Some Major Payment Processors Support Acceptance of Apple Pay Online and on Mobile in the Applicable Countries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Set up an Easy Payment Gateway

SCIENCE & TECHNOLOGY AUSTRALIA NICK YOUNGSON / ALPHA STOCK SET UP AN EASY PAYMENT GATEWAY DO YOU NEED A QUICK, EASY AND COST-EFFECTIVE WAY TO TAKE CREDIT CARD PAYMENTS ONLINE AND OVER THE PHONE? There are many ways in which your members or stakeholders can make payments for member dues, events registrations and other activities online. With so many payment gateways available it can be a task to choose a provider, as it’s not one size fits all. This How-To is designed to help you identify and implement the most suitable payment gateway for your operational needs. Payment gateways are fantastic way to manage your members’ or stakeholders’ credit card data, ensuring that financial transactions with your organisation are easy and secure. So how do you go about deciding what you need, which provider to choose and how to get it up and running? THE VERY FIRST STEP IS TO IDENTIFY YOUR NEEDS: Are you looking for simple payment options to take credit card payments over the phone? Most payment gateway providers allow you to manually enter credit cards for payment, however this is not best practice. This method is generally considered insecure, carries privacy implications, and comes with a higher fraud risk. It can also result in double handling, meaning a loss of productivity for staff or volunteers. Are you looking for a payment option that integrates with your website, or a hosted service? An integrated service sits within your website and allows people to make payments directly on the same page as the product, membership or service they are purchasing. -

Eway Integration with Keap Strengthens As Preferred Payments Provider

Eway Integration With Keap Strengthens as Preferred Payments Provider Aug 31, 2021 BRISBANE, Australia, Aug. 31, 2021 /PRNewswire/ -- Leading ecommerce payments provider Eway has finalised an agreement with CRM platform Keap that will see Eway become the preferred payment provider for its customers in Australia and New Zealand. Keap provides sales and marketing automation software to entrepreneurial small businesses and incorporates invoicing and payments to help customers get paid. Eway's payments gateway has been integrated into the Keap platform enabling consultants, coaches & trailblazers to easily and securely accept one-off or recurring credit card payments directly in the Keap app. Eway Australia and New Zealand Managing Director Bob Lowe said, "We're delighted to extend our partnership with Keap through this agreement as a local payments partner. "Our locally-based support network, fast onboarding, low rates and fast settlements are helping small and medium businesses get paid on time, with lower administration costs, and providing a seamless payment experience for their customers." Scott Martineau, Keap co-founder said, "With Eway's payments integration, Keap customers will get paid faster while spending less time chasing payments and more time running their businesses. "Eway is a fantastic partner and we're excited that our customers benefit from additional ways to get paid and at the same time have access to a dedicated local support team." For more information, visit: https://keap.com/payment-partner/eway Since launching in 1998, Eway has become a dominant player in the Australian and New Zealand ecommerce payments space. It's core mission is to make secure online payments effortless for our partners and their customers. -

Part 2 Set up Shop Build and Launch an E-Commerce Website

PART 2 SET UP SHOP BUILD AND LAUNCH AN E-COMMERCE WEBSITE Our definitive guide to selling online ] smarter.telstra.com.au [ POWERED BY TELSTRA INTRODUCTION You’ve done your homework, ordered your stock, selected a shipping provider and chosen an e-commerce platform to power your new online business. If you’re ready to build your The first e-book outlined the research e-commerce website, this e-book and preparation needed to plan your is for you. e-commerce business. The journey Our Definitive Guide is the second in continues here, turning your e-commerce a three-part series, mapping every business plan into an online reality. stage of your e-commerce journey In the third part, you’ll learn how to from idea to launch, and beyond. promote your new e-commerce website, to attract and keep more customers. Time to start building! TECHNICAL TERMS EXPLAINED BY STAY ON TRACK WITH THE TEAM AT NETO [DOWNLOAD NOW] OUR HANDY CHECKLIST 1. WEBSITE DESIGN Your website only has a few seconds to make the right impression before visitors click the back button. Thankfully, you don’t have to be a design genius to have a great-looking site! EXPLORE CURRENT CHOOSE A DESIGN CUSTOMISE TRENDS IN TEMPLATE YOUR DESIGN E-COMMERCE DESIGN Many e-commerce platforms Make the design your own by adding Make a note of your favourite online come with a large library of design your logo and images. Your template retailers. Why do you like them? templates. For a fee, some will help may also have settings to adjust the What would you like to replicate? you to integrate a design template layout, colour scheme and more to from elsewhere. -

