Market Update Commerce Enablement Q1 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Cap Close ADV 1598 67Th Pctl 745,214,477.91 $ 23.96

Market Cap Close ADV 1598 67th Pctl $ 745,214,477.91 $ 23.96 225,966.94 801 33rd Pctl $ 199,581,478.89 $ 10.09 53,054.83 2399 Ticker_ Listing_ Effective_ Revised Symbol Security_Name Exchange Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M AAMC Altisource Asset Management Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L AEL American Equity Inv Life Hldg Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L AHL ASPEN Insurance Holding Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

2015 Valuation Handbook – Guide to Cost of Capital and Data Published Therein in Connection with Their Internal Business Operations

Market Results Through #DBDLADQ 2014 201 Valuation Handbook Guide to Cost of Capital Industry Risk Premia Company List Cover image: Duff & Phelps Cover design: Tim Harms Copyright © 2015 by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748- 6008, or online at http://www.wiley.com/go/permissions. The forgoing does not preclude End-users from using the 2015 Valuation Handbook – Guide to Cost of Capital and data published therein in connection with their internal business operations. Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. -

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

Fidelity® Total Market Index Fund

Quarterly Holdings Report for Fidelity® Total Market Index Fund May 31, 2021 STI-QTLY-0721 1.816022.116 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.3% Shares Value Shares Value COMMUNICATION SERVICES – 10.1% World Wrestling Entertainment, Inc. Class A (b) 76,178 $ 4,253,780 Diversified Telecommunication Services – 1.1% Zynga, Inc. (a) 1,573,367 17,055,298 Alaska Communication Systems Group, Inc. 95,774 $ 317,970 1,211,987,366 Anterix, Inc. (a) (b) 16,962 838,941 Interactive Media & Services – 5.6% AT&T, Inc. 11,060,871 325,521,434 Alphabet, Inc.: ATN International, Inc. 17,036 805,292 Class A (a) 466,301 1,099,001,512 Bandwidth, Inc. (a) (b) 34,033 4,025,764 Class C (a) 446,972 1,077,899,796 Cincinnati Bell, Inc. (a) 84,225 1,297,065 ANGI Homeservices, Inc. Class A (a) 120,975 1,715,426 Cogent Communications Group, Inc. (b) 66,520 5,028,912 Autoweb, Inc. (a) (b) 6,653 19,028 Consolidated Communications Holdings, Inc. (a) 110,609 1,035,300 Bumble, Inc. 77,109 3,679,641 Globalstar, Inc. (a) (b) 1,067,098 1,707,357 CarGurus, Inc. Class A (a) 136,717 3,858,154 IDT Corp. Class B (a) (b) 31,682 914,343 Cars.com, Inc. (a) 110,752 1,618,087 Iridium Communications, Inc. (a) 186,035 7,108,397 DHI Group, Inc. (a) (b) 99,689 319,005 Liberty Global PLC: Eventbrite, Inc. (a) 114,588 2,326,136 Class A (a) 196,087 5,355,136 EverQuote, Inc. -

NOTICE by Yahoo!

Polaris IP, LLC v. Google Inc. et al Doc. 631 Att. 1 Exhibit A Dockets.Justia.com UNITED STATES DISTRICT COURT EASTERN DISTRICT OF TEXAS BRIGHT RESPONSE, LLC DEFENDANTS' JOINT TRIAL EXHIBIT LIST V. CIVIL ACTION NO. 2:07-CV-371 GOOGLE INC., YAHOO!, INC. Presiding Judge Plaintiff's Attorneys Defendants' Attorneys Hon. Magistrate Charles Verhoeven, Amy Candido - Google Inc. Marc Fenster, David Pridham, Alex Giza, Judge Chad Everingham William Rooklidge, Jennifer Doan - Yahoo!, Inc. Andrew Spangler, Adam Hoffman, John Hueston, Adam Goldberg, Elizabeth Wiley, Andrew Weiss Trial Dates Court Reporter Courtroom Deputy August 2 - August 6, 2010 Susan Simmons Jan Lockhart EX. # DATE OFFERED MARKED ADMITTED DATES BATES BEG BATES END DOCUMENT DESCRIPTION Objections DX0001 8/2/2010 X 8/2/2010 1/30/2001 BR000097 BR000110 U.S. Patent 6,182,059 - Angotti DX0002 8/2/2010 X 8/2/2010 No Date BR000111 BR000345 File History for '059 Patent Merchant & Gould Consulting DX0003 8/2/2010 X 8/2/2010 2/4/2003 BR001263 BR001265 agreement with Amy Rice Amy Rice Patent Declaration for DX0004 8/2/2010 X 8/2/2010 6/9/1998 RICE000033 RICE000034 Application No. 09/054,233 DX0005 8/2/2010 X 8/2/2010 4/2/1998 BR000547 BR000585 Patent Application No. 09/054,233 Automatic Message Interpretation and DX0007 8/2/2010 X 8/2/2010 No Date HSU0235 HSU0281 Routing System Brightware PowerPoint presentation entitled, "Automated Customer DX0009 8/2/2010 X 8/2/2010 No Date RICE001117 RICE001203 Interaction on the Net" Technology Transfer Plan for DX0011 8/2/2010 X 8/2/2010 01/02/96 RICE000834 RICE000851 Knowledge-Based Systems Confidential Outside Counsel Only Page 1 of 27 EX. -

