Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DA 02-1285 Note: Save This File Under the CUID Number 01 02 03 04 05

DA 02-1285 Federal Communications Commission Approved by OMB 3060-0647 Washington, DC 20554 Expiration Date 04/30/2003 2002 FCC ANNUAL CABLE PRICE SURVEY Note: Save this file under the CUID number A. Operator Information Community 01 6-digit community unit identification (CUID) number 02 Name of community 03 Name of county (primary, if this community overlaps counties) 04 5-digit Zip Code associated with highest number of subscribers in community 05 Has the FCC made a finding of "effective competition" within this community? (yes or no) 06 Is this community's basic service tier charge subject to local regulation? (yes or no) Cable System (defined as area served by a single headend) 07 Name of cable system serving this community 08 Name of cable operator (if different) 09 Street address and/or post office box 10 City, state and Zip Code 11 Highest system capacity, in MHz (e.g., 7 50), as of July 1, 2001 12 Highest system capacity, in MHz, as of July 1, 2002 13 Year in which this capacity was achieved 14 Is this system affiliated with a multiple system operator (MSO)? (yes or no) 15 Is this system part of a MSO cluster of two or more systems? (yes or no) * * In close geographic proximity and sharing personnel, management, marketing, and/or technical facilities. Parent Entity 16 Ultimate parent entity name 17 Name of survey contact person 18 Telephone number of contact person 19 Number of cable subscribers that parent entity serves nationwide Certification I certify that I have examined this report and all statements of fact therein are true, complete, and correct to the best of my knowledge, information, and belief, and are made in good faith. -

Dan Dellinger Past National Commander Will Be a Special Guest in January During the Illinois American Legion Family Caravan

American Legion Department of Illinois 2014—2015 Department Commander Hank Robards DECEMBER 2014 Dan Dellinger Past National Commander Will be a Special Guest in January during the Illinois American Legion Family Caravan Dan Dellinger of Vienna, Va., was elected National Commander of the 2.4 million-member American Legion on Aug. 29, 2013 in Houston, during the 95th national convention of the nation’s largest veterans organization. As of He became an Army Infantry officer after graduating with a degree in criminology from Indiana University of Pennsylvania. He served at Fort November 26, 2014 Benning, Ga., during the Vietnam War and entered the U.S. Army Reserve in 1972, separating from the service in 1984 at the rank of captain. A member of the Dyer-Gunnell American Legion Post 180 in Vienna since 1982, he was made a life member in 1990. He has served as Post, District and Department commander and chaired numerous committees. At the national District Commander level, he chaired the Legislative, National Security, and Economics Commissions 7 LAMPERT as well as the Aerospace Committee. He served as Chairman of the Legislative 23 HARRIS Council and Membership and Post Activities Committee. He has been a member of the Foreign Relations Council, Policy Coordination, Veterans Planning and 21 NARGELENAS Coordinating Committees as well as the Legislative Council. 11 STIEG Dellinger is a member of the Sons of the American Legion, Past Commanders 8 MC NELLIS and Adjutants Club, Past Department Commander’s Club, ANAVICUS and the 13 GROHARING Citizens Flag Alliance. He has served as a presidential appointee on the Federal Taskforce on SBA Hiring and as vice mayor of the Town of Vienna, Virginia as 17 MATHENY well as serving three terms as town councilman. -

AGENDA REGULAR MEETING City Council of the Town of Colma Colma Community Center 1520 Hillside Boulevard Colma, CA 94014 Wednesday, March 11, 2015 at 7:30 PM

