August 13, 2021 the Honorable Greg Abbott the Honorable Mike Morath

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Williamson County Texas

Williamson County Texas Total and Per Farm Overview, 2017 and change since 2012 (Z) Percent of state agriculture sales % change 2017 since 2012 Share of Sales by Type (%) Number of farms 2,634 +4 Crops 58 Land in farms (acres) 559,261 (Z) Livestock, poultry, and products 42 Average size of farm (acres) 212 -3 Total ($) Land in Farms by Use (%) a Market value of products sold 114,923,000 -11 Cropland 41 Government payments 6,359,000 +74 Pastureland 51 Farm-related income 9,386,000 +23 Woodland 5 Total farm production expenses 123,085,000 -1 Other 2 Net cash farm income 7,583,000 -55 Acres irrigated: 1,586 Per farm average ($) (Z)% of land in farms Market value of products sold 43,631 -14 Government payments Land Use Practices (% of farms) (average per farm receiving) 13,387 +144 Farm-related income 13,864 +25 No till 3 Reduced till 3 Total farm production expenses 46,729 -4 Intensive till 9 Net cash farm income 2,879 -56 Cover crop 2 Farms by Value of Sales Farms by Size Number Percent of Total a Number Percent of Total a Less than $2,500 1,424 54 1 to 9 acres 336 13 $2,500 to $4,999 349 13 10 to 49 acres 1,173 45 $5,000 to $9,999 261 10 50 to 179 acres 660 25 $10,000 to $24,999 280 11 180 to 499 acres 236 9 $25,000 to $49,999 114 4 500 to 999 acres 107 4 $50,000 to $99,999 69 3 1,000 + acres 122 5 $100,000 or more 137 5 Williamson County Texas, 2017 Page 2 Market Value of Agricultural Products Sold Rank Counties Rank Counties Sales in Producing in Producing ($1,000) State b Item U.S. -

Calculating Texas Sales Tax Texas Residents Are Required to Pay 6.25% Sales Tax to the State of Texas When Purchasing a Vehicle

Travis County Tax Office Calculating Texas Sales Tax Texas residents are required to pay 6.25% sales tax to the state of Texas when purchasing a vehicle. If sales tax was paid in another state, the vehicle owner will get credit for the sales tax already paid on the vehicle and will pay the difference between the rates when titling the vehicle in Texas. Use the following to determine how much is owed: Proof of Sales Tax Paid Sales Tax Due Bill of sale includes an itemized sales tax No sales tax is due to the state of Texas. Provide collection that is 6.25% or more proof of sales tax paid by submitting the itemized bill of sale. Bill of sale is not itemized or no sales tax has Sales tax is calculated using the following formula: been paid to the state where the vehicle was (Vehicle Price – Trade in Value) x 6.25%. purchased Example: The vehicle was purchased for $29,500 and there was a trade in value of $5,400. Step 1: Calculate the amount subject to tax 29,500 – 5,400 = 24,100 Step 2: Multiply the result by .0625% 24,100 x .0625 Sales Tax Due in Texas = $1,506.25 Provide proof of sales tax paid by submitting the itemized bill of sale along with $1,506.25. Bill of sale includes an itemized sales tax Sales tax is calculated using the following formula: collection that is less than 6.25% (Vehicle Price - Trade in Value) x (6.25% - percent paid to your state) Example: The vehicle was purchased for $29,500 and there was a trade in value of $5,400. -

