KDX Kanda Ekimae Building)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Certified Facilities (Cooking)

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

TOKYO TRAIN & SUBWAY MAP JR Yamanote

JR Yamanote Hibiya line TOKYO TRAIN & SUBWAY MAP Ginza line Chiyoda line © Tokyo Pocket Guide Tozai line JR Takasaka Kana JR Saikyo Line Koma line Marunouchi line mecho Otsuka Sugamo gome Hanzomon line Tabata Namboku line Ikebukuro Yurakucho line Shin- Hon- Mita Line line A Otsuka Koma Nishi-Nippori Oedo line Meijiro Sengoku gome Higashi Shinjuku line Takada Zoshigaya Ikebukuro Fukutoshin line nobaba Todai Hakusan Mae JR Joban Asakusa Nippori Line Waseda Sendagi Gokokuji Nishi Myogadani Iriya Tawara Shin Waseda Nezu machi Okubo Uguisu Seibu Kagurazaka dani Inaricho JR Shinjuku Edo- Hongo Chuo gawa San- Ueno bashi Kasuga chome Naka- Line Higashi Wakamatsu Okachimachi Shinjuku Kawada Ushigome Yushima Yanagicho Korakuen Shin-Okachi Ushigome machi Kagurazaka B Shinjuku Shinjuku Ueno Hirokoji Okachimachi San-chome Akebono- Keio bashi Line Iidabashi Suehirocho Suido- Shin Gyoen- Ocha Odakyu mae Bashi Ocha nomizu JR Line Yotsuya Ichigaya no AkihabaraSobu Sanchome mizu Line Sendagaya Kodemmacho Yoyogi Yotsuya Kojimachi Kudanshita Shinano- Ogawa machi Ogawa Kanda Hanzomon Jinbucho machi Kokuritsu Ningyo Kita Awajicho -cho Sando Kyogijo Naga Takebashi tacho Mitsu koshi Harajuku Mae Aoyama Imperial Otemachi C Meiji- Itchome Kokkai Jingumae Akasaka Gijido Palace Nihonbashi mae Inoka- Mitsuke Sakura Kaya Niju- bacho shira Gaien damon bashi bacho Tameike mae Tokyo Line mae Sanno Akasaka Kasumi Shibuya Hibiya gaseki Kyobashi Roppongi Yurakucho Omotesando Nogizaka Ichome Daikan Toranomon Takaracho yama Uchi- saiwai- Hachi Ebisu Hiroo Roppongi Kamiyacho -

Kagurazaka Campus 1-3 Kagurazaka,Shinjuku-Ku,Tokyo 162-8601

Tokyo University of Science Kagurazaka Campus 1-3 Kagurazaka,Shinjuku-ku,Tokyo 162-8601 Located 3 minutes’ walk from Iidabashi Station, accessible via the JR Sobu Line, the Tokyo Metro Yurakuchom, Tozai and Namboku Lines, and the Oedo Line. ACCESS MAP Nagareyama- Unga Otakanomori Omiya Kasukabe Noda Campus 2641 Yamazaki, Noda-shi, Chiba Prefecture 278-8510 Kanamachi Kita-Senju Akabane Tabata Keisei-Kanamachi Ikebukuro Nishi- Keisei-Takasago Nippori Katsushika Campus 6-3-1 Niijuku, Katsushika-ku, Nippori Oshiage Tokyo 125-8585 Asakusa Ueno Iidabashi Ochanomizu Shinjuku Kinshicho Akihabara Asakusabashi Kagurazaka Campus Kanda 1-3 Kagurazaka, Shinjuku-ku, Tokyo 162-8601 Tokyo ■ From Narita Airport Take the JR Narita Express train to Tokyo Station. Transfer to the JR Yamanote Line / Keihin-Tohoku Line and take it to Akihabara Station. Transfer to the JR Sobu Line and take it to Iidabashi Station. Travel time: about 1 hour 30 minutes. ■ From Haneda Airport Take the Tokyo Monorail Line to Hamamatsucho Station. Transfer to the JR Yamanote Line / Keihin-Tohoku Line and take it to Akihabara Station. Transfer to the JR Sobu Line and take it to Iidabashi Station. Travel time: about 45 minutes. ■ From Tokyo Station Take the JR Chuo Line to Ochanomizu Station. Transfer to the JR Sobu Line and take it to Iidabashi Station. Travel time: about 10 minutes. ■ From Shinjuku Station Take the JR Sobu Line to Iidabashi Station. Travel time: about 12 minutes. Building No.10 Building No.11 Annex Building No.10 Building No.5 CAMPUS MAP Annex Kagurazaka Buildings For Ichigaya Sta. Building No.11 Building No.12 Building No.1 1 Building No.6 Building No.8 Building Building No.13 Building Building (Morito Memorial Hall) No.7 No.2 No.3 3 1 The Museum of Science, TUS (Futamura Memorial Hall) & Building Mathematical Experience Plaza No.9 2 2 Futaba Building (First floor: Center for University Entrance Examinations) Tokyo Metro Iidabashi Sta. -

