News Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Geoscience BC and Island Coastal Economic Trust Announce the Northern Vancouver Island Exploration Geoscience Project

Geoscience BC and Island Coastal Economic Trust Announce the Northern Vancouver Island Exploration Geoscience Project Geoscience BC and the Island Coastal Economic Trust (ICET) are pleased to announce the funding of the Northern Vancouver Island (NVI) Exploration Geoscience Project. Geoscience BC’s Board has approved $530,000 for project activities, which is being matched by $400,000 from ICET, for a total project budget of $930,000. In addition, the Ministry of Jobs, Tourism and Innovation has provided generous support for stakeholder engagement in the project development phase, through the Campbell River Regional Economic Pilot initiative. “This project was a definite priority coming out of the recent Regional Economic Investment Pilot in Campbell River,” said Pat Bell, B.C. Minister of Jobs, Tourism and Innovation. “It’s easy to see why because mining presents tremendous opportunity for job creation in B.C. and for the north Vancouver Island. The data being collected is essential to moving forward and delivering on the potential for job creation in the region.” The NVI Exploration Geoscience Project will generate new geoscience data for northern Vancouver Island, near the communities of Campbell River, Port Hardy, Port McNeill, Alert Bay, Port Alice and Zeballos. This new regional information will help attract mineral exploration interest and investment, increase the understanding of the mineral potential, and provide local First Nations and communities with more information on the geology of the region. “On behalf of the Board of Directors of the Island Coastal Economic Trust, I am pleased to participate in the announcement for this project, which is the Trust's first opportunity in the mining sector,” said Camela Tang, ICET Vice Chair. -

MUNICIPAL INSPECTOR with the DISTRICT of PORT HARDY

MUNICIPAL INSPECTOR with the DISTRICT OF PORT HARDY Located on the northern most tip of beautiful Vancouver Island, Port Hardy is a wilderness paradise that invites both locals and tourists to “Live the Adventure.” From its traditional resource-based “roots” to today’s emerging eco-tourism, green energy and aquaculture sectors, the region remains committed to maintaining a wholesome, unspoiled natural environment for its 4,132 (2016 census) residents and three neighbouring First Nations bands. The District offers contract building inspection services to Port McNeill, Port Alice and Coal Harbour making this position diverse. In recent years, the cost of construction in Port Hardy has increased with new development occurring and major renovations to key facilities including the Airport, RCMP office and the installation of a new Coast Guard Depot on the horizon. The District is a great place to work with a strong support team of staff and managers. The District is seeking an individual to fill the role of Municipal Inspector, a position that is responsible for: • Processing applications for building permits related to new construction and alterations / renovations / additions / relocation / demolition to/of existing buildings and structures; • Examining and reviewing building plans, drawings and applicable documentation to ensure conformity with bylaws, codes (Building, Fire and Plumbing) and related standards; • Inspecting buildings and properties to ensure compliance with bylaws, codes and standards; • Enforcement of the Provincial Fire -