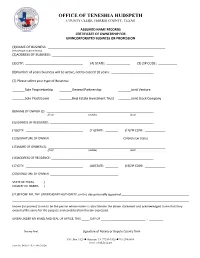

1-2 Owners Application

OFFICE OF TENESHIA HUDSPETH COUNTY CLERK, HARRIS COUNTY, TEXAS ASSUMED NAME RECORDS CERTIFICATE OF OWNERSHIP FOR UNINCORPORATED BUSINESS OR PROFESSION (1)NAME OF BUSINESS: (Please type or print clearly) (2)ADDRESS OF BUSINESS: (3)CITY: (4) STATE: (5) ZIP CODE: (6)Number of years business will be active, not to exceed 10 years: (7) Please select your type of Business: Sole Proprietorship General Partnership Joint Venture Sole Practitioner Real Estate Investment Trust Joint Stock Company (8)NAME OF OWNER (1): (first) (middle) (last) (9)ADDRESS OF RESIDENCE: (10)CITY: (11)STATE: (12)ZIP CODE: (13)SIGNATURE OF OWNER (14)Veteran Status (15)NAME OF OWNER (2): (first) (middle) (last) (16)ADDRESS OF RESIDENCE: (17)CITY: (18)STATE: (19)ZIP CODE: (20)SIGNATURE OF OWNER STATE OF TEXAS } COUNTY OF HARRIS } (21)BEFORE ME, THE UNDERSIGNED AUTHORITY, on this day personally appeared known (or proven) to me to be the person whose name is subscribed in the above statement and acknowledged to me that they executed the same for the purpose and consideration therein expressed. GIVEN UNDER MY HAND AND SEAL OF OFFICE, THIS DAY OF , . Notary Seal Signature of Notary or Deputy County Clerk P.O. Box 1525 Houston, TX 77251-1525 713-274-8686 www.cclerk.hctx.net Form No. D-02-07 (Rev. 09/03/2020) GUIDE FOR COMPLETING THE ASSUMED NAME (D/B/A/) APPLICATION Type or print all entries on your application clearly (1) The name of your business (2) Street number and street name of your business location (3) City where business is located (4) State where your business is located (5) 5-digit address mailing code of your business (6) How many years will your business name stay active, cannot exceed 10 years (7) Select your type of business/service (8) Name of the business owner (9) Street number and name of your residence location, no P.O. -

Penal Code Offenses by Punishment Range Office of the Attorney General 2

PENAL CODE BYOFFENSES PUNISHMENT RANGE Including Updates From the 85th Legislative Session REV 3/18 Table of Contents PUNISHMENT BY OFFENSE CLASSIFICATION ........................................................................... 2 PENALTIES FOR REPEAT AND HABITUAL OFFENDERS .......................................................... 4 EXCEPTIONAL SENTENCES ................................................................................................... 7 CLASSIFICATION OF TITLE 4 ................................................................................................. 8 INCHOATE OFFENSES ........................................................................................................... 8 CLASSIFICATION OF TITLE 5 ............................................................................................... 11 OFFENSES AGAINST THE PERSON ....................................................................................... 11 CLASSIFICATION OF TITLE 6 ............................................................................................... 18 OFFENSES AGAINST THE FAMILY ......................................................................................... 18 CLASSIFICATION OF TITLE 7 ............................................................................................... 20 OFFENSES AGAINST PROPERTY .......................................................................................... 20 CLASSIFICATION OF TITLE 8 .............................................................................................. -

Gonzales County Texas

Gonzales County Texas Total and Per Farm Overview, 2017 and change since 2012 Percent of state agriculture 2 sales % change 2017 since 2012 Share of Sales by Type (%) Number of farms 1,612 -4 Land in farms (acres) 614,280 +1 Crops 7 Average size of farm (acres) 381 +5 Livestock, poultry, and products 93 Total ($) Land in Farms by Use (%) a Market value of products sold 560,829,000 +8 Government payments 478,000 -60 Cropland 10 Farm-related income 4,249,000 +39 Pastureland 68 Total farm production expenses 412,189,000 -4 Woodland 18 Net cash farm income 153,367,000 +69 Other 4 Acres irrigated: 1,529 Per farm average ($) (Z)% of land in farms Market value of products sold 347,909 +12 Government payments Land Use Practices (% of farms) (average per farm receiving) 7,471 +32 Farm-related income 10,388 +30 No till 1 Total farm production expenses 255,700 -1 Reduced till 1 Net cash farm income 95,141 +75 Intensive till 1 Cover crop 1 Farms by Value of Sales Farms by Size Number Percent of Total a Number Percent of Total a Less than $2,500 503 31 1 to 9 acres 84 5 $2,500 to $4,999 196 12 10 to 49 acres 349 22 $5,000 to $9,999 216 13 50 to 179 acres 548 34 $10,000 to $24,999 251 16 180 to 499 acres 337 21 $25,000 to $49,999 156 10 500 to 999 acres 154 10 $50,000 to $99,999 117 7 1,000 + acres 140 9 $100,000 or more 173 11 Gonzales County Texas, 2017 Page 2 Market Value of Agricultural Products Sold Rank Counties Rank Counties Sales in Producing in Producing ($1,000) State b Item U.S. -

