ABUNDANT RESOURCES, ABSENT DATA: Measuring the Openness of Australian Listed Mining, Oil and Gas Companies on the African Continent SUMMARY of FINDINGS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capital Expenditure Project Listing

CAPITAL EXPENDITURE PROJECT LISTING 1 January 1993 to 31 December 2016 NEDBANK GROUP ECONOMIC UNIT 07 February 2017 NOTES: Definition: The schedule is a listing of capital projects announced in the Republic of South Africa. It includes: Only projects valued at R20 million or more. Projects of an expansionary nature, i.e. capex which allows for an increase in the level of output, rather than pure replacement investment which involves the replacement of worn-out or outdated capital goods necessary for the continued operation and the maintenance of current output levels. The exceptions are: investment in equipment or machinery which reduces the harmful effects of pollution, and technological upgrading of equipment and machinery. Projects funded by both the private and public sectors. Projects reflecting direct foreign involvement. The listing is compiled on a sectoral basis, conforming to the Standard Industrial Classification. Limitations: Any analysis of the data needs to take account of the limitations outlined below: The schedule highlights significant areas of investment expenditure and not the absolute total value of all capital investment undertaken in the country. It serves as a rough guide to the general direction in which investment is moving and as an indication of the level of confidence in the economy. The full extent of replacement capital expenditure is not captured as mainly expansionary capital expenditure are published and recorded. In certain sectors a reliable indication of investment activity is not possible as typical investments are not large enough to be included in the schedule, even though the total capital expenditure in the sector may be substantial. -

Market Opener Advisor on 1300 651 898 Or [email protected]

Need more information? Contact your State One Market Opener advisor on 1300 651 898 or [email protected] Please see disclaimer at end of Wednesday 18 January 2017 document. Markets Today’s Stock Watch SFE 200 Futures (9.30am AEDST) 5642 -9 -0.2 NZX 50 7063 -0.1 -0.0 Wesfarmers Ltd (WES) DJIA Futures 19743 0 0.0 Anticipating $135M - $140M interim EBIT for the group’s S&P 500 Futures 2263 -10 -0.4 resources business, approximately in line with 1H FY 2016 and NASDAQ Futures 5040 -21 -0.4 greater than previous guidance. December quarter Curragh coal production increased 22.5% from the previous quarter, to 3.2Mt, Local Markets Commentary although the gain was largely due to adverse weather during the September quarter. For the year, metallurgical coal output fell The Australian market opens mid-week trade on 14.4% to 7.2Mt and steaming coal 1.9% to 3.4Mt. Bengalla largely negative leads. attributable coal production rose 2.7% to 3.4Mt. US equities markets traded for the first time this week. Incitec Pivot (IPL) In overnight commodities trade, gold and WTI Expecting to receive $US35.1M in damages related to delays for crude continued higher. Copper extended the Louisiana, US Waggaman ammonia plant. Monday’s fall. Iron ore turned lower. RCR Tomlinson (RCR) / Pilbara Minerals (PLS) The $A gained further after appreciating to $138M - $148M EPC contract secured by RCR for PLS’s WA ~US75.45c early yesterday evening. Pilgangoora lithium-tantalum project. Locally today, a monthly consumer sentiment report is due from Westpac and the Melbourne Institute, Integrated Research (IRI) 10.30am AEDST. -

