Georgia Lottery 2015 Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Powerball® and Mega Millions® DRAW GAME OVERVIEW Powerball and Mega Millions Are the Two Multijurisdictional, Rolling Jackpot Games Played Across the Nation

IX TEXAS LOTTERY COMMISSION 2020 ANNUAL REPORT AND 2021 – 2022 COMPREHENSIVE BUSINESS PLAN Table of Contents SECTION 1: 2020 ANNUAL REPORT TEXAS LOTTERY COMMISSION Message from the Chairman ............................................................... 4 Message from the Executive Director .................................................. 5 2020 ANNUAL REPORT AND Texas Lottery Commission Overview: History ....................................... 6 2021 – 2022 COMPREHENSIVE BUSINESS PLAN Meet the Commissioners ........................................................................ 7 Texas Model: Management and Organizational Structure ...................... 8 Executive Summary: Commitment to Texans ...................................... 10 Vision, Mission and Core Values ........................................................11 Product Highlights: Scratch Tickets and Draw Games ........................ 12 Draw Game Overview ...................................................................... 14 Sales and Revenue: Product Sales Performance Charts .......................16 Benefiting Texas .............................................................................. 20 Where the Money Goes ......................................................................... 21 SECTION 1: 2020 ANNUAL REPORT Players ........................................................................................... 22 Retailers ......................................................................................... 24 Social Responsibility ....................................................................... -

Review of the Florida Lottery, 2017

January 2018 Report No. 18-01 Review of the Florida Lottery, 2017 at a glance Scope ________________ Lottery transfers to the Educational Enhancement As directed by the Legislature, OPPAGA Trust Fund decreased in Fiscal Year 2016-17 to examined the Department of the Lottery and $1.656 billion or $36 million less than the prior year. assessed options to enhance its earning This decrease is primarily due to lower overall draw 1, 2 game sales and transfers, and appears more capability and improve its efficiency. significant due to a record setting Powerball jackpot ____________ that increased ticket sales for the prior year. Background Several additional game and product distribution The Department of the Lottery generates funds options are available to further increase transfers to for education by selling draw and scratch-off education. However, some options could represent games. Draw games allow players to select from expanded gambling. In addition, the introduction of a range of numbers on a play slip. Draw game new games likely would result in shifts in sales from tickets are printed by terminals that are connected existing games. to the Lottery’s contracted terminal-based gaming The Lottery continues to outperform the legislative system for a drawing at a later time. Scratch-off performance standard for its operating expense rate, games are tickets with removable covering that which is second lowest in the nation. players scratch off to determine instantly whether The Lottery should continue its ongoing efforts to they have won. protect the integrity of the Lottery by The Lottery is self-supporting and receives no . -

Response to Vendor Questions for Request for Proposal for Website

Response to Vendor Questions for Request for Proposal for Website Redesign AND Request for Information for Mobile App Design and Implementation Issued by Multi-State Lottery Association RFP/RFI Date of Issuance: April 19, 2017 Response to Vendor Questions Date of Issuance: May 4, 2017 Proposals to RFP Due May 15, 2017 by no later than 5:00 P.M. CT Responses to RFI Due: May 17, 2017 by no later than 5:00 P.M. CT Summary of Services Requested MUSL is requesting proposals for the design of the PowerballTM website (powerball.com), and possibly associated sub-content for other games. Additionally, MUSL is requesting information on the design, implementation and maintenance of a mobile application for use by players and others interested in the lottery games. Multi-State Lottery Association Websites Redesign Request for Proposal Page 1 of 10 Response to Vendor Questions MULTI-STATE LOTTERY ASSOCIATION Vendors may submit responses to either, or both projects. If you chose to respond to both projects, please submit separate responses. Timeline for the RFP May 1, 2017 - Written questions from interested Vendors due May 5, 2017 - Written responses to Vendor questions and distributed to all Vendors May 15, 2017 - Proposals due Week of May 22, 2017 - Vendor proposal evaluation and selection process June, 2017 - Successful Vendor selected June, 2017 - Contract negotiations June, 2017 - Project kick-off Meeting Timeline for the RFI May 17, 2017 - Information submitted by Vendors interested in the mobile application design Response to Vendor Questions MUSL has reviewed all questions submitted by interested Vendors and made an effort to compile and categorize a distinct list of the questions for which it has a response. -