Ochanomizu University

OCHANOMIZU UNIVERSITY UNIVERSITY GUIDE 2017-2018 Mission “Ochanomizu University will support all women, regardless of age or nationality, in protecting their individual dignity and rights, freely developing their unique qualities and capabilities, and pursuing personal learning so as to satisfy their intellectual appetites.” As a pioneer of women’s education in Japan, Ochanomizu University offers programs that will develop women who are influential leaders in politics, economics, academia, culture, and other fields on the international stage. These programs—that of the “21st century Ochanomizu University model”—focus on three areas: 1. Development of higher education for women into the future 2. Centralization of research and 21st century liberal arts education 3. Social contribution and international exchange Cutting-edge research and development based on new ways of thinking is a unique feature of research at Ochanomizu University. 1 A Message from the President Ochanomizu University—established in 1875 as Japan’s first institution of higher education exclusively for women—celebrated the 140th anniversary of Contents its foundation last year. Over the decades we have excelled as a true pioneer in women’s education, perennially blazing new paths for women with the desire 1 Mission to learn and be of service to society. Large numbers of our graduates have gone 2 A Message from the President on to make outstanding contributions in academic research, education, industrial endeavor, government service, the media and various other fields, steadily building University Overview the cornerstone for further success by women in Japan. 3 Educational Characteristics Currently our university is answering the demands of society by cultivating women with broad perspectives and rich sensitivities who will play a key role 3 History in the future of Japan and the rest of the world. -

Ministry of the Environment

List of Public Service Corporations under the Jurisdiction of the Ministry of the Environment ●Public Service Corporations (selected) (As of April 2001) Name of the corporation Address of the main office Telephone number <Under supervision of the Minister’s Secretariat> Environmental Information Center 8F, Office Toranomon1Bldg., 1-5-8 Toranomon, Minato-ku, Tokyo 105-0001 03-3595-3992 Earth, Water and Green Foundation 6F, Nishi-shinbashi YK Bldg., 1-17-4 Nishi-shinbashi, Minato-ku, Tokyo 105-0003 03-3503-7743 <Under supervision of the Waste Management and Recycling Department> Ecological Life and Culture Organization (ELCO) 6F, Sunrise Yamanishi Bldg., 1-20-10 Nishi-shinbashi, Minato-ku, Tokyo 105-0003 03-5511-7331 Japan Environmental Sanitation Center 10-6 Yotsuya-kamicho, Kawasaki-ku, Kawasaki-shi, Kanagawa Prefecture 210-0828 044-288-4896 The National Federation of 4F, Daini-AB Bldg., 3-1-17 Roppongi, Minato-ku, Tokyo 106-0032 03-3224-0811 Industrial Waste Management Associations Japan Industrial Waste Technology Center 2F, Nihonbashi Koa Bldg., 2-8-4 Nihonbashi-horidomecho, Chuo-ku, Tokyo 103-0012 03-3668-6511 Japan Industrial Waste Management Foundation Sakura Shinbashi Bldg., 2-6-1 Shinbashi, Minato-ku, Tokyo 105-0004 03-3500-0271 All Japan Private Sewerage Treatment Association 7F, Tokyo Yofuku Kaikan, 13 Ichigaya-hachimancho, Shinjuku-ku, Tokyo 162-0844 03-3267-9757 Japan Education Center of Environmental Sanitation 2-23-3 Kikukawa, Sumida-ku, Tokyo 130-0024 03-3635-4880 Waste Water Treatment Equipment Engineer Center Kojimachi 4-chome Bldg., 4-3 Kojimachi, Chiyoda-ku, Tokyo 102-0083 03-3237-6591 Japan Sewage Works Association 1F, Nihon Bldg., 2-6-2 Otemachi, Chiyoda-ku, Tokyo 100-0004 03-5200-0811 Japan Waste Management Association 7F, IPB Ochanomizu, 3-3-11 Hongo, Bunkyo-ku, Tokyo 113-0033 03-5804-6281 Japan Sewage Treatment Plant Operation and 5F, Sakura Bldg., 1-3-3 Uchikanda, Chiyoda-ku, Tokyo 101-0047 03-5281-9291 Maintenance Association, INC. -

