Applicable Federal Rates (AFR) for the Current Month for Purposes of Section 1274(D) of the Internal Revenue Code

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Update August 12, 2021

COVID-19 Update August 12, 2021 As of August 11, 2021, the total of laboratory-confirmed and probable COVID-19 cases reported among Connecticut residents is 361294, including 329441 laboratory-confirmed and 31853 probable cases. Two hundred forty-seven patients are currently hospitalized with laboratory-confirmed COVID-19. There have been 8307 COVID-19-associated deaths. Overall Summary Total* Change Since Yesterday COVID-19 Cases (confirmed and probable) 361294 +742 COVID-19 Tests Reported (molecular and antigen) 10141490 +21101 Daily Test Positivity* 3.52% Patients Currently Hospitalized with COVID-19** 247 +17 Total Change since 8/5/21 COVID-19-Associated Deaths 8307 +11 *Includes confirmed plus probable cases **Includes 190 unvaccinated or unknown vaccination status cases (77% of total census) Cases Admissions Total Cases: 361,294 Total Hospitalizations: 37,310 Hospital Census Deaths Hospital Census: 8/11/2021: 247 Total Deaths: 8307 1 All data are preliminary and subject to change. COVID-19 Cases and Associated Deaths by County of Residence as of 08/11/21. COVID-19 Cases COVID-19-Associated Deaths County Confirmed Probable Confirmed Probable Fairfield County 93,907 9,419 1,776 429 Hartford County 81,660 6,259 2,008 439 Litchfield County 13,337 1,795 259 39 Middlesex County 12,121 1,258 288 87 New Haven County 85,507 10,045 1,850 295 New London County 22,050 1,443 351 101 Tolland County 9,063 949 149 39 Windham County 10,757 510 154 42 Pending address validation 1,039 175 1 0 Total 329441 31853 6836 1471 National COVID-19 statistics and information about preventing spread of COVID-19 are available from the Centers for Disease Control and Prevention. -

Exemptions from Diploma Requirements

THE STATE EDUCATION DEPARTMENT / THE UNIVERSITY OF THE STATE OF NEW YORK Commissioner of Education E-mail: [email protected] President of the University of the State of New York Twitter:@NYSEDNews 89 Washington Avenue, Room 111 Tel: (518) 474-5844 Albany, New York 12234 Fax: (518) 473-4909 March 19, 2021 To: District Superintendents Superintendents of Schools Principals of Public, Religious, and Independent Schools Leaders of Charter Schools From: Betty A. Rosa, Commissioner Subject: Exemptions from Diploma Requirements and Cancellation of the August 2021 Administration of the New York State (NYS) High School Regents Examination Program in Response to the Ongoing Impact of the COVID-19 Pandemic The purpose of this memorandum is to inform you that the New York State Education Department (NYSED) is cancelling all but four of the Regents Examinations scheduled to be administered in June 2021 and all of the Regents Examinations scheduled to be administered in August 2021. This memorandum also provides information on the adjustments with respect to the assessment requirements that students must ordinarily meet in order to earn diplomas, credentials, and endorsements so that the current pandemic will not adversely impact students. June 2021 Administration of the NYS High School Regents Examination Program Currently, NYSED plans to administer the following Regents Examinations in June 2021: Algebra I, Earth Science (written test only), English Language Arts, and Living Environment. NYSED is required to administer these four exams to comply with the federal Every Student Succeeds Act (ESSA). A schedule of administration dates for these four Regents Examinations is forthcoming. These examinations shall be administered only in instances where schools and districts can ensure the health and safety of students and teachers. -

August September October July November December January

2019 2020 JULY JANUARY S M T W T F S 2019-20 BVSD CALENDAR S M T W T F S 1 2 3 4 5 6 1 2 3 4 July 4 Independence Day 7 8 9 10 11 12 13 August 7-13 District professional development days 5 D 7 8 9 S 11 14 15 16 17 18 19 20 14 & 15 *Kindergarten Assessment Days 12 13 14 15 16 17 18 21 22 23 24 25 26 27 14 First day of school for 1-5, 6th and 9th grade 19 20 21 22 23 24 25 28 29 30 31 15 First day for 7, 8, 10-12 26 27 28 29 30 31 16 & 19 *Staggered start for Kindergarten *Schools will inform parents of their schedules including any assessment days. AUGUST September 2 Labor Day – no school FEBRUARY S M T W T F S 13 Elementary Assessment Day S M T W T F S 1 2 3 16 District professional development day – no school 1 4 5 6 D D D 10 October 14 District professional development day – no school 2 3 4 5 6 7 8 November 11 Veterans Day – no school 11 D D 14 15 16 17 9 10 11 12 T D 15 25-26 Fall conference exchange days/no classes 16 17 18 19 20 21 22 18 19 20 21 22 23 24 28-29 Thanksgiving break – no school 25 26 27 28 29 30 31 Dec. 23-Jan. 3 Winter break 23 24 25 26 27 28 29 January 6 District professional development day – no school SEPTEMBER 20 Martin Luther King, Jr. -

