Pie Face Franchise System Profile

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

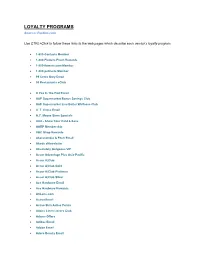

LOYALTY PROGRAMS Source: Perkler.Com

LOYALTY PROGRAMS Source: Perkler.com Use CTRL+Click to follow these links to the web pages which describe each vendor’s loyalty program. 1-800-Contacts Member 1-800-Flowers Fresh Rewards 1-800-flowers.com Member 1-800-petmeds Member 99 Cents Only Email 99 Restaurants eClub A Pea In The Pod Email A&P Supermarket Bonus Savings Club A&P Supermarket Live Better Wellness Club A. T. Cross Email A.C. Moore Store Specials AAA - Show Your Card & Save AARP Membership ABC Shop Rewards Abercrombie & Fitch Email Abode eNewsletter Absolutely Gorgeous VIP Accor Advantage Plus Asia-Pacific Accor A|Club Accor A|Club Gold Accor A|Club Platinum Accor A|Club Silver Ace Hardware Email Ace Hardware Rewards ACLens.com Activa Email Active Skin Active Points Adairs Linen Lovers Club Adams Offers Adidas Email Adobe Email Adore Beauty Email Adorne Me Rewards ADT Premium Advance Auto Parts Email Aeropostale Email List Aerosoles Email Aesop Mailing List AETV Email AFL Rewards AirMiles Albertsons Preferred Savings Card Aldi eNewsletter Aldi eNewsletter USA Aldo Email Alex & Co Newsletter Alexander McQueen Email Alfresco Emporium Email Ali Baba Rewards Club Ali Baba VIP Customer Card Alloy Newsletter AllPhones Webclub Alpine Sports Store Card Amazon.com Daily Deals Amcal Club American Airlines - TRAAVEL Perks American Apparel Newsletter American Eagle AE REWARDS AMF Roller Anaconda Adventure Club Anchor Blue Email Angus and Robertson A&R Rewards Ann Harvey Offers Ann Taylor Email Ann Taylor LOFT Style Rewards Anna's Linens Email Signup Applebee's Email Aqua Shop Loyalty Membership Arby's Extras ARC - Show Your Card & Save Arden B Email Arden B. -

AIBT Student-Guide-2018-Sydney.Pdf

Australia Institute of Business & Technology Australia Institute of Business & Technology STUDENT GUIDE SYDNEY IMPORTANT INFORMATION AND EMERGENCY CONTACTS EMERGENCY Emergency Services Dial 000 for Police, Fire or Ambulance AIBT Policelink 131 444 for non emergency INTERNATIONAL STUDENT SUPPORT International Student Support can assist students settle into life and study in Aus Student Assistance Line +61 468 691 910 24/7 Service UNDER 18 YEARS We help facilitate adequate homestay arrangements for under 18 years students and maintain suitable accommodation, support and general welfare arrangements. Mr. Unwana-Abasi Johnsoni +61 1300 128 199 [email protected] COUNSELLING SERVICES Talk to our counsellor about coping with your studies or stress management. This is a free and confidential service Mr. Zohrab Balian +61 421 341 300 [email protected] JOB PLACEMENT Our Program assists international students to further develop their communication skills in a professional setting and gain practical workplace experience to enhance their career opportunities Dennis McBurney +61 1300 128 199 [email protected] DISABILITY SERVICES We support students with disabilities giving them an equal opportunity to participate and succeed in their selected courses of study. Student Support +61 1300 128 199 [email protected] ACCOMMODATION There are several accommodation options to choose in Sydney. The price of accommodation can vary from $100 per week to over $400 per week depending on the suburb, area and location. Utilities such as electricity are charged separately while in the case of shared accommodation even water and internet might be charged separately. In New South Wales, a refundable rental bond of 4 weeks applies to all new tenants. -

