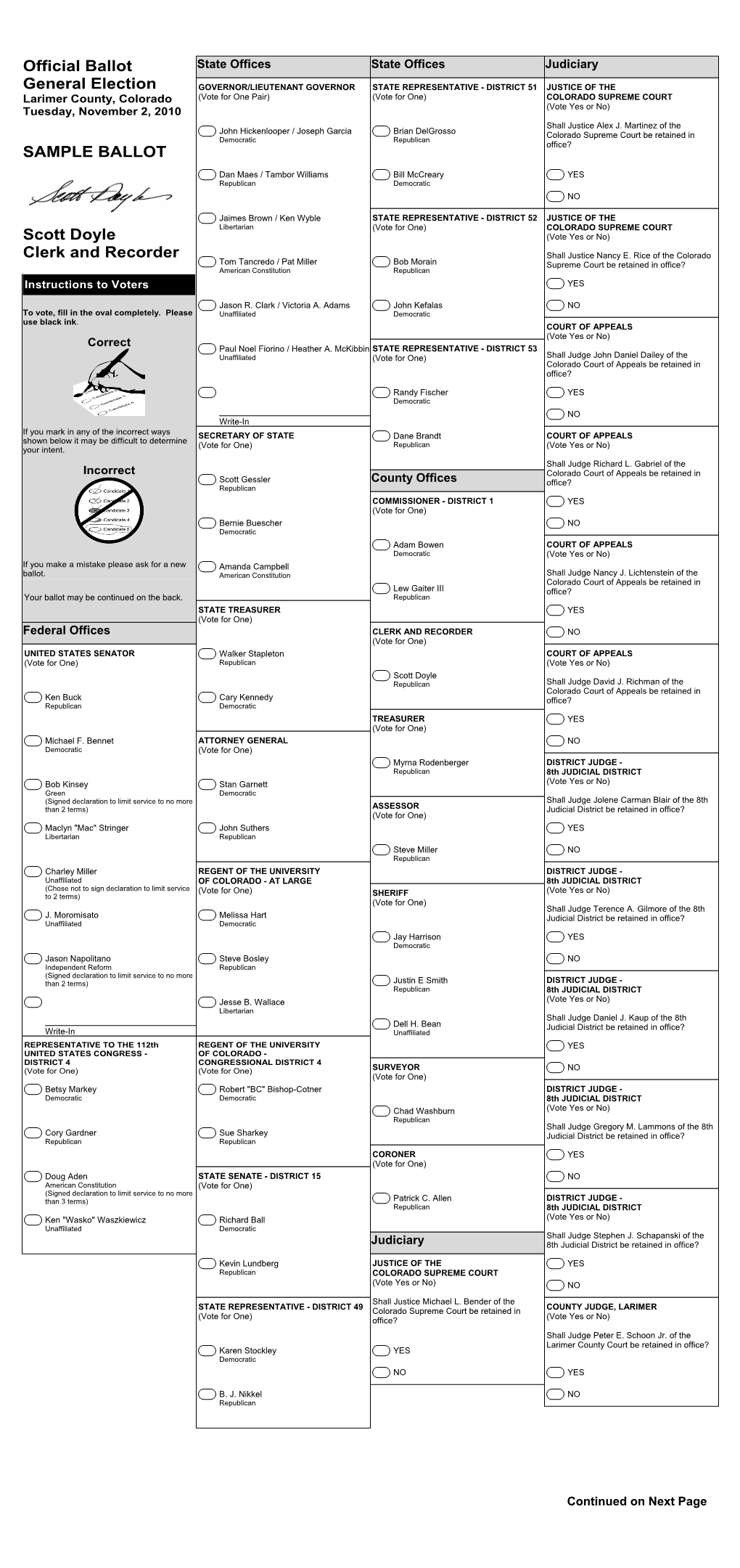

2010 General Election

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ROCKY FLATS PLANT COMMUNITY RELATIONS PLAN Environmental Restoration Program

