Harshad Mehta and the Billion-Dollar Scam

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Role of Corporate Goverance and Sebi : a Critical Analysis

Journal of Xi'an University of Architecture & Technology Issn No : 1006-7930 ROLE OF CORPORATE GOVERANCE AND SEBI : A CRITICAL ANALYSIS Dr. Neetu Prakash Assistant Professor, Guru Nanak Khalsa College for Women, Model Town, Ludhiana ABSTRACT Corporate frauds or financial crimes or financial frauds can be classified as white-collar crimes, which represent the illegal acts that are characterized by deceit, concealment or violation of trust. The fraudulent exercises practiced by Enron, WorldCom and Martha Steward shook the world. Of these scandals, the Enron accounting scandal was the most infamous one. There were similar allegations against the WorldCom Company, whose CEO Bernard Ebbers hid an expenditure of $11 bn; later this led the company to bankruptcy. Frauds have occurred in almost every country in the world, in almost every sector, including banking, insurance, telecom, automobile industry, health, and the list is endless. The growing focus on cross-border expansion, high levels of growth with internal processes not keeping pace and large number of new employees joining the organization are making most companies vulnerable to greater fraud risk in recent times. The IT hackers and fraudsters can pose a significant threat of a financial crime. Cyber-crimes, economic crimes, ethical crimes, falsification of accounts by showing inflated profits, breach of fiduciary duty, breach of confidential information, non- disclosure of material facts etc. are causing enormous harm to the rights and interests or the society. Every such corporate fraud is a heinous crime against humanity, as it adversely affects and ruins the fortunes of large segments of innocent people. There are several adverse consequences of financial crimes. -

Private Sector Opinion Issue 11

Private Sector Opinion CRASHES, BAILOUTS, REGULATIONS Issue 11 Foreword With the recent stock market frauds in markets around the world such as the Madoff case in the U.S. and the recent Satyam fraud in India, no nation can hold A Global Corporate its head high and claim to have good corporate governance. The reality is that the problems of fraud, faulty audits, misleading accounts, lack of transparency, Governance Forum conflicts of interest, criminal destruction of records and a long list of other cor- porate governance violations, are not limited to emerging markets but are very Publication much in evidence in developed markets as well. Given recent events then, the importance of sound corporate governance is becoming increasingly apparent. International organizations like the OECD, the World Bank and the International Corporate Governance Network (ICGN), along with major fund managers, are formulating sets of codes and principles that can be applied globally. It is also clear, however, that governments have generally done a poor job of policing the complex world of finance and that the greater part of the task will be left to self- policing on the part of the participants. There is no doubt about it: sound corporate governance pays. Several studies undertaken by various organizations have shown that: there is a direct relation- ship between good corporate governance and investment returns. The oversight that comes from transparency and accountability creates a structure where the managers are discouraged from mismanaging the company, be it though a lack of diligence or care, improper decision-making, or even intentioned unconscio- nable behavior. -

Case License to Bank

Case License to Bank Raji Ajwain1 Abstract This case study has been modelled upon the recent working paper released by the RBI 2. .. As the Indian economy surges ahead, the requirements of the consumers, the profile of the stakeholders and the complexity of the operations is undergoing a huge change. The interlocking of the financial community worldwide and at the same time the uniqueness of the Indian situation make it a tough balancing act for the regulator(RBI). The need to encourage sound operations, robust regulations keeping in mind the public interest and watching the growth options are some of the issues discussed herein. The case aims at highlighting international practices along with those followed in Indian so as to invite a discussion on topics listed in this important document released by the Indian regulator (RBI) which is bound to impact the future course of the banking industry. Keywords: Reserve Bank of India, License, Non-Banking Financial Company It is a muggy Monday afternoon in Mumbai. The senior officials of the Reserve Bank of India (RBI)2 along with the banking industry representatives have congregated in the board room to decide upon some crucial issues one among which was the granting of new bank licenses to prospective candidates(see Illustration # 1). The list of the applicants is impressive and has a good sprinkling of leading names of NBFC’s, leading real estate players, banking professionals with impeccable qualifications etc. If the weather outside the room is humid, the temperature inside the board room fluctuates rapidly, sometimes soaring very quickly, the atmosphere 1 Faculty, Symbiosis Centre for Management and Human Resource Development, Pune- 411057 Email: [email protected] 134 charged by the discussions between the board members. -