February 29, 2008 for Immediate Release New City Residence Investment Corporation 1-10-6 Roppongi, Minato-Ku, Tokyo Jun Arai, Ex

February 29, 2008 For Immediate Release New City Residence Investment Corporation 1-10-6 Roppongi, Minato-ku, Tokyo Jun Arai, Executive Director (Securities Code: 8965) Asset Management Company: CBRE Residential Management K.K. Jun Arai, President Inquiries: Taizo Mori, Chief Investment Officer TEL: +81-3-6229-3860 Notice Concerning the Proposed Sale of Investment Asset New City Residence Investment Corporation (“NCRI”) today announced its decision to sell the following investment asset. 1.Sale Details ① Asset Type : Beneficiary interests in trust that places real estate in trust ② Property Names : New City Residence Mita (hereafter, referred to as “investment asset to be sold”) ③ Total Sale Price (planned) : ¥1,060,000,000 (exclusive of transfer costs, adjusted amount of property tax and urban planning tax, as well as consumption tax and local consumption tax) ④ Total Acquisition Price : ¥986,000,000 ⑤ Total Book Value : ¥994,990,159 (As of August 31, 2007) ⑥ Difference between Total Sale : ¥65,009,841 (difference between ③ and ⑤) Price (planned) and Total Book Value ⑦ Execution date of the trust : February 29, 2008 beneficiary interests sale and purchase agreement ⑧ Delivery Date (planned) : March 25, 2008 ⑨ Buyer : Y.K. M C Okinawa (Please refer to 4. below for details) 2.Reasons for Sale As a result of a comprehensive review based on the asset management targets and policy as designated in NCRI’s Articles of Incorporation, which took into account trends in the real-estate trading market, prospects of developments in the area, revenue projections, state of individual properties, overall portfolio composition and other factors, NCRI made sure that the transfer timing, transfer value, etc. -

RFID Subwayticket Art

RFID subwayticket art Ryota Kimura (ZKM) S.U.I. -Smart Urban Intelligence- (2006) Used technology in this work A card type of RFID (= “smart card”), that is actually and broadly used in Tokyo area “SUICA” -Super Urban Intelligent Card- JR’s (=Japan Railway Company) application service mainly for railway ticket, partly for particular e-money JR's slogan : ”Touch and go!” “sui sui” ---means “verrrry smoothly” And... almost all the people are seduced and attracted because of its efficiency and comfort. But... It's based on stored electronic data that are managed by others (=corporation) So it can be analyzed by 'others' anytime anyplace for the tool for various administration / governance. “Felica” = name of the RFID protocol ・ISO 18092 ・contactless passive RFID (13.56MHz) ・There is particular unencrypted area In this card, → 20 records(max) of history of movement etc. is stored and is able to be read out with simple C code cf.) “MiFare” = name of the RFID protocol ・ISO 14443 Type A ・contactless passive RFID (13.56MHz) ・de-facto standard of smart card ・actually new police tool Oyster card (London Subway) Objective of the work To point out -- ・Ambivalent situation on our existence interwoven with digital technology by using the same technology. ・Possibility and dangerousness of surveillance of data and administration of each individuals Adding to that – ・Exploring and understanding some strange aspect or characteristics of “data” “Bot art” using RFID technology Reading the data inside the card and automatically interprets them with very arbitrary or violent way. = linking the data with AI tech Bot computes and speaks.. -

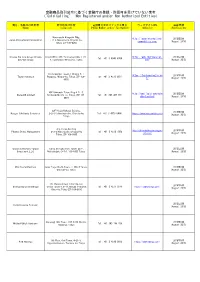

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) Marunouchi Kitaguchi Bldg. http://japaninternational 2018年8月 Japan International Commodities 1-6-5, Marunouchi, Chiyoda-ku, commodities.com/ (August 2018) Tokyo, ZIP 100-8262 Resona Dai-Ichi Group/Resona Head Office: 32F, Toranomon Hills, 1-23- https://www.rdgfinancial. 2018年8月 Tel: +81 3 4540 6704 Day-Ichi Group 4, Toranomon, Minato-ku, Tokyo com/ (August 2018) Izumi Garden Tower, 1 Chome-6-1 https://taylormckenzie.ne 2018年8月 Taylor mckenzie Roppongi, Minato-ku, Tokyo, ZIP 106- Tel: +81 3 4579 5691 t/ (August 2018) 0032 48F Shinbashi Tokyu Bldg 4-21-3, http://www.fsajp.com/delw 2018年8月 Delwebb Limited Shinbashi Minato-ku, Tokyo, ZIP 105- Tel: +81 345 405 931 ebb-limited/ (August 2018) 0004 22F Hibiya Kokusai Building, 2018年8月 Kangyo Yokohama Securities 2-2-3 Uchisaiwai-cho, Chiyoda-ku, Tel: +81 3 4579 0434 https://www.kysecurities.com (August 2018) Tokyo 4FL Yusen Building http://phoenixdirectmanagem 2018年8月 Phoenix Direct Management 2-3-2 Marunouchi, Chiyoda-ku Tel: +81 3 4578 7985 ent.com/ (August 2018) Tokyo, ZIP 100-0005 Grace Investment/ Grace Tokyo Shinjuku Park Tower, 29/F, 2018年8月 Investment L.L.C Nishishinjuku 3-7-1, 163-1055 Tokyo (August 2018) IBG Capital Partners Gran Tokyo North Tower, 1-208-5 Yaesu, 2018年8月 Chiyoda-ku, Tokyo (August 2018) 13F Harumi Island Triton Square 2018年8月 Shinhan Daiwa Brokerage Office -