COVID-19 Travel Restrictions Installation Status Update, August 25, 2021

As of August 23, 2021 COVID-19 Travel Restrictions Installation Status Update Criteria for Lifting Travel Restrictions Step 1: Meet Installation Criteria (No Travel Restrictions, HPCON below Charlie, Essential Services Available, Quality Assurance in place for Movers) Step 2: Director of Administration and Management (DA&M), the Secretary of a Military Department, or a Combatant Commander approve lifting travel restrictions for an installation Step 1 criteria must be met before travel restrictions can be lifted for an installation by the DA&M, the Secretary of a Military Department, or a Combatant Commander. If installation conditions are subsequently not met, the approval authority decides if travel restrictions should be reinstated. Unrestricted travel is allowed for Service members or civilians between installations that have met the criteria of the Secretary of Defense memorandum on the conditions- based approach to personnel movement and travel dated March 15, 2021. If either installation does not meet the criteria, an exemption or waiver would be required. Travel Restrictions LIFTED at 190 of 230 Installations (83%) (Met: Step 1 & Step 2) Of the 190 installations with lifted travel restrictions this week, 4 reinstated travel restrictions while 0 lifted restrictions. 1 of 8 As of August 23, 2021 Travel Installation Service Country/State Restrictions Lifted ABERDEEN PROVING GROUND Army USA - MD Yes ANNISTON ARMY DEPOT Army USA - AL Yes BAUMHOLDER H.D.SMITH BRCKS Army Germany Yes CAMP CASEY TONGDUCHON Army South Korea Yes CAMP DODGE Army USA - IA Yes CAMP HENRY Army South Korea Yes CAMP HUMPHREYS Army South Korea Yes CAMP ZAMA TOKYO Army Japan Yes CARLISLE BARRACKS Army USA - PA Yes DETROIT ARSENAL Army USA - MI Yes FORT BELVOIR Army USA - VA Yes FORT BENNING Army USA - GA Yes FORT BLISS Army USA - TX Yes FORT BRAGG Army USA - NC Yes FORT CAMPBELL Army USA - KY Yes FORT CARSON Army USA - CO Yes FORT CUSTER TRNG CTR Army USA - MI Yes FORT DETRICK Army USA - MD Yes FORT DRUM Army USA - NY Yes FORT GEORGE G. -

Press Release (2021/17/PR)

2021/17/PR IPCC PRESS RELEASE 9 August 2021 Climate change widespread, rapid, and intensifying – IPCC GENEVA, Aug 9 – Scientists are observing changes in the Earth’s climate in every region and across the whole climate system, according to the latest Intergovernmental Panel on Climate Change (IPCC) Report, releaseD toDay. Many of the changes observeD in the climate are unprecedented in thousands, if not hunDreDs of thousanDs of years, anD some of the changes already set in motion—such as continued sea level rise—are irreversible over hundreds to thousanDs of years. However, strong anD sustaineD reDuctions in emissions of carbon dioxide (CO2) anD other greenhouse gases would limit climate change. While benefits for air quality would come quickly, it could take 20-30 years to see global temperatures stabilize, according to the IPCC Working Group I report, Climate Change 2021: the Physical Science Basis, approveD on Friday by 195 member governments of the IPCC, through a virtual approval session that was helD over two weeks starting on July 26. The Working Group I report is the first instalment of the IPCC’s Sixth Assessment Report (AR6), which will be completeD in 2022. “This report reflects extraordinary efforts unDer exceptional circumstances,” said Hoesung Lee, Chair of the IPCC. “The innovations in this report, anD aDvances in climate science that it reflects, provide an invaluable input into climate negotiations and decision-making.” Faster warming The report provides new estimates of the chances of crossing the global warming level of 1.5°C in the next DecaDes, anD finDs that unless there are immeDiate, rapid and large-scale reductions in greenhouse gas emissions, limiting warming to close to 1.5°C or even 2°C will be beyond reach. -

