells produce to Asian, European and local markets. The group’s CEO Harold Edwards recently told www.freshfruitportal.com the company was ‘very close’ to announcing new acquisitions in the South American country…Edwards explained many of these recent purchases had been intended mainly to increase profit margins rather than fruit volumes. “Right now our average selling price for a 40-pound carton is US$29-30, and with all investments we’ve made in supply chain and packing, we put out a 40 pound box today for US$12-13 a carton, so that’s massive markets,” he said. “If we look at outside growers, where we just represent the growers and market their fruit, we made somewhere between US$1 and $2 a carton.”… “We then purchase those acres, and then incorporate them into our integrated supply chain, not at US$2 margin, but at today’s US$20 margin.”… “We have invested US$75 million worth of capital buying these ranches and making these investments, of which 40% are producing today, while 60% is new orchard replanting, real estate…“So we’re not going to flood the market or put more lemons out there, we’re just going to try to control more lemons.” He also highlighted Limoneira’s entire market share was relatively small, with the company only supplying 2 million cartons of the 30 million consumed annually in the U.S…“About 30% of what we produce has gone into export markets…Key markets for Limoneira…include the Philippines, Malaysia, Thailand, Japan, and South Korea.