Japan Information for Business Visitors UKTI GUIDE .Pdf

INFORMATION FOR BUSINESS VISITORS TO JAPAN Contents Page 1. Arrival at Narita Airport: getting into Tokyo 2 2. Banks: where to withdraw money 4 3. Commercial Department: guide to our services 5 4. Doing Business in Japan: 10 dos and don’ts 7 5. Earthquake Preparedness 9 6. General Information: shopping, restaurants, media 10 7. Accommodation in Tokyo: hotels & monthly apartments 13 8. Interpreters: terms of employment & application form 20 9. Japan Rail Pass 24 10. Medical Assistance 25 11. Mobile Phones 26 12. Smoking Policy in Chiyoda Ward 27 13. Useful & Emergency Telephone Numbers 28 14. Useful Addresses in the UK: preparing before you go 30 15. Maps: - how to get to the British Embassy 31 - instructions for your taxi driver 31 - Tokyo Subway map 32 Commercial Department British Embassy Tokyo May 2006 Arrival in Tokyo: getting into Tokyo 1. The international airport for Tokyo (Narita) is about 70 kms from Central Tokyo. Public transport is safe, reliable, easy to use and fast. The following instructions will help guide you to the Embassy or your hotel. Arrival at Narita Airport 2. As at most airports, follow the arrival signs through Quarantine and Immigration, collect baggage and then exit the customs area proceeding through either the red or green channel. Travel to Tokyo 3. Do not take a taxi to downtown Tokyo unless you are prepared for a long ride and a huge bill. 4. The most convenient way to Tokyo is to take the so-called “Limousine Bus” either to the Tokyo City Air Terminal (TCAT) or, if known, direct to your hotel. -

Kōrakuen & Akihabara

©Lonely Planet Publications Pty Ltd 136 Kōrakuen & Akihabara KŌRAKUEN & KUDANSHITA | KANDA & AKIHABARA | KAGURAZAKA Neighbourhood Top Five 1 Koishikawa Kōrakuen kart for a spin dressed in a selection of Japanese crafts (p138) Slipping into the Super Mario cosplay outfit. at this beneath-the-train- beautiful verdant world 3 3331 Arts Chiyoda tracks mall between Aki- of this classic traditional (p139) Encountering dino- habara and Ueno. garden with its central saurs made from old plastic 5 Akagi-jinja (p143) pond, charming bridges and toys amid the contemporary Threading your way seasonal flowerings. art galleries in this former through the stone-flagged 2 Akiba Kart (p146) Ex- school turned arts-and- streets of Kagurazaka, with periencing the blazing neon culture centre. its atmospheric shops and and wacky otaku (geek) vibe 4 2k540 Aki-Oka Artisan bars, to find this thoroughly of ‘Akiba’ while taking a go- (p144) Browsing a choice modern shrine. IKE-NO- Ueno- HATA kōen KOISHIKAWA ¦# HONGŌ Keisei £# Ueno Ueno # 0 1 km e0 0.5 miles Ueno- ¦#Kasuga Hongō- Yushima hirokōji Kōrakuen ¦# ¦# ¦# sanchōme ¦# £# Okachimachi BUNKYŌ-KU KAGURAZAKA 1##æ 5#æ YUSHIMA ¦# KŌRAKU Suehirochō Ōku 3#â# ¦# Kagurazaka bo-d HONGŌ 4##þ ōri ¦# Iidabashi Kuramaebashi-dōri ¦# Suidōbashi H Ushigome- £# on Iidabashi £# g ¦#Suehirochō ¦# kagurazaka Suidōbashi ō- dō M Ochanomizu ¦# i ri AKIHABARA r e ō ji WAKAMIYA- d r £# i- o Ochanomizu 2#Ø# r -dō MISAKI- Akihabara CHŌ o FUJIMI b r CHŌ KANDA- £# o i Shin- t o Ochanomizu ¦# AWAJICHŌ ICHIGAYA- S Jimbōchō TAMACHI ¦# Y Iwamotochō -