Marriage License Requirements

REQUIREMENTS FOR MARRIAGE LICENSE APPLICATON IN GALVESTON COUNTY 1. THE MARRIAGE LICENSE DEPARTMENT IS LOCATED ON THE 2ND FLOOR OF THE JUSTICE CENTER, 600 59th STREET, GALVESTON, TX OR 174 CALDER DRIVE, LEAGUE CITY, TX. OFFICE HOURS ARE 8:00 AM TO 5:00 PM, MONDAY THROUGH FRIDAY, EXCEPT HOLIDAYS. 2. BOTH APPLICANTS MUST SUBMIT PROOF OF AGE AND IDENTITY BY PROVIDING ONE OF THE FOLLOWING: (A) DRIVERS LICENSE (B) STATE ID (C) A U.S. OR FOREIGN PASSPORT OR (D) CERTIFIED COPY OF THE APPLICANT'S BIRTH CERTIFICATE (ALONG WITH A PICTURE ID). (Section 2.005 Texas Family Code). 3. EACH APPLICANT IS REQUIRED TO KNOW OR PRESENT THEIR SOCIAL SECURITY NUMBER (IF APPLICABLE). 4. THE FEE FOR A MARRIAGE LICENSE IS $81 CASH, CREDIT OR DEBIT CARD. THE GALVESTON COUNTY CLERK'S OFFICE WILL NOT ACCEPT CHECKS. 5. APPLICANTS UNDER THE AGE OF 18 (MINORS 16-17) RESIDENTS OF TEXAS AND OUT OF STATE, MUST PETITION A COURT FOR THE REMOVAL OF THE DISABILITIES OF A MINOR BEFORE APPLYING FOR A MARRIAGE LICENSE IN GALVESTON COUNTY. ALL MINORS MUST APPEAR AND PROVIDE TO THE COUNTY CLERK A CERTIFIED COPY OF THE COURT ORDER "REMOVAL OF DISABILITIES OF MINORITY" GRANTED BY THE STATE OF TEXAS OR ANOTHER STATE, IN ORDER FOR THE MINOR TO APPLY FOR A MARRIAGE LICENSE. THIS APPLIES TO ALL MINOR MARRIAGES FILED AFTER 09/01/17. (SB1705) 6. THE COUNTY CLERK MAY NOT ISSUE A MARRIAGE LICENSE IF EITHER APPLICANT INDICATES THAT THE APPLICANT HAS BEEN DIVORCED WITHIN THE LAST 30 DAYS, UNLESS: (A) THE APPLICANTS WERE DIVORCED FROM EACH OTHER; OR (B) THE PROHIBITION AGAINST REMARRIAGE IS WAIVED BY THE COURT (Section 2.009 Texas Family Code). -

Gonzales County Texas

Gonzales County Texas 2012 2007 % change Number of Farms 1,674 1,861 - 10 Land in Farms 609,790 acres 654,077 acres - 7 Average Size of Farm 364 acres 351 acres + 4 Market Value of Products Sold $517,760,000 $404,019,000 + 28 Crop Sales $23,246,000 (4 percent) Livestock Sales $494,513,000 (96 percent) Average Per Farm $309,295 $217,098 + 42 Government Payments $1,202,000 $441,000 + 173 Average Per Farm Receiving Payments $5,645 $4,079 + 38 Farms by Size, 2012 Land in Farms, 2012 by Land Use 700 600 Pastureland 500 70.4% 400 Farms 300 Other uses 200 1.9% Cropland 100 11.3% 0 1-9 10-49 50-179 180-499 500-999 1,000+ Woodland 16.3% Acres Gonzales County – Texas Ranked items among the 254 state counties and 3,079 U.S. counties, 2012 Item Quantity State Rank Universe 1 U.S. Rank Universe 1 MARKET VALUE OF AGRICULTURAL PRODUCTS SOLD ($1,000) Total value of agricultural products sold 517,760 12 254 102 3,077 Value of crops including nursery and greenhouse 23,246 88 253 1,627 3,072 Value of livestock, poultry, and their products 494,513 8 254 45 3,076 VALUE OF SALES BY COMMODITY GROUP ($1,000) Grains, oilseeds, dry beans, and dry peas 3,689 108 238 1,857 2,926 Tobacco - - - - 436 Cotton and cottonseed (D) (D) 165 (D) 635 Vegetables, melons, potatoes, and sweet potatoes 647 60 199 1,004 2,802 Fruits, tree nuts, and berries (D) (D) 215 (D) 2,724 Nursery, greenhouse, floriculture, and sod (D) 23 165 (D) 2,678 Cut Christmas trees and short rotation woody crops - - 46 - 1,530 Other crops and hay 4,361 71 252 672 3,049 Poultry and eggs 402,262 2 241 -

