2015 Annual Report; and 1.3 There Are Reasonable Grounds to Believe That the Company Will Be Able to Pay Its Debts As and When They Become Due and Payable

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2015 Annual Results 19 August 2015 Agenda

2015 Annual Results 19 August 2015 Agenda • Merger update and strategic focus Angus McNaughton • Financial results Richard Jamieson Angus McNaughton Richard Jamieson • Portfolio performance Chief Executive Officer CFO and EGM Investments Stuart Macrae • Development update Jonathan Timms • FY16 focus and guidance Stuart Macrae Jonathan Timms Angus McNaughton EGM Leasing EGM Development 2 Merger update and strategic focus Angus McNaughton Cranbourne Park, VIC Merger benefits on track with a strong platform for growth • Strategic focus remains unchanged • Operational cost synergies on track • Over 60% of operational cost savings1 already locked in • Merger financing savings achieved1 with over $100m lower cost • Weighted average cost of debt reduced to 4.2% • Integration is on program • Key operational teams finalised and team co-locations underway • Solid FY15 performance • Statutory net profit of $675.1m • Underlying earnings up 6.2%2 • Development pipeline increased to $3.1b and current projects on or ahead of plan The Myer Centre Brisbane, QLD 1. On a run-rate or annualised basis. 2. On an aggregate basis. 4 Strategic focus remains unchanged Retail real estate • We will own, manage and develop Australian retail assets across the spectrum • Portfolio composition will evolve as developments occur and asset recycling continues Operational excellence • High performance intensive asset management approach • Continuous improvement of systems and processes • Strongly committed to responsible investment and sustainability • Development of a fully -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

2017 Annual Report

19 September 2017 The Manager Market Announcements Office Australian Securities Exchange Dear Manager, 2017 ANNUAL REPORT Attached is the Wesfarmers Limited 2017 Annual Report. A copy of the report will be sent by mid-October 2017 to those shareholders who have elected to receive a copy. The report is also available on the company’s website www.wesfarmers.com.au. Yours faithfully, LJ KENYON COMPANY SECRETARY For personal use only Wesfarmers Annual 2017 Report 2017 Annual Report Delivering value today and tomorrow For personal use only The primary objective of Wesfarmers is to provide a satisfactory return to its shareholders. About Wesfarmers About this report From its origins in 1914 as a Western This annual report is a summary Wesfarmers is committed to reducing Australian farmers’ cooperative, of Wesfarmers and its subsidiary the environmental footprint associated Wesfarmers has grown into one of companies’ operations, activities and with the production of the annual Australia’s largest listed companies. financial position as at 30 June 2017. In report and printed copies are only With headquarters in Western Australia, this report references to ‘Wesfarmers’, posted to shareholders who have its diverse business operations ‘the company’, ‘the Group’, ‘we’, ‘us’ and elected to receive a printed copy. This cover: supermarkets, liquor, hotels ‘our’ refer to Wesfarmers Limited (ABN report is printed on environmentally and convenience stores; home 28 008 984 049) unless otherwise stated. responsible paper manufactured under improvement; department stores; ISO 14001 environmental standards. References in this report to a ‘year’ office supplies; and an Industrials are to the financial year ended division with businesses in chemicals, 30 June 2017 unless otherwise stated. -

Aurizon Debt Investor Roadshow December 2016

Aurizon Debt Investor Roadshow December 2016 “Aurizon – Australia’s largest rail freight operator” Pam Bains – VP Network Finance (Network CFO) David Collins – VP Finance & Group Treasurer Further information is available online at www.aurizon.com.au Important notice No Reliance on this document This document was prepared by Aurizon Holdings Limited (ACN 146 335 622) (referred to as “Aurizon” which includes its related bodies corporate). Whilst Aurizon has endeavoured to ensure the accuracy of the information contained in this document at the date of publication, it may contain information that has not been independently verified. Aurizon makes no representation or warranty as to the accuracy, completeness or reliability of any of the information contained in this document. Document is a summary only This document contains information in a summary form only and does not purport to be complete and is qualified in its entirety by, and should be read in conjunction with, all of the information which Aurizon files with the Australian Securities Exchange. Any information or opinions expressed in this document are subject to change without notice. Aurizon is not under any obligation to update or keep current the information contained within this document. Information contained in this document may have changed since its date of publication. No investment advice This document is not intended to be, and should not be considered to be, investment advice by Aurizon nor a recommendation to invest in Aurizon. The information provided in this document has been prepared for general informational purposes only without taking into account the recipient’s investment objectives, financial circumstances, taxation position or particular needs. -

