August 6, 2019 the Honorable Charles P. Rettig Commissioner

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

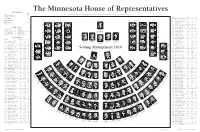

2020 Minnesota House of Representatives Seating Chart

The Minnesota House of Representatives House Leadership Seat Melissa Hortman .................................... 139 Minnesota House of Representatives Public Information Services, 651-296-2146 or 800-657-3550 Speaker of the House District Room* 296- Seat Ryan Winkler.......................................... 102 44A Klevorn, Ginny (DFL) .........581 ....... 5511 ..... 104 Majority Leader 37A Koegel, Erin (DFL) .............375 ....... 5369 ..... 126 48B Kotyza-Witthuhn, Carlie (DFL) ....567 ............7449 ...........81 Golden Valley—45B Bloomington—49B Shelly Christensen Kurt Daudt ............................................... 23 Mike Freiberg Stillwater—39B 58A Koznick, Jon (R) .................229 ....... 6926 ......... 5 Seat 129 Steve Elkins Seat 135 Minority Leader Seat 124 9B Kresha, Ron (R) ...................207 ....... 4247 ....... 12 Seat 6 41B Kunesh-Podein, Mary (DFL)... 445 ..........4331 ......... 97 Seat 1 Seat 11 Mary Franson Luverne—22A Alexandria—8B Joe Schomacker 5B Layman, Sandy (R) ..............233 ....... 4936 ....... 38 Shane Mekeland House Officers Clear Lake—15B Maplewood—53A Rosemount—57B St. Peter—19A Jeff Brand 59A Lee, Fue (DFL) ....................485 ....... 4262 ..... 125 Seat 128 John Huot Tou Xiong Tou Seat 134 Patrick D. Murphy .......... 142 Marilee Davis .................. 141 Seat 123 Seat 139 Chief Clerk Desk Clerk Melissa Hortman 66B Lesch, John (DFL) ...............563 ....... 4224 ..... 116 Timothy M. Johnson ....... 143 David G. Surdez ............. 140 Brooklyn Park—36B Seat 7 Seat 2 26A Liebling, Tina (DFL) ...........477 ....... 0573 ..... 114 Speaker of the House Seat 12 Peggy Scott Ron Kresha 1st Asst. Chief Clerk Legislative Clerk John Poston Andover—35B Little Falls—9B Brooklyn Center—40B Lake Shore—9A International Falls—3A 4A Lien, Ben (DFL) ..................415 ....... 5515 ....... 72 Gail C. Romanowski ....... 144 Bob Meyerson ................... 69 South St. Paul—52A Samantha Vang Seat 127 2nd Asst. -

2018 Election Directory of the Minnesota Legislature

2018 ELECTION DIRECTORY for the 2019-2020 MINNESOTA LEGISLATURE Minnesota House of Representatives Nov. 7, 2018 2019-2020 House Membership Statistics List as of Nov. 7, 2018 59 Republican members 75 DFL members 86 members are men 48 members are women 46 Republican men 40 DFL men 13 Republican women 35 DFL women Newly elected members 39 newly elected members 5 newly elected Republican members 34 newly elected DFL members 29.1 percent of 2019-20 members did not serve last session 20 newly elected members are men 19 newly elected members are women 86.4 percent of incumbents on the ballot were re-elected 15 Republican incumbents lost (includes Rep. Jim Knoblach who suspended his campaign Sept. 21) 0 DFL incumbents lost 24 seats were open at the time of the election 2 races were uncontested (Mahoney, Pelowski, Jr.) New House DFL members Patty Acomb ................................. 44B Dave Lislegard ................................ 6B Kristin Bahner.............................. 34B Jamie Long .................................... 61B Robert Bierman ...........................57A Alice Mann ................................... 56B Jeff Brand ......................................19A Kelly Moller ..................................42A Hunter Cantrell ............................56A Kelly Morrison ............................. 33B Michelle (Shelly) Christensen .... 39B Mohamud Noor ........................... 60B Anne Claflin .................................54A John Persell .....................................5A Heather Edelson ..........................49A -