CSA Global Report Template 2019

NI 43-101 TECHNICAL REPORT Séguéla Project, Worodougou Region, Côte d’Ivoire CSA Global Report Nº R182.2019 Report Effective Date: 19 March 2019 www.csaglobal.com Author and Qualified Person Matthew Cobb, MAIG, MIAMG ROXGOLD INC. NI 43-101 TECHNICAL REPORT FOR THE SÉGUÉLA PROJECT, WORODOUGOU REGION, CÔTE D’IVOIRE Report prepared for Client Name Roxgold Inc. Project Name/Job Code ROXMRE02 Contact Name Paul Weedon Contact Title VP Exploration Office Address 360 Bay Street, Suite 500 Toronto, Ontario Canada M5H 2V6 Report issued by CSA Global Pty Ltd Level 2, 3 Ord Street West Perth, WA 6005 AUSTRALIA CSA Global Office T +61 8 9355 1677 F +61 8 9355 1977 E [email protected] Division Resources Report information Filename R182.2019 ROXMRE02 Roxgold Seguela NI 43-101 - DRAFT Report Effective Date 19 March 2019 Report Signature Date 23 July 2019 Report Status Final Author and Qualified Person Signature Matthew Cobb Coordinating PhD (Geology), MSc Author (Geostatistics), BSc (Hons), MAIG, MIAMG Ian Trinder Peer Reviewer MSc (Geology) P.Geo Aaron Meakin BSc (Hons) Geology, CSA Global Authorisation GradDipAppFin, MAppFin, MAusIMM CP (Geo) © Copyright 2019 CSA Global Report № R182.2019 II ROXGOLD INC. NI 43-101 TECHNICAL REPORT FOR THE SÉGUÉLA PROJECT, WORODOUGOU REGION, CÔTE D’IVOIRE Date and Signature Page This Report titled “NI 43-101 Technical Report for the Séguéla Project, Worodougou Region, Côte d’Ivoire”, prepared for Roxgold Inc. with an effective date of 19 March 2019 was prepared and signed by the following author: _________________________________ Dated at Perth, Australia 12 April 2019 Matthew Cobb, PhD (Geology), MSc (Geostatistics), BSc (Hons), MAIG, MIAMG Principal Resource Geologist CSA Global Pty Ltd Report Effective Date: 19 March 2019 CSA Global Report № R182.2019 III ROXGOLD INC. -

Small and Mid-Cap Resources March 2017 Review

Small and Mid-Cap Resources March 2017 Review The Momentum Continues - 2017 to be a Good Year WHO IS IIR? Independent Investment Research, “IIR”, is an independent investment research house based in Australia and the United States. IIR specialises in the analysis of high quality commissioned research for Brokers, Family Offices and Fund Managers. IIR distributes its research in Asia, United States and the Americas. IIR does not participate in any corporate or capital raising activity and therefore it does not have any inherent bias that may result from research that is linked to any corporate/ capital raising activity. IIR was established in 2004 under Aegis Equities Research Group of companies to provide investment research to a select group of retail and wholesale clients. Since March 2010, IIR (the Aegis Equities business was sold to Morningstar) has operated independently from Aegis by former Aegis senior executives/shareholders to provide clients with unparalleled research that covers listed and unlisted managed investments, listed companies, structured products, and IPOs. IIR takes great pride in the quality and independence of our analysis, underpinned by high caliber staff and a transparent, proven and rigorous research methodology. INDEPENDENCE OF RESEARCH ANALYSTS Research analysts are not directly supervised by personnel from other areas of the Firm whose interests or functions may conflict with those of the research analysts. The evaluation and appraisal of research analysts for purposes of career advancement, remuneration and promotion is structured so that non-research personnel do not exert inappropriate influence over analysts. Supervision and reporting lines: Analysts who publish research reports are supervised by, and report to, Research Management. -

Plan Cadre De Gestion Environnementale Et Sociale (Pcges) ------Rapport Final

REPUBLIQUE DE COTE D’IVOIRE Union – Discipline – Travail -------------------------------- MINISTERE DU PETROLE, DE L’ENERGIE ET DES ENERGIES RENOUVELABLES -------------------------------- -------------------------------- PROJET DE RENFORCEMENT DES OUVRAGES DU SYSTEME ELECTRIQUE ET D’ACCES A L’ELECTRICITE (PROSER) – PHASE 1 : ELECTRIFICATION RURALE DE 1088 LOCALITES(PROSER) - PHASE 1 : PROJET D’ELECTRIFICATION RURALE DE 1088 LOCALITES ------------------------------- LOT 3 : ELECTRIFICATION RURALE DE 164 LOCALITES DANS LES DISTRICTS DE LA VALLEE DU BANDAMA, DES SAVANES ET DU DENGUELEET DU DENGUELE ------------------------------- PLAN CADRE DE GESTION ENVIRONNEMENTALE ET SOCIALE (PCGES) ------------------------------- RAPPORT FINAL -- Octobre 2019 -- 0 TABLE DES MATIERES SIGLES ET ACRONYMES ------------------------------------------------------------------------------------------------------------------------------------ 4 LISTE DES TABLEAUX---------------------------------------------------------------------------------------------------------------------------------------- 6 LISTE DES PLANCHES --------------------------------------------------------------------------------------------------------------------------------------- 7 1. RÉSUMÉ -------------------------------------------------------------------------------------------------------------------------------------------------------- 8 2. INTRODUCTION -------------------------------------------------------------------------------------------------------------------------------------------- -