Attention ASX Company Announcements Platform. Lodgement of Open Briefing

Attention ASX Company Announcements Platform. Lodgement of Open Briefing. Wesfarmers Limited Wesfarmers House 40 The Esplanade Perth Western Australia 6000 Date of Lodgement: 17-Nov-2004 Title: Open Briefing. Wesfarmers. Briefing Day Discussion The content of this Open Briefing reflects management and analyst discussion at the Wesfarmers Briefing Day held in Sydney on Thursday November 11, 2004. General Corporate Issues corporatefile.com.au Wesfarmers seems to be a little more conservative than other companies on the macro outlook for some of its industries. BHP, for example, seems a lot more bullish. Is there a risk Wesfarmers misses out on some good projects if you are too conservative? Michael Chaney, CEO Wesfarmers We often think about this issue and we’re continually reviewing our assumptions but I’m confident that we haven’t been too conservative. I believe that our assumptions are broadly similar to companies such as BHP for example. Projects or companies are often valued differently by different parties because of strategic considerations rather than different pricing assumptions. Although we have missed opportunities over the years, we’ve still recorded the highest TSR on the ASX over 20 years. Investors should be confident with our management team because we have entrenched and strict valuation disciplines and methodologies. We’ll miss out on more opportunities but enough opportunities should come up to maintain our shareholder returns. corporatefile.com.au Coal prices will fall at some stage. Will that influence you to take a more conservative stance on dividends in the next couple of years in order to avoid the possibility of having to cut dividends after coking prices fall? 1 Michael Chaney I don’t think so because that would be inconsistent with our dividend policy which is to always pay out 100% of our franking credits. -

Amazon Coming to a Car Yard Near You: Cole

Amazon coming to a car yard near you: Cole Digital ‘story teller’ Jeff Cole, right, with David Evans. ‘Eventually (Jeff Bezos) will sell every new automobile in North America’ October 7, 2018 By DAMON KITNEY, STUART McEVOY Amazon could be set to transform another industry He calls himself a “story teller” of the digital world. His clients think he can see into the future. Jeffrey Cole has spent more than three decades advising governments and many of the world’s largest and most successful companies on their digital strategies. In Australia those companies have included Telstra, Wesfarmers, Westpac and the other big banks. Amazon coming to a car yard near you: Cole !2 These days he is a member of the investment committee of the listed Evans & Partners Global Disruption Fund, which now has over $400 million under management and ambitions to grow that to $1 billion in the short to medium term. The fund has just completed an $8m capital raising to provide liquidity for new unit holders. Ask Cole the next industry in the world to be “Amazoned” — that is, disrupted and transformed by Jeff Bezos’s global tech colossus — and his answer is instant. “I think eventually he will sell every new automobile in North America. A lot of manufacturers feel they are saddled to their dealers. A lot of them now want to get rid of the dealer relationship. Tesla, for instance, does not have dealerships. I think you will see Amazon go to manufacturers and say ‘Get out of the dealership business’, and turn the dealerships into service centres,’’ the fast-talking American tells The Australian during a visit to Australia from his US base. -