AGENDA REGULAR MEETING City Council of the Town of Colma Colma Community Center 1520 Hillside Boulevard Colma, CA 94014 Wednesday, March 11, 2015 at 7:30 PM PLEDGE OF ALLEGIANCE AND ROLL CALL ADOPTION OF AGENDA PRESENTATION . Proclamation in Honor of American Red Cross Month . City Manager’s Commendation PUBLIC COMMENTS Comments on the Consent Calendar and Non-Agenda Items will be heard at this time. Comments on Agenda Items will be heard when the item is called. CONSENT CALENDAR 1. Motion to Accept the Minutes from the February 11, 2015 Regular Meeting. 2. Motion to Accept the Minutes from the February 17, 2015 Special Meeting. 3. Motion to Approve Report of Checks Paid for February 2015. 4. Motion to Adopt a Resolution Directing City Manager to Submit Beacon Award Application. 5. Motion to Adopt a Resolution Approving Agreement for Animal Control Services. 6. Motion to Adopt a Resolution Amending Colma Administrative Code Subchapter 1.10, Master Fee Schedule, Relating to Animal Control. 7. Motion to Accept the 2014 Annual Report on the Implementation of the General Plan, Including the Housing Element. 8. Motion to Adopt a Resolution Approving Contract Amendment with Ratcliff for Architectural Services for Town Hall Project. 9. Motion to Adopt a Resolution Approving Contract with Best Best & Krieger LLP for Legal Services. Page 1 of 2 10. Motion to Adopt Ordinance Amending Section 5.15.060 of the Colma Municipal Code, Relating to Requests for Reasonable Accommodations in Housing (second reading). NEW BUSINESS 11. BULK TV SERVICES Consider: Motion to Adopt a Resolution Authorizing the City Manager to Negotiate a Bulk Cable Television Services Agreement. -

Nevada Broadcasters Association Sober Moms Total Dollar Return and Spots Aired for April 2016

Sober Moms Total Dollar Return and Spots Aired For April 2016 Monthly Investment : $5000.00 Region Spots Aired Region Total Estimated Value Southern Radio 450 Southern Radio $45,000.00 Southern Television 280 Southern Television $47,825.00 Northern and Rural Radio 606 Northern and Rural Radio $45,450.00 Northern and Rural Television 483 Northern and Rural Television $76,215.00 Monthly Spot Total 1,819 Monthly Value Total $214,490.00 Campaign Spot Total 10,482 Campaign Value Total $1,309,610.00 Monthly Return on Investment 42:1 Total Return on Investment 51:1 Spots Aired Day Parts Spots Aired 31% 6am to 7pm 6am to 7pm 575 47% 7pm to 12am 396 7pm to 12am 12am to 6am 848 22% 12am to 6am Station Frequency Format Spots Total Value* 6a-7p 7p-12a 12a-6a KBAD 920 AM Sports 6 $600.00 4 1 1 KCYE 102.7 FM Coyote Country 10 $1,000.00 0 0 10 KDWN 720 AM News/Talk 10 $1,000.00 0 0 10 KENO 1460 AM Sports 5 $500.00 1 1 3 KISF 103.5 FM Regional Mexican 8 $800.00 0 1 7 KJUL 104.7 FM Adult Standards 26 $2,600.00 0 14 12 KKLZ 96.3 FM Classic Rock 8 $800.00 1 0 7 KLAV 1230 AM Talk/Information 6 $600.00 3 1 2 KLUC 98.5 FM Contemporary Hits 38 $3,800.00 0 0 38 KMXB 94.1 FM Modern Adult Contemporary 35 $3,500.00 0 0 35 KMZQ 670 AM News/Talk 51 $5,100.00 19 14 18 KOAS 105.7 FM Jazz 10 $1,000.00 0 0 10 KOMP 92.3 FM Rock 5 $500.00 0 0 5 KPLV 93.1 FM Oldies 12 $1,200.00 3 2 7 KQLL 102.3 FM /1280 AM Oldies 13 $1,300.00 0 4 9 KRGT 99.3 FM Spanish Urban 8 $800.00 1 0 7 KRLV 1340 AM Sports Talk 7 $700.00 5 1 1 KSNE 106.5 FM Adult Contemporary 12 $1,200.00 2 3 7 KUNV 91.5 FM Jazz 42 $4,200.00 16 24 2 KVEG 97.5 FM Contemporary Hits, Rhythmic 5 $500.00 0 0 5 KVGS 107.9 FM Rhythm & Blues 10 $1,000.00 0 0 10 KWID 101.9 FM Mexican Regional Music 6 $600.00 0 2 4 KWNR 95.5 FM Country Music 12 $1,200.00 0 0 12 KWWN 1100 AM News/Talk 6 $600.00 2 0 4 KXNT 840 AM News/Talk 21 $2,100.00 1 2 18 KXPT 97.1 FM Classic Rock Hits 6 $600.00 0 0 6 KXQQ 100.5 FM Rhythmic Hot AC 35 $3,500.00 0 0 35 KXTE 107.5 FM Alternative Rock 37 $3,700.00 1 12 24 Spanish stations are represented in BLUE ink. -