Equity Financing for Africa

ASX – Equity Financing for Africa There are now over 210 ASX mining and exploration companies with 1,200 projects in Africa spread across 36 countries. Over $5.6 billion has been raised through follow-on raisings by ASX listed companies for projects in Africa over the last 5 years. Source: IntierraLive August 2013 Mining Companies by Stage of Projects Number of Listed Mining Companies in Africa Diversified HKE 11 7% Producer 17% JSE 54 LSE & AIM 99 TSX & TSXV 192 Explorer 76% ASX 218 Source: IntierraLive, August 2013 Source: Intierralive, August 2013 • Over 210 ASX listed companies with assets in Africa • 1,200 projects spread across 36 African nations. • Of these projects, 37% are at grass-roots stage, 34% at exploration stage, and 29% are at advanced exploration stage ASX – Equity Financing for Africa Top 100 Stocks ASX COMPANY NAME COMPANY MARKET SECTOR* CODE TYPE^ CAPITALISATION (A$)* BHP BHP Billiton Limited Diversified $100,750,749,963 Diversified Metals & Mining RIO Rio Tinto Limited Producer $22,820,684,166 Diversified Metals & Mining NCM Newcrest Mining Limited Producer $7,565,463,283 Gold AAI Alcoa Inc. Diversified $7,274,558,272 Aluminium AWC Alumina Limited Diversified $2,764,132,230 Aluminum ZIM Zimplats Holdings Limited Producer $915,996,392 Precious Metals & Minerals LYC Lynas Corporation Ltd Producer $735,300,484 Diversified Metals & Mining AQA Aquila Resources Limited Producer $733,011,906 Coal & Consumable Fuels PDN Paladin Energy Ltd Producer $732,539,332 Coal & Consumable Fuels AGO Atlas Iron Limited Producer $677,740,214 -

2016 ASX Listed Mining Companies

2016 ASX Listed Mining Companies 3D Resources Limited Attila Resources Limited Boral Limited. A1 Consolidated Gold Limited Audalia Resources Limited Boss Resources Limited Abm Resources Nl Augur Resources Limited Botswana Metals Limited Accent Resources Nl Aurelia Metals Limited Bougainville Copper Limited Activex Limited Auroch Minerals Ltd Breaker Resources Nl Adelaide Resources Limited Aurora Minerals Limited Brickworks Limited Admiralty Resources Nl. Aus Tin Mining Ltd Brighton Mining Group Limited Aeon Metals Limited. Ausgold Limited Brockman Mining Limited Aeris Resources Limited Ausmon Resources Limited Broken Hill Prospecting Limited Agrimin Limited Ausquest Limited Bulletin Resources Limited Aguia Resources Limited Ausroc Metals Ltd Burey Gold Limited Alacer Gold Corp. Austral Gold Limited Burrabulla Corporation Limited Alara Resources Limited Australasian Resources Limited Buxton Resources Limited Alchemy Resources Limited Australia New Agribusiness & Chemical Buymyplace.Com.Au Limited Alcoa Inc. Group Ltd Cabral Resources Limited Alicanto Minerals Limited Australia United Mining Limited Caeneus Minerals Ltd Alkane Resources Limited Australian Bauxite Limited. Cannindah Resources Limited Alliance Resources Limited Australian Mines Limited Canyon Resources Limited Alloy Resources Limited Australian Pacific Coal Limited Cape Lambert Resources Limited Alt Resources Limited Australian Vanadium Limited Capital Mining Limited Altech Chemicals Ltd Avalon Minerals Limited Capral Limited Altona Mining Limited Avanco Resources Limited -