Approval Letter

Our STN: BL 125742/0 BLA APPROVAL BioNTech Manufacturing GmbH August 23, 2021 Attention: Amit Patel Pfizer Inc. 235 East 42nd Street New York, NY 10017 Dear Mr. Patel: Please refer to your Biologics License Application (BLA) submitted and received on May 18, 2021, under section 351(a) of the Public Health Service Act (PHS Act) for COVID-19 Vaccine, mRNA. LICENSING We are issuing Department of Health and Human Services U.S. License No. 2229 to BioNTech Manufacturing GmbH, Mainz, Germany, under the provisions of section 351(a) of the PHS Act controlling the manufacture and sale of biological products. The license authorizes you to introduce or deliver for introduction into interstate commerce, those products for which your company has demonstrated compliance with establishment and product standards. Under this license, you are authorized to manufacture the product, COVID-19 Vaccine, mRNA, which is indicated for active immunization to prevent coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) in individuals 16 years of age and older. The review of this product was associated with the following National Clinical Trial (NCT) numbers: NCT04368728 and NCT04380701. MANUFACTURING LOCATIONS Under this license, you are approved to manufacture COVID-19 Vaccine, mRNA drug substance at Wyeth BioPharma Division of Wyeth Pharmaceuticals LLC, 1 Burtt Road, Andover, Massachusetts. The final formulated product will be manufactured, filled, labeled and packaged at Pfizer Manufacturing Belgium NV, Rijksweg 12, Puurs, Belgium and at Pharmacia & Upjohn Company LLC, 7000 Portage Road, Kalamazoo, Michigan. The diluent, 0.9% Sodium Chloride Injection, USP, will be manufactured at Hospira, Inc., (b) (4) and at Fresenius Kabi USA, LLC, (b) (4) . -

August 15, 1945

REMEMBERING V-J DAY AAuugguusstt 1155,, 11994455 The celebrations on V-E Day (Victory in Europe), May 8, 1945, were spontaneous and joyful, yet everyone knew that the end of the War in Europe gave the world only partial peace. The War in the Pacific raged on with increased savagery. On August 6 th , 1945, facing the prospect of an invasion of the Japanese home islands, President Harry Truman ordered the dropping of the newly-developed atomic bomb on the Japanese city of Hiroshima. In a single flash, four square miles of the city were destroyed and 130,000 people were killed. Three days later a second atomic bomb was dropped on the city of Nagasaki. This bomb killed between 65,000 and 75,000 people. On the same day, forces of the Soviet Union invaded Japanese-held Manchuria. On August 14 th , 1945, facing armies and new weapons they could never hope to overcome, the Japanese government accepted defeat. The next day, August 15 th , 1945, was proclaimed Victory over Japan (VJ) Day, although the signing of the official instrument of surrender was not to occur until September 2nd , 1945, aboard the USS Missouri, in Tokyo Bay. There, representatives of nine Allied nations were present to accept the Japanese surrender. Throughout the day of August 14 th , anticipation mounted as people listened to the radio or called their local newspaper for the latest word. The New York Times announced that its revolving news sign in Times Square would remain on continuously during the wait. Many people lingered below the sign, knowing the biggest celebration of all would occur there. -