Breakfast Numbers of Guest Rooms : 130 Room

A 3 minute walk from Jimbocho Station. Located within walking distance of Ochanomizu and Suidobashi, this hotel is perfect for business or sightseeing. We accept cashless payment only - credit card or QR code payment. Please use a credit card or QR code payment system for payments of charges. ROOM EQUIPMENTS / AMENITY Women's amenity kit * Image for illustrative purposes. * Women's amenity kit is offered at the lobby. * Mobile charger is lent at the front desk. NUMBERS OF GUEST ROOMS : 130 Twin Maximum Numbers number of Room Type Room size(㎡) Bed size(mm) of rooms Floor people Single 9.0~9.5 1,200 1 35 2~8 Double 9.5~10.3 1,400 2 34 2~9 Superior Double 11.5 1,400 2 30 2~9 Comfort Double 11.3 1,400 2 8 2~9 Deluxe Double 11.4~11.9 1,600 2 6 3~8 Relax Double 13.5 1,400 3 2 9 (sofa bed available) Twin(Connecting) 13.6 1,200×2 2 6 3~8 Boutique Twin 18.3 1,200×2 3 2 9 (sofa bed available) * Image for illustrative purposes. Universal Twin 20.4 1,200×2 2 1 2 Connecting 11.4 1,600 2 6 3~8 Deluxe Double ● Non-Smoking Room: 96 rooms (2,3,5,6,7,9 floor) ● Smoking Room: 34 rooms (4,8 floor) BREAKFAST 【LITTLE MERMAID(1st floor)】 OPEN HOURS : 6:30~10:00AM(9:30L.O.) NUMBERS OF SEATS : 30 MENU : Enjoy your breakfast at LITTLE MERMAID, the bakery on the first floor of the hotel. -

Tokyo City Map 1 Preivew

A B C D E F G H J K L M N O P Q R S T U V 2#Takadanobaba Ueno- N# 0500m kľen 00.25miles Waseda Tokyo 2# Bľto-ike H Ko ľ UENO- Tokugawa Shľgun Rei-en a Keisei Ueno, Yanaka & Asakusa KOISHIKAWA H kusai-d Same scale as main map k Tokyo Iriya o ch A SAKURAGI A (Tokugawa J# u Tokyo University Ueno ng o IMADO s University 2# Shinobazu-d k Gyokurin-ji Gallery of Heiseikan Shľgun Cemetery) a Branch o 1 1 i ľ n r Kototoi-d y - - Hospital - Hľryu-ji ľ d d ľ a d ľ ľ Treasures ri #J y - ľ r r e e w ri i A Tokyo National Museum i i Shinobazu-ike NEZU Tokyo National r a A m Hyľkeikan ľ w ri m d A ľ ľ University of - - ri i ľ Fine Arts & Music k Ś Tokyo ľri E -d h Tľyľkan bazu Ameyoko Regional Ct S hino C ASAKUSA Arcade Tokyo Metropolitan A KyŚ Museum of Art Rinnľ-ji A KITA-UENO Traditional Crafts Yoshino-d #J Kasuga Iwasaki-teien #J Museum Sumida- #JYushima Ueno- J# kľen Kľrakuen Ueno-hirokľji Nezu A J# Hongľ okachimachi Ueno Zoo Ao YanakaInsetUeno, Asakusa & See J# ANational Museum of ri Sanchľme J# ľ 2# IKE-NO- Nature and Science d J# Ai 2 Ueno-kľenA! r 2 e ) Matsuzakaya Okachimachi HATA a Yushima A National Museum Hanayashiki #J iv Miyamaoto Ai Shuto Expwy No 1 Asakusa Sensľ-ji w Spa LaQua Ueno Tľshľ-gŚ Kappab isago- R a Tenjin of Western Art Kototo g K ashi Hon- View Hotel H A Five-Storey a - jA UENO o i-d id a ri Pagoda ľ d nc dľ Ai Asakusa-jinja ri m i Koishikawa h ri u m Aesop ľ R MATSUGAYA Awashima-dľ AA S u Kľrakuen Baseball Hall of Fame HONGĽ Tokyo d NISHI- A i (S Bridge A A Amuse Museum r Ko HIGASHI- KAGURAZAKA A & Museum Metropolitan