Presentación De Powerpoint

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Monthly Bulletin of Operational Statistics

Monthly Bulletin of Operational Statistics May 2021 PASSENGERS TRANSPORTED IN SCHEDULED DOMESTIC OPERATIONS MEXICAN AIRLINES Passengers transported in Scheduled Domestic Operations, broken down by airline. Percentage share in the domestic passenger transportation market. jan-may 21 jan-may 20 jan-may 21 Annual Accumulated (millions of passengers) Vivaaerobus Magnicharters TAR Aeromar 27.4% 0.9% 0.6% 0.9%Calafia Aeroméxico Group Airlines 0.4% Aeroméxico 15.9% Connect Aeroméxico Calafia Aeroméxico Aeroméxico Volaris Interjet Vivaaerobus Magnicharters TAR Aeromar Airlines Total Group Aeroméxico ▲50.5% 29.1% Connect 6.26 13.2% ▲49.6% ▲61.1% 4.48 4.16 4.22 ▲94.0% ▼100.0% Volaris 3.00 ▲17.3% 40.7% 2.45 2.62 2.04 2.27 1.74 1.26 ▲44.6% ▼18.5% ▼20.1% ▲63.2% Percentage share in the domestic passenger transportation market. may-21 0.10 0.14 0.10 0.09 0.17 0.14 0.040.06 Vivaaerobus Magnicharters TAR Aeromar 28.0% 1.2% 0.5% ▲959.7% 0.8% Calafia 1,601 Airlines 0.4% Aeroméxico ▲745.5% ▲1083.5% 14.2% 1,035 1,070 ▲520.8% ▲1162.7% Aeroméxico Group Aeroméxico 541 494 27.1% Connect 12.9% ▼100.0% ▲1891.5% ▲574.9% ▲1141.0% 151 122 80 90 43 15 0.0 45.2 1.0 20.7 4.6 31.1 1.3 16.4 Volaris may-20 may-21 Monthly May (thousands of passengers) 41.9% Source: SCT, SST, AFAC, DDE. Information provided by airlines. May 2021 2 TOTAL Monthly passengers transported in Scheduled Domestic Operations Accumulated passengers transported in Scheduled Domestic Operations (millions) (millions) 2019 2020 2021 Projection 2019 2020 2021 ▼39.0% ▼47.3% 4.43 ▼45.7% 53.53 ▲890.3% 4.09 ▲56.0% ▲741.8% 3.82 44.05 ▲0.9% 3.48 3.17 3.14 2 R =0.8552 2.92 3.14 2.71 2.32 28.24 2.70 2.12 ▼40.7% 21.03 2.22 1.67 ▲23.5% 15.39 0.89 12.47 0.39 0.41 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Accumulated until May Annual Accumulated (2021 projected) Source: SCT, SST, AFAC, DDE. -

Una Evaluación Sobre La Desregulación Del Mercado De Aerolíneas En México

Una evaluación sobre la desregulación del mercado de aerolíneas en México Víctor Valdés y José Carlos Ramírez* Fecha de recepción: 9 de abril de 2008; fecha de aceptación: 22 de abril de 2010. Resumen: El objetivo principal de este trabajo es evaluar el impacto de la desre- gulación en el comportamiento reciente de los principales indicadores de desem- peño de la industria de aerolíneas en México. Para tal efecto, se estiman tres modelos econométricos que buscan diferenciar el peso de las medidas desregulato- rias del de “otras variables” en la explicación del curso actual tomado por la indus- tria. Los resultados estadísticos sostienen, con algunas limitaciones, que la desre- gulación: 1) ha tenido un efecto positivo pero marginal en el crecimiento del volumen de pasajeros; 2) ha sido condición necesaria pero no suficiente para esta- blecer una estructura competitiva de precios, y 3) ha generado beneficios que no han sido acompañados por mejores condiciones de competencia en el mercado de aerolíneas. Palabras clave: metodología, desregulación, industria aérea en México. An Evaluation on the De-regulation of Mexico’s Airline Market Abastract: This paper is aimed at assessing the impact of deregulation initiatives on the recent performance of Mexico’s airline industry. By doing so, three econome- tric models are estimated with the view of differentiating the weights of deregula- tion variables from the ones of non-deregulation variables. The main statistical findings support the idea that deregulation in Mexico’s airlines: 1) has had only a marginal positive effect on the number of passengers; 2) has been no influential in establishing a definite competitive price structure in the market, and 3) has rendered insufficient benefits for improving competition conditions in the airline market. -

