Private Equity Alert

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Leadership Newsletter Winter 2020 / 2021

T���������, M���� ��� T����������������� Leadership Newsletter Winter 2020 / 2021 GTCR Firm Update Since the firm’s inception in 1980, GTCR has Technology, Media and Tele- partnered with management teams in more communications than 200 investments to build and transform growth businesses. Over the last twenty years alone, GTCR has invested over $16 billion in approximately 100 platform acquisitions, 30+ 95+ PLATFORMS ADD-ONS including more than 65 companies that have been sold for aggregate enterprise value of over $ $50 billion and another 14 companies that have 25B+ been taken public with aggregate enterprise value PURCHASE of more than $34 billion. In November 2020, PRICE we closed GTCR Fund XIII, the firm’s largest fund to date, with $7.5 billion of limited partner capital commitments. This fund follows GTCR Fund Acquisition Activity Since 2000 XII, which we raised in 2017, with $5.25 billion As of January 15, 2021* of limited partner capital commitments. GTCR currently has 25 active portfolio companies; ten of these companies are within the Technology, Media and Telecommunications (“TMT”) industry. Page 1 / Continues on next page Technology, Media and Telecommunications Group Update Since 2000, GTCR has completed over 30 new platform investments and over 95 add-on acquisitions within the TMT industry, for a total of over 125 transactions with a combined purchase price of over $25 billion. During just the past year, we have realized several of these investments, selling three businesses and completing the partial sale of two additional companies, for a combined enterprise value of over $9 billion. Our TMT franchise includes ten active portfolio companies and one management start-up, which together have completed nearly 30 add-on acquisitions under our ownership, representing approximately $3 billion of GTCR invested capital. -

Not Mitt Romney's Bain Capital: Boston Investment Firm Home To

Not Mitt Romney’s Bain Capital: Boston investment firm home to diverse political views - Business - The Boston Globe Interested in documentaries? Click here to view our latest free screening. TEXT SIZE MANAGE ACCOUNT LOG OUT NEWS BusinessMETRO MARKETS TECHNOLOGY ARTS BUSINESS BETABOSTON SPORTS OPINION Red Sox Live 3 8 POLITICS LIFESTYLE Final MAGAZINE INSIDERS AtTODAY'S Bain, PAPER a broad range of viewpoints is the new reality E-MAIL FACEBOOK TWITTER GOOGLE+ LINKEDIN 57 http://www.bostonglobe.com/...romney-bain-capital-boston-investment-firm-home-diverse-political-views/gAGQyqkSROIoVubvsCXJxM/story.html[5/23/2015 10:37:45 PM] Not Mitt Romney’s Bain Capital: Boston investment firm home to diverse political views - Business - The Boston Globe SUZANNE KREITER/GLOBE STAFF Former Governor Deval Patrick, a Democrat, is joining Bain Capital — an investment firm founded by his predecessor on Beacon Hill, Republican Mitt Romney. By Beth Healy and Matt Rocheleau GLOBE STAFF APRIL 16, 2015 There are two chestnuts that drive Bain Capital partners crazy: First, the notion that they are ruthless capitalists who enjoy firing people. Second, that they are all card-carrying Republicans. Fifteen long years since Mitt Romney left the Boston investment firm he founded, those old impressions still rankle. Enter Deval Patrick, former Massachusetts governor and a Democrat closely aligned with President Obama, named this week a Bain managing director who will focus on “social impact” investing. The newest Bain employee — and the public spirit implied by his new job — would seem to contradict the firm’s old image. But current and former partners, and close observers of the firm say Bain Capital is more of a big tent than many might think. -

Private Equity and Value Creation in Frontier Markets: the Need for an Operational Approach