! DRAFT ROCKY FLATS PLANT COMMUNITY RELATIONS PLAN Environmental Restoration Program U S Department of Energy Rocky Flats Plant Golden, Colorado January 1991 ADMlN RECORD January 22, 19% -1 . TABLE OF CONTENTS Page A Overview 1 B Site Description 4 C Community Background 13 D Objectives 20 E Community Relations Activities 21 Appendix A List of Contacts and Interested Parties Appendix B IAG List of Rocky Flats Plant Hazardous Substances Appendix C Community Interview Plan Appendix D Information Repositories and Suggested Locations for Public Meetings Appendix E Public Comment Opportunities Appendix F List of Acronyms and Glossary of Terms Appendix G References Figure 1 General Location of the Rocky Flats Plant figure 2 Surface Water Drainage Patterns at the Rocky Flats Plant Figure 3 Location of Ground Water contamination at the Rocky Flats Plant in 1989 Figure 4 Location of Ground Water Monitoring Wells at the Rocky Flats Plant in 1989 \ \ ROCKY FLATS PLANT COMMUNITY RELATIONS PLAN Rocky Flats Plant, Golden, Colorado A Overview The Rocky Flats Plant Communrty Relatrons Plan describes the mechanisms through which the Rocky Flats Plant near Golden, Colorado, will inform and involve the public in environmental restoration and related environmental activities at the facility Community interest in the plant has increased over the years since operations began in 1952 Current interest in plant activities is high, particularly concerning environmental and health issues, and public comments indicate that interest will likely remain high throughout -

2012 Political Contributions

2012 POLITICAL CONTRIBUTIONS 2012 Lilly Political Contributions 2 Public Policy As a biopharmaceutical company that treats serious diseases, Lilly plays an important role in public health and its related policy debates. It is important that our company shapes global public policy debates on issues specific to the people we serve and to our other key stakeholders including shareholders and employees. Our engagement in the political arena helps address the most pressing issues related to ensuring that patients have access to needed medications—leading to improved patient outcomes. Through public policy engagement, we provide a way for all of our locations globally to shape the public policy environment in a manner that supports access to innovative medicines. We engage on issues specific to local business environments (corporate tax, for example). Based on our company’s strategy and the most recent trends in the policy environment, our company has decided to focus on three key areas: innovation, health care delivery, and pricing and reimbursement. More detailed information on key issues can be found in our 2011/12 Corporate Responsibility update: http://www.lilly.com/Documents/Lilly_2011_2012_CRupdate.pdf Through our policy research, development, and stakeholder dialogue activities, Lilly develops positions and advocates on these key issues. U.S. Political Engagement Government actions such as price controls, pharmaceutical manufacturer rebates, and access to Lilly medicines affect our ability to invest in innovation. Lilly has a comprehensive government relations operation to have a voice in the public policymaking process at the federal, state, and local levels. Lilly is committed to participating in the political process as a responsible corporate citizen to help inform the U.S. -

State Election Results, 1992

To: Citizens of Colorado From: Natalie Meyer, Secretary of State Subject: 1992 Abstract of Votes I am pleased to publish the 1992 Abstract of Votes Cast which provides as complete a picture of Colorado voting behavior as our data will provide. Compiled from material filed at our office, this publication profiles the voting patterns of Colorado voters in the presidential primary, primary and the general election. Some 1,597,186 electors exercised their voice at the polls in November 1992. This abstract is dedicated to those who realize that every ·voice is critical and counted in determining the direction of local and national governmental affairs. Our system of government would cease to exist without a concerned constituency who participates at every level of the electoral process. 1 TABLE OF CONTENTS PAGE Glossary of Abstract Terms 1 Directory of Elected and Appointed Officials 2 Presidential Primary Election 42 Primary Election Abstract U.S. Senate 48 U.S. Congress 51 State Board of Education 55 Regents of the University of Colorado 56 State Senate 59 State Representative 63 District Attorneys 80 General Election Abstract Presidential Electors 86 U.S. Senate 88 U.S. Congress 90 State Board of Education 91 Regents of the University of Colorado 93 State Senate 94 State Representative 96 District Attorneys 106 RTD District Directors 110 Moffat Tunnel Commissioners 112 Judicial 113 Ballot Issues 126 Registered Voters{furnout 142 ii iii GLOSSARY OF ABSTRACT TERMS Assembly Meeting of delegates of a political party held to designate candidates for nomination at a primary election. Assemblies are held every two years. -