Client Service Agreement Terms and Conditions

Client Service Agreement Terms and Conditions Version 1 Hong Kong Eway Terms and Conditions Recitals 1. Eway is the owner of trademarks, patents, trade secrets, copyrights, processes, know how, registered designs or other Intellectual Property and provides payment gateway services to online merchants. 2. Eway has agreed to grant You with access to the Site, the Services, and use of certain Intellectual Property and Confidential Information as set out in this Agreement. 3. All products of Eway or an affiliate including the Eway website, payment processing pages and online documentation (collectively, the “Services”) are subject to the Terms and Conditions stated below. 4. By the use of the Site or the Services You agree to be bound by this Agreement. If You do not agree to the Terms and Conditions set out below You must not use the Site or the Services. 1. Interpretation – Definitions 1.1 In these Terms and Conditions, the following terms have the following meanings: “Account” means Your user name and identifying particulars supplied to Eway at the commencement of this Agreement. “Anniversary Date” means an anniversary of the Commencement Date. “Agreement” means this agreement as amended from time to time including schedules and terms included by reference. “Business” means all activities associated with on-line gateway transactions including purchases and refunds and includes development of the Site, the Services and Intellectual Property. “Cardholder” means the person acquiring goods or services from You and payment for the goods or services is processed through use of the Services. “Cardholder Data” means information supplied by You to Eway about the Cardholder, including but not limited to the Cardholder’s name, credit card details, address and contact details. -

Country Specific Features

Country Specific Features March 15, 2017 2016.2 General Notices Sample Code NetSuite Inc. may provide sample code in SuiteAnswers, the Help Center, User Guides, or elsewhere through help links. All such sample code is provided “as is” and “as available,” for use only with an authorized NetSuite Service account, and is made available as a SuiteCloud Technology subject to the SuiteCloud Terms of Service at www.netsuite.com/tos. NetSuite may modify or remove sample code at any time without notice. No Excessive Use of the Service As the Service is a multi-tenant service offering on shared databases, customers may not use the Service in excess of limits or thresholds that NetSuite considers commercially reasonable for the Service. If NetSuite reasonably concludes that a customer’s use is excessive and/or will cause immediate or ongoing performance issues for one or more of NetSuite’s other customers, NetSuite may slow down or throttle such customer’s excess use until such time that the customer’s use stays within reasonable limits. If a customer’s particular usage pattern requires a higher limit or threshold, then the customer should procure a subscription to the Service that accommodates a higher limit and/ or threshold that more effectively aligns with the customer’s actual usage pattern. Integration with Third Party Applications NetSuite may make available to Customer certain features designed to interoperate with third party applications. To use such features, Customer may be required to obtain access to such third party applications from their providers, and may be required to grant NetSuite access to Customer’s account(s) on such third party applications. -