Support.Com, Inc. Annual Report 2017

support.com, Inc. Annual Report 2017 Form 10-K (NASDAQ:SPRT) Published: April 27th, 2017 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K/A (Amendment No. 1) (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2016 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File No. 000-30901 SUPPORT.COM, INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 94-3282005 (State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.) 900 Chesapeake Drive, 2nd Floor, Redwood City, CA 94063 (Address of Registrant’s Principal Executive Offices) (Zip Code) Registrant’s telephone number including area code: (650) 556-9440 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $.0001 par value The NASDAQ Capital Market Preferred Stock Purchase Rights The NASDAQ Capital Market Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Profunds Semiannual Report

Toppan Merrill - ProFunds Funds VP Main Semi-Annual Report [Funds] 06-30-2021 ED [AUX] | bliteck | 24-Aug-21 00:06 | 21-1908-3.aa | Sequence: 1 CHKSUM Content: 54117 Layout: 6120 Graphics: 61486 CLEAN Semiannual Report JUNE 30, 2021 ProFunds VP Access VP High Yield Short Small-Cap Asia 30 Small-Cap Banks Small-Cap Growth Basic Materials Small-Cap Value Bear Technology Biotechnology Telecommunications Bull UltraBull Consumer Goods UltraMid-Cap Consumer Services UltraNasdaq-100 Dow 30 UltraShort Dow 30 Emerging Markets UltraShort Nasdaq-100 Europe 30 UltraSmall-Cap Falling U.S. Dollar U.S. Government Plus Financials Utilities Government Money Market Health Care Industrials International Internet Japan Large-Cap Growth Large-Cap Value Mid-Cap Mid-Cap Growth Mid-Cap Value Nasdaq-100 Oil & Gas Pharmaceuticals Precious Metals Real Estate Rising Rates Opportunity Semiconductor Short Dow 30 Short Emerging Markets Short International Short Mid-Cap Short Nasdaq-100 JOB: 21-1908-3 CYCLE#;BL#: 7; 0 TRIM: 8.25" x 10.75" AS: New York: 212-620-5600 COLORS: ~note-color 2, Black GRAPHICS: ProFunds_CVR_logo_k.eps, ProFunds_FC_art_k.eps V1.5 Toppan Merrill - ProFunds Funds VP Main Semi-Annual Report [Funds] 06-30-2021 ED [AUX] | bliteck | 24-Aug-21 00:06 | 21-1908-3.ac | Sequence: 1 CHKSUM Content: 53432 Layout: 22726 Graphics: 0 CLEAN Table of Contents 1 Message from the Chairman 188 ProFund VP Short Emerging Markets 3 Financial Statements and 192 ProFund VP Short International Financial Highlights 196 ProFund VP Short Mid-Cap 4 ProFund Access VP High Yield -

List of Section 13F Securities, First Quarter

List of Section 13F Securities First Quarter FY 2013 Copyright (c) 2013 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2013, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2013. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by [ Section 13(f)(1) and Rule 13f-1] thereunder. -

