THE 13TH ANNUAL GLOBE and MAIL ONLINE BROKERS SURVEY Rob Carrick

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Bankruptcy Court District of Delaware

Case 20-11779-LSS Doc 55 Filed 07/09/20 Page 1 of 19 UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE ------------------------------------------------------------ x In re : Chapter 11 : VIVUS, INC., et al., : Case No. 20–11779 (LSS) : : Debtors.1 : (Joint Administration Requested) ------------------------------------------------------------ x NOTICE OF FILING OF PROPOSED REDACTED VERSION OF THE CREDITOR MATRIX PLEASE TAKE NOTICE that, pursuant to Rule 9018-1(d)(ii) of the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware, VIVUS, Inc. and its debtor affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases, hereby file the attached proposed redacted version of the Creditor Matrix2 with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable are: Vivus B.V. (1942); Vivus Digital Health Corporation (0625); VIVUS, Inc. (6179); and Vivus Pharmaceuticals Limited (9329). The Debtors’ corporate headquarters and service address is 900 E. Hamilton Avenue, Suite 550, Campbell, CA 95008. 2 Contemporaneously herewith, the Debtors have filed the Motion of Debtors for Entry of Order (I) Authorizing Debtors to Redact Certain Personal Identification Information in Creditor Matrix and Certain Other Documents and (II) Granting Related Relief. RLF1 23325296v.1 Case 20-11779-LSS Doc 55 Filed 07/09/20 Page 2 of 19 Dated: July 9, 2020 Wilmington, Delaware /s/ Sarah E. Silveira RICHARDS, LAYTON & FINGER, P.A. Mark D. -

DENIS FRAYCE and MAXWELL WALLACE Plaintiffs

Court File No./N° du dossier du greffe: CV-20-00638868-00CP Court File No.: ONTARIO SUPERIOR COURT OF JUSTICE Electronically issued : 27-Mar-2020 Délivré par voie électroniqueB E T W E E N : Toronto DENIS FRAYCE and MAXWELL WALLACE Plaintiffs - and - BMO INVESTORLINE INC., CIBC INVESTOR SERVICES INC., CREDENTIAL QTRADE SECURITIES INC., DESJARDINS SECURITIES INC., HSBC SECURITIES (CANADA) INC., NATIONAL BANK FINANCIAL INC., QUESTRADE INC., RBC DIRECT INVESTING INC., SCOTIA CAPITAL INC., TD WATERHOUSE CANADA INC., LAURENTIAN BANK SECURITIES INC., and BBS SECURITIES INC. Defendants STATEMENT OF CLAIM Proceeding Under the Class Proceedings Act, 1992 TO THE DEFENDANTS: A LEGAL PROCEEDING HAS BEEN COMMENCED AGAINST YOU by the plaintiff. The claim made against you is set out in the following pages. IF YOU WISH TO DEFEND THIS PROCEEDING, you or an Ontario lawyer acting for you must prepare a statement of defence in Form 18A prescribed by the Rules of Civil Procedure, serve it on the plaintiff’s lawyer or, where the plaintiff does not have a lawyer, serve it on the plaintiff, and file it, with proof of service, in this court office, WITHIN TWENTY DAYS after this statement of claim is served on you, if you are served in Ontario. If you are served in another province or territory of Canada or in the United States of America, the period for serving and filing your statement of defence is forty days. If you are served outside Canada and the United States of America, the period is sixty days. Instead of serving and filing a statement of defence, you may serve and file a notice of intent to defend in Form 18B prescribed by the Rules of Civil Procedure. -