Análisis Estratégico Sobre El Desarrollo De Las Líneas Aéreas De Bajo Costo En México Nova Scientia, Vol

Nova Scientia E-ISSN: 2007-0705 [email protected] Universidad De La Salle Bajío México Canseco González, Adriana Denisse; Zúñiga Alcaraz, Catya; Blanco Martínez, Luis Análisis estratégico sobre el desarrollo de las líneas aéreas de bajo costo en México Nova Scientia, vol. 7, núm. 15, 2015, pp. 343-363 Universidad De La Salle Bajío León, Guanajuato, México Disponible en: http://www.redalyc.org/articulo.oa?id=203342741020 Cómo citar el artículo Número completo Sistema de Información Científica Más información del artículo Red de Revistas Científicas de América Latina, el Caribe, España y Portugal Página de la revista en redalyc.org Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto Canseco, Adriana D. et al. Revista Electrónica Nova Scientia Análisis estratégico sobre el desarrollo de las líneas aéreas de bajo costo en México Strategic analysis of Mexico’s low-cost airlines development Adriana Denisse Canseco González1, Catya Zúñiga Alcaraz1 y Luis Blanco Martínez2 1Departamento de Logística y Dirección en la Cadena de Suministro, Universidad Popular Autónoma del Estado de Puebla, Puebla 2Departamento de Dirección de Organizaciones, Universidad Popular Autónoma del Estado de Puebla, Puebla México Adriana Denisse Canseco González. E-mail: [email protected] © Universidad De La Salle Bajío (México) Análisis estratégico sobre el desarrollo de las líneas aéreas de bajo costo en México Resumen Introducción: En las últimas décadas, las aerolíneas alrededor del mundo se han enfrentado a un constante crecimiento del mercado. Estas han hecho modificaciones significativas tanto en sus operaciones como en sus costos, que les ha permitido responder eficazmente dichos cambios, desarrollando un nuevo modelo de negocio llamado “de bajo costo”. -

Air Transport Industry Analysis Report

Annual Analyses of the EU Air Transport Market 2016 Final Report March 2017 European Commission Annual Analyses related to the EU Air Transport Market 2016 328131 ITD ITA 1 F Annual Analyses of the EU Air Transport Market 2013 Final Report March 2015 Annual Analyses of the EU Air Transport Market 2013 MarchFinal Report 201 7 European Commission European Commission Disclaimer and copyright: This report has been carried out for the Directorate General for Mobility and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract MOVE/E1/5-2010/SI2.579402. These views have not been adopted or in any way approved by the European Commission and should not be relied upon as a statement of the European Commission's or the Mobility and Transport DG's views. The European Commission does not guarantee the accuracy of the information given in the report, nor does it accept responsibility for any use made thereof. Copyright in this report is held by the European Communities. Persons wishing to use the contents of this report (in whole or in part) for purposes other than their personal use are invited to submit a written request to the following address: European Commission - DG MOVE - Library (DM28, 0/36) - B-1049 Brussels e-mail (http://ec.europa.eu/transport/contact/index_en.htm) Mott MacDonald, Mott MacDonald House, 8-10 Sydenham Road, Croydon CR0 2EE, United Kingdom T +44 (0)20 8774 2000 F +44 (0)20 8681 5706 W www.mottmac.com Issue and revision record StandardSta Revision Date Originator Checker Approver Description ndard A 28.03.17 Various K. -

Annual Report 2007

EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 1 Analyses of the European air transport market Annual Report 2007 EUROPEAN COMMISSION EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 2 Air Transport and Airport Research Annual analyses of the European air transport market Annual Report 2007 German Aerospace Center Deutsches Zentrum German Aerospace für Luft- und Raumfahrt e.V. Center in the Helmholtz-Association Air Transport and Airport Research December 2008 Linder Hoehe 51147 Cologne Germany Head: Prof. Dr. Johannes Reichmuth Authors: Erik Grunewald, Amir Ayazkhani, Dr. Peter Berster, Gregor Bischoff, Prof. Dr. Hansjochen Ehmer, Dr. Marc Gelhausen, Wolfgang Grimme, Michael Hepting, Hermann Keimel, Petra Kokus, Dr. Peter Meincke, Holger Pabst, Dr. Janina Scheelhaase web: http://www.dlr.de/fw Annual Report 2007 2008-12-02 Release: 2.2 Page 1 Annual analyses of the European air transport market Annual Report 2007 Document Control Information Responsible project manager: DG Energy and Transport Project task: Annual analyses of the European air transport market 2007 EC contract number: TREN/05/MD/S07.74176 Release: 2.2 Save date: 2008-12-02 Total pages: 222 Change Log Release Date Changed Pages or Chapters Comments 1.2 2008-06-20 Final Report 2.0 2008-10-10 chapters 1,2,3 Final Report - full year 2007 draft 2.1 2008-11-20 chapters 1,2,3,5 Final updated Report 2.2 2008-12-02 all Layout items Disclaimer and copyright: This report has been carried out for the Directorate-General for Energy and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract TREN/05/MD/S07.74176. -