Managing a Wildfire with a Water Pistol

The Official Publication of the North American Association of State & Provincial Lotteries LotteryMarch Issue 2011 Insights Member Lotteries Profile in Success: 4th Quarter Calendar Sales by Product The Texas Lottery Commission 2009 vs. 2010 by Patricia McQueen, Staff Writer, NASPL Managing a Wildfire with a Water Pistol The Newest “mini” Multi-State Game The Story of Holly Lahti, the Idaho Lottery Decades of Dollars Rolls out in Georgia, and the January Mega Millions Jackpot Kentucky and Virginia by David Workman, Idaho Lottery Public Relations In This Issue Lottery Insights March Issue 2011 From the President NASPL Lottery Leadership Jeff Anderson, Director, Idaho Lottery Institute - Update Page 4 Page 22 Internet Gambling Bill Wins MDI Launches 300th Web NASPL Staff Support from Major Indian Site for a Lottery Customer Gaming Association Page 24 David B. Gale Page 6 Executive Director Intralot Launches Live New Jersey Governor Sitting Presenter Bingo Thomas C. Tulloch Director of Administration on Bill Legalizing Web Betting Page 26 Page 8 Andrew White IGT Launch Triple Bonus (NSI) Project Manager Profile in Success: Spin Roulette™ The Texas Lottery Page 27 Tamika Ligon Program Planning Coordinator Patricia McQueen, Staff Writer, NASPL Page 10 Managing a Wildfire with John Koenig a Water Pistol Graphic Designer Smyrna Boys & Girls Club Receives The Story of Holly Lahti, the Idaho $15,000 in Educational Technology Lottery and the January Mega Janine Hutzell Accounting Courtesy of GTECH Corporation Millions Jackpot GTECH’s After School Advantage David Workman, Idaho Lottery Cindy Horn Initiative Helps Local Children Public Relations Tradeshow Coordinator Bridge the Digital Divide Page 28 Page 14 Patricia McQueen Staff Writer Gaming Laboratories The Newest “mini” International’s 10th Annual Multi-State Game North American Roundtable Circulation: Decades of Dollars rolls out in Draws Record Crowds Lottery Insights ISSN 1528-123X, Georgia, Kentucky and Virginia Page 36 March 2011, Volume No. -

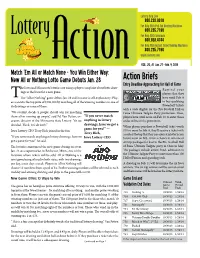

MATION As of Jan

Lottery IOWA LOTTERY GAME INFORMATION As of Jan. 27, 2014 Game Start Date 592 BINGO TIMES 10-Orange/Green 03/31/08 631 LUCKY DIAMONDS 03/30/09 ENDING SCRATCH GAMES 666 LIFETIME RICHES 04/05/10 667 CASH BONANZA 05/24/10 VOL. 20, #1 Jan. 27 - Feb. 9, 2014 724 CROSSWORD-Green/Purple 05/06/11 Game Start Date Last Date to Pay Prizes 735 LUCKY JAR BINGO 12/27/11 723 ACES HIGH 01/06/12 751 DID I WIN? - GOLD SERIES 01/06/12 713 SIZZLING 7S 03/28/11 01/28/14 Match ‘Em All or Match None - You Win Either Way: 758 ROULETTE 04/05/12 714 $30,000 CLUB 02/02/12 01/28/14 757 SUPER CROSSWORD 04/09/12 717 SUPER CROSSWORD 04/18/11 01/28/14 Action Briefs 761 HOT $50,000 04/09/12 731 MONOPOLY™ 07/18/11 01/28/14 New All or Nothing Lotto Game Debuts Jan. 28 765 TRIPLE FORTUNE 05/31/12 734 5X THE MONEY 05/31/12 01/28/14 762 GEMSTONE 10s 06/27/12 Entry Deadline Approaching for Hall of Fame 766 VETERANS SILVER 6s 06/27/12 736 LUCKY ELVES BINGO 09/26/11 01/28/14 he Iowa and Minnesota lotteries are using a player complaint about lotto draw- 767 SCRABBLE™ 06/27/12 747 VETERANS DOUBLE DOUBLER 01/06/12 01/28/14 Remind your 768 SUPER CASHOUT 06/27/12 750 MATCH & WIN™ 2ND EDITION 01/06/12 01/28/14 ings as the basis for a new game. -