WhatResearch a CAIA Member Review Should Know Investment Strategies CAIAInvestmentCAIA Member Member Strategies Contribution Contribution Private Equity and Value Creation in Frontier Markets: The Need for an Operational Approach Stephen J. Mezias Afzal Amijee Professor of Entrepreneurship and Family Enterprise Founder and CEO of Vimodi, a novel visual discussion with INSEAD, based at the Abu Dhabi campus application and Entrepreneur in Residence at INSEAD 42 Alternative Investment Analyst Review Private Equity and Value Creation in Frontier Markets Private Equity and Value Creation in Frontier Markets What a CAIA Member Should Know Investment Strategies 1. Introduction ership stakes, earning returns for themselves and the Nowhere else is the operational value creation approach LPs who invested with them. While this clarifies that more in demand than in the Middle East North Africa capturing premiums through ownership transactions is (MENA) region. Advocating and building operational a primary goal for GPs, it does not completely address capabilities requires active investment in business pro- the question of what GPs need to do to make the stakes cesses, human capital, and a long-term horizon. Devel- more valuable before selling the companies in question. oping the capabilities of managers to deliver value from There are many ways that the GPs can manage their in- operations will not only result in building capacity for vestments to increase value, ranging from bringing in great companies, but will also raise the bar for human functional expertise, e.g., sound financial management, talent and organizational capability in the region. In the to bringing in specific sector operational expertise, e.g., long term, direct support and nurturing of the new gen- superior logistics capabilities. -

PE Pulse Quarterly Insights and Intelligence on PE Trends February 2020

PE Pulse Quarterly insights and intelligence on PE trends February 2020 This document is interactive i. ii. iii. iv. v. Contents The PE Pulse has been designed to help you remain current on capital market trends. It captures key insights from subject-matter professionals across EY member firms and distills this intelligence into a succinct and user-friendly publication. The PE Pulse provides perspectives on both recent developments and the longer-term outlook for private equity (PE) fundraising, acquisitions and exits, as well as trends in private credit and infrastructure. Please feel free to reach out to any of the subject matter contacts listed on page 25 of this document if you wish to discuss any of the topics covered. PE to see continued strength in 2020 as firms seek clear air for deployment We expect overall PE activity to remain strong in 2020. From a deal perspective, deployment remains challenging. Geopolitical developments will continue to shape the 2019 was a strong year from a fundraising perspective, Currently, competition for deals is pushing multiples dispersion of activity. In the US, for example, activity has albeit slightly off the high-water mark of 2017. While well above the top of the last cycle. In the US, purchase continued largely unabated, driven by a strong macro valuations and the challenges in deploying capital multiples have reached 11.5x (versus 9.7x in 2007), and backdrop and accommodative lending markets. PE firms continue to raise concerns among some LPs, any 11.1x in Europe (versus 10.3x in 2007). As a result, firms announced deals valued at US$249b, up 3% from last hesitation in committing fresh capital is being offset to are seeking “clearer air” by moving downmarket into the year, making it among the most active years since the a degree by entirely new investors that are moving into growth capital space, where growth rates are higher and global financial crisis (GFC). -

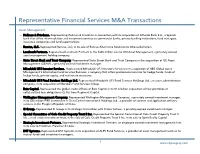

Representative Financial Services M&A Transactions

Representative Financial Services M&A Transactions Asset Management • Hellman & Friedman. Representing Hellman & Friedman in connection with its acquisition of Allfunds Bank S.A., a Spanish bank that offers intermediation and investment services to commercial banks, private banking institutions, fund managers, insurance companies and fund supermarkets. • Ramius, LLC. Represented Ramius, LLC, in its sale of Ramius Alternative Solutions to AllianceBernstein. • Landmark Partners. Represented Landmark Partners in the $465 million sale to OM Asset Management, a privately owned asset management holding company. • State Street Bank and Trust Company. Represented State Street Bank and Trust Company in the acquisition of GE Asset Management (GEAM), a privately owned investment manager. • Mitsubishi UFJ Investor Services. Represented Mitsubishi UFJ Investors Services in its acquisition of UBS Global Asset Management’s Alternative Fund Services Business, a company that offers professional services for hedge funds, funds of hedge funds, private equity, and real estate structures. • Mitsubishi UFJ Fund Services Holdings Ltd. Represented Mitsubishi UFJ Fund Services Holdings Ltd., an asset administration company, in its acquisition of Meridian Fund Services Group. • Bain Capital. Represented the global credit affiliate of Bain Capital in its $1.6 billion acquisition of four portfolios of collateralized loan obligations (CLOs) from Regiment Capital. • Wellington Management Company. Represented Wellington Management Company, a privately owned investment manager, in its $85 million PIPE investment in ChinaCache International Holdings Ltd., a provider of content and application delivery services in the People’s Republic of China. • 3i Group. Represented 3i Group in its strategic transaction with Fraser Sullivan, a privately owned investment manager. • Special Committee of Cole Credit Property Trust II Inc. -