Nevada Broadcasters Association Sober Moms Total Dollar Return

Sober Moms Total Dollar Return and Spots Aired For May 2016 Monthly Investment : $5000.00 Region Spots Aired Region Total Estimated Value Southern Radio 515 Southern Radio $51,500.00 Southern Television 232 Southern Television $42,350.00 Northern and Rural Radio 498 Northern and Rural Radio $37,350.00 Northern and Rural Television 377 Northern and Rural Television $60,260.00 Monthly Spot Total 1,622 Monthly Value Total $191,460.00 Campaign Spot Total 12,104 Campaign Value Total $1,501,070.00 Monthly Return on Investment 37:1 Total Return on Investment 49:1 Spots Aired Day Parts Spots Aired 29% 6am to 7pm 6am to 7pm 468 51% 7pm to 12am 333 7pm to 12am 20% 12am to 6am 821 12am to 6am Station Frequency Format Spots Total Value* 6a-7p 7p-12a 12a-6a KBAD 920 AM Sports 8 $800.00 2 2 4 KCYE 102.7 FM Coyote Country 8 $800.00 0 0 8 KDWN 720 AM News/Talk 8 $800.00 0 0 8 KENO 1460 AM Sports 8 $800.00 1 3 4 KISF 103.5 FM Regional Mexican 10 $1,000.00 1 2 7 KJUL 104.7 FM Adult Standards 23 $2,300.00 0 5 18 KKLZ 96.3 FM Classic Rock 7 $700.00 0 0 7 KLAV 1230 AM Talk/Information 8 $800.00 4 1 3 KLUC 98.5 FM Contemporary Hits 31 $3,100.00 0 0 31 KMXB 94.1 FM Modern Adult Contemporary 30 $3,000.00 0 0 30 KMZQ 670 AM News/Talk 55 $5,500.00 18 11 26 KOAS 105.7 FM Jazz 8 $800.00 0 0 8 KOMP 92.3 FM Rock 8 $800.00 0 0 8 KPLV 93.1 FM Oldies 13 $1,300.00 5 2 6 KQLL 102.3 FM /1280 AM Oldies 16 $1,600.00 1 5 10 KQRT 105.1 FM Mexican Regional Music 15 $1,500.00 5 3 7 KRGT 99.3 FM Spanish Urban 10 $1,000.00 3 1 6 KRLV 1340 AM Sports Talk 8 $800.00 4 1 3 KRRN 92.7 -

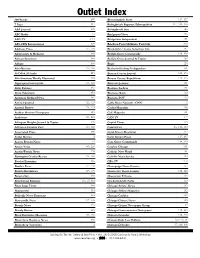

Outlet Index

Outlet Index 600 Words 207 Bloomingdale Press 117, 137 7 Days 217 Bolingbrook Reporter/Metropolitan 117, 140, 146 ABA Journal 185 Bolingbrook Sun 146 ABC Radio 31 Bridgeport News 226 ABC-TV 2, 16 Bridgeview Independent 151 ABS-CBN International 197 Brighton Park/McKinley Park Life 226 Addison Press 117, 136 Brookfield / Lyons Suburban Life 137 Adolescents & Medicine 185 Buffalo Grove Countryside 119, 128 African-Spectrum 189 Buffalo Grove Journal & Topics 128 Afrique 189 Bugle 126 Afro-Netizen 113, 189 Burbank-Stickney Independent 151 Al-Offok Al-Arabi 215 Bureau County Journal 121, 176 Alfa American Weekly Illustrated 203 Bureau County Republican 121, 176 Algonquin Countryside 118, 128 Business Journal 101 Alsip Express 151 Business Ledger 101 Alton Telegraph 153 Business Week 182 American Medical News 182 BusinessPOV 113 Antioch Journal 122, 123 Cable News Network - CNN 2 Antioch Review 118, 123 Cachet Magazine 190 Arabian Horizon Newspaper 215 Café Magazine 101 Arabstreet 113, 215 CAN TV 1, 7 Arlington Heights Journal & Topics 128 Capital Times 153 Arlington Heights Post 119, 128 Capitol Fax Sec 1:34, 109 Associated Press 108 Carol Stream Examiner 137 At the Movies 2 Carol Stream Press 117, 137 Aurora Beacon News 91 Cary-Grove Countryside 118, 129 Austin Voice 189, 224 Catalyst Chicago 101 Austin Weekly News 224 Catholic New World 101 Barrington Courier-Review 118, 128 Catholic News Service 109 Bartlett Examiner 136 CBS-TV 2, 8 Bartlett Press 117, 136 Champaign News Gazette 154 Batavia Republican 117, 136 Charleston Times-Courier 110, -