Brand Armani Jeans Celebry Tees Rochas Roberto Cavalli Capcho

Brand Armani Jeans Celebry Tees Rochas Roberto Cavalli Capcho Lady Million Just Over The Top Tommy Hilfiger puma TJ Maxx YEEZY Marc Jacobs British Knights ROSALIND BREITLING Polo Vicuna Morabito Loewe Alexander Wang Kenzo Redskins Little Marcel PIGUET Emu Affliction Bensimon valege Chanel Chance Swarovski RG512 ESET Omega palace Serge Pariente Alpinestars Bally Sven new balance Dolce & Gabbana Canada Goose thrasher Supreme Paco Rabanne Lacoste Remeehair Old Navy Gucci Fjallraven Zara Fendi allure bridals BLEU DE CHANEL LensCrafters Bill Blass new era Breguet Invictus 1 million Trussardi Le Coq Sportif Balenciaga CIBA VISION Kappa Alberta Ferretti miu miu Bottega Veneta 7 For All Mankind VERNEE Briston Olympea Adidas Scotch & Soda Cartier Emporio Armani Balmain Ralph Lauren Edwin Wallace H&M Kiss & Walk deus Chaumet NAKED (by URBAN DECAY) Benetton Aape paccbet Pantofola d'Oro Christian Louboutin vans Bon Bebe Ben Sherman Asfvlt Amaya Arzuaga bulgari Elecoom Rolex ASICS POLO VIDENG Zenith Babyliss Chanel Gabrielle Brian Atwood mcm Chloe Helvetica Mountain Pioneers Trez Bcbg Louis Vuitton Adriana Castro Versus (by Versace) Moschino Jack & Jones Ipanema NYX Helly Hansen Beretta Nars Lee stussy DEELUXE pigalle BOSE Skechers Moncler Japan Rags diamond supply co Tom Ford Alice And Olivia Geographical Norway Fifty Spicy Armani Exchange Roger Dubuis Enza Nucci lancel Aquascutum JBL Napapijri philipp plein Tory Burch Dior IWC Longchamp Rebecca Minkoff Birkenstock Manolo Blahnik Harley Davidson marlboro Kawasaki Bijan KYLIE anti social social club -

Short Communication Health and Nutrition Content Claims on Australian Fast-Food Websites

Public Health Nutrition: 20(4), 571–577 doi:10.1017/S1368980016002561 Short Communication Health and nutrition content claims on Australian fast-food websites Lyndal Wellard1,*, Alexandra Koukoumas2, Wendy L Watson1 and Clare Hughes1 1Cancer Programs Division, Cancer Council NSW, 153 Dowling St, Woolloomooloo, NSW 2011, Australia: 2Faculty of Health and Behavioural Sciences, University of Wollongong, Wollongong, NSW, Australia Submitted 17 March 2016: Final revision received 3 August 2016: Accepted 15 August 2016: First published online 17 October 2016 Abstract Objective: To determine the extent that Australian fast-food websites contain nutrition content and health claims, and whether these claims are compliant with the new provisions of the Australia New Zealand Food Standards Code (‘the Code’). Design: Systematic content analysis of all web pages to identify nutrition content and health claims. Nutrition information panels were used to determine whether products with claims met Nutrient Profiling Scoring Criteria (NPSC) and qualifying criteria, and to compare them with the Code to determine compliance. Setting: Australian websites of forty-four fast-food chains including meals, bakery, ice cream, beverage and salad chains. Subjects: Any products marketed on the websites using health or nutrition content claims. Results: Of the forty-four fast-food websites, twenty (45 %) had at least one claim. A total of 2094 claims were identified on 371 products, including 1515 nutrition content (72 %) and 579 health claims (28 %). Five fast-food products with health (5 %) and 157 products with nutrition content claims (43 %) did not meet the requirements of the Code to allow them to carry such claims. Conclusions: New provisions in the Code came into effect in January 2016 after a 3-year transition. -