CUSTODIAL AGREEMENTS As of March 31, 2019

Contact: Samantha Duffield Manager, Financial Compliance Phone: (416) 943-4662 Email: [email protected] CUSTODIAL AGREEMENTS The following is an alphabetical listing of prescribed Custodial Agreements executed as of March 31, 2019 between the Mutual Fund Dealers Association of Canada (MFDA), as bare trustee on behalf of Members, and mutual fund companies and other financial institutions, in accordance to the Member Regulation Notice MSN-0058, Acceptable Securities Locations. Please ensure that your assets held are included in the types of products listed by the entity. Fund Manager/ Financial Institution Type of Products 1 1832 Asset Management L.P. Mutual Fund / Hedge Fund / Labour Dynamic Mutual Fund Sponsored Fund / Deposit Accounts 2 Acker Finley Asset Management Inc. Mutual Fund 3 ACM Advisors Ltd. Mortgage Investment Fund 4 Acorn Global Investments Inc. Hedge Fund 5 ADS Canadian Bank GIC’s / High Interest Savings Account 6 AGF Investments Inc. Mutual Fund / Pooled Fund - Acuity Pooled Funds - AGF Pooled Funds - AGF family of mutual funds - AGF Elements family of mutual funds - Harmony family of mutual funds 7 AIP Asset Management Inc. Mutual Fund / Hedge Fund / Limited Partnership 8 AlphaNorth Asset Management Mutual Fund 9 Arrow Capital Management Inc. Investment Products 10 ATB Investment Management Inc. Mutual Fund 11 Aurion Capital Management Inc. Pooled Fund 12 Aventine Management Group Inc. Mutual Fund 13 B2B Bank GIC’s / High Interest Investment Accounts 14 Bank of Montreal GIC’s / High Interest Savings Accounts 15 Bank of Montreal Mortgage Corporation GIC’s 16 Bank of Nova Scotia (The) GIC’s 17 Barometer Capital Management Inc. Mutual Fund / Pooled Fund Doc 110950 Page 1 of 30 Fund Manager/ Financial Institution Type of Products 18 BC Advantage Fund Management Limited Venture Capital Corporation (VCC) Funds 19 B.E.S.T. -

2019 DELEGATE LIST First Name Last Name Organization Niramay

2019 DELEGATE LIST First Name Last Name Organization Niramay . 1985 Chuck Lee AIMCO Stephan Dumais Air Canada Pension Investments Sean McCready Anson Advisors Inc. Hector Fernandez Crespo Banco Santander Enrique Verdu Aguilar Banco Santander, S.A Daryl Blattberg Bank of America Isabel Docal Bank of America Jerry Hubert Bank of America Merrill Lynch Zahir Antia Bank of Canada Harri Vikstedt Bank of Canada Spencer Bailey Bank of Montreal Stéphanie Jules Bank of Montreal Deborah Wise Bank of Montreal Abhinav Chandra Barclays Heather Gidaly Barclays Charles Tacopino Barclays David Jeffrey BBS SECURITIES INC. Nick Hay BlackRock Marc Kitay BMO John Mitrano BMO JINSONG WANG BMO Daniel Antchipalovski BMO Capital Markets Nick Chan BMO Capital Markets Tamy Chen BMO Capital Markets Annaleigh Greene BMO Capital Markets Kimberley Jansen BMO Capital Markets john Loynd BMO Capital Markets Jordan Lupu BMO Capital Markets Pamela Murphy BMO Capital Markets Alina Popa BMO Capital Markets MJ Schuessler BMO Capital Markets Stephanie Stoyan BMO Capital Markets Anthony Venditti BMO Capital Markets 1 of 7 5/22/2019 Melissa Kelman BMO Financial Group Chris Beswick BMO Private Investment Counsel Inc. Kathleen Cooney BNP Paribas Don De Vito BNP Paribas Robert Lakeman BNP Paribas MIKE SAUNDERS BNP PARIBAS Vincent Tieu BNP Paribas Ilkhom Babajanov BNY Mellon Eric Badger BNY Mellon Wesley Cook BNY Mellon Keith Donohue BNY Mellon Cezan Duong BNY Mellon William Kelly BNY Mellon Richard Marquis BNY Mellon Patric Ochoa BNY Mellon Taras Sidorenko BNY Mellon John Templeton BNY Mellon Ted Thresher BNY Mellon Simon Tomlinson BNY Mellon Daniel Yardin BNY Mellon Phil Zywot BNY Mellon Michael Madaio BNY Mellon | Pershing Michael Silecchia BNY Mellon | Pershing Carol Penhale Broadridge Financial Solutions Valarie Thorgerson Broadridge Financial Solutions Inc Mike Airey Broadridge Financial Solutions Inc. -