2018-AMSD-House-Legi

AMSD Member Districts Minnesota House of Representatives 2018 House School District District Legislator Phone Email Anoka-Hennepin 31A Kurt Daudt 651-296-5364 [email protected] 31B Cal (Calvin) K. Bahr 651-296-2439 [email protected] 34A Joyce Peppin 651-296-7806 [email protected] 35A AbigaiL WheLan 651-297-9010 [email protected] 35B Peggy Scott 651-296-4231 [email protected] 36A Mark UgLem 651-296-5513 [email protected] 36B MeLissa Hortman 651-296-4280 [email protected] 37A Erin KoegeL 651-296-5369 [email protected] 37B NoLan West 651-296-4226 [email protected] 38A Linda Runbeck 651-296-2907 [email protected] 40B Debra HiLstrom 651-296-3709 [email protected] 41A Connie Bernardy 651-296-5510 [email protected] Bloomington 49B PauL Rosenthal 651-296-7803 [email protected] 50A Linda SLocum 651-296-7158 [email protected] 50B Andrew CarLson 651-296-4218 [email protected] Brooklyn Center 40B Debra HiLstrom 651-296-3709 [email protected] Burnsville-Eagan-Savage 51A Sandra A. Masin 651-296-3533 [email protected] 51B Laurie Halverson 651-296-4128 [email protected] 55A Bob Loonan 651-297-9010 [email protected] 56A Drew Christensen 651-297-9010 [email protected] 56B Roz Peterson 651-297-9010 [email protected] 57A Erin Maye Quade 651-296-5506 [email protected] Columbia Heights 41A Connie Bernardy 651-296-5510 [email protected] 41B Mary Kunesh-Podein 651-296-4331 -

2021-2022 Minnesota House of Representatives Minneapolis and Saint Paul

2021-2022 Minnesota House of Representatives Minneapolis and Saint Paul North Oaks Brooklyn Park 10 St. Vincent Fridley ¤£ Mahtomedi Humboldt 41A Connie Bernardy (DFL) Brooklyn Center Warroad ¨¦§694 Lancaster Roseau New Brighton Birchwood Village Roosevelt Arden Hills Hallock Anoka Shoreview Kittson Gem Lake White Bear Lake Badger Vadnais Heights Roseau Williams Lake Bronson 42A Kelly Moller (DFL) Greenbush 40B Samantha Vang (DFL) Hilltop Baudette Halma Kennedy Columbia Heights 45A Cedrick Frazier (DFL) Donaldson Lake of the Woods Karlstad Ranier 42B Jamie Becker-Finn (DFL) Strathcona New Hope International Falls Strandquist 41B Sandra Feist (DFL) Crystal ¨¦§694 Stephen 01A John Burkel (R) ¤£75 Middle River Marshall Argyle Newfolden Littlefork Robbinsdale Little Canada St. Anthony Holt Grygla 59A Fue Lee (DFL) Oslo Viking ¤£61 Alvarado Warren Roseville Maplewood Koochiching North St. Paul Goodridge Big Falls Thief River Falls 43A Peter Fischer (DFL) Pennington 02A Matthew Grossell (R) 60A Sydney Jordan (DFl) St. Hilaire Orr 45B Mike Freiberg (DFL) ¤£71 East Grand Forks Plummer Kelliher Ramsey Beltrami Winton Lauderdale 66A Alice Hausman (DFL) 43B Leon Lillie (DFL) Red Lake Falls Mizpah Ely Oakdale Golden Valley 01B Debra Kiel (R) Red Lake Oklee Falcon Heights Northome 03A Rob Ecklund (DFL) Fisher Brooks Effie Cook Crookston Tower Trail Funkley Grand Marais Gully Bigfork 59B Esther Agbaje (DFL) Polk Mentor Gonvick Cook Clearbrook Blackduck 66B Athena Hollins (DFL) Erskine Climax McIntosh Leonard Tenstrike Babbitt Squaw Lake 394 Fosston -

Minnesota Legislature Member Roster

2015-2016 Minnesota House of Representatives Members Phone Phone District Member/Party Room* 651-296- District Member/Party Room* 651-296- 55B Albright, Tony (R) .................................................407 ......................... 5185 43B Lillie, Leon (DFL) ...................................................277 ......................... 1188 62B Allen, Susan (DFL) ................................................229 ......................... 7152 60A Loeffler, Diane (DFL) ...........................................337 ......................... 4219 9A Anderson, Mark (R) .............................................579 ......................... 4293 39B Lohmer, Kathy (R) ................................................501 ......................... 4244 12B Anderson, Paul (R) ...............................................597 ......................... 4317 48B Loon, Jenifer (R) ....................................................449 ......................... 7449 44A Anderson, Sarah (R) ............................................583 ......................... 5511 55A Loonan, Bob (R) ....................................................523 ......................... 8872 5B Anzelc, Tom (DFL) ................................................317 ......................... 4936 30B Lucero, Eric (R) ......................................................515 ......................... 1534 44B Applebaum, Jon (DFL) .......................................223 ......................... 9934 10B Lueck, Dale (R) ......................................................423 -