List-Of-Participating-Stores

PARTICIPATING STORES Adairs House Salon Express Ally Fashion LA Nails Scents Alterations R Us Jay Jays Shaver Shop Anna’s Cards and Gifts Jamaica Blue Shingle Inn Angus & Coote JB Hi-Fi Silk Relaxation Babaz Barbers Jeanswest SILK Laser Clinics Bakers Delight The Jerky Co Silver Sponge Car Wash Berry Me Premium Frozen Jim Kidd Sports Skewerz Kebabz Yoghurt Just Cuts Small Asian Café Boost Juice Kmart Smokemart & Gift Box Bras N Things Kurdish Kebabs Source Bulk Foods Bud N Bee Florist Laubman & Pank Specsavers Bucking Bull Lorna Jane Spendless Shoes City Beach Lovisa Strandbags City of Gold Major Luck Lottery Centre Sumo Salad Cold Rock Ice Creamery Michael Hill Sussan Coles Mike's Multi Service Kiosk Suzanne Grae Colette Mobile Tech Target Connor Momo Hair Design The Blue Budha Cotton On Muffin Break The Body Shop Cotton On Body Nando’s The Bra Bar Donut King NewsXpress The Coffee Club Dusk Novo Shoes The Source Bulk Foods EB Games Ocean Keys Book Exchange Telstra Enhance Fashion Accessories Ocean Keys Fresh Tui Na Massage Essence Café Ocean Keys Spa & Beauty Two Buck Shop and More Essential Beauty Ollie's Place Kidswear Typo Flight Centre OPSM Vodafone Five Star Meat & Poultry Options Optometrists Volona and Associates Fix N Shop Pandora Watch Works Friendlies Pharmacy Price Attack Wendy’s Milk Bar Gamesworld Priceline Pharmacy W.Lane Go Vita Professional Nail Care Woolworths Great Wall Chinese Prouds The Jewellers Zubias Beauty Grill’d Red Dot Hi Thai Rockmans NON PARTICIPATING STORES Australia Post Kmart Tyre Optus Sapporo Sushi Travel Money Oz Yomato Sushi Lowes . -

New Zealand Country and Sector Analysis Report

MAY 2014 NEW ZEALAND COUNTRY AND SECTOR ANALysIS REPORT 2014 DFS Services L.L.C. Auckland, NZ SECTOR ANALysIS OVERVIEW Diners Club International® is owned by Discover We realize our customers, especially those in Financial Services® (NYSE: DFS), a direct the corporate sector, desire ease of card use banking and payment services company with when traveling globally. In recognition of this one of the most recognized brands in U.S. need, Diners Club continues to increase card financial services. Established in 1950, Diners acceptance in the travel and entertainment Club International became the first multi-purpose (T&E) sector. Additionally, we are optimizing charge card in the world, launching a financial geographical and sector penetration within revolution in how consumers and companies select markets. pay for products and services. Today, Diners This Country and Sector Analysis report serves as Club® is a globally recognized brand serving the a quarterly guide to merchant acceptance within payment needs of select and affluent consumers, select countries. This report provides a snapshot offering access to more than 512 airport lounges of acceptance at travel and entertainment worldwide, and providing corporations and (T&E) merchants which had a minimum of one small business owners with a complete array of transaction over a rolling 12 month period. expense management solutions. With acceptance Additionally, we have added an external source, in more than 185 countries and territories, millions Lanyon1, as a source for the hotel sector. of merchant locations and access to over 1M cash access locations and ATMs, Diners Club is uniquely qualified to serve its cardmembers all over the world. -

SBA Franchise Directory Effective March 31, 2020

SBA Franchise Directory Effective March 31, 2020 SBA SBA FRANCHISE FRANCHISE IS AN SBA IDENTIFIER IDENTIFIER MEETS FTC ADDENDUM SBA ADDENDUM ‐ NEGOTIATED CODE Start CODE BRAND DEFINITION? NEEDED? Form 2462 ADDENDUM Date NOTES When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Collateral Assignment of Lease and Lease S3606 #The Cheat Meal Headquarters by Brothers Bruno Pizza Y Y Y N 10/23/2018 Addendum may not be executed. S2860 (ART) Art Recovery Technologies Y Y Y N 04/04/2018 S0001 1‐800 Dryclean Y Y Y N 10/01/2017 S2022 1‐800 Packouts Y Y Y N 10/01/2017 S0002 1‐800 Water Damage Y Y Y N 10/01/2017 S0003 1‐800‐DRYCARPET Y Y Y N 10/01/2017 S0004 1‐800‐Flowers.com Y Y Y 10/01/2017 S0005 1‐800‐GOT‐JUNK? Y Y Y 10/01/2017 Lender/CDC must ensure they secure the appropriate lien position on all S3493 1‐800‐JUNKPRO Y Y Y N 09/10/2018 collateral in accordance with SOP 50 10. S0006 1‐800‐PACK‐RAT Y Y Y N 10/01/2017 S3651 1‐800‐PLUMBER Y Y Y N 11/06/2018 S0007 1‐800‐Radiator & A/C Y Y Y 10/01/2017 1.800.Vending Purchase Agreement N N 06/11/2019 S0008 10/MINUTE MANICURE/10 MINUTE MANICURE Y Y Y N 10/01/2017 1. When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Addendum to Lease may not be executed. -