Harshad Mehta Case: Stock Market and Bank Receipt Scam

ISSN (Online) : 2455 - 3662 SJIF Impact Factor :4.924 EPRA International Journal of Multidisciplinary Research Monthly Peer Reviewed & Indexed International Online Journal Volume: 4 Issue:7 July 2018 Published By : EPRA Journals CC License Volume: 4 | Issue: 7 | July 2018 SJIF Impact Factor: 4.924 ISSN (Online): 2455-3662 EPRA International Journal of Multidisciplinary Research (IJMR) HARSHAD MEHTA CASE: STOCK MARKET AND BANK RECEIPT SCAM ABSTRACT Kapil Kamdar Researcher in this research paper explains how one of Student, the biggest stock scandal in 1992 had been done by Indore Institute of Law, Indore, Harshad Mehta and how Harshad Mehta deceitfully washed over Rs 24,000 crore in the share trading Madhya Pradesh, system over a three-year time frame. Impact of this India scandal on legal regime of india and regulatory authority like SEBI and RBI. KEYWORDS: stock scandal, stockbroker, Bombay Stock Exchange INTRODUCTION demise at age 47 out of 20012. It was claimed that Georg Hegel, scholar once stated: "We gain from Mehta occupied with a gigantic stock control plot history what we don't gain from history." This financed by useless bank receipts, which his firm statement is fit, particularly in the light of the Rs facilitated in "prepared forward" transactions 13,000-crore Nirav Modi-Punjab National Bank between banks. Mehta was indicted by the Bombay scam. Why? Since back when India had quite High Court and Supreme Court of India as far as recently opened up its business sectors to the world concerns him in a financial scandal esteemed at in 1991, a stock dealer named Harshad Mehta had Rs.4999 Crores which occurred on the Bombay Stock done scam by abusing the loopholes in the Indian Exchange (BSE). -

Fraudulent Financial Practices and Investor Protection in the Indian

FINAL REPORT OF UGC SPONSORED MAJOR RESEARCH PROJECT ON FRAUDULENT FINANCIAL PRACTICES AND INVESTOR PROTECTION IN THE INDIAN CAPITAL MARKET – ROLE OF SEBI F. No. 5-46/2014 (HRP) Dated 10th October, 2015 MRP-MAJOR-COMM-2013-8437 (GENERAL) Submitted to the UNIVERSITY GRANTS COMMISSION New Delhi By Dr. GADDAM NARESH REDDY PRINCIPAL INVESTIGATOR DEPARTMENT OF COMMERCE UNIVERSITY COLLEGE OF COMMERCE & BUSINESS MANAGEMENT OSMANIA UNIVERSITY HYDERABAD 2018 PREFACE The Indian securities markets have come a long way in the last three decades in terms of both quantitative as well as qualitative transformations. They have also witnessed quite a few ups and downs including a global financial crisis. The relationship between the rate of economic growth and growth in the securities market is two-fold and symbiotic. Strong economic growth helps securities market to develop and developed securities market mobilizes capital to fuel economic growth. In this ever changing global financial landscape, financial markets too are evolving, growing and getting more complex. To effectively regulate these markets, the regulators and policymakers need to be proactive, keep themselves updated and upgraded. Over a period of time, SEBI has strengthened both its regulatory purview and internal capacity to ensure that the interests of the investors are well protected. Efforts are under way to deepen the corporate bonds market, widen the penetration of mutual funds across the country and strengthening the commodities market. The efforts of the government and of policymakers, the Indian financial market will ascend to newer heights. Corporate sectors, stock markets, and the profession of accounting are increasingly gaining importance which calls for a more efficient and transparent working of corporate sectors. -

Top 100 Women in Finance in India

PremierPremier MembershipMembership NetworkNetwork forfor FinancialFinancial ServicesServices ProfessionalsProfessionals Exqualifi is a premier membership network set up by Association of International Wealth Management of India (AIWMI) for financial services leaders, professionals and aspirants. Exqualifi has been designed as a continuing education platform meant to offer its members opportunities to earn professional designations; to participate in multidisciplinary knowledge initiatives, enable networking at conferences; and offer one single platform for interaction, cross-pollination of ideas and collaboration. Exqualifi provides the opportunity for practitioners and related professionals to connect and advance their focused area of practice. They aim to benefit the practitioner, their area of specialization, the clients they serve, and the industry at large. An exclusive, by-invite membership An exciting membership for Thought Leaders, Entrepreneurs for full time/ part time and Prominent CXOs working in the students of undergraduate Financial Services Sector. and post-graduate courses under 25 years of age. Charter Professional Student Membership Membership Membership A prolific membership for career-oriented professionals working in the financial services and allied sectors. AIWMI, Level 9, Platina, Block G, Plot C-59, Bandra-Kurla Complex, Mumbai - 400051 +91 86574 87782 | memberships@exqualifi.com |www.exqualifi.com Welcome We are extremely excited to present to you the second edition of our Power List- India’s Top 100 Women in Finance- 2020. The world of finance used to be seen as an industry only for men for the longest time. However, that has changed in the last few years. Today, there are a number of successful women professionals in the country who are playing key roles in shaping India's financial sector and inspiring others to follow them. -