How Will Financial Services Private Equity Investments Fare in the Next Recession?

How Will Financial Services Private Equity Investments Fare in the Next Recession? Leading funds are shifting to balance-sheet-light and countercyclical investments. By Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith are partners with Bain & Company’s Financial Services and Private Equity practices. They are based, respectively, in London, New York, Boston and London. Copyright © 2019 Bain & Company, Inc. All rights reserved. How Will Financial Services Private Equity Investments Fare in the Next Recession? At a Glance Financial services deals in private equity have grown on the back of strong returns, including a pooled multiple on invested capital of 2.2x in recent years, higher than all but healthcare and technology deals. With a recession increasingly likely during the next holding period, PE funds need to develop plans to weather any storm and potentially improve their competitive position during and after the downturn. Many leading funds are investing in balance-sheet-light assets enabled by technology and regulatory change. Diligences now should test target companies under stressful economic scenarios and lay out a detailed value-creation plan, including how to mobilize quickly after acquisition. Financial services deals by private equity funds have had a strong run over the past few years, with deal value increasing significantly in Europe and the US(see Figure 1). Returns have been strong as well. Global financial services deals realized a pooled multiple on invested capital of 2.2x from 2009 through 2015, higher than all but healthcare and technology deals (see Figure 2). -

Francesco Pascalizi Appointed Co-Head of the Milan Office Alongside Fabrizio Carretti

PERMIRA STRENGTHENS ITS PRESENCE IN ITALY: FRANCESCO PASCALIZI APPOINTED CO-HEAD OF THE MILAN OFFICE ALONGSIDE FABRIZIO CARRETTI London/Milan, 24 October 2019 –Francesco Pascalizi has been appointed co-head of Permira in Italy and joins Fabrizio Carretti in the leadership of the Milan office. Francesco Pascalizi has worked closely with Fabrizio Carretti for more than 12 years and has contributed significantly to developing Permira’s business in the Italian market, having completed several investments in the industrial and consumer space. He currently serves on the Board of Arcaplanet and Gruppo La Piadineria, acquired by the Permira Funds respectively in 2016 and 2017. Fabrizio Carretti commented: “I am really delighted to have Francesco join the leadership of the Milan team – I am sure that his appointment will further strengthen our position in the Italian market”. Francesco Pascalizi added: “I am very pleased to join Fabrizio and look forward to continue developing Permira’s franchise in Italy, a country to which we are strongly committed”. Francesco Pascalizi joined Permira in 2007 and he is a member of the Industrial Tech & Services team. He has worked on a number of transactions including La Piadineria, Arcaplanet, eDreams OdigeO, and Marazzi Group. Prior to joining Permira, Francesco worked in the private equity group at Bain Capital and before that he was part of M&A team at UBS in both Milan and London. He has a degree in Business Administration from Bocconi University, Italy. ABOUT PERMIRA Permira is a global investment firm. Founded in 1985, the firm advises funds with total committed capital of approximately €44bn (US$48bn) and makes long-term investments, including majority control investments as well as strategic minority investments, in companies with the objective of transforming their performance and driving sustainable growth. -