Discontinued Label Templates

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw -

2019 Annual Report 1 2019 the YEAR in REVIEW

Wesfarmers Annual Report Annual Wesfarmers 2019 2019 WESFARMERS ANNUAL REPORT ABOUT WESFARMERS ABOUT THIS REPORT All references to ‘Indigenous’ people are intended to include Aboriginal and/or From its origins in 1914 as a Western This annual report is a summary Torres Strait Islander people. Australian farmers’ cooperative, Wesfarmers of Wesfarmers and its subsidiary Wesfarmers is committed to reducing the has grown into one of Australia’s largest companies’ operations, activities and environmental footprint associated with listed companies. With headquarters in financial performance and position as at the production of this annual report and Perth, Wesfarmers’ diverse businesses in this 30 June 2019. In this report references to printed copies are only posted to year’s review cover: home improvement; ‘Wesfarmers’, ‘the company’, ‘the Group’, shareholders who have elected to receive apparel, general merchandise and office ‘we’, ‘us’ and ‘our’ refer to Wesfarmers a printed copy. This report is printed on supplies; an Industrials division with Limited (ABN 28 008 984 049), unless environmentally responsible paper businesses in chemicals, energy and otherwise stated. manufactured under ISO 14001 fertilisers and industrial safety products. Prior References in this report to a ‘year’ are to environmental standards. to demerger and divestment, the Group’s the financial year ended 30 June 2019 businesses also included supermarkets, unless otherwise stated. All dollar figures liquor, hotels and convenience retail; and are expressed in Australian -

Download (4Mb)

University of Warwick institutional repository: http://go.warwick.ac.uk/wrap A Thesis Submitted for the Degree of PhD at the University of Warwick http://go.warwick.ac.uk/wrap/72955 This thesis is made available online and is protected by original copyright. Please scroll down to view the document itself. Please refer to the repository record for this item for information to help you to cite it. Our policy information is available from the repository home page. University of Warwick Doctoral Thesis Buyer-Seller Relations, Prices and Development: A Structural Approach Exploring the Garment Sector in Bangladesh Supervisor: Author: Prof. Christopher Woodruff Julia Cajal Grossi and Prof. Gregory Crawford A thesis submitted in fulfilment of the requirements for the degree of Doctor of Philosophy in the Department of Economics June 2015 Declaration of Authorship I, Julia Cajal Grossi, declare that this thesis titled, `Buyer-Seller Relations, Prices and Development: A Structural Approach Exploring the Garment Sector in Bangladesh' and the work presented in it are my own. I confirm that: This work was done wholly or mainly while in candidature for a research degree at this University. Where any part of this thesis has previously been submitted for a degree or any other qualification at this University or any other institution, this has been clearly stated. Where I have consulted the published work of others, this is always clearly at- tributed. Where I have quoted from the work of others, the source is always given. With the exception of such quotations, this thesis is entirely my own work. I have acknowledged all main sources of help (Please, see AppendixK with details on specific contributions to this thesis). -

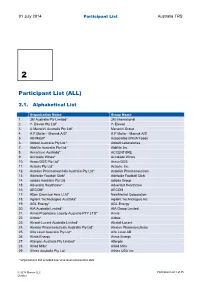

Participant List (ALL)

01 July 2014 Participant List Australia TRS 2 Participant List (ALL) 2.1. Alphabetical List Organization Name Group Name 1. 3M Australia Pty Limited* 3M International 2. 7- Eleven Pty Ltd* 7- Eleven 3. A Menarini Australia Pty Ltd* Menarini Group 4. A P Moller - Maersk A/S* A P Moller - Maersk A/S 5. AB Mauri* Associated British Foods 6. Abbott Australia Pty Ltd.* Abbott Laboratories 7. AbbVie Australia Pty Ltd.* AbbVie Inc 8. Accenture Australia* ACCENTURE 9. Accolade Wines* Accolade Wines 10. Acrux DDS Pty Ltd* Acrux DDS 11. Actavis Pty Ltd* Actavis, Inc. 12. Actelion Pharmaceuticals Australia Pty Ltd* Actelion Pharmaceuticals 13. Adelaide Football Club* Adelaide Football Club 14. adidas Australia Pty Ltd adidas Group 15. Adventist Healthcare* Adventist Healthcare 16. AECOM* AECOM 17. Afton Chemical Asia LLM* NewMarket Corporation 18. Agilent Technologies Australia* Agilent Technologies Inc 19. AGL Energy* AGL Energy 20. AIA Australia Limited* AIA Group Limited 21. Aimia Proprietary Loyalty Australia PTY LTD* Aimia 22. Airbus* Airbus 23. Alcatel-Lucent Australia Limited* Alcatel-Lucent 24. Alexion Pharmaceuticals Australia Pty Ltd* Alexion Pharmaceuticals 25. Alfa Laval Australia Pty Ltd* Alfa Laval AB 26. Alinta Energy Alinta Energy 27. Allergan Australia Pty Limited* Allergan 28. Allied Mills* Allied Mills 29. Allnex Australia Pty Ltd Allnex USA Inc. * Organisations that provided executive level remuneration data © 2014 Mercer LLC Participant List 1 of 35 October 01 July 2014 Participant List Australia TRS Organization Name Group Name 30. Alphapharm* Alphapharm 31. Alstom Ltd* Alstom 32. Amadeus IT Pacific Pty Ltd* Amadeus SAS 33. Ambulance Victoria * Ambulance Victoria 34. AMD Australia Advanced Micro Devices 35. -