C02-Side View

FULTON RESERVOIR REGULATING BUILDING ACCESS STAIR REPLACEMENT REFERENCE ONLY FOR DRAWING LIST JULY 30, 2019 Atlin ● Atlin Atlin C00 COVER L Liard R C01 SITE PLAN C02 SIDE VIEW Dease Lake ● Fort ine R ● S1.1 GENERAL NOTES AND KEY PLAN kkiii Nelson tititi SS S3.1 DETAILS SHEET 1 S3.2 DETAILS SHEET 2 S3.3 DETAILS SHEET 2 Stewart Fort St ●Stewart Hudson’s John Williston Hope John L ● New Dawson● Creek Dixon upert Hazelton ● ● ● Entrance cce R Mackenzie Chetwynd iiinn Smithers ● Terrace Smithers Masset PrPr ● ● ● ● ● Tumbler Ridge Queen ttt Kitimat Houston Fort Ridge iii Kitimat ●Houston ● ● Charlotte sspp Burns Lake ● St James dds Burns Lake San Fraser R ●● a Fraser Lake ● ● Fraser R Haida Gwaii HecateHecate StrStr Vanderhoof ● Prince George McBride Quesnel ● Quesnel ● ● Wells Bella Bella ● Valemount● Bella Bella ● Bella Williams Valemount Queen Coola Lake Kinbasket Charlotte ● Kinbasket L Sound FraserFraserFraser R RR PACIFIC OCEAN ColumbiaColumbia ●100 Mile Port House Hardy ● ● Port McNeill Revelstoke Golden ●● Lillooet Ashcroft ● Port Alice Campbell Lillooet RR Campbell ● ● ● ● River Kamloops Salmon Arm ● Vancouver Island Powell InvermereInvermere ●StrStr Whistler Merritt ●Vernon Nakusp Courtenay ●River ● ● ●Nakusp ● Squamish Okanagan Kelowna Elkford● Port ofofSechelt ● ●Kelowna Alberni G ● L Kimberley Alberni eeoror Vancouver Hope Penticton Nelson ● Tofino ● ● giagia ● ● ● ● ee ● ● ● Castlegar Cranbrook Ucluelet ● oo ● ksvillvillm o● ●Abbotsford Osoyoos Creston Parks aim ● ●Trail ●Creston Nan mithithith ●Sidney Ladys ●Saanich JuanJuan -

The Corporation of the Village of Alert

THE CORPORATION OF THE VILLAGE OF ALERT BAY 15 Maple Road- Bag Service 2800, Alert Bay, British Columbia V0N 1A0 TEL: (250)974-5213 FAX: (250) 974-5470 Email: [email protected] Web: www.alertbay.ca REGULAR MEETING OF COUNCIL AGENDA MONDAY OCTOBER 24, 2016 AT 7:00 PM IN THE COUNCIL CHAMBERS OF THE MUNICIPAL HALL 1. CALL TO ORDER: 2. ADOPTION OF AGENDA: 3. INTRODUCTION OF LATE ITEMS: 4. DELEGATIONS/PETITIONS/PRESENTATIONS: a) CHERYL AND ART FARQUHARSON – VARIANCE REQUEST 5. ADOPTION OF MINUTES: a) MINUTES OF THE REGULAR MEETING OF SEPTEMBER 12, 2016 b) MINUTES OF THE REGULAR MEETING OF SEPTEMBER 26, 2016 6. OLD BUSINESS AND BUSINESS ARISING FROM THE MINUTES: 7. CORRESPONDENCE FOR INFORMATION: a) VISITOR CENTRE NETWORK STATISTICS SEPTEMBER 2016 b) AMBULANCE SERVICE IMPACT ON COMMUNITY 8. CORRESPONDENCE FOR ACTION: 9. NEW BUSINESS: a) REQUEST FOR DECISION – COMMUNITY NEWSLETTER PRINTING COSTS b) REQUEST FOR DECISION – FIRE HALL SOLAR INSTALLATION 10. STAFF REPORTS: a) ADMINISTRATION AND PUBLIC WORKS REPORT 11. BYLAWS/POLICIES: 12. COUNCIL REPORTS: 13. QUESTION PERIOD: 14. NEXT SCHEDULED MEETING DATE: NOVEMBER 14, 2016 15. ADJOURNMENT: THE CORPORATION OF THE VILLAGE OF ALERT BAY V/J % Bag Service 2800, Alert Bay, British Columbia VON 1A0 TEL: (250) 974-5213 FAX: (250) 974-5470 RT BAY nan:ALEornlc xumxwmu DELEGATIONREQUESTFORM Name of erson or gro up ishing to appear: Ciel?!Ezrgyaffo/1 Subje (Refpresentation : W farm/6 Purpose of presentation information only requesting a policy change her (provide details) Contact pe rson (if different than above): Telephone s’i(n«2AL,¢ EmailAddress: e Will you be providing supporting documentation? :iYes No If yes: handouts at meeting publication in agenda (must be received by 5:00pm the Thursday prior to the ‘ meeting Technical requirements: Please indicate the items you will require for your presentation. -