ELECTION DIRECTORY for the 2021-2022 MINNESOTA LEGISLATURE

Preliminary 2020 ELECTION DIRECTORY for the 2021-2022 MINNESOTA LEGISLATURE Minnesota House of Representatives and Minnesota Senate Jan. 5, 2021 2021-2022 House Membership Statistics 70 DFL members 64 Republican members 51 members are women 83 members are men 13 Republican women 51 Republican men 38 DFL women 32 DFL men Newly elected members 23 newly elected members for 2021-22, includes two former members 12 newly elected DFL members 11 newly elected Republican members 17.2 percent of 2021-22 members did not serve last session 11 newly elected members are women 12 newly elected members are men 89 percent of incumbents on the ballot were re-elected 0 Republican incumbents lost 5 DFL incumbents lost 18 seats were open at the time of the election 4 races were uncontested (18A Dean Urdahl; 28A Gene Pelowski, Jr.; 49A Heather Edelson; 60B Mohamud Noor) New House DFL members Esther Agbaje ............................... 59B Emma Greenman ........................ 63B Kaela Berg ..................................... 56B Jessica Hanson .............................56A Liz Boldon .................................... 25B Athena Hollins ............................. 66B Sandra Feist .................................. 41B Heather Keeler ...............................4A Cedrick Frazier ............................45A Liz Reyer ....................................... 51B Luke Frederick ............................. 19B John Thompson ...........................67A New House Republican members Susan Akland ...............................19A Patricia -

July 1, 2019 New Laws

PUBLIC INFORMATION SERVICES 175 State Office Building Minnesota 100 Rev. Dr. Martin Luther King Jr. Blvd. St. Paul, MN 55155 House of 651-296-2146 800-657-3550 Representatives Fax: 651-297-8135 Melissa Hortman, Speaker FOR IMMEDIATE RELEASE Updated: Aug. 27, 2019 You‘re invited to speak your mind Talk with legislators, voice your opinion at Minnesota State Fair Fairgoers are invited to weigh in on hot political topics and meet with legislators during their visit to the House of Representatives’ booth at the 2019 Minnesota State Fair. Among the booth highlights is the annual House opinion poll that draws the attention of around 10,000 participants and will, once again, be available. Fairgoers can let their opinions be known on a number of issues, including recreational marijuana use, firearm background checks and felon voting rights. Poll results are scheduled to be on the House website (www.house.mn) Sept. 3, the day after the fair closes. Also back is a photo opportunity as you stand behind of a replica of the House Speaker’s desk. Complete with flags and the Abraham Lincoln portrait, the display gives you a feel for what it is like to stand in this position of power. Be sure to find out the fascinating history behind the portrait. The House of Representatives exhibit is located in the Education Building on Cosgrove Street, just north of Dan Patch Avenue. The following is a list of representatives planning to attend (as of 9 a. m. Aug. 27). Thursday, Aug. 22 10 a.m. to noon: Rep. -

2017 Minnesota House of Representatives Minneapolis and Saint Paul

2017 Minnesota House of Representatives Minneapolis and Saint Paul Includes Results from 2/14/2017 Special Election North Oaks Brooklyn Park 10 St. Vincent Fridley ¤£ Mahtomedi Humboldt 41A Connie Bernardy DFL Brooklyn Center Warroad ¦¨§694 Lancaster 40B Debra Hilstrom DFL Roseau New Brighton Birchwood Village Arden Hills Roosevelt Hallock Anoka Shoreview Kittson White Bear Lake Badger 42A Randy Jessup R Gem Lake Vadnais Heights Lake Bronson Roseau Williams Greenbush Hilltop Baudette Halma Kennedy Columbia Heights Donaldson Lake of the Woods 45A Lyndon Carlson Sr. DFL 42B Jamie Becker-Finn DFL Karlstad Ranier 41B Mary Kunesh-Podein DFL Strathcona New Hope International Falls Strandquist 01A Dan Fabian R Crystal ¦¨§694 Stephen ¤£75 Middle River Marshall 43A Peter Fischer DFL Newfolden Argyle Littlefork 59A Fue Lee DFL Robbinsdale Little Canada St. Anthony Holt Grygla Oslo Viking ¤£61 Alvarado Warren Roseville Maplewood Koochiching North St. Paul Goodridge 60A Diane Loeffler DFL Big Falls 45B Mike Freiberg DFL Thief River Falls 02A Matthew Grossell R Pennington 66A Alice Hausman DFL 43B Leon Lillie DFL St. Hilaire Orr ¤£71 East Grand Forks Plummer Kelliher Ramsey Beltrami Winton Lauderdale Red Lake Falls Mizpah Ely Oakdale Red Lake Golden Valley 01B Debra Kiel R Oklee 59B Raymond Dehn DFL Falcon Heights Northome 03A Rob Ecklund DFL Fisher Brooks Effie Cook Crookston Tower Trail Funkley Grand Marais 66B John Lesch DFL Gully Bigfork Polk Mentor Gonvick Cook Clearbrook Blackduck Erskine Clearwater 67A Tim Mahoney DFL Climax 60B Ilhan Omar -