A Case Study on Punjab National Bank Scam

Journal of Xi' an Shiyou University, Natural Science Edition ISSN : 1673-064X A Case Study on Punjab National Bank Scam (Is it only a scam or failure of the combined banking system?) Dr. Meda Srinivasa Rao Dr. B. Kishore Babu Professor, KL Business School, Professor, KL Business School Koneru Lakshmaiah Education Koneru Lakshmaiah Education Foundation, Foundation Vaddeswaram, Vaddeswaram, Andhra Pradesh-522502 Andhra Pradesh-522502 Abstract: The “biggest bank loot scam in 70 years” in independent India happened in one of the largest Public Sector Bank that had trembled entire banking sector. Punjab National Bank (PNB) India’s second largest public sector bank released a disaster on Valentine's Day i.e. 14th February 2018 by revealing a scam of Rs.11,400 crore directed by one of the country's richest businessman of the diamond, Nirav Modi. He ranked 85th on Forbes’s 2017 list of India’s richest people. Nirav Modi had directed and executed the scam with the support of Deputy Manager of PNB Mumbai branch named Gokul Nath Shetty and clerk Manoj Kharat. Modi and his Uncle Mehul Choksi schemed with these two people. They had facilitated the issuance of unauthorized LOU (Letter of Undertaking) to Modi and his company without following an appropriate procedure. The post scam had impacted shares of PNB by evaporating the market capitalization value worth of Rs.8000 crore due to that the entire banking sector was under shocking waves. Whistleblower had transcribed to the Prime Minister’s Office (PMO) at 2016, notifying the government for the “biggest bank loot scam in 70 years” but no prompt action was taken by the government. -

Trent Cover.Pmd

C M Y K LETTER OF OFFER Dated: April 30, 2007 For Equity Shareholders of the Company only (Incorporated on 5th December, 1952 under the Indian Companies Act, 1913 as Lakme Limited and name changed to Trent Limited with effect from June 15, 1999) Registered Office: Bombay House, 24 Homi Mody Street, Mumbai 400 001, Maharashtra, India Tel. No. + 91-22-6665 8282 Fax No. + 91-22-2204 2081, Contact Person: Mrs. H. R. Wadia, Company Secretary and Compliance Officer, E-mail: [email protected]; Website: www.mywestside.com Corporate Office: Enterprise Center, 2nd Floor, 17/5 C.S.T., Off. Nehru Road, Vile Parle (East), Mumbai - 400 057, Maharashtra, India. Tel. No. +91-22-6676 7575 Fax No. +91-22-2612 7097 FOR PRIVATE CIRCULATION TO THE EQUITY SHAREHOLDERS OF OUR COMPANY ONLY LETTER OF OFFER ISSUE OF 31,52,147 FULLY PAID EQUITY SHARES WITH A FACE VALUE OF RS.10/- EACH AT A PREMIUM OF RS. 490/- PER EQUITY SHARE FOR AN AMOUNT AGGREGATING TO RS. 157,60,73,500 ON RIGHTS BASIS TO THE EXISTING SHAREHOLDERS OF OUR COMPANY IN THE RATIO OF 1 FULLY PAID EQUITY SHARE FOR EVERY 5 EQUITY SHARES HELD BY THE EXISTING SHAREHOLDERS ON THE RECORD DATE, THAT IS ON MAY 15, 2007 GENERAL RISKS Investments in equity and equity related securities involve a degree of risk and investors should not invest any funds in this Issue unless they can afford to take the risk of losing their investment. Investors are advised to read the Risk Factors carefully before taking an investment decision in this Issue. -

IAIP Newsletter June 2019.Cdr

NEWSLETTER J U N E 2 0 1 9 www.cfasociety.org/india Quotable Quotes If you are born poor, it’s not your fault. But if you die poor, it’s your fault. - Bill Gates NEWSLETTER - June 2019 1 INDEX Message from the CFA Society India Board ........................................................................................ 3 Cover Story Budget - Vision document for 5 years ...................................................................................... 5 RBI's revised debt resolution rules more prudential, less punitive ........................................... 7 Women in Finance ............................................................................................................................... 11 In Conversation with… Sanjiv Singhal - Founder & COO, Scripbox ............................................................................ 13 Gaurav Hinduja - Co-founder and Managing Director, Capital Float .............................. 16 ExPress Where is the Alpha? ................................................................................................................. 20 Modern monetary theory- A resurrection of a failed idea .................................................. 25 Book Review Masterclass with Super Investors ............................................................................................. 31 An Economist walks into a Brothel .......................................................................................... 32 Advocacy Update ............................................................................................................................... -