Aug. 23, 2021 Powerball Drawing Results

FOR IMMEDIATE RELEASE MEDIA CONTACT: Media Relations, 512-344-5131 [email protected] DELAYED PROCESSING – AUG. 23, 2021 POWERBALL DRAWING RESULTS Statement from the Multi-State Lottery Association: The official results of the Powerball® and Double Play® drawings on Monday, Aug. 23 have been delayed due to several lotteries needing extra time to complete the required security protocols. Powerball has strict security requirements that must be met by all 48 lotteries before and after each drawing to produce official draw results. Without the draw results, the next estimated jackpot cannot be calculated and, in some jurisdictions, prizes on winning tickets cannot be paid. The Powerball drawing on Monday night was held at 11:56 p.m. ET, and the Double Play drawing was held at 12:21 a.m. ET. Both drawings were live streamed on Powerball.com, and recorded video was posted to the Powerball website and the Powerball YouTube channel. The winning numbers from both drawings are also available on Powerball.com. While most jurisdictions were able to complete the required protocols on time, two lotteries need additional processing time. While we apologize for the delay in delivering the information to the public, the additional time enables us to ensure that we are reporting the official and verified number of prize winners. Please hold on to your tickets, and we will let you know when retailers are able to pay prizes on winning tickets from the August 23 Powerball and Double Play drawings. About the Texas Lottery Beginning with the first ticket sold in 1992, the Texas Lottery has generated $33 billion in revenue for the state and distributed $71 billion in prizes to lottery players. -

Review of the Florida Lottery, 2018

Review of the Florida Lottery, 2018 Report No. 19-03 Date: February 2019 February 2019 Report No. 19-03 Review of the Florida Lottery, 2018 EXECUTIVE SUMMARY Lottery transfers to the Educational Enhancement Trust Fund increased in Fiscal Year 2017-18 to $1.758 billion, or REPORT SCOPE $102 million more than the prior year.12This increase is As directed by the Legislature, primarily due to higher scratch-off game transfers as well OPPAGA examined the Department as higher Powerball and Mega Millions draw game transfers. of the Lottery and assessed options to enhance its earning capability Several additional game and product distribution options and improve its efficiency.1, 2 are available to further increase transfers to education. However, some options could represent expanded gambling. The Department of the Lottery continues to outperform the legislative performance standard for its operating expense rate, which is the second lowest in the nation. The department maintains a comprehensive product mix by regularly adding new games, enhancing existing games, and retiring games. In addition, the Florida Lottery recently received the North American Association of State and Provincial Lotteries and the National Council on Problem Gambling certification for implementing a responsible gaming program. However, department operations could be further enhanced. Although the department has multiple layers of security to ensure the integrity of lottery games, it should include an evaluation of its security measures for fast play games in the scope of its next contracted security study. The department continues to implement its retailer integrity program and anticipates further enhancements once it fully implements its new gaming system contract. -

Meeting Minutes Marketing and Retailer Relations Committee of the South Carolina Education Lottery Board of Commissioners October 17, 2012 10:30 A.M