Annual Report

Building Long-term Wealth by Investing in Private Companies Annual Report and Accounts 12 Months to 31 January 2021 Our Purpose HarbourVest Global Private Equity (“HVPE” or the “Company”) exists to provide easy access to a diversified global portfolio of high-quality private companies by investing in HarbourVest-managed funds, through which we help support innovation and growth in a responsible manner, creating value for all our stakeholders. Investment Objective The Company’s investment objective is to generate superior shareholder returns through long-term capital appreciation by investing primarily in a diversified portfolio of private markets investments. Our Purpose in Detail Focus and Approach Investment Manager Investment into private companies requires Our Investment Manager, HarbourVest Partners,1 experience, skill, and expertise. Our focus is on is an experienced and trusted global private building a comprehensive global portfolio of the markets asset manager. HVPE, through its highest-quality investments, in a proactive yet investments in HarbourVest funds, helps to measured way, with the strength of our balance support innovation and growth in the global sheet underpinning everything we do. economy whilst seeking to promote improvement in environmental, social, Our multi-layered investment approach creates and governance (“ESG”) standards. diversification, helping to spread risk, and is fundamental to our aim of creating a portfolio that no individual investor can replicate. The Result Company Overview We connect the everyday investor with a broad HarbourVest Global Private Equity is a Guernsey base of private markets experts. The result is incorporated, London listed, FTSE 250 Investment a distinct single access point to HarbourVest Company with assets of $2.9 billion and a market Partners, and a prudently managed global private capitalisation of £1.5 billion as at 31 January 2021 companies portfolio designed to navigate (tickers: HVPE (£)/HVPD ($)). -

Presidential Politics & Private Equity

Roundtable Presidential Politics & Private Equity Sponsored by Sponsored by 029_MAJOct12 1 9/7/2012 7:07:28 PM Roundtable o explore the impact of the 2012 presidential election on middle- new president, or the existing president, is going to market dealmaking, Mergers & Acquisitions convened a special face. Will taxes go up? Will dividends go up? Will capital gains go up? Will “ObamaCare” get repealed? 5roundtable, held at the Nasdaq exchange and sponsored by Fifth As I’ve canvassed small businesses across the state Street Finance Corp. (Nasdaq: FSC) and Rutan & Tucker LLP. Partici- of Connecticut, I’ve found higher healthcare costs are the number one, two and three things concern pants included four private equity investors, two members of government ing them. I’ve been talking to the 60 or 70 private equity sponsors that we lend to about their portfolio (a Democrat and a Republican), two lenders, an investment banker, an companies, and this is a big issue. So, the question is: attorney and a consultant. Most of the roundtable participants are sup- Does healthcare get repealed? How do you forecast your business, how do you forecast what you want to porting former Governor Mitt Romney (R-Mass.) in the election, which do, and how do you think about deals and lending? This environment creates great uncertainty. underscores the Bain Capital co-founder’s popularity among his private The country is also going to make a choice be equity peers. tween what I call statist and capitalist, not Democrat and Republican. This is a statist president. This is a president who wants a bigger, better government. -

Sheila Bair Goes on the Attack Again

Trial to Amplify the Citi-EMI Discord New York Times By Peter Lattman October 13, 2010 Guy Hands and David Wormsley once made beautiful music together. For more than a decade, Mr. Hands, pictured, the flamboyant British financier, struck prominent deals and Mr. Wormsley, a star banker at Citigroup in London, advised on them. They made piles of money and became close friends, and accompanied each other to the opera. In May 2007, Mr. Hands made the most audacious bet of his career. His firm paid $6.7 billion for the EMI Group, the record label that carried the Beatles and Frank Sinatra. Mr. Wormsley auctioned off the company, and Citigroup provided about $4.3 billion in loans to finance the deal. Then the music stopped. On Monday, Mr. Hands and Mr. Wormsley will face off in a federal courtroom in Manhattan. Barring an 11th-hour settlement, a six-person jury will decide the outcome of a lawsuit brought by Mr. Hands’s private equity firm against Citigroup over its role in EMI’s sale. Mr. Hands accuses his once-trusted adviser of deceiving him during the auction process. At the trial, Citigroup’s lawyers are expected to depict his lawsuit as a Hail Mary pass to try to salvage a failed investment and portray Mr. Hands as having a classic case of buyers’ remorse. Representatives for the bank say that it has done nothing wrong, and that the case is a negotiating tactic by Mr. Hands. Citigroup, which still owns all of EMI’s loans, has for more than a year been locked in restructuring talks with Mr. -