Cote D'ivoire DEV 200465

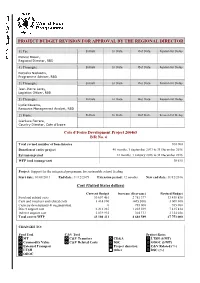

PROJECT BUDGET REVISION FOR APPROVAL BY THE REGIONAL DIRECTOR 5) To: Initials In Date Out Date Reason for Delay Denise Brown, Regional Director, RBD 4) Through: Initials In Date Out Date Reason for Delay Natasha Nadazdin, Programme Adviser, RBD 3) Through: Initials In Date Out Date Reason for Delay Jean-Pierre Leroy, Logistics Officer, RBD 2) Through: Initials In Date Out Date Reason for Delay Lydie Kouame, Resource Management Analyst, RBD 1) From: Initials In Date Out Date Reason for Delay Gianluca Ferrera, Country Director, Cote d’Ivoire Cote d'Ivoire Development Project 200465 B/R No. 4 Total revised number of beneficiaries 300 000 Duration of entire project 40 months, 1 September 2013 to 31 December 2016 Extension period 12 months, 1 January 2016 to 31 December 2016 WFP food tonnage (mt) 38 615 Project: Support for the integrated programme for sustainable school feeding Start date: 01/09/2013 End date: 31/12/2015 Extension period: 12 months New end date: 31/12/2016 Cost (United States dollars) Current Budget Increase (Decrease) Revised Budget Food and related costs 30 657 461 2 781 377 33 438 838 Cash and vouchers and related costs 3 414 800 (405 500) 3 009 300 Capacity development & augmentation 0 765 000 765 000 Direct support cost 6 212 235 1 203 599 7 415 834 Indirect support cost 2 819 915 304 113 3 124 028 Total cost to WFP 43 104 411 4 648 589 47 753 000 CHANGES TO: Food Tool C&V Tool Project Rates MT C&V Transfers CD&A LTSH ($/MT) Commodity Value C&V Related Costs DSC ODOC ($/MT) External Transport Project duration C&V Related (%) LTSH Other DSC (%) ODOC NATURE OF THE INCREASE 1. -

Chinese Mining Activity in Latin America: a Review of Recent Findings by IACOB KOCH-WESER*

CHINA AND LATIN AMERICA REPORT Chinese Mining Activity in Latin America: A Review of Recent Findings BY IACOB KOCH-WESER* Summary Findings A comprehensive review of China’s global mining activity is necessarily complex and multi-disciplinary. Mining is after ver the past decade, China has rapidly emerged all an activity, not an economic sector per se, like oil and gas. as the world’s leading consumer and importer of Although iron ore accounts for the bulk of China’s metals Ominerals. Minerals are used in a growing number imports in both value and volume terms, a diverse set of non- of applications, from simple steel tubes in China’s sprawling ferrous metals, each with unique dynamics, also figures into the infrastructure projects, to wires and magnets in high-technol- equation. At the macro-level, mining has to do with why and ogy gadgets destined for export. Under the aegis of China’s how China acquires natural resources—an issue that pertains official “Going-Out” strategy, China’s global mining activity to energy and agriculture as well. Mineral extraction can raise has also surged. Conservative data from China’s Ministry of broader questions about China’s industrial policy, resource use, Commerce (MOFCOM) indicates that mining accounted for engagement in foreign trade, investment, and capital markets, a fifth of China’s non-financial outbound investment from and not least, its relations with resource-rich economies. 2003–2012 (see Figure 1). Estimates based on individual This review draws selectively from the literature to explore a deals are far higher (see Appendix Table 1). -

Cote D'ivoire Project Appraisal R

AFRICAN DEVELOPMENT BANK PROJECT TO IMPROVE ACCESS TO ELECTRICITY IN RURAL AREAS COUNTRY : COTE D’IVOIRE closure Authorized Public Dis PROJECT APPRAISAL REPORT d e ure Authoriz Public Disclos RDGW October 2018 Translated Document TABLE OF CONTENTS I. STRATEGIC ORIENTATION AND RATIONALE ...................................................................... 1 1.1. Project Linkages with Country Strategy and Objectives ............................................................. 1 1.2. Rationale for Bank Intervention .................................................................................................. 1 1.3. Aid Coordination ......................................................................................................................... 2 II. PROJECT DESCRIPTION ............................................................................................................ 3 2.1. Project Description and Components ......................................................................................... 3 2.2. Technical Solution Adopted and Alternatives Considered .......................................................... 4 2.3. Project Type ................................................................................................................................ 5 2.4. Project Cost and Financing Arrangements ................................................................................. 5 2.5. Project Area and Beneficiaries .................................................................................................. -

