HSSEB Quarter 1 2020.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HSS Engineers Is Currently Bidding for Railway, Renewable Energy and Water-Related Projects to Expand Its Order Book

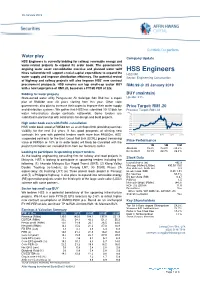

28 January 2019 Water play Company Update HSS Engineers is currently bidding for railway, renewable energy and water-related projects to expand its order book. The government’s ongoing water asset consolidation exercise and planned water tariff HSS Engineers hikes nationwide will support crucial capital expenditure to expand the HSS MK water supply and improve distribution efficiency. The potential revival Sector: Engineering Construction of highway and railway projects will also improve HSS’ new contract procurement prospects. HSS remains our top small-cap sector BUY RM0.99 @ 25 January 2019 with a new target price of RM1.20, based on a FY19E PER of 22x. Bidding for water projects BUY (maintain) State-owned water utility Pengurusan Air Selangor Sdn Bhd has a capex Upside: 21% plan of RM30bn over 30 years starting from this year. Other state governments also plan to increase their capex to improve their water supply Price Target: RM1.20 and distribution systems. We gather that HSS has submitted 10-12 bids for Previous Target: RM1.18 (RM) water infrastructure design contracts nationwide. Some tenders are 2.00 1.80 submitted in partnership with contractors for design and build projects. 1.60 1.40 1.20 High order book even with ECRL cancellation 1.00 0.80 HSS’ order book stood at RM588.6m as at 30 Sept 2018, providing earnings 0.60 0.40 visibility for the next 2-3 years. It has good prospects of winning new 0.20 0.00 contracts this year with potential tenders worth more than RM300m. HSS’ Dec-16 May-17 Oct-17 Mar-18 Aug-18 Jan-19 suspended contracts for the East Coast Rail Link (ECRL) project (remaining Price Performance value of RM95m or 16% of its order book) will likely be cancelled with the project termination; we excluded them from our forecasts earlier. -

USMC Fact Sheet

Hotels Nearby To Campus Thistle Hotel (www.thistle.com) Jalan Sungai Chat, 80100 Johor. Campus Address Distance : 20.7 km Tel: +607 - 222 9234 No 3, Persiaran Canselor 1, Kota Ilmu, Approx: 18mins EduCity@Iskandar, 79200 Nusajaya, Johor. Pariss Hotel (www.parisshotel.com.my) Tel: +607 - 560 2560 No 38, Jalan Bestari 7/2, Taman Nusa Bestari 81300 Skudai, Johor. Nearby Airports From Campus Distance: 10.3 km Tel: +607 - 232 8250 Senai International Airport, Johor. Approx: 10 mins Distance: 33km Tune Hotel (www.tunehotels.com) Changi International Airport, Singapore. Danga Bay, Lot PTB 22819, Distance: 60km Jalan Skudai, Mukim Bandar Johor, 80200 Johor. Distance: 17 km Tel: +607 - 2329010 Approx: 15 mins Car Hire Service Hotel Granada (www.htlgranada.com) Persona Berkat Solution Car Rental Jalan Indah 15/2 , Tel: +6016 - 410 6640 Taman Bukit Indah, 81200 Johor. Distance: 10.6km Tel: +607 - 231 8888 May Flower Car Rental Approx: 11 mins Tel: +607 - 224 1357 Traders Hotel Puteri Harbour Wahdah Car Rental (www.shangri-la.com/johor/traders/) Tel: +607 234 8645 Persiaran Puteri Selatan, Puteri Harbour, 79000 Nusajaya, Johor. Distance: 6.2 km Tel : +607-560 8888 Approx: 9mins Campus Address: No 3, Persiaran Canselor 1, Kota Ilmu, EduCity@Iskandar, 79200 Nusajaya, Johor. Tel: +607 - 560 2560 How To Get To Our Campus Taxi Service Driving Changi Airport To Campus From Kedah Taxi Azman : +6019-772 5048 Distance: 766 km Approx. 7 hours 43 mins * Please call and make your booking 3 days ahead From Penang Distance: 687km Approx. 7 hours From Ipoh Distance: 531km Approx. 5.5 hours Senai International Airport To Campus From Kuala Lumpur Purchase the taxi voucher from the airport, not Distance: 326km Approx. -