Online & Database Services | Business Wire

Online & Database Services | Business Wire / Endoscopy SNL Archive SNL Financial SOA world Magazine SocialMedia.com socialpicks.com Soester Anzeiger online Software Residence International SoftwareDev.ITBusinessNet.com SogoTrade.com Sohu Information (mobile) Sohu Weibo (mobile) solarserver.de Solid Waste as well as Recycling SolidEarth.com SolidWaste.com Solinger-Tageblatt.de Sonepar-us.com Sony Electronics, Inc. Sony Photographs Entertainment Inc. Sony Vegas Software South Dakota Enterprise News South Florida Digital City.com Southern Ledger Southern Magazines SouthFlorida.Citybizlist.com Southwest Cyberport Member Services Southwest Securities, Inc. SOXTelevision.com Soyatech LLC SpainByNet.com Spark Management SPDR index spdrindex.com Spear Leeds & Kellogg (REDI & Eagle Software) Spear Leeds & Kellogg Online Specialty Retailers, Inc. SpecialtyFoodAmerica.com Speed411.com SpeedUs.com Spencer Stuart SPIE Spinshell.tv SplitTrader.com Spokane.net Spokesman Review Online SpokesmanReview.com sports-expo.com SportsBusinessDaily.com Sportsmates sportsvenue-technology.com SportsX-ray.com Sprint Nextel Sprint Portal Sprynet Ssanet.biz (Security online News) SSGM St. RoseRadio.com Rouze royalgazette.com RRCN.com RRHHdigital.com RROnline RSE-et-PED rsselectronics RSVP Information RTI International Metals, Inc. RTSMicro.com Rubiconquest Ruby-on-Rails Rukeyser.com RW Baird RWE IT UK Ltd (aka INNOGY) RXCentric - Doctors Net Access RXTimes.com S&P Comstock Online S&P Dividend Department S&P personal Wealth S1/Postilion SacBee.com SacBee.com (The Sacramento Bee) Sacramento Bee Online SafetyOnline.com Safeway Sageware.com SAL DOW DL (Sungard financial Reseller) SAL Economic services Inc. Salary.com Sales On-line Direct SalesForce.com SalesRepCentral.com Saludalia.com SaludaliaMédica.com SaludeOne.com Salynch.com Salzgitter Zeitung online Sam Brown (aka Fall Lane) Samurai Factory Inc. -