Golden Goose Announces Majority Investment from Permira Funds

Golden Goose announces majority investment from Permira Funds MILAN - February 12, 2020 – Golden Goose, Permira and The Carlyle Group (NASDAQ: CG) today announced that a company backed by Permira funds has agreed to acquire Carlyle’s majority stake in Golden Goose. Established in 2000 in Venice, Italy, Golden Goose is one of the fastest growing and most distinctive luxury fashion brands, widely recognised for its iconic sneakers. The company has operations in Europe, US and Asia, has a network of 100 Directly Owned Stores (DOS) and a fast growing online presence. Carlyle acquired Golden Goose in March 2017 through Carlyle Europe Partners IV (CEP IV), a European-focused, upper-mid market buyout fund, and Carlyle Asia Growth Partners V (CAGP V). During their ownership, revenues have grown from €100m to estimated revenues in excess of €260m for 2019. Carlyle has a well-established track record in consumer brands globally, with investments including Moncler, Twinset and Hunkmöller. Permira has a strong track record of partnering with global consumer brands and their management teams to successfully grow their businesses and enhance their market leading positions. The consumer team have made 33 investments totaling over €9.6bn with total current sales of €3.6bn. Existing and previous investments include Dr. Martens, the iconic British footwear brand, Reformation, the leading digitally-led clothing brand, Hugo Boss and Valentino. Silvio Campara, CEO at GG said: “Since the foundation of Golden Goose in 2000, we have strived to create innovative products for our customers, combining craftsmanship and a refined and modern style. We thank Carlyle for their support and partnership in leading the company through a phenomenal period of growth. -

THE GLOBAL FINANCIAL CRISIS a Plan for Regulatory Reform May 2009

COMMITTEE ON CAPITAL MARKETS REGULATION THE GLOBAL FINANCIAL CRISIS A Plan for Regulatory Reform May 2009 Copyright © 2009. All rights reserved. COMMITTEE ON CAPITAL MARKETS REGULATION The Committee on Capital Markets Regulation is an independent and nonpartisan 501(c)(3) research organization dedicated to improving the regulation of U.S. capital markets. Twenty-five leaders from the investor community, business, finance, law, accounting, and academia comprise the Committee’s Membership. The Committee Co-Chairs are R. Glenn Hubbard, Dean of Columbia Business School and John L. Thornton, Chairman of the Brookings Institution. The Committee’s President and Director is Hal S. Scott, Nomura Professor and Director of the Program on International Financial Systems at Harvard Law School. The Committee’s research on the regulation of U.S. capital markets provides policymakers with a nonpartisan, empirical foundation for public policy. COMMITTEE ON CAPITAL MARKETS REGULATION MEMBERS William J. Brodsky Chairman & CEO, Chicago Board Options Exchange; Chairman, World Federation of Exchanges Roel C. Campos* Partner in Charge, Cooley Godward Kronish LLP; Former SEC Commissioner Peter C. Clapman President & CEO, Governance for Owners USA Inc. Samuel A. DiPiazza, Jr. Global CEO, PricewaterhouseCoopers Daniel L. Doctoroff President, Bloomberg L.P. Scott C. Evans** Executive Vice President of Asset Management, TIAA-CREF William C. Freda Vice Chairman & U.S. Managing Partner, Deloitte Robert R. Glauber Visiting Professor, Harvard Law School; Former Chairman & CEO, NASD Robert Greifeld** CEO, The NASDAQ OMX Group, Inc. Kenneth C. Griffin President & CEO, Citadel Investment Group LLC R. Glenn Hubbard Dean and Russell L. Carson Professor of Finance and Economics, Columbia Business School Abigail P.