Abstract of Votes Cast Which Provides As Complete a Picture of Colorado Voting Behavior As Our Data Will Provide

1 PRESIDENTIAL PRIMARY ELECTION Marcli 3, 1992 primary”election August 11, 1992 GENERAL ELECTION Published by NATALIE MEYER Elections and Licensing Division Office of the Secretary of State 1560 Broadway, Suite 200 Phone (303) 894-2680 Natalie Meyer, Secretaiy of State ^ Merilyn Handley, Deputy Secretary of State Donetta Davidson, Elections Officer Michele Burton, Staff Assistant II ; PRICE: $6.00 To: Citizens of Colorado From: Natalie Meyer, Secretary of State Subject: 1992 Abstract of Votes I am pleased to publish the 1992 Abstract of Votes Cast which provides as complete a picture of Colorado voting behavior as our data will provide. Compiled from material filed at our office, this publication profiles the voting patterns of Colorado voters in the presidential primary, primary and the general election. Some 1,597,186 electors exercised their voice at the polls in November 1992. This abstract is dedicated to those who realize that every voice is critical and counted in determining the direction of local and national governmental affairs. Our system of government would cease to exist without a concerned constituency who participates at every level of the electoral process. 1 11 TABLE OF CONTENTS PAGE Glossary of Abstract Terms 1 Directory of Elected and Appointed Officials 2 Presidential Primary Election 42 Primary Election Abstract U.S. Senate 48 U.S. Congress 51 State Board of Education 55 Regents of the University of Colorado 56 State Senate 59 State Representative 63 District Attorneys 80 General Election Abstract Presidential Electors 86 U.S. Senate 88 U.S. Congress 90 State Board of Education 91 Regents of the University of Colorado 93 State Senate 94 State Representative 96 District Attorneys 106 RTD District Directors 110 Moffat Tunnel Commissioners 112 Judicial 113 Ballot Issues 126 Registered Voters/Tumout 142 111 Gl.OSSAKY OF ABSTRACT TERMS Assrubly Meciing of delegates of a political party held to designate candidates for nomination at a primary election. -

2010-2019 Election Results-Moffat County 2010 Primary Total Reg

2010-2019 Election Results-Moffat County 2010 Primary Total Reg. Voters 2010 General Total Reg. Voters 2011 Coordinated Contest or Question Party Total Cast Votes Contest or Question Party Total Cast Votes Contest or Question US Senator 2730 US Senator 4681 Ken Buck Republican 1339 Ken Buck Republican 3080 Moffat County School District RE #1 Jane Norton Republican 907 Michael F Bennett Democrat 1104 JB Chapman Andrew Romanoff Democrat 131 Bob Kinsley Green 129 Michael F Bennett Democrat 187 Maclyn "Mac" Stringer Libertarian 79 Moffat County School District RE #3 Maclyn "Mac" Stringer Libertarian 1 Charley Miller Unaffiliated 62 Tony St John John Finger Libertarian 1 J Moromisato Unaffiliated 36 Debbie Belleville Representative to 112th US Congress-3 Jason Napolitano Ind Reform 75 Scott R Tipton Republican 1096 Write-in: Bruce E Lohmiller Green 0 Moffat County School District RE #5 Bob McConnell Republican 1043 Write-in: Michele M Newman Unaffiliated 0 Ken Wergin John Salazar Democrat 268 Write-in: Robert Rank Republican 0 Sherry St. Louis Governor Representative to 112th US Congress-3 Dan Maes Republican 1161 John Salazar Democrat 1228 Proposition 103 (statutory) Scott McInnis Republican 1123 Scott R Tipton Republican 3127 YES John Hickenlooper Democrat 265 Gregory Gilman Libertarian 129 NO Dan"Kilo" Sallis Libertarian 2 Jake Segrest Unaffiliated 100 Jaimes Brown Libertarian 0 Write-in: John W Hargis Sr Unaffiliated 0 Secretary of State Write-in: James Fritz Unaffiliated 0 Scott Gessler Republican 1779 Governor/ Lieutenant Governor Bernie Buescher Democrat 242 John Hickenlooper/Joseph Garcia Democrat 351 State Treasurer Dan Maes/Tambor Williams Republican 1393 J.J. -