Diapositiva 1

Competition in the domestic airline sector in Mexico* Agustin J. Ros Senior Economist, OECD April 23, 2010 * This work is output from the CFC-OECD Competition Assessment Project. Opinions expressed do not necessarily reflect official views of the OECD nor of the governments of its member countries nor the Mexican Competition Commission. 1 Outline of presentation i. Summary of main results ii. Review of competition concerns iii. Structure of the market, 1989-2008 iv. Summary of 2009 econometric study v. Policy recommendations & estimate of benefits 2 Summary of main results 1. Strong passenger growth, 1989-2008. Compound growth rate of 5.40%, economy grew at 3.00% 2. Declining concentration, 1989-2008. 1989 HHI of 4396, 2008 HHI of 1766 3. Emergence of low cost carrier as strong competition. LCCs captured 1/3 of market within several years 3 Summary of econometric analysis 4. Average fares are 30% lower on routes with low cost carriers, robust result. 5. Average fares are between 40% and 80% higher at Mexico City Airport (saturated) airport, robust result. 6. Average fares are between 11% and 23% lower when incumbents compete, statistical significance varies. 4 Competition concerns COFECO has examined competition conditions in airlines on several occasions, barriers identified: 1. No cabotage service and 25% foreign ownership restriction. 2. Barriers to airport facilities, esp. in saturated airport. 3. SCT discretion in awarding concessions and additional routes. 4. Structural barriers (sunk costs, attracting customers to new airline, etc). -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

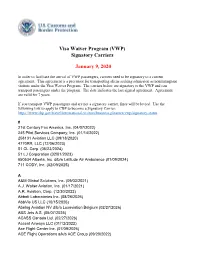

Signatory Visa Waiver Program (VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers January 9, 2020 In order to facilitate the arrival of VWP passengers, carriers need to be signatory to a current agreement. This agreement is a precursor for transporting aliens seeking admission as nonimmigrant visitors under the Visa Waiver Program. The carriers below are signatory to the VWP and can transport passengers under the program. The date indicates the last signed agreement. Agreement are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. (07/09/2026) ACE Flight Operations a/k/a ACE Group (09/20/2022) ACG Logistics LLC (02/25/2026) ACM Air Charter Luftfahrtgesellschaft GmbH (02/22/2025) ACP Jet Charter, Inc. -

IMPORTANCIA DE LAS LÍNEAS AÉREAS EN EL SECTOR TURISMO DE MÉXICO Cecilia García Muñoz Aparicio1 Universidad Juárez Autónoma De Tabasco [email protected]

Journal of Tourism and Heritage Research (2019), vol , nº 1, pp. 220-234. García Muñoz C. “Importance of aerial lines in the México tourism sector” IMPORTANCIA DE LAS LÍNEAS AÉREAS EN EL SECTOR TURISMO DE MÉXICO Cecilia García Muñoz Aparicio1 Universidad Juárez Autónoma de Tabasco [email protected] Resumen El turismo hoy en día es una actividad que aporta al crecimiento económico ya que de acuerdo con la Cámara Nacional de Aerotransportes (2017) el número de pasajeros se incrementó 10.7%, pasando de 73.2 millones de pasajeros en 2015 a poco más de 82 millones de pasajeros en 2016, incremento que de acuerdo con la disminución de los precios de los boletos de avión. En México el transporte genera actividades como el traslado de personas, animales, mercancías y equipo. El objetivo del trabajo es conocer la importancia de las líneas aéreas en el desarrollo del Turismo. La metodología utilizada es de tipo descriptivo explicativo para medir el fenómeno a través de fuentes secundarias. Como resultado existen empresas de capital nacional posicionadas en el mercado como Aeroméxico, interjet, Viva Aerobús, Volaris, Aeromar, Mayair y TAR entre otras, mismas que contribuyen al desarrollo y crecimiento económico del país a través de la generación de más de un millón de empleos y su aportación al producto interno bruto. Palabras clave: empresa, líneas aéreas, turismo. 1 Universidad Juárez Autónoma de Tabasco, [email protected] 220 Journal of Tourism and Heritage Research (2019), vol , nº 1, pp. 220-234. García Muñoz C. “Importance of aerial lines in the México tourism sector” IMPORTANCE OF AERIAL LINES IN THE MEXICO TOURISM SECTOR Summary Tourism today is an activity that contributes to economic growth because according to the National Air Transportation Chamber (2017) the number of passengers increased 10.7%, from 73.2 million passengers in 2015 to just over 82 million passengers in 2016, increase that according to the decrease in the prices of airline tickets. -