1-800 Flowers.Com, Inc

FLWS 1-800 Flowers.Com, Inc. - Class A Common Stock FCOB 1St Colonial Bancorp Inc FNRC 1St Nrg Corp TDCH 30Dc Inc TSIOF 361 Degrees Intl Ltd TDEY 3D Eye Solutions Inc DPSM 3D Pioneer Systems Inc DDD 3D Systems Corporation Common Stock TDCP 3Dicon Corp DDDX 3Dx Industries Inc MMM 3M Company Common Stock PSPW 3Power Energy Group Inc CATV 4Cable Tv Intl Inc FOUR 4Licensing Corp BARZ 5Barz International Inc RNWR 808 Renewable Energy Corp EIHDF 888 Holdings Plc Ord EGHT 8X8 Inc - Common Stock DRWN A Clean Slate Inc SHLM A. Schulman, Inc. - Common Stock AOS A.O. Smith Corporation Common Stock AMKBY A.P Moller-Mrs Uns/Adr AEMMY A2A Spa Unsp/Adr AACAY Aac Techs Hldgs Unsp/Adr ELUXY Ab Electrolux B S/Adr RJA Ab Svensk Ekportkredit (Swedish Export Credit Corporation) Elements Linked To The Rogers International Commodity Index - Agriculture Total Return Structured Product ABCFF Abacus Mining & Expl Corp ABKI Abakan Inc ATTBF Abattis Bioceuticals Ord ABB Abb Ltd Common Stock ABLZF Abb Ltd Zuerich ABT Abbott Laboratories Common Stock ABBV Abbvie Inc. Common Stock ABBY Abby Inc ABCZY Abcam Plc Adr AGOAF Abengoa Sa Abg/Ac B ABGOF Abengoa Sa Ord ABGB Abengoa, S.A. - American Depositary Shares ANF Abercrombie & Fitch Company Common Stock ABBAF Aberdeen Asian Income Fun ABDNY Aberdeen Asset Mgmt Adr IAF Aberdeen Australia Equity Fund Inc Common Stock GCH Aberdeen Greater China Fund, Inc. Common Stock IF Aberdeen Indonesia Fund, Inc. (Common Stock ABMD Abiomed, Inc. - Common Stock ABOT Abot Mining Co Ida Cap ABHD Abtech Holdings Inc ACCA Acacia Diversified Hldgs ACTG Acacia Research Corporation - Common Stock AKR Acadia Realty Trust Common Stock AXDX Accelerate Diagnostics, Inc. -

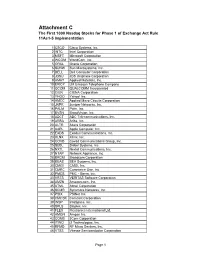

Attachment C the First 1000 Nasdaq Stocks for Phase 1 of Exchange Act Rule 11Ac1-5 Implementation

Attachment C The First 1000 Nasdaq Stocks for Phase 1 of Exchange Act Rule 11Ac1-5 Implementation 1 CSCO Cisco Systems, Inc. 2 INTC Intel Corporation 3 MSFT Microsoft Corporation 4 WCOM WorldCom, Inc. 5 ORCL Oracle Corporation 6 SUNW Sun Microsystems, Inc. 7 DELL Dell Computer Corporation 8 JDSU JDS Uniphase Corporation 9 AMAT Applied Materials, Inc. 10 ERICY LM Ericsson Telephone Company 11 QCOM QUALCOMM Incorporated 12 CIEN CIENA Corporation 13 YHOO Yahoo! Inc. 14 AMCC Applied Micro Circuits Corporation 15 JNPR Juniper Networks, Inc. 16 PALM Palm, Inc. 17 BVSN BroadVision, Inc. 18 ADCT ADC Telecommunications, Inc. 19 ARBA Ariba, Inc. 20 ALTR Altera Corporation 21 AAPL Apple Computer, Inc. 22 EXDS Exodus Communications, Inc. 23 XLNX Xilinx, Inc. 24 COVD Covad Communications Group, Inc. 25 SEBL Siebel Systems, Inc. 26 NXTL Nextel Communications, Inc. 27 NTAP Network Appliance, Inc. 28 BRCM Broadcom Corporation 29 BEAS BEA Systems, Inc. 30 CMGI CMGI, Inc. 31 CMRC Commerce One, Inc. 32 PMCS PMC - Sierra, Inc. 33 VRTS VERITAS Software Corporation 34 AMZN Amazon.com, Inc. 35 ATML Atmel Corporation 36 SCMR Sycamore Networks, Inc. 37 PSIX PSINet Inc. 38 CMCSK Comcast Corporation 39 INSP InfoSpace, Inc. 40 SPLS Staples, Inc. 41 FLEX Flextronics International Ltd. 42 AMGN Amgen Inc. 43 COMS 3Com Corporation 44 ITWO i2 Technologies, Inc. 45 RFMD RF Micro Devices, Inc. 46 VTSS Vitesse Semiconductor Corporation Page 1 47 INKT Inktomi Corporation 48 EXTR Extreme Networks, Inc. 49 SDLI SDL, Inc. 50 MFNX Metromedia Fiber Network, Inc. 51 VRSN VeriSign, Inc. 52 IMNX Immunex Corporation 53 COST Costco Wholesale Corporation 54 KLAC KLA-Tencor Corporation 55 TRLY Terra Networks, S.A. -