August 2021 Lunch.Pdf

Huntsville City Schools Lunch MENU August 2021 Wednesday, August 4 Thursday, August 5 Friday, August 6 Chicken Bites Beef Taco Salad Hotdog on WW Bun Green Peas w/Tortilla Chips Baked Beans Cut Carrots Chili Beans Baked Chips Fresh Apples Corn Fruit Cup Milk Choice Fruit Cup Milk Choice Milk Choice Monday, August 9 Tuesday, August 10 Wednesday, August 11 Thursday, August 12 Friday, August 13 Cheeseburger w/WG Bun BBQ Chicken Sandwich Pizza Spaghetti w/Meat Sauce Deli Turkey and Cheese on Baked Chips Oven Fries Garden Salad Bread stick Hoagie Roll Lettuce, Tomato & Pickle Baked Beans Corn Steamed Broccoli Lettuce,Tomato Fruit Cup Assorted Fruit Fresh Fruit Baby Carrots Baked Chips Milk Choice Milk Choice Milk Choice Assorted Fruit Fresh Fruit Milk Choice Milk Choice Monday, August 16 Tuesday, August 17 Wednesday, August 18 Thursday, August 19 Friday, August 20 Country Fried Steak Roast Turkey w/Gravy Chicken Tenders Chicken Fajita Hot Pocket WW Roll WW Roll Potato Wedges Flour Tortilla Baked Chips Mashed Potatoes w/Gravy Sweet Potatoes Steamed Carrots Lettuce, Tomaato, Cheese Sweet Potato Fries Green Beans Blackeye Peas Assorted fruit Chili Beans Steamed Broccoli Fresh Apple Sliced Peaches Milk Choice Corn Assorted Fruit Milk Choice Milk Choice Assorted Fruit Milk Choice Milk Choice Monday, August 23 Tuesday, August 24 Wednesday, August 25 Thursday, August 26 Friday, August 27 Bar B Que Pork Sandwich Lemon Pepper Chicken Crispitos(2) Chicken Alfredo BBQ/Buffalo Chicken Wings Baked Chips Sweet Potatoes Romaine Salad Green Beans Brown Rice Oven Fries Pinto Beans Baked Chips Steamed Carrots 5 Way Mix Vegetables Baked Beans Roll Corn Assorted Fruit Fruit Cup Fresh Apple Assorted Fruit Fresh Banana Milk Choice Milk Choice Milk Choice Milk Choice Milk Choice Monday, August 30 Tuesday, August 31 Steak Nuggets Lasagna Roll Mashed Potatoes w/Gravy Green Beans Pinto Beans Baby Carrots Roll Roll Fresh Fruit Fruit Cup Milk Choice Milk Choice Offer vs. -

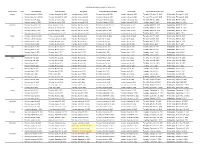

Utility Billing Dates 2021

2021 Reading & Billing Schedule for Website.xlsx Billing Month Cycle Start Read date Finish read date Billing Date Due Date & Bank Draft Date Penalty Date Pay by dates to avoid cut off Cut off date January 1 Monday, December 21, 2020 Thursday, December 24, 2020 Thursday, January 7, 2021 Thursday, January 28, 2021 Tuesday, February 2, 2021 Tuesday, February 16, 2021 Wednesday, February 17, 2021 2 Monday, December 28, 2020 Thursday, December 31, 2020 Thursday, January 14, 2021 Thursday, February 4, 2021 Tuesday, February 9, 2021 Tuesday, February 23, 2021 Wednesday, February 24, 2021 3 Monday, January 4, 2021 Thursday, January 7, 2021 Thursday, January 21, 2021 Thursday, February 11, 2021 Tuesday, February 16, 2021 Tuesday, March 2, 2021 Wednesday, March 3, 2021 4 Monday, January 11, 2021 Thursday, January 14, 2021 Thursday, January 28, 2021 Thursday, February 18, 2021 Tuesday, February 23, 2021 Tuesday, March 9, 2021 Wednesday, March 10, 2021 February 1 Tuesday, January 19, 2021 Friday, January 22, 2021 Thursday, February 4, 2021 Thursday, February 25, 2021 Tuesday, March 2, 2021 Tuesday, March 16, 2021 Wednesday, March 17, 2021 2 Monday, January 25, 2021 Thursday, January 28, 2021 Thursday, February 11, 2021 Thursday, March 4, 2021 Tuesday, March 9, 2021 Tuesday, March 23, 2021 Wednesday, March 24, 2021 3 Monday, February 1, 2021 Thursday, February 4, 2021 Thursday, February 18, 2021 Thursday, March 11, 2021 Tuesday, March 16, 2021 Tuesday, March 30, 2021 Wednesday, March 31, 2021 4 Monday, February 8, 2021 Thursday, February 11, 2021 -