Causeway Link Buses Now Available from Mall of Medini to Singapore

5/5/2016 Causeway Link buses now available from Mall of Medini to Singapore | New Straits Times | Malaysia General Business Sports and Lifestyle News Causeway Link buses now available from Mall of Medini to Singapore BY CHUAH BEE KIM 16 MARCH 2016 @ 8:30 PM Tweet ISKANDAR PUTERI: Those who commute to Singapore can now head to the Mall of Medini to take the Causeway Link buses to the republic. Handal Indah Sdn Bhd executive director Rozlan A. Bakar said the mall has more than 1,000 parking spaces for commuters to park their cars before taking the buses to Singapore to work. Rozlan said there are 50 trips from the mall to the Sultan Abu Bakar Customs, Immigration and Quarantine Complex in the Second Link from as early as 5am, and daily services from the Sultan Iskandar CIQ Building to Singapore via the Causeway. A total of 1.1 million commuters use the Causeway Link buses daily to and from Singapore to Johor per month, which is about 36,000 commuters a day. On challenges faced by Handal Indah, Rozlan said the company has a shortage of bus drivers and the road conditions also cause buses to have a shorter lifespan and suffer breakdowns. "A total of 150 buses can head to Singapore in a day, and the same number come to Johor via Singapore," he told a Press conference here today. "However, we take steps to improve comfort for commuters and we upgrade on technology," he said. As for buses plying routes in the city, Rozlan said there are 200 buses for this and the waiting time is 20 minutes per bus. -

Behavioral Intention to Use Public Transport Based on Theory of Planned Behavior

MATEC Web of Conferences 47, 003 08 (2016) DOI: 10.1051/matecconf/201647003 08 C Owned by the authors, published by EDP Sciences, 2016 Behavioral Intention to Use Public Transport Based on Theory of Planned Behavior Kamarudin Ambak1,a, Kanesh Kumar Kasvar1, Basil David Daniel1, Joewono Prasetijo1 and Ahmad Raqib Abd Ghani1 1Smart Driving Research Center, Universiti Tun Hussein Onn Malaysia, 86400 Batu Pahat, Johor, Malaysia Abstract. An increase in population generates increasing in travel demand. In Malaysia, public transport become an important modes of transport that connection people. This paper presents behavioural intention to use public transport especially public bus based on Theory of Planned Behaviour (TPB). A questionnaire survey was conducted to identify factors that contribute and influence users to use public bus and to determine factor that most dominant using TPB model. A total of 282 questionnaires were distributed in selected area of Batu Pahat and Kluang. Correlation and regression analysis were used for this study. Results show that the Attitude toward public transport is the most dominant factor compared with Subjective Norm and Perceived Behavior Control that influencing users to use public bus. Majority respondents were agreed that they prefer to use public bus because it is cheap to travel and no other choices of other transfer modes. As for the recommendation, this study can be extended in future as part of strategic sustainable transportation system in Batu Pahat and Kluang areas. 1 Introduction Malaysia is one of the substantial developing nations in South East Asia. Transportation plays vital role in Malaysia economic contribution. Modern day busy lifestyles have increased the value of time. -

Economic Performance and Prospects

(FRQRPLF 3HUIRUPDQFHDQG 3URVSHFWV Chapter 3.indd 47 9/30/11 4:42:27 AM 48 Chapter 3.indd 48 9/30/11 4:42:27 AM Economic Performance and Prospects Overview by the Government such as tax incentives and liberalisation measures to attract investment, Economy continues to expand particularly in the oil and gas as well as services sectors. Public expenditure is envisaged to remain he Malaysian economy continued to expand supportive of economic activities with expansion Tdespite the more challenging external in capital spending by the Non-Financial Public environment. Real Gross Domestic Product Enterprises (NFPEs). (GDP) registered a growth of 4.4% during the first half of 2011. The moderation was On the supply side, all sectors are expected due to slowing exports following the weaker- to post positive growth, except mining due than-expected United States (US) economic to lower production of crude oil. In tandem performance, deepening euro sovereign debt with robust private consumption, the services crisis, global supply chain disruptions resulting sector is envisaged to grow strongly led by from earthquake and tsunami in Japan as well the wholesale and retail trade, finance and as rising global inflation. The moderation was insurance, real estate and business services as also partly attributed to the high-base effect well as communication sub-sectors. Despite the as GDP grew at a strong pace of 9.5% during contraction in output of electrical and electronics Economic Performance and the same period in 2010. However, the growth (E&E) and transport equipment in the first half momentum is expected to pick up in the second of 2011, the manufacturing sector is expected to half of the year on the back of resilient private record positive growth supported by strong output Prospects consumption and strong private investment. -