Chicago – June 5, 2020 – Total Living Network Expands COVID-19 Specials Messaging As the COVID-19 Pandemic Evolves, So Do T

Chicago – June 5, 2020 – Total Living Network expands COVID-19 specials messaging As the COVID-19 pandemic evolves, so do TLN’s specials about the crisis. In addition to prayer and ministry episodes, news-based interviews and conversations have been added. Hosted by Debra Fraser, President/CEO of the Total Living Network as well as Jerry K. Rose, Chairman of the TLN Board, new specials include the following guests: • Dennis Prager, nationally syndicated radio • John Hansen, Lead Pastor, Centerpoint talk show host and best-selling author Church • Dr. Mark Jobe, President, Moody Bible • Dave Patterson, Lead Pastor, The Father’s Institute House • Dr. and Bishop Horace Smith, Assistant • David Cannistraci, Lead Pastor, Gateway City Professor of Pediatrics at Northwestern Church Feinberg School of Medicine, past Director of • Bishop Johnathan Logan, Senior Pastor, Comprehensive Sickle Cell Program at Ann & Cornerstone Community Church Robert H. Lurie Children’s Hospital of • Ken Foreman, Senior Pastor, Cathedral of Chicago and Pastor of Apostolic Faith Church. Faith • Dr. Willie Wilson, philanthropist and • Terry Inman, Senior Pastor, Harbor Light entrepreneur Church • Chris Nelson, Director of Government and • Dwight Surratt, Senior Pastor, Carefree Community Affairs, Comcast/Greater Chicago Church Region • Bishop Jerry Macklin, Founder & Pastor, Glad • Pastors Florin Cimpean and Christian Ionescu Tidings Church who opened their churches in May despite the • Terry Brisbane, Lead Pastor, Cornerstone IL shelter-in-place order Church • James -

Effect Upon Nearby Fcc Licensed Rf Facilities

APPENDIX G1 ENGINEERING REPORT CONCERNING THE EFFECT UPON NEARBY FCC LICENSED RF FACILITIES Evans Associates Montezuma II Wind Project RF Study ENGINEERING REPORT CONCERNING THE EFFECT UPON NEARBY FCC LICENSED RF FACILITIES DUE TO THE CONSTRUCTION OF A WIND ENERGY PROJECT In SOLANO COUNTY, CALIFORNIA “MONTEZUMA II WIND PROJECT” ICF Jones & Stokes August 18, 2010 By: B. Benjamin Evans, P.E. Evans Associates 210 South Main Street Thiensville, WI 53092 262-242-6000 PHONE 262-242-6045 FAX www.evansassoc.com Copyright 2010 Page 1 Evans Associates Montezuma II Wind Project RF Study ENGINEERING REPORT CONCERNING THE EFFECT UPON NEARBY FCC LICENSED RF FACILITIES DUE TO THE CONSTRUCTION OF THE MONTEZUMA II WIND ENERGY PROJECT In SOLANO COUNTY, CALIFORNIA ICF Jones & Stokes I. INTRODUCTION AND RESULTS SUMMARY This engineering report describes the results of a study and analysis to determine the locations of FCC-licensed microwave and fixed station radio frequency facilities that may be adversely impacted as a result of the construction of wind turbines in the Montezuma II wind project area in Solano County, California. This report describes impact zones and any necessary mitigation procedures, along with recommendations concerning individual wind turbine siting. All illustrations, calculations and conclusions contained in this document are subject to on-site verification1. Frequently, wind turbines located on land parcels near RF facilities can cause one or more modes of RF impact, and may require an iterative procedure to minimize adverse effects. This procedure is necessary in order to ensure that disruption of RF facilities either does not occur or, in the alternative, that mitigation procedures will be effective. -