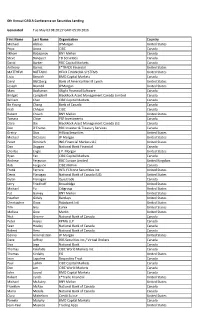

2016 CASLA Delegate List May 3.Xlsx

6th Annual CASLA Conference on Securities Lending Generated Tue May 03 08:20:27 GMT‐05:00 2016 First Name Last Name Organization Country Michael Alchus JPMorgan United States Priya Arora CIBC Canada Ilkhom Babajanov BNY Mellon Canada Steve Banquier TD Securities Canada David Barker RBC Capital Markets Canada Anthony Barros E*TRADE Financial United States MATTHEW BATTAINI HELIX FINANCIAL SYSTEMS United States Livio Bencich BMO Capital Markets Canada Daryl Blattberg Bank of America Merrill Lynch United States Joseph Brambil JPMorgan United States Marc Buchanan 4Sight Financial Software Canada Bridget Campbell BlackRock Asset Management Canada Limited Canada William Chan CIBC Capital Markets Canada Bo Young Chang Bank of Canada Canada Krati Chhajer CIBC Canada Robert Chiuch BNY Mellon United States Tamara Close PSP Investments Canada Clare Dai BlackRock Asset Management Canada Ltd. Canada Don D'Eramo RBC Investor & Treasury Services Canada Greicy Diaz Hilltop Securities United States Michael DiCesare JP Morgan United States Peter Diminich ING Financial Markets LLC United States Dan Duggan National Bank Financial Canada Charles Engle J.P. Morgan United States Ryan Fan CIBC Capital Markets Canada Andrew Ferguson RBC Europe Limited United Kingdom Rob Ferguson CIBC Mellon Canada Frank Ferrara INTL FCStone Securrities Inc United States Denis Flanagan National Bank of Canada (US) United States Dylan Flanagan Questrade Canada Jerry Friedhoff Broadridge United States Michael Fu Citigroup United States Pat Garvey BNY Mellon United States Heather Gidaly Barclays United States Christopher Gioia Rabobank Intl United States Tim Gits Eurex United States Melissa Gow Markit United States Nick Greene National Bank of Canada Canada Peter Hayes KPMG LLP Canada Sean Healey National Bank of Canada Canada Robert Hess National Bank of Canada Canada Genna Himmelstein JP Morgan United States Dave Jeffrey BBS Securities Inc./ Virtual Brokers Canada Siva Jega National Bank Canada Thomas Kalafatis CIBC World Markets Inc. -

Filed by the Lion Electric Company Pursuant to Rule 425 of The

Filed by The Lion Electric Company pursuant to Rule 425 of the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a-12 under the Securities and Exchange Act of 1934, as amended Subject Company: Northern Genesis Acquisition Corp. Commission File No. 001-39451 The following communication was made available by The Lion Electric Company (the “Company”) on its website at https://www.thelionelectric.com/, directing viewers to a webpage on Northern Genesis Acquisition Corp.’s (“NGA”) website at https://www.northerngenesis.com/, on March 24, 2021: The following communication was made available by NGA on its website at http://www.northerngenesis.com/ on March 24, 2021: Your vote matters We encourage you to vote in favor of the business combination with Lion Electric today! Voting is Simple Every vote is important. Regardless of the number of shares you hold, we encourage you to vote and make your voice heard. If you owned Northern Genesis (NYSE: NGA) stock as of the close of business on March 18, 2021, you are entitled to vote and are urged to vote as soon as possible before April 23, 2021. Voting online or via telephone are the easiest ways to vote – and they are both free: Vote Online (Highly recommended): Follow the instructions provided by your broker, bank or other nominee on the Voting Instruction Form mailed (or e-mailed) to you. To vote online, you will need your voting control number, which is included on the Voting Instruction Form. CHECK YOUR EMAIL FOR VOTING! If you hold at Robinhood or Interactive Brokers from g Proxydocs.com For all others check for an email from g Proxyvote.com Vote by Telephone: Follow the instructions provided by your broker, bank or other nominee on the Voting Instruction Form mailed (or e-mailed) to you. -

Name Badges Are Required for Admittance Into All Conference Sessions and Social Events

Please Note: Name badges are required for admittance into all conference sessions and social events. Due to the size of the event and hotel, there will be SECURITY for both the social and business events. Please remember to wear your name badge at all times! If your name does not appear on the attached attendee list you are NOT a registered conference attendee. Only registered attendees with name badges will be admitted into the conference sessions and social events. Please visit the Conference Website or send an email to [email protected] to register today We appreciate your cooperation. Private Events: A private event is an invitation-only outing, dinner party, or reception hosted by an organization or group other than the RMA. Private events are not considered part of the conference agenda and, as such, should not interfere with the conference program or sponsored events. We ask that you support the sponsors of all of the conference events recognizing their financial commitment to the particular events (food/beverage cost) and the conference and please DO NOT plan any conflicting events during Monday, Tuesday, Wednesday or Thursday evenings. If your organization is planning an event for these nights, please plan the start of the event after 7:30 p.m. RMA would also very much appreciate your cooperation in refraining from scheduling any other events, such as golf outings and special tours, during the conference business program Hotel Accommodations Information: Breathtaking Naples beachfront hotel with a tradition of unparalleled luxury and service Marvel at the stunning views from the private balconies and world-class suites at The Ritz-Carlton, Naples. -