2019-2020 Minnesota House of Representatives Minneapolis and Saint Paul

2019-2020 Minnesota House of Representatives Minneapolis and Saint Paul Includes Results from 02/04/2020 Special Election North Oaks Brooklyn Park 10 St. Vincent Fridley Mahtomedi Humboldt 41A Connie Bernardy DFL Brooklyn Center Warroad 694 Lancaster Roseau New Brighton Birchwood Village Roosevelt Arden Hills Hallock Anoka Shoreview Kittson White Bear Lake Badger Gem Lake Vadnais Heights Roseau Williams Lake Bronson 42A Kelly Moller DFL Greenbush 40B Samantha Vang DFL Hilltop Baudette Halma Kennedy Columbia Heights 45A Lyndon R. Carlson DFL Donaldson Lake of the Woods Karlstad Ranier 42B Jamie Becker-Finn DFL Strathcona New Hope International Falls Strandquist 41B Mary Kunesh-Podein DFL Crystal 694 Stephen 01A Dan Fabian R 75 Middle River Marshall Argyle Newfolden Littlefork Robbinsdale Little Canada St. Anthony Holt Grygla 59A Fue Lee DFL Oslo Viking 61 Alvarado Warren Roseville Maplewood Koochiching North St. Paul Goodridge Big Falls Thief River Falls 43A Peter M Fischer DFL Pennington 02A Matthew J. Grossell R 60A Sydney Jordan DFL St. Hilaire Orr 45B Mike Freiberg DFL 71 East Grand Forks Plummer Kelliher Ramsey Beltrami Winton Lauderdale 66A Alice Hausman DFL 43B Leon M. Lillie DFL Red Lake Falls Mizpah Ely Oakdale Golden Valley 01B Debra Kiel R Red Lake Oklee Falcon Heights Northome 03A Rob Ecklund DFL Fisher Brooks Effie Cook Crookston Tower Trail Funkley Grand Marais Gully Bigfork 59B Raymond Dehn DFL Polk Mentor Gonvick Cook Clearbrook Blackduck 66B John Lesch DFL Erskine Climax McIntosh Leonard Tenstrike Babbitt Squaw Lake 394 Clearwater Turtle River Nielsville Beltrami Fosston 60B Mohamud Noor DFL 67A Tim Mahoney DFL Fertile Winger St. -

Legislative Scorecard

2015 LEGISLATIVE SCORECARD WHAT HAPPENED IN THE 2015 LEGISLATIVE SESSION he 2015 legislative session ended in May 2015 with 5 e-mails made by our supporters made a huge difference in pro-gun bills sitting within SF878 – the Omnibus Public advancing legislation. Safety Bill. With a threatened veto from Governor TDayton, activists and supporters from the Minnesota Gun In terms of the scorecard, many legislators achieved a Owners PAC made thousands of phone calls and sent nearly perfect score of 100% on our graded votes. In addition, many 202,000 e-mails in support of the legislation. After nearly a legislators also co-authored pro-gun bills that had scored week’s delay Governor Dayton signed the bills into law on votes. It’s fantastic that Minnesotan’s law-abiding gun May 22nd, 2015. owners have such a strong pro-Second Amendment legislature in place. Contained within the Omnibus Public Safety Bill were some of the most important pro-second amendment legislation we’ve seen in a generation here in Minnesota: • HF1434 legalized the possession and use of suppressors, in line with federal law, for all lawful purposes in Minneso- ta. • HF372 removed the duplicative requirement that permit holders send a letter to the Commissioner of Public Safety if they intended to carry at the State Capitol Complex. • HF830 clarified existing law so that Minnesotans could We scored all floor votes on pro-gun legislation and amend- purchase long-guns in other states in accordance with federal law. ments. In addition, we scored all anti-gun amendments that came up on the floor as well. -