Construction Sector Remains Challenging As the Federal Government Is Reviewing Ongoing Infrastructure Projects to Reduce Costs by 20-33%

4 October 2018 Waiting for the other shoe to drop Sector Update The outlook for the Construction sector remains challenging as the federal government is reviewing ongoing infrastructure projects to reduce costs by 20-33%. Projects that could be affected include the Construction Klang Valley MRT Line 2 (MRT2) and LRT Line 3 (LRT3), Pan Borneo Highway (PBH) and Gemas-Johor Bahru Electrified Double Tracking (EDT). There are opportunities in state government projects in Penang and Sarawak. Maintain our NEUTRAL call. Top BUYs are IJM, Suncon Neutral (maintain) and HSS. Potential MRT2 cost cuts We gather that the MRT2 project could see a 25% reduction in cost to RM24bn from an initial estimate of RM32bn. The MMC Gamuda Joint Absolute Performance (%) Venture (JV) will be the most affected as it is the main contractor for the underground section and the Project Delivery Partner (PDP) for the above- 1M 3M 12M ground section of the MRT2. Other listed contractors that could be affected AQRS (6.4) (14.9) (37.9) due to ongoing work on above-ground packages secured include Ahmad Gamuda (10.0) 2.8 (37.1) HSS Eng 2.2 33.3 (9.5) Zaki, Gadang, George Kent, IJM Corp, MRCB, MTD ACPI, Mudajaya, IJM Corp (6.3) 1.7 (45.9) SunCon, TRC, TSR and WCT. Since the cost reductions will come from MRCB 0.7 15.8 (23.2) the reduction in the scope of works, we believe only the contract values will Suncon (0.4) (6.5) (37.4) be reduced while profit margins should be preserved. -

Spatial Management Plan

6 -1 CHAPTER 6 SPATIAL MANAGEMENT PLAN The Spatial Management Plan is a basic framework that drives the translation of national strategic directions to the state level. The Spatial Management Plan consist of aspects related to spatial Three (3) Types of State Spatial availability (land use and transportation), growth areas (Conurbation, Management Plan Promoted Development Zone, Catalyst Centre and Agropolitan Centre), settlement hierarchies, resource management (forest, water, food, Spatial Growth Framework energy source and other natural resources) and disaster risk areas 1 Plan (tsunami, flood, landslide, coastal erosion and rise in sea level). Resource Management Plan A Spatial Management Plan at the state level is prepared to translate 2 national strategic directions to the state level (all states in Peninsular Natural Disaster Risk Area Malaysia, Sabah and Labuan Federal Territory) especially for strategic 3 Management Plan directions that have direct implications on a spatial aspect such as: . 1. Growth and development of cities as well as rural areas that is balanced and integrated (PD1 and PD 2); 2. Connectivity and access that is enhanced and sustainable (PD3); 3. Sustainable management of natural resources, food resources and State Spatial Management Plan heritage resources (KD1); involve the following states: 4. Management of risk areas (KD2); 5. Low carbon cities and sustainable infrastructure (KD3); and 1. Perlis pp. 6 - 8 6. Inclusive community development (KI1, KI2 and KI3). 2. Kedah pp. 6 - 14 3. Pulau Pinang pp. 6 - 20 This management plan shall become the basis for planning growth areas, conservation of resource areas as well as ensuring planning 4. Perak pp. 6 - 26 takes into account risks of natural disaster. -

Kuala Lumpur a State 85 Kuala Lumpur – City-State of the Future? 88

Contents Executive Director’s Note 3 Section 1: Evaluation of Local Authorities in Malaysia History of Local Govornment Election in Malaysia 6 Revisiting the Athi Nahappan Report Part 1 16 Section 2: Separation of Powers Between the Three Levels of Government The Malaysian Federation: A Contradiction in Terms? 21 How Incompetency in Local Governments Help to Preserve Political Hegemony in Malaysia 25 Double Decentralisation: The Way Forward for Sabah 30 Section 3: Governance in Our Local Authorities Strength from the Grassroots: Practices of Participatory Governance 35 Communications as a Key Competency 39 It’s All About the Money 43 Understanding Local Authority Financial Reports 46 Section 4: Running Our Cities & Towns BRT: Rethinking Expensive Public Transport Projects in Malaysian Cities 51 An Aged-Friendly City For All - Rich or Poor 54 The Truth behind Solid Waste Management and Incinerators 59 A Lucrative Dirty Business 62 The Road Less Taken 68 Section 5: Revisiting the Local Government Election Revisiting the Athi Nahappan Report Part 2 : Recommendations 73 Will Local Government Elections Erode Malay Rights? 79 Local Democracy: More Politics or Less? 82 Beyond Local Government: Making Kuala Lumpur a State 85 Kuala Lumpur – City-State of the Future? 88 Issue 1, 2015 - pg. 1 REFSA QUARTERLY Editorial Team Executive Director | Steven Sim Chee Keong Deputy Executive Director | Wong Shu Qi Editor | Lam Choong Wah Assistant Editor | Rosalind Chua Intern | Yap Lay Sheng Layout Design | PM Wang Published by Research For Social Advancement Bhd (Refsa) 2nd Floor,Block A Wenworth Building Jalan Yew, Off Jalan Pudu 55100 Kuala Lumpur. Tel: 03 9285 5808 Fax: 03 92818104 Executive Director’s Note By Steven Sim Executive Director, REFSA Local authorities are fertile grounds for mission. -