Off* for Visitors

Welcome to The best brands, the biggest selection, plus 1O% off* for visitors. Stop by Macy’s Herald Square and ask for your Macy’s Visitor Savings Pass*, good for 10% off* thousands of items throughout the store! Plus, we now ship to over 100 countries around the world, so you can enjoy international shipping online. For details, log on to macys.com/international Macy’s Herald Square Visitor Center, Lower Level (212) 494-3827 *Restrictions apply. Valid I.D. required. Details in store. NYC Official Visitor Guide A Letter from the Mayor Dear Friends: As temperatures dip, autumn turns the City’s abundant foliage to brilliant colors, providing a beautiful backdrop to the five boroughs. Neighborhoods like Fort Greene in Brooklyn, Snug Harbor on Staten Island, Long Island City in Queens and Arthur Avenue in the Bronx are rich in the cultural diversity for which the City is famous. Enjoy strolling through these communities as well as among the more than 700 acres of new parkland added in the past decade. Fall also means it is time for favorite holidays. Every October, NYC streets come alive with ghosts, goblins and revelry along Sixth Avenue during Manhattan’s Village Halloween Parade. The pomp and pageantry of Macy’s Thanksgiving Day Parade in November make for a high-energy holiday spectacle. And in early December, Rockefeller Center’s signature tree lights up and beckons to the area’s shoppers and ice-skaters. The season also offers plenty of relaxing options for anyone seeking a break from the holiday hustle and bustle. -

2018 Australia Survey

AUSTRALIA SURVEY 2018 SURVEY (WAVE 2) AUGUST 30, 2019 INTERNATIONAL FOOD POLICY STUDY 2018 – AUSTRALIA SURVEY ACKNOWLEDGEMENTS FUNDING FOR THE INTERNATIONAL FOOD POLICY STUDY WAS PROVIDED BY A CANADIAN INSTITUTES OF HEALTH RESEARCH (CIHR) PROJECT GRANT, WITH ADDITIONAL SUPPORT FROM AN INTERNATIONAL HEALTH GRANT, THE PUBLIC HEALTH AGENCY OF CANADA (PHAC), AND A CIHR-PHAC APPLIED PUBLIC HEALTH CHAIR. THE STUDY HAS NO AFFILIATIONS WITH THE FOOD INDUSTRY AND THERE ARE NO CONFLICTS OF INTERESTS TO DECLARE. SUGGESTED CITATION HAMMOND D. INTERNATIONAL FOOD POLICY STUDY: AUSTRALIA SURVEY – 2018 SURVEY (WAVE 2). UNIVERSITY OF WATERLOO. AUGUST 2019. CONTACT DAVID HAMMOND PhD SCHOOL OF PUBLIC HEALTH & HEALTH SYSTEMS UNIVERSITY OF WATERLOO WATERLOO, ON CANADA N2L 3G1 [email protected] WWW.DAVIDHAMMOND.CA 2 INTERNATIONAL FOOD POLICY STUDY 2018 – AUSTRALIA SURVEY LIST OF MEASURES INTRODUCTION .................................................................................................................................... 7 SMARTPHONES 7 ELIGIBILITY INTRO 7 AGE 7 SEX AT BIRTH 7 INFO 7 CONSENT 7 DEMOGRAPHICS ................................................................................................................................... 8 PREAMBLE 8 GENDER 8 STUDENT STATUS 8 OCCUPATION 8 CHILDREN – ANY 8 CHILDREN IN HOME - NUMBER 9 CURRENT LIVING SITUATION 9 FOOD SOURCES .................................................................................................................................... 9 FOOD SOURCE – 9 EATING OUT FREQUENCY 9 FOOD -