United States Securities and Exchange Commission Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM N-PX ANNUAL REPORT OF PROXY VOTING RECORD OF REGISTERED MANAGEMENT INVESTMENT COMPANIES INVESTMENT COMPANY ACT FILE NUMBER: 811-121 NAME OF REGISTRANT: VANGUARD WELLINGTON FUND ADDRESS OF REGISTRANT: PO BOX 2600, VALLEY FORGE, PA 19482 NAME AND ADDRESS OF AGENT FOR SERVICE: ANNE E. ROBINSON PO BOX 876 VALLEY FORGE, PA 19482 REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: (610) 669-1000 DATE OF FISCAL YEAR END: NOVEMBER 30 DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD US QUALITY FACTOR ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 1st Source Corp. TICKER: SRCE CUSIP: 336901103 MEETING DATE: 4/18/2019 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1a: ELECT DIRECTOR DANIEL B. FITZPATRICK ISSUER YES FOR FOR PROPOSAL #1b: ELECT DIRECTOR NAJEEB A. KHAN ISSUER YES FOR FOR PROPOSAL #1c: ELECT DIRECTOR CHRISTOPHER J. MURPHY, ISSUER YES FOR FOR IV PROPOSAL #2: RATIFY BKD LLP AS AUDITOR ISSUER YES FOR FOR --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3M Company TICKER: MMM CUSIP: 88579Y101 MEETING DATE: 5/14/2019 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1a: ELECT DIRECTOR THOMAS "TONY" K. BROWN ISSUER YES FOR FOR PROPOSAL #1b: ELECT DIRECTOR PAMELA J. CRAIG ISSUER YES FOR FOR PROPOSAL #1c: ELECT DIRECTOR DAVID B. DILLON ISSUER YES FOR FOR PROPOSAL #1d: ELECT DIRECTOR MICHAEL L. ESKEW ISSUER YES FOR FOR PROPOSAL #1e: ELECT DIRECTOR HERBERT L. HENKEL ISSUER YES FOR FOR PROPOSAL #1f: ELECT DIRECTOR AMY E. HOOD ISSUER YES FOR FOR PROPOSAL #1g: ELECT DIRECTOR MUHTAR KENT ISSUER YES FOR FOR PROPOSAL #1h: ELECT DIRECTOR EDWARD M. -

Industry Risk Premia Company List in the 2014 Valuation

The information and data presented in the 2014 Valuation Handbook – Guide to Cost of Capital/ Industry Risk Premia Company List has been obtained with the greatest of care from sources believed to be reliable, but is not guaranteed to be complete, accurate or timely. Duff & Phelps, LLC expressly disclaims any liability, including incidental or consequential damages, arising from the use of the 2014 Valuation Handbook – Guide to Cost of Capital/Industry Risk Premia Company List or any errors or omissions that may be contained in either the 2014 Valuation Handbook – Guide to Cost of Capital/ Industry Risk Premia Company List. Copyright © 2014 Duff & Phelps, LLC. All Rights Reserved. No part of this publication may be reproduced or used in any other form or by any other means – graphic, electronic, or mechanical, including photocopying, recording, taping, or information storage and retrieval systems – without Duff & Phelps’ prior, written permission. To obtain permission, please write to: Valuation Handbook, Duff & Phelps, 311 S. Wacker Dr., Suite 4200, Chicago, IL 60606. Your request should specify the data or other information you wish to use and the manner in which you wish to use it. In addition, you will need to include copies of any charts, tables, and/or figures that you have created based on that information. There is a $1,500 processing fee per request. There may be additional fees depending on your proposed usage. The forgoing does not preclude End-users from using the 2014 Valuation Handbook and data published therein in connection with their internal business operations. Published by: Duff & Phelps, LLC 311 South Wacker Drive Suite 4200 Chicago, IL 60606 (312) 697-4600 www.duffandphelps.com NOTE: The full-information beta analysis employed to form the industry risk premia provided in Table 5.7 of the Valuation Handbook –Guide to Cost of Capital uses a cross-sectional regression in which a company’s exposure to an industry (as defined by SIC code) is based on a sales-based weighted methodology.