About the Movement Control Order Ministry of Transport of Malaysia

Frequently Asked Question (FAQ) About the Movement Control Order Ministry of Transport of Malaysia (MOT) NO 2 LAND 1. Are the department / agency counters under the MOT (JPJ, APAD, LPKP Sabah and LPKP Sarawak) operating during the duration of this Movement Control Order? All JPJ, APAD, Sabah LPKP and Sarawak LPKP service counters are fully closed to the public from March 20, 2020 until the expiry of the Movement Control Order. The RTD service at the Post Office was also discontinued during this period. However, during the MCO period, the Minister of Transport applied the provisions of the law under Section 66 (1) of the Road Transport Act 1987 (Act 333) by granting EXEMPTION to all drivers with driving license from the need to RENEW THEIR DRIVER'S LICENSE through special law effective March 25, 2020. This means that anyone with an expired driving license can still use their vehicle provided that the vehicle is required to have valid insurance coverage and drivers are advised to bring a copy of their insurance certificate or e-cover note of driving while driving during the MCO period. Licensees must renew their licenses within 30 days after the MCO is declared end. Another reminder, as required by law, all commercial vehicle owners and private vehicle owners must ensure that vehicles have valid insurance coverage during the MCO period. 2. Does driving study and driving test at the Driving Institute continue during this period? All activities and courses, Driving Education Curriculum (KPP) talks, driving training, theory testing and practice testing at the Institute for Driving and Part 1 testing (KPP01 - theory) at the e-Services Center (MyEG, KOMMS and MYSPEED) are postponed to March 18, 2020. -

Soalan Lisan Brtlis Yb

NEGERI PULAU PINANG MINIT PERSIDANGAN MESYUARAT PERTAMA PENGGAL PERSIDANGAN KELIMA DEWAN UNDANGAN NEGERI PULAU PINANG YANG KETIGA BELAS 19 MEI 2017, 22 MEI 2017 HINGGA 25 MEI 2017 Dikeluarkan oleh PEJABAT SETIAUSAHA KERAJAAN BAHAGIAN DEWAN UNDANGAN NEGERI PULAU PINANG 1 MESYUARAT PERTAMA PENGGAL PERSIDANGAN KELIMA DEWAN UNDANGAN NEGERI PULAU PINANG YANG KETIGA BELAS Kandungan Muka Surat Minit Persidangan 19 Mei 2017 (Jumaat) 3 Minit Persidangan 22 Mei 2017 (Isnin) 12 Minit Persidangan 23 Mei 2017 (Selasa) 80 Minit Persidangan 24 Mei 2017 (Rabu) 85 Minit Persidangan 25 Mei 2017 (Khamis) 91 2 MINIT PERSIDANGAN MESYUARAT PERTAMA PENGGAL PERSIDANGAN KELIMA DEWAN UNDANGAN NEGERI PULAU PINANG YANG KETIGA BELAS Tarikh : 19 MEI 2017(JUMAAT) Masa : 9.30 Pagi Tempat : Dewan Undangan Negeri Lebuh Light, George Town Pulau Pinang. HADIR Bil. Nama Ahli Kawasan 1. Y.A.B. Lim Guan Eng Ketua Menteri / Air Putih 2. YB. Dato' Law Choo Kiang Yang di-Pertua Dewan Undangan Negeri 3. YB. Dato' Haji Mohd Rashid Bin Hasnon Timbalan Ketua Menteri I/ Pantai Jerejak 4. YB. Prof. Dr. P. Ramasamy A/L Palanisamy Timbalan Ketua Menteri II/Perai 5. YB. Chow Kon Yeow Padang Kota 6. YB. Dato' Haji Abdul Malik Bin Abul Kassim Batu Maung 7. YB. Chong Eng Padang Lalang 8. YB. Lim Hock Seng Bagan Jermal 9. YB. Law Heng Kiang Batu Lancang 10. YB. Phee Boon Poh Sungai Puyu 11. YB. Jagdeep Singh Deo A/L Karpal Singh Datok Keramat 12. YB. Dr. Afif Bin Bahardin Seberang Jaya 13. YB. Dato' Haji Maktar Bin Haji Shapee Timbalan Yang di-Pertua Dewan Undangan Negeri/Sungai Bakap 14. -