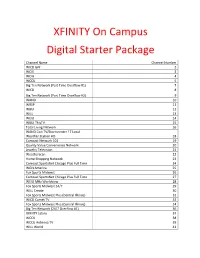

XFINITY on Campus Digital Starter Package

XFINITY On Campus Digital Starter Package Channel Name Channel Number WICD Grit 2 WCIX 3 WCIA 4 WCCU 5 Big Ten Network (Part Time Overflow #1) 7 WICD 8 Big Ten Network (Part Time Overflow #2) 9 WAND 10 WRSP 11 WBUI 12 WILL 13 WEIU 14 WBUI ThisTV 15 Total Living Network 16 WAND Cozi TV/Stormcenter 17 Local Weather Station HD 18 Comcast Network 101 19 Quality Value Convenience Network 20 Jewelry Television 21 Weatherscan 22 Home Shopping Network 23 Comcast SportsNet Chicago Plus Full Time 24 WGN America 25 Fox Sports Midwest 26 Comcast SportsNet Chicago Plus Full Time 27 WEIU MHz Worldview 28 Fox Sports Midwest 24/7 29 WILL Create 30 Fox Sports Midwest Plus (Central Illinois) 32 WICD Comet TV 33 Fox Sports Midwest Plus (Central Illinois) 34 Big Ten Network (24/7 Overflow #1) 36 XFINITY Latino 37 WCCU 38 WCCU Antenna TV 39 WILL World 41 WAND Cozi TV/Stormcenter 17 Local Weather Station 43 Home Shopping Network 2 85 EVINE Live 89 The Weather Channel 101 Fox News Channel 103 Cable News Network 104 HLN 105 msnbc 106 Consumer News & Business Channel 112 Bloomberg TV 113 Fox Business Network 114 Cable Satellite Public Affairs Network 123 Cable Satellite Public Affairs Network 2 124 Cable Satellite Public Affairs Network 3 125 U of I Educational Access 131 Local Access Programming 132 Champaign Government Television 133 Parkland College Educational TV 134 Leased Access 135 Urbana Public TV Ch. 6 136 ESPN 203 ESPN2 204 NBC Sports Network 205 Fox Sports 1 206 The Golf Channel 214 Outdoor Channel 220 The Sportsman Channel 221 Comcast SportsNet Chicago -

Federal Communications Commission DA 08-154 1/01/07 1/01/08 1

Federal Communications Commission DA 08-154 Federal Communications Commission Approved by OMB 3060-0647 Washington, DC 20554 Expiration Date: 02/28/09 2007/2008 Annual Cable Price Survey (Save file under CUID code in Question 1) A. Community 1. 6-digit community unit identification (CUID) 2. Name of the community associated with this CUID 3. Name of county in which the community is situated 4. 5-digit Zip Code in community with the highest number (or a significant portion) of subscribers Below, Questions 5 and 6 pertain to "Effective Competition" status. Local governments have authority to regulate the price of the basic service tier unless the FCC grants an "Effective Competition" petition for the franchise area. If the FCC has granted Effective Competition status, the answer to question 5 is "yes" and the answer to question 6 is "no". If the FCC has not granted Effective Competition status, the answer to question 5 is "no" (even if you have competition in the community) and the answer to question 6 depends on whether the local government exercises its authority to regulate the price of the basic service tier. 5. Has the FCC made a finding of "Effective Competition" for this community? (yes or no) 6. Does the local government regulate the basic tier rate in this community? (yes or no) B. System 7. Name of cable system 8. Street address and/or POB 9. City, state and Zip Code 1/01/07 1/01/08 10. System's operating capacity in the community, in MHz (e.g., 750) 11. Is system part of a geographic cluster of systems sharing personnel or facilities? (yes or no) C. -