In the United States Bankruptcy Court for the District of Delaware

Case 15-10585-LSS Doc 245 Filed 04/21/15 Page 1 of 12 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re: ) Chapter 11 ) Quicksilver Resources Inc., et al.,1 ) Case No. 15-10585 (LSS) ) Debtors. ) Jointly Administered ) )Hearing Date: May 12, 2015 at 10:00 a.m. (EDT) )Obj. Deadline: May 5, 2015 at 4:00 p.m. (EDT) DEBTORS’ APPLICATION FOR ENTRY OF AN ORDER AUTHORIZING THE EMPLOYMENT AND RETENTION OF KPMG LLP AS TAX CONSULTANT NUNC PRO TUNC TO THE PETITION DATE The above-captioned debtors and debtors in possession (collectively, the “Debtors”) seek entry of an order, substantially in the form attached hereto as Exhibit A (the “Proposed Order”), (a) authorizing the Debtors to employ and retain KPMG LLP (“KPMG”) as tax consultant, nunc pro tunc to the Petition Date (as defined herein) pursuant to that certain engagement letter dated February 12, 2015, annexed as Exhibit 1 to Exhibit A (the “Engagement Letter”), by and between KMPG and Quicksilver Resources Inc. (“Quicksilver”); (b) approving the terms of the Engagement Letter; and (c) granting related relief. In support of the Application, the Debtors submit the Declaration of Chuck Thompson (the “Thompson Declaration”), which is attached hereto as Exhibit B. In support of the Application, the Debtors respectfully set forth as follows: 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, are: Quicksilver Resources Inc. [6163]; Barnett Shale Operating LLC [0257]; Cowtown Drilling, Inc. [8899]; Cowtown Gas Processing L.P. -

Includes Comment Letters Received

INCLUDES CSA NOTICE AND REQUEST FOR COMMENT MANDATING A SUMMARY DISCLOSURE DOCUMENT FOR EXCHANGE-TRADED MUTUAL FUNDS AND ITS DELIVERY COMMENT PROPOSED AMENDMENTS TO NATIONAL INSTRUMENT 41-101 GENERAL PROSPECTUS REQUIREMENTS AND TO COMPANION POLICY 41-101CP TO NATIONAL INSTRUMENT 41-101 GENERAL PROSPECTUS REQUIREMENTS AND RELATED CONSEQUENTIAL AMENDMENTS LETTERS June 18, 2015 Introduction The Canadian Securities Administrators (the CSA or we) are publishing for a comment period of 90 days proposed amendments to National Instrument 41-101 General Prospectus Requirements (the Rule), Companion Policy 41-101CP to National Instrument 41-101 General Prospectus RECEIVED Requirements (the Companion Policy) and related consequential amendments to National Instrument 81-106 Investment Fund Continuous Disclosure and Companion Policy 81-106CP to National Instrument 81-106 Investment Fund Continuous Disclosure (the Consequential Amendments). New Form 41-101F4 Information Required in an ETF Facts Document (Form 41-101F4) is part of the Rule. We refer to the proposed amendments to the Rule, the proposed changes to the Companion Policy and the Consequential Amendments together as the Proposed Amendments. The Proposed Amendments are part of Stage 3 of the CSA’s implementation of the point of sale disclosure project (the POS Project). The Proposed Amendments will require mutual funds in continuous distribution, the securities of which are listed and traded on an exchange or an alternative trading system (ETFs), to produce and file a summary disclosure document called “ETF Facts”, which must be made available on the ETF’s or the ETF manager’s website. The Proposed Amendments also introduce a new delivery regime which will require dealers that receive an order to purchase ETF securities to deliver an ETF Facts to investors within two days of the purchase. -