PCPC Letter to Governors Regarding

Hon. Kay Ivey Hon. Mike Dunleavy Hon. Doug Ducey Governor Governor Governor State of Alabama State of Alaska State of Arizona Hon. Asa Hutchinson Hon. Gavin Newsom Hon. Jared Polis Governor Governor Governor State of Arkansas State of California State of Colorado Hon. Ned Lamont Hon. John Carney Hon. Ron DeSantis Governor Governor Governor State of Connecticut State of Delaware State of Florida Hon. Brian Kemp Hon. David Ige Hon. Brad Little Governor Governor Governor State of Georgia State of Hawaii State of Idaho Hon. JB Pritzker Hon. Eric Holcomb Hon. Kim Reynolds Governor Governor Governor State of Illinois State of Indiana State of Iowa Hon. Laura Kelly Hon. Andy Beshear Hon. John Bel Edwards Governor Governor Governor State of Kansas Commonwealth of Kentucky State of Louisiana Hon. Janet Mills Hon. Larry Hogan Hon. Charlie Baker Governor Governor Governor State of Maine State of Maryland Commonwealth of Massachusetts Hon. Gretchen Whitmer Hon. Tim Walz Hon. Tate Reeves Governor Governor Governor State of Michigan State of Minnesota State of Mississippi Hon. Mike Parson Hon. Steve Bullock Hon. Pete Ricketts Governor Governor Governor State of Missouri State of Montana State of Nebraska Hon. Steve Sisolak Hon. Chris Sununu Hon. Phil Murphy Governor Governor Governor State of Nevada State of New Hampshire State of New Jersey Personal Care Products Council 1620 L Street, NW Suite 1200 Washington, DC 20036 March 19, 2020 Page 2 of 3 Hon. Michelle Lujan Grisham Hon. Andrew Cuomo Hon. Roy Cooper Governor Governor Governor State of New Mexico State of New York State of North Carolina Hon. Doug Burgum Hon. -

International Exchange Fact Sheet

International Exchange Fact Sheet GENERAL CONTACT INFORMATION APPLICATION INFORMATION OFFICIAL NAME WEBSITE The University of Texas Austin global.utexas.edu/isss/students/exchange/apply SCHOOL WEBSITE APPLICATION PROCESS utexas.edu 1. Home institution submits nomination (Students may be nominated for in-person or virtual exchange) CONTACT INFORMATION & ADDRESS 2. Student completes UT Exchange Admission Application PHYSICAL ADDRESS Some Academic departments require additional review or application International Student and Scholar materials. Please visit the exchange application page for details. Services (ISSS) The University of Texas at Austin APPLICATION DEADLINE 2400 Nueces Street, Suite B Austin, Texas 78705 FALL SEMESTER (AUGUST–DECEMBER) March 1 PHONE +1 (512) 471–2477 SPRING SEMESTER (JANUARY–MAY) October 1 EXCHANGE WEBSITE global.utexas.edu/isss/students/exchange POST-ADMISSION STEPS AND DEADLINE 1. Login to myIO portal ADMINISTRATIVE CONTACT PERSONS 2. Provide the following information in myIO a. Passport INCOMING STUDENTS CONTACT b. Current Academic Transcript c. English Proficiency Tina Ross d. Proof of Funding (required in order to obtain J-1 visa) Senior Program Coordinator e. Academic Information Sheet (course preferences) Sponsored and Exchange Programs, ISSS DEADLINE PHONE Rolling deadline. Students will not receive DS-2019 until (512) 232–9572 they have successfully completed all steps in myIO. EMAIL [email protected] IMMIGRATION AND VISA REQUIREMENTS OUTGOING STUDENTS CONTACT EXCHANGE STUDENTS Students participating in the reciprocal exchange program are Lucie Zacharova issued Form DS-2019 to apply for a J-1 visa to cover the duration Assistant Director of Education Abroad of their academic study period, usually one or two semesters. Reciprocal exchange students enroll in a non-degree academic PHONE program, according to the terms of exchange agreements between (512) 475–8769 UT Austin and their home universities. -