2007/08 Human and Social Services Grant Recipients (PDF)

Gaming Policy and Enforcement Branch 2007/08 Direct Access Grants - Human and Social Services City Organization Name Payment Amount 100 Mile House 100 Mile House Food Bank Society $ 40,000.00 100 Mile House Cariboo Family Enrichment Centre Society 22,146.00 100 Mile House Educo Adventure School 22,740.00 100 Mile House Rocky Mountain Cadets #2887 - Horse Lake Training Centre 7,500.00 100 Mile House South Cariboo SAFER Communities Society 136,645.00 Abbotsford Abbotsford Community Services 25,000.00 Abbotsford Abbotsford Hospice Society 73,500.00 Abbotsford Abbotsford Learning Plus Society 16,000.00 Abbotsford Abbotsford Restorative Justice & Advocacy Association 28,500.00 Abbotsford Abbotsford Youth Commission 63,100.00 Abbotsford BC Schizophrenia Society - Abbotsford Branch 36,000.00 Abbotsford Fraser Valley Youth Society 5,000.00 Abbotsford Hand In Hand Child Care Society 75,000.00 Abbotsford John MacLure Community School Society 18,500.00 Abbotsford Jubillee Hall Community Club 20,000.00 Abbotsford Kinsmen Club of Abbotsford 7,000.00 Abbotsford L.I.F.E. Recovery Association 30,000.00 Abbotsford PacificSport Regional Sport Centre - Fraser Valley 50,000.00 Abbotsford Psalm 23 Transition Society 20,000.00 Abbotsford Scouts Canada-2nd Abbotsford 6,900.00 Abbotsford St. John Society-Abbotsford Branch 10,000.00 Abbotsford The Center for Epilepsy and Seizure Education BC 174,000.00 Abbotsford Upper Fraser Valley Neurological Society 28,500.00 Agassiz Agassiz Harrison Community Services 44,000.00 Aldergrove Aldergrove Lions Seniors Housing -

Community Paramedicine Contacts

Community Paramedicine Contacts ** NOTE: As of January 7th, 2019, all patient requests for community paramedicine service should be faxed to 1- 250-953-3119, while outreach requests can be faxed or e-mailed to [email protected]. A centralized coordinator team will work with you and the community to process the service request. For local inquiries, please contract the community paramedic(s) using the station e-mail address identified below.** CP Community CP Station Email Address Alert Bay (Cormorant Island) [email protected] Alexis Creek [email protected] Anahim Lake [email protected] Ashcroft [email protected] Atlin [email protected] Barriere [email protected] Bella Bella [email protected] Bella Coola [email protected] Blue River [email protected] Boston Bar [email protected] Bowen Island [email protected] Burns Lake [email protected] Campbell River* [email protected] Castlegar [email protected] Chase [email protected] Chemainus [email protected] Chetwynd [email protected] Clearwater [email protected] Clinton [email protected] Cortes Island [email protected] Cranbrook* [email protected] Creston [email protected] Dawson Creek [email protected] Dease Lake [email protected] Denman Island (incl. Hornby Island) [email protected] Edgewood [email protected] Elkford [email protected] Field [email protected] Fort Nelson [email protected] Fort St. James [email protected] Fort St. John [email protected] Fraser Lake [email protected] Fruitvale [email protected] Gabriola Island [email protected] Galiano Island [email protected] Ganges (Salt Spring Island)* [email protected] Gold Bridge [email protected] Community paramedics also provide services to neighbouring communities and First Nations in the station’s “catchment” area. -