Duke University Medical Center Curriculum Vitae Updated: 7/2009

Duke University Medical Center Curriculum Vitae Updated: 7/2009 Name Harold G. Koenig, M.D., M.H.Sc. Primary Appointment Psychiatry Secondary Appointment Medicine Present Academic Rank Professor, Psychiatry & Behavioral Sciences Associate Professor, Medicine First Appointment 7/1/92 Clinical Assistant Professor Medical Licensure #00-32386, North Carolina Specialty Certification Family Medicine, 7/85, recertified 7/93 Geriatric Medicine, 7/88 Psychiatry, 1/95, recertified 7/05 Geriatric Psychiatry, 11/96 Birth Date December 25, 1951 Birthplace Lodi, California Citizenship United States of America EDUCATION: Place Date Degree High School St. Mary's, Stockton 1966-70 diploma College Stanford University 1970-74 BS PROF TRAINING: Place Date Degree Nursing School San Joaquin Delta 1978-80 RN Medical School UC San Francisco 1974-76,80-82 MD Family Medicine Univ of Mo, Columbia 1982-85 -- Geriatric Medicine Duke Univ Med Ctr 1986-89 -- Biometry Duke University 1986-89 MHSc Psychiatry Duke Univ Med Ctr 1989-91 -- Geropsychiatry Fellow Duke Univ Med Ctr 1991-92 -- 1 ACADEMIC CAREER: Place Date Clin Asst Prof, Psychiatry Duke Univ Med Ctr 1992-1993 Research Psychiatrist FCI Butner, NC 1992-1993 Senior Fellow Aging Center, DUMC 1992-present Assistant Professor, Psychiatry Duke Univ Med Ctr 7/1/1993-6/30/96 Assistant Professor, Medicine Duke Univ Med Ctr 7/1/1993-6/30/98 Associate Professor, Psychiatry Duke Univ Med Ctr 7/1/1996-6/30/01 Associate Professor, Medicine Duke Univ Med Ctr 7/1/1998-present Associate Professor, with tenure Duke Univ Med Ctr 7/1/2001-3/31/04 Professor, Psychiatry Duke Univ Med Ctr 4/1/2004-present REFEREED JOURNALS: 1. -

Radio Frequency Impact Report

ENGINEERING REPORT CONCERNING THE EFFECTS UPON FCC LICENSED RF FACILITIES DUE TO CONSTRUCTION OF THE SAND HILL WIND ENERGY PROJECT IN ALTAMONT PASS ALAMEDA COUNTY, CALIFORNIA Prepared for Tetra Tech, Inc. May 23, 2013 By: B. Benjamin Evans, P.E. Evans Engineering Solutions 216 Green Bay Rd., Suite 105 Thiensville, WI 53092 262-518-0002 PHONE 262-518-0005 FAX www.evansengsolutions.com Sand Hill Wind, CA RF Impact Report Page 1 ENGINEERING REPORT CONCERNING THE EFFECTS UPON FCC LICENSED RF FACILITIES DUE TO CONSTRUCTION OF THE SAND HILL WIND ENERGY PROJECT IN ALTAMONT PASS ALAMEDA COUNTY, CALIFORNIA I. INTRODUCTION This engineering report describes the results of a study and analysis to determine the locations of federally-licensed (FCC) microwave and fixed station radio frequency (RF) facilities that may be adversely impacted as a result of the construction of the Sand Hill wind energy project in Alameda County, California. This document describes impact zones and any necessary mitigation procedures, along with recommendations concerning individual wind turbine siting. All illustrations, calculations and conclusions contained in this document are based on FCC database records. Frequently, wind turbines located on land parcels near RF facilities can cause more than one mode of RF impact, and may require an iterative procedure to minimize adverse effects. This procedure is necessary in order to ensure that disruption of RF facilities either does not occur or, in the alternative, that mitigation procedures will be effective. The purpose of this study is to facilitate the siting of turbines to avoid such unacceptable impact. The Sand Hill wind project as currently planned involves the replacement of 40 wind turbines in Altamont Pass in Alameda County, California.