Technical Efficiency of Farms, and Fight Against Poverty: Case of the Cashew Sector in Côte D’Ivoire

Journal of Agricultural Science; Vol. 12, No. 2; 2020 ISSN 1916-9752 E-ISSN 1916-9760 Published by Canadian Center of Science and Education Technical Efficiency of Farms, and Fight Against Poverty: Case of the Cashew Sector in Côte d’Ivoire Noufou Coulibaly1, Kone Siaka1, Yapi Yapo Magloire2 & Toure Sally3 1 Management and Applied Economics Department, Institute National Polytechnique Houphouët Boigny, Yamoussoukro, Côte d’Ivoire 2 Agriculture and Animal Science Department, Institute National Polytechnique Houphouët Boigny, Yamoussoukro, Côte d’Ivoire 3 College of Agronomy, Agro-economy Section, Institute National Polytechnique Houphouët Boigny, Yamoussoukro, Côte d’Ivoire Correspondence: Noufou Coulibaly, Management and Applied Economics Department, Institute National Polytechnique Houphouët Boigny, Yamoussoukro, Côte d’Ivoire. E-mail: [email protected] Received: June 17, 2019 Accepted: August 29, 2019 Online Published: January 15, 2020 doi:10.5539/jas.v12n2p106 URL: https://doi.org/10.5539/jas.v12n2p106 Abstract Cashew was introduced in the north of Côte d’Ivoire to support the economy in the region. This study was conducted to evaluate the technical efficiency of cashew farms in Côte d’Ivoire. The technical efficiency of producers was measured using the Data Envelopment Analysis approach, and the determinants of this efficiency were identified using a TOBIT model. Data were collected in 4 regions: GBEKE, HAMBOL, PORO and WORODOUGOU. In the four regions studied, the average technical efficiency is 49.2% in Variable Scale Efficiency (VRS) and 38.3% in Constant Return to Scale (CRS). Based on our results, the producers in the study area were not efficient. The producers who follow the good practices, have a technical coefficient estimated at 74.2%, and superior to those who follow the good practices, of which, the coefficient is estimated at 70.2%, in Variable Scale Efficiency (VRS). -

Ivory Coast: Administrative Structure

INFORMATION PAPER Ivory Coast – Administrative Structure The administrative structure of Ivory Coast1 was revised in September 2011. The new structure, which consists of 14 districts (2 autonomous districts and 12 regular districts) at first-order (ADM1) level, is as follows: ADM1 – 14 districts (2 autonomous districts and 12 regular districts) ADM2 – 31 regions (fra: région) ADM3 – 95 departments (fra: départment) ADM4 – 498 sub-prefectures (fra: sous-préfecture) Details of the ADM1s and ADM2s are provided on the next page. A map showing the administrative divisions can be found here: http://www.gouv.ci/doc/1333118154nouveau_decoupage_administrative_ci.pdf The previous structure, consisting of 19 regions at first-order level, was reorganised as follows: 1. The cities of Abidjan and Yamoussoukro were split from their regions (Lagunes and Lacs, respectively) to form autonomous districts. 2. The northern regions of Denguélé, Savanes, Vallée du Bandama, and Zanzan were re- designated as districts with no change in territory. 3. The old Agnéby and Lagunes regions, excluding Abidjan (see no. 1), merged to form Lagunes district. 4. Bafing and Worodougou regions merged to form Woroba district. 5. The department of Fresco was transferred from Sud-Bandama to Bas-Sassandra region to form Bas-Sassandra district; the remainder of Sud-Bandama region merged with Fromager to form Gôh-Djiboua district. 6. Dix-Huit Montagnes (18 Montagnes) and Moyen-Cavally regions merged to form Montagnes district. 7. Haut-Sassandra and Marahoué regions merged to form Sassandra-Marahoué district. 8. N'zi-Comoé and Lacs regions, excluding Yamoussoukro (see no. 1), merged to form Lacs district. 9. Moyen-Comoé and Sud-Comoé regions merged to form Comoé district.