Rumble Sheet July 2021

The Village of Port Alice RUMBLE SHEET Municipal Office Newsletter August Deadline is July 26th July 2021 Inside…. Village Municipal Office News………...2-4 Community Centre Wildlife Information…………………….....5 Health Services & Information……….….6 Religious Services Community Messages…….….……….7-11 Community Services & Business…12-13 For Sale or Rent………………...………..14 Thursday July 1st All Village buildings and yards will be closed for the Statutory Holiday. Let us all do our part to keep Port Alice clean and beautiful. Please put your garbage and pet waste into the garbage cans provided throughout town. Thank you View the Rumble Sheet online: http://portalice.ca/village-office/rumble-sheets www.portalice.ca Municipal Office News MAYOR'S CORNER Village Council Meetings JULY 2021 Council Meetings are held the 2nd & Here comes the sun. First day of Summer and soon we should be 4th Wednesday of the month in the mask free. I would like to thank everyone in our Village for their Larry Pepper Room in the patience and understanding through these difficult times. Community Centre at 7:00 pm. Newly retired baby-boomers with a mortgage-free home, love of Agendas are available online or at the outdoors, aversion to traffic and getting to know the neighbors has revitalized Port Alice. Thank you for making this the Village Office for viewing. At this your home. time we may not have public in One of the most interesting changes we are experiencing is the attendance but questions and number of businesses that are opening in our area supporting concerns can be submitted to be the Port Alice community. -

Port Alice's Economic Development Strategy 1

Port of Potential – Port Alice’s Economic Development Strategy 1 Table of Contents Introduction ............................................................................................................................... 6 Purpose of the Port of Potential Strategy ............................................................................... 6 Past reports and plans ............................................................................................................ 7 How was the community involved? ....................................................................................... 8 1. Where are we now? ............................................................................................................ 10 Regional economic context .................................................................................................. 10 2. Where do we want to go? ................................................................................................... 10 Economic vision .................................................................................................................... 10 Objectives ............................................................................................................................. 10 3. How will we get there? ....................................................................................................... 12 How we came up with our actions and strategies ................................................................. 12 Our actions and strategies ................................................................................................... -

2019 Climate Action Revenue Incentive Program (CARIP) Survey

2019 Climate Action Revenue Incentive Program (CARIP) Survey 2019 Climate Action Revenue Incentive Program (CARIP) Survey Overview INTRODUCTION: The 2019 CARIP survey highlights and celebrates local government climate action in British Columbia. Local governments are required to submit the 2019 CARIP/ Carbon Neutral Progress Survey by June 1, 2020. Detailed survey instructions, FAQs and definitions can be found in the CARIP Program Guide for 2019 Claims. Once the survey is complete, please download a copy of your responses (you will be given the download link at the end of the survey). SURVEY CONTENT: 1. Section 1: Local Government Information 2. Section 2: Narrative Focus 2019 Corporate Climate Action2019 Community-wide Climate Action2019 Climate Change Adaptation Action 3. Section 3: 2019 Carbon Neutral Reporting Section 1 – Local Government Information Name of Local Government:* ( ) 100 Mile House, District of ( ) Abbotsford, City of ( ) Alert Bay, The Corporation of the Village of ( ) Anmore, Village of ( ) Armstrong, City of ( ) Ashcroft, The Corporation of the Village of ( ) Barriere, District of ( ) Belcarra, Village of ( ) Bowen Island, Municipality ( ) Burnaby, City of ( ) Burns Lake, The Corporation of the Village of ( ) Cache Creek, Village of ( ) Campbell River, City of ( ) Canal Flats, Village of ( ) Capital Regional District ( ) Cariboo Regional District ( ) Castlegar, City of ( ) Central Coast Regional District ( ) Central Saanich, The Corporation of the District of ( ) Chase, Village of ( ) Chetwynd, District ( ) Chilliwack, -