Meeting Minutes Marketing and Retailer Relations Committee of the South Carolina Education Lottery Board of Commissioners October 17, 2012 10:30 A.M. The Marketing and Retailer Relations Committee of the South Carolina Education Lottery Board of Commissioners held a meeting on Wednesday, October 17, 2012, at 10:30 a.m. in the fourth-floor conference room (#443), located at 1333 Main Street, Columbia, South Carolina, with the following committee members participating: Sam Litchfield, Chair Dr. Edward Keith Moffatt Burriss Karen Ballentine Lee Edwards The Chair called the meeting to order. Terminal Generated Game Concepts The Chairman recognized Jay Johnson, Director of Marketing and Product Development, to brief the Committee on the results of the focus group testing recently conducted in Greenville, Columbia and Charleston with the assistance of Intralot (SCEL’s online vendor) and “Focus With Fettig.” Lottery players and licensed retailers were included in the groups. The participants favored “Carolina Cash 6,” “Decades of Dollars,” and “Fast Play,” respectively. Carolina Cash 6 ($2 price point) would offer several “plays” for one price and multiple ways to win up to $200,000, taxes paid. Decades of Dollars is a multi-jurisdictional game offering a fixed top prize paid as an annuity or as a lump-sum. Fast Play is Add-A- Play without a purchase prerequisite of another terminal game. Each game could enhance SCEL’s current product mix. The fourth concept, Hot Lotto Sizzler, was not as well-received as the other games. It is also the least likely to fit within our current product mix as it is similar to and has the same draw days as Powerball®. -

Lottery Sales Have Increased

January 2016 Report No. 16-01 Lottery Sales Have Increased; Transfers to the Educational Enhancement Trust Fund Remain Stable at a glance Scope _________________ Lottery transfers to the Educational Enhancement Trust Fund As directed by the Legislature, OPPAGA increased slightly in Fiscal Year 2014-15 to $1.496 billion, or examined the Department of the Lottery and $1 million more than the prior year. The leveling off in assessed options to enhance its earning capability transfers is due to a combination of factors including lower and improve its efficiency.1, 2 overall draw game sales and fewer unclaimed prizes. Several additional game and product distribution options are _____________ available to increase transfers to education. However, some Background of these options could represent expanded gambling. The Department of the Lottery generates funds for The Lottery’s operating expense rate continues to meet education by selling draw and scratch-off games. legislative performance standards and is the second lowest Draw games allow players to select from a range of in the nation. numbers on a play slip. Draw game tickets are printed by terminals that are connected to the The Lottery should Lottery’s contracted terminal-based gaming system . continue its efforts to expand the retailer network; for a drawing at a later time. Scratch-off games are . continue its efforts to improve its data analysis and tickets with removable covering that players scratch reporting capabilities for identifying and investigating off to determine instantly whether they have won. potential ticket theft or brokering by retailers, as well The Lottery is self-supporting and receives no as increase the number of retailer locations with ticket general revenue. -

June 30, 2011

Arkansas Lottery Commission An Enterprise Fund of the State of Arkansas Alicia Rose Jonesboro Chukwukere Ekeh Ratasha Whaley Shayla Morrow North Little Rock Blytheville Hartman Bradley Huggins Jessica Corbitt Benton Lexa Comprehensive Annual Financial Report for the Fiscal Year Ended JUNE 30, 2011 Kent Broughton Brandon Booth Pine Bluff Little Rock Receiving this scholarship has helped me tremendously with my finances and has given me THE OPPORTUNITY TO SUCCEED in reaching my future goals. While furthering my education has been costly, being a recipient has helped me with my undergraduate experiences and my overall life.” Britni Means | Junior Philander Smith College Malvern Arkansas Lottery Commission An Enterprise Fund of the State of Arkansas Comprehensive Annual Financial Report For the Fiscal Year Ended June 30, 2011 Mike Beebe Governor, State of Arkansas Julie Baldridge Interim Director Prepared by Finance Division I am currently a freshman at Arkansas State University majoring in the Radiologic Sciences program. Upon receiving the Arkansas Lottery Scholarship, I have been able to pursue my EDUCATIONAL DREAMS without the burden of financial instability. I am blessed to have received this scholarship for it has allowed me to focus more on my studies while reducing my parents’ fear of not being able to financially support my decision to attend college.” Kourtney Hatcher | Freshman Arkansas State University Jonesboro Arkansas Lottery Commission An Enterprise Fund of the State of Arkansas Comprehensive Annual Financial Report For the -