Colorado 2018 Primary Election Results and Analysis

June 27, 2018 Colorado 2018 Primary Election Results and Analysis Colorado held its primary election last night, setting the stage for the November general election where Walker Stapleton (R) and Jared Polis (D) will compete to replace term-limited Gov. John Hickenlooper (D). In all the statewide races, substantially more votes were cast in Democratic primary contests than in Republican races. Figures from the secretary of state’s office indicate that, as of midnight, 1,158,700 voters had returned their mail-in ballots, a number that represents more than 30 percent of the state’s total registered voters. Ballots are still being processed, with July 5 being the last day for military and overseas ballots to arrive and the last day for a voter to cure a missing signature or signature discrepancy. Even without the final numbers, it is clear that voter turnout was up significantly from the 2016 primary election when only 21 percent of the electorate participated—an all-time low. This year’s high primary turnout was due in part to Colorado’s new law allowing unaffiliated voters to participate for the first time. Of the 1,158,700 ballots tallied thus far, 280,958 were cast by unaffiliated voters, 412,411 by Republicans and 465,331 by Democrats. Ballots cast in the Democratic primary for governor exceeded those cast in the Republican primary by more than 100,000. This difference was consistent in congressional and state legislative races as well. In a state with voter registration roughly even among Republican, Democrat and unaffiliated voters, this trend is notable and may reflect intensity. -

Colorado Political Climate Survey Topline Election Report

Colorado Political Climate Survey Topline Election Report October 2018 Carey E. Stapleton E. Scott Adler Anand E. Sokhey Survey Lead Director Associate Director About the Study: American Politics Research Lab The American Politics Research Lab (APRL) is housed in the Department of Political Science at the University of Colorado Boulder. APRL is a non-partisan academic unit that supports basic research, educational activities, and public engagement on issues related to American politics. Lab faculty, student fellows, and affiliates pursue scholarly activities over a broad range of topics, utilizing a wide variety of research methodologies and analysis. Current lab projects include research on political behavior, state and local politics, and political agendas and recurring legislation in the U.S. Congress. The Lab is also home to the annual Colorado Political Climate Survey. APRL hosts a seminar series that includes talks by lab associates as well as distinguished scholars doing work related to the study of American politics. Colorado Political Climate Survey In October 2018, the American Politics Research Lab (APRL) conducted the third annual Colorado Political Climate (CPC) survey. The CPC is a survey of the political and policy attitudes of Coloradans. The study is designed to gauge the public’s political and partisan leanings, their opinions on a number of key issues facing the state, their attitudes toward major statewide and national political figures, and the outlook for the 2018 election. Methodology The sample is representative of registered voters in Colorado. It consists of 800 individual responses and has an overall margin of error of +/- 3.5%. The margin of error for subgroups is larger due to smaller sample sizes. -

2014 Report of Political Financial Support

2014 2014 Lilly Political Contributions As a biopharmaceutical company that treats serious diseases, Lilly plays an important role in public health and its related policy debates. It is important that our company shapes global public policy debates on issues specific to the people we serve and to our other key stakeholders including shareholders and employees. Our engagement in the political arena helps address the most pressing issues related to ensuring that patients have access to needed medications—leading to improved patient outcomes. Through public policy engagement, we provide a way for all of our locations globally to shape the public policy environment in a manner that supports access to innovative medicines. We engage on issues specific to local business environments (corporate tax, for example). Based on our company’s strategy and the most recent trends in the policy environment, our company has decided to focus on three key areas: innovation, health care delivery, and pricing and reimbursement. More detailed information on key issues can be found in our 2014 Corporate Responsibility Update. Through our policy research, development, and stakeholder dialogue activities, Lilly develops positions and advocates on these issues. Government actions such as price controls, pharmaceutical manufacturer rebates, and access to Lilly medicines affect our ability to invest in innovation. Lilly has a comprehen- sive government relations operation to have a voice in the public policymaking process at the federal, state, and local levels. Lilly is committed to participating in the political process as a responsible corporate citizen to help inform the U.S. debate over health care and pharmaceutical innovation. -