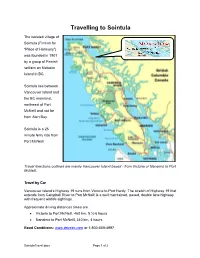

Travelling to Sointula

Travelling to Sointula The isolated village of Sointula (Finnish for “Place of Harmony”) was founded in 1901 by a group of Finnish settlers on Malcolm Island in BC. Sointula lies between Vancouver Island and the BC mainland, northeast of Port McNeill and not far from Alert Bay. Sointula is a 25 minute ferry ride from Port McNeill. Travel directions outlined are mainly Vancouver Island based - from Victoria or Nanaimo to Port McNeill. Travel by Car Vancouver Island’s Highway 19 runs from Victoria to Port Hardy. The stretch of Highway 19 that extends from Campbell River to Port McNeill is a well maintained, paved, double lane highway with frequent wildlife sightings. Approximate driving distances times are: Victoria to Port McNeill, 460 km, 5 ½-6 hours Nanaimo to Port McNeill, 340 km, 4 hours Road Conditions: www.drivebc.com or 1-800-550-4997 SointulaTravel.docx Page 1 of 2 Travel by Air Pacific Coastal Airlines operate daily scheduled flights between the Port Hardy Airport (YZT) and Vancouver Airport’s South Terminal (YVR) with approximately one hour flying time. These flights leave from a smaller, adjacent airport in Vancouver called the South Terminal. A shuttle bus service runs frequently between Vancouver Main Terminal and the South Terminal. Pacific Coastal Airlines: www.pacific-coastal.com or 1-800-663-2872 or 604-273-8666. WestJet has flights to Vancouver (YVR), Victoria (YYJ), Nanaimo (YCD) and Comox (YQQ). WestJet: www.westjet.com or 1-888-937-8538 (1-888-WESTJET) Air Canada has flights to Vancouver (YVR), Victoria (YYJ), Nanaimo (YCD) and Comox (YQQ). -

BC Forest History Newsletter 78

Published by the Forest History Association of British Columbia No. 78 Victoria, British Columbia December 2005 FHABC 2005 AGM REPORT The FHABC’s 2005 AGM was held on September 17th at the Tigh-Na-Mara Resort Spa & Conference Centre in Parksville. The main items of business concerned the newsletter, a web page, our healthy finances, charitable tax status, funding for upcoming publications, and how to raise our profile and promote all aspects of forest history. President Stan Chester reported on the oral history project, the display and book prizes at the ABCFP AGM, and the developments at Green Timbers in Surrey. Mike Apsey updated us on the Forest History Society’s progress in forming a Canadian Chapter and Edo Nyland described the 75th anniversary celebrations of Alberta Sustainable Resource Development and the formation of the Forest History Association of Alberta. Following lunch we relocated to Cathedral Grove in MacMillan Provincial Park, on the highway to Port Alberni. Retired B.C. Provincial Parks forester Kerry Joy was our guide and kindly provided an interesting and informative presentation on the human and natural histories of the park. A written version follows. The current FHABC Executive is as listed in the December 2004 newsletter, number 75. Recycled paper 2 A BRIEF HISTORY OF CATHEDRAL GROVE, MACMILLAN PROVINCIAL PARK by Kerry Joy Let’s start with Cathedral Grove’s origins as a public protected area. In 1886 a wagon road between Nanaimo and Alberni, some 85 km, was completed. It was located on the north side of Cameron Lake. In 1911 the road was relocated to the south side of the lake and a railway was built on the north side. -

Project Comeback

Project Comeback Creating vibrant rural communities by retaining and attracting a young adult population December 2012 – November 2014 Contents Executive Summary................................................................................................................. 3 Introduction............................................................................................................................. 5 Participating Communities ....................................................................................................... 5 Research: Literature Review on Youth Out-Migration .............................................................. 6 Trends in Youth Out-Migration ............................................................................................ 6 Push and Pull Factors ........................................................................................................... 7 Survey Development ............................................................................................................... 8 Survey Results and Community Workshops ............................................................................. 8 Survey Discussion ............................................................................................................... 8 “Youth” ........................................................................................................................... 9 Common Themes ............................................................................................................