Building the Brand 2 INSIGHTS September/October 2015

DEBUNKING NASPL ASSOCIATE MANAGING GAMES, LOTTERY MYTHS MEMBER PROFILES TEXAS STLYLE The Official Publication of the North American Association of State & Provincial Lotteries INSIGHTSSeptember/October 2015 NASPL 2015 Building the Brand 2 INSIGHTS September/October 2015 From the NASPL Staff President David B. Gale Executive Director Thomas C. Tulloch Director of Administration Andrew White VP of Operations Tamika Ligon Director of Program Planning John Koenig Graphic Designer This saying has always been one of my favorites: Happiness happens on the way to success. Janine Hutzell Accounting Patricia McQueen Editor And if the past year is any indication, we’re pretty happy in the North American lottery industry. Yes, we saw Jake Coy Vendor Relations some stressors in the past 12 months, but we stacked up Mike Duff NSI Coordinator some enviable results at the same time. Combined, U.S. and Canadian lotteries sold more than US$78 billion in products while raising some US$23 billion in proceeds for the worthy causes benefitted by our organizations. NASPL Executive Committee Interestingly, our success was achieved against a backdrop Terry Rich President of some fairly significant stressors. Paula Harper Bethea First Vice-President We kept up conversations in Washington, D.C., where lawmakers discussed proposals May Scheve Reardon Second Vice-President that would establish federal regulation of Internet gaming in the United States, thwarting Rose Hudson Treasurer states’ rights to provide (or not provide) the gambling products that their citizens desire. Our efforts were noticed, and have made a difference. Charlie McIntyre Secretary Gary Grief Immediate Past President Along the way, we’ve also worked on ideas for new games, renewed retailer collaboration and better lotto-game branding; held collaborative meetings, workshops and seminars; David Loeb Pres. -

Options Exist for Increasing Lottery Proceeds for Education

Options Exist for Increasing Lottery Proceeds for Education Final Report to the Joint Legislative Program Evaluation Oversight Committee Report Number 2017-03 May 1, 2017 Program Evaluation Division North Carolina General Assembly Legislative Office Building, Suite 100 300 North Salisbury Street Raleigh, NC 27603-5925 919-301-1404 www.ncleg.net/PED 75 copies of this public document were printed at a cost of $41.55 or $0.55 per copy. A limited number of copies are available for distribution through the Legislative Library: Rooms 2126, 2226 Room 500 State Legislative Building Legislative Office Building Raleigh, NC 27601 Raleigh, NC 27603 919-733-7778 919-733-9390 The report is also available online at www.ncleg.net/PED. NORTH CAROLINA GENERAL ASSEMBLY Legislative Services Office Paul Coble, Legislative Services Officer Program Evaluation Division John W. Turcotte 300 N. Salisbury Street, Suite 100 Director Raleigh, NC 27603-5925 Tel. 919-301-1404 Fax 919-301-1406 May 1, 2017 Members of the Joint Legislative Program Evaluation Oversight Committee North Carolina General Assembly Legislative Building 16 West Jones Street Raleigh, NC 27601 Honorable Members: The Joint Legislative Program Evaluation Oversight Committee’s 2015–17 Work Plan directed the Program Evaluation Division to evaluate whether the North Carolina State Lottery is providing the maximum benefit to the State by examining its operations, existing revenue- generating strategies, and efforts to reduce costs. I am pleased to report that the NC Lottery cooperated with us fully and was at all times courteous to our evaluators during the evaluation. Sincerely, John W. Turcotte Director AN EQUAL OPPORTUNITY/AFFIRMATIVE ACTION EMPLOYER PROGRAM EVALUATION DIVISION NORTH CAROLINA GENERAL ASSEMBLY May 2017 Report No.