Credit Unions Get out the Vote (Cu Gotv)

CREDIT UNIONS GET OUT THE VOTE (CU GOTV) CANDIDATE INFO Redistricting Notice: Listed below are candidates in districts throughout the entire state. Due to redistricting, you may be voting for candidates in districts which are new to you. For additional information please visit Find my district Congressional District 1 Diana DeGette (Democrat) PO Box 61337 Denver CO 80206 Currently serves as Representative in Congressional District 1 http://www.degette.com/ Twitter Richard Murphy (Republican) 20140 E. 40th Ave. Denver CO 80249 Twitter Danny Stroud (Republican) 5650 W. Quincy Avenue, Unit 5 Denver CO 80235 [email protected] http://dannystroudforcongress.com/ Twitter Congressional District 2 Kevin Lundberg (Republican) PO Box 643 Loveland CO 80539 [email protected] http://lundberg2012.com/ Twitter Facebook Jared Polis (Democrat) 2208 Pearl Street Boulder CO 80302 Currently serves as Representative in Congressional District 2 [email protected] http://www.polisforcongress.com/ Twitter Facebook Eric Weissmann (Democrat) PO Box 18082 Boulder CO 80308 http://ericweissmann.com/ YouTube Twitter Facebook Congressional District 3 Gregory Gilman (Libertarian) 12391 County Road 255 Westcliffe CO 81252 http://www.gilman2010.com/ Facebook Gaylon Kent (Libertarian) 40255 Riverbend Trail Steamboat Springs CO 80487 http://thefreedomtrain.com/ Sal Pace (Democrat) PO Box 1510 Pueblo CO 81002 [email protected] http://www.paceforcolorado.com/ Twitter Facebook Scott Tipton (Republican) P.O. Box 1582 Cortez CO 81321 Currently serves as Representative in Congressional District 3 [email protected] http://votetipton.com/ Twitter Facebook Congressional District 4 Doug Aden (Constitutional ) 6708 County Road 41 Fort Lupton CO 80621 http://dougaden.com/ Cory Gardner (Republican) P.O. Box 2408 Loveland CO 80539 Currently serves as Representative in Congressional District 4 http://www.corygardner.com/ Brandon Shaffer (Democrat) P.O. -

December 7-8, 2017 Hilton Denver Inverness Hotel • Englewood #HIHC17 Hotel Map

Informing Policy. Advancing Health Leading Through the Divide December 7-8, 2017 Hilton Denver Inverness Hotel • Englewood #HIHC17 Hotel Map WiFi Instructions Locate and connect to the network named Hilton Denver Inverness. You should be taken to a login page in your browser. Scroll down past sign-in and click on the Guest WiFi Connect button, then click “I have a promotional code.” Enter the code hotissues2017. Happy surfing! Livestreaming We will be livestreaming portions of the conference for those who are unable to join us in person. Interested viewers may find the video stream on CHI’s website, coloradohealthinstitute.org. Welcome to Hot Issues in Health. We have heard a lot this year about all that Gold Sponsors, Anthem Blue Cross and Blue divides us – politics, race, gender, income and Shield and the Colorado Hospital Association; geography. our Silver Sponsor, UnitedHealthcare; and our Bronze Sponsor, COPIC. The health world is coping with divides as well. Despite much progress over the past decade, We are grateful to the elected officials joining health outcomes and access to care still us at this forum, including state legislators, depend a great deal on a person’s social and county commissioners, city council members economic circumstances. And every day we and candidates for important positions deal with gaps between the public and private throughout our state. Your presence sends a sectors, the rapid pace of technology and the strong message about your commitment to slow, deliberate speed of public policy. health in Colorado. This year’s Hot Issues in Health conference My colleagues at the Colorado Health Institute confronts these divides and seeks to bridge have been working for months to bring you the gaps. -