![[2015] Qirc 044](https://docslib.b-cdn.net/cover/4252/2015-qirc-044-2974252.webp)

[2015] Qirc 044

QUEENSLAND INDUSTRIAL RELATIONS COMMISSION CITATION: Re: National Retail Association Limited, Union of Employers [2015] QIRC 044 PARTIES: National Retail Association Limited, Union of Employers (Applicant) CASE NO: TH/2014/9 PROCEEDING: Application to amend Order - Trading Hours Non- Exempt Shops Trading by Retail - State (Mt Isa Area) DELIVERED ON: 9 March 2015 HEARING DATES: 24, 25 November 2014 16 January 2015 (Applicant Submissions) 19 February 2015 (Respondent Submissions) MEMBER: Deputy President Swan ORDERS : 1. The Application is dismissed. CATCHWORDS: INDUSTRIAL LAW - TRADING HOURS ORDER - Application to amend trading hours order - Inspections - Opposition from Master Grocers Australia - Strong consumer opposition to Application - Various Surveys conducted - Members of Parliament opposition to Application - Limited local support for Application except for 1 Survey and evidence of Commerce North West Support - No evidence from Mt Isa City Council. CASES: Trading (Allowable Hours) Act 1990 s 21, s 26 APPEARANCES: Mr J. Franken, for National Retail Association Limited, Union of Employers, the Applicant. Mr D Sztrajt, for Master Grocers Australia Limited. Decision [1] This Application is made by the National Retail Association Limited, Union of Employers (NRA) to amend the Trading Hours - Non-Exempt Shops Trading by Retail - State (the Order) pursuant to s 21 of the Trading (Allowable Hours) Act 1990 (Act) in the Mt Isa Area. [2] The Application seeks the amendment to the order as follows: 2 1. By inserting the following new provisions in clause 3.2 of the Order as follows: (31) Mt Isa Area Opening Time Closing Time Monday to Friday 8.00 am 9.00 pm Saturday 8.00 am 5.00 pm Sunday 9.00 am 6.00 pm Public Holidays (as defined) 8.30 am 5.30 pm Excluding Good Friday, 25 April, Labour Day, 25 December 2. -

Australian Official Journal Of

Vol: 21 , No. 22 7 June 2007 AUSTRALIAN OFFICIAL JOURNAL OF TRADE MARKS Did you know a searchable version of this journal is now available online? It's FREE and EASY to SEARCH. Find it at http://pericles.ipaustralia.gov.au/ols/epublish/content/olsEpublications.jsp or using the "Online Journals" link on the IP Australia home page. The Australian Official Journal of Designs is part of the Official Journal issued by the Commissioner of Patents for the purposes of the Patents Act 1990, the Trade Marks Act 1995 and Designs Act 2003. This Page Left Intentionally Blank (ISSN 0819-1808) AUSTRALIAN OFFICIAL JOURNAL OF TRADE MARKS 7 June 2007 Contents General Information & Notices IR means "International Registration" Amendments and Changes Application/IRs Amended and Changes ...................... 7624 Registrations/Protected IRs Amended and Changed ................ 7626 Registrations Linked ............................... 7620 Applications for Extension of Time ...................... 7624 Applications for Amendment .......................... 7624 Applications/IRs Accepted for Registration/Protection .......... 7134 Applications/IRs Filed Nos 1176566 to 1178864 ............................. 7105 Applications/IRs Lapsed, Withdrawn and Refused Lapsed ...................................... 7627 Withdrawn..................................... 7628 Refused ...................................... 7628 Australian Competition and Consumer Commission Matters Initial Assessment Given by the ACCC ....................... 7633 Assignments, Transmittals and Transfers