Online Payments Options

STRATEGY What you need to know about popular The table below outlines some of the key facts users need to know about nine of the most popular online payment gateways. The options listed here are by no means exhaustive. A product’s inclusion should not be regarded as an endorsement by Chartered online payment options for you and your clients. Accountants Australia and New Zealand. Information included in this guide has come from the relevant vendors or associated websites. Product/ Upfront costs Ongoing costs Certified partners Where is the data stored? Transaction fees Accepted payments Direct debit Recurring Do you Company facility payments allow split facility payments on invoices? Pinch None. None. Transaction fees only. Xero, Intuit and Reckon in the accounting Azure cloud servers within Australia. 2.5% + A$0.30 for credit card transactions and 1% + A$0.30 for direct debit bank account American Express, Mastercard, Visa, Yes. Yes. Coming very Payments software space and referral partnerships transactions. Volume discussions can be had. and bank account direct debit options soon. with bookkeepers and software available. integration specialists. Windcave None. A$30 per month or Xero, Shopify, WooCommerce, Magento, New Zealand. Australia – A$0.30 + 1.7% (Mastercard/Visa). American Express, Account2Account, No. Yes. No. NZ$30 per month. Chargify. New Zealand – NZ$0.30 + 2.8% (Mastercard/Visa). Alipay, Discover, Diners, Mastercard, Most pricing is on application and depends on volume. PayPal, UnionPay, Visa, WeChat Pay. GoCardless None. Depends on business size. Self Over 200 billing and subscription software Cloud. Self serve – 1% + A$0.40 per transaction. -

Payments and Payment Processing

Payments and Payment Processing September 9, 2020 2020.2 Copyright © 2005, 2020, Oracle and/or its affiliates. All rights reserved. This software and related documentation are provided under a license agreement containing restrictions on use and disclosure and are protected by intellectual property laws. Except as expressly permitted in your license agreement or allowed by law, you may not use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish, or display any part, in any form, or by any means. Reverse engineering, disassembly, or decompilation of this software, unless required by law for interoperability, is prohibited. The information contained herein is subject to change without notice and is not warranted to be error- free. If you find any errors, please report them to us in writing. If this is software or related documentation that is delivered to the U.S. Government or anyone licensing it on behalf of the U.S. Government, then the following notice is applicable: U.S. GOVERNMENT END USERS: Oracle programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, delivered to U.S. Government end users are "commercial computer software" pursuant to the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, use, duplication, disclosure, modification, and adaptation of the programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, shall be subject to license terms and license restrictions applicable to the programs. No other rights are granted to the U.S. Government. This software or hardware is developed for general use in a variety of information management applications. -

12 January 2012

QUARTERLY UPDATE & APPENDIX 4C Sydney, 31 July 2015: Mint Payments (ASX: MNW) (“Mint” or “the Company”) today reported its cash flow for the quarter ended 30 June 2015. Operating Cash Receipts of $681,000 reflects an increase of 28% from the previous quarter. At the end of the quarter, the Company had total available funds of $5.4 million (excluding Placement funds of $4 million and proceeds from the Share Purchase Plan, both announced subsequent to the end of the June quarter on 21 July 2015). SUCCESSFUL COMPLETION OF PLACEMENT & SHARE PURCHASE PLAN On 21 July 2015, the Company announced that it had completed a placement to a strategic investor, Vix Investments Limited (as manager for Utilico Investments Limited LON: UIL) (“Placement”). The Placement was made pursuant to s708 (11) of the Corporations Act 2001, to raise $4,000,000. Vix Investments Limited is a global Fintech investor specialising in the payments sector. Other current and recent Vix portfolio investments in the payments sector locally include the recently ASX listed Touchcorp (ASX: TCH), on-line identity verification experts Vix Verify, mobile recharge and payments provider Fusion Payments, international student payments specialist Cohort Solutions, virtual card payments processor Optal, and transport ticketing/payments solutions provider Vix Technology. The Company also recently announced a Share Purchase Plan (“SPP”) for existing shareholders at the same price as the Placement. The amount raised by the SPP will be capped at $1,000,000. The funds raised by the Placement and SPP combined with existing cash and available funds, will be used to pursue growth opportunities for the Company through the execution of the Company’s omni-channel payments strategy, entry into select Asia-Pacific markets and general working capital. -