GDL License Eligibility by Birthday Chart

Page 1 Earliest date applicant can receive a No driver education Applicant's 16th probationary driver's license after completion: Earliest date birthday successfully completing driver applicant can receive a education course probationary driver's license January 01 On Apr 01 of their 16th year On Sep 28 of their 16th year January 02 On Apr 02 of their 16th year On Sep 29 of their 16th year January 03 On Apr 03 of their 16th year On Sep 30 of their 16th year January 04 On Apr 04 of their 16th year On Oct 01 of their 16th year January 05 On Apr 05 of their 16th year On Oct 02 of their 16th year January 06 On Apr 06 of their 16th year On Oct 03 of their 16th year January 07 On Apr 07 of their 16th year On Oct 04 of their 16th year January 08 On Apr 08 of their 16th year On Oct 05 of their 16th year January 09 On Apr 09 of their 16th year On Oct 06 of their 16th year January 10 On Apr 10 of their 16th year On Oct 07 of their 16th year January 11 On Apr 11 of their 16th year On Oct 08 of their 16th year January 12 On Apr 12 of their 16th year On Oct 09 of their 16th year January 13 On Apr 13 of their 16th year On Oct 10 of their 16th year January 14 On Apr 14 of their 16th year On Oct 11 of their 16th year January 15 On Apr 15 of their 16th year On Oct 12 of their 16th year January 16 On Apr 16 of their 16th year On Oct 13 of their 16th year January 17 On Apr 17 of their 16th year On Oct 14 of their 16th year January 18 On Apr 18 of their 16th year On Oct 15 of their 16th year January 19 On Apr 19 of their 16th year On Oct 16 of their 16th -

Visa Bulletin for August 2021

United States Department of State Bureau of Consular Affairs VISA BULLETIN Number 56 Volume X Washington, D.C. IMMIGRANT NUMBERS FOR AUGUST 2021 A. STATUTORY NUMBERS This bulletin summarizes the availability of immigrant numbers during August for: “Final Action Dates” and “Dates for Filing Applications,” indicating when immigrant visa applicants should be notified to assemble and submit required documentation to the National Visa Center. Unless otherwise indicated on the U.S. Citizenship and Immigration Services (USCIS) website at www.uscis.gov/visabulletininfo, individuals seeking to file applications for adjustment of status with USCIS in the Department of Homeland Security must use the “Final Action Dates” charts below for determining when they can file such applications. When USCIS determines that there are more immigrant visas available for the fiscal year than there are known applicants for such visas, USCIS will state on its website that applicants may instead use the “Dates for Filing Visa Applications” charts in this Bulletin. 1. Procedures for determining dates. Consular officers are required to report to the Department of State documentarily qualified applicants for numerically limited visas; USCIS reports applicants for adjustment of status. Allocations in the charts below were made, to the extent possible, in chronological order of reported priority dates, for demand received by July 8th. If all reported demand could not be satisfied, the category or foreign state in which demand was excessive was deemed oversubscribed. The final action date for an oversubscribed category is the priority date of the first applicant who could not be reached within the numerical limits. If it becomes necessary during the monthly allocation process to retrogress a final action date, supplemental requests for numbers will be honored only if the priority date falls within the new final action date announced in this bulletin. -

August 1St 2021

See pages 6-7 for weekend Mass Readings and common texts August 1, 2021 CELEBRATING THE TWELFTH ANNIVERSARY OF THE DEDICATION OF ST. FRANCIS DE SALES CHURCH St. Francis de Sales Parish 900 Ida Street Lansing, Kansas 66043 PARISH STAFF Father William McEvoy PASTOR We would be honored if you would become a registered [email protected] Office: (913) 727-3742 member of our parish! There are many ways you can do this: Rectory: (913) 727-1930 1) Stop by the Welcome Table in the back of church. Sister Josephine Macias, CDP DIRECTOR OF FAITH FORMATION 2) Come by the parish office during the week. [email protected] Sharon Kermashek 3) Call the parish office at (913) 727-3742 PARISH LIFE COORDINATOR 4) Register via our parish webpage: StFrancisLansing.org [email protected] Joan Leonard MUSIC DIRECTOR [email protected] Nancy Elmer Xavier Catholic School BUSINESS MANAGER Now Enrolling for the 2021-2022 school year! [email protected] For more information or to enroll please visit leavenworthcatholicschool- Christopher Klepper s.org or contact Lisa Forge: (913) 682- 7801. FACILITIES MANAGER Thank you for your continued to support to Leavenworth Catholic [email protected] Schools. You can support your parish and Leavenworth Catholic Schools by online giving at stfrancislansing.org Bulletin Deadline: Please submit bulletin re- quests to the parish office by noon Friday at least one week prior to the week for desired publication. Scripture Readings for Next Week Sunday, August 8, 2021 1 Kings 19:4-8•Eph 4:30–5:2• Jn 6:41-51 Saturday, August 7th at St.