House District Reports by Institution

Alexandria Technical and Community College Credit Student Enrollment by House District Fiscal Year 2018-2019 Representative and District Enrollment District 08B: Rep. Mary Franson 654 District 12B: Rep. Paul Anderson 499 District 12A: Rep. Jeff Backer 318 District 01B: Rep. Debra Kiel 167 District 09A: Rep. John Poston 134 District 01A: Rep. John Burkel 131 District 02A: Rep. Matt Grossell 93 District 09B: Rep. Ron Kresha 92 District 02B: Rep. Steve Green 92 District 04B: Rep. Paul Marquart 87 District 17A: Rep. Tim Miller 80 District 08A: Rep. Jordan Rasmusson 73 District 13A: Rep. Lisa Demuth 54 District 17B: Rep. Dave Baker 52 District 16A: Rep. Chris Swedzinski 48 District 16B: Rep. Paul Torkelson 43 District 05A: Rep. Matt Bliss 42 District 13B: Rep. Tim O'Driscoll 39 District 14A: Rep. Tama Theis 38 District 15B: Rep. Shane Mekeland 37 District 21A: Rep. Barb Haley 35 District 18A: Rep. Dean Urdahl 33 District 18B: Rep. Glenn Gruenhagen 28 District 29A: Rep. Joe McDonald 24 District 30B: Rep. Eric Lucero 23 District 14B: Rep. Dan Wolgamott 22 District 29B: Rep. Marion O'Neill 22 District 22B: Rep. Rod Hamilton 21 District 21B: Rep. Steve Drazkowski 20 District 15A: Rep. Sondra Erickson 19 District 31A: Rep. Kurt Daudt 18 District 11B: Rep. Nathan Nelson 17 District 06A: Rep. Julie Sandstede 16 District 23B: Rep. Jeremy Munson 15 District 30A: Rep. Paul Novotny 15 District 05B: Rep. Spencer Igo 15 District 32A: Rep. Brian Johnson 14 District 47A: Rep. Jim Nash 14 District 22A: Rep. Joe Schomacker 14 System Office Research, Academic and Student Affairs Division 11/19/2020 Alexandria Technical and Community College Credit Student Enrollment by House District Fiscal Year 2018-2019 Representative and District Enrollment District 10B: Rep. -

Judiciary Finance and Civil Law Division

Judiciary Finance and Civil Law Division Meets: Tuesday, Wednesday and Thursday at 9:45 a.m. in Room 10 DFL Committee Members Committee Chair Rep. John Lesch (DFL) District: 66B Rep. Kaohly Her (DFL) District: 64A 563 Rev. Dr. Martin Luther King Jr. Blvd. 359 Rev. Dr. Martin Luther King Jr. Blvd. St Paul, MN 55155 St Paul, MN 55155 651-296-4224 651-296-8799 Email: [email protected] Email: [email protected] @johnlesch @KaohlyVangHer Vice Chair Rep. Tina Liebling (DFL) District: 26A Rep. Kelly Moller (DFL) District: 42A 477 Rev. Dr. Martin Luther King Jr. Blvd. 569 Rev. Dr. Martin Luther King Jr. Blvd. St Paul, MN 55155 St Paul, MN 55155 651-296-0573 651-296-0141 Email: [email protected] Email: [email protected] @TinaLiebling @KellyForUs Rep. Carlos Mariani (DFL) District: 65B 381 Rev. Dr. Martin Luther King Jr. Blvd. Rep. Hunter Cantrell (DFL) District: 56A St Paul, MN 55155 421 Rev. Dr. Martin Luther King Jr. Blvd. 651-296-9714 St Paul, MN 55155 Email: [email protected] 651-296-4212 @Cmarianirosa Email: [email protected] @HCantrellMN Rep. Mohamud Noor (DFL) District: 60B 379 Rev. Dr. Martin Luther King Jr. Blvd. Rep. Andrew Carlson (DFL) District: 50B St Paul, MN 55155 557 Rev. Dr. Martin Luther King Jr. Blvd. 651-296-4257 St Paul, MN 55155 Email: [email protected] 651-296-4218 @mohamudnoor Email: [email protected] @AndrewCarlsonMN Rep. Jay Xiong (DFL) District: 67B 423 Rev. Dr. Martin Luther King Jr.