Beware the Fat in the Froth

Page 1 of 2 Date: 22 June 2010 Contact: Rebecca Cook - 0438 316 435 Beware the fat in the froth Health coalition calls for menu labelling to sort fat from fiction Health conscious consumers may be unwittingly ordering energy dense snacks and drinks, which contain up to a quarter of their daily kilojoule intake, due to a lack of clear menu labelling, according to a group of health agencies. Jane Martin, Senior Policy Adviser for the Obesity Policy Coalition, said that many consumers would be surprised to find that some seemingly innocuous items such as frappes and smoothies contained around a quarter of an adult‟s recommended daily energy intake. To make matters worse many products with healthy sounding names are at the top of the worst offenders list. “As consumers are becoming more health conscious, fast food outlets are trying to capitalise on this by heavily promoting foods or drinks as „healthier options‟; however, in many cases these products are equally high in energy as some standard menu items. “Some of the highest kilojoule menu items have names such as the Blueberry Blast, Garden Goodness and Green Tea Venti. While some of these products contain valuable nutrients, few people would realise that there‟s less than a 100 kilojoules difference between a Big Mac and the McDonald‟s Crispy Chicken Caesar Salad. “Clearer labelling on menus at fast food outlets would help consumers sort the fat from the fiction at a glance. Traffic light labels, whereby foods are colour coded based on whether levels of fat, saturated fat, sugar and salt are high, medium and low, would help people make healthier choices. -

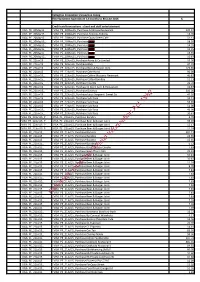

Callaghan Innovation 2015/16 Expenses

Callaghan Innovation transaction listing Entertainment expenditure 12 months to 30 June 2016 $ Credit card transactions - client and staff entertainment VISA PE_20May15_ VISA PE_20May15_Purchase Ambrosia Restaurant 109.57 VISA PE_20May15_ VISA PE_20May15_Purchase Andrew Andrew 14.78 VISA PE_20May15_ VISA PE_20May15_Purchase Quay Street Cafe 51.13 VISA PE_20May15_ VISA PE_20May15_Purchase s9(2)(a) 58.50 VISA PE_20May15_ VISA PE_20May15_Purchase s9(2)(a) 14.35 VISA PE_20May15_ VISA PE_20May15_Purchase s9(2)(a) 14.35 VISA PE_20May15_ VISA PE_20May15_Purchase s9(2)(a) 13.91 VISA PE_20May15_ VISA PE_20May15_Purchase s9(2)(a) 10.87 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Acme & Co Limited 53.00 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Bbqs 47.39 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Beer & Burger Joint 125.65 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Cafe Hanoi 90.00 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Caffee Massimo Newmark 40.87 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Caltex Bombay 11.13 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Casetta 32.70 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase D Store Cafe & Restaurant 10.87 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Davincis 500.00 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Louis Sergeant Sweet Co 43.20 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Sub Rosa 59.13 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Sub Rosa 55.65 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Sub Rosa 51.00 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Sub Rosa 46.96 VISA PE_22Jun15_ VISA PE_22Jun15_Purchase Sub Rosa 30.87 VISA -

Health and Nutrition Content Claims on Australian Fast-Food Websites Lyndal Wellard Cancer Council, NSW

University of Wollongong Research Online Faculty of Science, Medicine and Health - Papers Faculty of Science, Medicine and Health 2017 Health and nutrition content claims on Australian fast-food websites Lyndal Wellard Cancer Council, NSW Alexandra G. Koukoumas University of Wollongong, [email protected] Wendy L. Watson Cancer Council, NSW, [email protected] Clare Hughes Choice, Cancer Council, NSW Publication Details Wellard, L., Koukoumas, A., Watson, W. L. & Hughes, C. (2017). Health and nutrition content claims on Australian fast-food websites. Public Health Nutrition,20 (4), 571-577. Research Online is the open access institutional repository for the University of Wollongong. For further information contact the UOW Library: [email protected] Health and nutrition content claims on Australian fast-food websites Abstract Objective: To determine the extent that Australian fast-food websites contain nutrition content and health claims, and whether these claims are compliant with the new provisions of the Australia New Zealand Food Standards Code ('the Code'). Design: Systematic content analysis of all web pages to identify nutrition content and health claims. Nutrition information panels were used to determine whether products with claims met Nutrient Profiling Scoring Criteria (NPSC) and qualifying criteria, and to compare them with the Code to determine compliance. Setting: Australian websites of forty-four fast-food chains including meals, bakery, ice cream, beverage and salad chains. Subjects: Any products marketed on the websites using health or nutrition content claims. Results: Of the forty-four fast-food websites, twenty (45 %) had at least one claim. A total of 2094 claims were identified on 371 products, including 1515 nutrition content (72 %) and 579 health claims (28 %).