US Asian Wire Distribution Points

US Asian Wire Distribution Points NewMediaWire’s comprehensive US Asian Wire delivers your news to targeted media in the Asian American community. Reaches leading Asian−American media outlets and over 375 trades and magazines dealing with political, finance, education, community, lifestyle and legal issues impacting Asian Americans as well as Online databases and websites that feature or cover Asian−American news and issues and The Associated Press. Please note, NewMediaWire includes free distribution to trade publications and newsletters. Because these are unique to each industry, they are not included in the list below. To get your complete NewMediaWire distribution, please contact your NewMediaWire account representative at 310.492.4001. aahar Newspaper Adhra Pradesh Times Newspaper Afternoon Despatch and Courier Newspaper Agence Kampuchea Press Newspaper Akila Daily Newspaper Algorithmica Japonica Newspaper am730 Newspaper Anand Rupwate Newspaper Andhra News Newspaper Andrha Pradesh Times Newspaper ANTARA News Agency Newspaper ASAHI PASOCOM Newspaper ASAHI SHIMBUN Newspaper Asahi Shimbun Newspaper Asahi Shimbun International Satellite Ed Newspaper Asia Insurance Review Newspaper Asia Pacific Management News Newspaper Asia Source Newspaper ASIA TIMES Newspaper Asian Affairs: An American Review Newspaper Asian American Press Newspaper Asian American Times Online Newspaper Asian Enterprise Magazine Newspaper Asian Focus Newspaper Asian Fortune Newspaper Asian Herald Newspaper Asian Industrial Reporter Newspaper Asian Journal Newspaper -

CUSTODIAL AGREEMENTS As of April 30, 2019

Contact: Samantha Duffield Manager, Financial Compliance Phone: (416) 943-4662 Email: [email protected] CUSTODIAL AGREEMENTS The following is an alphabetical listing of prescribed Custodial Agreements executed as of April 30, 2019 between the Mutual Fund Dealers Association of Canada (MFDA), as bare trustee on behalf of Members, and mutual fund companies and other financial institutions, in accordance to the Member Regulation Notice MSN-0058, Acceptable Securities Locations. Please ensure that your assets held are included in the types of products listed by the entity. Fund Manager/ Financial Institution Type of Products 1 1832 Asset Management L.P. Mutual Fund / Hedge Fund / Labour Dynamic Mutual Fund Sponsored Fund / Deposit Accounts 2 Acker Finley Asset Management Inc. Mutual Fund 3 ACM Advisors Ltd. Mortgage Investment Fund 4 Acorn Global Investments Inc. Hedge Fund 5 ADS Canadian Bank GIC’s / High Interest Savings Account 6 AGF Investments Inc. Mutual Fund / Pooled Fund - Acuity Pooled Funds - AGF Pooled Funds - AGF family of mutual funds - AGF Elements family of mutual funds - Harmony family of mutual funds 7 AIP Asset Management Inc. Mutual Fund / Hedge Fund / Limited Partnership 8 AlphaNorth Asset Management Mutual Fund 9 Arrow Capital Management Inc. Investment Products 10 ATB Investment Management Inc. Mutual Fund 11 Aurion Capital Management Inc. Pooled Fund 12 Aventine Management Group Inc. Mutual Fund 13 B2B Bank GIC’s / High Interest Investment Accounts 14 Bank of Montreal GIC’s / High Interest Savings Accounts 15 Bank of Montreal Mortgage Corporation GIC’s 16 Bank of Nova Scotia (The) GIC’s 17 Barometer Capital Management Inc. Mutual Fund / Pooled Fund Doc 110950 Page 1 of 30 Fund Manager/ Financial Institution Type of Products 18 BC Advantage Fund Management Limited Venture Capital Corporation (VCC) Funds 19 B.E.S.T.