MY Credit Outlook 2020 – Chartbook & Views

January 6, 2020 MY Credit Outlook 2020 – Chartbook & Views Late Cycle, Not End of Cycle FIXED INCOME FIXED Malaysia Winson Phoon|+65 6812 8807|[email protected] Se Tho Mun Yi|+603 2074 7606|[email protected] THIS REPORT HAS BEEN PREPARED BY MAYBANK KIM ENG RESEARCH SEE PAGE 61-66 FOR IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS Contents Supply Review: 2019 3 Bumitama Agri Ltd 33 DRB-HICOM Bhd 35 Supply Outlook: 2020 8 Eco World Capital Assets Bhd 37 Eco World International Bhd 39 Demand Profile 10 First Resources Ltd 41 Fortune Premiere Sdn Bhd 43 GG Bonds 15 Gamuda Bhd 45 Genting Malaysia Bhd 47 Credit Condition & Spreads 17 IJM Corporation Bhd 49 Kuala Lumpur Kepong Bhd 51 Sector Outlook Mah Sing Group Bhd 53 Banking Sector 25 Press Metal Aluminium Hldgs Bhd 55 Construction Sector 26 UEM Sunrise Bhd 57 Plantation Sector 27 Power Sector 28 Appendix Property Sector 29 List of Outstanding GG bonds 60 Solar Sector 30 PDS maturity in 2019: Toll Road Sector 31 Corporates 61 FI (Bank) 64 Credit Views: Selected Issuers FI (Non-bank FI & Others) 65 Strictly Private & Confidential Page 1 MYR Credit: Supply Review, Supply Outlook and Demand Profile Strictly Private & Confidential Page 2 Supply Review 2019: Gross PDS supply was little changed at MYR105b (2018: MYR104b) Gross PDS Issuance by Rating: Lower high-grade supply Gross/Net PDS Issuance, 2015–2020F was offset by an increase in unrated bond issuances *2019: Urusharta Jamaah’s MYR27.55b issuance related to the restructuring of non-performing assets under LTH is excluded -

Malaysian Journal of Civil Engineering 28 Special Issue (3):240-251(2016)

Malaysian Journal of Civil Engineering 28 Special Issue (3):240-251(2016) SEPKA 2016 ESTIMATING DISSOLVED OXYGEN DEPLETION IN INNER WESTERN JOHOR STRAIT, MALAYSIA USING A THREE DIMENSIONAL WATER QUALITY MODEL Maznah Ismail1, Noor Baharim Hashim1*& Ziba Kazemi2 1Universiti Teknologi Malaysia/Department of Hydraulic and Hydrology, Malaysia 2Department of Civil Engineering, Islamic Azad University of Ahar *Corresponding Author: [email protected] Abstract: Characterization of changes in inner Western Johor Strait (WJS) of monitoring works was successfully carried out. Eight water quality data sets collected in this area from Second Link to Causeway Link. An extensive dissolved oxygen (DO) data set was used to develop a statistically meaningful way of estimating mean DO from discrete measurements in inner WJS. Relationships among bottom water DO, vertical stratification, and the factors responsible for stratification-destratification in this narrow stretch of water along the WJS with some recent continuous monitoring data. Therefore, it is imperative that the environmental of reclamation and dredging works, municipal or industrial discharge, marine aquaculture and shipping activities in this area be effectively controlled and managed. The purpose of this study was to assess the water quality condition in the Inner Western Johor Strait and the estimating the spatial variable ties of the mean salinity, temperature and dissolved oxygen conditions in WJS. An application of the three dimensional water quality model Environmental Fluid Dynamic Code (EFDC) was developed for the inner WJS to investigate the DO depletion along the strait and surrounding areas. The twenty-one state variable water quality model available in EFDC included multiple dissolved and particulate organic carbon constituents, as well as organic and inorganic nutrients, DO, and three phytoplankton constituents.