Descargar Libro

Impactos económicos de la salida del mercado de Mexicana de Aviación ______________________________________________________________ Ignacio Javier Cruz Rodríguez* *Ignacio es economista por la FES Acatlán-UNAM, maestro y doctor en economía por la misma institución. Es miembro del Sistema Nacional de Investigadores. En el campo profesional se ha desempeñado como analista y consultor en temas de competencia así como en precios de transferencia. En docencia, ha impartido diversos cursos de licenciatura en FES Acatlán-UNAM. Es autor de diversos artículos publicados en revistas especializadas. Actualmente ocupa una cátedra CONACYT jóvenes investigadores asignado al Centro de Investigaciones Socioeconómicas (CISE) de la Universidad Autónoma de Coahuila (UAdeC) donde imparte el seminario para posgrado en economía del transporte. 1 Como parte de la política editorial del Centro De investigaciones Socioeconómicas (CISE), las obras publicadas por investigadores de este centro fueron sujetas al arbitraje doble ciego, garantizando así que el material es académicamente pertinente y conveniente su publicación. Esta obra se publicó gracias al apoyo del Programa de Fortalecimiento de la Calidad de Instituciones Educativas (PROFOCIE) y de la Universidad Autónoma de Coahuila. También forma parte de los materiales generados en el marco de la Red Análisis y Evaluación Políticas Económicas y Sociales (RAEPES). 2 Primera edición mayo 2017 Reservados todos los derechos conforme a la ley © Ignacio Javier Cruz Rodríguez © Centro de Investigaciones Socioeconómicas © Universidad Autónoma de Coahuila Boulevard Venustiano Carranza s/n Colonia República, C.P. 25280, Saltillo, Coahuila ISBN: 978-607-506-288-4 Impreso y hecho en México 3 ÍNDICE Prólogo 5 Introducción 7 Capítulo 1. El escenario global y nacional 13 1.1 Algunos hechos estilizados 17 1.1.1 Transporte aéreo y grandes ciudades 18 1.2 El liderazgo en el transporte de pasajeros 25 Capítulo 2. -

Download (704Kb)

Munich Personal RePEc Archive Economic competition in air transport of passengers in Mexico. A review of the current situation Carlos-Enrique, Cardoso-Vargas 20 December 2015 Online at https://mpra.ub.uni-muenchen.de/79858/ MPRA Paper No. 79858, posted 26 Jun 2017 08:54 UTC Competencia económica en el sector de transporte aéreo de pasajeros en México. Una revisión de la situación actual Carlos Enrique Cardoso-Vargas* (Versión diciembre 2015) Summary: This paper presents a brief review of the current conditions of economic competition in the sector of air travel in Mexico. So, this shows the most relevant legal framework for the sector and highlights of recent years; the document also shows the conditions of competition in the market through the analysis of concentration indices, prices, relationship between prices and market power, competition intra and inters airports and barriers to free competition. The results show a slight increase in economic concentration in the sector, however, in terms of the legislation this situation does not provide evidence that this competition process being affected. The main constraints on competition appear to be the prevailing physical barriers in the operation of the Mexico City International Airport and some aspects of current legislation. Resumen: En este trabajo se presenta una revisión sucinta de las condiciones actuales de la competencia económica en el sector de transporte aéreo de pasajeros en México. Además, muestra lo más relevante del marco legal del sector y los eventos más sobresalientes de los últimos años; asimismo, se destacan las condiciones de competencia en el mercado mediante el análisis de índices de concentración, precios, relación entre precios y poder de mercado, competencia intra e inter aeropuertos y las barreras que limitan la libre concurrencia.