COVID-19 Compilation – May 27, 2020 Courtesy of Cornerstone Government Affairs

COVID-19 Compilation – May 27, 2020 Courtesy of Cornerstone Government Affairs Common Acronyms Centers for Disease Control and Prevention (CDC), World Health Organization (WHO), National Institutes of Health (NIH), Personal Protective Equipment (PPE), Department of Health and Human Services (HHS), Department of Defense (DOD), Department of Homeland Security (DHS), United States Department of Agriculture (USDA), Central Command (CENTCOM), Department of Housing and Urban Development (HUD), Centers for Medicare and Medicaid Services (CMS), Transportation Security Administration (TSA), Department of Veterans Affairs (VA), Assistant Secretary for Preparedness and Response (ASPR), Biomedical Advanced Research and Development Authority (BARDA) Washington, D.C. • The FDA issued a guidance entitled “Reporting a Temporary Closure or Significantly Reduced Production by a Human Food Establishment and Requesting FDA Assistance During the COVID-19 Public Health Emergency.” The guidance provides a mechanism for FDA-regulated establishments (human food facilities and farms) to voluntarily notify the agency of temporary closures and significant reductions in operations and to request assistance from FDA on issues that might affect continuity of their operations during the pandemic. • The FDA issued a guidance document entitled “Effects of the COVID-19 Public Health Emergency on Formal Meetings and User Fee Applications” to provide answers to frequently asked questions. The agency is providing answers concerning certain aspects of sponsor requests for formal meetings with industry, user fee applications goals and timelines, and prioritization of drug and biological application reviews. • The FDA issued a letter to health care providers to remind reprocessing staff in health care facilities to use the correct sterilization cycle associated with certain models of the Advanced Sterilization Products (ASP) STERRAD Sterilization Systems and to only decontaminate compatible N95 or N95-equivalent respirators for reuse during the COVID-19 pandemic. -

Denton County Data Sheet

Denton County, Texas Adult Criminal Justice Data Sheet For more information, contact Leah Pinney at [email protected], or (512) 441-8123 ext. 109. The Texas Criminal Justice Coalition seeks the implementation of realistic criminal justice strategies that safely reduce the State’s costly over-reliance on incarceration – creating stronger families, less taxpayer waste, and safer communities. Below, we have provided comprehensive information about Denton County’s adult population at various stages of criminal justice system involvement. We have also provided the associated costs at each stage to highlight the significant expense to incarcerate or supervise these populations. Total County Population Denton County Population:1 780,612 STAGE 1: Pretrial Jail Detention Of all the people incarcerated in Texas’ county jails, more than half (on average) have not been convicted of the crime for which they are accused. They are in pretrial detention, awaiting trial.2 Many men and women cannot afford the bond that would allow them to return to the community prior to trial; others are not given that option by judges, despite presenting little flight risk or posing no danger to public safety. This leads to unnecessary and costly jail overcrowding. Denton County Jail Population:3 1,119 Denton County Jail Pretrial Population:4 874 (78%) » Number of Pretrial Defendants with Misdemeanor Charges: 153 » Number of Pretrial Defendants with State Jail Charges: 2 » Number of Pretrial Defendants with Felony Charges: 563 Statewide Average Cost to County -

Governor Abbott Signs Tobacco 21 Into Law

PRESS RELEASE 06.08.19 Governor Abbott Signs Tobacco 21 Into Law Austin, TX – Senator Eddie Lucio (D-Brownsville), joint authored legislation increasing the age to purchase tobacco from 18 to 21 years. Texas gov. signs law increasing age to buy tobacco products to 21∗ Texas Gov. Greg Abbott has signed Senate Bill 21 into law, which will end the sale of tobacco products to those under 21. Supporters say increasing the minimum age by three years should reduce the risk of addiction. Abbott on Friday signed the legislation, which covers cigarettes, e-cigarettes or other tobacco products. The only exception to the law is for those in the military. The law will go into effect September 1. Anyone caught breaking this new law, the bill states, will face a Class C misdemeanor and a fine of up to $500. Texas is among a growing number of states raising the tobacco age. Illinois signed similar legislation in May. States where the legal age is already 21 include Hawaii, California, New Jersey, Oregon, Maine and Massachusetts. Laws will take effect later this year in Arkansas and Virginia. Shelby Massey with the American Heart Association told CNN affiliate KXAN-TV, "Delaying the age when young people first begin to use tobacco -- the leading cause of preventable death -- will reduce the risk they will develop a deadly addiction." The number of middle and high school tobacco users increased by 36% between 2017 and 2018, according to the Centers for Disease Control and Prevention (CDC). The increase, the CDC states, is due to the "surge in e-cigarette use." "The skyrocketing growth of young people's e-cigarette use over the past year threatens to erase progress made in reducing youth tobacco use.