Senate Journal-1St Day-January 10, 2018 Page 1 SENATE JOURNAL 1

Senate Journal-1st Day-January 10, 2018 Page 1 SENATE JOURNAL 1 Seventy-first General Assembly 2 STATE OF COLORADO 3 Second Regular Session 4 5 6 1st Legislative Day Wednesday, January 10, 2018 7 8 9 10 Prayer By the chaplain, Pastor David Almanzar, Cañon Community Baptist Church, Cañon City. 11 12 Presentation Mile High Honor Guard - Technical Sergeant Scott Chambers, 140th Medical Group; 13 of Colors Technical Sergeant Diana Westfall, 140th Force Support Squadron; Airman First Class 14 Jeffrey Harris, 460th Contracting Squadron; and Airman First Class Jordan Kuwada, 15 566 Intelligence Squadron. 16 17 Pledge of By Douglas County Sheriff's Deputy Victor J. Holbert. 18 Allegiance 19 20 Musical By Laura, Kayla, Aria, and Alyssa Saunders of Arvada, performing "The Star-Spangled 21 Presentation Banner". 22 23 Call to The hour of 10:00 a.m. having arrived, the Second Regular Session of the Senate of the 24 Order Seventy-First General Assembly of the State of Colorado, pursuant to law, was called to 25 order by Senator Kevin J. Grantham, President of the Senate of the Seventy-First General 26 Assembly of the State of Colorado. 27 ____________ 28 29 Roll Call Present--35 30 31 Quorum The President announced a quorum present. 32 33 ____________ 34 35 36 Election of On motion of Majority Leader Holbert, Effie Ameen was nominated to serve as Secretary 37 Secretary of the Senate during the Second Regular Session of the Seventy-First General Assembly. 38 The motion was adopted by a unanimous vote. 39 40 Oath of The President administered the oath of office to Effie Ameen, Secretary of the Senate. -

2010 Arapahoe County General Election Sample Ballot

CONGRESSIONAL STATE REPRESENTATIVE COURT OF APPEALS 2010 Arapahoe DISTRICT 36 REPRESENTATIVE TO THE (Vote for One) ( Vote Yes or No) 112th UNITED STATES CONGRESS Gary Marshall Republican Shall Judge John Daniel County DISTRICT 7 Dailey of (Vote for One) Su Ryden Democratic the Colorado Court of Appeals General Ed Perlmutter STATE REPRESENTATIVE Democratic DISTRICT 37 be retained in office? (Vote for One) Shall Judge Richard L. Gabriel Election Spencer Swalm Republican of the Colorado Court of Ryan Frazier Appeals be retained in office? Republican Brett Godfrey Democratic Shall Judge Nancy J. Sample Ballot Lichtenstein of the STATE REPRESENTATIVE Colorado Court of Buck Bailey DISTRICT 38 Libertarian (Vote for One) Appeals be retained in (Signed declaration to limit office? All contests may not service to no more than 3 terms) Joe Rice Democratic STATE Shall Judge David J. be included on all Kathleen Conti Republican Richman of the Colorado GOVERNOR / Court of Appeals be LIEUTENANT GOVERNOR STATE REPRESENTATIVE ballots. Check on (Vote for One Pair) DISTRICT 39 retained in office? (Vote for One) John Hickenlooper DISTRICT JUDGE your precinct for Carol "Casey" Levine Democratic Joseph Garcia Democratic 18th JUDICIAL specific contests. David Balmer Republican DISTRICT ( Vote Yes or No) Dan Maes STATE REPRESENTATIVE Republican Tambor Williams DISTRICT 40 Shall Judge Angela R. FEDERAL (Vote for One) Arkin of the 18th Judicial UNITED STATES SENATOR Jaimes Brown Cindy Acree Republican District be retained in (Vote for One) Ken Wyble Libertarian office? (Write-In) Shall Judge Richard Ken Buck th Republican Tom Tancredo STATE REPRESENTATIVE B.Caschette of the 18 American Constitution DISTRICT 41 Judicial District be Pat Miller (Vote for One) retained in office? Michael F.