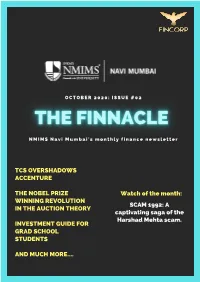

FINNACLE Newsletter Issue 2

O C T O B E R 2 0 2 0 : I S S U E # 0 2 N M I M S N a v i M u m b a i ' s m o n t h l y f i n a n c e n e w s l e t t e r TCS OVERSHADOWS ACCENTURE THE NOBEL PRIZE Watch of the month: WINNING REVOLUTION SCAM 1992: A IN THE AUCTION THEORY captivating saga of the Harshad Mehta scam. INVESTMENT GUIDE FOR GRAD SCHOOL STUDENTS AND MUCH MORE.... FOREWORD Dear readers, Thank you for taking time out of your busy day to read the second issue of this e-Newsletter! Welcome to the second issue of Finnacle. I am extremely proud to roll out the second edition of the monthly newsletter written by the students of NMIMS, Navi Mumbai. The entire team at Fincorp would like to thank readers for the overwhelming response to the first issue of Finnacle, released in September 2020. I thank our campus director - Dr. P.N. Mukherjee and our faculty mentor - Dr. Nupur Gupta for their constant support and encouragement. I would also like to thank the students of NMIMS, Navi Mumbai who took time out of their busy schedules to contribute to this newsletter. “Finnacle” endeavors in contributing to the knowledge frontier in the dynamic world of finance with professionally researched articles on contemporary topics. The Fincorp Team consists of a group of young management students that have a keen interest as well as an expansive knowledge base in finance. -

The Growth of Sebi

THE GROWTH OF SEBI - FROM HARSHAD MEHTA TO SUBRATA ROY By Simran Chandok410 INTRODUCTION The Securities Exchange Board of India popularly known as SEBI is in its 27th year of existence. However, the original architects of SEBI would not recognize what it has become today. From a mere regulatory authority to a statutory authority; from a silent spectator to the market watchdogs; SEBI has come a long way since its inception. SEBI came into existence on 12th April, 1988. It replaced the Controller of Capital Issues Department of the Government. In 1988, SEBI had limited powers with a negligible jurisdiction. In 1992, the SEBI Act bestowed a plethora of responsibilities on the body and gave it a statutory status. Thus after 1992, SEBI was known as a statutory authority and its jurisdiction extended to the whole country except the erstwhile princely states of Jammu & Kashmir. The SEBI Board is headed by a Chairman (nominated by the Union Government of India). The Board consists of 2 Officers from the Union Finance Ministry serving as whole time members, 1 member from the Reserve Bank of India (RBI) and 5 members nominated by the RBI (at least 3 out of 5 RBI nominated members must be whole time members). Currently, U.K. Sinha is the Chairman of the SEBI Board. Since its inception, SEBI has grown steadfastly. Its gradual growth can be analyzed through 3 scams- Harshad Mehta Securities Fraud, Satyam Scandal and Sahara Scam. DEVELOPMENT OF SEBI THROUGH THE 3 DECADES Harshad Mehta Securities Fraud (1988-1995) 410 2nd Year BBA LLB (Hons.), Symbiosis Law School, Pune International Journal For Legal Developments & Allied Issues Volume 1 Issue 2 [ISSN 2454-1273] 205 In 1988, SEBI had limited powers. -

Scheme Information Document Uti Credit Risk

SCHEME INFORMATION DOCUMENT UTI CREDIT RISK FUND (Formerly Known as UTI-Income Opportunities Fund) (An open ended debt scheme predominantly investing in AA and below rated corporate bonds (excluding AA+ rated corporate bonds)) This Product is suitable for investors who are seeking* • Reasonable income and capital appreciation over medium to long term • Investment in debt and money market instruments • RISKOMETER _____________________________________________________________________________________________ * Investors should consult their financial advisers if in doubt about whether the product is suitable for them UTI Mutual Fund UTI Asset Management Company Limited UTI Trustee Company Private Limited Address of the Mutual Fund, AMC and Trustee Company: UTI Tower, Gn Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. Website: www.utimf.com The particulars of the Scheme have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI, nor has SEBI certified the accuracy or adequacy of the Scheme Information Document (SID). This Scheme Information Document sets forth concisely the information about the scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this Scheme Information Document after the date of this Document from the Mutual Fund / UTI Financial Centres (UFCs) / Website / Distributors or Brokers. The investors are advised to refer to the Statement of Additional Information (SAI) for details of UTI Mutual Fund, Tax and Legal issues and general information on www.utimf.com .