Payment Methods Report 2019 Innovations in the Way We Pay

Insights into Payments Payment Methods Report 2019 Innovations in the Way We Pay Endorsement partners: Key media partner: Payment Methods Report 2019 Innovations in the Way We Pay Contact us For inquiries on editorial opportunities please contact: Email: [email protected] To subscribe to our newsletters, click here For general advertising information, contact: Mihaela Mihaila Email: [email protected] RELEASE VERSION 1.0 JUNE 2019 COPYRIGHT © THE PAYPERS BV ALL RIGHTS RESERVED TEL: +31 20 893 4315 FAX: +31 20 658 0671 MAIL: [email protected] Management Summary The fourth edition of our Payment Methods Report presents the latest updates, trends, and innovations in the way people pay in an omnichannel world. By providing insightful content, we aim to keep our readers updated with the latest dynamics of the payments industry, an industry that is continually evolving at a rapid pace. There is a lot of interest into what is new in (e)commerce payments, and the results of a Worldpay report show it clearly: overall, ecommerce is expected to surpass USD 4.6 trillion globally by 2022, with 140 online payment methods in use today. According to the report, e-wallets have gained a lot of popularity thanks to the seamless experience they provide. Online banking payments are also in the spotlight, as they are convenient for both consumers and merchants, while cash is still king at the POS. As more studies like this have appeared, it has become clear to us that an in-depth approach to the status of payment methods and innovations in the way people pay would be useful. -

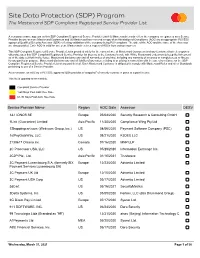

Mastercard SDP Compliant Registered Service Provider List

Site Data Protection (SDP) Program The Mastercard SDP Compliant Registered Service Provider List A company’s name appears on this SDP Compliant Registered Service Provider List if (i) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers and (ii) Mastercard has received a copy of an Attestation of Compliance (AOC) by an appropriate PCI SSC approved Qualified Security Assessor (QSA) reflecting validation of the company being PCI compliant. The date of the AOC and the name of the Assessor are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This SDP Compliant Registered Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this SDP Compliant Registered Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the SDP Compliant Registered Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a PCI SSC approved QSA provides a “snapshot” of security controls in place at a point in time. -

Artisan Consulting Has Worked with the Following Financial Services Organisations to Improve How They Manage Customer Relationships Using Salesforce® Products

Optimising Customer Information Management FOR THE FINANCIAL SERVICES INDUSTRY Let’s build something better Artisan Consulting has worked with the following Financial Services Organisations to improve how they manage customer relationships using Salesforce® products. Representative Case Studies where Artisan has helped organisations in the Financial Services Industry include: https://www.oliverhume.com.au/ https://www.lendi.com.au/ https://www.racv.com.au/ https://australia.bmsgroup.com/ Sales Cloud, Experience Cloud Sales Cloud, Service Cloud, Experience Sales Cloud, Service Cloud, Experience Sales Cloud, Service Cloud, Marketing Cloud Cloud, Integration and Marketing Clouds Cloud (Pardot) Oliver Hume is a property developer and fund manager who uses Salesforce to Lendi operates an Online Home Loan RACV provides a wide range of services BMS Australia is a specialist insurance manage property developments. Platform and uses Salesforce to manage for members include home and motor broker providing policies to allied health Artisan provided Salesforce Architecture, broker relationships and loan insurance policies through a JV with IAG. professionals in Australia and NZ. applications. Program Governance and Development Artisan provided Architecture, Artisan delivered the first greenfield Services during the period 2015-2018 Artisan performed a Technical Audit Development, Consulting and DevOps implementation which went live in 2020 including work on Commission followed by work to enhance how resources during the period 2017-2020. which included integration to UCP. Management and Trust Accounting. customer data was managed. (no longer operating) https://www.eway.com.au/ https://www.ezidebit.com/ https://www.mebank.com.au/ Salesforce Services Sales Cloud, Experience Cloud, Financial Sales Cloud, Service Cloud, Experience Sales Cloud, Service Cloud, Experience Sales Cloud, Service Cloud Services Cloud Cloud, Shield Cloud. -

GLOBAL PAYMENTS INC. (Exact Name of Registrant As Specified in Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended May 31, 2016 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-16111 GLOBAL PAYMENTS INC. (Exact name of registrant as specified in charter) Georgia 58-2567903 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: 770-829-8000 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange Title of each class on which registered Common Stock, No Par Value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.